Professional Documents

Culture Documents

Relationship Between Inflation and Foreign Trade

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relationship Between Inflation and Foreign Trade

Copyright:

Available Formats

International Journal of Business Marketing and Management (IJBMM)

Volume 2 Issue 5 June 2017, P.P.01-07

ISSN: 2456-4559

www.ijbmm.com

Relationship between Inflation and Foreign Trade

Shimaa Galal, DuYu Lan

School of Foreign Trade, Nanjing University of Science and Technology, Nanjing China 210094

Abstract The substantial increase in global economic integration during recent decades initiated a heated debate on the

impact of foreign trade on inflation. As understanding this impact is of crucial importance for the optimal design and conduct

of monetary policy, the topic has attracted significant interest not only among academics but also policy makers. One of the

key determinants of the sensitivity of inflation is foreign trade changes. This paper therefore helps explain the fact that

empirical studies fail to find a robust relationship between foreign trade and the inflation. Foreign Trade affects the

sensitivity of inflation to both the marginal cost and the relative international prices. Relationship between inflation and

foreign trade in Egypt is a mutual relationship. Because each one affects the other, and Egypt has a high inflation rates and

regarding to foreign trade statistics shows that imports are higher than exports.

I. INTRODUCTION

Since the seminal paper by Romer (1993), the question of the impact of trade openness on inflation and the inflation –

output trade-off has received much attention in macroeconomic literature. The results of this research are far from

conclusive. Empirical and theoretical studies identified a number of factors which affect the relationship between trade

openness and the sensitivity of inflation to output fluctuations. They include goods- and labour-market structures (Bowdler

and Nunziata, 2010; Daniels and VanHoose, 2006), political regime (Caporale and Caporale, 2008), exchange rate regime

(Bowdler, 2009), trade costs (Cavelaars, 2009), capital mobility (Daniels and VanHoose, 2009), the importance of imported

commodities in production (Pickering and Valle, 2012) and exchange rate pass-through (Daniels and Van Hoose, 2013),

For more than 50 years, several studies have estimated the relationship between inflation and trade openness. Some of

them found negative relationship and some of them positive. Triffin and Grubel (1962) tested the hypothesis that both the

degree of openness and the degree of economic integration affected the balance of payments deficits and inflationary

pressures, confirmed that high degree of economic integration with more open economies tended to experience lower

inflation in 5 advanced European Economic Community countries. Iyoha (1973)‟s study is one of the very first studies on the

relationship between inflation and openness in less developed countries. He estimated ordinary least-squares regression

method of 33 less developed countries and analyzed the relationship for both yearly and 5-year averaged data from 1960-61

through 1964-65 and resulted a negative relationship between inflation and the degree of openness measured by the import-

income ratio. According to Iyoha, “if rapid inflation in fact discourages domestic capital accumulation and if increased

capital accumulation is needed for development, it will turn out that an outward-looking trade policy resulting in more

openness is optimal” Romer (1993) used a Barro-Gordon type of model for a cross-section of 114 countries and tested a

prediction of models in which the absence of pre-commitment in monetary policy leads to inefficiently high inflation.

According to Romer (1993), “the larger and hence less open, an economy is, the greater is the incentive to expand, and so the

higher is the equilibrium rate of inflation. Thus, models of inefficiently high inflation arising from the absence of pre-

commitment predict an inverse relationship between openness and inflation”. Lane (1997) examined the time-consistent

inflation rate to the degree of trade openness of an economy. Lane (1997) expanded the Romer (1993)‟s explanations on the

negative relationship between openness and inflation rate. He used the 15-year (over 1973-1988) average of annual data and

undertakes only a cross section analysis of 114 countries using OLS. In his paper, he found the openness effect is

strengthened when country size is included as a control variable, which suggests that openness is not just working through a

terms of trade effect. The strength of the empirical evidence suggests trade openness should be taken seriously as a

determinant of average inflation over the long-run.

Sachida et al (2003) used a data of 152 countries for the 1950-1992 period by applying panel data and found that the

higher the gains, in terms of product, in generating an inflationary „„surprise‟‟, the greater the incentives will be for the

government to effect such a „„surprise‟‟. The authors verified Romer (1993)‟s study with an extension; they also proved that

the negative relationship between openness and inflation is not specific to a group of countries, nor is it specific to a cer tain

time period. Thus, countries in which there was an increase in trade openness, also observed a reduction in their rates of

inflation. Ashra (2002)‟s study is based on a panel data model for 15 developing countries which are from Latin America,

South Asia and East Asia for 3 year periods; 1980-97,1980-89 and 1990-97. He analyzed with different groupings to

investigate the potential difference. He used exports plus import as a percentage of GDP as a measure of openness for all the

countries in the panel. He found exports and imports of goods and services had a significant influence on the inflation rate.

The exports were observed be positively associated with inflation rate whereas imports were observed to 1980s, the

openness–inflation relationship is more significant among less indebted countries. More open economies also tend to have

less variable inflation, though only in the 1990s. According to IMF(2006)‟s World Economic Outlook that entitle as

“Globalization and Inflation, measures of trade and financial integration are highly correlated. In this report, IMF stated that

more open economies tend to experience lower inflation rates. have a negative impact. Gruben and McLeod (2004) used

dynamic panel estimations of five-year averages for inflation and import shares over the period 1971-2000. They argued

International Journal of Business Marketing and Management (IJBMM) Page 1

Relationship between Inflation and Foreign Trade

Romer (1993) and Terra (1998)‟s hypothesis and resulted a negative openness-inflation correlation strengthened in the 1990s

across all country groups. And contrary to Terra‟s (1998) hypothesis, except during Bowdler and Nunziata (2006) extended

