Professional Documents

Culture Documents

FGB - NBAD - ADX Annoucement and Press Release

Uploaded by

yannisxylasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FGB - NBAD - ADX Annoucement and Press Release

Uploaded by

yannisxylasCopyright:

Available Formats

NOT FOR PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO ANY JURISDICTION

OUTSIDE THE UNITED ARAB EMIRATES WHERE TO DO SO WOULD VIOLATE THE RELEVANT LAWS

OF, OR REGULATIONS APPLICABLE TO, SUCH JURISDICTION

FGB and NBAD boards recommend merger to create the largest bank

in the Middle East and North Africa region

- Creates the largest bank in the MENA region by assets1 with total assets of AED642 billion

(US$175 billion)2

- Leading position in the UAE both in terms of loan and deposit market shares

- Presence in 19 countries

- Complementary businesses to leverage on strengths in consumer and wholesale banking

- Content on the proposed merger: www.bankfortheUAE.com

Abu Dhabi, 3 July 2016: First Gulf Bank PJSC (FGB) and National Bank of Abu Dhabi PJSC (NBAD) announce

today that their boards of directors have voted unanimously to recommend to shareholders a merger of

the two Abu Dhabi-listed banks.

The proposed merger will create a bank with the financial strength, expertise, and global network to

support the UAE’s economic ambitions at home and drive the country’s growing international business

relationships.

The combined bank will be the largest bank in the Middle East and North Africa region, with AED642 billion

(US$175 billion)1 of assets and a combined market capitalisation of approximately AED106.9 billion

(US$29.1 billion)3. It will be the leading financial institution in the United Arab Emirates (UAE), with a 26

percent4 share of outstanding loans, and will operate an international network of branches and offices

spanning 19 countries. Both entities will continue to operate independently until the merger becomes

effective, which is expected in the first quarter of 2017.

The proposed transaction is a merger of equals and will be executed through a share swap, with FGB

shareholders receiving 1.254 NBAD shares for each FGB share they hold. The exchange ratio implies a

discount to FGB's shareholders of 3.9 percent based on closing share prices on June 30, 2016, and a discount

of 12.2 percent to the three months’ average pre-leak share price as on June 16, 2016.

Following the issue of the new NBAD shares, FGB shareholders will own approximately 52 percent of the

combined bank and NBAD shareholders will own approximately 48 percent. The Government of Abu Dhabi

and related entities will own approximately 37 percent.

On the effective date of the merger, FGB shares will be delisted from the Abu Dhabi Securities Exchange.

The combined bank will retain NBAD’s legal registrations and the brand name of “National Bank of Abu

Dhabi”. Its board will include four nominated directors of FGB and four nominated directors of NBAD. His

Highness Sheikh Tahnoon Bin Zayed Al Nahyan, who is currently Chairman of FGB, is the Chairman

designate. His Excellency Nasser Ahmed Alsowaidi, who is currently Chairman of NBAD, is the Vice

Chairman designate, and Mr. Abdulhamid M. Saeed, who is currently Board Member and Managing Director

of FGB, is the Chief Executive Officer designate for the combined bank. New board and management will

assume the new roles when merger becomes effective; until then Mr Andre Sayegh and Mr Alex Thursby

will continue to lead their banks independently as Group Chief Executive Officers of FGB and NBAD

respectively.

1. Based Q1 2016 financials -1-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

His Highness Sheikh Tahnoon Bin Zayed Al Nahyan, Chairman of FGB, said:

“The new, well-balanced bank will be an engine of UAE growth, driving further investment and economic

diversification, and advancing the ambitions of entrepreneurs and the people they employ. The bank will have

the strength and expertise to support the development of the UAE’s private sector, from SMEs to large

companies gathering strength to expand beyond their national borders. It is well positioned to be the strategic

banking partner to the government and its agencies.”

His Excellency Nasser Ahmed Alsowaidi, Chairman of NBAD, said:

"Now, more than ever, the UAE will benefit from a strong, financial partner with the capacity to meet new

challenges, drive domestic growth, and support the country’s ever-greater connections to the global economy.

