Professional Documents

Culture Documents

Estimating A Demand Function - It's About Time

Uploaded by

Sebastián RojasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimating A Demand Function - It's About Time

Uploaded by

Sebastián RojasCopyright:

Available Formats

Estimating a demand function — it’s about time

Our earlier look at estimating a demand function demonstrated how multiple regres-

sion could be used to estimate the demand for gasoline as a function of various predictors,

including its price. The simple model described at the end of the case was based on the

price index of gasoline (logPG), per capita income (logI) and Year2 (YRSQ):

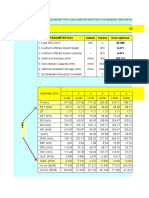

Regression Analysis

The regression equation is

logGpc = - 3.73 - 0.164 logPG + 1.21 logI -0.000139 YRSQ

Predictor Coef SE Coef T P VIF

Constant -3.7258 0.2082 -17.90 0.000

logPG -0.16397 0.01874 -8.75 0.000 5.8

logI 1.21090 0.05384 22.49 0.000 5.5

YRSQ -0.00013895 0.00001835 -7.57 0.000 1.5

S = 0.01207 R-Sq = 96.9% R-Sq(adj) = 96.6%

Analysis of Variance

Source DF SS MS F P

Regression 3 0.145410 0.048470 332.44 0.000

Residual Error 32 0.004666 0.000146

Total 35 0.150076

Although this model fits the data reasonably well, it does suffer from a difficulty —

it does not address the time ordering of the data. In fact, the residuals from this model

exhibit autocorrelation, as can be seen from this time series plot:

c 2014, Jeffrey S. Simonoff

1

2

1

SRES1

-1

-2

Index 10 20 30

The Durbin–Watson statistic supports this, as it equals 0.50; so does the runs test

(although a bit weaker):

Runs Test: SRES1

SRES1

K = 0.0100

The observed number of runs = 13

The expected number of runs = 18.7778

20 Observations above K 16 below

The test is significant at 0.0478

The ACF plot of the standardized residuals also indicates autocorrelation:

c 2014, Jeffrey S. Simonoff

2

Autocorrelation Function for SRES1

1.0

Autocorrelation

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

1 2 3 4 5 6 7 8 9

Lag Corr T LBQ Lag Corr T LBQ

1 0.68 4.06 17.93 8 -0.30 -1.13 37.47

2 0.34 1.47 22.55 9 -0.35 -1.24 43.54

3 0.13 0.52 23.23

4 -0.10 -0.40 23.64

5 -0.24 -0.97 26.18

6 -0.25 -0.98 29.01

7 -0.29 -1.11 32.96

As we’ve discussed, one approach for handling autocorrelation is to use a lagged version

of the target variable as a predictor (Lagged logGpc, saying that the previous year’s gas

consumption goes a long way to predicting this year’s consumption, due to basic stability

in the process). Also, in thinking about the dynamics of how people decide to use their

automobiles, it seems reasonable to consider also using a lagged version of the price index

of gasoline, Lagged logPG (saying that consumption might be affected not only by current

price, but previous price, because of the perception of people that prices are increasing

or decreasing). Generally speaking, using lagged versions of predictors is not designed to

specifically address autocorrelation (as the use of the lagged target as a predictor often is),

but rather based on such use making sense in context.

Here is a scatter plot of logged per capita consumption on the previous year’s logged

per capita consumption. We can see that there is a strong relationship, although it is

apparently weaker for the higher values. I haven’t bothered to give the plot of logged per

capita consumption versus previous year’s price index, since it looks very similar to the

one for current year’s price index that we saw earlier.

c 2014, Jeffrey S. Simonoff

3

Here is output for a regression using these variables, along with logPG, as predictors

(I could have used a best subsets regression here, but it’s clear that all three variables

provide a lot of predictive power):

