Professional Documents

Culture Documents

12 Accountancy 2018 Sample Paper 2

Uploaded by

Sukhjinder SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Accountancy 2018 Sample Paper 2

Uploaded by

Sukhjinder SinghCopyright:

Available Formats

CBSE

Class 12 2017-18

Accountancy Sample Paper-02

General Instruction: -

1. All question are complusory.

2. Marks are Given alongwith their questions.

PART A (Partnership and Company accounts)

Q1 what are the number of months taken for calculation of interest on drawings if drawings

are charged at the end of each quarter? (1)

Q2 A B and C are partners with no partnership deed. A advances 10,000 as loan to the firm

and demands interest @12% p.a. Is A correct give reasons? (1)

Q3 what is the maximum discount that can be offered in case of reissue of shares. (1)

Q4 Pass journal entry for reissue of shares- 1000 shares were reissued at 70, 80 paid up. (1)

Q5 calculate interest on debentures- rs 5,00,000 7% debentures issued on 1st april 2013. (1)

Q6 A B C are partners sharing profits and losses in the ratio of 3:2:1. B retires from the firm.

Calculate gaining ratio and new ratio. (1)

Q7 This question contains two parts – (3)

a) Gauri limited converted 450 10% debentures of 100 Each at a premium of 10% by

converting them in to equity shares of 100 each issued at a premium of 25%. Pass journal

entry.

b) S Ltd took a loan from PNB of 1,00,000 by issuing 10,000 debentures of 12 each as collateral

security. Pass journal entry and show it in the balance sheet.

Q8 M ltd issued 2000 shares of 10 each at a premium of 5 payable – 3 on application 5 on

allotment(including premium) and balance on first and final call. Prepare the cash book of

the company. (3)

Material downloaded from myCBSEguide.com. 1 / 23

Q9 Rohit Mohit and Sohit are partners sharing profit and losses in the ratio of 2:1:1.. Their

capitals on 31st march 2017 are 5,30,000 6,40,000 and 7,90,000. Their drawings were rohit =

70,000 mohit = 60,000 and sohit = 10,000. Partnership deed provided to charge interest on

capital @10% p a and interest on drawings @ 5%. Prepare profit and loss appropriation

account. (3)

Q10 Designs unlimited is in a garment business . it decided to install 100 toilets in school

under swachh bharat. It purchased material from Indian traders limited costing 225000.

Payment was made 5000 through cheque and remaining by issuing equity shares of 10 each

at 10% premium. Pass journal entries. (3)

Q11 A B and C are partners sharing profits in the ratio of capitals. Their capitals were 50,000

25,000 and 25,000. The following omissions were made-

i) Interest on capital @5%

ii) Salary to C 1000 per month

iii) The profit for the year was 33000 which was distributed equally. Pass journal entry . (4)

Q12 Pawan Iqbal and Rick are partners sharing profits in the ratio of 2:2:1. From april 2016

they decided to share profits in the ratio of 1:2:2. On that date following balances appeared –

profit and loss account(debit balance) = 40,000 general reserve = 140,000 deferred revenue

expenditure=20,000. Pass adjusting entry. (4)

Q13 K S and R are partners sharing profits and losses in the ratio of 3:2:1.on 31st march 2016

their balance sheet was as follows- (6)

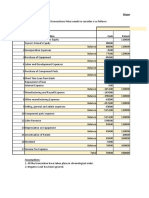

Liabilities Amount Assets Amount

Creditors 72000 70,000

Cash at bank

General reserve 24000 50000

Investments

Capitals – 15000

Patents

K- 75000 25000

Stock

S-70000 20000

Debtors

R- 50000 195000 75000

Building

36000

Machinery

291000 291000

Material downloaded from myCBSEguide.com. 2 / 23

R died on 31st may 2016

i) Goodwill of the firm be valued at 3 years purchase of average profits of last 5 years ,which

were 2011- 40000 2012 -40000 2013- 30,000 2014 – 40,000 2015- 50,000

ii) Richa share of profits till the date of death to be calculated on average profit of last two

years.

Prepare richa capital account.

Q14 following is the balance sheet of harsh and sureshwho share profits in the ratio of 3:2 (6)

Liabilities Amount Assets Amount

31500 21000

Plant and machinery

Creditors 1250 3000

Stock

General reserve

Debtors 10,000

Capitals – 9500

-provision(500)

Harsh -5000 9000 5750

Bank

Suresh -4000 2500

Profit and loss account

41750 41750

The firm was dissolved on 31st march. Plant and machinery realized 16000 and stock 2500.

