Professional Documents

Culture Documents

Felton Review / EMERGE Response

Uploaded by

eric_roper0 ratings0% found this document useful (0 votes)

333 views37 pagesProvided to the Star Tribune

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProvided to the Star Tribune

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

333 views37 pagesFelton Review / EMERGE Response

Uploaded by

eric_roperProvided to the Star Tribune

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 37

MINN@SOTA

FADD econcic Sevetonmens

mn.gov/deed

Financial and Compliance Review and Investigation

Phase One Preliminary Report

November 22, 2017

Felton Financial Forensics, LLC

5200 Tifton Drive, Minneapolis, MN 55439

Phone: 612.490.1940

www-feltonforensics.com

‘Phase One Financial and Compliance Review and investigation

Phase One Report ~ November 22, 2017

Table of Contents

bxecUTIVe SUMMARY. 4

FINANCIAL REVIEW BACKGROUND. 5

REVIEW OMECTIVE 5

RESULTS SUMMARY. 5

REPORT ORGANIZATION 6

WHAT Is THE UNITY OPPORTUNITY COLLABORATIVE (UOC)? 6

voc senvices: : 6

Project Speci Pla 6

VOC Budget. 7

‘Allowable Cost per Grant Agreement 7

ewence, = 8

BACKGROUND AND OVERVIEW. 8

FINDING 1: BOUBLE-BOOKED UOC INCOME. ns °

FINDING 2: CIRCUMVENTION OF CHECK SIGNING LIMITS, 9

FINDING 3: LACK OF ADEQUATE SUPPORT/NONADHERENCE TO CONTRACTS, a

FINDING 4: MAY FXCEED UOC ADMINISTRATIVE RUDGE. 2

MINNEAPOLIS URBAN LEAGUE. 2B

[BACKGROUND AND OVERVIEW 3

SABATHAN ne = 14

[BACKGROUND AND OVERVIEW. 14

FINDINGS 1, 2,3: LACK OF SUPPORT/DISALLOWED EXPENSES/NON-IOC EXPENSES. 15

STAIRSTEP 16

BACKGROUND AND OVERVIEW... 16

‘OVERALL SUMMARY AND CONCLUSION v7

[EXHIBIT | ~ CHECK 15735 - $42,000. 18

[EXHIBIT LB ~ CHECK 15736 - $40,000, 19

XII HA ~CHECK 26018 - $35,000, 20

EXHIBIT 1.8 ~ CHECK 16019 -$35,000. 2

‘EXHIBIT ILC ~ CHECK 16020 - $34,414.99, 2

[EXHIBIT ILA ~ BERTELSON ~ FLOOR CLEANER - $372.60 ~ 100% TO UOC 23

EXHIBIT 6 ~ BERTELSON ~ TONER - $103.99 100% TO UOC 2

EXHIBIT IILC- SAM'S CLUB ~ BACK TO SCHOOL SUPPLIES - $1,628.31 ~ NON-UOC 2

Page 20130

hase One Financial and Compliance Review and investigation

Phase One Report = November 22, 2017

[EXHIBIT ILD - SAM'S CLUB PROGRAM SUPPLIES - $1,612.42 ~ NON-UOC. 26

[APPENDIX | FINANCIAL REVIEW PLAN 2

[APPENDIK Il REQUESTED INFORMATION 29

‘Appendi- SIZE COMPARISONS OF UOC PARTNERS. 30

Page 3.0f30

Phase One Financial and Compliance Review and investigation

‘Phase One Report ~ November 22, 2017,

EXECUTIVE SUMMARY

‘The state of Minnesota's Department of Employment and Economic Development (DEED) has

contracted with elton Financial Forensics to plan and perform a financial compllance review ofthe

‘Master Grant contract between DEED's Workforce Development Division and EMERGE Community

Development and its sub-grantees.

Phase One included reviewing transactions that ocurred from July 2, 2046 through December 31,2016.

‘The results of Phase One would determine if Phase Two was needed, Phase Two would cover January 3,

2017 through tune 30,2017.

EMERGE and sub grantees are also known asthe Unity Opportunity Collaborative (UOC). The UOC

‘members comprise Minnespols Publ Schools, Aineapois Urban League, Sabathani Community

Center, Staistep Foundation, and EMERGE. EMERGE serves as the lead grant recipient and is

responsible for the fiscal management and reporting on behalf ofthe UOC.

‘All LOC members except Minneapolis Publi Schools were part of Phase One, Since the Minneapolis

Public Schools di not request funding for the period under ths eview, they were not included inthe

‘Te purpose of Phase One was to ensure that evidence of payments and financial reconciliation back to

‘the General Ledgers forall granted funds was satisfactory. My Phase One findings were as follows:

For EMERGE

1. Double booked $365,822 in UOC grants

2. Circumwented check signing authority levels by splitting the amount of UOC check

disbursements to the sub-grantees. Spit UOC check dsbursements totaled $267,415

3. Lacked adequate support for UOC expenses.

4 May exceed UOC administrative budget by lune 30, 2017, based on the current eun ate

For Sabathani Community Center

41. tacked adequate support for UOC expenses.

2. Incurred disallowed UOC expenditures

3. Used UOC funds for non- UOC purposes

Phase One of the review dé nat find concrete evidence of malfeasance during the period under review

However, do consider some ofthese fndings emblematic of poor internal controls, undisciplined

recordkeeping, por understanding of adequate expense documentation, and poor understanding of

“allowable” expense under the terms ofthis grant agreement

‘Additional information on these violations is provided inthe boy ofthis report.

Page 4 of 30

Phase One Financial and Compliance Review and Investigation

hase One Report ~ November 22, 2017

FINANCIAL REVIEW BACKGROUND

‘The state of Minnesota's Department of Employment and Economic Development (OEED) has

contracted with Felton Financial Forensics to plan and perform financial compliance review ofthe

‘Master Grant contract between DEED's Workforce Development Division and EMERGE Community

Development and its sub grantees.

