Professional Documents

Culture Documents

Slides Seminaire Validation

Uploaded by

V Prasanna ShrinivasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Slides Seminaire Validation

Uploaded by

V Prasanna ShrinivasCopyright:

Available Formats

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Value-at-Risk Models

Christophe Hurlin

University of Orléans

Séminaire Validation des Modèles Financiers. 29 Avril 2013

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Introduction

The Value-at-Risk (VaR) and more generally the Distortion Risk

Measures (Expected Shortfall, etc.) are standard risk measures

used in the current regulations introduced in Finance (Basel 2), or

Insurance (Solvency 2) to …x the required capital (Pillar 1), or to

monitor the risk by means of internal risk models (Pillar 2).

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Introduction

De…nition

Let frt gTt=1 be a given P&L series. The daily (conditional) VaR for

a nominal coverage rate α is de…ned as

Pr[ rt < VaR t jt 1 (α) Ft 1] =α

where Ft 1 denotes the set of information available at time t 1.

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Introduction

Who does use VaR? What for?

Bank risk manager Measure …rm-level market, credit, op. risk

Bank executives Set limits (management)

Banking regulators Determine capital requirements

Exchanges Compute margins

Regulators Forecast systemic risk (CoVaR)

Industry Ex: EDF, spot prices of electricity

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

"Disclosure of quantitative measures of market risk, such

as value-at-risk, is enligthening only when accompanied

by a thorough discussion of how the risk measures were

calculated and how they related to actual performance",

Alan Greenspan (1996)

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Introduction

De…nition

Backtesting is a set of statistical procedures designed to check if

the real losses are in line with VaR forecasts (Jorion, 2007).

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Introduction

Whatever the type of use of VaR, the VaR forecasts are

generated by an internal risk model.

This model is used to produced a sequence of pseudo out-of

sample VaR forecasts for a past period (typically one year)

The backtesting is based on the comparison of the observed

P&L to these VaR forecasts.

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Outlines

1 How to test the validity of a VaR model?

2 What are the backtesting strategies?

3 What are the good practices?

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Remark 1: Ex-post VaR is not observable, so it is impossible to

compute traditional statistics or criteria such as MSFE.

Remark 2: There is no proxy for the VaR contrary to the volatility

(realized volatility, Andersen and Bollerslev 1998)

Patton, A.J. (2011) Volatility forecast comparison using imperfect volatility

proxies, Journal of Econometrics, 260, 246-256.

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Backtesting procedures are based on VaR exceptions

De…nition

We denote It (α) the hit variable associated to the ex-post

observation of an α% VaR exception at time t :

(

1 if rt < VaR t jt 1 (α)

It (α) =

0 else

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Christo¤ersen (1998) : VaR forecasts are valid if and only if the

violation process It (α) satis…es the following two assumptions:

1 The unconditional coverage (UC) hypothesis.

2 The independence (IND) hypothesis.

Christo¤ersen P.F. (1998), Evaluating interval forecasts, International Economic

Review, 39, pp. 841-862.

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

De…nition (unconditional coverage hypothesis)

The unconditionnal probability of a violation must be equal to the

α coverage rate

Pr [It (α) = 1] = E [It (α)] = α.

If Pr [It (α) = 1] > α, the risk is under-estimated

If Pr [It (α) = 1] < α, the risk is over-estimated

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

De…nition (independence hypothesis)

VaR violations observed at two di¤erent dates must be

independently distributed.

It (α) and Is (α) are independently distributed for t 6= s

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Figure: Illustration: violations’cluster

8

VaR(95%)

P&L

6

-2

-4

-6

0 50 100 150 200 250

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Figure: Illustration: violations’cluster

8

VaR(95%)

P&L

6

-2

-4

-6

0 50 100 150 200 250

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

De…nition (conditional coverage hypothesis)

The violation process satis…es a di¤erence martingale assumption.

E [ It (α) j Ft 1] =α

Christophe Hurlin Backtesting

Introduction

Backtesting Principles

Testing strategies

Recommandations

Backtesting Principles

Remark: These assumptions can be expressed as distributional

assumptions.

Under the UC assumption, each variable It (α) has a Bernouilli

distribution with a probability α.

Itt (α) Bernouilli (α)

Under the IND assumption, these variables are independent, and

the number of violations has a Binomial distribution.

T

∑ It (α) B (T , α )

t =1

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

What are the backtesting strategies?

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

Let us consider a sequence of daily VaR out-of-sample forecasts

T

VaR t jt 1 (α) t =1 and the corresponding observed P&L.

How to test the validity of the internal risk model?

Hurlin C. and Pérignon C. (2012), Margin Backtesting,

Review of Futures Market, 20, pp. 179-194

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

Testing strategies:

1 Frequency-based tests

2 Magnitude-based tests

3 Multivariate tests

4 Independence tests

5 Duration-based tests

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

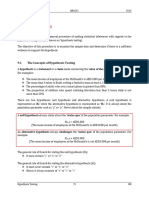

Figure: BIS "Tra¢ c Light" System

Note: VaR(1%, 1 day), 250 daily observations

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

De…nition

Christo¤ersen (1998) proposes a Likelihood Ratio statistic for UC

de…ned as:

h i

LRUC = 2 ln (1 α)T H αH

h i

d

+2 ln (1 H/T )T H (H/T )H ! χ2 (1)

T !∞

where H = ∑Tt=1 It (α) denotes the total number of exceedances.

