Professional Documents

Culture Documents

Announcement 2006 37

Uploaded by

IRS0 ratings0% found this document useful (0 votes)

31 views1 pageIf an organization listed above submits information that warrants the renewal of its classification as a public charity or as a private operating foundation, the Inter nal Revenue Service will issue a ruling or determination letter. Grantors and contributors may thereafter rely upon such ruling or determination as pro vided in section 1.509(a)-7 of the Income Tax Regulations.

Original Description:

Original Title

announcement 2006 37

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIf an organization listed above submits information that warrants the renewal of its classification as a public charity or as a private operating foundation, the Inter nal Revenue Service will issue a ruling or determination letter. Grantors and contributors may thereafter rely upon such ruling or determination as pro vided in section 1.509(a)-7 of the Income Tax Regulations.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views1 pageAnnouncement 2006 37

Uploaded by

IRSIf an organization listed above submits information that warrants the renewal of its classification as a public charity or as a private operating foundation, the Inter nal Revenue Service will issue a ruling or determination letter. Grantors and contributors may thereafter rely upon such ruling or determination as pro vided in section 1.509(a)-7 of the Income Tax Regulations.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

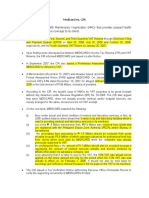

Mauldin Scholarship Fund Account, Teen Education and Mentoring, qualifies.

However, the Service is not

N. Little Rock, AR Encinitas, CA precluded from disallowing a deduction

Mayoral Fellows Foundation of United Hope Foundation, for any contributions made after an or

San Diego, Del Mar, CA Los Angeles, CA ganization ceases to qualify under section

Mission of Love Care Home, Inc., Walk in Love Outreach, Inc., Decatur, GA 170(c)(2) if the organization has not timely

Valdosta, GA Western Brown Youth Football filed a suit for declaratory judgment under

Mt. Moriah Community Ministry, Inc., Association, Williamsburg, OH section 7428 and if the contributor (1) had

Blytheville, AR Western US Falun Dafa Association, knowledge of the revocation of the ruling

Namaste International, Allentown, PA San Jose, CA or determination letter, (2) was aware that

National Bicycle Greenway, Palo Alto, CA such revocation was imminent, or (3) was

New York Raptors Special Hockey Club, If an organization listed above submits in part responsible for or was aware of the

Inc., Larchmont, NY information that warrants the renewal of activities or omissions of the organization

Olivias House of Love, Houston, TX its classification as a public charity or as that brought about this revocation.

One Class at a Time, Fremont, CA a private operating foundation, the Inter If on the other hand a suit for declara

Open Hearth Foundation, Rockford, IL nal Revenue Service will issue a ruling or tory judgment has been timely filed, con

Organization for Africans With Diabetes, determination letter with the revised clas tributions from individuals and organiza

Inc., Bronx, NY sification as to foundation status. Grantors tions described in section 170(c)(2) that

Our Kids Can Too, Inc., and contributors may thereafter rely upon are otherwise allowable will continue to

West Palm Beach, FL such ruling or determination letter as pro be deductible. Protection under section

Playground Foundation, Gardonsville, VA vided in section 1.509(a)–7 of the Income 7428(c) would begin on June 5, 2006, and

Project 2000 — Community Center, Tax Regulations. It is not the practice of would end on the date the court first deter

Moses Lake, WA the Service to announce such revised clas mines that the organization is not described

PS & QS Character Education Through sification of foundation status in the Inter in section 170(c)(2) as more particularly

Social Graces, Inc., East Pointe, GA nal Revenue Bulletin. set forth in section 7428(c)(1). For indi

Psalms One Hundred and Fifty vidual contributors, the maximum deduc

Instrumental Gospel Ensemble of, tion protected is $1,000, with a husband

Stockton, CA Deletions From Cumulative and wife treated as one contributor. This

Raj & Neelam Modi Charitable Trust, benefit is not extended to any individual, in

List of Organizations

Inc., Albertson, NY whole or in part, for the acts or omissions

Randy Caldwell Ministries, Inc., Contributions to Which of the organization that were the basis for

League City, TX are Deductible Under Section revocation.

Resurrection Ministries, Texarkana, TX 170 of the Code

Scottsdale Airpark Rotary Foundation, Budget and Credit Counseling

Scottsdale, AZ Announcement 2006–37 Services, Inc.

See Spot Fund, Inc., Garden Grove, CA New York, NY

Seniors Learning Together, Inc., The names of organizations that no Felton Dean Minority and Disadvantaged

Apple Valley, MN longer qualify as organizations described Youth Sports Foundation, Inc.