Regression Analysis

The regression equation is

logGpc = - 0.0529 + 1.08 Lagged logGpc - 0.328 logPG

+ 0.290 Lagged logPG

35 cases used 1 cases contain missing values

Predictor Coef SE Coef T P VIF

Constant -0.05288 0.03063 -1.73 0.094

Lagged l 1.07507 0.03256 33.01 0.000 2.3

logPG -0.32784 0.03625 -9.04 0.000 45.4

Lagged l 0.29023 0.03358 8.64 0.000 39.4

S = 0.008158 R-Sq = 98.4% R-Sq(adj) = 98.3%

Analysis of Variance

Source DF SS MS F P

Regression 3 0.127284 0.042428 637.51 0.000

Residual Error 31 0.002063 0.000067

Total 34 0.129347

c 2014, Jeffrey S. Simonoff

4

The model fits very well, and the autocorrelation has apparently been removed. We

might also consider a further simplification of the model. Note that the estimated slopes

for logged price and lagged logged price are very similar in magnitude and of opposite sign;

that suggests that replacing the two variables with their difference could provide similar

fit, and would be easily interpretable as implying that it is simply the change in price,

along with the previous year’s consumption, that are related to current consumption. A

partial F -test of this hypothesis (βlogPG = −βlaglogPG ), however, does not support this

simplification (F = 22.8, p < .0001), so we will not pursue this further.

A time series plot of the residuals, however, shows that there is a clear outlier:

0

SRES2

-1

-2

-3

-4

Index 10 20 30

This outlier corresponds to 1991:

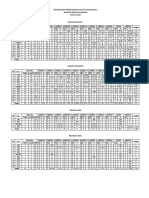

Row Year logGpc SRES2 HI2 COOK2

1 1960 0.85772 * * *

2 1961 0.85583 -2.19803 0.166530 0.241328

3 1962 0.86806 0.02270 0.174651 0.000027

4 1963 0.87579 -0.80749 0.145953 0.027857

5 1964 0.89125 0.07544 0.130924 0.000214

6 1965 0.90611 0.61353 0.113090 0.011999

7 1966 0.92591 0.88899 0.089974 0.019534

8 1967 0.93752 -0.14895 0.073089 0.000437

c 2014, Jeffrey S. Simonoff

5

9 1968 0.96368 1.35005 0.068043 0.033268

10 1969 0.98779 1.19743 0.067586 0.025983

11 1970 1.00721 0.01578 0.094891 0.000007

12 1971 1.02345 -0.61246 0.127361 0.013687

13 1972 1.03491 -1.30374 0.157625 0.079513

14 1973 1.05138 0.80589 0.135470 0.025443

15 1974 1.02465 -0.97127 0.237654 0.073521

16 1975 1.03286 0.15422 0.051697 0.000324

17 1976 1.04569 0.34341 0.060323 0.001893

18 1977 1.05460 0.08992 0.069092 0.000150

19 1978 1.07060 0.77236 0.081818 0.013289

20 1979 1.04468 0.09022 0.221465 0.000579

21 1980 0.99919 -1.22083 0.316834 0.172805

22 1981 0.99262 1.04975 0.148019 0.047863

23 1982 0.99460 -0.55284 0.118739 0.010295

24 1983 1.01066 1.50700 0.103501 0.065548

25 1984 1.01604 0.23891 0.080059 0.001242

26 1985 1.01414 -0.34561 0.073825 0.002380

27 1986 1.04995 -0.15029 0.292040 0.002329

28 1987 1.05783 0.63400 0.049303 0.005211

29 1988 1.05873 -0.78952 0.063589 0.010582

30 1989 1.06109 0.86471 0.058482 0.011611

31 1990 1.05335 0.55444 0.084320 0.007077

32 1991 1.03261 -3.51351 0.076899 0.257095

33 1992 1.04080 0.58789 0.068258 0.006330

34 1993 1.04596 0.00685 0.068665 0.000001

35 1994 1.04710 -0.29816 0.065460 0.001557

36 1995 1.05415 0.63187 0.064769 0.006913

This year was the year of a serious recession and the first Gulf War (Operation Desert

Storm), so apparently gasoline consumption decreased during this time period. As an

outlier, we could contemplate removing this case and reanalyzing the data. Unfortunately,

if we do that, we will disturb the natural time ordering in the data. An alternative approach

is to substitute a “reasonable” value, such as the average of the two neighboring values,

for the outlying value, and then reanalyze the entire adjusted data set. This is admittedly

an ad hoc solution, and more complex (and theoretically justified) substitution methods

are possible. Still, very simple techniques like this can work quite adequately.