Before contacting Felton Financial Forensics, DEED attempted to resolve the issues with EMERGE

directly. On September 1, 2017, DEED sent letter to Mike Wynne, President and CEO of EMERGE,

‘expressing concerns about EMERGE’s abt to comply withthe contract's Project Specific Pan. The

letter demanded that EMERGE cease all services and incur no further costs under the contract terms

nti" ful financial reconciliation ofall expenses expended under ths grant” and other noncompllance

Issues were resolved

‘The letter gave notice to EMERGE that “DEED may conduct a formal audit review ofthis grant and

recoup any payments made by DEED that are not substantiated by records showing that the funds were

used as required” if EMERGE and its sub grantees did not cooperate fll with this letter. EMERGE was

‘ven ten (20) days, unt September 11, 2017, to resolve these issues. The letter documented that these

concerns had alzo been communicate orally to Mr. Wynne

‘one month after the deadline, the issues were stil unresolved. At this pint, BED engaged Felton

Financial Forensics to perform a Financial and Compliance Review and investigation of EMERGE and its

subvgrantees, The purpose ofthis review was to ensure that evidence of payments and financial,

reconciliation back to the General Ledgers for al granted funds was satisfactory.

REVIEW OBJECTIVE

‘The objective ofthis review sto Investigate whether there Is satisfactory evidence of payments and

financial reconilations back tothe General Ledger forthe UOC partners under review (EMERGE,

Minneapolis Urban League, Sabathani Community Center, and Staistep] forthe peri of lly 2, 2086,

‘through December 31,2016, Please see Appendi| forthe review plan.

‘The review plan was shared with representatives from EMERGE, Hylden Law Fim (counsel for EMERGE),

Metropolitan lance of Connected Communities (MACC) (accounting, IT, and MR service provider to

EMERGE), and Sabathani Community Center prior tothe stat ofthe fldwork. See Append Il fr sts

‘of documentation requested and reviewed.

| conducted my review in accordance with lawful financial compliance and examination techniques,

\which included an examination af books and records voluntary interviews of appropriate personnel,

and additional evidence-gathering procedures as deemed necessary under the circumstances

RESULTS SUMMARY

Phase One of the review didnot find concrete evidence of malfeasance during the period under review,

but uncovered issues emblematic of poor internal controls, undiscipined record keeping, poor

understanding of adequate expense documentation, and poor understanding of “allowable” expense

under the terms ofthis grant agreement.

ge 507 30

Phase One Financial and Compliance Review and investigation

‘Phase One Report ~ November 22,2017

REPORT ORGANIZATION

| provide brief description ofthe Unity Opportunity Collaborative (UOC) ad its goals. Next, | provide a

bref background on each organization, then report on and provide evidence of my ancial findings.

WHAT IS THE UNITY OPPORTUNITY COLLABORATIVE (UOC)?

The Unity Opportunity Collaborative (UOC) isa partnership of ive Twin Cities community-based

organizations: EMERGE, Minneapolis Public Schools, Minneapolis Urban League, Sabathani Community

Center, andthe Startep Foundation, The callaborative's tated purpose ito develop programs "to

‘overcome economic dlspartes that Afican-Americans and African immigrants face” in the Twin Cites

‘metropolitan area by developing and deploying “new and innovative approaches to education and

workforce development.”

EMERGE isthe ead grant recipient and is responsible forthe fiscal management and reporting on behalf

ofthe collaborative. Pease see Appendix Il for additional information such as graphical side-by-side

comparisons of each partner's total expenditures and number of full-time equivalent employees.

UOC SERVICES

The UOC offers series ats different ses in North and South Minneapols. The Master Grant

‘Agreement between DEED and EMERGE awarded $4,037,500 to EMERGE and is fellow UOC partners to

‘develop education and career training programs to help prepare African-Americans and Afians to

achieve workplace success and assist them as they transition into the workforce

Project Specific Plan

The Project Specific Pan inthe grant agreement detailed sx key objectives tobe accomplished bythe

{UOC from July 1, 2016 though une 30,2018

GED Preparation

Employment Readiness Talning

Dightal Readiness

Career Credentialing

Job Placement

Transitional Employment

Page 6 of30

Phase One Financial and Compliance Review and investigation

ase One Report = Novernber 22, 2017

vos Budget

Tora

mes | mes AL

pupuc | URBAN tnowvioua

expense careconies | ewense | scHoors | veacue_|sasaraani| srainsrer | euDcers

[administration 12006 | 7saos|sosaa| 74250] saga] 203.750

(contracted Sevices 7 zi

Participant wage/tinge | 225263 = |

[rect Services ‘io32.e33 | e7as8| —sis70| —sas79| a5a300 | 3315,960

Support Services 19956 = [23571 [ —_sep00[ 15000" 92.527

[Total Expenses $ia20058]§ 754031 | 599.379 |$ 742.588 |$ 521.494 [54037500]

Allowable Cost per Grant Agreement

‘+ Administration —Up to ten percent (10%) of available program funds may be budgeted for

administration costs, which shall consist of ll direct and indirect costs associated with the program

‘management. Administrative costs include staff costs for program direction, coordination, and

‘management; program evaluation and data collection; an office support staf. Staff travel costs not

specifically relate to direct services are also considered administrative costs.

1 Contracted Services ~ This expenciture category i used fr funds subcontracted to anther

‘organization to carry out activities described in the work pla.

+ Parcipant Wages and Fringe Denchits Wages and benefit paid sirectly to participants while

engaged in program actives, as wellas stipends provided for educational activities, should be

included in this cost category.

‘+ Direct Services ~This category covers costs assocated with providing rect services to participants,

EXCLUDING costs of participant wages an fringe benefits and suppor services. Wages and fringe

benefits fr staff providing direct services to participants should be included in this cost category.

+ Support Services ~ Support Services funds are used for tems that are necessary for participant to

Participate in the program, suchas transportation, clothing, tools, childcare, housing/ental

assistance, schoo! related expenses, et. These expenses may be paid directly to te participant or

toa third-party vendor.

+ Please note: Workforce Investment Act (WIA) funded grants also prohibits certain activites, Al

costs associated with an unallowable activity ae considered unallowable cost, regardless oftheir

allowability under ther ccumstances, The prohibited activites are

‘© Employment-generating activites An exception is made only for those employer outreach

and job development activites evecty relate to participants.

©The wages of incumbent employees participating in Statewide economic development

activities.