Boschen and Weise (2003)‟s study and found that increased openness reduces the probability of an inflation start, both

directly, and indirectly through restricting the role of general elections in triggering inflation starts. Mukhtar (2010 and 2012)

examined Romer (1993)‟s hypothesis for Pakistan. He applied multivariate co-integration and VECM techniques for the

period of 1960 to 2007. His findings showed that there is a significant negative long run relationship between inflation and

trade openness. Batra (2001) argues that protectionism is not inflationary, at least in the US. Alfaro (2005) found that

openness does not play a role in restricting inflation in the short run but fixed exchange rate regime does with a panel data

set of developed and developing countries between 1973 and 1998. Kim and Beladi (2005) estimated the relation between

trade openness and price level for 62 countries and analyzed a negative relation for developing countries but a positive

relation for advanced economies such as the U.S., Belgium, and Ireland. Evans (2007) found a positive relationship between

openness and inflation rate: higher degree of openness in a country is associated with a higher equilibrium inflation rate. He

also examined how the level of imperfect competition, both within a country and between countries, affects the relationship

between openness and inflation. Zakaria (2010) examined the relationship between trade openness and inflation in Pakistan

using annual time-series data for the period 1947 to 2007 and found a positive relation.

Feleke (2014) examined his study for Ethiopia using annual time series data over the period 1970/1971- 2010/2011 by

applying auto regressive distributed lag(ARDL) model for inflation and indicated that the role of trade openness on reducing

inflation is insignificant both in the long run and short run, in the contrary to Romer (1993) hypothesis play a role in

restricting inflation in the short run but fixed exchange –rate regime does with a panel data set of developed and developing

countries between 1973 and 1998.

II. INFLATION and FOREIGN TRADE in EGYPT

2.1. Inflation in EGYPT

Consumer prices in Egypt jumped 10.3 percent year-on-year in April 2016, following a 9 percent rise in the previous

month. The inflation rate accelerated for the first time since November last year, reaching the highest in four months, after

the central bank devalued the currency by nearly 13 percent in March. Policymakers also hiked the interest rate by 150 bps in

order to diminish anticipated inflationary pressure. Core inflation rate also accelerated to 9.5 percent from 8.4 percent.

Inflation Rate in Egypt averaged 8.96 percent from 1958 until 2016, reaching an all time high of 35.10 percent in June of

1986 and a record low of -4.20 percent in August of 1962. Inflation Rate in Egypt is reported by the Central Bank of Egypt.

Figure 1 EGYPT inflation rate

In Egypt, the headline Consumer Price Index (CPI) measures the change in the cost of a fixed basket of goods and

services that are purchased by a representative sample of households from urban areas, which include Cairo, Alexandria,

urban Lower Egypt, urban Upper Egypt, Canal cities and Frontier governorates. The most important categories in the

headline CPI are Food and Beverages (40 percent of total weight); Housing, Water, Electricity, Gas and other Fuels (18.4

percent); Medical Care (6.3 percent) and Transportation (5.7 percent). Clothing and Footwear account for 5.4 percent of total

index and Education for 4.6 percent. Hotels, Cafes and Restaurants represent 4.4 percent of total weight and Furnishings,

Household Equipment and Routine Maintenance of the Dwelling for 3.8 percent. Miscellaneous Goods and Services account

for 3.7 percent, Communications 3.1 percent, Recreation and Culture 2.4 percent and Tobacco and Related Products 2.2

percent. This page provides - Egypt Inflation Rate - actual values, historical data, forecast, chart, statistics, economic

calendar and news. Egypt Inflation Rate - actual data, historical chart and calendar of releases - was last updated on May of

2016.

Inflation rates in Egypt are shaped by a mix of external and internal factors. Global food and energy prices are the

most important imported inflation drivers. Internal factors, on the other hand, include the pace of economic growth, changes

in nominal incomes, growth of the money supply, changes in foreign exchange and interest rates as well as the efficiency of

internal trade markets.

Egypt has ‘stagflation’ situation.”

The rise in the cost of production on one hand, and structural changes in the Egyptian economy on the other hand,

represents necessary and sufficient conditions

The occurrence of stagflation in the Egyptian economy due to lower levels of economic growth, Egypt has high

unemployment rates and low global food prices. Despite this decline, Egypt‟s average inflation remained higher than most of

its trading partners and peer countries.

International Journal of Business Marketing and Management (IJBMM) Page 2

Relationship between Inflation and Foreign Trade

Figure 2 Stagflation scenario

Figure 3 Macro indicators in wrong directions

(The risk of stagflation)

2.2. Egypt GDP Growth Rate

The Gross Domestic Product (GDP) in Egypt expanded 4.50 percent in the second quarter of 2015 over the same

quarter of the previous year. GDP Growth Rate in Egypt averaged 3.81 percent from 1992 until 2015, reaching an all time

high of 7.30 percent in the first quarter of 2008 and a record low of -4.30 percent in the first quarter of 2011. GDP Growth

Rate in Egypt is reported by the Central Bank of Egypt.

Figure 4 EGYPT GDP annual growth rate

Egypt has one of the most developed and diversified economies in the Middle East. Until 2010, Egyptian economy

was growing an average 5 percent a quarter as a result of several economic reforms attracting foreign investments. During

that time, the economy and the living standards for majority of population improved. Yet, living conditions for the average

Egyptian still remained poor and large income disparities continued to grow, leading to the public discontent. The 2011

revolution, which brought down President Hosni Mubarak regime, have caused economic slowdown as political and

institutional uncertainty and rising insecurity continue to hurt tourism, manufacturing, and construction. This page provides -

Egypt GDP Growth Rate - actual values, historical data, forecast, chart, statistics, economic calendar and news. Egypt GDP

Growth Rate - actual data, historical chart and calendar of releases - was last updated on May of 2016.

2.3. Foreign trade in Egypt

Egypt‟s trade profile is characterized by huge trade deficits. The economy is highly dependent on oil exports, which is

its major source of foreign income together with tourism receipts and US financial and military aid. It has to import most of

its food, other commodities and equipment, since both its agricultural and industrial sectors are not well-developed.

Since the 1990s, the government has pioneered several economic reforms through foreign donor aid. However,

measurable benefits of these economic reforms are yet to be seen.