Expansion across fast growing emerging markets presents a vast business opportunity for our customers and

for us, as a larger, stronger, combined bank. We will have the capital, expertise and international networks to

be the preferred financial partner for anyone doing business along the West-East corridor. And, we will act as

the primary link for businesses and governments that want to access regional and global capital markets.”

Mr. Abdulhamid M. Saeed, Chief Executive Officer Designate, said:

“FGB and NBAD are two of the UAE’s most successful banks with proven growth strategies. They are highly

complementary businesses, each with strong and experienced leadership teams. The new bank will draw on

these strengths to provide excellent service to our customers and take advantage of the opportunities we see

in our home market and internationally.”

The boards of FGB and NBAD believe that the merger offers significant benefits to customers and investors.

It results in the combination of two best-in-class consumer and wholesale businesses. FGB has a market-

leading consumer banking franchise, with one of the strongest credit card offerings in the UAE and a long-

standing National Housing Loan programme run for the Abu Dhabi government. NBAD is a leader in the

UAE in wholesale banking and capital markets advisory with strong international connectivity.

The combined bank will be well-diversified, with loans to the corporate sector representing 52 percent2 of

the total loan book, loans to the retail sector accounting for 26 percent2, and loans to the government sector

representing 22 percent.2 It will have presence in 19 countries, and be well positioned in key financial

centres including Singapore, Hong Kong, Geneva, London and Washington DC.

Economies of scale will help maintain a lean and efficiently run organisation. The merger is expected to

deliver cost synergies of approximately AED500 million (US$136 million) annually. Cost benefits are

expected to be realised over three years, and the one-time integration costs are expected at approximately

AED600 million (US$163 million). The combined bank will offer the potential for revenue synergies with

enhanced product suite of banking products and services across a larger, combined platform.

Furthermore, the combined bank will have the capital strength and strong core liquidity to pursue a range

of high growth opportunities. These include opportunities in home market, supporting UAE corporates

with international ambitions, leveraging an enhanced technology platform, more effectively using the

expanded distribution capabilities and increasing wealth management cross-selling activity.

The bank’s new leadership is committed to nurturing the talent needed to deliver the highest quality

service and operating best-in-class governance. At the top of its agenda is the combination of two successful

groups of employees into a unified, customer driven culture, based on the shared values of enterprise,

teamwork, empowerment and accountability. The bank will benefit from a strong pool of talent, and will

strive to remain the employer of choice in the sector through effective programmes in employee

engagement, reward and development. Attracting and developing high-performing UAE nationals is a

central priority.

The merger is subject to a number of conditions, including the approval of the merger by at least 75 per

cent by value of the shares represented at quorate general assembly meetings of FGB and NBAD. The

merger is also subject to receipt of all required regulatory approvals.

- Ends -

1. Based Q1 2016 financials -2-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

TRANSACTION OVERVIEW

STRATEGIC RATIONALE

The proposed transaction is a merger of equals that creates the largest bank in the Middle East and North

Africa region by assets. The combined bank will have total assets of AED642 billion (US$175 billion)2,

equity of AED90.0 billion (US$24.5 billion)2, and a market capitalisation of approximately AED106.9 billion

(US$29.1 billion)3. It will also benefit from an international network that spans 19 countries.

The new bank is in a strong position to play a key role in supporting the UAE’s economic ambitions;

financing growth as the country continues to implement its economic diversification strategy, developing

Emirati banking and finance expertise, and helping to drive international business relationships.

The boards of directors of FGB and NBAD believe that the merger offers significant benefits to customers

and investors. It accelerates the growth strategies of these two successful and complementary Abu Dhabi

banks. FGB has a market-leading consumer banking franchise, with one of the strongest credit card

offerings in the UAE and a long-standing National Housing Loan programme run for the Abu Dhabi

government. NBAD is a leader in the UAE in wholesale banking and capital markets advisory with strong

international connectivity.