For a nominal risk of 5%, the null of UC can not be rejected if

and only if H < 7 for T = 250 and α = 1%.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

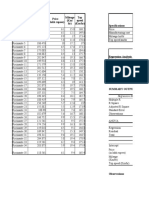

Example

Berkowitz and O-Brien (2002) consider the VaR forecasts of six US

commercial banks

Berkowitz, J., and O-Brien J. (2002), How Accurate are the

Value-at-Risk Models at Commercial Banks, Journal of

Finance.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

Figure: Bank Daily VaR Models

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

Figure: Violations of Banks’99% VaR

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

Testing strategies:

1 Frequency-based tests

2 Magnitude-based tests

3 Multivariate tests

4 Independence tests

5 Duration-based tests

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

All these tests do not take into account the magnitude of the

losses beyond the VaR

Example

Consider two banks that both have a one-day 1%-VaR of $100

million. Assume each bank reports three VaR exceptions, but the

average VaR exceedance is $1 million for bank A and $500 million

for bank B.

In this case, standard backtesting methodologies would indicate

that the performance of both models is equal and acceptable.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Figure: Daily VaR and P/L for SocGen 2008

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Figure: Daily VaR and P/L for SocGen 2008

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

The Risk Map

Colletaz G., Hurlin C. and Perignon C. (2013), The Risk

Map: a new tool for Risk Management, forthcoming in

Journal of Banking and Finance

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

We propose a VaR backtesting methodology based on the number

and the severity of VaR exceptions: this approach exploits the

concept of "super exception".

De…nition

We de…ne a super exception using a VaR with a much smaller

coverage probability α0 , with α0 < α. In this case, a super

exception is de…ned as a loss greater than VaRt (α0 ).

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Figure: VaR Exception vs. VaR Super Exception

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Solution

Given VaR exceptions It (α) and VaR super exception It (α0 ), we

de…ne a Risk Map that jointly accounts for the number and the

magnitude of the VaR exceptions

Let us consider a given UC test with a statistic Z (α) based on the

violations sequence fIt (α)gTt=1 .

H0 : E [It (α)] = α

H1 : E [It (α)] 6= α.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Number of VaR Exceptions (N)

Non-rejection area for test

on VaR exceptions

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Based on the same UC test, it is possible to test for the

magnitude of VaR exceptions, via the VaR super exceptions

fIt (α0 )gTt=1

H0 : E It α0 = α0

H1 : E It α0 6= α0

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Non-rejection

area for test

on VaR super

exceptions

Number of VaR Super Exceptions (N’)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

We can also test jointly for both magnitude and frequency of VaR

exceptions:

H0 : E [It (α)] = α and E It α0 = α0

Multivariate approach

Perignon C. and Smith, D. (2008), A New Approach to

Comparing VaR Estimation Methods, Journal of

Derivatives

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

15

14

13

12

Number of VaR Exceptions (N)

11

10

9

8

7

6

5

4

3 Nominal risk 5%

2

1 Nominal risk 1%

0

0 1 2 3 4 5 6 7 8

Number of VaR Super Exceptions (N')

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

Figure: Backtesting Bank VaR: La Caixa (2007-2008)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: magnitude-based tests (2/5)

15

14

13

12

Number of VaR Exceptions (N)

11

10

9

8

7

6

5

4

3 Nominal risk 5%

2

1 Nominal risk 1%

0

0 1 2 3 4 5 6 7 8

Number of VaR Super Exceptions (N')

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

Testing strategies:

1 Frequency-based tests

2 Magnitude-based tests

3 Multivariate tests

4 Independence tests

5 Duration-based tests

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: multivariate tests (3/5)

Intuition: Testing the validity of the VaR model for M coverage

rates, with M > 1.

Perignon C. and Smith, D. (2008), A New Approach to

Comparing VaR Estimation Methods, Journal of

Derivatives

Hurlin C. and Tokpavi, S. (2006), ”Backtesting

Value-at-Risk Accuracy: A Simple New Test”, Journal of

Risk

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: multivariate tests (3/5)

Perignon and Smith (2008) consider the null:

H0,MUC : E [It (α)] = α and E It α0 = α0 .

Let us denote:

J0,t = 1 J1,t J2,t

0)

1 if VaR t jt 1 (α < rt < VaR t jt 1 (α)

J1,t =

0 otherwise

1 if rt < VaR t jt 0)

1 (α

J2,t = .

0 otherwise

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: multivariate tests (3/5)

De…nition (Perignon and Smith, 2008)

The multivariate unconditional coverage test is a LR test given by:

h i

H H

LRMUC = 2 ln (1 α)H 0 α α0 1 α0 2

" #

H 0 H 0 H0 H1 H 1 H 2 H 2

+2 ln 1 .