2.4. Egypt Balance of Trade

Egypt recorded a trade deficit of 2866 USD Million in May of 2016. Balance of Trade in Egypt averaged -717.91

USD Million from 1957 until 2016, reaching an all time high of 235.50 USD Million in January of 2004 and a record low of

-5056.10 USD Million in August of 2014. Balance of Trade in Egypt is reported by the Central Agency for Public

Mobilization and Statistics.

International Journal of Business Marketing and Management (IJBMM) Page 3

Relationship between Inflation and Foreign Trade

Figure 5 Egypt Balance of Trade

Egypt has been recording trade deficits since 2004, as imports have grown at a faster rate than exports, mostly due to a

rise in petroleum and wheat imports. The major exports are oil and other mineral products, chemicals, agricultural products,

livestock and textiles. Egypt imports mineral and chemical products, agricultural products, livestock and foodstuff,

machinery and electrical equipment and base metals. Main trading partners are the European countries (38 percent of total

exports and 31 percent of total imports) and the Arab countries (28 percent of exports and 13.5 percent of imports). Others

include: United States, China and India. This page provides - Egypt Balance of Trade - actual values, historical data,

forecast, chart, statistics, economic calendar and news. Egypt Balance of Trade - actual data, historical chart and calendar of

releases - was last updated on August of 2016.

2.5. Egypt Exports

Exports in Egypt increased to 2078 USD Million in May from 1889 USD Million in April of 2016. Exports in Egypt

averaged 536.02 USD Million from 1957 until 2016, reaching an all time high of 2991.20 USD Million in June of 2008 and

a record low of 12.63 USD Million in July of 1959. Exports in Egypt are reported by the Central Agency for Public

Mobilization and Statistics.

Figure 6 EGYPT EXPORTS

In Egypt, exports account for about a quarter of GDP. The major exports are oil and other mineral products (32

percent of total exports), chemical products (12 percent), agricultural products, livestock and others fats (11 percent) and

textiles (10.5 percent, mainly cotton). Other exports include: base metals (5.5 percent), machinery and electrical appliances

(4.5 percent) and foodstuff, beverages and tobacco (4 percent). Major export partners are Italy, Spain, France, Saudi Arabia,

India and Turkey. Others include: United States, Brazil and Argentina. This page provides - Egypt Exports - actual values,

historical data, forecast, chart, statistics, economic calendar and news. Egypt Exports - actual data, historical chart and

calendar of releases - was last updated on August of 2016.

Figure 7 EGYPT IMPORTS

2.6. Egypt imports

Imports in Egypt increased to 4944 USD Million in May from 4606 USD Million in April of 2016. Imports in Egypt

averaged 1251.06 USD Million from 1957 until 2016, reaching an all time high of 7111 USD Million in August of 2014 and

International Journal of Business Marketing and Management (IJBMM) Page 4

Relationship between Inflation and Foreign Trade

a record low of 33.05 USD Million in July of 1957. Imports in Egypt is reported by the Central Agency for Public

Mobilization and Statistics

Egypt imports mainly mineral and chemical products (25 percent of total imports), agricultural products, livestock and

foodstuff (24 percent, mainly wheat, maize and meat), machinery and electrical equipment (15 percent) and base metals (13

percent). Other imports include raw hides, wood, paper-making products, textiles and footwear (9.5 percent), artificial resins

and rubber (6 percent) and vehicles and aircraft (5.5 percent).

Main import partners are Germany, Italy, China, Turkey, Saudi Arabia, Kuwait and Lebanon, United States and India.

This page provides - Egypt Imports - actual values, historical data, forecast, chart, statistics, economic calendar and news.

Egypt Imports - actual data, historical chart and calendar of releases - was last updated on August of 2016.

2.7 Foreign Trade commodity Structure in Egypt:

According to the latest studies the top 5 Products exported by Egypt are Crude Petroleum (18%), Petroleum Gas

(10%), Refined Petroleum (8.6%), Gold (4.5%), and Nitrogenous Fertilizers (3.4%).

And the top 5 Products imported by Egypt are refined Petroleum (9.5%), Wheat (7.5%), Crude Petroleum (3.3%),

Semi-Finished Iron (3.2%), and Petroleum Gas (2.9%).

The top 5 Export destinations of Egypt are Italy (8.0%), United States (7.9%), India (6.4%), Germany (4.7%), and

Saudi Arabia (4.6%). Also the top 5 Import origins of Egypt are China (10%), United States (6.7%), Russia (6.6%), Ukraine

(6.4%), and Turkey (5.1%).

III. Empirical analysis of relationship between Inflation and Foreign Trade

This paper employed a VAR model with two variables. it used the monthly inflation rate to measure the inflation in

Egypt expressed in inflation variable and use total volume of foreign trade to represent trade in Egypt, expressed in Trade

variable. All data comes from the website: www.TRADINGECONOMICS.com. The data ranged from January 2010 to

December 2016. And this paper use monthly data. The sample has a capacity of 84; conform to the requirements of the

empirical test.

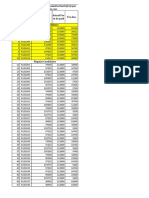

3.1 Descriptive statistics and Stationarity Test

The Inflation and Trade are both time series variable, we need to test time series stationarity. Test results are shown in

Table 1.

Figure 8 Descriptive statistics

Table 1 Unit Root Test Results

The first-order

The first-

The original The difference

order

Variable series threshold original series

difference

(1%) series P threshold

series p

(1%)

Inflation -3.511262 0.9746 -3.512290 0.0000

Trade -3.512290 0.0167 -3.513344 0.0000

Table 2 Granger Causality Test Result

Observed

Lag Period Null Hypothesis F-Statistic Probability

Number

DINFLATION does not Granger

2.47811 0.0907

Cause DTRADE

2 81

DTRADE does not Granger

0.43778 0.6471

Cause DINFLATION

International Journal of Business Marketing and Management (IJBMM) Page 5

Relationship between Inflation and Foreign Trade

From the above test results, level test to the sequence Inflation and Trade showed the p value is greater than threshold under

the 1% confidence level, and it can't refuse no unit root hypothesis. So Inflation and Trade are non-stationary series. Next,

get the stationarity test on new sequence which is first order difference, and the p values are close to zero, under the

confidence level of 1%, it rejects the null hypothesis.