Page 7 of30

Phase one Financial and Compliance Review and investigation

Phase One Report November 22, 2017

EMERGE

BACKGROUND AND OVERV'

Based in North Minneapolis and Cedar Riverside, EMERGE helps people facing significant obstacles

redefine themselves, Their mission i to help adits and youth access jobs, financial coaching, supportive

housing, and other key services along pathways to brighter futures,

Mike Wynne ste President and CEO. Mr. Wynne has led the organization since its launch in 2006,

Before that, he serve ina succession of positions with Pillsbury Urited Communities, EMERGE'S

heritage organization. He was fist hired az direct service staf person in 1988 and then served as

Center Director, Program Director, and Vice President before launching EMERGE init curcent Form,

Mr. Wynne earned his 8A in Sociology and Urban Studes from Hamline Univesity. He has completed

‘graduate certifiations in Nonprofit Management and Finance at the Unversity of St. Thomas, The

James Shannon Insitute fr Renewing Community Leadership, The Executive Leadership Institute atthe

University of Michigan Schools of Socal Work & Business, and the Stanford Graduate School of Business

Executive Program in Social Entrepreneurship

EMERGE operates with 69 FTEs (Full-Time Employees) and in 2016 had expenses of $8,902,157,

‘Asummary ofthe findings pertaining to EMERGE Is below,

4. Double-tooked $365,822 in UOC grants

2. Circunwented check signing authority levels by splitting the amount of UOC check

isbursements tothe sub-grantees. Spit UOC check disbursements totaled $267,415,

3. Lacked adequate support for UOC expenses.

4. May exceed UOC administrative budget by June 30, 2017, based on the current run rate

"information sourced rom EMERGES webite

Page 8 0f30

Phase One Financial and Compliance Review and investigation

hase One Report~ November 22,2017

FINDING 1: DOUBLE-BOOKED UOC INCOME

EMERGE and the sub-grantees both recorded significant portions of the same UOC income (se below

for amount}.

In other words, EMERGE recorded in ts financial books revenue belonging tothe subgrantees. In

addition, the sub-grantees also recorded the same amaunt of revenues in thelr financial books. This is

treet violation of Generally Accepted Accounting Principles (GAAP) per rules promulgated by the

Financlal Accounting Standards Board (FASB). ASB's accounting rules are recognized as authoritative by

the Securities and Exchange Commission (SC), the American institute of CPAs (AICPA), andthe state

Boards of Accountancy, including the state of Minnesota's Board of Accountancy

fazed on consultation with thelr external auditors, EMERGE believes double booking of income Is

allowed in this circumstance because the grant agreement s between DEED and Emerge rather than

DEED, Emerge and four sub-grantees, Emerge cits the following to support thelr postion:

1. EMERGE controls the revenue being passed through them tothe sub-grantees

2. EMERGE has the right and responsibly to change, modify or cancelits agreement with the sub

grantees for any number of reasons per the contract terms with each sub-grantee,

‘Therefore, in summation, EMERGE believes the aforementioned elements of control are the

litinguishing factors which led them to record the activity the way they did

EMERGE'S management asked me to make clear tothe reader that this inding pertains to its financial

statement presentation only. This is separate from the financial status reports (FSA) filed by EMERGE

{vith DEED. The scope ofthis review did not include reviewing FSHs for complance withthe contract.

‘Amounts Recorded in both EMERGE’s and Sub-grantees' Financial Statements

Double

‘Account Name Revenue/Cost center __| Booked

[Grants and Contracts income - State of Minnesota [0701 Minneapolis Urban League [$ 005

[Grams and Contracts income state of Minnesota_[0703- Sabathani Comm Ct. 76753

[rants and Contracts income State of Minnesota [0704- Stairstep Foundation 190,658

[Total Grant income Recordedin Both Grantee's and Sub-Grantees' General Ledger | $365,822,

FINDING 2: CIRCUMVENTION OF CHECK SIGNING LIMITS

EMERGE’ check signing policy states that checks over $50,000 requir the handwritten signatures of

the President/CEO and ether the Boacd Char, Goard Vice Chair, or Board Secretary. The Vice President

of Finance & Budget Development and the President/CEO both violated ths policy by making several

{VOC payments under the $50,000 limit to pay a single requested amount. See below for examples, end

Exhibits LA L.A 1.8, LC for actual canceled checks.

Page 9 of 30

: Phase One Financial and Compliance Review and investigation

Phase One Report = November 2, 2017

EXAMPLE ONE

‘Check Details

‘GheckWwade ] Check | Check ] check

Payableta: | Number| pate _| Amount

starstep Foundation 15735 [09/206 | 42000

[starstep Foundation 15736 [oa/20ns|s 40.000,

TotalDollarAmountof checks $82,000,

f AMPLE TWO

‘Check Details

Gheckwiade | Check | check [Check

Payableto: | Number| Date _| Amount

[sbathanicomcer | 16018 [11/30/16 | $ 35,000.00

[sbathanicomew | 16019 [11/30/36 | $ 3500000

[sbathanicomew | 16020 [an/sovi6 | $ 34414 99

Total Dollar Amount of Checks | $104,414 99

EMERGE Signing Authority Matrix

vaue | signing aumnortty Levets

7a athorned Tar agency puraasng reauess, or puraaina Cras

s9t0$3,000 | + Manager(s)

+ Died)

{Vice Presents

‘Rpprovel this level requires ane (1 handwaten Sonate

sroovtorasany 1 Ys pate of Sma ees rm

ace ecm’

~ Trove! ts eve egies two (2) hand ween wana

snes:

ic President of Finance & Business Development

es Prien of Conny are servers

$25,000 0

+ President/CEO and; must als incude an of he flowing authorized

1 Rove aE TT PES Two (2) Fan WN TRIES

ae san authorized sone:

+ Board chair or:

Board Secretary

1+ Presden/CE0 and must also incude one of he Following Board of rectors

Page 10 0f30

hase One Financial and Compliance Review and Investigation

Phase One Report ~ November 22, 2017

FINDING 3: LACK OF ADEQUATE SUPPORT/NONADHERENCE TO CONTRACTS

In most cases of disallowed costs, the cause is lack of proper documentation. Alcosts require an

invoice, origina ecept, purchase order, contractor ether form of documentation All cost

‘documentation requires authorized signatures and evidence of receipt ofthe goods or services

purchased.

