Professional Documents

Culture Documents

Taxation Trends in The European Union - 2012 168

Uploaded by

d05registerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Trends in The European Union - 2012 168

Uploaded by

d05registerCopyright:

Available Formats

Developments in the Member States

Part II

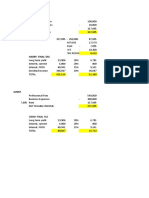

EUROPEAN UNION 27

GDP-WEIGHTED AVERAGES

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2010

A. Structure of revenues % of GDP € bn

Indirect taxes 13.7 13.4 13.3 13.3 13.3 13.4 13.5 13.5 13.1 12.9 13.2 1 618.6

VAT 7.0 6.9 6.8 6.8 6.8 6.9 7.0 7.0 6.9 6.7 7.0 860.7

Excise duties and consumption taxes 3.0 2.9 3.0 3.0 2.9 2.8 2.7 2.6 2.6 2.6 2.7 325.0

Other taxes on products (incl. import duties) 1.7 1.6 1.6 1.6 1.7 1.7 1.8 1.8 1.6 1.5 1.5 182.7

Other taxes on production 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.1 2.0 250.1

Direct taxes 14.1 13.6 13.1 12.9 12.8 13.2 13.7 13.9 13.8 12.8 12.6 1 545.9

Personal income 9.8 9.6 9.4 9.2 8.9 9.1 9.2 9.4 9.4 9.3 9.1 1 114.9

Corporate income 3.1 2.9 2.6 2.4 2.7 2.9 3.3 3.3 3.0 2.2 2.4 289.3

Other 1.1 1.1 1.1 1.3 1.2 1.2 1.2 1.2 1.3 1.2 1.2 141.7

Social contributions 12.7 12.6 12.5 12.7 12.6 12.5 12.4 12.2 12.5 12.9 12.7 1 550.2

Employers´ 7.2 7.2 7.2 7.3 7.2 7.2 7.1 7.1 7.2 7.4 7.3 896.2

Employees´ 4.1 4.0 3.9 3.9 3.9 3.8 3.8 3.7 3.8 3.9 3.8 467.8

Self- and non-employed 1.4 1.4 1.4 1.4 1.5 1.5 1.5 1.4 1.5 1.6 1.5 186.2

TOTAL 40.4 39.5 38.8 38.8 38.7 39.0 39.5 39.4 39.3 38.4 38.4 4 700.7

B. Structure by level of government % of total taxation

Central government 52.9 52.8 52.0 51.2 51.8 52.0 52.2 52.4 50.8 48.5 50.2 2 361.4

1)

State government 18.8 18.1 19.7 20.1 20.4 20.4 20.8 21.2 21.5 21.4 19.9 308.8

Local government 9.5 9.6 9.8 10.0 10.3 10.4 10.3 10.3 10.4 10.7 10.3 482.7

Social security funds 35.6 36.2 36.4 36.6 36.1 35.8 35.6 35.2 36.3 37.9 37.4 1 528.9

EU institutions 1.5 1.4 1.1 0.9 0.7 0.8 0.8 0.8 0.8 0.7 0.7 32.6

C. Structure by type of tax base % of GDP

Consumption 11.4 11.1 11.1 11.1 11.1 11.1 11.1 11.0 10.8 10.7 11.0 1 350.5

Labour 20.2 20.1 19.8 19.8 19.5 19.5 19.3 19.2 19.6 20.0 19.6 2 405.1

Employed 18.6 18.5 18.2 18.2 17.9 17.8 17.7 17.7 18.1 18.4 18.1 2 216.7

Paid by employers 7.8 7.8 7.7 7.9 7.8 7.7 7.7 7.7 7.9 8.0 8.0 975.8

Paid by employees 10.9 10.7 10.5 10.4 10.1 10.1 10.1 10.0 10.2 10.3 10.1 1 240.9

Non-employed 1.6 1.6 1.6 1.6 1.6 1.6 1.6 1.5 1.5 1.6 1.5 188.4

Capital 8.9 8.4 8.0 8.0 8.2 8.5 9.2 9.3 8.9 7.8 7.8 958.4

Capital and business income 6.1 5.7 5.3 5.3 5.4 5.7 6.3 6.5 6.1 5.2 5.3 646.5

Income of corporations 3.2 2.9 2.7 2.6 2.8 3.0 3.4 3.4 3.1 2.3 2.4 300.0

Income of households 0.9 0.7 0.7 0.7 0.7 0.8 0.9 0.9 0.9 0.8 0.8 99.9

Income of self-employed (incl. SSC) 2.1 2.0 1.9 2.0 1.9 1.9 2.0 2.1 2.1 2.1 2.0 246.6

Stocks of capital / wealth 2.8 2.7 2.7 2.7 2.8 2.8 2.9 2.9 2.8 2.6 2.5 311.8

D. Environmental taxes % of GDP

Environmental taxes 2.7 2.6 2.6 2.6 2.6 2.5 2.5 2.4 2.3 2.4 2.4 290.8

Energy 2.1 2.0 2.0 2.0 2.0 1.9 1.9 1.8 1.7 1.8 1.8 219.6

Of which transport fuel taxes : : : 1.6 1.6 1.5 1.5 1.4 1.4 1.4 1.4

Transport (excl. fuel) 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 60.6

Pollution/resources 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 10.6

E. Implicit tax rates %

Consumption 20.0 19.6 19.6 19.6 19.7 19.7 19.8 20.0 19.6 19.1 19.7

Labour employed 36.7 36.4 36.0 36.1 35.9 35.9 36.0 36.2 36.5 36.0 36.0

Capital : : : : : : : : : : :

Capital and business income : : : : : : : : : : :

Corporations : : : : : : : : : : :

Households : : : : : : : : : : :

Real GDP growth (annual rate) 3.9 2.2 1.3 1.4 2.5 2.0 3.3 3.2 0.3 -4.3 1.9

See Annex B for explanatory notes. For classification of taxes please visit: http://ec.europa.eu/taxtrends

1) This level refers to the Länder in AT and DE, the gewesten en gemeenschappen / régions et communautés in BE and comunidades autónomas in ES.

