Professional Documents

Culture Documents

Conditions of Employment For Professional Staff

Uploaded by

kumaraperumalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Conditions of Employment For Professional Staff

Uploaded by

kumaraperumalCopyright:

Available Formats

Conditions of employment for staff

in the Professional category

International Maritime Organization

www.imo.org

September 2007

imo_conditions_PS.indd 1 20/11/2007 11:13:01

Conditions for appointments of one year or more

The following text is intended to clarify the conditions of employment that are being

offered to you. You may find further details on the conditions of employment under Staff

Regulations and Staff Rules.

1. Duration of appointment (Staff Rule 104.3(b)) 4. Allowances

Professional staff at IMO are normally given (a) Assignment grant (Staff Rule 103.3)

an appointment for a specified period of time,

To compensate for the initial extraordinary costs

typically two years, which may be extended

incurred on your moving to a new location you

subject to the needs of the Organization and

will receive an entitlement called “assignment

to satisfactory performance of staff. Such

grant”. The amount of the grant consists of 30

appointments, called “Fixed-term appointments”,

days of DSA* in respect of the staff member,

do not carry any expectancy of renewal or

and thirty days DSA at half rate for each family

conversion to any other type of appointment and

member recognized as your dependant by the

may be terminated by the Secretary-General

United Nations and who joins you at the duty

or by the staff member concerned on 30 days’

station.

notice, subject to conditions prescribed in the

Staff Regulations and Staff Rules. (b) Dependency allowance (Staff Rule 103.9)

Staff members who are internationally recruited

2. Medical examination may also receive an amount entitled “Dependency

allowance” in respect of their dependent children

Our offer of appointment is subject to a and spouse under conditions set by the Secretary

satisfactory outcome of a medical examination General as defined in the Staff Regulations and

to be carried out under the responsibility of a Staff Rules. To qualify as a dependant, a child

Medical Adviser of the United Nations. We will must be under the age of 18, or, if in full-time

send you a confirmation of our offer once you attendance at a school or university, under the age

have been medically cleared. of 21. A spouse may also qualify as dependent

if his/her occupational earnings, if any, do not

3. Salary exceed the equivalent of the lowest entry level

at the base of the salary system (G.2, Step 1, for

Our salaries contain two basic components, a net New York).

salary and a post adjustment. The net salary is

identical for all staff members at the same level in (c) Education grant (Staff Rule 103.8)

the United Nations, whereas the post adjustment Staff members who are internationally recruited

component varies between duty stations to are eligible for an education grant to cover part

compensate for differences in purchasing power. of the cost of educating children in full-time

The post adjustment is readjusted periodically. attendance at an educational institution. The

Salaries of United Nations staff from all amount of the grant is equivalent to 75 per cent of

categories are expressed in gross and net terms, allowable costs. The allowable cost varies from

the difference between the two being the staff duty station to duty station, subject to a maximum

assessment. Staff assessment is an internal United amount which is announced annually. A staff

Nations form of “taxation”, and is analogous to member whose home country is the country of

taxes on salaries applicable in most countries. his/her official duty station is not entitled to this

grant, except in respect of physically or mentally

Staff members who do not have a recognized disabled children.

dependant will receive a net salary at the single rate,

whereas a staff member with one or more recognized

dependants will receive a salary at the dependency * DSA is the Daily Subsistence Allowance, which is a

rate, on behalf of the first dependant; for the other standard amount intended to defray the subsistence costs

dependants, a dependency allowance is payable. of a staff member travelling to a different duty station.

imo_conditions_PS.indd 2 20/11/2007 11:13:01

4. Allowances (continued) 8. Pension fund (Staff Regulation 6.1)

(d) Rental subsidy IMO staff members with appointments of

(Administrative Circular ADMIN/91/87)