9000 were collected from debtors. Creditors were paid 30,000. Prepare realization account

partner’s capital account and bank account.

Q15 a) A B C are partners sharing profit and losses in the ratio of 5:3:2. Pass journal entries-

(3)

i) The value of fixed assets =1,00,000. Fixed assets are overvalued by 20%

ii) Make provision for outstanding expenses =10,000

iii) Goodwill of the firm was valued at 50,000. The new ratio was 3:2 . C retired from the firm.

(b) A ltd purchased rs 25000 of its own debentures of rs 100 each at rs 90 reedemed at a

premium of 10%. Pass journal entries for cancellation. (3)

Material downloaded from myCBSEguide.com. 3 / 23

Q16 radha limited issued 40,000 shares of rs 10 each at a premium of rs 2 per share payable –

4 on application 5 on allotment (including premium)and on call 3 per share. applications

were received for 60,000 shares . allotment was made on pro rata basis to the applicants of

48000 shares . excess money was adjusted towards allotment.C to whom 1600 shares were

allotted failed to pay allotment and J to whom 2000 shares were allotted failed to pay call

money . these shares were forfeited and reissued at rs 15 fully paid up. Pass journal entries.

(8)

Or

Q16 f ltd issued 2,00,000 shares of 20 each payable 4 on application 6 on allotment and

balance on first and final call. Application were received for 3,00,000 shares and pro rata

allotment was made to all applicants.money overpaid on application was adjusted towards

allotment. Sohan who applied for 3000 shares failed to pay allotment and call money. His

shares were forfeited. Half of these shares were reissued at rs 18 fully paid up. Pass journal

entries. (8)

Q17 A and D are partners sharing profits in the ratio of 3:2. There balance sheet was as

follows –

Liabilities Amount Assets Amount

38500 2000

Cash

Creditors 15000

Stock

Employees provident fund 4000 1500

Prepaid expenses

Workmen compensation fund

Debtors 9400

Capitals 2500 9000

- Provision(400)

A- 26000 19000

Machinery

B- 13000 35000

Building

39000 5000

Furniture

86500 86500

i) R is admitted with a capital of rs 16000 and the new ratio is 5:3:2

ii) R brings necessary amount of goodwill in cash

iii) Stock is depreciated at 5%

Material downloaded from myCBSEguide.com. 4 / 23

iv) Provision for doubtful debts to be made at 500

v) Furniture depreciated by 10%

vi) Building valued at 40,000

vii) Capitals of partners to be adjusted on the basis of new partner’s capital making necessary

adjustment in cash.

Prepare necessary accounts . (8)

Part – B( Analysis of financial statements)

Q18 under which type of activity will you classify purchase of investments while preparing

cash flow statement. (1)

Q19 cash flow from operating activities = 23000

Cash flow from financing activity = 15000

Net increase in cash and cash equivalent – 22000

Calculate cash flow from investing activity. (1)

Q20 prepare comparative balance sheet – (4)

Particulars 31st march 2015 31st march 2016

Equity and liability

Shareholder fund

a) Share capital 2,00,000 3,00,000

b) Reserve and surplus 2,00,000 2,00,000

Non current liabilities

Long term borrowings 40,000 1,60,000

c) Current liabilities 60,000 1,00,000

5,00,000 7,60,000

Assets

Non current assets

a) Fixed assets 4,00,000 6,00,000

Material downloaded from myCBSEguide.com. 5 / 23

Current assets 1,00,000 1,60,000

500000 760,000

Q21 draw the balance sheet of a company as per schedule III of companies act 2013. (4)

Q22 from the following information calculate – (4)

a.) Quick ratio

b.) Return on investment.

Sales = 4,00,000 opening stock 50,000 closing stock 60,000 current assets 2,00,000 working

capital (60,000) net profit = 140000 total assets = 6,00,000

Q23 prepare cash flow statement – (6)

Particulars Note no 2016 2017

Share capital 225000

225000

Reserve and surplus 189000

178000

Non current liabilities

Loan 135000

-

Current liabilities

Creditors 67000

84000

Provision for tax 5000

37500

621000

524500

Assets

Fixed assets 160000

200000

Investments 30000

25000

Current assets

Inventories 332000

225000

Cash and cash equivalent 99000

74500

621000

524500

Notes to account

Material downloaded from myCBSEguide.com. 6 / 23

Particulars 2016 2017

Reserve and surplus

General reserve 150000 155000

Statement of profit and loss 28000 34000

Adjustments-

a) Investments costing 4000 was sold for 4250

b) Provision for tax made was 4500

c) Dividend paid during the year 20,000

d) A part of fixed assets costing 5000 was sold for 6000 and the profit was included in profit

and loss account.