T T T T

where Hi = ∑Tt=1 Ji ,t , for i = 0, 1, 2, denote the count variable

associated with each of the Bernoulli variables.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: multivariate tests (3/5)

Hurlin and Tokpavi (2006):

A natural test of the CC is the univariate Ljung-Box test of

H0,CC : r1 = ... = rK = 0

where rk denotes the k th autocorrelation:

K

rk2

b

∑

d

LB (K ) = T (T + 2) ! χ2 (K )

k =1

T k T !∞

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: multivariate tests (3/5)

De…nition (Hurlin and Tokpavi, 2006)

Let Θ = fθ 1 , .., θ m g be a discrete set of m di¤erent coverage rates

0

and Hitt = [Hitt (θ 1 ) : Hitt (θ 2 ) : ... : Hitt (θ m )]

(

1 θ i if rt < VaR t jt 1 (θ i )

Hitt (θ i ) =

θi else

Under the null of CC (martingale di¤erence):

0

H0,CC : E [Hitt Hitt k = 0m 8k = 1, ..., K

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

Testing strategies:

1 Frequency-based tests

2 Magnitude-based tests

3 Multivariate tests

4 Independence tests

5 Duration-based tests

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

LR tests

Christo¤ersen (1998) assumes that the violation process It (α) can

be represented as a Markov chaine with two states:

1 π 01 π 01

Π=

1 π 11 π 11

π ij = Pr [ It (α) = j j It 1 (α) = i ]

De…nition

The null of CC can be de…ned as follows:

1 α α

H0,CC : Π = Πα =

1 α α

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

LR tests

Christo¤ersen (1998) assumes that the violation process It (α) can

be represented as a Markov chaine with two states:

1 π 01 π 01

Π=

1 π 11 π 11

π ij = Pr [ It (α) = j j It 1 (α) = i ]

De…nition

The null of IND can be de…ned as follows:

1 β β

H0,IND : Π = Π β =

1 β β

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (4/5)

The corresponding LR statistics are de…ned by:

h i

LRIND = 2 ln (1 H/T )T H (H/T )H

d

+2 ln [(1 π b n0101 (1

b 01 )n00 π π b n1111 ]

b 11 )n10 π ! χ2 (1)

T !∞

h i

T H H

LRCC = 2 ln (1 α) (α)

d

+2 ln [(1 π b n0101 (1

b 01 )n00 π π b n1111 ]

b 11 )n10 π ! χ2 (2)

T !∞

By de…nition:

LRCC = LRUC + LRIND

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: frequency-based tests (1/5)

Figure: Violations of Banks’99% VaR

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Regression based tests

Engle and Manganelli (2004) suggest another approach based

on a linear regression model. This model links current margin

exceedances to past exceedances and/or past information.

Let Hit (α) = It (α) α be the demeaned process associated

with It (α):

1 α if rt < VaR t jt 1 (α)

Hitt (α) = .

α otherwise

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Regression based tests

Consider the following linear regression model:

K K

Hitt (α) = δ + ∑ βk Hitt k (α) + ∑ γk zt k + εt

k =1 k =1

where the zt k variables belong to the information set Ωt 1

(lagged P&L, squared past P&L, past margins, etc.)

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Regression based tests

The null hypothesis test of CC corresponds to testing the joint

nullity of all the regression coe¢ cients:

H0,CC : δ = βk = γk = 0, 8k = 1, ..., K .

since under the null :

E [Hitt (α)] = E [It (α) α] = 0 () Pr [It (α) = 1] = α

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

De…nition (Engle and Manganelli, 2004)

Denote Ψ = (δ β1 ...βK γ1 ...γK )0 the vector of the 2K + 1

parameters in this model and Z the matrix of explanatory variables

of model, the Wald statistic, denoted DQCC , then veri…es:

b 0Z 0Z Ψ

Ψ b d

DQCC = ! χ2 (2K + 1)

α (1 α ) T !∞

b is the OLS estimate of Ψ.

where Ψ

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Regression based tests

Extension: A natural extension of the test of Engle and Manganelli

(2004) consists in considering a (probit or logit) binary model

linking current violations to past ones

Dumitrescu E., Hurlin C. and Pham V. (2012),

Backtesting Value-at-Risk: From Dynamic Quantile to

Dynamic Binary Tests, Finance

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

De…nition (Dumitrescu et al., 2012)

We consider a dichotomic model:

Pr [ It (α) = 1 j Ft 1] = F (π t ) .

where F (.) denotes a c.d.f. and the index π t satis…es the

following autoregressive representation:

q1 q2 q3

πt = c + ∑ βj π t j + ∑ δj It j (α) + ∑ γj xt j ,

j =1 j =1 j =1

where l (.) is a function of a …nite number of lagged values of

observables, and xt is a vector of explicative variables.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: independence tests (4/5)

Regression based tests

1

H0 : β = 0, δ = 0, γ = 0 and c = F (α) .

since under the null of CC:

1

Pr(It = 1 j Ft 1) = F (F (α)) = α.

The Dynamic Binary (DB) LR test statistic is:

1

DBLR CC = 2 ln L(0, F (α); It (α), Zt ) ln L(θ̂, ĉ; It (α), Zt )

d

! χ2 (dim(Zt ))

T !∞

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies

Testing strategies:

1 Frequency-based tests

2 Magnitude-based tests

3 Multivariate tests

4 Independence tests

5 Duration-based tests

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

The UC, IND, and CC hypotheses also have some implications

on the time between two consecutive VaR margin exceedances.

Let us denote by dv the duration between two consecutive

VaR margin violations:

dv = tv tv 1

where tv denotes the date of the v th exceedance.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Under CC hypothesis, the duration process dv has a geometric

distribution:

Pr [dv = k ] = α (1 α )k 1

k2N .