The combined bank will be a well-diversified, full-service financial institution, with strong offerings in

consumer banking, wealth management, wholesale banking, SME banking and capital markets advisory.

While the UAE market is likely to remain the main focus, the bank’s size, expertise and international reach

will promote further development of an international business, particularly in wholesale banking, capital

markets advisory, and other key segments, such as affluent banking.

Greater economies of scale will permit effective investment in the bank’s spine, in areas including

technology, risk management, compliance and governance, as well as in customer digital platforms.

FINANCIAL BENEFITS OF THE MERGER

The combined bank will benefit from strong financial metrics. Its proforma tier one ratio is 15.7%2, well

above the UAE Central Bank’s prescribed minimum of 8%, and its proforma total capital ratio is 16.9% 2.

The combined bank’s funding profile will be diverse, with proforma wholesale funding accounting for 30%2

of the total, customer deposits making up 69%2 and other liabilities accounting for 1%2. Proforma deposits

are well diversified, with corporate deposits accounting for 33%2, government and other public sector

deposits 33%2, and retail deposits 22% 2. The combined bank’s proforma loan-to-deposit ratio is 94%2.

The combined bank’s key profitability metrics are among the best in the sector, with a proforma net interest

margin of 2.30%2, a cost-to-income ratio of 30%2 and a return on average equity of 14.1%2.

TERMS OF THE MERGER

The merger is intended to be effected by way of a merger pursuant to Article 283(1) of UAE Federal Law

No. 2 of 2015 concerning Commercial Companies (the “Companies Law”). Subject to the satisfaction of the

conditions to the merger, upon the effective date of the merger the assets and liabilities of FGB will be

assumed by NBAD in consideration for the issue of new NBAD shares to FGB shareholders. Upon the

merger becoming effective, shareholders of FGB will become shareholders in NBAD, the FGB shares will be

delisted from the Abu Dhabi Securities Exchange and FGB will be dissolved.

The merger will result in new NBAD shares being issued to FGB shareholders on the basis of 1.254 NBAD

shares for each FGB share they hold.

Following the issue of the new NBAD shares, FGB shareholders would own approximately 52% of the

combined company and NBAD shareholders would own approximately 48%.

1. Based Q1 2016 financials -3-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

CONDITIONS TO THE MERGER AND REQUIRED SHAREHOLDER ACTION

The merger is subject to, amongst other things, the following conditions:

(a) resolutions approving the merger and certain ancillary matters having been passed by the

requisite majority of the shareholders attending and entitled to vote at the General Assembly

Meetings of FGB and NBAD respectively; and

(b) all consents that have been identified by each of the FGB and NBAD boards of directors as

necessary to the implementation of the merger (including all required regulatory consents) having

been obtained.

Further details on the FGB and NBAD General Assembly Meetings will be sent to FGB and NBAD

shareholders in due course and contained in the Shareholder Circular.

Following satisfaction of the conditions listed above, the FGB and NBAD boards of directors will apply for

a resolution of the UAE Minister of Economy and / or the Chairman of the Securities and Commodities

Authority approving the merger and the associated steps required to implement the merger including the

dissolution of FGB, the increase in the share capital of NBAD and the amendments to NBAD’s articles of

association. It is currently anticipated that, subject to the satisfaction of these conditions, the merger will

become effective in Q1 2017. This timeframe is indicative only and is subject to change.

OTHER INFORMATION

Credit Suisse and UBS Investment Bank are acting as financial adviser to NBAD and FGB, respectively.

Allen & Overy LLP and Freshfields Bruckhaus Deringer LLP are acting as legal adviser to NBAD and FGB,

respectively.

Brunswick Group is acting as strategic communications adviser to FGB and NBAD.

For full details on the merger, investors should refer to the shareholder circular which will be published

in due course.

