Professional Documents

Culture Documents

Tax Advisory BIR Form Shall Be Used For VAT PDF

Uploaded by

Andrew Benedict PardilloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Advisory BIR Form Shall Be Used For VAT PDF

Uploaded by

Andrew Benedict PardilloCopyright:

Available Formats

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

TAX ADVISORY

In compliance with Section 40 of the TRAIN Law mandating every person subject to

the percentage taxes imposed under Title V of the Tax Code, as amended, to file a quarterly

return of his gross sales, receipts or eamings and pay the tax due thereon within twenty-five

(25) days after the end of each taxable quarter, the following instructions must be observed:

1. A1l taxpayers subject to percentage tax pursuant to Section 116 of the Tax Code and

those who will be subject thereto due to change of registration from VAT to Non-VAT,

are required to pay the percentage tax on a quarterly basis using BIR Form No. 2551Q.

There is no need to file and pay monthly percentage tax on their monthly gross receipts

using BIR Form No. 2551M.

2. Taxpayers who are required to withhold Other Percentage Taxes and Value-added Tax

under Revenue Regulations No. 2-98, as amended,shall continue to withhold and remit

taxes on a monthly basis using BIR Form No. 1600 - Remittance Return of VAT and

Other Percentage Taxes Withheld, considering that taxes withheld are held in trust for

the government.

Furthermore, BIR Form No. 1600 (Remittance Return of VAT and Other Percentage

Taxes Withheld) shall still be used for VAT withheld on govemment money payments

and payments to non-residents.

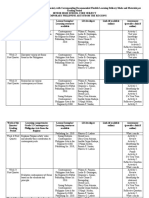

In summary please refer to the following:

Subject What to file and pay

Percentage Taxpayer Quarterly Percentage Tar (BIR Form

2sslQ)

Monthly Remittance Return of Value-

Withholding agents (Percentage and VAT) added Tax and Other Percentage Taxes

withheld (BlR Form 1600)

Monthly Remittance Return of Value-

Withholding of VAT on Government Money

added Tax and Other Percentage Taxes

Payments and Payments to Non-Residents

Withheld (BIR Form 1600)

In this regard, all concerned taxpayers are hereby advised to strictly comply with the

abovementioned procedures starting taxable year 2018.

Issued this Sth day of February 2018.

Quezon City, Metro Manila

CAESAR R. DULAY

Commissioner of Internal Revenue

' 013172

You might also like

- RR No. 02-2006Document10 pagesRR No. 02-2006odessaNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- SEMINAR ON NGAsDocument63 pagesSEMINAR ON NGAsHelen Joy Grijaldo JueleNo ratings yet

- TRAIN Law tax rate transition proceduresDocument2 pagesTRAIN Law tax rate transition proceduresAnonymous HQymOK61No ratings yet

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocument7 pagesTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- RMC No 51-2008Document7 pagesRMC No 51-2008Yasser MangadangNo ratings yet

- Streamlined BIR Transfer Pricing GuidelinesDocument3 pagesStreamlined BIR Transfer Pricing GuidelinesJejomarNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30No ratings yet

- 1 Train Law Draft ModuleDocument17 pages1 Train Law Draft ModuleDaehan CollegeNo ratings yet

- Percentage TaxDocument5 pagesPercentage TaxGIGI BODONo ratings yet

- General Provisions and Tax Procedures: Arie Pratama, Se, Cpsak, Cpma, CertifrDocument64 pagesGeneral Provisions and Tax Procedures: Arie Pratama, Se, Cpsak, Cpma, CertifrKucing HitamNo ratings yet

- 111 Tax GuideDocument81 pages111 Tax Guideavelito bautistaNo ratings yet

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055No ratings yet

- WTAXESDocument31 pagesWTAXESlance757No ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Description: BIR Form 2550M BIR Form No. 2307Document17 pagesDescription: BIR Form 2550M BIR Form No. 2307Montessa GuelasNo ratings yet

- BIR Registration RequirementsDocument27 pagesBIR Registration RequirementsCrizziaNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018Document2 pagesRR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018sdysangcoNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- 2019 Year End AdjustmentDocument86 pages2019 Year End AdjustmentATRIYO ENTERPRISESNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- VAT Guide: Rates, Returns, Filing ProceduresDocument33 pagesVAT Guide: Rates, Returns, Filing ProceduresvicsNo ratings yet

- RR 12-01Document6 pagesRR 12-01matinikkiNo ratings yet

- TAX2Document2 pagesTAX2Nicolyn Rae EscalanteNo ratings yet

- Taxation Guide For Expatriates Working in IndonesiaDocument4 pagesTaxation Guide For Expatriates Working in IndonesiamdcharisNo ratings yet