Serving Seniors, Inc., Dublin, OH in section 170(c)(2) of the Internal Rev Lawton, OK

Sisters Outreach Foundation, Gretna, LA enue Code of 1986 are listed below. Guardian Angel Academy, Inc.

Southwest Institute of Fitness and Generally, the Service will not disallow Front Royal, VA

Training, Phoenix, AZ deductions for contributions made to a Northwest Passage Foundation

Spay Fund, Inc., Society Hill, SC listed organization on or before the date Salt Lake City, UT

Students Tutorial Enrichment Program, of announcement in the Internal Revenue The Paul Revere Society

Inc., Bowie, MD Bulletin that an organization no longer Mill Valley, CA

2006–23 I.R.B. 1039 June 5, 2006

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- AQA GCSE 9 1 Business 2nd EdiDocument329 pagesAQA GCSE 9 1 Business 2nd EdiMysterio Gaming100% (6)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- PE Ratio Factors Book vs Market ValueDocument28 pagesPE Ratio Factors Book vs Market Valuebeyonce0% (1)

- Tax317 Group Project SSTDocument23 pagesTax317 Group Project SSTNik Syarizal Nik MahadhirNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Ongc Product Experience.Document1 pageOngc Product Experience.harvinder singhNo ratings yet

- Knowledge Utilization as a Networking ProcessDocument27 pagesKnowledge Utilization as a Networking ProcessKathy lNo ratings yet

- CPA Review School Philippines Tax Filing PenaltiesDocument7 pagesCPA Review School Philippines Tax Filing PenaltiesLisa ManobanNo ratings yet

- Principles of MacroecomicsDocument366 pagesPrinciples of MacroecomicsBruno SaturnNo ratings yet

- GST May2023 V1Document213 pagesGST May2023 V1FhfhhNo ratings yet

- Ds8 Japan TaxesDocument2 pagesDs8 Japan TaxesVishwesh SinghNo ratings yet

- LeAnn Bobleter Sargent Bankruptcy Income Records Maple Grove City Council MemberDocument12 pagesLeAnn Bobleter Sargent Bankruptcy Income Records Maple Grove City Council MemberghostgripNo ratings yet

- Jio FiberDocument1 pageJio FiberBalachandar PNo ratings yet

- Understanding Taxation FundamentalsDocument34 pagesUnderstanding Taxation FundamentalsKaren DammogNo ratings yet

- G.R. No. L-19727Document14 pagesG.R. No. L-19727Amicus CuriaeNo ratings yet

- SKU - DDE - UG Prospectus - 2011 - 12Document53 pagesSKU - DDE - UG Prospectus - 2011 - 12divakar.rsNo ratings yet

- Generational Wealth Management: A Guide For Fostering Global Family WealthDocument28 pagesGenerational Wealth Management: A Guide For Fostering Global Family WealthRavi Kumar100% (1)

- Guide To Budgeting Dave RamseyDocument23 pagesGuide To Budgeting Dave Ramseyarief100% (5)

- Recto Vs RepublicDocument6 pagesRecto Vs RepublicCharlene GalenzogaNo ratings yet

- Accounting For Managers PDFDocument367 pagesAccounting For Managers PDFNiranjan Kumar100% (2)

- Micro 2013 ZA QPDocument8 pagesMicro 2013 ZA QPSathis JayasuriyaNo ratings yet

- Macro Economic Trends of Sri LankaDocument13 pagesMacro Economic Trends of Sri LankathilangacNo ratings yet

- Heirs of Tancoco v. CADocument28 pagesHeirs of Tancoco v. CAChris YapNo ratings yet

- Jnu Ma Economics Entrance PaperDocument29 pagesJnu Ma Economics Entrance PaperYedu T DharanNo ratings yet

- Date Sheet Dec 2015 PDFDocument126 pagesDate Sheet Dec 2015 PDFamandeep651No ratings yet

- Philippine Health Providers Tax LiabilityDocument3 pagesPhilippine Health Providers Tax Liabilityana ortizNo ratings yet

- Philippine Financial Reporting Standards: Number TitleDocument3 pagesPhilippine Financial Reporting Standards: Number TitleMariaNo ratings yet

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- Difference Between Indian and United State tXATION SystemDocument8 pagesDifference Between Indian and United State tXATION SystemamitNo ratings yet

- RTG Rights Offer CircularDocument46 pagesRTG Rights Offer CircularGodknows MudzingwaNo ratings yet

- Theories of Poverty and Community DevelopmentDocument13 pagesTheories of Poverty and Community DevelopmentOm Prakash100% (2)

- Medicard vs. CIRDocument4 pagesMedicard vs. CIRAnneNo ratings yet