Professional Documents

Culture Documents

Jean MM - 07 14 2010

Uploaded by

rsteve5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jean MM - 07 14 2010

Uploaded by

rsteve5Copyright:

Available Formats

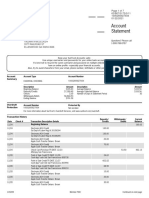

Statement of Account

Last statement: June 11, 2010

This statement: July 14, 2010

Total days in statement period: 33

030-000-927-1 029 286

Page 1 of 1

JEAN COX STEVENS Direct inquiries to:

RAYMOND H STEVENS 770-576-4471

WILLIAM E COX

1320 KNOLL WOODS CT

ROSWELL GA 30075-3407

Summary of Account Balance

Account Number Ending Balance

Premium Money Market 030-000-927-1 $116,901.17

Premium Money Market Account Number 030-000-927-1

Beginning balance 116,754.88

Deposits/Credits 146.29 Low balance 116,754.88

Withdrawals/Debits 0.00 Average balance 116,754.88

Ending balance 116,901.17 Average collected balance 116,754.00

Interest paid year to date 1,069.37

Deposits/Other Credits

Date Transaction Type Description Amount

07-14 Interest Credit 146.29

Balance Summary

Date Amount Date Amount Date Amount

06-11 116,754.88 07-14 116,901.17

Interest Summary

Annual percentage yield earned 1.39% Average balance for APY 116,754.88

Interest-bearing days 33 Interest 146.29

Overdraft/Return Item Fees

Total for Total

this period year-to-date

Total Overdraft Fees $0.00 $0.00

Total Returned Item Fees $0.00 $0.00

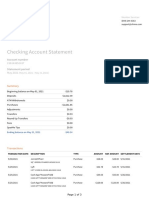

Checks and Debits Outstanding Follow these easy steps to reconcile your checkbook to the "Ending

Check No. Amount Balance" shown on the front of this statement:

1) Make sure that all the transactions listed on this statement have also been

entered in your checkbook register, including all deposits, credits, checks,

check card transactions, ATM transactions and other debits. Make sure

the amounts are the same in both places.

2) Mark the checks and other debits in your checkbook that have been paid

by the bank; mark the credits in your checkbook that have cleared the

bank.

3) Enter all the items that have not yet been paid by the bank and are still

outstanding. These are items that are not shown on this statement and

have not appeared on any previous statement.

4) Enter the “Ending Balance” shown on this

statement. $________________

5) Add (+)

Deposits not shown on this statement (if any) + ________________

6) Subtract (-) $________________

Checks and/or other debits still outstanding -________________

Balance $________________

Should equal the balance in your checkbook

Total

If your account does not balance, please check the following: amount you think is in error so that you may have use of the

• Have you added and subtracted correctly - both in your money during the time it takes us to complete the investigation.

checkbook register and in steps 3-6 above?

• Have you correctly entered the amounts of each deposit, Order of Payments

credit, check or other debit in your checkbook? Checks or other items and charges drawn on or made to your

• Do all checks and other debits you have marked as paid account may be paid in any order we determine. We may do so

appear on this statement? Are any still outstanding that you even if it results in an insufficient balance in your account or

have marked as paid? more service charges by paying a particular item before others

• Have all deposits been added to your checkbook record and that otherwise could have been paid. However, our customary

do the amounts agree with the amounts on this statement? practice is to pay transactions presented at the same time in

• Have you carried the correct balance forward from one descending order of amount.

checkbook register page to the next?

• Are you sure that all items you show as outstanding are not Billing Rights Summary

on this statement or any previous statement? (Personal Reserve Account Only)

In case of errors or questions about your statement:

Electronic Fund Transfers Preauthorized Credits If you think your statement is wrong or if you need more

If you have arranged to have direct deposits made to your information about a transaction on the statement, write us (on a

account, you can call us at the telephone number indicated on separate sheet) at the address indicated on page one of this

page one of this statement to find out whether or not the deposits statement as soon as possible. We must hear from you no later

have been made. than 60 days after we sent you the FIRST statement on which the

error or problem appeared. You can telephone us, but doing so

Electronic Fund Transfer Disclosure will not preserve your rights. In your letter, give us the following

In case of errors or questions about your electronic transfers: information:

If you think your statement or receipt is wrong or if you need (1) Your name and account number.

more information about a transfer on the statement or receipt, (2) Describe the error and explain as clearly as you can why

please telephone us at the number or write us at the address you believe there is an error. If you need more information,

indicated on page one of this statement as soon as possible. We describe the item you are unsure about.

must hear from you no later than 60 days after we sent you the (3) Tell us the dollar amount of the suspected error.