c 2014, Jeffrey S. Simonoff

6

For these data, the gas consumption of 1.03261 is too low, relative to the values of

1.05335 for 1990 and 1.0408 for 1992, so the averaged value of 1.04708 is substituted (of

course, when discussing our results, we must note that they no longer apply to 1991,

or future years that might be like 1991; recessions, for example). Here is the resultant

regression output:

Regression Analysis

The regression equation is

logGpc = - 0.0565 + 1.08 Lagged logGpc - 0.334 logPG

+ 0.298 Lagged logPG

35 cases used 1 cases contain missing values

Predictor Coef SE Coef T P VIF

Constant -0.05651 0.02576 -2.19 0.036

Lagged l 1.07892 0.02739 39.39 0.000 2.3

logPG -0.33409 0.03049 -10.96 0.000 45.4

Lagged l 0.29759 0.02824 10.54 0.000 39.4

S = 0.006862 R-Sq = 98.9% R-Sq(adj) = 98.8%

Analysis of Variance

Source DF SS MS F P

Regression 3 0.128926 0.042975 912.79 0.000

Residual Error 31 0.001460 0.000047

Total 34 0.130386

The model fits slightly better, but the coefficients have changed little. More impor-

tantly, there is no autocorrelation, and no outliers are apparent:

c 2014, Jeffrey S. Simonoff

7

Normal Probability Plot of the Residuals

(response is logGpc)