3.1 VAR Model

This section will have first-order difference sequence and used DInfaltion and DTrade to replace the original

sequence Inflation and Trade, the VAR model is established with the adjusted sequence. The model algebraic expression is

following:

DINFLATION= C(1,1)*DINFLATION(-1)

+C(1,2)*DINFLATION(-2)

+C(1,3)*DTRADE(-1)

+C(1,4)*DTRADE(-2) + C(1,5)

DTRADE = C(2,1)*DINFLATION(-1)

+C(2,2)*DINFLATION(-2)

+C(2,3)*DTRADE(-1)

+ C(2,4)*DTRADE(-2) + C(2,5)

3.2 Stationarity Test of the VAR Model

After the establishment of VAR model, this section is to implement stationary test on the model. The results are in Error!

Reference source not found.. All reciprocal value of the root is within the unit circle, so the VAR model is stable.

Figure 9 Inverse Roots of AR Characteristics Polynomial

3.3 Granger Causality Test

According to

Table 2, under the confidence level of 10%, it can't refuse the trade is the granger cause of the inflation, but

rejected the inflation is not the granger reason of the trade.

3.4 Empirical results

Through these tests, it can be concluded that the VAR model established was stable, and can draw from the

granger causality test that inflation is the granger reason of trade in Egypt. The estimation results indicate that there do exist

relationships between the inflation and trade. And the results indicate that there is a long-term stable equilibrium

relationship.

IV. Conclusion

An insight into Inflation, GDP growth rate, foreign trade, exports, imports, commodity structure, regional structure

of foreign trade in Egypt, and the suitable policies to solve the inflation problems was provided.

As an empirical analysis of relationship between inflation and foreign trade, this paper employed a VAR model

with two variables and used the monthly inflation rate to measure the inflation in Egypt expressed in inflation variable and

use total volume of foreign trade to represent trade in Egypt, expressed in Trade variable.

Test results, level test to the sequence Inflation and Trade showed the p value is greater than threshold under the

1% confidence level, and it can't refuse no unit root hypothesis. So Inflation and Trade are non-stationary series.

After that stationarity test on new sequence were obtained which is first order difference, and the p values are close

to zero, under the confidence level of 1%, it rejects the null hypothesis.

First-order difference sequence and used DInfaltion and DTrade to replace the original sequence inflation and

trade, the VAR model is established. The analysis demonstrated that both inflation and foreign trade have a mutual

relationship. Egyptian government activities to improve the economy, and the policies should be taken were declared to

solve the inflation problems can be concluded in using: Monetary Policy, Fiscal policy, Trade policy Subsidies, Quotas and

increasing foreign investments.

International Journal of Business Marketing and Management (IJBMM) Page 6

Relationship between Inflation and Foreign Trade

REFERENCES

[1.] Alfaro, L. (2005). Inflation, Openness, And Exchange-Rate Regimes: The Quest For Short-Term Commitment, Journal of

Development Economics, 77: 229-49. doi: 10.1016/j.jdeveco.2004.02.006

[2.] Ashra, S. (2002). Inflation and Openness: A Study of Selected Developing Economies, Working Paper No. 2002 (84), Indian

Council For Research On International Economic Relations, New Delhi, India.

[3.] Ateş, İ, Bostan A. (2007). Türkiye‟de Dış Ticaretin Serbestleşmesi Ve Yoksullaştıran Büyüme (1989-2004), Muğla Üniversitesi

SBE Dergisi (İlke), Bahar, Sayı:18.

[4.] Batra, R. (2001). Are Tariffs Inflationary?, Review of International Economics, 9: 373-82. doi: 10.1111/1467-9396.00286

[5.] Boschen, J. and Weise C. (2003). What Starts Inflation: Evidence From the OECD Countries, Journal of Money, Credit and

Banking 35: 324-349.

[6.] Bowdler C. and Nunziata L. (2006). Trade Openness and Inflation Episodes in the OECD, Journal of Money, Credit and Banking,

Vol. 38, No. 2 (March), 553-563.

[7.] Bowdler, C. and Malik A. (2005). Openness and Inflation Volatility: Cross-Country Evidence. CSAE Working Paper Series, No:

2005-08, Center for the Study of African Economies, University of Oxford.

[8.] Evans, R.W. (2007). Is Openness Inflationary? Imperfect Competition and Monetary Market Power, Working Paper No. 2007 (1),

Federal Reserve Bank of Dallas.

[9.] Feleke, M. (2014). Effect of Trade Openness n Inflation in Ethiopia (An Auto Regressive Distributive Lag Approach), Economic

Policy Analysis MSc Thesis, Addis Ababa University, October.

[10.] Gökalp, M. F. (2000). Liberalizasyon Sürecinde Türkye‟de Dış Ticaret Hadleri Trendi ve Dış Ticaret Hadlerindeki Değişmelerin

Gelir Etkisi, DEÜ İIBF Dergisi, Cilt:15, Sayı:1, 49-65.

[11.] Gruben, W.C., McLeod, D. (2004). The Openness–Inflation: Puzzle Revisited. Applied Economics Letters, 11: 465-68. DOI:

10.1080/1350485042000244477

[12.] Hepaktan, C. E. (2008), Türkiye‟nin Dönüşüm Sürecinde Dış Ticaret Politikaları, 2. Ulusal İktisat Kongresi, 20-22 Şubat, İzmir.

[13.] IMF (2006). How Has Globalization Affected Inflation?. World Economic Outlook, Chapter III, 97-134.

[14.] Iyoha, M. A. (1973). Inflation and “Openness” in Less Developed Economies: A Cross-Country Analysis, Economic Development

and Cultural Change, 22(1): 31-38. doi: 10.1086/451001

[15.] Kim, M., Beladi, H. (2005). Is Free Trade Deflationary, Economics Letters, 89: 343-349.