FIRST statement on which the error or problem appeared. You do not have to pay any amount in question while we are

(1) Tell us your name and account number. investigating, but you are still obligated to pay the parts of your

(2) Describe the error or the transfer you are unsure about. statement that are not in question. While we investigate your

Explain as clearly as you can why you believe there is an error or question, we cannot report you as delinquent or take any action to

why you need more information. collect the amount you question.

(3) Tell us the dollar amount of the suspected error.

We will investigate your complaint and will correct any error

promptly. For Consumer/Personal accounts if we take more than

10 business days to do this, we will recredit your account for the

You might also like

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- American Express Serve Statement SummaryDocument6 pagesAmerican Express Serve Statement SummaryJohn Bean0% (1)

- Estmt - 2021 05 24Document4 pagesEstmt - 2021 05 24Aditya Pangestu ArdanaNo ratings yet

- Member checking statement July 2020Document2 pagesMember checking statement July 2020Devin GaulNo ratings yet

- J 2145 Shadow Ridge RD Conway Arkansas 72032 Destin Barkely: Simple Checking 182379407956Document1 pageJ 2145 Shadow Ridge RD Conway Arkansas 72032 Destin Barkely: Simple Checking 182379407956hash guruNo ratings yet

- October, 2023Document3 pagesOctober, 2023Nestor MartinezNo ratings yet

- Discover Card: Make A Payment Confirmation PrintableDocument1 pageDiscover Card: Make A Payment Confirmation PrintableAnup KathetNo ratings yet

- OctoberDocument7 pagesOctoberkaty.haugland2No ratings yet

- Frequently Asked Questions On Electronic Clearing ServiceDocument7 pagesFrequently Asked Questions On Electronic Clearing Serviceravi150888No ratings yet

- Bank Statement: If You Have Any Questions About Your Statement, Please Call Us at 021-622299Document1 pageBank Statement: If You Have Any Questions About Your Statement, Please Call Us at 021-622299Tri Adi NugrohoNo ratings yet

- Statement RaxonDocument4 pagesStatement Raxonwarfa jibrilNo ratings yet

- Attachment 16268014602Document5 pagesAttachment 16268014602Web TreamicsNo ratings yet

- Member Statement SummaryDocument3 pagesMember Statement Summarycathy clarkNo ratings yet

- Statement NewDocument2 pagesStatement NewabhiramNo ratings yet

- September 13, 2018 Statement PDFDocument6 pagesSeptember 13, 2018 Statement PDFAnonymous MNcPT60% (1)

- MarchDocument4 pagesMarchsgtfrnzNo ratings yet

- Christopher Collins January Bank StatementDocument2 pagesChristopher Collins January Bank StatementJim Boaz100% (1)

- Bank StatementDocument1 pageBank StatementAndré QueirozNo ratings yet

- Bank Statement Template 16 PDFDocument2 pagesBank Statement Template 16 PDFBara CreativesNo ratings yet

- First Tech Credit Union Fees ScheduleDocument3 pagesFirst Tech Credit Union Fees ScheduleNamtien UsNo ratings yet

- Transaction Summary: Contact UsDocument1 pageTransaction Summary: Contact UsJesseneNo ratings yet

- Financial Summary Account# Balance Financial Summary Account# BalanceDocument3 pagesFinancial Summary Account# Balance Financial Summary Account# BalanceShelvya ReeseNo ratings yet

- Statement For Blink LTD As at 31jul2020 PDFDocument1 pageStatement For Blink LTD As at 31jul2020 PDFMary Anne JamisolaNo ratings yet