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadNo ratings yet

- RMC No. 23-2007-Government Payments WithholdingDocument7 pagesRMC No. 23-2007-Government Payments WithholdingWizardche_13No ratings yet

- Value Added Taxes Part 2Document15 pagesValue Added Taxes Part 2Deo CoronaNo ratings yet

- Notes On Withholding Tax and Income Tax FilingDocument20 pagesNotes On Withholding Tax and Income Tax FilingnengNo ratings yet

- Taxation Reviewer - REODocument202 pagesTaxation Reviewer - REOtmica7260No ratings yet

- Bir Vat QueriesDocument8 pagesBir Vat QueriesMinerva Bautista RoseteNo ratings yet

- Large Taxpayers Regulations on Filing & Payment DatesDocument3 pagesLarge Taxpayers Regulations on Filing & Payment DatesLady Ann CayananNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605alona_245883% (6)

- BIR Regulations Expand eFPS Coverage to Include NGA Tax FilingsDocument7 pagesBIR Regulations Expand eFPS Coverage to Include NGA Tax FilingsJerwin DaveNo ratings yet

- RMC No 16-2013Document3 pagesRMC No 16-2013Eric DykimchingNo ratings yet

- How Does The BIR Conduct Its Audit: By: Ms. Jorhiza Ortelano EstebanDocument13 pagesHow Does The BIR Conduct Its Audit: By: Ms. Jorhiza Ortelano EstebanRheneir MoraNo ratings yet

- Obligations: 1. RegistrationDocument5 pagesObligations: 1. RegistrationPhilip AlamboNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- CPAR-Quarter 1-Module 2Document50 pagesCPAR-Quarter 1-Module 2Andrew Benedict Pardillo79% (82)

- Melc Cpar Q1Document4 pagesMelc Cpar Q1Andrew Benedict Pardillo100% (3)

- Yan Hain Nanangonon Ko PirikoDocument16 pagesYan Hain Nanangonon Ko PirikoAndrew Benedict PardilloNo ratings yet

- Basic Concepts (Cost Accounting)Document9 pagesBasic Concepts (Cost Accounting)alexandro_novora6396No ratings yet

- Regulatory framework for business transactions and corporate voting requirementsDocument2 pagesRegulatory framework for business transactions and corporate voting requirementsMarissaNo ratings yet

- Rabies Module Grade 2 NewDocument54 pagesRabies Module Grade 2 NewDonna Mae Castillo KatimbangNo ratings yet

- Filipino: Activity SheetsDocument6 pagesFilipino: Activity SheetsAndrew Benedict Pardillo100% (1)

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloNo ratings yet

- Business Law and Taxation ReviewerDocument5 pagesBusiness Law and Taxation ReviewerJeLo ReaNdelar100% (2)

- Cash and Accounts Receivable PDFDocument11 pagesCash and Accounts Receivable PDFAndrew Benedict PardilloNo ratings yet

- Cup 1Document82 pagesCup 1Andrew Benedict PardilloNo ratings yet

- Aud Probs Resa PDFDocument37 pagesAud Probs Resa PDFAndrew Benedict PardilloNo ratings yet

- Business Law and TaxationDocument21 pagesBusiness Law and TaxationAndrew Benedict PardilloNo ratings yet

- CP ARDocument12 pagesCP ARAndrew Benedict PardilloNo ratings yet

- Img 011Document2 pagesImg 011Andrew Benedict PardilloNo ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- TranslationDocument2 pagesTranslationAndrew Benedict PardilloNo ratings yet

- Estate Tax LectureDocument7 pagesEstate Tax LectureVanilyn LaresmaNo ratings yet

- Deed of Sale of A Motor Vehicle-1Document2 pagesDeed of Sale of A Motor Vehicle-1BenNo ratings yet

- Test Bank - Inc TX-MDGDocument5 pagesTest Bank - Inc TX-MDGjaysonNo ratings yet

- Estate Tax LectureDocument7 pagesEstate Tax LectureVanilyn LaresmaNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- BIR eFPS filing proceduresDocument0 pagesBIR eFPS filing proceduresGrace A. ManaloNo ratings yet

- Analyze Incremental Costs & Revenues for Better DecisionsDocument80 pagesAnalyze Incremental Costs & Revenues for Better DecisionsJoshNo ratings yet

- Tax Advisory On Withholding Tax - 2.6.18Document1 pageTax Advisory On Withholding Tax - 2.6.18Gil Pino100% (1)