[16.] Lane, P.R. (1997). Inflation in Open Economics, Journal of International Economics 42, 327–347. DOI:

10.1016/j.econlet.2005.06.016.

[17.] Okay, E., Baytar R., Sarıdoğan, E. (2012). The Effects of the Exchange Rate Changes on The Current Account Balance in the

Turkish Economy. İktisat, İşletme ve Finans, 27 (310), 79-101. doi: 10.3848/iif.2012.310.3069 Sachsida, A., Galrao, F., Loureiro,

P.R.A., (2003).

[18.] Does Greater Trade Openness Reduce Inflation? Further Evidence Using Panel Data Techniques. Economics Letters, 81: 315-19.

Doi: 10.1016/S0165-1765(03)00211-8

[19.] Samimi, A.J., Ghaderi S., Hosseinzadeh R., Nademi Y. (2011). Openness and Inflation: New Emprical Panel Data Evidence.

Economics Letter, 117: 573-577. Doi: 10.1016/j.econlet.2012.07.028

[20.] Triffin, R., Grubel, H. (1962). The Adjustment Mechanism to Differential Rates of Monetary Expansion among the Countries af

The European Economic Community. Review of Economics and Statistics, 44: 486-91.

[21.] UNESCAP (2009). Trade Statistics In Policymaking – A Handbook Of Commonly Used Trade Indices And Indicators- Revised

Edition, Prepared By Mia Mikic and John Gilbert, UN Publications, St/ESCAP/2559, NY:USA.

[22.] Whitman, M.V.N. (1969). Economic Openness and International Financial Flows. Journal of Money, Credit and Banking, 1 (4):

727-49.

[23.] Zakaria, M. (2010). Openness and Inflation: Evidence From Time Series Data. Doğuş Üniversitesi Dergisi, 11(2): 313-322.

International Journal of Business Marketing and Management (IJBMM) Page 7

You might also like

- RELATIONSHIP BETWEEN OPENNESS, INFLATION AND GROWTHDocument12 pagesRELATIONSHIP BETWEEN OPENNESS, INFLATION AND GROWTHamal zahraNo ratings yet

- An Empirical Analysis On Inflation and Economic Growth in IndiaDocument26 pagesAn Empirical Analysis On Inflation and Economic Growth in IndiaNisarg DarjiNo ratings yet

- Does Proxy of Openness or Methodology Matter To Hold Romer'S Hypothesis?Document12 pagesDoes Proxy of Openness or Methodology Matter To Hold Romer'S Hypothesis?Muhammad TanverNo ratings yet

- Inflation and Economic Growth in MalaysiaDocument20 pagesInflation and Economic Growth in MalaysiaNurulSyahidaHassanNo ratings yet

- Inflation, Inflation Uncertainty and Economic Growth Nexus in Pakistan: A Granger Causality TestDocument28 pagesInflation, Inflation Uncertainty and Economic Growth Nexus in Pakistan: A Granger Causality TestInternational Journal of Management Research and Emerging SciencesNo ratings yet

- Trade Openness and Inflation Relationship in IndiaDocument12 pagesTrade Openness and Inflation Relationship in IndiaTirta Yoga VirgooNo ratings yet

- FulltextDocument26 pagesFulltextpertuNo ratings yet

- Impact of Trade Openness On GDP Growth: Does TFP Matter?Document37 pagesImpact of Trade Openness On GDP Growth: Does TFP Matter?MehrajNo ratings yet

- 11996-Article Text-34281-1-10-20190429Document17 pages11996-Article Text-34281-1-10-20190429alekya.nyalapelli03No ratings yet

- The Impact of Trade Openness On Economic Growth in China - An Empirical AnalysisDocument11 pagesThe Impact of Trade Openness On Economic Growth in China - An Empirical AnalysisMd. Shahinur RahmanNo ratings yet

- Exchange Rate and Macro Economic Aggregates in NigeriaDocument9 pagesExchange Rate and Macro Economic Aggregates in NigeriaAlexander DeckerNo ratings yet

- The Effect of Free Trade Agreements On Poverty: The Case of MexicoDocument30 pagesThe Effect of Free Trade Agreements On Poverty: The Case of MexicoHanako Taniguchi PoncianoNo ratings yet

- IBF AssignmentDocument8 pagesIBF AssignmentAbdelazim Nabil ElhakimNo ratings yet

- The International Dimension of Inflation: Evidence From Disaggregated Consumer Price DataDocument20 pagesThe International Dimension of Inflation: Evidence From Disaggregated Consumer Price DataFadel MuhammadNo ratings yet

- Root,+journal+manager,+05 IJEFI 6041+elfaki+okey 20180208 V1Document7 pagesRoot,+journal+manager,+05 IJEFI 6041+elfaki+okey 20180208 V1Mesba HoqueNo ratings yet

- The Impact of Inflation and Unemployment On Your CountryDocument12 pagesThe Impact of Inflation and Unemployment On Your CountryHüseyn AbdulovNo ratings yet

- FfffffffffffffffsDocument12 pagesFfffffffffffffffsMichStevenNo ratings yet

- Inflation Nexus Economic Growth: Proof From Ethiopia: Abdi MohammedDocument8 pagesInflation Nexus Economic Growth: Proof From Ethiopia: Abdi MohammedaijbmNo ratings yet

- Effects of Terms of Trade and Volatility on Economic GrowthDocument13 pagesEffects of Terms of Trade and Volatility on Economic GrowthphirlayayadilNo ratings yet

- The Causal Analysis of The Relationship Between Inflation and Output Gap in TurkeyDocument7 pagesThe Causal Analysis of The Relationship Between Inflation and Output Gap in TurkeytheijesNo ratings yet

- Noble GroupDocument2 pagesNoble GroupromanaNo ratings yet

- Gravity ModelDocument20 pagesGravity ModelYusriana RianaNo ratings yet

- Impact of Exchange RateDocument9 pagesImpact of Exchange RateEr Akhilesh SinghNo ratings yet