Below is sample of the expenditures tested that were found to either lack adequate documentation

for payments or nonadherence to contract terms or both.

event :

Tetarions [oa ore] min ao anos |

[sac att Aw asp

: nal esa | eenco| sae fest petom tenet embses aman 350%

faa [tess ces here 0 sce omnes” ot

lawman osnsne] ass | s2s0000| 546 perms s20eftsi1s00wstorSmomaot tga ete

in astro o aa|

lcwnecomanisons ss | ezncn) sas [earn mts aren neni

Jawoonsnesson finan so | rac] 5 lsmtenontontenrmttertnntins

louronencors —|anaare| ase | arnon] sores orn

juucwassee —|onnanc| ass) secon] 6 frsmingtonintiyaunonse econ

Page 11 of 30

1a One Financial and Compliance Review and investigation

Phase One Report November 22, 2017

FINDING 4; MAY EXCEED UOC ADMINISTRATIVE BUDGE}

EMERGE'S administrative budget i $142,006. =MERGE'S net actual administrative cost forthe last four

‘manths (September, October, November and December of 2016 is $103,668. This averages $25,900 per

‘month, Based ona run rate of $25,900, EMERGES total administrative cost forthe remaining sixmenths

of fiscal year 2017 is projected to be $185,400; and when added tothe actual administrative expenses

Incuted in 2016, EMERGE'S total administrative cost are projected tobe $258,068. This represents a

projected overage of $117,062 or 82% over budget.

Page 12 of 30

Phase One Financial and Compliance Review and Investigation

Phase One Report = November 22, 2017

MINNEAPOLIS URBAN LEAGUE?

BACKGROUND AND OVERVIEW

‘The Minneapolis Urban League (MUL isa community-based nonproft organization that was founded in

1926, The mission ofthe Minneapols Urban League isto link African descendants and other people of

color to opportunities that result in economic success and prosperity, and to effectively advocate for

policies that eradicate racial disparities.

Steven Belton isthe President and CEO, Mr. Belton isan experienced executive, attorney, and

community leader with over thirty years tenure In high-level positions in state government, public

Sehools and the nonprofit and private sectors. He has worked as Chie of Staff, Execute Director of

Employee Relations, and Director of Diversity and Equal Opportunity forthe Minneapolis Public Schools;

was a partner and litigator at Leonard, Stret and Deinard where he specialized in employment, product

labilty, an family aw; served as President and CEO of the Urban Coalition of Minneapolis; and was

txecutve Director of the State Council on Black Minnesotans, Currently he serves asa youth minister

and is on the preaching staff at Park Avenue United Methodist Church in south Minneapolis.

Me. Betton earned a An political science from Washington Universit in St.Louis and a Juris Doctorate

{com the Univesity of Michigan Law Schoo! in Ann Arbor. He has completed two-thirds ofthe

requirements ofa Master of Divinity degree at Luther Theological Seminary in St. Paul

[MUL operates with 20.875 FTEs (Full-Time Employees) and had expenses of $2,073,231 In 2016.

‘There were no reportable findings forthe Minneapolis Urban League.

Pnformation sourced rm the Minneapolis Urban League's website

Page 13 0f30

1 One Financial and Compliance Review and Investigation

Phase One Report ~ November 22,2017

SABATHANI

ACKGROUND AND OVERVIEW

“The Sabathani Community Center was established in 1966 with the purpose of enriching the community

‘nd proving a safe space for its youth, Sabathani continues to offer that safe place for community

Youth, butts primary mission has grown. The Center now aso serves asa resource to familes and

Seniors

‘indy Booker is the Executive Director. Ms. Booker has served inthis ole for the past fur years and is

responsible fr providing leadership to nine direct reports inal areas of operations, including human

resources, payrall, finance, rogram supervision, development, IT, and landlord relationships.

‘Sabthani operates with 18.5 FTEs (Ful-Time Employees) and had expenses of $2,386,652 in 2016,

‘Asummary ofthe Sabathani Community Center's ings is below

1. lacked adequate support for UOC expenses.

2. Incured disallowed UOC expenaitures

3. Used UOC funds for non-UOC purposes.

® information source rom the Satathani Community Center's website and Unked in

Page 14 of 30

Phase One Financial and Compliance Review and Investigation

Phase One Report= November 22, 2017

FINDINGS 1, 2, 3: LACK OF SUPPORT/DISALLOWED EXPENSES/NON: IOC EXPENSES

Presented inthe chart below is a sample ofthe expenditures with Findings 2,2, or3. Names with "+*"

signifies a copy ofthe expenditure ean be found io EXHIBIT IA, LB, I, and I. in the back ofthis

report

(CONTRACT COMPUANCE REVIEW - SAMPLE RESULTSOF BXPENDITURE TESTING

| oa as aT RR] —— co

Tone ern sts

ee etooteneneoceres

ersleansen- | aren SESE | gas] aa [eran ad

ieee: |actualchack amount was,

tsussenzesacy

nnuaelaveen, | aa raanzrerournencen | 2oenco] 1.2 |ftalteceamontos

7 ea “? |s360 not $2.088.

vase 88 | anf suomies rsa] 2a. [menvoceene

ore ama na | ea fr-rane wen] 2 Raeeen

eenansfiescus | gis arccrosoroosumuts | agar] 22 |ronvocessene

oe oppor prover

oyavacloccunncr | — frye seen] 1 [toe

Toe OTTER

rssfearason | arms rooncnen nso] a2. |itmersoetocpopane

fe im ouang srt

eo co

aveeenrason | arm fomee sas] 12 [itowroeuoe povane

lets etd

Page 15 of 30

Phase One Financial and Compliance Review and vestigation

hase One Report= November 22, 2017

STAIRSTEP,

BACKGROUND AND OVERVIEW:

The Staistep Foundation was formed in 1982 as God inspired response toa set of challenges

confronting society at large and Afrcan-Amerlcansin particular. The founders ofthe Staistep

Foundation believed the lack of community was the cause The founders belleved thatthe palo

ingicators leading to societal distress (teen pregnancy, youth crime, drug abuse, et.) were not new, but

had become more intense and widespread than in other historical time periods because the critical

Connections of people one to another were replaced by isolation and alienation The sense of

‘community had been broken. Stairstep's goal was to rebuild community among African-American

people

‘Alfred Babington-Johnson i the President and CEO. Mr. Babington-Johnson Is 8 founding member ofthe

Stirstep Foundation and has served ais president and CEO since te organization's inception. M.

Babington-Johnson has a Bachelor of Arts fom Howard University and a Masters in Divinity from Bethel

Seminary. Mr. Babington-Johnson is aso an ordained minster.

‘The Stastep Foundation operates wit 3 FTES (Full-Time Employees) and had expenses of $644,471 in

2016.