2) Adjusted averages

n.a. not applicable, : not available

Date of extraction: 13/01/2012

Source: Commission Services and Eurostat (online data code gov_a_tax_ag)

Taxation trends in the European Union 167

You might also like

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 219Document1 pageTaxation Trends in The European Union - 2012 219d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 225Document1 pageTaxation Trends in The European Union - 2012 225d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 223 PDFDocument1 pageTaxation Trends in The European Union - 2012 223 PDFd05registerNo ratings yet

- Taxation Trends in The European Union - 2012 221Document1 pageTaxation Trends in The European Union - 2012 221d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 223Document1 pageTaxation Trends in The European Union - 2012 223d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 214Document1 pageTaxation Trends in The European Union - 2012 214d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 222Document1 pageTaxation Trends in The European Union - 2012 222d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 217Document1 pageTaxation Trends in The European Union - 2012 217d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 213Document1 pageTaxation Trends in The European Union - 2012 213d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 212Document1 pageTaxation Trends in The European Union - 2012 212d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 215Document1 pageTaxation Trends in The European Union - 2012 215d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 211Document1 pageTaxation Trends in The European Union - 2012 211d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 198Document1 pageTaxation Trends in The European Union - 2012 198d05registerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Format of Standby Letter of CreditDocument2 pagesFormat of Standby Letter of CreditZahedul Ahasan80% (10)

- Pay SlipDocument1 pagePay SlipAnonymous QrLiISmpF100% (1)

- Aug 10 PayslipDocument1 pageAug 10 PayslipBry GutierrezNo ratings yet

- B2B 042023 09bftpk9626k1zi GSTR2B 14052023Document7 pagesB2B 042023 09bftpk9626k1zi GSTR2B 14052023Raja GuptaNo ratings yet

- Deductible Losses and NOLCO RulesDocument5 pagesDeductible Losses and NOLCO RulesDiane HeartphiliaNo ratings yet

- Holt On IAS 12 NewDocument4 pagesHolt On IAS 12 NewMurad MuradovNo ratings yet

- Education Loan InterestDocument1 pageEducation Loan Interestravi lingam100% (2)

- Corporations - An: Kristie DewaldDocument38 pagesCorporations - An: Kristie DewaldJenniferNo ratings yet

- Invoice INV-0038Document1 pageInvoice INV-0038Rabbie LeguizNo ratings yet

- Singapore Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreDocument28 pagesSingapore Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax Centrehằng phạmNo ratings yet

- Inti OrozcoDocument2 pagesInti OrozcoMundo Real100% (1)

- ZIM Taxation 2010Document57 pagesZIM Taxation 2010Paul Kazuwa50% (2)

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- RMC 25-2011 SummaryDocument2 pagesRMC 25-2011 SummaryCinNo ratings yet

- Tax Invoice: Smart Lifts & ElectricalsDocument1 pageTax Invoice: Smart Lifts & ElectricalsYours PharmacyNo ratings yet

- 12 Economics Notes Macro Ch04 Government Budget and The EconomyDocument7 pages12 Economics Notes Macro Ch04 Government Budget and The EconomyvatsadbgNo ratings yet

- October2022Document2 pagesOctober2022Yaaro SumailaNo ratings yet

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- RSPL payslip October 2019Document1 pageRSPL payslip October 2019mukesh sahuNo ratings yet

- CIR v. MirantDocument4 pagesCIR v. MirantAngelique Padilla UgayNo ratings yet

- The Case of The Brazilian Fiscal Responsibility Law: Rules, Results and ChallengesDocument44 pagesThe Case of The Brazilian Fiscal Responsibility Law: Rules, Results and ChallengesandremonoNo ratings yet

- ANNEXUREDocument1 pageANNEXUREkessartiNo ratings yet

- Basic Tax Principles ExplainedDocument46 pagesBasic Tax Principles Explained在于在No ratings yet

- Tax Law 2 ProjectDocument16 pagesTax Law 2 Projectrelangi jashwanthNo ratings yet

- BAIBF 09011 Business Taxation Group DDocument15 pagesBAIBF 09011 Business Taxation Group DShahaab ZulkiflyNo ratings yet

- Nov 2022Document12 pagesNov 2022Chandu NeredibilliNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- 2020 W-4 FormDocument4 pages2020 W-4 FormFOX Business100% (8)

- Concentrix Daksh Services Philippines CorporationDocument2 pagesConcentrix Daksh Services Philippines CorporationMike Gonzales JulianNo ratings yet

- IRM 5300 Balance Due Account Procedures, Form #09.062Document156 pagesIRM 5300 Balance Due Account Procedures, Form #09.062Sovereignty Education and Defense Ministry (SEDM)No ratings yet