ABOUT FGB

As a leading bank in the UAE, FGB had total assets of AED 227.4 billion (US$61.9 billion) and shareholder

equity of AED 32.8 billion (US$8.9 billion)1 as of March-end 2016 making it one of the largest banks in the

UAE based on Equity. Established in 1979 and headquartered in Abu Dhabi, UAE, FGB offers a full range of

financial services to business and consumer sectors throughout a network of 23 branches across the UAE.

Internationally, FGB has branches in Singapore and Qatar, representative offices in India, Hong Kong, Seoul

and London and a subsidiary in Libya.

FGB is recognised as a world-class organisation committed to maximising value for shareholders,

customers and employees as it focuses on delivering banking products and services that meet client needs

and support the UAE’s dynamic economy. In line with its commitment to excellence the Bank continues to

invest significantly in people and technology to provide superior service standards. FGB has an A2 long-

term rating from Moody’s, A+ from Fitch and A from S&P. with a stable outlook.

For more information please visit our corporate webpage at: www.fgbgroup.com.

ABOUT NBAD

NBAD has one of the largest networks in the UAE, with an expanding network of 114 branches and cash

offices and more than 574 ATMs across the country. NBAD’s growing international network consists of

about 60 branches and offices in 18 countries stretching across five continents from the Far East to the

Americas, giving it the largest global network among all UAE banks.

Since 2009, NBAD has been ranked consecutively as one of the World’s 50 Safest Banks by the prestigious

Global Finance magazine, which also named NBAD the Safest Bank in the Emerging Markets and the Middle

East.

1. Based Q1 2016 financials -4-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

NBAD is rated senior long term/short term AA-/A-1+ by Standard & Poor's (S&P), Aa3/P1 by Moody’s, AA-

/F1+ by Fitch, A+ by Rating and Investment Information Inc (R&I) Japan, and AAA by RAM (Malaysia) ,

giving it one of the strongest combined rating of any Global financial institution.

A comprehensive financial institution, NBAD offers a range of banking services including retail, investment

and Islamic banking. NBAD grows strategically toward its vision to be recognised as the World’s Best Arab

Bank.

In September 2015, NBAD became the first bank in the UAE to sign up to the Equator Principles, a voluntary

set of guidelines based on International Finance Corporation standards on social and environmental

sustainability and the World Bank Group's environmental, health and safety guidelines. Environmental and

social risk management is a key priority for NBAD, therefore policies and standards will continue to evolve

in response to emerging risks and new product development. NBAD is also consistently one of the top 10

rated companies across the S&P Hawkamah Pan Arab ESG Index, the Institute for Corporate Governance.

For more information please visit our corporate webpage at: www.nbad.com.

FURTHER INFORMATION

www.bankfortheUAE.com

FGB NBAD

Tim Burnell Michael Miller

Head of Corporate Affairs Head of Investor, Media and Public Relations

+971(0) 50 651 5393 +971 (0) 50 619 7116

Tim.burnell@fgb.ae michael.miller@nbad.com

Sofia El Boury

Head of Investor Relations

+971 (0) 50 836 6031

sofia.elboury@fgb.ae

Brunswick

Will Anderson

Partner

wanderson@brunswickgroup.com

+971 (0) 50 557 2633

1. Based Q1 2016 financials -5-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

IMPORTANT NOTICES

Shareholders in NBAD and FGB should not exercise voting rights at the general assembly meeting of NBAD or

the general assembly meeting of FGB respectively, except on the basis of information in the shareholder

circular to be published in due course in connection with the merger (the Shareholder Circular). The

Shareholder Circular will include a discussion of certain risk factors which should be taken into account when

considering whether to vote in favour of the resolutions to be considered at the NBAD and FGB general

assembly meetings to be convened to approve the merger and certain related matters.

Instructions to shareholders of NBAD and FGB as to how to attend and vote in respect of the merger at the

general assembly meetings will be contained in the Shareholder Circular and in the Chairmen's letter (the

Chairmen's Letter) to be posted to shareholders in due course. The Shareholder Circular will be available to

view in due course at each of NBAD and FGB’s websites at www.nbad.com and www.fgbgroup.com respectively

or, alternatively, hard copies of the Shareholder Circular will be available (without charge) from the offices of

each of NBAD (in the case of NBAD shareholders) and FGB (in the case of FGB shareholders).