Material downloaded from myCBSEguide.com. 7 / 23

Class XII

Accountancy Sample Paper-02

[Solutions]

Part A

Ans.1 4.5

Ans.2 A is incorrect as in the absence of partnership deed interest on loan payable is 6% p a

Ans 3 the amount in share forfeited account is the maximum discount that can be offered at

the time of reissue of shares.

Ans 4

Particulars LF Debit Credit

Bank a/c (1000*70) DR

7000

Share forfeited a/c DR

1000

To share capital a/c (1000*80)

8000

(being 1000 shares reissued )

8000 8000

Ans 5 interest on debentures = 500000*7/100 = 35000

Ans 6 old ratio = 3:2:1

B retires so new ratio= 3:1 and gaining ratio =3:1

Ans 7 a)

Particulars LF Debit Credit

10% debentures a/c (450*100) dr

Premium on redemption a/c dr(450*10)

To debenture holder 45000

(being debentures redeemed at a premium of 10%) 4500 49500

Debenture holder a/c dr

Material downloaded from myCBSEguide.com. 8 / 23

To equity share capital a/c(396*100)

To securities premium a/c(396*25) 49500 39600

9900

No of shares = 49500/100+25 =396

Q7 b) journal entry

Particulars LF Debit Credit

Debenture suspense/c (10,000*12)

To %debentures

1,20,000

(being debentures issued as collateral security) 1,20,000

Balance sheet extract

Particulars Note no Amount

Non current liabilities

Long term borrowings 1 1,00,000

Notes to account

Particulars Note no Amount

Long term borrowings

Loan from PNB 1,00,000

1

%Debentures 1,20,000

-debenture suspense (120,000)

Ans 8

Particulars Amount Particulars Amount

6000 30,000

To share application 10,000

Material downloaded from myCBSEguide.com. 9 / 23

To share allotment By bal c/d

To share first and final call 14000

30,000 30,000

Ans 9 profit and loss appropriation account

Particulars Amount Particulars Amount

703000

To interest on capital

Rohit 60,000

Mohit70,000

2,10,000

Sohit 80,000 By net profit

7000

By int on drawings

To profit (transferred to partner capital account) Rohit 3500

Rohit 250000 Mohit 3000

Mohit 125000 Sohit 500

Sohit 125000

5,00,000

710,000 7,10,000

interest on drawings =

Rohit = 70,000*5/100= 3500

Mohit = 60,000*5/100=3000

Sohit = 10,000*5/100=500

Note –months are not taken for interest on drawings as per annum is not written with the

percentage.

For interest on capital

Calculation of opening capital

Particulars Rohit Mohit Sohit

Closing capital 530,000 6,40,000 790,000

+drawings 70,000 60,000 +10,000

6,00,000 7,00,000 8,00,000

6,00,000*10/100=60,000

Material downloaded from myCBSEguide.com. 10 / 23

7,00,000*10/100= 70,000

800000*10/100= 80,000

Ans 10

Particulars Lf Debit Credit

Assets a/c dr 2,25,000

To Indian traders ltd 2,25,000

(being material taken from Indian traders)

Indian traders ltd dr

To bank a/c 5000

(being amount paid by cheque) 5000

Indian traders ltd dr

To share capital a/c(20,000*10) 2,20,000

To securities premium(20,000*1) 2,00,000

(being shares issued to Indian traders) 20,000

450,000 450,000

No of shares = 2,20,000/10+1 = 20,000

Ans 11

Particulars LF Debit Credit

A’s capital a/c dr

B’s capital a/c dr 500

To C ‘s capital a/c 5750

6250

(being adjusting entry passed)

Working note

Particulars A B C Firm

Interest on capital 2500 1250 1250 (5000)

Salary 12000 (12000)

Material downloaded from myCBSEguide.com. 11 / 23

Wrong profit (11000) (11000) (11000) 33000

Adjusting profit 8000 4000 4000 (16000)