1

Normal Score

-1

-2

-3 -2 -1 0 1 2

Standardized Residual

0

SRES3

-1

-2

-3

Index 10 20 30

c 2014, Jeffrey S. Simonoff

8

Autocorrelation Function for SRES2

1.0

Autocorrelation

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

1 2 3 4 5 6 7 8

Lag Corr T LBQ Lag Corr T LBQ

1 -0.19 -1.12 1.36 8 0.01 0.07 8.35

2 0.07 0.41 1.56

3 0.06 0.35 1.72

4 -0.22 -1.27 3.82

5 -0.10 -0.56 4.28

6 0.04 0.20 4.34

7 -0.29 -1.58 8.34

Runs Test: SRES2

SRES2

K = -0.0148

The observed number of runs = 22

The expected number of runs = 17.8000

21 Observations above K 14 below

The test is significant at 0.1328

Cannot reject at alpha = 0.05

Row Year logGpc SRES3 HI3 COOK3

1 1960 0.85772 * * *

2 1961 0.85583 -2.55989 0.166530 0.327330

3 1962 0.86806 0.09034 0.174651 0.000432

4 1963 0.87579 -0.90839 0.145953 0.035255

5 1964 0.89125 0.13495 0.130924 0.000686

6 1965 0.90611 0.78300 0.113090 0.019544

7 1966 0.92591 1.09185 0.089974 0.029467

8 1967 0.93752 -0.15210 0.073089 0.000456

9 1968 0.96368 1.61432 0.068043 0.047567

10 1969 0.98779 1.42412 0.067586 0.036752

c 2014, Jeffrey S. Simonoff

9

11 1970 1.00721 -0.00708 0.094891 0.000001

12 1971 1.02345 -0.76761 0.127361 0.021499

13 1972 1.03491 -1.59821 0.157625 0.119489

14 1973 1.05138 0.93727 0.135470 0.034414

15 1974 1.02465 -1.09989 0.237654 0.094282

16 1975 1.03286 0.12996 0.051697 0.000230

17 1976 1.04569 0.33488 0.060323 0.001800

18 1977 1.05460 0.02913 0.069092 0.000016

19 1978 1.07060 0.82485 0.081818 0.015157

20 1979 1.04468 0.10898 0.221465 0.000845

21 1980 0.99919 -1.44476 0.316834 0.242012

22 1981 0.99262 1.16183 0.148019 0.058629

23 1982 0.99460 -0.81402 0.118739 0.022320

24 1983 1.01066 1.64740 0.103501 0.078331

25 1984 1.01604 0.14236 0.080059 0.000441

26 1985 1.01414 -0.54445 0.073825 0.005907

27 1986 1.04995 -0.45074 0.292040 0.020952

28 1987 1.05783 0.63208 0.049303 0.005180

29 1988 1.05873 -1.08116 0.063589 0.019844

30 1989 1.06109 0.91787 0.058482 0.013083

31 1990 1.05335 0.55781 0.084320 0.007163

32 1991 1.04708 -2.15160 0.076899 0.096413

33 1992 1.04080 0.55002 0.068258 0.005541

34 1993 1.04596 -0.14783 0.068665 0.000403

35 1994 1.04710 -0.50620 0.065460 0.004487

36 1995 1.05415 0.60268 0.064769 0.006289

The residual versus fitted plot gives a slight indication of structure, but given the very

high R2 here, it is unlikely that any corrective action would make much of a difference.

c 2014, Jeffrey S. Simonoff

10

Residuals Versus the Fitted Values

(response is logGpc)

1

Standardized Residual

-1

-2

-3

0.85 0.95 1.05

Fitted Value

This new gas demand function has an appealing intuitive justification. Given the last

two years’ prices, gasoline demand is directly to last year’s demand (1% higher demand

last year is associated with 1.08% estimated expected increase this year). Given last year’s

demand and price, this year’s demand is inversely related to this year’s price, which is the

inverse demand / price relationship expected from economic theory (1% higher price is

associated with .33% estimated expected decrease in demand). Further, given this year’s

price and last year’s demand, this year’s demand is directly related to last year’s price

(1% higher price last year is associated with .30% estimated expected increase in demand

this year). This also makes sense, since a higher value of last year’s price, given this year’s

price is fixed, is consistent with a decreasing price trend, which would encourage additional

consumption. The standard error of the estimate implies that per capita gas demand can

be predicted to within 3% (10.013724 = 1.03).

The fill–in method for handling an outlier used here has two limitations that are

worth noting. First, adjusting the target (y) value will not fix leverage points, so they

are characterized by unusual predictor values, not unusual target values. Second, unusual

observations often occur in “patches” in time series data, reflecting a temporary change in

the underlying structure of the process; a constant fill–in for four or five (say) consecutive

time periods is obviously not accurately reflecting what we think the series really should

be.

c 2014, Jeffrey S. Simonoff

11

An alternative that addresses both of these points (and is thus the only alternative for

handling leverage points) is to create an indicator variable that defines the outlier or patch

of outliers, equaling one for all observations in the patch, and zero otherwise (isolated

outliers that are not in a consecutive patch of years have a 0/1 variable defined for each

of them). Including this variable in the regression will effectively remove the influence of

the unusual values from the regression fit. Here is how this works for these data (with

Year1991 defining only 1991).

Regression Analysis

The regression equation is

logGpc = - 0.0604 + 1.08 Lagged logGpc - 0.341 logPG

+ 0.305 Lagged logPG - 0.0298 Year1991

35 cases used 1 cases contain missing values

Predictor Coef SE Coef T P

Constant -0.06036 0.02421 -2.49 0.018

Lagged l 1.08300 0.02574 42.07 0.000

logPG -0.34073 0.02873 -11.86 0.000

Lagged l 0.30539 0.02670 11.44 0.000

Year1991 -0.029833 0.006696 -4.46 0.000

S = 0.006433 R-Sq = 99.0% R-Sq(adj) = 98.9%

Analysis of Variance

Source DF SS MS F P

Regression 4 0.128105 0.032026 773.86 0.000

Residual Error 30 0.001242 0.000041

Total 34 0.129347

The fitted coefficients are virtually the same as when the fill–in method is used. One

additional piece of information from this approach is the coefficient for Year1991: given

previous year’s gasoline consumption, and this and last year’s gasoline price index, the

observed logged per capita consumption for 1991 is seen to have been .0298 lower than

c 2014, Jeffrey S. Simonoff

12

expected (translating to a demand roughly 6.6% lower than expected that year), and this

amount is significantly different from zero (p < .001). Thus, the t–test for the indicator

variable is a formal test of whether the point is an outlier (but remember that it would

not necessarily be significant for a leverage point).

Two issues related to software in general and Minitab in particular if you use this

method:

(1) You should set the standardized residual for any observations identified by a single

0/1 variable equal to 0 (Minitab sets them equal to *, since they are technically 0/0).