‘There were no reportable findings forthe Starstep Foundation

"formation soured trom the Starstep Foundation’s webste,

Page 16 0f 30

Phase One Financial and Compliance Review and Investigation

ase One Report = November 22, 2017

OVERALL SUMMARY AND CONCLUSION

‘The final decision as to whether a Phase Two Is warranted rests with DEED's executive

‘management, In my opinion, there seems to be enough evidence of poor internal controls,

Lundsciplined record keeping, poor understanding of adequate expense documentation, and poor

Understanding of “allowable” expense under the terms of this grant agreement to warrant a Phase Two

review.

Page 17 of 30,

‘Phase One Financial and Compliance Review and investigation

Phase One Report= November 22, 2017

EXHIBIT L.A ~ CHECK 15735 - $42,000

Commercial Electronic Office - Transaction Search

Date Printed:11/14/2017 12:57 PM PT

SERRA on aac,

‘STAIRSTEPFOUNOKTION

woustasr ossoo00 4943570191 264"

Page 18 of 30,

Phase One Financial and Compliance Review and Investigation

hase One Report = November 2, 2017

EXHIBIT LB — CHECK 15736 - $40,000

Commercial Electronic Office - Transaction Search

Date Printed:11/14/2017 12:57 PM PT

Check 15736 - 40000.00 USD

Aton

[STAINSTE? FOUNDATION

woas?a6e 8090000 49r39 70494 2640

ner

Page 19 0f30

hase One Financial and Compliance Review and investigation

‘Phase One Report ~ November 22,2017,

EXHIBIT IA ~ CHECK 16018 - $35,000

Commercial Electronic Office - Transaction Search

Date Printed:11/14/2017 01:08 PM PT

Check 16018 - 35000.00 USD

a a

NER anoint

woweo.er "20940000 193970194 2640"

Page 20 0f 30

One Financial and Compliance Review and Investigation

hase One Report - November 22, 2017

EXHIBIT 1.8 ~ CHECK 16019 - $35,000

|Commercial Electronic Office - Transaction Search

Date Printed:11/14/2017 01:09 PM PT

wossosae "209 4000049H39 70454 2510

Page21 of 30

Phase One Financial and Compliance Review and investigation

‘Phase One Report Nover 7

EXHIBIT 1. ~ CHECK 16020 - $34,414.99

Commercial Electronic Office - Transaction Search

Date Printed:11/15/2017 10:16 PM PT.

saan conn cons

Bein a

wossoz0" oainono1eHsE7ONaN ete

Page 22 0f 30

hase One Financial and Compliance Review and investigation

Phase One Report = November 22, 2017

EXHIBIT IIA ~ BERTELSON ~ FLOOR CLEANER - $372.60 ~ 100% TO UOC

ee

Secs et teh wets

i

a

SS es ee ee ee

ae rae i

Page 23 of 30

Phase One Financial and Compliance Review and Investigation

‘Phase One Report ~ Novernber 22, 2017

EXHIBIT IIL8 ~BERTELSON — TONER - $103.99 ~ 100% TO UOC

Involoe Paap tot +

ber alson | StL n20%6 oe-42001e4

ee ee ae ae

— esse

= ae z

—

Page 24 of 30

hase One Financial and Compliance Review and investigation

‘Phase One Report = November 22, 2017

EXHIBIT ILC - SAM'S CLUB ~ BACK TO SCHOOL SUPPLIES - $1,628.31 ~ NON-UOC

Sons Cub MCSYNCE ame

PO Box 960016,

Se een | ys” —

Expenses

aoa ae — fre aI

joensen freee van

eget fen ua

akan Se Ee er ag

lesson, frase ra

ro en

looters |rmt tren The al

eestor. am 2 3 sects

if Bill Total: $4,186.75

Page 25 of 30

Phase One Report = November 22,2017

EXHIBIT IILD - SAM'S CLUB ~ PROGRAM SUPPLIES - $1,612.42 ~ NON-UOC

Bill

Shenae ee =, =

Ssnscia oS =

rand P6016 aw? Jno sent

Expenses

rT

Page 26 0f 30

16 One Financial and Compliance Review and investigation =

Phase One Report~ November 22, 2017

APPENDIX | ~ FINANCIAL REVIEW PLAN.

Financial and Compliance Review and investigation

Contract Compliance Examination - Phase One

october 18,2017

‘Objective - Phase One: “Investigate that evidence of payments and financial reconciation back to the

General Ledger’ was satisfactory a stated inthe last bullat point on Page S of Deputy Commissioner

Hanson Will's letter dated September 1, 2017, to Mr. Wynne,

Initial Examination Scope - Phase One: Covered the six-month period of lly 1, 2026 December 3,

2016, during which $651X in cash advances and $386K in expenditure payments were made to EMERGE

from DEED (per SWIFT, the State's accounting and procurement system),

Initial Requested Documents - Phase One: EMERGE operates on a calendar year with 212/31 yearend,

‘which means that their2016 annual financial auit should have been completed by May 15,2017;

therefore, DEED is requesting:

‘+ EMERGE's 2016 financial audit report, management summary, and findings

‘EMERGE's summary and the detalles General Ledger tha les tothe 2016 audlted fnancial

(© Obtain EMERGE's approval to contact external auditor(s} for mapping/crosswalk of

summary General Ledger to financial statements}

Reconcile 2016 cash advances and expenditures (made by DEED to EMERGE) to the 2016

detaled General Ledger

+ Examine documentation supporting the 2016 cash advances and expenditures (made by DEED

to EMERGE) to ensure the expenditures are allowable per the Master Contract, workplan (PSP

Projet Speci Plan), budget, and legislation, nd that supporting documentation is satisfactory

‘+ Bxamine the books and records ofthe sub grantees and sub-ecpients from the same time

period, when necessary, to show satisfactory evidence of payments, ensure expenditures are

allowable per the workplan, PSP, budget, and legislation, and that supporting documentation is

satisfactory

‘© Examine the books and records related to consultants and independent contractors from the

same time period, when necessary o show satisfactory evidence of payments, ensure

expenditures are allowable per the workplan, PSP, budget and legislation, and that supporting

documentation is satisfactory.

Phase Il-The Phase One results will determine the next steps related tothe objective and scope of

Phase'l if determined necessary.

