Professional Documents

Culture Documents

2007 Indiana Electronic Filing Danielle

Uploaded by

sweetsavageOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007 Indiana Electronic Filing Danielle

Uploaded by

sweetsavageCopyright:

Available Formats

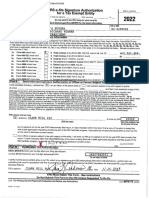

2007 PFC Letter for Electronic Filers

02/17/2008

Dear Taxpayer: 349-82-2391

Your electronically filed 2007 Indiana Individual Income Tax Return indicates a

balance owed to the Indiana Department of Revenue in the amount of $ 99.00 .

If you have any questions regarding this amount owed, you should consult the

tax preparer who prepared your income tax return electronically. Avoid penalty

and interest charges by making your payment before the April 15,2008, tax due date.

You may pay by mail, by telephone, or via the Internet.

To pay by paper check or money order, mail your payment and the tear-off coupon at

the bottom of this letter to: Indiana Department of Revenue, PO Box 1674,

Indianapolis, IN 46206-1674. Make your check or money order payable to “Indiana

Department of Revenue”. PLEASE DO NOT SEND CASH.

You may also pay by using the Indiana IN-ePay System. You may pay by electronic

Check (eCheck) over the Internet by accessing our webpage at www.in.gov/dor/epay

and follow the instructions. The fee for paying by eCheck is $1.00.

Finally, you may also use the Indiana IN-ePay System to pay by a major credit card

You can access this payment method at the webpage indicated above or by touch

tone telephone at 1-800-2PAYTAX (1-800-272-9829) toll free. You will then be

prompted for the information necessary to make your payment. A convenience fee

will be charged by the credit card processor based on the amount of tax you are

paying. You will be told what the fee is and you will have the option to cancel or

continue the credit card transaction.

Sincerely,

INDIANA DEPARTMENT OF REVENUE

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _Cut on_line before

_ mailing.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

PFC

Mail and make check payable to:

Indiana Department of Revenue

P.O. Box 1674

Indianapolis IN 46206-1674

Danielle E Knoblett

356 Mill Springs Amount Due:

fillmore, IN 46128

DCN 0 0 8

Form Do Not Mail

This Form Indiana Individual Income Tax

IT-8453OL

State Form 46201 DECLARATION OF ELECTRONIC FILING

(R6 / 8-07) For the tax year January 1 - December 31, 2007

First Name(s) and Middle Initial(s) Last Name Your Social Security Number

Danielle E Knoblett 349-82-2391

Spouse's First Name(s) and Middle Initial(s) Last Name Spouse's Social Security Number

Street Address Apartment Number

356 Mill Springs

City State Zip Code Daytime Telephone Number

fillmore IN 46128 (765)246-6050

Part I Tax Return Information (Whole Dollar Amounts Only)

1. Federal Adjusted Gross Income (Form IT-40, Line 1 or IT-40EZ, Line 1) . . . . . 1. 9,854.00

2. Indiana taxable income (Form IT-40, Line 15 or IT-40EZ, Line 5) . . . . . . . . 2. 8,854.00

I

DO NOT MAIL

3. Total Indiana tax (Form IT-40, Line 22 or IT-40EZ, Line 9) . . . . . . . . . . . .

4. Total state tax withheld (Form IT-40, Line 23 or IT-40EZ, Box 10) . . . . . . . .

5. Total county tax withheld (Form IT-40, Line 24 or IT-40EZ, Box 11) . . . . . . .

3.

4.

5.

434.00

335.00

N

6. Total Indiana tax credits (Form IT-40, Line 31 or IT-40EZ, Line 13) . . . . . . . 6. 335.00

7. Refund (Form IT-40, Line 39 or IT-40EZ, Line 16) . . . . . . . . . . . . . . . . . 7. D

8. Amount you owe (Form IT-40, Line 44 or IT-40EZ, Line 21) . . . . . . . . . . .

Part II Direct Deposit

8. 99.00

I

A

A

T 9. Routing number Note: The first two digits of the routing number must be 01 - 12 or 21 - 32.

T

A

C 10. Account number Do Not Mail

H

W

2

F

O

11. Type of account: Checking Savings Hoosier Works MC This Form

My request for direct deposit of my refund includes my authorization for the Indiana Department of Revenue to furnish my

N

R

financial institution with my routing number, account number, account type, and social security number to insure my refund is

M

S

H

E

R

properly deposited.

A

E

Part III Declaration of Taxpayer

If I have filed a balance due return, I understand that if the IDOR does not receive full and timely payment of my tax liability, I

will remain liable for the tax liability and all applicable interest and penalties.

Under penalties of perjury, I declare that the amounts in Part I above agree with the amounts on the corresponding lines of the

electronic portion of my 2007 income tax return. To the best of my knowledge and belief, my return is true correct and complete.

I consent to allow my transmitter to send my return, this declaration, and accompanying schedules and statements to the IDOR.