(2) If you are doing model selection (using best subsets, for example), you must be careful

to force the indicator variables that define the unusual observations into all models,

to make sure that those points are effectively omitted from the sample. This is par-

ticularly important for a leverage point, since its corresponding indicator will not

necessarily be identified as an important predictor by best subsets, even if its inclu-

sion could greatly change the fitted regression.

c 2014, Jeffrey S. Simonoff

13

You might also like

- Repairable Non RepairableDocument33 pagesRepairable Non Repairablemobile legendNo ratings yet

- Examination in Land Economy For The Degree of Master of PhilosophyDocument6 pagesExamination in Land Economy For The Degree of Master of PhilosophytatslaNo ratings yet

- Ass No 4Document10 pagesAss No 4Muhammad Bilal MakhdoomNo ratings yet

- Business Research: Corporate Governance in Financial Institutions of BangladeshDocument31 pagesBusiness Research: Corporate Governance in Financial Institutions of BangladeshShahriar HaqueNo ratings yet

- Tugas Kalibrasi ModelDocument8 pagesTugas Kalibrasi ModelFajar100% (1)

- ArXiv 2012 L+PDocument9 pagesArXiv 2012 L+PHedim OsmanovicNo ratings yet

- The Box-Jenkins PracticalDocument9 pagesThe Box-Jenkins PracticalDimpho Sonjani-SibiyaNo ratings yet

- Rain Water Basin DesignDocument11 pagesRain Water Basin DesignSturza AnastasiaNo ratings yet

- Tugas Praktikum Pak MansurDocument6 pagesTugas Praktikum Pak MansurFuadNo ratings yet

- Chapter 9Document15 pagesChapter 9Fanny Sylvia C.No ratings yet

- General Linear Model Do MinitabDocument48 pagesGeneral Linear Model Do MinitabJose MadymeNo ratings yet

- Relationship between GDP and Exports over Time: A Case Study of IndiaDocument7 pagesRelationship between GDP and Exports over Time: A Case Study of IndiaAnimesh NandaNo ratings yet

- Homework #1 Analyzes Non-Stationary Time Series DataDocument21 pagesHomework #1 Analyzes Non-Stationary Time Series Dataсимона златковаNo ratings yet

- Arch Garch AssignmentDocument5 pagesArch Garch AssignmentSurbhiVijhaniNo ratings yet

- Uji Asumsi Atau Uji Persyaratan AnalitisDocument3 pagesUji Asumsi Atau Uji Persyaratan AnalitisGladya PurbaNo ratings yet

- Full Factorial DesignDocument14 pagesFull Factorial DesignPae TankNo ratings yet

- 2-Siklus RegresiDocument27 pages2-Siklus RegresiAryNo ratings yet

- Tutorial 3 SolutionDocument8 pagesTutorial 3 Solutionthanusha selvamanyNo ratings yet

- ECM Lampiran 1 DataDocument12 pagesECM Lampiran 1 DataDevi SantikasariNo ratings yet

- Econometrics Hina NazDocument17 pagesEconometrics Hina NazHina Naz (F-Name :Khadim Hussain)No ratings yet

- Drag On A SphereDocument16 pagesDrag On A SphereMiketanenbaumNo ratings yet

- Tugas 3 EKOMET Muh RAFIDocument5 pagesTugas 3 EKOMET Muh RAFIdaffa luthfianNo ratings yet

- XRF Data Analysis InsightsDocument3 pagesXRF Data Analysis InsightsSakura ShirayukiNo ratings yet

- PBI por sectores económicos 1997-2021Document6 pagesPBI por sectores económicos 1997-2021Robert ParrillaNo ratings yet

- Analysis of Residuals and Panel Data Regression ResultsDocument3 pagesAnalysis of Residuals and Panel Data Regression ResultsVeyrazzNo ratings yet

- Controlling Interest Rates - Bank of Russia Monetary Policy EfficiencyDocument5 pagesControlling Interest Rates - Bank of Russia Monetary Policy EfficiencyJ MNo ratings yet

- PreviewDocument8 pagesPreviewGoldy ThariqNo ratings yet

- Nested Anova RevisedDocument6 pagesNested Anova RevisedRanjeet DongreNo ratings yet