This distribution characterizes the memory-free property of

the violation process It (α) with E (dv ) = 1/α

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

De…nition

Christo¤ersen and Pelletier (2004) use under the null hypothesis

the exponential distribution:

g (dv ; α) = α exp ( αdv ) .

Under the alternative hypothesis, they postulate a Weibull

distribution for the duration variable:

h i

h (dv ; a, b ) = ab bdvb 1 exp (adv )b .

H0,IND : b = 1 H0,CC : b = 1, a = α

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Drawback: we have to postulate a distribution for the duration

under the alternative (misspeci…cation of the VaR model).

Solution: Candelon et al. (2001) propose a J-test based on

orthonormal polynomials associated to the geometric distribution.

Candelon B., Colletaz G., Hurlin C. et Tokpavi S. (2011),

"Backtesting Value-at-Risk: a GMM duration-based

test", Journal of Financial Econometrics,

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Candelon et al. (2001)

In the case of continuous distributions, the Pearson distributions

(Normal, Student, etc.) are associated to some particular

orthonormal polynomials whose expectation is equal to zero.

These polynomials can be used as special moments to test for

a distributional assumption (see. Bontemps and Meddahi,

Journal of Econometrics, 2005).

In the discrete case, orthonormal polynomials are de…ned for

distributions belonging to the Ord’s family (Poisson, Pascal,

hypergeometric, etc.).

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Candelon et al. (2001)

De…nition

The orthonormal polynomials associated to a geometric

distribution with a success probability β are de…ned by the

following recursive relationship, 8d 2 N :

(1 β) (2j + 1) + β (j d + 1)

Mj +1 (d; β) = p Mj (d; β)

(j + 1) 1 β

j

Mj 1 (d; β) ,

j +1

for any order j 2 N , with M 1 (d; β) = 0 and M0 (d; β) = 1 and:

E [Mj (d; β)] = 0 8j 2 N , 8d 2 N .

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Candelon et al. (2001)

Example

We can show that if d follows a geometric distribution of

parameter β, then:

p

M1 (d; β) = (1 βd ) / 1 β

with

E [M1 (d; β)] = 0

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Candelon et al. (2001)

Our duration-based backtest procedure exploits these moment

conditions.

More precisely, let us de…ne fd1 ; ...; dN g a sequence of N

durations between VaR violations, computed from the

sequence of the hit variables fIt (α)gTt=1 .

Under the CC assumption, the durations di , i = 1, .., N, are

i.i.d. geometric(α). Hence, the null of CC can be expressed

as follows:

H0,CC : E [Mj (di ; α)] = 0, j = f1, .., p g ,

where p denotes the number of moment conditions.

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Candelon et al. (2001)

De…nition

The null hypothesis of CC can be expressed as

H0,CC : E [M (di ; α)] = 0,

where M (di ; α) denotes a (p, 1) vector whose components are the

orthonormal polynomials Mj (di ; α) , for j = 1, .., p. Under some

regularity conditions:

!| !

1 N 1 N

JCC (p ) = p ∑ M (di ; α) p ∑ M (di ; α)

d

! χ2 (p )

N i =1 N i =1 N !∞

Christophe Hurlin Backtesting

Frequency-based tests

Introduction

Magnitude-based tests

Backtesting Principles

Multivariate tests

Testing strategies

Independence tests

Recommandations

Duration-based tests

Testing strategies: duration-based tests (5/5)

Candelon et al. (2001)

De…nition

Under UC, the mean of durations between two violations is equal

to 1/α, and the null hypothesis is

H0,UC : E [M1 (di ; α)] = 0.

with a test statistic equal to

!2

N

1

∑ M1 (di ; α)

d

JUC = p ! χ2 (1)

N N !∞

i =1

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Recommandations

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Recommandation 1: Test, test and test

Recommandation 2: Check the P&L data

Recommandation 3: The power of your tests may be low..

Recommandation 4: Take into account the estimation risk

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Recommandation 1: Test, test and test

Each type of test (frequency, severity, independence,

conditional coverage, multivariate test etc..) captures one

type of potential misspeci…cation of the VaR model.

It is important to use a variety of tests

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Recommandation 2: Check the P&L data

Frésard, L., C. Perignon, and W., Anders (2011), The

Pernicious E¤ects of Contaminated Data in Risk Management,

Journal of Banking and Finance.

1 A large fraction of US and international banks validate their

market risk model using P&L data that include fees and

commissions and intraday trading revenues.

2 Distinction between dirty P/L and hypothetical P/L (JP.

Morgan, Romain Berry 2011).

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Recommandation 3: The power of your tests may be low..

De…nition

The power of a backtesting test corresponds to its capacity to

detect misspeci…ed VaR model.

Pr [ Rejection H0 j H1 ]

Example

Berkowitz, J., Christo¤ersen, P. F., and Pelletier, D., 2013,

Evaluating Value-at-Risk Models with Desk-Level Data.

Management Science.

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Hurlin C. et Tokpavi S. (2008), ”Une Evaluation des

Procédures de Backtesting : Tout va pour le Mieux dans le

Meilleur des Mondes", Finance

Idea: we use 6 di¤erent methods (GARCH, RiskMetrics, HS,

CaviaR, Hybride, Delta Normale) to forecast a VaR(5%) on the

same asset (GM, Nasdaq), and we apply the backtests (LR, DQ,

Duration based tests) on a set of 500 samples (rolling window) of

T = 250 forecasts.