- Chari Boru Bariso's Econ GuidsesDocument6 pagesChari Boru Bariso's Econ GuidsesSabboona Gujii GirjaaNo ratings yet

- Alemu AdelaDocument11 pagesAlemu AdelaKaasahun Dangura KDNo ratings yet

- Comparative Economic ResearchDocument26 pagesComparative Economic ResearchdanoshkenNo ratings yet

- Macroeconomic Factors and Economic Growth in MauritiusDocument35 pagesMacroeconomic Factors and Economic Growth in MauritiusSami YaahNo ratings yet

- Exchange Rate VolatilityDocument31 pagesExchange Rate Volatilitykhoerul mubinNo ratings yet

- Trade Growth Poverty Link PakistanDocument13 pagesTrade Growth Poverty Link PakistanRana ToseefNo ratings yet

- RRCVIII 39 Paper 01Document16 pagesRRCVIII 39 Paper 01ahtisham xargarNo ratings yet

- Tanvir Sir1Document14 pagesTanvir Sir1tania abdullahNo ratings yet

- Nhom 7- Trade Policy on Economic GrowthDocument30 pagesNhom 7- Trade Policy on Economic GrowthThanh HàNo ratings yet

- Confp 04 PDocument22 pagesConfp 04 PSherwein AllysonNo ratings yet

- Impact of Exchange Rate On Trade and GDP For India A Study of Last Four DecadeDocument17 pagesImpact of Exchange Rate On Trade and GDP For India A Study of Last Four DecadeHimanshuChaurasiaNo ratings yet

- Inflation in MalaysiaDocument15 pagesInflation in MalaysiaAinashikinabdullahNo ratings yet

- Inflation ProposalDocument6 pagesInflation Proposalfatai ayinlaNo ratings yet

- The Linkages Among Economic Growth, Foreign Direct Investment, Capital Formation and Trade Openness: Investigation Based On VecmDocument16 pagesThe Linkages Among Economic Growth, Foreign Direct Investment, Capital Formation and Trade Openness: Investigation Based On VecmHusnaanaNo ratings yet

- The Economic Growth-Inflation-Shadow Economy Trilogy: Developed Versus Developing CountriesDocument18 pagesThe Economic Growth-Inflation-Shadow Economy Trilogy: Developed Versus Developing CountriesDella AudiaNo ratings yet

- The Relationship Between Inflation and Economic GrowthDocument21 pagesThe Relationship Between Inflation and Economic Growthasmar farajovaNo ratings yet

- Inflation and Economic Growth:: Threshold Effects and Transmission MechanismsDocument75 pagesInflation and Economic Growth:: Threshold Effects and Transmission MechanismsSya ZanaNo ratings yet

- Jepe 5Document43 pagesJepe 5Amar zayaNo ratings yet

- Econometrics PG Presentation - Does Trade Cause GrowthDocument15 pagesEconometrics PG Presentation - Does Trade Cause GrowthOscar ChipokaNo ratings yet

- Globalization 5Document3 pagesGlobalization 5Yram GambzNo ratings yet

- Money Supply, in Ation and Economic Growth Co-Integration and Causality AnalysisDocument18 pagesMoney Supply, in Ation and Economic Growth Co-Integration and Causality AnalysisNouf ANo ratings yet

- The Relationship Between Trade Openness andDocument18 pagesThe Relationship Between Trade Openness andNur AlamNo ratings yet

- D I E P ': Eterminants of Nflation and Conomic Growth in AkistanDocument23 pagesD I E P ': Eterminants of Nflation and Conomic Growth in AkistanMALL OF ATTOCKNo ratings yet

- The Effects of Inflation On Growth: Some International EvidenceDocument12 pagesThe Effects of Inflation On Growth: Some International EvidenceshellyNo ratings yet

- Editor in chief,+EJBMR 993Document7 pagesEditor in chief,+EJBMR 993HaiderNo ratings yet

- Exposure to External Country Shocks and Income VolatilityDocument23 pagesExposure to External Country Shocks and Income VolatilityPrem KumarNo ratings yet

- Reseach BRM Hazara UniversityDocument13 pagesReseach BRM Hazara UniversitySadia ShahzadiNo ratings yet

- Jfe V2i3p16Document15 pagesJfe V2i3p16tassawarNo ratings yet

- Chapter 2 Literature Review-1Document15 pagesChapter 2 Literature Review-1Ahmad Ali GillNo ratings yet

- Palgrave Macmillan Journals International Monetary FundDocument22 pagesPalgrave Macmillan Journals International Monetary FundSamuel Mulu SahileNo ratings yet

- USBCHDCBJDocument15 pagesUSBCHDCBJDhenmark MaguadNo ratings yet

- Exchange Rate Pass Through in India: Abhishek KumarDocument15 pagesExchange Rate Pass Through in India: Abhishek KumarinventionjournalsNo ratings yet

- Shadow Economy, Political Stability and Inflation - JAE2017Document27 pagesShadow Economy, Political Stability and Inflation - JAE2017umadmazharNo ratings yet

- Explaining Corruption: Are Open Countries Less Corrupt?Document11 pagesExplaining Corruption: Are Open Countries Less Corrupt?Alina ZakharchukNo ratings yet

- Final - PJSS-31-1-05 (1) ADocument14 pagesFinal - PJSS-31-1-05 (1) AAsad MuhammadNo ratings yet

- NBER Macroeconomics Annual 2016From EverandNBER Macroeconomics Annual 2016Martin EichenbaumNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Analysis of The Turnover Intention of Private Employees in SurabayaDocument13 pagesAnalysis of The Turnover Intention of Private Employees in SurabayaInternational Journal of Business Marketing and ManagementNo ratings yet

- GDP Modeling Using Autoregressive Integrated Moving Average (ARIMA) : A Case For Greek GDPDocument10 pagesGDP Modeling Using Autoregressive Integrated Moving Average (ARIMA) : A Case For Greek GDPInternational Journal of Business Marketing and ManagementNo ratings yet