- NR Report 1Document10 pagesNR Report 1shailesh upadhyayNo ratings yet

- SPSS - BW AsigesDocument6 pagesSPSS - BW AsigesBAGAS PUTRA PRATAMANo ratings yet

- Newton Raphson Submission FileDocument9 pagesNewton Raphson Submission Fileshailesh upadhyayNo ratings yet

- DF SS MS F Significan Ce FDocument4 pagesDF SS MS F Significan Ce FRamil AliyevNo ratings yet

- Regresi PanelDocument25 pagesRegresi PanelM. Yusuf DaliNo ratings yet

- ParallelDocument9 pagesParallelSagar RawalNo ratings yet

- Tema 8Document10 pagesTema 8MaríaDelCarmenRiveroArdayaNo ratings yet

- C) Statistical Empirical Findings: Statistic - HTMDocument3 pagesC) Statistical Empirical Findings: Statistic - HTMalexisgarefalakisNo ratings yet

- Caso 3 Homework7SolutionsDocument8 pagesCaso 3 Homework7SolutionsdeyviNo ratings yet

- Analisis PPT T5 2022Document6 pagesAnalisis PPT T5 2022norhashimahNo ratings yet

- CGT21027 BIDM Individual AssignmentDocument7 pagesCGT21027 BIDM Individual AssignmentBhargav Sri DhavalaNo ratings yet

- Seminar Final Word FileDocument8 pagesSeminar Final Word FileGhulam MustafaNo ratings yet

- 3 V Regression Mod 2Document39 pages3 V Regression Mod 2Rajat AggarwalNo ratings yet

- Fea 1Document9 pagesFea 1Mubah SalahuddinNo ratings yet

- Metabolism and Distribution Fibrinogen: N. H. Claeys RDocument20 pagesMetabolism and Distribution Fibrinogen: N. H. Claeys RRA denNo ratings yet

- Test ModelDocument17 pagesTest ModelThanapat ThepubonNo ratings yet

- Practica N° 1 PIB, X e M regression analysisDocument5 pagesPractica N° 1 PIB, X e M regression analysisJesse PalmaNo ratings yet

- RXNSDocument10 pagesRXNSArcangelo Di TanoNo ratings yet

- Solución de La Primera Practica Calificada de Econometria IDocument6 pagesSolución de La Primera Practica Calificada de Econometria IJuan DiazNo ratings yet

- OutputDocument2 pagesOutputMUHAMMED ASHIQ VNo ratings yet

- Redundant Fixed Effects Tests FP To DLLP 2Document2 pagesRedundant Fixed Effects Tests FP To DLLP 2Kartika Amalia100% (1)

- Data and Model SpecificationDocument4 pagesData and Model SpecificationSakib AhmedNo ratings yet

- Correlation, Regression and Test of Signficance in RDocument16 pagesCorrelation, Regression and Test of Signficance in RpremNo ratings yet

- BFBV ReportDocument22 pagesBFBV ReportAASTHA MITTALNo ratings yet

- UJIAN AKHIR SEMESTER EKONOMETRIKA TIME SERIESDocument5 pagesUJIAN AKHIR SEMESTER EKONOMETRIKA TIME SERIESKPAT KiverNo ratings yet

- Assignment - 01 - SEC - B - GROUP No. 11Document14 pagesAssignment - 01 - SEC - B - GROUP No. 11RahulTiwariNo ratings yet

- Experiment 1 Control ValvesDocument26 pagesExperiment 1 Control Valvesabu hassan100% (1)

- M Alfitrah Gilang Dianto 213210363Document4 pagesM Alfitrah Gilang Dianto 213210363M. Alfitrah Gilang DiantoNo ratings yet

- National Institute of Technology, Tiruchirappalli MBA Trimester Examination, Basic Data Analytic Marathon ExamDocument22 pagesNational Institute of Technology, Tiruchirappalli MBA Trimester Examination, Basic Data Analytic Marathon ExamArjun Jinumon PootharaNo ratings yet

- Pipe flow analysis resultsDocument4 pagesPipe flow analysis resultsJuan MendozaNo ratings yet