6 months or longer participate in the United

Nations Joint Staff Pension Fund. A contribution

Under certain circumstances a rental subsidy can of 7.9% of their pensionable salary is deducted

be granted to staff members newly arrived at the from their salary on a monthly basis. The

duty station when the rent represents too high a Organization contributes 15.8% of the pensionable

proportion of the total remuneration. salary. Once staff members have completed five

years of contributory service in the Pension

Fund, they become vested in the Fund; that is,

5. Travel and removal they become entitled to a pension, upon reaching

the mandatory retirement age of 62 or upon early

(a) Travel (Staff Rule 107.1, 107.2 and 107.4) retirement at the age of 55. Staff members who

leave the organization before completing five

IMO will bear the travel expenses of an years of contributory service to the Fund may

internationally recruited staff member and his/ recover the amounts they have contributed to the

her dependants from the place of recruitment Fund. Details on the functioning of the Pension

to the country of the duty station. Dependants Fund are contained in document JSPB/G.4/

who may travel at United Nations expense are: a Rev.16.

spouse and unmarried children under the age of

18 years or under the age of 21 years if they are 9. Repatriation grant (Staff Rule 109.4)

in full-time attendance at a school or university

or of any age if they are totally and permanently To facilitate the re-insertion into the home

disabled. country of the staff member upon separation

from the Organization, a repatriation grant is

(b) Removal (Staff Rule 107.20) paid to international staff members. Such grant

is payable to staff members whom the United

IMO will also bear the actual reasonable costs of

Nations is obligated to repatriate and who do

shipment of your personal and household goods. not remain in the country of the duty station

Detailed information will be provided to you after separation from the service. The amount of

before your initial journey. the grant shall be proportional to the length of

service with the United Nations and is specified

in Annex 4 of the Staff Rules.

6. Home leave (Staff Rule 105.3)

The Organization pays an economy fare round- 10. Income tax

trip ticket to internationally recruited staff

Salaries and other emoluments paid by the United

members and their recognized dependants every

Nations are normally exempt from national

two years to their home country. The purpose

income tax. Staff members from countries

of the home leave is to allow international staff which do not exempt United Nations income

members and their dependants to renew cultural from national tax will receive reimbursement of

and family ties at their home country. national income tax paid in relation to their UN

salaries.

7. Health Insurance Note: A staff member whose home country is the

country of his/her official duty station shall not

Staff members are automatically enrolled in a be eligible for the allowances and entitlements

health insurance scheme. Their eligible family specified in points 4.(a),(c), and (d), 5.(a) and (b),

members may also be affiliated to the scheme. 6 and 9.

imo_conditions_PS.indd 3 20/11/2007 11:13:01

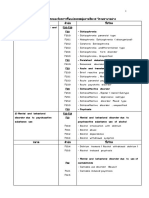

Benefits of group medical, hospital and dental plan

(For further detail regarding this plan, see internet address www.vanbreda-international.com)

By virtue of the contract being offered, you and your family members (spouse and

one or more children who are not married and are not working, up to the end of the

calendar year in which they reach the age of 25) will be covered by a group medical,

hospital and dental plan which offers the following benefits:

Outpatient treatment Optical lenses

The costs of optical lenses are reimbursable to

Expenses involved in respect of medical treatment beneficiaries with one year or more of coverage.

prescribed by doctors qualified to treat patients These are reimbursed at the rate of 80%, including

are reimbursed at 80%. contact lenses, disposable lenses with a maximum

of £30 per lens and a maximum of two lenses in

any two-year period. Fees for examination of the

Inpatient hospitalization eyes for glasses are not reimbursed.

If you or your family members covered by this Radiological treatment

plan have to be hospitalized, the costs of inpatient Radiological treatment is reimbursable at the rate

hospital services are reimbursed at a rate of 100% of 80%, provided the patient was referred to the

(excluding doctors’ fees) and include: specialist by the attending physician.

• bed and board; Treatment for alcohol and drug abuse

• general nursing services; Treatment for alcohol and drug abuse includes

• use of operating rooms and equipment; inpatient treatment for detoxification and

• use of recovery rooms and equipment; rehabilitation at a facility certified for such treatment,

• x-ray examinations; subject to the prior approval of Vanbreda, and is

• drugs and medicine for use in the hospital. normally limited to 30 days in a calendar year. The

Reimbursement of hospital accommodation costs of outpatient counselling for diagnosis and

(bed and board) expenses will be subject to a treatment are reimbursable at the rate of 50% and

daily room rate cap of £550 per day in the U.K. to a maximum reimbursement of £650 for no more

than 50 visits per insured person per calendar year.