The following documents will be sent to shareholders of NBAD and FGB: the Chairmen's Letter (which will

include the notice of the general assembly meeting of NBAD to be convened for the purpose of, amongst other

things, approving the merger (the NBAD GAM) and the notice of the general assembly meeting of FGB to be

convened for the purpose of, amongst other things, approving the merger (the FGB GAM)) and a form of proxy

in respect of the NBAD GAM (in the case of NBAD shareholders) or the FGB GAM (in the case of FGB

shareholders).

This announcement is not intended to and does not constitute, or form part of, an offer to acquire, issue or sell

or an invitation to acquire, subscribe for or sell any securities or the solicitation of any vote or approval in any

jurisdiction in connection with or pursuant to the merger or otherwise, nor will there be any acquisition, issue,

sale, subscription or transfer of the securities referred to in this announcement in any jurisdiction, in

contravention of applicable law or regulation. The Shareholder Circular will contain the full terms and

conditions of the merger, including details of how to vote at the NBAD GAM and the FGB GAM. Any vote or

other response to the merger should be made only on the basis of such document.

The publication or distribution of this announcement in jurisdictions other than the UAE may be restricted by

law and/or regulation and therefore any persons who are subject to the laws and regulations of any

jurisdiction other than the UAE should inform themselves about, and observe, any applicable requirements.

Any failure to comply with the applicable requirements may constitute a violation of the laws and/or

regulations of any such jurisdiction.

Nothing contained in this announcement is intended to be or shall be deemed to be a forecast, projection or

estimate of the future financial performance of NBAD or FGB and no statement in this announcement should

be interpreted to mean that earnings per share for current or future financial periods of NBAD or FGB will

necessarily match or exceed historical published earnings per share.

Neither the content relating to the merger on NBAD’s website or FGB’s website or any other website, nor the

content of any website accessible from hyperlinks on any of such websites is incorporated into, or forms part

of, this announcement.

Credit Suisse AG (Hong Kong) Limited, is acting exclusively as financial adviser to NBAD and for no one else in

connection with the merger and will not be responsible to anyone other than NBAD for providing the

protections afforded to clients of Credit Suisse or for providing advice in relation to the merger, the content of

this announcement or matters referred to in this announcement.

UBS AG (London Branch) is acting exclusively as financial adviser to FGB and for no one else in connection

with the merger and will not be responsible to anyone other than FGB for providing the protections afforded

to clients of UBS or for providing advice in relation to the merger, the content of this announcement or matters

referred to in this announcement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This announcement contains certain forward-looking statements with respect to NBAD and FGB. These

forward-looking statements can be identified by the fact that they do not relate only to historical or current

1. Based Q1 2016 financials -6-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

facts. Forward-looking statements often use words such as "anticipate", "target", "expect", "estimate",

"intend", "plan", "will", "goal", "believe", "aim", "may", "would", "could" or "should" or other words of similar

meaning or the negative thereof. Forward-looking statements in this announcement include, without

limitation, statements relating to the following: (i) preliminary synergy estimates, expenses, financial

conditions and future prospects; (ii) business and management strategies and the expansion and growth of

the operations of the bank (NBAD); and (iii) the merger, the issue of the new NBAD shares, related matters

and the dates on which events are expected to occur.