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Example

LRCC tests: for 47% of the samples, we don’t reject (at 5%) the

null for any of the six VaR forecats. In 71% of the samples, we

reject at the most one VaR.

Example

DQCC tests: for 20% of the samples, we don’t reject (at 5%) the

null for any of the six VaR forecats. In 51% of the samples, we

reject at the most one VaR.

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

The power of a consistent test tends to 1 when the sample

size tends to ini…nity.

Recommandation: increase at the maximum the sample size

of your backtest.. (T = 500, 750 or more.)

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Recommandation 4: Take into account the estimation risk

The risk dynamic is usually represented by a parametric or

semi-parametric model, which has to be estimated in a

preliminary step. However, the estimated counterparts of risk

measures are subject to estimation uncertainty.

Replacing, in the theoretical formulas, the true parameter

value by an estimator induces a bias in the coverage

probabilities.

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Escanciano and Olmo (2010, 2011) studied the e¤ects of

estimation risk on backtesting procedures. They showed how

to correct the critical values in standard tests used to assess

VaR models.

Escanciano, J.C. and J. Olmo (2010) Backtesting Parametric

Value-at-Risk with Estimation Risk, Journal of Business and

Economics Statistics.

Escanciano, J.C. and J. Olmo (2011) Robust Backtesting Tests

for Value-at-Risk Models. Journal of Financial Econometrics.

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Backtesting

Estimation Adjusted VaR

Gouriéroux and Zakoian (2013) a method to directly adjust the

VaR to estimation risk ensuring the right conditional coverage

probability at order 1/T :

Pr rt < EVaR t jt 1 (α) = α + oP (1/T )

Gouriéroux C. and Zakoian J.M. (2013), Estimation Adjusted

VaR, forthcoming in Econometric Theory.

Christophe Hurlin Backtesting

Introduction Test, test and test

Backtesting Principles Check the P&L data

Testing strategies The power of your tests may be low...

Recommandations Estimation risk

Thank you for your attention

Christophe Hurlin Backtesting

You might also like

- A Primer of Ecological Statistics, 2nd EditionDocument638 pagesA Primer of Ecological Statistics, 2nd EditionAnaCarolinaDevidesCastello75% (4)

- CHAPTER 8 Sampling and Sampling DistributionsDocument54 pagesCHAPTER 8 Sampling and Sampling DistributionsAyushi Jangpangi0% (1)

- Computer AssignmentDocument6 pagesComputer AssignmentSudheender Srinivasan0% (1)

- Tarea 4.2 Analisis de Regresesion MBA 5020Document4 pagesTarea 4.2 Analisis de Regresesion MBA 5020dilcia riveraNo ratings yet

- Original PDF A Primer of Ecological Statistics 2nd Edition PDFDocument41 pagesOriginal PDF A Primer of Ecological Statistics 2nd Edition PDFalice.bueckers152100% (34)

- Week5 Slides Hypothesis+testingDocument42 pagesWeek5 Slides Hypothesis+testingKinnata NikkoNo ratings yet

- Point Estimation and Interval Estimation: Learning ObjectivesDocument58 pagesPoint Estimation and Interval Estimation: Learning ObjectivesVasily PupkinNo ratings yet

- Practical Guide To Sequential Design - Webinar SlidesDocument28 pagesPractical Guide To Sequential Design - Webinar Slidestila12negaNo ratings yet

- Topic 9 Hypothesis TestingDocument12 pagesTopic 9 Hypothesis TestingMariam HishamNo ratings yet

- COR 006 ReviewerDocument5 pagesCOR 006 ReviewerMargie MarklandNo ratings yet

- bootstrapDocument12 pagesbootstrapIgnacioCortésFuentesNo ratings yet

- Method Validation: With ConfidenceDocument52 pagesMethod Validation: With ConfidenceAnonymous RrGVQj100% (2)

- PSYC 2070: Psychological Statistics: Hypothesis TestingDocument14 pagesPSYC 2070: Psychological Statistics: Hypothesis TestingChan WaiyinNo ratings yet

- Hypothesis Testing: Ervin C. ReyesDocument15 pagesHypothesis Testing: Ervin C. ReyesReyes C. ErvinNo ratings yet

- Evidence Based Medicine & Basic Critical AppraisalDocument47 pagesEvidence Based Medicine & Basic Critical AppraisalMohmmed Abu MahadyNo ratings yet

- MT Lectures 1-10Document178 pagesMT Lectures 1-10tuncerrNo ratings yet

- Chapter4 Statistical Hypothesis TestingDocument225 pagesChapter4 Statistical Hypothesis Testing古寒州No ratings yet

- Analitik Kimyada Yöntem Geliştirme Ve Veri Analizi ÖdevDocument18 pagesAnalitik Kimyada Yöntem Geliştirme Ve Veri Analizi ÖdevYağmur SoysalNo ratings yet

- Toc - 41r-08 - Range Risk AnalysisDocument4 pagesToc - 41r-08 - Range Risk AnalysisdeeptiNo ratings yet

- PS 9-2Document6 pagesPS 9-2justinesantana86No ratings yet

- VarbacktestsDocument28 pagesVarbacktestsHhp YmNo ratings yet

- Hypotheses TestingDocument8 pagesHypotheses TestingVon Adrian Inociaan HernandezNo ratings yet

