Professional Documents

Culture Documents

Income Tax Withholding Form

Uploaded by

Septian Bayu KristantoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Withholding Form

Uploaded by

Septian Bayu KristantoCopyright:

Available Formats

staples area

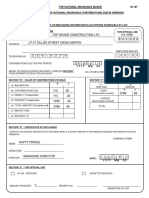

INCOME TAX WITHHOLDING

ART. 21 FOR EMPLOYEE OR

RECIPIENTS OF PENSION OR RETIREMENT FORM 1721 - A1

ALLOWANCE AND First Page: for Income Recipient

RETIREMENT SAVING Second Page: For Withholder

INCOME RECEIPT

MINISTRY OF FINANCE OF RI PERIOD [mm - mm]

DIRECTORATE GENERAL OF TAXES NO : H.01 1 . 1 - . - H.02 -

TIN OF

WITHHOLDER : H.03

- .

NAME OF

WITHHOLDER : H.04

A. IDENTITY OF WITHHELD INCOME RECIPIENT

1. TIN : A.01 - . 6. STATUS / NUMBER OF DEPENDANT

ID NO/ M/ S/ HB /

2. PASSPORT

NO. : A.02 A.07 A.08 A.09

3. NAME : A.03 7. OCCUPATION A.10

4. ADDRESS : A.04 8. FOREIGNER A.11 YES

9. DOMICILE COUNTRY CODE : A.12

5. SEX A.05 MALE A.06 FEMALE

B. DETAIL OF INCOME AND CALCULATION OF INCOME TAX ART. 21

DESCRIPTION AMOUNT (Rp)

TAX OBJECT CODE : 21-100-01 21-100-02

GROSS INCOME :

1. SALARY/PENSION/RETIREMENT ALLOWANCE

2. INCOME TAX ALLOWANCE

3. OTHER ALLOWANCE, OVERTIME ALLOWANCE, ETC

4. HONORARIUM AND OTHER SIMILAR INCOME

5. INSURANCE PREMIUM PAID BY THE EMPLOYER

6. INCOME IN THE FORM OF BENEFIT IN KIND OR OTHER WHICH WITHHELD BY INCOME TAX ART. 21

7. BONUS, GRATIFICATION, PRODUCTION SERVICE AND GRATIFIKASI

8. TOTAL GROSS INCOME (1 TO 7)

DEDUCTION :

9. OCCUPATIONAL DEDUCTION / PENSION EXPENSE

10. PENSION CONTRIBUTION OR RETIREMENT CONTRIBUTION

11. TOTAL DEDUCTION (9 TO 10)

INCOME TAX ART 21 CALCULATION :

12. TOTAL NET INCOME (8-11)

13. PREVIOUS PERIOD NET INCOME

14. TOTAL NET INCOME FOR INCOME TAX ART 21 CALCULATION (ANNUAL / ANNUALIZED)

15. PERSONAL EXEMPTION

16. ANNUAL / ANNUALIZED TAXABLE INCOME (14 - 15)

17. INCOME TAX ART. 21 OF ANNUAL / ANNUALIZED INCOME

18. INCOME TAX ART. 21 WHICH ALREADY WITHHELD IN THE PREVIOUS PERIOD

19. INCOME TAX ART 21 PAYABLE

20. INCOME TAX ART 21 AND ART 26 WHICH ALREADY BEEN WITHHELD AND SETTLED

C. IDENTITY OF WITHHOLDER

1. TIN : C.01 - . 3. DATE & SIGN

2. NAME : C.02 C.03 - -

[dd - mm - yyyy]

You might also like

- Income Tax Calculator For MaleDocument10 pagesIncome Tax Calculator For MaleSri GuganNo ratings yet

- Bayero University, Kano Bayero Business School: A. Course DescriptionDocument56 pagesBayero University, Kano Bayero Business School: A. Course DescriptionMoses AhmedNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- DD 2887Document1 pageDD 2887Jake JonesNo ratings yet

- Atlas Consolidated Mining and Development Corp. v. CIRDocument1 pageAtlas Consolidated Mining and Development Corp. v. CIRms_paupauNo ratings yet

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- Russell V NACS National Attorney Collection Services FDCPA ComplaintDocument6 pagesRussell V NACS National Attorney Collection Services FDCPA ComplaintghostgripNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- ACAS Taxation 2 (Income Tax - Full Midterm Coverage)Document15 pagesACAS Taxation 2 (Income Tax - Full Midterm Coverage)Steven OrtizNo ratings yet