These forward-looking statements involve known and unknown risks, uncertainties and other factors which

may cause the actual results, performance or achievements of any such person, industry results, strategies or

events, to be materially different from any results, performance, achievements or other events or factors

expressed or implied by such forward-looking statements. Many of the risks and uncertainties relating to

forward-looking statements are beyond NBAD and FGB’s ability to control or estimate precisely, such as future

market conditions and the behaviours of other market participants, and therefore undue reliance should not

be placed on such statements. Forward-looking statements are not guarantees of future performance. They

have not, unless otherwise indicated, been reviewed by the auditors of NBAD or FGB. Forward-looking

statements are based on numerous assumptions, including assumptions regarding the present and future

business strategies of NBAD and FGB and the environment in which each will operate in the future. All

subsequent oral or written forward-looking statements made by or attributable to NBAD or FGB or any

persons acting on their behalf are expressly qualified in their entirety by the cautionary statement above.

More information about such risks and uncertainties will be included in the Shareholder Circular.

NBAD and FGB assume no obligation to, and do not intend to, update any forward-looking statements, except

as required pursuant to applicable law and regulation.

- Ends -

1. Based Q1 2016 financials -7-

2. Preliminary pro-forma numbers as of Q1 2016

3. As of 30 June 2016, based on closing price

4. Based on Central Bank of UAE data as of March

2016

You might also like

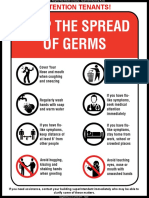

- Noise & Germs Memo 2020Document2 pagesNoise & Germs Memo 2020yannisxylasNo ratings yet

- Goossens' Messiah OrchestrationDocument3 pagesGoossens' Messiah OrchestrationyannisxylasNo ratings yet

- Top 10 Forex Indicators That Every Trader Should KnowDocument9 pagesTop 10 Forex Indicators That Every Trader Should KnowyannisxylasNo ratings yet

- Merger Factsheet 030716Document1 pageMerger Factsheet 030716yannisxylasNo ratings yet

- Hatem Gasmi: ExperienceDocument2 pagesHatem Gasmi: ExperienceyannisxylasNo ratings yet

- The History of Money: How Paper Began to Circulate as a Medium of ExchangeDocument29 pagesThe History of Money: How Paper Began to Circulate as a Medium of ExchangeyannisxylasNo ratings yet

- Critical Editions Catalogue MeyerbeerDocument3 pagesCritical Editions Catalogue MeyerbeeryannisxylasNo ratings yet

- Key To Successful New RoutesDocument8 pagesKey To Successful New RoutesyannisxylasNo ratings yet

- Jean Claude Juncker ArticleDocument3 pagesJean Claude Juncker ArticleyannisxylasNo ratings yet

- FGB and NBAD Have Successfully Merged To Create The UAEs Largest BankDocument4 pagesFGB and NBAD Have Successfully Merged To Create The UAEs Largest BankyannisxylasNo ratings yet

- Goossens' Messiah OrchestrationDocument3 pagesGoossens' Messiah OrchestrationyannisxylasNo ratings yet

- ΠΑΠΑΔΙΑΜΑΝΤΗ Η Χηρα ΠαπαδιαDocument5 pagesΠΑΠΑΔΙΑΜΑΝΤΗ Η Χηρα ΠαπαδιαyannisxylasNo ratings yet

- Merger Factsheet 030716Document1 pageMerger Factsheet 030716yannisxylasNo ratings yet

- FGB and NBAD Have Successfully Merged To Create The UAEs Largest BankDocument4 pagesFGB and NBAD Have Successfully Merged To Create The UAEs Largest BankyannisxylasNo ratings yet

- ΠΑΠΑΔΙΑΜΑΝΤΗ Χρήστος ΜηλιωνηςDocument108 pagesΠΑΠΑΔΙΑΜΑΝΤΗ Χρήστος ΜηλιωνηςyannisxylasNo ratings yet

- Cimbasso and Tuba in Verdi's OperasDocument65 pagesCimbasso and Tuba in Verdi's Operasyannisxylas100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- THE ESSENCE OF THE FRAUDDocument30 pagesTHE ESSENCE OF THE FRAUDsumthintado100% (1)

- LNS 2010 1 1336 Syariah1Document34 pagesLNS 2010 1 1336 Syariah1jacceecheeNo ratings yet

- Deposits Statement ReviewDocument1 pageDeposits Statement ReviewMarto NineNo ratings yet