- TP04 BasicStatistics p3Document6 pagesTP04 BasicStatistics p3tommy.santos2No ratings yet

- Pertemuan Ix (Analisis Statistik)Document58 pagesPertemuan Ix (Analisis Statistik)Chairunnisa Amelia S.Pd., M.Pd.No ratings yet

- Point Estimation and Interval Estimation: Learning ObjectivesDocument58 pagesPoint Estimation and Interval Estimation: Learning ObjectivesAnirban GoswamiNo ratings yet

- Week5 InferentionalstatDocument54 pagesWeek5 InferentionalstatdüşünennurNo ratings yet

- Pelletier Wei Backtesting v03Document37 pagesPelletier Wei Backtesting v03kecandirNo ratings yet

- 4-Pres-Sardjito-Prof. Dr. Djaswadi Dasuki - M.ph. - PhD. - SpOGDocument12 pages4-Pres-Sardjito-Prof. Dr. Djaswadi Dasuki - M.ph. - PhD. - SpOGLukas Anjar KrismulyonoNo ratings yet

- Chapter 4: Verification of Compendial MethodsDocument58 pagesChapter 4: Verification of Compendial MethodsBesfort KryeziuNo ratings yet

- Malhotra Mr7e 07Document41 pagesMalhotra Mr7e 07PeterParker1983No ratings yet

- Predictive Accuracy EvaluationDocument13 pagesPredictive Accuracy EvaluationSarFaraz Ali MemonNo ratings yet

- Introduction to T-test IDocument33 pagesIntroduction to T-test Iamedeuce lyatuuNo ratings yet

- HEALTH RISK ASSESSMENT: PRINSIP DAN APLIKASIDocument33 pagesHEALTH RISK ASSESSMENT: PRINSIP DAN APLIKASIRika ParafitaNo ratings yet

- 02 Utility Functions and Risk Aversion Coefficients SlidesDocument66 pages02 Utility Functions and Risk Aversion Coefficients SlidesJeremey Julian PonrajahNo ratings yet

- Improvements On CVBootstrapDocument14 pagesImprovements On CVBootstrapGuilherme MartheNo ratings yet

- Setting OELs, DR Robert Susman, SafebridgeDocument38 pagesSetting OELs, DR Robert Susman, SafebridgeMostofa RubalNo ratings yet

- A Calibration Hierarchy For Risk ModelsDocument10 pagesA Calibration Hierarchy For Risk ModelsGuilherme MartheNo ratings yet

- Practical Laboratory MedicineDocument10 pagesPractical Laboratory MedicineAbebeNo ratings yet

- Goodness of Fit FariasDocument15 pagesGoodness of Fit FariasHannan KüçükNo ratings yet

- Myhaccp - Operational Prerequisite Programmes Oprps - 2019-02-21Document5 pagesMyhaccp - Operational Prerequisite Programmes Oprps - 2019-02-21PrincessNovie Khryss PasionNo ratings yet

- Violation of OLS Assumptions: AutocorrelationDocument11 pagesViolation of OLS Assumptions: AutocorrelationAnuska JayswalNo ratings yet

- Estimating Uncertainty from Fuel SamplingDocument6 pagesEstimating Uncertainty from Fuel SamplingHAMCHI MohammedNo ratings yet

- Chapter Seven: Causal Research Design: ExperimentationDocument35 pagesChapter Seven: Causal Research Design: ExperimentationAshish H.K. JhaNo ratings yet

- Accuracy of Lelli Test for Detecting ACL TearsDocument5 pagesAccuracy of Lelli Test for Detecting ACL TearsMultan SohanhalwaNo ratings yet

- ASNE94 Paper PDFDocument6 pagesASNE94 Paper PDFAriana Lucia Rocha MendezNo ratings yet

- Analytical Method Validation and Quality AssuranceDocument19 pagesAnalytical Method Validation and Quality AssuranceAhmad ZaidiNo ratings yet

- Modelling Long-Run Relationship in Finance: Introductory Econometrics For Finance' © Chris Brooks 2013 1Document18 pagesModelling Long-Run Relationship in Finance: Introductory Econometrics For Finance' © Chris Brooks 2013 1Nouf ANo ratings yet

- Applied Statistics: Testing of HypothesesDocument21 pagesApplied Statistics: Testing of Hypothesesiiyousefgame YTNo ratings yet

- Hypothesis-Fall 20Document5 pagesHypothesis-Fall 20RupalNo ratings yet

- Screening and Diagnostic TestsDocument34 pagesScreening and Diagnostic TestsQuỳnh Anh Phạm HoàngNo ratings yet

- Model Diagnostics and Violation of OLS Assumptions: Session EightDocument95 pagesModel Diagnostics and Violation of OLS Assumptions: Session EightaimenNo ratings yet

- Evidence-Based Medicine Intrapericardial Left Ventricular Assist Device For Advanced Heart FailureDocument9 pagesEvidence-Based Medicine Intrapericardial Left Ventricular Assist Device For Advanced Heart FailureputrishabrinaNo ratings yet

- Conducting Hypothesis Tests Using Classical and P-Value MethodsDocument34 pagesConducting Hypothesis Tests Using Classical and P-Value MethodsManzanilla FlorianNo ratings yet

- Assessing Accuracy of Value at Risk Models in Real-TimeDocument23 pagesAssessing Accuracy of Value at Risk Models in Real-Timerzrt rt r tzrNo ratings yet