I also consent to the IDOR sending an acknowledgement of receipt of transmission and an indication of whether or not my

return is accepted, and, if rejected, the reason(s) for the rejection.

Please

Sign Here

Taxpayer's Signature Date Spouse's Signature Date

1064

You might also like

- Fext 2022-04-17 1650241773772 PDFDocument2 pagesFext 2022-04-17 1650241773772 PDFFera PetersonNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryKevin Ray BajadoNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryCalvin LeeNo ratings yet

- Oddo Brothers Cpas: William & Regina LittleDocument30 pagesOddo Brothers Cpas: William & Regina Littlebill littleNo ratings yet

- Acs Support PDocument9 pagesAcs Support PBrian Petro67% (3)

- CO Tax Payment FormDocument1 pageCO Tax Payment FormNicholas ZiesmerNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummarySUSAN VILLAFLORNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryNetEmbassyNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List Summaryrazulmohammad01No ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryNetEmbassyNo ratings yet

- US Internal Revenue Service: F8453ol - 2000Document2 pagesUS Internal Revenue Service: F8453ol - 2000IRSNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryElisha JeonParkNo ratings yet

- Dixo2460 19i FCDocument32 pagesDixo2460 19i FCHengki Yono100% (1)

- FederalDocument24 pagesFederalNeil NitinNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- U.S. Individual Income Tax Declaration For An IRS E-File Online ReturnDocument2 pagesU.S. Individual Income Tax Declaration For An IRS E-File Online ReturnIRSNo ratings yet

- FederalDocument15 pagesFederalNeil NitinNo ratings yet

- Yesebel Rivera Alomar 2023Document9 pagesYesebel Rivera Alomar 2023yesebelrNo ratings yet

- 2010 Application For Extension of Time To File Form IT-9Document2 pages2010 Application For Extension of Time To File Form IT-9Tyler RoachNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryMaria Gina B. ParanalNo ratings yet

- 2021 Individual 20546 (Lawrence, Stephen R. and Bette F.) ClientDocument18 pages2021 Individual 20546 (Lawrence, Stephen R. and Bette F.) ClientVANDA MOORENo ratings yet

- Ein Verification Letter 05Document2 pagesEin Verification Letter 05tontiw63No ratings yet

- US Internal Revenue Service: F8453ol - 2001Document2 pagesUS Internal Revenue Service: F8453ol - 2001IRSNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List Summaryian nasolNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List Summaryian nasolNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- Singh, Jashanpreet Tax PDF 2020 SignedDocument20 pagesSingh, Jashanpreet Tax PDF 2020 SignedJashan Dere AalaNo ratings yet

- US 1040 Main Information Sheet 2021: Email Taxpayer Occupation Spouse Occupation Filing StatusDocument7 pagesUS 1040 Main Information Sheet 2021: Email Taxpayer Occupation Spouse Occupation Filing StatusRaquel Carrero100% (2)

- SSS Payment SummaryDocument2 pagesSSS Payment SummaryEightbol NallimNo ratings yet

- 2010 Psztur R Form 1040 Individual Tax ReturnDocument20 pages2010 Psztur R Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- IRS Form 1040-SS Filing for 2019 Tax YearDocument4 pagesIRS Form 1040-SS Filing for 2019 Tax YearNoemi DíazNo ratings yet

- Payor's SSS Contribution SummaryDocument2 pagesPayor's SSS Contribution SummaryREYNALDO R REYES100% (1)

- Best EIN Verification Letter 05 - BackupDocument2 pagesBest EIN Verification Letter 05 - BackupYooo100% (1)

- 2013 Financial StatementsDocument31 pages2013 Financial Statementsapi-307029847100% (1)

- 2015 Sams C Form 1040 Individual Tax Return - FilingDocument8 pages2015 Sams C Form 1040 Individual Tax Return - FilingNguyen Hien LuongNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - RecordsDocument232 pages2019 Chandler D Form 1040 Individual Tax Return - Recordswhat is this100% (3)

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryErlinda TorresNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryREYNALDO R REYESNo ratings yet

- Form 1099-INT - 2022 - Template1 - Document 01Document9 pagesForm 1099-INT - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- US Internal Revenue Service: F8453ol - 2005Document2 pagesUS Internal Revenue Service: F8453ol - 2005IRSNo ratings yet

- eCCL5D230391929997 PDFDocument2 pageseCCL5D230391929997 PDFAmparo PasenoNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryMjlc StudioNo ratings yet

- eCCL5C240491285858Document2 pageseCCL5C240491285858jonjonNo ratings yet

- Instructions For Recipient: Copy BDocument2 pagesInstructions For Recipient: Copy Bjohana150218No ratings yet

- Fowlis, Jesse - T183Document2 pagesFowlis, Jesse - T183End UserNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryChristian MaquilanNo ratings yet

- BIR Form 2307 - May2022Document12 pagesBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryConcepcion BorjaNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryJulie SibalNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummarymagsinodanicamayNo ratings yet

- EIN Letter From IRSDocument2 pagesEIN Letter From IRSAnnabelParkNo ratings yet

- 2020 Tax ReturnDocument16 pages2020 Tax ReturnTbahajBayan100% (1)

- CLR 2020 Tax ReturnDocument14 pagesCLR 2020 Tax ReturnAlexander Barno AlexNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryChristian MaquilanNo ratings yet

- FEIN Assignment LetterDocument2 pagesFEIN Assignment LetterKealamākia Foundation0% (1)

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummarySafferoNo ratings yet

- Apple Card Statement - April 2023Document4 pagesApple Card Statement - April 2023bugzy000No ratings yet

- The Great Debate Over Hard and Soft Benefits in Loyalty ProgramsDocument13 pagesThe Great Debate Over Hard and Soft Benefits in Loyalty ProgramsSha Kumar100% (1)

- Become Debt Free Now by Gregory Mannarino.Document20 pagesBecome Debt Free Now by Gregory Mannarino.momentumtrader100% (1)

- MobikwikDocument14 pagesMobikwikapi-556903190No ratings yet

- Acupuncture Needles and TCM ProductsDocument21 pagesAcupuncture Needles and TCM Productsluke3No ratings yet

- Oracle Payment Interface: Oracle Hospitality Simphony 2.9 Native Driver Installation Guide Release 6.1Document34 pagesOracle Payment Interface: Oracle Hospitality Simphony 2.9 Native Driver Installation Guide Release 6.1Ravi PampanaNo ratings yet

- SecurePay Response CodesDocument8 pagesSecurePay Response CodesM J RichmondNo ratings yet

- IeltsDocument2 pagesIeltsraman.kumar.1688No ratings yet

- Norwex Consultant Application Form CanadaDocument2 pagesNorwex Consultant Application Form Canadajlees7707No ratings yet

- Reaction PaperDocument4 pagesReaction PaperDonald KamNo ratings yet

- Magna Cart A For MeralcoDocument7 pagesMagna Cart A For Meralcost_richard04No ratings yet

- Information Systems Audit Report: Western Australian Auditor General's ReportDocument52 pagesInformation Systems Audit Report: Western Australian Auditor General's ReportAnonymous SqfMt6qeNo ratings yet

- United States v. Pervaz, 1st Cir. (1997)Document70 pagesUnited States v. Pervaz, 1st Cir. (1997)Scribd Government DocsNo ratings yet

- Toefl Ibt Examinee Fee Voucher ServiceDocument2 pagesToefl Ibt Examinee Fee Voucher ServiceKevin JunkarinNo ratings yet

- Your CIBIL Score Where You StandDocument50 pagesYour CIBIL Score Where You StandApoorva kNo ratings yet

- Busnetticket 20220313145552Document1 pageBusnetticket 20220313145552Hasbi AshShidiqNo ratings yet

- For Bank Use Only For Bank Use Only: EP001057957 Sourcing Channel EP001057957 Sourcing ChannelDocument5 pagesFor Bank Use Only For Bank Use Only: EP001057957 Sourcing Channel EP001057957 Sourcing ChannelKishore L NaikNo ratings yet

- Online Shopping SystemDocument31 pagesOnline Shopping SystemDapborlang Marwein86% (7)

- Charges 2007Document1 pageCharges 2007ajbryceNo ratings yet

- Jio BillDocument1 pageJio BilllalitarathodvasNo ratings yet

- Doa-Sblc 100M Lease (12%) - Nab (02.08.2023)Document19 pagesDoa-Sblc 100M Lease (12%) - Nab (02.08.2023)Kencana WunguNo ratings yet

- Denali Individual Dental All Other States - AETNADocument10 pagesDenali Individual Dental All Other States - AETNAJohn BerkowitzNo ratings yet

- Gap Analysis of Services Offered in Retail BankingDocument92 pagesGap Analysis of Services Offered in Retail Bankingjignay100% (18)

- PWC 2019 Employee Wellness Survey PDFDocument37 pagesPWC 2019 Employee Wellness Survey PDFKaterinNo ratings yet

- SABB Platinum Visa Credit Card StatementDocument2 pagesSABB Platinum Visa Credit Card Statementsabah alsannaa100% (1)

- HDFC Bank - We Understand Your World - Stock Analysis & ValuationDocument93 pagesHDFC Bank - We Understand Your World - Stock Analysis & ValuationDeep SukhwaniNo ratings yet

- STATEMENTS, September2023 3287Document7 pagesSTATEMENTS, September2023 3287aduadjoechristophereduNo ratings yet

- Lumen OhmDocument7 pagesLumen Ohmapi-388593380No ratings yet

- Document Status ViewsDocument14 pagesDocument Status Viewssapgts weekendNo ratings yet

- Congratulations! Your Booking Is Now Confirmed.: Price RP 12,442,514Document4 pagesCongratulations! Your Booking Is Now Confirmed.: Price RP 12,442,514Cyara gNo ratings yet