- This Study Resource Was: A Domestic Corporation Provided The Following Data For 2020Document4 pagesThis Study Resource Was: A Domestic Corporation Provided The Following Data For 2020Anne Marieline BuenaventuraNo ratings yet

- Leonen Qa Taxation LawDocument12 pagesLeonen Qa Taxation LawHarriz Dela CruzNo ratings yet

- Form 1770 Attachment - Calculating Domestic IncomeDocument5 pagesForm 1770 Attachment - Calculating Domestic IncomeellenruntunuwuNo ratings yet

- General Instructions For The Completion PDF Form 1770 SDocument14 pagesGeneral Instructions For The Completion PDF Form 1770 SHafiedz S100% (1)

- VISA Statement Letter for South Korea Visa ApplicationDocument1 pageVISA Statement Letter for South Korea Visa ApplicationAnnisa YutamiNo ratings yet

- Income Tax Withholding FormDocument2 pagesIncome Tax Withholding FormOki IndriawanNo ratings yet

- Ni 189Document2 pagesNi 189AkidaNo ratings yet

- 2660 - JS2 - G - Anisah Rahmiwati - 1005037Document1 page2660 - JS2 - G - Anisah Rahmiwati - 1005037sardianakusumaputri690No ratings yet

- Form-1770-Attachment I Page 1Document1 pageForm-1770-Attachment I Page 1rover2010No ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Employment TaxesDocument10 pagesEmployment TaxesMcKenzieLawNo ratings yet

- I Fue - SR EditDocument2 pagesI Fue - SR EditharoldNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- ReportDocument2 pagesReportAnthony VinceNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Cta 2D CV 06202 A 2009apr14 AssDocument21 pagesCta 2D CV 06202 A 2009apr14 AssAlfonso LeeNo ratings yet

- GST APL-01 Speedway Surgical CoDocument14 pagesGST APL-01 Speedway Surgical CoUtkarsh KhandelwalNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Allison Charles - 5118 - ScannedDocument8 pagesAllison Charles - 5118 - ScannedZach EdwardsNo ratings yet

- Financial Status Report: Section I - Personal DataDocument2 pagesFinancial Status Report: Section I - Personal Datatokidokisean tagadagzNo ratings yet

- Taxation 2: Income Tax and DeductionsDocument19 pagesTaxation 2: Income Tax and DeductionsAprilNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Zalyn Vale Format - 1Document14 pagesZalyn Vale Format - 1Jonnel CatadmanNo ratings yet

- Number: Text Area Text AreaDocument2 pagesNumber: Text Area Text Areatokidokisean tagadagzNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Budget Prep Form TemplateDocument15 pagesBudget Prep Form Templatemardee justoNo ratings yet

- TDS Certificate SummaryDocument14 pagesTDS Certificate SummaryVaibhav NagoriNo ratings yet

- Form 12A FormatDocument1 pageForm 12A FormatjaipalmeNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Fidelity Bond Application Form (FBAF)Document2 pagesFidelity Bond Application Form (FBAF)noeljarabata3No ratings yet

- Amrd - Payment - ChallanDocument1 pageAmrd - Payment - Challanelluri.sudhakarNo ratings yet

- PF Calculation Sheet SL - No. Location No - of Employee PF Salary Emps Cont. (12%) Empr Cont (3.67%)Document4 pagesPF Calculation Sheet SL - No. Location No - of Employee PF Salary Emps Cont. (12%) Empr Cont (3.67%)maninder_10No ratings yet

- Yuchengco Vs CIR, CTA PDFDocument67 pagesYuchengco Vs CIR, CTA PDFMonaVargasNo ratings yet

- 20 SCT SDG q2072 Volume I GCC 1599794563Document59 pages20 SCT SDG q2072 Volume I GCC 1599794563nguyen huyNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Court Affirms Tax Refund for LuzvimindaDocument11 pagesCourt Affirms Tax Refund for LuzvimindaHenson MontalvoNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Seec Form 20Document27 pagesSeec Form 20str3268No ratings yet

- Term Loan Agreement 3Document141 pagesTerm Loan Agreement 3befaj44984No ratings yet

- ABS-CBN SEC Form 17 (02272024)Document6 pagesABS-CBN SEC Form 17 (02272024)Verafiles NewsroomNo ratings yet

- BIR Form 1601-C GuideDocument2 pagesBIR Form 1601-C GuideDeebees Marie Erazo TumulakNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- Travel OrderDocument4 pagesTravel OrderAldrin NolascoNo ratings yet