(500) (5750) 6250 0

Ans 12

Particulars LF Debit Credit

Rick capital a/c dr

To pawan capital a/c 16000

16000

(being adjusting entry passed)

sacrificing ratio = old ratio-new ratio

2/5-1/5= 1/5

2/5-2/5 =0

1/5-2/5 = -1/5

General reserve – profit and loss- deferred revenue expenditure

=140,000-40,000-20,000 = 80,000

80,000*1/5 = 16000

Ans 13 R’s capital account

Particulars Amount Particulars Amount

50,000

By bal b/d

4000

By general reserve

12000

By K’s capital a/c

8000

By S’s capital a/c

75250

By profit and loss suspense a/c

To R’s executor loan a/c 1250

75250 75250

Q14 realisation account

Particulars Amount Particulars Amount

By creditors

21000 31500

Material downloaded from myCBSEguide.com. 12 / 23

3000 By provision for doubtful debts 500

10,000 By bank

To Plant and machinery

30,000 Plant and machinery 16000

To Stock

Stock 2500

To Debtors

Debtors 9000 27500

To bank a/c

By loss transferred to partner

capital account

Harsh 2700

Suresh 1800 4500

64000 64000

Partner’s capital account

Particulars Harsh Suresh Particulars Harsh Suresh

4000

2700 1800 5000 500

To loss

1500 1000 750

To profit and loss By bal b/d

account By general

1550 1700

To bank reserve

4500

5750 4500 5750

Bank account

Particulars Amount Particulars Amount

5750 30,000

To bal b/d By realization

27500 1550

To realization a/c By harsh capital a/c

1700

By suresh capital a/c

33250 33250

Ans 15 a)

Material downloaded from myCBSEguide.com. 13 / 23

Particulars LF DEBIT CREDIT

a) Revaluation a/c dr

20,000

To fixed assets

20,000

(being assets depreciated)

b) Revaluation a/c dr

10,000

To outstanding expenses

10,000

(being provision created for outstanding

expenses)

c) A ‘s capital a/c dr

6000

B’s capital a/c dr

4000

To C ‘s capital a/c

10,000

(being adjustment for goodwill made for

retiring partner)

40,000 40,000

b.

Particulars Lf Debit Credit

Own debentures a/c dr(250*90)

22500

To bank a/c

22500

(being debentures purchased from open

market)

%debentures a/c dr

25000

Premium on redemption a/c dr

2500

To own debentures

22500

To gain on cancellation

5000

(being debentures cancelled)

Gain on cancellation a/c dr

5000

To capital reserve

Material downloaded from myCBSEguide.com. 14 / 23

(being gain on cancellation transferred to 5000

capital reserve)

55000 55000

Ans 16

Particulars Lf Debit Credit

Bank a/c dr

To share application a/c

(being application received)

240000

240000

Share application a/c dr

To share capital

To share allotment

240000

To bank a/c 160000

(being application due and money 32000

adjusted on allotment) 48000

Share allotment a/c dr

To share capital a/c

To securities premium a/c

200000

(being allotment due) 120000

80000

Bank a/c dr(200000-32000-6720)

To share allotment/c

(being allotment received)

161280

161280

Share first call a/c dr

To share capital

(being first call due)

120000

120000

Material downloaded from myCBSEguide.com. 15 / 23

Bank a/c dr(120000—10800)

To share first and final call a/c

(being money received on first call) 109200

109200

For C

Share capital a/c dr

Securities pemium a/c dr

To share allotment 16000

To share first call a/c 3200

To share forfeited/c 6720

(being shares forfeited) 4800

7680

For J

Share capital a/c dr

To share first call a/c

To share forfeited a/c 20,000

(being shares forfeited) 6000

14000

Bank a/c dr

To share capital a/c

To securities premium 54000

(being shares reissued) 36000

18000

Share forfeited a/c dr

To capital reserve

(being amount transferred to capital 21680

reserve) 21680

Or

Particulars Lf Debit Credit

12,00,000

Material downloaded from myCBSEguide.com. 16 / 23

12,00,000

Bank a/c dr

To share application a/c

12,00,000

(being application received)

800,000

4,00,000

Share application a/c dr

To share capital

To share allotment

(being application due and money

1200000

adjusted on allotment)

1200000

Share allotment a/c dr

To share capital a/c

792,000

(being allotment due)