- Member Statements-04302021Document2 pagesMember Statements-04302021bNo ratings yet

- April Bank StatementDocument1 pageApril Bank StatementQuiskeya LLCNo ratings yet

- MCCLOUDY Jan Statements2021Document7 pagesMCCLOUDY Jan Statements2021David GarciaNo ratings yet

- StatementDocument4 pagesStatementtochi efienokwuNo ratings yet

- Texas Bank April30Document4 pagesTexas Bank April3076xzv4kk5vNo ratings yet

- 3 Boa Aftan Sneed Dec 2023Document6 pages3 Boa Aftan Sneed Dec 2023raheemtimo1No ratings yet

- Review your credit union statementDocument3 pagesReview your credit union statementalysNo ratings yet

- Jpmorgan Chase Bank, N.A. P O Box 659754 San Antonio, TX 78265 - 9754 August 17, 2015 Through September 14, 2015 Account NumberDocument2 pagesJpmorgan Chase Bank, N.A. P O Box 659754 San Antonio, TX 78265 - 9754 August 17, 2015 Through September 14, 2015 Account NumberShorav SuriyalNo ratings yet

- NFC July 2023 UpdatedDocument3 pagesNFC July 2023 UpdatedMuhammad UsmanNo ratings yet

- Chime Bank Statement Summary May 2021Document3 pagesChime Bank Statement Summary May 2021Kalila JamesNo ratings yet

- 26 Estat PDFDocument4 pages26 Estat PDFRicky CazaresNo ratings yet

- Deanna STTMNTDocument2 pagesDeanna STTMNTShelvya ReeseNo ratings yet

- Stephanie December 2018 EStatementDocument2 pagesStephanie December 2018 EStatementSteve AllisonNo ratings yet

- ListDocument8 pagesListLuis RodríguezNo ratings yet

- Dover StatementDocument4 pagesDover StatementHeritage Digital ArtsNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityEduardo PerezNo ratings yet

- Bright Red March DoneDocument4 pagesBright Red March DoneAleesha AleeshaNo ratings yet

- StatementDocument4 pagesStatementUchi MoNo ratings yet

- EstatementDocument2 pagesEstatementIKEOKOLIE HOMEPCNo ratings yet

- 20230601-Bank Statement - UnlockedDocument6 pages20230601-Bank Statement - UnlockedAleesha AleeshaNo ratings yet

- Bank Statement LanayaDocument3 pagesBank Statement LanayashrondaNo ratings yet

- Greendot StatementDocument1 pageGreendot StatementSiobhan76No ratings yet

- Citibank Notice of Insufficient FundsDocument2 pagesCitibank Notice of Insufficient FundsChristopher TorresNo ratings yet

- Date Transaction Description Amount (In RS.)Document2 pagesDate Transaction Description Amount (In RS.)MITESH KUMAR100% (1)

- January 09, 2018Document6 pagesJanuary 09, 2018Monina JonesNo ratings yet

- Effective May 10, 2021 "Your Deposit Account Agreement" "Consumer Pricing Information"Document4 pagesEffective May 10, 2021 "Your Deposit Account Agreement" "Consumer Pricing Information"kayNo ratings yet

- USA SunTrust Bank StatementDocument1 pageUSA SunTrust Bank StatementLiam AbreuNo ratings yet

- Earnings Statement: Non NegotiableDocument3 pagesEarnings Statement: Non NegotiableKang KimNo ratings yet

- Summary of Accounts: 102101645 Lori Fudens Hair Designing, Inc. 140 Island Fly CLEARFLTER BEACH FL 33767-2216Document3 pagesSummary of Accounts: 102101645 Lori Fudens Hair Designing, Inc. 140 Island Fly CLEARFLTER BEACH FL 33767-2216bobNo ratings yet

- Christopher Collins March Bank StatementDocument2 pagesChristopher Collins March Bank StatementJim BoazNo ratings yet

- Citizens Bank Credit Card Statement: Account SummaryDocument1 pageCitizens Bank Credit Card Statement: Account SummaryMira KarkiNo ratings yet