Records Examination - DEED has aright to examine EMERGE’s and its sub-grantees' books and record

Per Paragraph 9 of Master Grant Contract EMERGE2O16M, DEED or a designated representative has the

Page27 of 30

hase One Financial and Compliance Review and Investigation

ase One Report ~ November 22, 2017

“right to examine, for audit purposes or otherwise, any books, documents, papers or records of

(GRANTEE" and "GRANTEE grees to fully cooperate in any such examination and/or aul.” Felton

Financial Forensics isa designated representative of DEED fo purposes of ths contract compliance

examination

Expectations - EMERGE wil ensue the designated representative will have onsite space to work, that

the MACC fiscal agent assigned to work on this grant is available, and thatthe third-party reviewer has

{ull access ta financial system(s) data and the General Ledger forthe duration of the review. DEED

‘expects fll cooperation and responsiveness to ensure the timely completion of the onsite financial and

compliance review and investigation. To ensure the integrity ofthe review, any communication during

‘this financial and compliance review and investigation must be dected tothe thira-pary eviewer.

Page 28 of 30

Phase One Financial nd Compa

ase One Report

ce Review and investigation

ber 22, 2017

APPENDIX iI~ REQUESTED INFORMATION.

Financial and Compliance Review and investigation

Contract Compliance Examination - Phase One

Requested Information, Documentation, or Items

[2016 External Audit Report

‘Summary General Ledger for Fiscal Calendar Year 2016

Mapping of Summary General Ledger to the External Audit Report

Detailed General Ledger for Fiscal Calendar Year 2016

‘Supporting Documentation for UOC Expenditures

Bank Reconciliations

Read-only Access to Checking and Savings Accounts

Budgets

[Operating Statistics

Page29 of 30

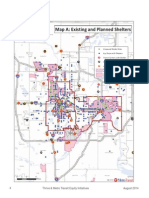

‘Appendix lll- SIZE COMPARISONS OF UOC PARTNERS.

‘Site comparison by

‘total 2016 expenses

Sie comparison by

total fulltime

equivalent

‘employees.

‘Size comparison by

‘average productivity

by full-time

equivalent employee

“Thiseffcieney

Indicator is caleulated

by dividing total

expenses by total

FTEs, Higher numbers

Isan indicator of high

efficiency.

2016 Total Organization-Wide Expenses

seonuisy

‘0.00000

8.000000

6.000000 a

‘009000 P36 sie,

Saseen

2.009000 wo

5

2016 Full-Time Equivalent (FTE) Employees

.00 tm zoars | OL

coe q wr ssaistep, 1000

Average Output per FTE (Expenses/FTE) Higher is.

Best

sean

0000 $9017 sem

Mut, so0.36

‘tam y “ ‘7

som

.

Page 30 of 30

November 27, 2017

Subject: EMERGE responds to Felton’s findings

Sender: Mike Wynne, EMERGE CEO

Recipient: Shawntera Hardy, DEED Commissioner

Emerge Community Development

Unity Opportunity Collaborative

Response to: Financial and Compliance Review and Investigation, Phase One, dated November 22,2017

November 27,2017

This is memo represents Emerge’scesponse tothe Financial and Compliance Review and investigation

[PReview") conducted by Felton Finane'al Consultants, LLC on behalf of DEED and provided in draft form

dated November 2, 2017.

‘We belive itis important to restate the environment in which the activities being reviewed were being

conducted, The state legistator appropriated, in 2016, $4.25 milion to create new communityled

effort to provide workforce services to people of primarily Aican descent by a. unique collaborative of

seorganizations. This old new approach combined the unique strengths of exch organization in@ way

that would overcome borsers that existed with traditional workforce practices and programs, The

‘collaborative stated on July 1" 2016 with lot af discussion and leaning amongst the gr0up.

‘Concurrenty, DEED was given the responsility to manage the appropriation which was outside of their

normal way of doing business. Under these circumstances - ramping up 2 completely new program, tis

‘not suprising thatthe actual contract between DEED and Emerge was not signed until September SUT

was retroactive to July 1", an acknowledgment by DEED that work providing direct services had started

July 1. This initiative was new tll partes and there were challenges and learnings experienced by the

collaborative and DEED alike. Again -thisis not unexpected, and more importanty through tala high

level service has been provided wih eau tha,

EMERGE ands partners ands Independent autor conclude thatthe Review shows no malfeasance,

no major accounting flaws, and highlights only minor recordkeeping deals that have been corrected

Detals or each finding are itemized below.

“Most importantly, EMERGE ands subgrantees request that al activites and funding should be

resumed immediately

DETAILED RESPONSE TO THE REVIEW REPORT AND FINDINGS

1. financial Review background carfiation

‘The background described in the report provides a description and timeline of events and activities that

occurred that gves an incomplete picture of the efforts put forth by Emerge to comply with the

directives of DEED. Emerge did meet with DEED on September 1, 2017 where DEED described ther

concerns and outined its expectations. This was followed up witha formal letter. Emerge did provide 2

robust response on September 11” as requested. In adton, Emerge reached out to DEED for

claniflation and guidance on several issues bu dd na receive a response. On September 29" DEED

senta list of 28 issues where further response was required, Emerge responded as requested by

(October 6", again in a robust manner and believing ithad satisfied 22 ofthe 28 issues. The remaining

Issues were either in progress or awaiting lscussion/larifieation From OFED. Emerge received no

response to any of ts cequess for clafeation and discussion. In addition tothe two detailed memos,

‘urmuativey 35 exhibits were also provided in support of ts responses. Emerge then received notice on

‘October 16" thatthe present compliance review and investigation would begin on October 18%.

2 Results

We would ike to highlight some important findings inthe report and also some important facts that dd

not find their way inte the report.

“+The review found NO evidence of malfeasance - Included

‘+ The autor was able to tie the detailed financial records back tothe audited financial,

statements - Not Included

‘+ There were no findings fr Minneapolis Urban League - Included

+ There were no findings for Stairtep Foundation Included

+ Cash advanced from DEED was managed appropriately - Not Included

‘© Total cash advanced from DEED was S652K

(© Total expense for the cllaboratve was S899

© Advanced cash was LESS than expense by $248

‘+ Emerge distributed cash advances t its subs very quickly following the receipt from DEED. in

‘two instances Emerge actualy disbursed funds prior tits receipt from DEED ~ Not Included

Ernerge Receipt Date from D&D Emerge Disbursement Date to Subs

("september 19,2016 ‘September 20,2016

(October 15,2016 ‘October 13,2016

November 15,2016 | November 16,2016

December 2, 2016 November 30, 2016

December, 2016 December 8, 2016

43. Emerge strongly disagrees withthe contention that there are poor internal controls, unlscoines

record keeping, poor understanding of adequate expense documentation and poor understanding of

allowable expenses under the terms of this agreement.