792000

Bank a/c dr(1200000-400,000-8000)

To share allotment/c

20,00,000

(being allotment received)

20,00,000

Share first call a/c dr

To share capital

1980,000

(being first call due)

1980,000

Bank a/c dr(2000000—20,000)

To share first and final call a/c

(being money received on first call)

40,000

For C

8000

Share capital a/c dr

20,000

To share allotment

12,000

To share first call a/c

Material downloaded from myCBSEguide.com. 17 / 23

To share forfeited/c

(being shares forfeited)

18000

2000

Bank a/c dr 20,000

Share forfeited a/c dr

To share capital a/c

(being shares reissued) 4000

4000

Share forfeited a/c dr

To capital reserve

(being amount transferred to capital

reserve)

Ans 17 Revaluation account

Particulars Amount Particulars Amount

750

To stock

100 5000

To provision

500

To furniture

To profit (transferred to

3650 By building

partner’s capital account )

A-2190

5000

B-1460

5000

PARTNER’S CAPITAL ACCOUNT

PARTICULARS A D R PARTICULARS A D R

32625 17895 16000 26000 13000

Material downloaded from myCBSEguide.com. 18 / 23

By bal b/d 2190 1460

By revaluation 1500 1000

By general

reserve 1500 1000

To bal c/d

By workmen

compensation 16000

reserve

By cash 1435 1435

32625 17895 16000 By premium for 32625 17895 16000

goodwill

18695 16000

32625

16000 By bal b/d 6105

40,000 24000 7375

To bal c/d 16000 By cash a/c 24000 16000

40,000 24000 40,000

Cash a/c

Particulars Amount Particulars Amount

To bal b/d 2000 34350

To R ‘s capital a/c 16000

To premium for goodwill 2870

By bal c/d

To A ‘s capital a/c 7375

To D’s capital a/c 6105

34350 34350

Balance sheet

Liabilities Amount Assets Amount

38500

Creditors 34350

4000 Cash

Employees provident fund 14250

40,000 Stock

Capitals 1500

24000 Prepaid insurance

A 8900

16000 Debtors

D 19000

Machinery

R 40000

Material downloaded from myCBSEguide.com. 19 / 23

Building 4500

Furniture 122500

122500

Hidden goodwill = total capital- adjusted capital

=80,000-65650

=14350

Capital adjustment = total capital = 16000*10/2

=80,000

Divide 80,000 in the ratio of 5:3:2

Part –B

Ans 18 purchase of investment is considered as investing activity.

Ans 19 – cash flow from investing activity = 22000-23000-15000

=(16000)=cash used in investing activity

Ans 20

Particulars 2015 2016 Absolute change Percentage

Equity and liability

Shareholder fund

2,00,000 300,000 1,00,000 50%

a) Share capital

2,00,000 2,00,000 0 0

b) Reserve and surplus

Non current liabilities

40,000 1,60,000 120,000 300%

Long term borrowings

60,000 1,00,000 40,000 66.67%

Current liabilities

5,00,000 7,60,000 2,60,000 52%

Assets

Non current assets

400,000

Material downloaded from myCBSEguide.com. 20 / 23

a) Fixed assets 6,00,000 2,00,000 50%

1,00,000

Current assets 5,00,000 1,60,000 60,000 60%

7,60,000 2,60,000 52%

Ans 21 a) inventories

b) Trade receivables

c) Cash and cash equivalent

d) Current investments

Ans 22 quick assets = current assets- closing stock

=2,00,000-60,000= 140,000

Working capital = current assets – current liabilities

-60,000= 2,00,000-cl

Current liabilities= 140,000

Quick ratio = quick assets /current liabilities

=140,000/140,000 = 1:1

B capital employed= total assets- current liabilities

=600,000-140,000

=4,60,000

Return on investment = net profit before tax/ capital employed*100

=140,000/360,000*100= 38.89%

Ans 23 Cash flow statement AS- 3 revised

Particulars Amount Amount

I) cash flow from operating activities

net profit before tax and extra ordinary items

adjustment for non operating items

add depreciation 35000

less profit on sale of investment (250)

less profit on sale of fixed assets (1000) 35,500

operating profit before working capital changes

working capital changes

Material downloaded from myCBSEguide.com. 21 / 23

add decrease in current assets and increase in

current liabilities 33750

less increase in current assets and decrease in 69250

current liabilities

inventories (107000)

creditors (17000)

cash used in operating activities ((124000)

less tax paid

net cash used in operating activities (54750) (91750)