- 1601c FormDocument8 pages1601c FormPingLomaadEdulanNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- Form 16 TDS certificateDocument8 pagesForm 16 TDS certificateVikas PattnaikNo ratings yet

- CMP08 10afvpg0268g2zm 142021Document2 pagesCMP08 10afvpg0268g2zm 142021MILTON MOHANTYNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- It 000128980840 2021 00Document1 pageIt 000128980840 2021 00Salman GagaNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Chapter 02Document14 pagesChapter 02Septian Bayu KristantoNo ratings yet

- Template Engagement English v2Document4 pagesTemplate Engagement English v2Septian Bayu KristantoNo ratings yet

- 547 Source ResultsDocument26 pages547 Source ResultsSeptian Bayu KristantoNo ratings yet

- Top Accounting Journals by CiteScore 2018-2021Document8 pagesTop Accounting Journals by CiteScore 2018-2021Septian Bayu KristantoNo ratings yet

- Lampiran - 1 Formulir Pendaftaran ASEAN CPADocument4 pagesLampiran - 1 Formulir Pendaftaran ASEAN CPAridha azka rNo ratings yet

- Perpajakan Di Era New NormalDocument26 pagesPerpajakan Di Era New NormalSeptian Bayu KristantoNo ratings yet

- All About MHADA Housing SchemeDocument2 pagesAll About MHADA Housing SchemerutujaNo ratings yet

- Sales Kit - Big Sale March 2015 - West Malaysia PDFDocument43 pagesSales Kit - Big Sale March 2015 - West Malaysia PDFEnCikTarmeziNo ratings yet

- SM CH10Document32 pagesSM CH10Judz SawadjaanNo ratings yet

- Solved MR and Mrs Soon Are The Sole Shareholders of SWDocument1 pageSolved MR and Mrs Soon Are The Sole Shareholders of SWAnbu jaromiaNo ratings yet

- Accounting For Income Taxes Pt. 2: Temporary DifferencesDocument23 pagesAccounting For Income Taxes Pt. 2: Temporary Differenceskrisha milloNo ratings yet

- Eris Therapeutics LTD: Salary Slip For December - 2022Document1 pageEris Therapeutics LTD: Salary Slip For December - 2022Raja ThakurNo ratings yet

- International Tax Transfer Pricing MethodsDocument17 pagesInternational Tax Transfer Pricing MethodsAshish pariharNo ratings yet

- CS5 SopolDocument2 pagesCS5 SopolBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Test 1 - AimCAT 2019 - 2001Document7 pagesTest 1 - AimCAT 2019 - 2001Abha ChoudharyNo ratings yet

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- Solved During 2015 Rita Acquired and Placed in Service Two AssetsDocument1 pageSolved During 2015 Rita Acquired and Placed in Service Two AssetsAnbu jaromiaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceGanesh PrabuNo ratings yet

- Transactions Deemed Sales-OlDocument2 pagesTransactions Deemed Sales-OlDeeNo ratings yet

- Principles of Taxation2Document8 pagesPrinciples of Taxation2Daniel DialinoNo ratings yet

- Tax Invoice: Billed To: Invoice DetailsDocument1 pageTax Invoice: Billed To: Invoice Detailsbipin jainNo ratings yet

- Section 203, 204 and 222 and 223 of NIRCDocument2 pagesSection 203, 204 and 222 and 223 of NIRCKristine Jay Perez-CabusogNo ratings yet

- Inland Revenue Act Sri LankaDocument234 pagesInland Revenue Act Sri LankayohanmataleNo ratings yet

- Semester "FALL 2021": Taxation Management (Fin623)Document2 pagesSemester "FALL 2021": Taxation Management (Fin623)Ali Raza NoshairNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Best in Sytems Tech. 2021payrollsignedDocument20 pagesBest in Sytems Tech. 2021payrollsignedSombre Sumayo Jackie MarieNo ratings yet

- Notes From PT 365 2022Document1 pageNotes From PT 365 2022Atul KumarNo ratings yet

- PT Vloowless Kosmetik Indonesia PayslipDocument1 pagePT Vloowless Kosmetik Indonesia PayslipZyka OediNo ratings yet

- Sample Filled Form 12BDocument3 pagesSample Filled Form 12BSanjay sharma50% (2)

- Tax Notice Assessment No PayableDocument1 pageTax Notice Assessment No PayabletehtarikNo ratings yet

- Pump MRP January 2016Document4 pagesPump MRP January 2016navneetNo ratings yet

- Refund ApplicationDocument1 pageRefund ApplicationPaige TortorelliNo ratings yet