‘+ Many structures ae in place at Emerge that contradict the statement made above

1 Emerge engages MACC (Metropolitan Allance of Connected Communities) for much if

Its back offic operations including secounting services. MACC serves 50 plus non-profit

‘organizations and sable to provide capacity, experts, robust financial ystems,

segregation of duties and procesces ata much higher level than smal organizations

ould pravde on their own. The controle and recordkeeping in pace are VERY strong

2. Emerge’s long standing external auditors Carpenter Ever, a well-respected frm that

specialize in non-profit organizations. They conduct both a financial audit anda single

audit each year and have always issued a clean opinion

3. Emerge has consistently met all standards of non-profit accountability fo the

Minnesota Charities Review Council and was recently reconfirmed

4 Emerge succesfull manages over 20 separate contracts valued in excess of $7 millon

per year

‘+The list of items identified as having inadequate documentation was small and never was there

an instanceof no dacumentation. feshould be noted that where inadequate documentation

only was cited there was nat a contention that the expenses were invalid they simply could have

had better support. A small number of instances of inadequate documentation does not equate

to poor understanding of adequate documentation

The list of items deemed not allowable is even smaller and in many cases a good reason exists

that invalidates the conclusion derived from a cursory review. We would strongly isagre that

Emerge or its subs have @ poor understanding of allowable expenses,

Emerge had fourfindings. Each is addvessed in detal below.

1 Emerge double-booked $365,822 in UOC grants

‘© First of all the term “double-booked" mischaractrizes the situation. Emerge recorded

revenve and expense on its books for activity performed by itself and by its

subcontractors. The independent third-party subcontractors recorded revenue and

‘expense on their books for ther activity. Each organization independently recorded

‘ther activity appropriately which snot “double-booking”

© Asnoted in the report, Emerge consulted with ts external auditor as to the proper

‘method to record he activity. it wae determined that Emerge contracted with the subs

to perform certain aspects of the programing fr which Emerge was ultimately

responsible for and, therefor, it was tobe accounted for as an exchange transaction

(revenue earned when expenses occur) rather than asa grant/contribuion. Ths

method dictates recording the revenue earned {from DEED) and expenses incurred

{from subs) on its P&L

10 DEED had structured the contract where the subs were specified as secondary

recipients then the accounting may be diferent. As itis structured, the subs are only

‘mentioned as Emerges explanation ofthe budget/workplan forthe project and not

secondary recipients. Emerge has the responsiblity and authority to change, modify or

Cancel it agreement with the subs, This distnetion dictated the accounting treatment

(exhibit ~ extemal Auditor memo}

‘© Emerge does not benefit from one accounting method or another and therefore is

motivations only to record the activity properly

12 Emerge believes this @ non-issue as ithas no bearing the work performed or the

requested reimbursement from DEED.

2. Greumvention of eheck signing limits

‘© Emerge acknowledges this situation occured and it was a violation of our internal policy

(© Pleate nate the attached memo from aur Hoard Vice-Chair and Finance and Operations

Committee Chair (exhibit 2} noting their awareness that the pass-through payments

‘would occur they would have approved the payments and that we should have tity

adhered tothe policy.

‘© Thiswas done in god faith to expedite the payments to keep the collaborative

‘operational and does nat represent any typeof pattern within the organization.

3. Lacked adequate support for UOC expenses

© Inallinstances where lack of documentation was note, the invoice was present with

the payment documentation but the support forthe invoice was noted as insufficient by

the autor. In all cases, addtional support existed but they were nt with the invoices

asthey could have been. This has been corrected.

© Capable Communities the bling didnot coincide with the striet language inthe

contract. Ie lsimportant to note that the sues were minor and the bling dd align with

the spnt of the agreement.

‘©The contract has already been revised to align the spin ofthe agreement with

the actual contract language

‘+ Hours language was changed tobe an average of 30 hours per week

‘over the life ofthe contract. Thisallows some weeks tobe higher and

some tobe lower

*+ Language was changed to allow more flexbity as to when biling occurs

rather that strictly eequiring bling every two weeks.

+ Language was added to allow invoicing of expences but not mileage

+ witie Wallace ~ The contract did not mention reimbursement f expenses. This

again was 8 minor issue that has been corrected. The contract hasbeen revised

twallow for expenses tobe bile,

4. May exceed UOC administrative budget

‘© Emerge dsagrees that this an isue a all asthe budget cat

cannot be exceeded, if Emerge chooses to spend more inthis category it may do so but

‘tsimply wil not be reimbursed

sry amount is iit that

6, Sabothani Findings

+ Lack of adequate support for expenses

1+ Disallowed expenses

+ Non-U0C expenses

Sabathani had a total of eight expense items where one or more of the three findings was ite. Based

‘on comments inthe November 22" meeting it appears that there are valid explanations that would

‘make some ofthe expenses appropriate. Emerge will work with Sabathani to review each tem to

‘ensure the expenses are sufficiently substantiated. Inthe event that an expense is disallowed or non

UOC then these expenses will be adjusted out from any further reimbursement request.

7. CONCLUSION

This financial review has lasted more than a month, has put subgrantees in a highly vulnerable

financial state as they provide services already started without payment. EMERGE cannot continue to

serve a5 even a temporary funding source without assurances that DEED wil compensate it for ths

activity. EMERGE anditssubgrantees welcome the opportunity to continue to improve al related

processes, but funding must be reinstated immediately to avoid irreparable harm. We are confident

that allremainng issues canbe succesfull resolved and look forward to engaging with your staff inthis

process

From: Tica frown

Sent Wednesday, November 22,2017 3:41 PM

To: Mike Wynne (Wynnem@emerge-mnorg)

ce Colber Boyd (coktboyde@notmcom)

Subject Additional etalon Finding #3 ~ please forward

sake,

Can you please forward the below ema to Mark Felton of Felton Forensics on behalf of Colbert and me? Pease copy us

both when you sendit

‘Tank you,

Tricia

Dear Me, Feton,

‘The leadership of Emerge Community Development shared with me a finding in your review, finding (3) inthe Phase 1

Financial Compliance Review, indicating that Emerge leadership sta exceeded their check/expense approval authority

‘on two separate occasions in 2016. As Colbert Boyd (the board chair, copied here) andl are the Emerge Community

Development board oficer that are authorized to approve and ign, we wanted to formally acknowledge that we have

seen, reviewed and approve ofthese expenses. We further acknowledge thatthe issuing of multiple check forthe

same invoice shouldbe teated as a single expense and that tis the level ofthis single expanse, nat the check amounts,

that should dictate where we look in our financial polices for signing authority. This has bean confirmed and validated

by staff and we are confident in our shared understanding ofthis policy and commitment to abide y it.