(37000)

II) cash flow from investing activity

add sale of fixed assets

add sale of investment

less purchase of investment 6000

cash flow from investing activity 4250 1250

(9000)

III) Cash flow from financing activity

Issue of loan

Less dividend paid

Cash flow from financing activity 135000 115000

(20,000)

Net increase in cash and cash equivalent 24500

Add opening cash and cash equivalent 78500

99000

=closing cash and cash equivalent

investment

Particulars Amount Particulars AMOUNT

25000

TO BAL B/D 4250

250 By bank (sale)

To profit and loss account 30,000

9000 By bal c/d

To bank (purchase 34250

34250

Material downloaded from myCBSEguide.com. 22 / 23

Fixed assets

By bank (sale) 6000

To bal b/d 2,00,000

By dep 35000

Toprofit and loss account 1000

By balc/d 160,000

201000 201000

Provision for tax

Particulars Amount Particulars Amount

37000 4500

Tax paid By tax made

5000 37500

To bal c/d By bal b/d

42000 42000

Material downloaded from myCBSEguide.com. 23 / 23

You might also like

- Management AccountingDocument13 pagesManagement AccountingbhushspatilNo ratings yet

- Investment in R and R CompanyDocument1 pageInvestment in R and R CompanyKattNo ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Remidial Assignment B.tech - Bbs n'22Document9 pagesRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNo ratings yet

- Cash Flow Statement Problems-1Document5 pagesCash Flow Statement Problems-1Chandan ArunNo ratings yet

- Purchase ConsiderationDocument5 pagesPurchase ConsiderationAR Ananth Rohith BhatNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- Chapter 5 Amalgamtion of Companies HandoutsDocument7 pagesChapter 5 Amalgamtion of Companies Handoutsvikax90927No ratings yet

- Accountancy Test For 12THDocument2 pagesAccountancy Test For 12THAnuj SinghNo ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingAkshit JhingranNo ratings yet

- PGDM (2021-23) Exercise On Final AccountsDocument9 pagesPGDM (2021-23) Exercise On Final Accountspriyanshu guptaNo ratings yet

- Partnership Home WorkDocument3 pagesPartnership Home WorkVinay KumarNo ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Mid term exam questions on Accountancy for II PUCDocument4 pagesMid term exam questions on Accountancy for II PUCManju PNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- AnswersDocument4 pagesAnswersamitmehta29No ratings yet

- Asset Liability Expenses Income Owner's CapitalDocument4 pagesAsset Liability Expenses Income Owner's Capitalamitmehta29No ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- Income Statement and Balance Sheet for Xeta LtdDocument6 pagesIncome Statement and Balance Sheet for Xeta LtdNeelu AggrawalNo ratings yet

- Tutorial 1 Introduction To Accounting (Q)Document4 pagesTutorial 1 Introduction To Accounting (Q)lious liiNo ratings yet

- Chaithanya Info SystemsDocument5 pagesChaithanya Info SystemsMichael WellsNo ratings yet

- California Dispensers Financial StatementsDocument9 pagesCalifornia Dispensers Financial StatementsHarsh MaheshwariNo ratings yet

- 12 Accountancy Lyp 2008 Set1Document9 pages12 Accountancy Lyp 2008 Set1Yash VagrechaNo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- Analyzing Financial Statements and Cash Flows of CompaniesDocument56 pagesAnalyzing Financial Statements and Cash Flows of CompaniesAditi AgrawalNo ratings yet

- Retirement of Partnership FirmDocument3 pagesRetirement of Partnership FirmPawan Bhati 33No ratings yet

- Work Sheet 1 PDFDocument9 pagesWork Sheet 1 PDFProtik SarkarNo ratings yet

- Assets Cash Bank Land Insurance Pre-Paid Rent Inventory TotalDocument8 pagesAssets Cash Bank Land Insurance Pre-Paid Rent Inventory TotalAnuja KulkarniNo ratings yet

- Questions For Unit 4 RevisionDocument3 pagesQuestions For Unit 4 RevisionDimple PatelNo ratings yet

- Stock CombinationDocument1 pageStock CombinationKattNo ratings yet

- AdmissionDocument3 pagesAdmissionaashishNo ratings yet

- Transaction Analysis (2424)Document17 pagesTransaction Analysis (2424)AirForce ManNo ratings yet