- Chapter 6 (Part I)Document40 pagesChapter 6 (Part I)Natasha Ghazali0% (1)

- Measure of Central Tendency and VariabilityDocument73 pagesMeasure of Central Tendency and VariabilityKristine Joy HallaresNo ratings yet

- Data Analyisis FinalsDocument25 pagesData Analyisis FinalsAerol Magpile100% (1)

- SAS 2130 Statistics - Civil, BEdDocument4 pagesSAS 2130 Statistics - Civil, BEdIsaac OgolaNo ratings yet

- Assignment 1Document6 pagesAssignment 1Anonymous uIFbZlMNo ratings yet

- TTQC-Yarn Part (Class 6)Document12 pagesTTQC-Yarn Part (Class 6)A. S. M. Shafayat AzadNo ratings yet

- Case Analysis FinalDocument7 pagesCase Analysis FinalPatricia ArominNo ratings yet

- A. B. D. E.: AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Index ModelsDocument2 pagesA. B. D. E.: AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Index ModelsHayley ChengNo ratings yet

- Skittles Project Data This OneDocument4 pagesSkittles Project Data This Oneapi-2855517690% (1)

- Assignment 2 Edwin CastilloDocument10 pagesAssignment 2 Edwin CastilloEdwin CastilloNo ratings yet

- MASH WhatStatisticalTestHandout PDFDocument2 pagesMASH WhatStatisticalTestHandout PDFMatteoParolloNo ratings yet

- BIA B350F - 2022 Autumn - Specimen Exam PaperDocument13 pagesBIA B350F - 2022 Autumn - Specimen Exam PaperNile SethNo ratings yet

- ANALISIS FAKTOR DARI DATA MENTAH RAMA-dikonversiDocument3 pagesANALISIS FAKTOR DARI DATA MENTAH RAMA-dikonversiMuhammad Ramadhan As'arryNo ratings yet

- Quantitative Demand AnalysisDocument34 pagesQuantitative Demand AnalysisNhi BuiNo ratings yet

- Eviews Class ProblemsDocument3 pagesEviews Class ProblemsLakshmiNo ratings yet

- Fundamental Law FTDocument33 pagesFundamental Law FTRafael BeloNo ratings yet

- BUSINESS STATISTICS AND DATA ANALYSISDocument8 pagesBUSINESS STATISTICS AND DATA ANALYSISRavindra BabuNo ratings yet

- Notes 6Document13 pagesNotes 6webpixel servicesNo ratings yet

- Actuarial Science Cs 1 Exam PaperDocument5 pagesActuarial Science Cs 1 Exam PaperAbhishek KumarNo ratings yet

- William D. Penny - Signal Processing CourseDocument178 pagesWilliam D. Penny - Signal Processing Coursejomasool100% (1)

- Aqa Ms Ss1a W QP Jun13Document20 pagesAqa Ms Ss1a W QP Jun13prsara1975No ratings yet

- Chapter 02 PDFDocument73 pagesChapter 02 PDFnasim dashkhaneNo ratings yet

- Essentials of Business Statistics Communicating With Numbers 1st Edition Jaggia Test Bank DownloadDocument112 pagesEssentials of Business Statistics Communicating With Numbers 1st Edition Jaggia Test Bank DownloadcarrielivingstonocifrtkgnyNo ratings yet

- Mann-Whitney U TestDocument12 pagesMann-Whitney U Testnosheen murtazaNo ratings yet

- Probabilistic Maching LearningDocument856 pagesProbabilistic Maching LearningWarren EnglishNo ratings yet

- UpgradDocument8 pagesUpgradLata SurajNo ratings yet

- Identification Vs SpecificationDocument3 pagesIdentification Vs SpecificationEdgar RuizNo ratings yet

- Prediction Intervals: Chris ChatfieldDocument25 pagesPrediction Intervals: Chris ChatfieldPéter BobikNo ratings yet

- Factor Analysis: © Dr. Maher KhelifaDocument36 pagesFactor Analysis: © Dr. Maher KhelifaflyingvinceNo ratings yet

- Quantitative Techniques for Asian Poverty AnalysisDocument18 pagesQuantitative Techniques for Asian Poverty AnalysisRimjhimNo ratings yet