- Analysis of The Influence of Company Size On The Timeliness of Financial Reporting by Mediating Profitability and Leverage in Companies Listed On The Indonesian Stock ExchangeDocument7 pagesAnalysis of The Influence of Company Size On The Timeliness of Financial Reporting by Mediating Profitability and Leverage in Companies Listed On The Indonesian Stock ExchangeInternational Journal of Business Marketing and ManagementNo ratings yet

- Evaluation of Innovation Activities: An Empirical Investigation of Industrial Enterprises in Thai Nguyen ProvinceDocument7 pagesEvaluation of Innovation Activities: An Empirical Investigation of Industrial Enterprises in Thai Nguyen ProvinceInternational Journal of Business Marketing and ManagementNo ratings yet

- The Informational Efficiency Hypothesis of Markets: Theoretical Presentation and Empirical Test On The Moroccan Stock MarketDocument6 pagesThe Informational Efficiency Hypothesis of Markets: Theoretical Presentation and Empirical Test On The Moroccan Stock MarketInternational Journal of Business Marketing and ManagementNo ratings yet

- The Role of The Reputation of The Public Accountant Firm in Reducing Audit Delays in Companies Listed On The Indonesia Stock ExchangeDocument8 pagesThe Role of The Reputation of The Public Accountant Firm in Reducing Audit Delays in Companies Listed On The Indonesia Stock ExchangeInternational Journal of Business Marketing and ManagementNo ratings yet

- Impact of Corruption On Foreign Direct Investment: An Empirical Analysis For Sri LankaDocument13 pagesImpact of Corruption On Foreign Direct Investment: An Empirical Analysis For Sri LankaInternational Journal of Business Marketing and ManagementNo ratings yet

- Financial Leverage and Corporate Investment: Evidence From CameroonDocument12 pagesFinancial Leverage and Corporate Investment: Evidence From CameroonInternational Journal of Business Marketing and ManagementNo ratings yet

- Exploring The Value of Workplace Training: A Literature Review of Practices, Assessment Models, Challenges, and SolutionsDocument11 pagesExploring The Value of Workplace Training: A Literature Review of Practices, Assessment Models, Challenges, and SolutionsInternational Journal of Business Marketing and ManagementNo ratings yet

- Policy Measures and Monetary Policy On The Economic Growth of Taiwan in Post Covid-19Document6 pagesPolicy Measures and Monetary Policy On The Economic Growth of Taiwan in Post Covid-19International Journal of Business Marketing and ManagementNo ratings yet

- Financial Literacy Amongst Small Scale Farmers in ZambiaDocument13 pagesFinancial Literacy Amongst Small Scale Farmers in ZambiaInternational Journal of Business Marketing and Management100% (1)

- Cross-Strait Flights Service Quality and Customer Satisfaction Between Taiwan and The Mainland ChinaDocument9 pagesCross-Strait Flights Service Quality and Customer Satisfaction Between Taiwan and The Mainland ChinaInternational Journal of Business Marketing and ManagementNo ratings yet

- Impediments Encountered by Women Entrepreneurs in India: An OverviewDocument8 pagesImpediments Encountered by Women Entrepreneurs in India: An OverviewInternational Journal of Business Marketing and ManagementNo ratings yet

- Self-Development and Employee Commitment in Telecommunication Firms in NigeriaDocument9 pagesSelf-Development and Employee Commitment in Telecommunication Firms in NigeriaInternational Journal of Business Marketing and ManagementNo ratings yet

- Adoption of Halal Assurance Management Systems in Poultry Farming in Brunei DarussalamDocument10 pagesAdoption of Halal Assurance Management Systems in Poultry Farming in Brunei DarussalamInternational Journal of Business Marketing and ManagementNo ratings yet

- The Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesDocument5 pagesThe Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesInternational Journal of Business Marketing and ManagementNo ratings yet

- Effect of Risk, Capital, Good Corporate Governance, Efficiency On Financial Performance at Islamic Banks in IndonesiaDocument8 pagesEffect of Risk, Capital, Good Corporate Governance, Efficiency On Financial Performance at Islamic Banks in IndonesiaInternational Journal of Business Marketing and ManagementNo ratings yet

- Impact of Social Media Marketing On Consumer Buying Behavior: A Study Based On Clothing Brands in Sri LankaDocument12 pagesImpact of Social Media Marketing On Consumer Buying Behavior: A Study Based On Clothing Brands in Sri LankaInternational Journal of Business Marketing and ManagementNo ratings yet

- Marketing in HealthcareDocument3 pagesMarketing in HealthcareInternational Journal of Business Marketing and ManagementNo ratings yet

- Barriers To Accessing Formal Concessional Loans For The PoorDocument7 pagesBarriers To Accessing Formal Concessional Loans For The PoorInternational Journal of Business Marketing and ManagementNo ratings yet

- Is Your Workplace A "Cult?"Document2 pagesIs Your Workplace A "Cult?"International Journal of Business Marketing and ManagementNo ratings yet

- Factors Affecting The Product Innovation of Industrial Enterprises in Thai Nguyen Province: An Empirical InvestigationDocument6 pagesFactors Affecting The Product Innovation of Industrial Enterprises in Thai Nguyen Province: An Empirical InvestigationInternational Journal of Business Marketing and ManagementNo ratings yet

- Sustainable Arbitrage Based On Long-Term Memory Via SEVDocument9 pagesSustainable Arbitrage Based On Long-Term Memory Via SEVInternational Journal of Business Marketing and ManagementNo ratings yet

- Corporate Governance Expedites Bank Performance: Solving The Paradox From Bangladesh PerspectiveDocument10 pagesCorporate Governance Expedites Bank Performance: Solving The Paradox From Bangladesh PerspectiveInternational Journal of Business Marketing and ManagementNo ratings yet