- FRM 2017 Part I Garp Book 4 New EditionDocument343 pagesFRM 2017 Part I Garp Book 4 New Editionkanna275100% (3)

- Kerbala Journal of Pharmaceutical Sciences. No. (15) 2018 15) ﺩﺩﻌﻟﺍ ﺔﻳﻧﻻﺩﻳﺻﻟﺍ ﻡﻭﻠﻌﻠﻟ ءﻼﺑﺭﻛ ﺔﻠﺟﻣDocument17 pagesKerbala Journal of Pharmaceutical Sciences. No. (15) 2018 15) ﺩﺩﻌﻟﺍ ﺔﻳﻧﻻﺩﻳﺻﻟﺍ ﻡﻭﻠﻌﻠﻟ ءﻼﺑﺭﻛ ﺔﻠﺟﻣMarda LinaNo ratings yet

- At114 Audit Sampling PDF FreeDocument8 pagesAt114 Audit Sampling PDF FreeKaila SalemNo ratings yet

- Lecture 6Document11 pagesLecture 6alcinialbob1234No ratings yet

- Cognitive Behavior Therapy: Applying Empirically Supported Techniques in Your PracticeFrom EverandCognitive Behavior Therapy: Applying Empirically Supported Techniques in Your PracticeNo ratings yet

- The Design and Management of Medical Device Clinical Trials: Strategies and ChallengesFrom EverandThe Design and Management of Medical Device Clinical Trials: Strategies and ChallengesNo ratings yet

- Sensitivity Analysis in Practice: A Guide to Assessing Scientific ModelsFrom EverandSensitivity Analysis in Practice: A Guide to Assessing Scientific ModelsNo ratings yet

- Investment Guarantees: Modeling and Risk Management for Equity-Linked Life InsuranceFrom EverandInvestment Guarantees: Modeling and Risk Management for Equity-Linked Life InsuranceRating: 3.5 out of 5 stars3.5/5 (2)

- Fractals and Chaos in NatureDocument43 pagesFractals and Chaos in NatureV Prasanna ShrinivasNo ratings yet

- Hidden Neurons PDFDocument12 pagesHidden Neurons PDFmanojaNo ratings yet

- Discovering Process Models from Event Logs Using Workflow MiningDocument38 pagesDiscovering Process Models from Event Logs Using Workflow MiningV Prasanna ShrinivasNo ratings yet

- Improving Object Detection With One Line of Code: April 2017Document10 pagesImproving Object Detection With One Line of Code: April 2017V Prasanna ShrinivasNo ratings yet

- Introduction: What Is Ontology For?: Unauthenticated - 79.112.227.113 Download Date - 7/3/14 7:56 PMDocument13 pagesIntroduction: What Is Ontology For?: Unauthenticated - 79.112.227.113 Download Date - 7/3/14 7:56 PMalinm_escuNo ratings yet

- Automatic Image Filtering On Social Networks Using Deep Learning and Perceptual Hashing During CrisesDocument13 pagesAutomatic Image Filtering On Social Networks Using Deep Learning and Perceptual Hashing During CrisesV Prasanna ShrinivasNo ratings yet

- Heuristic Approachesfor Generating Local Process Models Through Log ProjectionsDocument9 pagesHeuristic Approachesfor Generating Local Process Models Through Log ProjectionsV Prasanna ShrinivasNo ratings yet

- Suggestive Annotation: A Deep Active Learning Framework For Biomedical Image SegmentationDocument8 pagesSuggestive Annotation: A Deep Active Learning Framework For Biomedical Image SegmentationV Prasanna ShrinivasNo ratings yet

- Comparative Study of Contributions of Nrsimha Bhārati Mahāswāmiji With That of Adi ShankaracharyaDocument5 pagesComparative Study of Contributions of Nrsimha Bhārati Mahāswāmiji With That of Adi ShankaracharyaV Prasanna ShrinivasNo ratings yet

- Unsupervised Event AbstractionDocument9 pagesUnsupervised Event AbstractionV Prasanna ShrinivasNo ratings yet

- Understanding OCR 2018Document24 pagesUnderstanding OCR 2018V Prasanna ShrinivasNo ratings yet

- Automated text annotation using tactical cognitive computingDocument2 pagesAutomated text annotation using tactical cognitive computingV Prasanna ShrinivasNo ratings yet

- A Reinforcement Learning-Based Adaptive Learning System: January 2018Document12 pagesA Reinforcement Learning-Based Adaptive Learning System: January 2018V Prasanna ShrinivasNo ratings yet

- An Analysis of Scale Invariance in Object DetectioDocument11 pagesAn Analysis of Scale Invariance in Object DetectioV Prasanna ShrinivasNo ratings yet

- An Approach To Extract Special Skills To Improve TDocument20 pagesAn Approach To Extract Special Skills To Improve TV Prasanna ShrinivasNo ratings yet

- An Algorithm For Japanese Character RecognitionDocument8 pagesAn Algorithm For Japanese Character RecognitionV Prasanna ShrinivasNo ratings yet

- Multidomain Document Layout Understanding using Few Shot Object DetectionDocument9 pagesMultidomain Document Layout Understanding using Few Shot Object DetectionV Prasanna ShrinivasNo ratings yet