- Cash Flow Statement AssignmentDocument2 pagesCash Flow Statement AssignmentYoungsonya JubeckingNo ratings yet

- Fa Assignment 2Document3 pagesFa Assignment 2JaneNo ratings yet

- Bba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Document5 pagesBba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Nikkie pieNo ratings yet

- Q4 Matshaba LimitedDocument1 pageQ4 Matshaba Limitedamosmalusi5No ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- Capital computations and financial statementsDocument2 pagesCapital computations and financial statementsKashan AzizNo ratings yet

- Xii Ca Model KeyDocument3 pagesXii Ca Model Keyapmmontage112No ratings yet

- Fundamentals of Accounting Worksheet #1Document2 pagesFundamentals of Accounting Worksheet #1SALENE WHYTENo ratings yet

- Q1-5: Trial Balance Adjustments and Financial StatementsDocument6 pagesQ1-5: Trial Balance Adjustments and Financial StatementsKRISHA UDANINo ratings yet

- Acct 1Document4 pagesAcct 1Susovan SirNo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- Module 3Document11 pagesModule 3Its Nico & SandyNo ratings yet

- Module 3Document11 pagesModule 3Its Nico & SandyNo ratings yet

- Single Entry (F. Y. B.com) Sem.1Document13 pagesSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- 30-Marks-ECFN-102-Advanced Accounting - Final Term Paper-BDocument2 pages30-Marks-ECFN-102-Advanced Accounting - Final Term Paper-BJawad AzizNo ratings yet

- Chapter 10 problems receivables solutionsDocument5 pagesChapter 10 problems receivables solutionsCORES LYRICSNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Problem 2: Liabilities AMT Assets AMT Capitals A B C CreditorsDocument6 pagesProblem 2: Liabilities AMT Assets AMT Capitals A B C CreditorsHaji HalviNo ratings yet

- SYbcom Ac Sem3Document56 pagesSYbcom Ac Sem3Anandkumar Gupta56% (9)

- FinanceDocument22 pagesFinanceromit.jaink1No ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Luqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsDocument5 pagesLuqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsQasim KhokharNo ratings yet

- Assignment July 2022Document6 pagesAssignment July 2022Dusabamahoro JoniveNo ratings yet

- Test TB Final Ac Single EntryDocument2 pagesTest TB Final Ac Single EntryMegha BhargavaNo ratings yet

- Case Studies CH 6 QuesDocument5 pagesCase Studies CH 6 QuesSukhjinder SinghNo ratings yet

- Particpation Exercise 2Document1 pageParticpation Exercise 2Sukhjinder SinghNo ratings yet

- Case Studies CH 5 QuesDocument6 pagesCase Studies CH 5 QuesSukhjinder SinghNo ratings yet

- Chapter 5 AnswersDocument7 pagesChapter 5 AnswersSukhjinder SinghNo ratings yet

- Participation Exercise 1 With KalerDocument2 pagesParticipation Exercise 1 With KalerSukhjinder SinghNo ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- Pro Forma of Cash Flow StatementDocument1 pagePro Forma of Cash Flow StatementSukhjinder SinghNo ratings yet

- Chapter 6 AnswersDocument5 pagesChapter 6 AnswersSukhjinder SinghNo ratings yet

- Pro Forma of Income StatementDocument1 pagePro Forma of Income StatementSukhjinder SinghNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- Study material on accounts for not-for-profit organisationsDocument40 pagesStudy material on accounts for not-for-profit organisationsdher1234No ratings yet

- Dhillon Entp212 PE1Document2 pagesDhillon Entp212 PE1Sukhjinder SinghNo ratings yet

- Change in Profit Sharing Ratio Amongst TDocument2 pagesChange in Profit Sharing Ratio Amongst TSukhjinder SinghNo ratings yet

- InfrastructureDocument6 pagesInfrastructureSukhjinder SinghNo ratings yet

- III Corporate AcDocument19 pagesIII Corporate AcSukhjinder SinghNo ratings yet

- Costing LessonDocument83 pagesCosting LessonSukhjinder SinghNo ratings yet

- Sales BudgetDocument8 pagesSales BudgetSukhjinder SinghNo ratings yet

- Small Businesses, Job Creation and Growth: Facts, Obstacles and Best PracticesDocument54 pagesSmall Businesses, Job Creation and Growth: Facts, Obstacles and Best PracticesTanmay GargNo ratings yet