- Check Stubs 1Document1 pageCheck Stubs 1Asya WashingtonNo ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Account Summary - 7902819734Document2 pagesAccount Summary - 7902819734hanhNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Captial Bank PDFDocument6 pagesCaptial Bank PDFayaNo ratings yet

- 2023 12 31 StatementDocument3 pages2023 12 31 StatementAlex NeziNo ratings yet

- Effective Rate and Compensating Balance CalculationsDocument4 pagesEffective Rate and Compensating Balance CalculationsLalaina EnriquezNo ratings yet

- Registration for ICACITE 2021 ConferenceDocument1 pageRegistration for ICACITE 2021 ConferenceKrishna KantNo ratings yet

- Allahabad Bank ChallanDocument2 pagesAllahabad Bank ChallanAshad R Reghu50% (2)

- Statement of Account PDFDocument2 pagesStatement of Account PDFASHU ARYANo ratings yet

- Amrit Homes, Sector - 88, FaridabadDocument10 pagesAmrit Homes, Sector - 88, FaridabadGaurav AggarwalNo ratings yet

- Quizzer 1 Cash and Cash EquivalentsDocument3 pagesQuizzer 1 Cash and Cash EquivalentsMocha FurrerNo ratings yet

- TUTORIAL 3 (Assignment Question)Document4 pagesTUTORIAL 3 (Assignment Question)davi gibranNo ratings yet

- A Study On RDCC BankDocument94 pagesA Study On RDCC BankBettappa patil33% (3)

- Rishitha Dance RecieptDocument1 pageRishitha Dance RecieptGS HarshithNo ratings yet

- Fabm2 q2 m3 Bank Reconciliation EditedDocument29 pagesFabm2 q2 m3 Bank Reconciliation EditedMaria anjilu VillanuevaNo ratings yet

- Bangalore University - Provisional Examination ResultsDocument2 pagesBangalore University - Provisional Examination ResultsMegha PkNo ratings yet

- Section 1 - AnswersDocument7 pagesSection 1 - AnswersDina AlfawalNo ratings yet

- Group8 - ReportDocument27 pagesGroup8 - ReportAgastin kNo ratings yet

- Internship Report Askari BankDocument107 pagesInternship Report Askari Bankafgan52No ratings yet

- Specimen of Education Loan Sanction LetterDocument1 pageSpecimen of Education Loan Sanction LetterNeha Sharma80% (5)

- Regulatory Framework for Lending ActDocument2 pagesRegulatory Framework for Lending ActmarkNo ratings yet

- Elements of Banking and Finance (FINA 1001) Semester I (2020/2021)Document38 pagesElements of Banking and Finance (FINA 1001) Semester I (2020/2021)Tia WhoserNo ratings yet

- Direct DebitDocument24 pagesDirect Debitatifhassansiddiqui100% (3)

- OFFICE DETAILSDocument14 pagesOFFICE DETAILSShanmugam SubramanyanNo ratings yet

- Questionnaire For Adoption of Mobile WalletDocument5 pagesQuestionnaire For Adoption of Mobile WalletAditya Shukla75% (12)

- AUB Credit CardDocument18 pagesAUB Credit CardLovely Jennifer Torremonia IINo ratings yet

- File 000Document2 pagesFile 000AngelicaNo ratings yet

- Banks, Shadow Banking, and FragilityDocument39 pagesBanks, Shadow Banking, and FragilityAdminAliNo ratings yet

- Revised Development ProjectDocument11 pagesRevised Development ProjectEngr. Mohammad Moinul HossainNo ratings yet

- Asnake InternshipDocument36 pagesAsnake Internshipkassahungedefaye312No ratings yet

- Act HQ PR#4Document4 pagesAct HQ PR#4Ann louNo ratings yet

- Rekening Perush PDFDocument3 pagesRekening Perush PDFRosarina HestyNo ratings yet

- Traveloka Refund Terms SummaryDocument7 pagesTraveloka Refund Terms SummaryherawatisusiNo ratings yet

- Account Opening Form For NRIDocument12 pagesAccount Opening Form For NRISanjay Jay SanjayNo ratings yet