- Learning Mahalanobis Distance For DTW Based Online Signature VerificationDocument7 pagesLearning Mahalanobis Distance For DTW Based Online Signature VerificationV Prasanna ShrinivasNo ratings yet

- A Reinforcement Learning-Based Adaptive Learning System: January 2018Document12 pagesA Reinforcement Learning-Based Adaptive Learning System: January 2018V Prasanna ShrinivasNo ratings yet

- Sindbad 1Document1 pageSindbad 1V Prasanna ShrinivasNo ratings yet

- A Nova Cosine SimilarityDocument12 pagesA Nova Cosine SimilarityV Prasanna ShrinivasNo ratings yet

- Sindbad 1Document1 pageSindbad 1V Prasanna ShrinivasNo ratings yet

- Infographics CVDocument1 pageInfographics CVV Prasanna ShrinivasNo ratings yet

- Sindbad 1Document1 pageSindbad 1V Prasanna ShrinivasNo ratings yet

- Radhegovinda 3Document3 pagesRadhegovinda 3V Prasanna ShrinivasNo ratings yet

- Gaur2020 Article Semi-supervisedDeepLearningBasDocument14 pagesGaur2020 Article Semi-supervisedDeepLearningBasV Prasanna ShrinivasNo ratings yet

- Sindbad 1Document1 pageSindbad 1V Prasanna ShrinivasNo ratings yet

- Sindbad 1Document1 pageSindbad 1V Prasanna ShrinivasNo ratings yet

- Radhegovinda 3Document3 pagesRadhegovinda 3V Prasanna ShrinivasNo ratings yet

- Lesson 4 - Testing A Population ProportionDocument2 pagesLesson 4 - Testing A Population ProportionYolanda DescallarNo ratings yet

- Silabus AACSB-S1 - Analitik Bisnis - Gasal 18-19Document5 pagesSilabus AACSB-S1 - Analitik Bisnis - Gasal 18-19Hadila Franciska StevanyNo ratings yet

- Radar Detection Clutter: in WeibullDocument8 pagesRadar Detection Clutter: in Weibullnaveen991606No ratings yet

- Student Assignment Analyzes Statistics ProblemsDocument2 pagesStudent Assignment Analyzes Statistics ProblemsKuberanNo ratings yet

- CH 4 Demand EstimationDocument27 pagesCH 4 Demand EstimationNovhendraNo ratings yet

- Introduction To Descriptive StatisticsDocument73 pagesIntroduction To Descriptive StatisticsVinay DuttaNo ratings yet

- FsagDocument5 pagesFsagthrowaway1609No ratings yet

- Econometric Lec7Document26 pagesEconometric Lec7nhungNo ratings yet

- MMW - Module 4-1Document80 pagesMMW - Module 4-1Arc EscritosNo ratings yet

- Hierarchical RegressionDocument3 pagesHierarchical RegressionWale AfebioyeNo ratings yet

- Overfitting and Underfitting in Machine LearningDocument3 pagesOverfitting and Underfitting in Machine LearningZahid JavedNo ratings yet

- MIT 6.437 Inference and Information Spring 2022 Course OverviewDocument7 pagesMIT 6.437 Inference and Information Spring 2022 Course OverviewNakul ShenoyNo ratings yet

- Answers To Student's Questions On Frequency DistributionDocument5 pagesAnswers To Student's Questions On Frequency DistributionAntoinette Stewart-AchéNo ratings yet

- Regression AnalysisDocument19 pagesRegression AnalysisPRANAYNo ratings yet

- Discussion 3Document29 pagesDiscussion 3Krisha DelapenaNo ratings yet

- 1 Problems 1: STAT 3004: Assignment 4Document3 pages1 Problems 1: STAT 3004: Assignment 4屁屁豬No ratings yet

- Skittles ProjectDocument9 pagesSkittles Projectapi-252747849No ratings yet

- Tugas Perbandingan Metode Ols Dan 2SLSDocument3 pagesTugas Perbandingan Metode Ols Dan 2SLSElmi ZakiyahNo ratings yet

- Point Pattern Analysis: Using Spatial Inferential StatisticsDocument34 pagesPoint Pattern Analysis: Using Spatial Inferential StatisticskimhoaNo ratings yet

- Commonly Used Statistical Terms ExplainedDocument4 pagesCommonly Used Statistical Terms ExplainedMadison Hartfield100% (1)

- PCA Explained: Dimension Reduction Using Principal Component AnalysisDocument53 pagesPCA Explained: Dimension Reduction Using Principal Component AnalysisOntime BestwritersNo ratings yet

- Hypothesis Testing: Prepared By: Mr. Ian Anthony M. Torrente, LPTDocument23 pagesHypothesis Testing: Prepared By: Mr. Ian Anthony M. Torrente, LPTAldrich MartirezNo ratings yet

- What Test Flowchart and TableDocument2 pagesWhat Test Flowchart and TableiyerpadmaNo ratings yet

- (Kaddour Hadri, William Mikhail, Kaddour Hadri, WiDocument616 pages(Kaddour Hadri, William Mikhail, Kaddour Hadri, Wichefika belhiaNo ratings yet

- 410Hw02 PDFDocument3 pages410Hw02 PDFdNo ratings yet

- Probability and Probability DistributionsDocument24 pagesProbability and Probability DistributionsShubham JadhavNo ratings yet

- Assignment 1Document2 pagesAssignment 1Dong NguyenNo ratings yet