Treatments subject to limitations Testing for the HIV virus

The cost of two blood tests per year.

Some treatments reimbursed under this plan are

subject to limitations as indicated below:

Major medical coverage

Dental treatment

Dental treatment is reimbursed at the rate of 80% As a complement to the reimbursements provided

up to a maximum sum of £575 per calendar year per for above, the beneficiaries will be reimbursed

beneficiary. The cost of dento-facial orthopaedics 80% of that portion of covered medical expenses

is covered for 4 years provided that treatment is which they have borne themselves after a

started before the patient’s fifteenth birthday. deduction of £120 per calendar year per insured

person, with a maximum of £350 per family.

Outpatient mental health

Outpatient mental health treatment must Second surgical opinion

be provided by a psychiatrist, a licensed

psychoanalyst, a licensed psychologist or a Prior to undergoing surgery, insured persons

licensed psychiatric social worker in order to be are recommended to obtain a second surgical

reimbursed at the rate of 80% of fees and up to a opinion. The cost of a second opinion rendered by

maximum of £650 per member per calendar year. a qualified physician in connection with a surgical

procedure will be reimbursed at 100%. The

Hearing aids second opinion must be provided by a physician

The costs of hearing aids are reimbursable to not associated or in practice with the physician

beneficiaries with one year or more of coverage, at the who originally recommended or proposed to

rate of 80% with a maximum of £300 per apparatus, perform the surgery. If the second opinion does

including the related examination, and a maximum not agree with the first, a third opinion may be

of one apparatus per ear in any period of three years. sought and will also be reimbursed at 100%.

imo_conditions_PS.indd 4 20/11/2007 11:13:02

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Ques BurnoutDocument1 pageQues BurnoutFarouk Ilmid Davik100% (5)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ADAA - Internal Audit ManualDocument166 pagesADAA - Internal Audit Manualkumaraperumal100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Test Bank For Abnormal Psychology 5th Canadian Edition by BarlowDocument37 pagesTest Bank For Abnormal Psychology 5th Canadian Edition by BarlowNancy Medez100% (37)

- Sample Audit Planning Memo TemplateDocument13 pagesSample Audit Planning Memo Templateyofacu19No ratings yet

- Crazy Therapies: What Are They? Do They Work?Document280 pagesCrazy Therapies: What Are They? Do They Work?mombakkesNo ratings yet

- Burns Depression PDFDocument1 pageBurns Depression PDFbc leonNo ratings yet

- 00 1 IndexDocument27 pages00 1 IndexkumaraperumalNo ratings yet

- UNOPS Procurement Manual enDocument182 pagesUNOPS Procurement Manual enmd_hd664No ratings yet

- 00 1 IndexDocument27 pages00 1 IndexkumaraperumalNo ratings yet

- Data Management PolicyDocument29 pagesData Management Policykumaraperumal0% (1)

- Manual For Procurement of Goods 2017-0-0Document266 pagesManual For Procurement of Goods 2017-0-0DhivaNo ratings yet

- Checklist of Potential Risks Goods and Services Procurement ProcessDocument14 pagesChecklist of Potential Risks Goods and Services Procurement ProcesskumaraperumalNo ratings yet

- UNOPS Jobs - Vacancy - Risk and Compliance OfficerDocument8 pagesUNOPS Jobs - Vacancy - Risk and Compliance OfficerkumaraperumalNo ratings yet

- Umaraperumal Hidambaram: Doha, Qatar +974 33292072Document5 pagesUmaraperumal Hidambaram: Doha, Qatar +974 33292072kumaraperumalNo ratings yet

- SAP Transaction Codes Guide for Accounts Payable and ReceivableDocument8 pagesSAP Transaction Codes Guide for Accounts Payable and ReceivablekumaraperumalNo ratings yet

- VN 18-04 Internal Oversight Officer (P.4), IOEO - ExternalDocument3 pagesVN 18-04 Internal Oversight Officer (P.4), IOEO - ExternalkumaraperumalNo ratings yet

- ISA 501 - InventoryDocument11 pagesISA 501 - InventorylizaugustinaNo ratings yet