- ECON-6152-2013T (UGRD) Economic Development: Grade 100.00 Out of 100.00Document24 pagesECON-6152-2013T (UGRD) Economic Development: Grade 100.00 Out of 100.00Jolly Charmz50% (2)

- Chapter # 4: Findings, Recommendation and SuggestionDocument5 pagesChapter # 4: Findings, Recommendation and Suggestionm0424mNo ratings yet

- Synopsis of Financial Analysis of Indian Overseas BankDocument8 pagesSynopsis of Financial Analysis of Indian Overseas BankAmit MishraNo ratings yet

- Swot NBPDocument8 pagesSwot NBPWajahat SufianNo ratings yet

- 0837 1026-Financial-Tyranny-Final All Pages PDFDocument110 pages0837 1026-Financial-Tyranny-Final All Pages PDFJorge ReisNo ratings yet

- C18 Krugman 11e+editDocument50 pagesC18 Krugman 11e+editJack WozniakNo ratings yet

- Bank Account StatementDocument1 pageBank Account Statementvu ducNo ratings yet

- 1 Corporate Finance IntroductionDocument41 pages1 Corporate Finance IntroductionPooja KaulNo ratings yet

- Agreement 1000243Document10 pagesAgreement 1000243Prakriti ComputerNo ratings yet

- UWN011 - NRI With GST DeclarationDocument5 pagesUWN011 - NRI With GST DeclarationSrigandh's WealthNo ratings yet

- Internship ReportDocument18 pagesInternship ReportSofonias MenberuNo ratings yet

- Financial Exclusion in Ireland An ExplorDocument234 pagesFinancial Exclusion in Ireland An ExplorRjendra LamsalNo ratings yet

- 1.2 Introduction To Cash ManagementDocument8 pages1.2 Introduction To Cash Managementasmamatha23No ratings yet

- JimDocument53 pagesJimJimmy JonesNo ratings yet

- Capital Structure Analysis of Sanima Bank ProposalDocument11 pagesCapital Structure Analysis of Sanima Bank ProposalRam Bahadur Sharki100% (1)

- Bajaj Finserv Limited - Leading Indian Financial Services CompanyDocument3 pagesBajaj Finserv Limited - Leading Indian Financial Services CompanySanam TNo ratings yet

- BMA 12e SM CH 33Document4 pagesBMA 12e SM CH 33Nikhil ChadhaNo ratings yet

- DMCI Homesaver Bonds Prospectus 2016Document287 pagesDMCI Homesaver Bonds Prospectus 2016Dani Kirky Ylagan100% (1)

- ISB511 - GA1 - Ar-Rahnu Muamalat and Ar-Rahnu AgrobankDocument17 pagesISB511 - GA1 - Ar-Rahnu Muamalat and Ar-Rahnu AgrobankSiti SurayaNo ratings yet

- CA Agro-Industrial Development Corp vs. CADocument13 pagesCA Agro-Industrial Development Corp vs. CAAJ LeoNo ratings yet

- Constnacias EditablesDocument2 pagesConstnacias EditablesErnesto Valdez ValdezNo ratings yet

- Bahrain Economic Vision 2030Document26 pagesBahrain Economic Vision 2030Thanasate PrasongsookNo ratings yet

- Capital Structure of Siddhartha Bank LimitedDocument14 pagesCapital Structure of Siddhartha Bank LimitedShreesha BhattaNo ratings yet

- Digital Banking Service in BangladeshDocument24 pagesDigital Banking Service in BangladeshlamiyahNo ratings yet

- Statement 20504220100050000 1702891004200Document12 pagesStatement 20504220100050000 1702891004200garenatopup4r1No ratings yet

- Module 7: Financial Fitness: Facilitator's ManualDocument49 pagesModule 7: Financial Fitness: Facilitator's ManualJeanrey LazNo ratings yet

- QuizDocument66 pagesQuizLancelot France-CummingsNo ratings yet