- E-Marketing and Savings Mobilization Drive of Selected Microfinance Banks in Uyo Metropolis, Akwa Ibom StateDocument6 pagesE-Marketing and Savings Mobilization Drive of Selected Microfinance Banks in Uyo Metropolis, Akwa Ibom StateInternational Journal of Business Marketing and ManagementNo ratings yet

- Examining The Relationship Between Reference Marketing, Brand Reputation and Industrial Customer Behaviors: The Mediating Role of Brand ReputationDocument19 pagesExamining The Relationship Between Reference Marketing, Brand Reputation and Industrial Customer Behaviors: The Mediating Role of Brand ReputationInternational Journal of Business Marketing and ManagementNo ratings yet

- The Chinese Influence in Africa: Neocolonialism or Genuine Cooperation?Document9 pagesThe Chinese Influence in Africa: Neocolonialism or Genuine Cooperation?International Journal of Business Marketing and ManagementNo ratings yet

- Statistical Analysis of Real Estate StocksDocument5 pagesStatistical Analysis of Real Estate StocksInternational Journal of Business Marketing and ManagementNo ratings yet

- How Dynamics of Tax Compliance in The New Normal EraDocument8 pagesHow Dynamics of Tax Compliance in The New Normal EraInternational Journal of Business Marketing and ManagementNo ratings yet

- Intellectual Capital Effect On Financial Performance and Company Value (Empirical Study On Financial Sector Companies Listed On The Indonesia Stock Exchange in 2020)Document11 pagesIntellectual Capital Effect On Financial Performance and Company Value (Empirical Study On Financial Sector Companies Listed On The Indonesia Stock Exchange in 2020)International Journal of Business Marketing and ManagementNo ratings yet

- Cost Acctg ReviewerDocument106 pagesCost Acctg ReviewerGregory Chase83% (6)

- Industry Structure, Competition, and Firm PerformanceDocument11 pagesIndustry Structure, Competition, and Firm Performancer G100% (1)

- Aid For Trade & NepalDocument36 pagesAid For Trade & NepalJaydeep PatelNo ratings yet

- Demand, Supply and ElasticityDocument39 pagesDemand, Supply and ElasticityRia Gupta100% (1)

- Abraham's Strategy: Split StealDocument6 pagesAbraham's Strategy: Split StealSwati JainNo ratings yet

- Basics of Capital BudgetingDocument26 pagesBasics of Capital BudgetingChaitanya JagarlapudiNo ratings yet

- A Formal Proof of Walras LawDocument6 pagesA Formal Proof of Walras LawgeromNo ratings yet

- Macro 2 Summer School - 6.24.08 Charles S. Mutsalklisana SproulDocument3 pagesMacro 2 Summer School - 6.24.08 Charles S. Mutsalklisana SprouljxyoonNo ratings yet

- Duty Credit Scrip: Sahil Chhabra - 39ADocument8 pagesDuty Credit Scrip: Sahil Chhabra - 39AsahilchhabraNo ratings yet

- Textbook Statistics TalebDocument17 pagesTextbook Statistics TalebDom DeSiciliaNo ratings yet

- IIMU PGPX - 2016 Assignment 1: A Report Submitted To Prof. Vinay RamaniDocument10 pagesIIMU PGPX - 2016 Assignment 1: A Report Submitted To Prof. Vinay RamaniGourav SinghalNo ratings yet

- ABM II KEY CORRECTIONSDocument4 pagesABM II KEY CORRECTIONSJomar Villena100% (1)

- Indian Currency Coins and BanknotesDocument2 pagesIndian Currency Coins and BanknotessadathnooriNo ratings yet

- Arvind Pai ThesisDocument80 pagesArvind Pai ThesisrakeshsampathNo ratings yet

- Container Transshipment and Port Competition PDFDocument30 pagesContainer Transshipment and Port Competition PDFMohamed Salah El DinNo ratings yet

- Property Registration Website in India - E-Stamp Duty Ready Reckoner PDFDocument9 pagesProperty Registration Website in India - E-Stamp Duty Ready Reckoner PDFSelvaraj VillyNo ratings yet

- Why The ISDA SIMM Methdology Is Not What I ExpectedDocument5 pagesWhy The ISDA SIMM Methdology Is Not What I Expected남상욱No ratings yet

- Pertemuan IDocument54 pagesPertemuan IArsdy NovalentioNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- Index Numbers (Maths)Document12 pagesIndex Numbers (Maths)Vijay AgrahariNo ratings yet

- Individual and Market Offer Curves ExplainedDocument8 pagesIndividual and Market Offer Curves ExplainedBorisTurkinNo ratings yet

- Fee Details 2013-14 Admitted Batch (E2Document18 pagesFee Details 2013-14 Admitted Batch (E2hariNo ratings yet

- (Affiliated To Satavahana University) : 1. Business Economics Is Mainly A Study at The Level ofDocument3 pages(Affiliated To Satavahana University) : 1. Business Economics Is Mainly A Study at The Level ofSadhi KumarNo ratings yet

- Accept Thomson Division Bid for New Box DesignDocument2 pagesAccept Thomson Division Bid for New Box Designruchika vartakNo ratings yet

- Implied Volatility PDFDocument14 pagesImplied Volatility PDFAbbas Kareem SaddamNo ratings yet

- Replacement Analysis and Economic Service Life CalculationDocument17 pagesReplacement Analysis and Economic Service Life CalculationRizki AnggraeniNo ratings yet

- A Simple and Reliable Way To Compute Option-Based Risk-Neutral DistributionsDocument42 pagesA Simple and Reliable Way To Compute Option-Based Risk-Neutral Distributionsalanpicard2303No ratings yet

- BM - Group 5A - The Case of Pricing PredicamentDocument11 pagesBM - Group 5A - The Case of Pricing PredicamentEsha SharmaNo ratings yet

- Mankiw Chapter 14Document12 pagesMankiw Chapter 14Mina SkyNo ratings yet

- Econ 1101 Practice Questions CompleteDocument79 pagesEcon 1101 Practice Questions Completepeter kong33% (3)