- IT Steering Committe TOFDocument1 pageIT Steering Committe TOFkumaraperumalNo ratings yet

- Audit ManualDocument185 pagesAudit Manualandysupa100% (4)

- It GovernanceDocument65 pagesIt Governanceadiltsa100% (11)

- Mental Health Case StudyDocument14 pagesMental Health Case Studyapi-545692127No ratings yet

- SociofobiaDocument15 pagesSociofobiaCamelia DurlaNo ratings yet

- Forma de Valoración de Atención Y Conducta, Versión para El Hogar: Niños (Inglés)Document12 pagesForma de Valoración de Atención Y Conducta, Versión para El Hogar: Niños (Inglés)Yesse Barba CespedesNo ratings yet

- ECT PolicyDocument74 pagesECT PolicyJS57No ratings yet

- Hilbert Van Dyck - EDY-Q - English Version - 2016Document6 pagesHilbert Van Dyck - EDY-Q - English Version - 2016İpek OMURNo ratings yet

- Davies Et Al (2013) - Forensic Case Formulation. Theoretical, Ethical and Practical IssuesDocument11 pagesDavies Et Al (2013) - Forensic Case Formulation. Theoretical, Ethical and Practical IssuesalexaNo ratings yet

- BupropionDocument23 pagesBupropiontheintrovNo ratings yet

- Billion-Dollar Business: Research Quarterly That Assessed Evidence OnDocument2 pagesBillion-Dollar Business: Research Quarterly That Assessed Evidence OnAnaSoareNo ratings yet

- Asperger's and Autism Diagnosis and TreatmentDocument1 pageAsperger's and Autism Diagnosis and TreatmentDouglas SouzaNo ratings yet

- Icd 10Document4 pagesIcd 10ÜnŶäÜnClubEverydayNo ratings yet

- The Literature ReviewDocument4 pagesThe Literature Reviewapi-535062764No ratings yet

- CRIM 3 PrelimDocument13 pagesCRIM 3 PrelimHan WinNo ratings yet

- Uhc Hsa 2000-80 1 17Document22 pagesUhc Hsa 2000-80 1 17api-252555369No ratings yet

- ReviewDocument13 pagesReviewSara IsabelNo ratings yet

- WHO 9789240012455-EngDocument49 pagesWHO 9789240012455-EngsofiabloemNo ratings yet

- Trust!: Executive Function Scores You CanDocument6 pagesTrust!: Executive Function Scores You CanFátima MndzNo ratings yet

- Cutting Disorders Self-Injurious Behaviors in TeensDocument12 pagesCutting Disorders Self-Injurious Behaviors in Teensapi-567684750No ratings yet

- Marie A. Leiner Research ProfessorDocument25 pagesMarie A. Leiner Research ProfessorAnali Peralta PerezNo ratings yet

- (Abram Hoffer) Psychiatry Yesterday (1950) and Today With Ocr Text PDF (Orthomolecular Medicine)Document77 pages(Abram Hoffer) Psychiatry Yesterday (1950) and Today With Ocr Text PDF (Orthomolecular Medicine)Anonymous gwFqQcnaXNo ratings yet

- Duchenne CareConsiderations 2018 Part3Document11 pagesDuchenne CareConsiderations 2018 Part3dilloniarbzNo ratings yet

- Men's Treatment GriffinDocument68 pagesMen's Treatment GriffintadcpNo ratings yet

- Guidelines Effective Nursing DocumentationDocument52 pagesGuidelines Effective Nursing DocumentationRichmon Joseph SantosNo ratings yet

- 2016 Titles Indexed in ScopusDocument1,016 pages2016 Titles Indexed in ScopusshankarNo ratings yet

- 06-06-2021 HMB KannadaDocument66 pages06-06-2021 HMB KannadaKiran SNNo ratings yet

- Allen Cognitive Level Test Explained: History, Materials, AdministrationDocument27 pagesAllen Cognitive Level Test Explained: History, Materials, AdministrationKimmy ChuNo ratings yet

- Dyscalculia F SDocument2 pagesDyscalculia F SAndrea ToledoNo ratings yet