- NFSDocument3 pagesNFSAndrew Benedict PardilloNo ratings yet

- DEED OF SALE OF MOTOR VEHICLE-templateDocument2 pagesDEED OF SALE OF MOTOR VEHICLE-templateIvy Mallari QuintoNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- BIRForm 1905 e TIS1Document2 pagesBIRForm 1905 e TIS1Anonymous NAlWIFI56% (16)

- Promotion of Life Skills: Problem Is Something That Is Difficult To Deal With or To UnderstandDocument55 pagesPromotion of Life Skills: Problem Is Something That Is Difficult To Deal With or To UnderstandPAMAJANo ratings yet

- Module 2 - Citizenship TrainingDocument34 pagesModule 2 - Citizenship TrainingPrincess Ivonne Manigo AtilloNo ratings yet

- Autocracy Vs DemocracyDocument3 pagesAutocracy Vs Democracy1year BallbNo ratings yet

- Rescissible ContractDocument2 pagesRescissible ContractCATHY ROSALESNo ratings yet

- Consumer Protection LawDocument22 pagesConsumer Protection LawHarmanSinghNo ratings yet

- United States v. Gregory Gilmore, 471 F.3d 64, 2d Cir. (2006)Document4 pagesUnited States v. Gregory Gilmore, 471 F.3d 64, 2d Cir. (2006)Scribd Government DocsNo ratings yet

- Non ProfitDocument72 pagesNon ProfitjessyjaviNo ratings yet

- Ironridge Breathes LIFE Into Debt ExchangesDocument2 pagesIronridge Breathes LIFE Into Debt ExchangesIronridge Global PartnersNo ratings yet

- MotionsDocument52 pagesMotionsMark Mcdonald100% (10)

- Cape Law Unit 2 Muliple Choice 3 PDFDocument3 pagesCape Law Unit 2 Muliple Choice 3 PDFSamantha ClarkeNo ratings yet

- Labor Union Certification DisputeDocument5 pagesLabor Union Certification DisputeAngelica Joyce BelenNo ratings yet

- DOJ Circular No. 70Document3 pagesDOJ Circular No. 70Sharmen Dizon Gallenero100% (1)

- Electrical Evidence Analysis Request FormDocument1 pageElectrical Evidence Analysis Request FormDimasalang PerezNo ratings yet

- Filipinas Broadcasting Network Vs AMEC-BCCM Case DigestDocument6 pagesFilipinas Broadcasting Network Vs AMEC-BCCM Case DigestAlyssa Mae Ogao-ogaoNo ratings yet

- Sample Thesis Title For Criminology Students in The PhilippinesDocument5 pagesSample Thesis Title For Criminology Students in The Philippinesh0nuvad1sif2100% (1)

- Savoie Plea Agreement RedactedDocument20 pagesSavoie Plea Agreement RedactedCLDC_GSNo ratings yet

- Arrieta vs. LlosaDocument5 pagesArrieta vs. LlosaJoni PurayNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument18 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Consing Vs JamandreDocument3 pagesConsing Vs JamandreBenedict Estrella100% (1)

- Del Socorro Vs Van WilsemDocument3 pagesDel Socorro Vs Van WilsemCarlos Leandro Arriero75% (4)

- 09 Chapter 4Document106 pages09 Chapter 4Ramanah VNo ratings yet

- Legal Research and Writing Assignment Discussion of CasesDocument15 pagesLegal Research and Writing Assignment Discussion of CasesjsuarezdeangNo ratings yet

- 3 Estafa - Gallardo vs. PeopleDocument7 pages3 Estafa - Gallardo vs. PeopleAtty Richard TenorioNo ratings yet

- Setting Up a Legal Business Credit ProfileDocument7 pagesSetting Up a Legal Business Credit ProfileMaryUmbrello-Dressler83% (12)

- Classification of Law: International, Municipal, Public & PrivateDocument18 pagesClassification of Law: International, Municipal, Public & PrivateMrutyunjay SaramandalNo ratings yet

- HR035-1 Request For Iqama - Local TransferDocument1 pageHR035-1 Request For Iqama - Local TransferAkram Sayeed100% (1)

- AMLA 4 PDIC V Gidwani GR 234616 PDFDocument17 pagesAMLA 4 PDIC V Gidwani GR 234616 PDFMARIA KATHLYN DACUDAONo ratings yet

- Invitation To Pre-Qualify and Bid: City of TanauanDocument2 pagesInvitation To Pre-Qualify and Bid: City of TanauandetailsNo ratings yet

- SULH - Group Asimen 2Document7 pagesSULH - Group Asimen 2Hamizah MuhammadNo ratings yet

- Ray McDonald Closeout MemoDocument7 pagesRay McDonald Closeout MemoDeadspin100% (1)