- Banking Services: Central BanksDocument3 pagesBanking Services: Central BanksSukhjinder SinghNo ratings yet

- Basic Accounting Principles and ConceptsDocument2 pagesBasic Accounting Principles and ConceptsSukhjinder Singh100% (1)

- 7.1 DirectingDocument12 pages7.1 DirectingSukhjinder SinghNo ratings yet

- The Language of Business Entities in BrazilDocument12 pagesThe Language of Business Entities in BrazilFabrício César FrancoNo ratings yet

- The Board of Directors: DR Safdar A ButtDocument26 pagesThe Board of Directors: DR Safdar A ButtAhsan100% (2)

- Government of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleDocument84 pagesGovernment of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleGifty BaidooNo ratings yet

- Pujita B Gaddi (10skcma044)Document17 pagesPujita B Gaddi (10skcma044)Pramod ShekarNo ratings yet

- Due Diligence ChecklistDocument12 pagesDue Diligence ChecklistNigel A.L. Brooks100% (1)

- Claremont COURIER 7.14.10Document24 pagesClaremont COURIER 7.14.10Claremont CourierNo ratings yet

- Business Plan (OASIS)Document41 pagesBusiness Plan (OASIS)uzair97No ratings yet

- Gautam Baid Q&ADocument9 pagesGautam Baid Q&AFahad SiddiqueeNo ratings yet

- 211 - F - Bevcon Wayors-A Study On Financial Cost Efficiency at Bevcon WayorsDocument70 pages211 - F - Bevcon Wayors-A Study On Financial Cost Efficiency at Bevcon WayorsPeacock Live ProjectsNo ratings yet

- Foreign Capital and ForeignDocument11 pagesForeign Capital and Foreignalu_tNo ratings yet

- Earnings Per ShareDocument15 pagesEarnings Per ShareMuhammad SajidNo ratings yet

- Turga Pumped Storage Project Cost SummaryDocument25 pagesTurga Pumped Storage Project Cost Summarynira365No ratings yet

- 4024 Y18 SP 2Document20 pages4024 Y18 SP 2Noor Mohammad KhanNo ratings yet

- Spring 2024 Template Feasibility Study by Saeed AlMuharramiDocument29 pagesSpring 2024 Template Feasibility Study by Saeed AlMuharramiMaathir Al ShukailiNo ratings yet

- Boynton SM CH 17Document34 pagesBoynton SM CH 17jeankopler100% (1)

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- HDocument21 pagesHFaizal KhanNo ratings yet

- Blue Print 3-5 Years Multi Finance: Marmin MurgiantoDocument6 pagesBlue Print 3-5 Years Multi Finance: Marmin MurgiantoRicky NovertoNo ratings yet

- Sindh Workers Welfare Fund Act SummaryDocument4 pagesSindh Workers Welfare Fund Act SummaryAamir ShehzadNo ratings yet

- Pecson v. CADocument2 pagesPecson v. CAchappy_leigh118No ratings yet

- Inventory Management and Cash BudgetDocument3 pagesInventory Management and Cash BudgetRashi MehtaNo ratings yet

- Sailendra Yak TSA Presentation EnglishDocument36 pagesSailendra Yak TSA Presentation EnglishInternational Consortium on Governmental Financial Management100% (1)

- Income Recognition & Asset Classification CA Pankaj TiwariDocument42 pagesIncome Recognition & Asset Classification CA Pankaj TiwariRakesh RajpurohitNo ratings yet

- Davao City Investment Incentive Code Rules and RegulationsDocument24 pagesDavao City Investment Incentive Code Rules and RegulationsjethrojosephNo ratings yet

- Easi-Pay Service Form (Takaful)Document4 pagesEasi-Pay Service Form (Takaful)slayman_obnNo ratings yet

- Cfa Ques AnswerDocument542 pagesCfa Ques AnswerAbid Waheed100% (4)

- Different Borrowers Types ExplainedDocument15 pagesDifferent Borrowers Types Explainedmevrick_guyNo ratings yet

- Tvs Motor Company LimitedDocument13 pagesTvs Motor Company LimitedAnonymous NlhcjsSjwzNo ratings yet

- Fical PolicyDocument51 pagesFical Policyrasel_203883No ratings yet

- Purchases & PayablesDocument12 pagesPurchases & Payablesrsn_surya100% (2)