Beyond the fact that we approve ofthe expenses referenced in finding #3, we want you to know that we would have

signed off on these expenses atthe time and ae confident that this was done in good Fath The full hoard approved the

subcontracts with UOC partners back in 2016 when they were originally executed and we were aware that UOC sub

‘contractor pass-through payments would occur. These payments were consistent with the start-up ofthe grant and

ere atthe time expedited to keep the collaboration operational. We aso understand that all the funds have been

accounted for in your review.

‘Thank you,

Patricia Brown, EMERGE Board Vie Chair and Finance and Operations Committee Char

CHIN Cede en

1 rae ae 0 Booman Het 88

Carpenter, Evert & Associates 952.891.0085 caspeteresect com

‘November 27,2037

‘Mr. Kevin Enda

Emerge Community Development

11834 Emerson Avenue North

Minneapolis, Minnesota 55411

Dear Kevin

"My understanding ofthe contrac arrangement i 2 flows:

4 DEED contracted with Emerge to perform certain programing, The contract as written isto be

accounted for as an exchange transaction (revenve earned when expenses occur) and not as 8

‘rant/contribution

‘2. tmerge s contracting withthe other service provers to pertorm certain aspects of the program

for which Emerge is ultimately responsible under the contract. These transactions are also

accounted for as exchange transactions.

3, Asa consequence of statement 3 and 2, the revenue and expense that is generate from the subs

activity i tobe recorded on Emerge’s books.

a. I would also expect the accounting forthe activity o be somewhat similar foreach

organization

'b. Since Emerge is utimately responsible forthe project/program, then | believe the revenue

‘and expenses ofthe projet/program should be accounted fr by Emerge.

4. IFDEED had specified the sub grantees/contractorsas secondary recipients inthe contract then

Emerge would be acting as an agent and then the secondary recipients’ activity would be

‘accounted for on the balance sheet rather than the P&L, This snot the case and therefore the

recording ofthe activity on the Ls appropriate.

Marc A. Colin, CPA

Carpenter, Evert and Associates, Ltd

You might also like

- Permit Fee ReportDocument32 pagesPermit Fee Reporteric_roper100% (1)

- Via Electronic Filing: Crown Hydro, LLC, Docket No. P-11175-025Document7 pagesVia Electronic Filing: Crown Hydro, LLC, Docket No. P-11175-025eric_roperNo ratings yet

- Lime Signed Bike Share ContractDocument12 pagesLime Signed Bike Share Contracteric_roperNo ratings yet

- Republic Services FlyerDocument2 pagesRepublic Services Flyereric_roperNo ratings yet

- Public Opinion Re Authority To Rename Lake CalhounDocument3 pagesPublic Opinion Re Authority To Rename Lake Calhouneric_roperNo ratings yet

- Minnesota Chamber Sick Time LawsuitDocument37 pagesMinnesota Chamber Sick Time Lawsuiteric_roperNo ratings yet

- DMTMO Audit ReportDocument10 pagesDMTMO Audit Reporteric_roperNo ratings yet

- American Dream Bond Doc - FinancingDocument7 pagesAmerican Dream Bond Doc - Financingeric_roperNo ratings yet

- Towerside MCES Presentation Letter 2018.11.12Document2 pagesTowerside MCES Presentation Letter 2018.11.12eric_roperNo ratings yet

- Emerge vs. MN DEED ComplaintDocument27 pagesEmerge vs. MN DEED ComplaintFluenceMediaNo ratings yet

- MLS Stadium Working GroupDocument2 pagesMLS Stadium Working Grouperic_roperNo ratings yet

- Johnson Stadium ResolutionDocument2 pagesJohnson Stadium Resolutioneric_roperNo ratings yet

- Lakes and Parks Alliance of Minneapolis V The Metropolitan Council, Order For Summary JudgmentDocument17 pagesLakes and Parks Alliance of Minneapolis V The Metropolitan Council, Order For Summary Judgmentdylanthmsyahoo.comNo ratings yet

- West Broadway Study AreaDocument1 pageWest Broadway Study Areaeric_roperNo ratings yet

- Funding Sources UsesDocument2 pagesFunding Sources Useseric_roperNo ratings yet

- Stadiums and ExemptionsDocument1 pageStadiums and Exemptionseric_roperNo ratings yet

- 2015 02 20 Legislative Consult Letter Daudt GMD PDFDocument1 page2015 02 20 Legislative Consult Letter Daudt GMD PDFRachel E. Stassen-BergerNo ratings yet

- Parking + Zoning MapDocument1 pageParking + Zoning Maperic_roperNo ratings yet

- Tunheim OrderDocument46 pagesTunheim Ordereric_roperNo ratings yet

- Pedestrian Priorities MapDocument1 pagePedestrian Priorities Maperic_roperNo ratings yet

- Good Cause Denial FAQ - Revised 11-3-2014Document2 pagesGood Cause Denial FAQ - Revised 11-3-2014eric_roperNo ratings yet

- StreetcarsDocument27 pagesStreetcarseric_roperNo ratings yet

- Proposed Shelter LocationsDocument1 pageProposed Shelter Locationseric_roperNo ratings yet

- Shelters ProposedDocument1 pageShelters Proposederic_roperNo ratings yet

- Towing Bid 2014Document33 pagesTowing Bid 2014eric_roperNo ratings yet

- TreehouseDocument2 pagesTreehouseeric_roperNo ratings yet

- North Minneapolis Greenway ConceptDocument1 pageNorth Minneapolis Greenway Concepteric_roperNo ratings yet

- Revised Term Sheet For Block 1 Development RightsDocument4 pagesRevised Term Sheet For Block 1 Development RightsSarah McKenzieNo ratings yet

- OP7924 Tow BidDocument30 pagesOP7924 Tow Bideric_roperNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)