Professional Documents

Culture Documents

Cost Volume Profit Analysis

Uploaded by

kishorej19Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Volume Profit Analysis

Uploaded by

kishorej19Copyright:

Available Formats

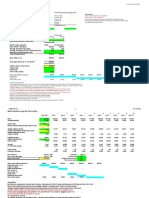

COST

VOLUME PROFIT ANALYSIS

This section is going to deal with sales, expenses and profits of an enterprise.

Profits of an enterprise are affected by many factors. The purpose of Cost volume

profit analysis (CVP) is to study all the factors and help in making decisions to

improve profits for the company.

Key factors influencing profits are:

1. Selling prices

2. Volume of sales

3. Variable cost

4. Fixed cost

The purpose of this chapter is to analyze relationship among the above-

mentioned factors in such a way that we can estimate change in profits with

change in any of the above factors.

CVP analysis finds out the relationship between sales, expenses and profits.

Let us first understand the basic structure to analyze financial information. Then

we will move towards techniques of CVP analysis.

HYPOTHETICAL EXAMPLE:

SALES 100,000

LESS: VARIABLE COST 40,000

CONTRIBUTION 60,000

LESS: FIXED COST 20,000

© Anuj Jindal successrbigradeb@gmail.com 1

EARNING BEFORE INTEREST AND TAXES (EBIT) 40,000

LESS: INTEREST 3000

EARNING AFTER INTEREST BEFORE TAXES 37,000

LESS: TAXES 3700

EARNING AFTER TAX/ PROFIT AFTER TAX 33,300

DIVIDENDS 33,300

The above example shows the entire structure, which is used to calculate overall

financial performance of a company from different dimensions. We will break

down the entire chain into different parts and analyze each part to understand

micro-performance of the enterprise.

A total of 3 techniques are used for making management decisions regarding

performance of the company:

1. Contribution margin concept

2. Break even analysis

3. Profit volume analysis

In 2016 RBI PHASE 2, one question was asked from break-even analysis. We

expect RBI to get into further details in this topic next year. This is the reason

that we are going to cover all 3 techniques related to CVP analysis.

CONTRIBUTION MARGIN CONCEPT:

© Anuj Jindal successrbigradeb@gmail.com 2

Contribution margin shows the relationship between sales and contribution of

the enterprise. Contribution margin helps us understand two important things:

1. The ratio of variable cost to sales- There is always a direct relation and

constant ratio between sales and variable cost. For example, a question

may say that variable costs are 40% of sales. This means that as sales

increase, variable cost will also increase proportionately due to a direct

relation between the two. So if sales are 1 lakh, variable cost will be

40,000 and if sales are increased to 2 lakh, variable cost will increase

proportionately to 80,000. Contribution margin helps us to understand

this ratio and decide whether the company has very high variable costs or

not.

2. The level of fixed costs- fixed costs are costs which remain fixed, no

matter what is the level of sales. Contribution margin to fixed cost

comparison helps us to understand whether contribution provided by a

company is enough to cover fixed costs or not. If not, then what level of

sales will be required to cover at least fixed costs.

The formula for contribution margin ratio (or PV Ratio) is:

(SALES – VARIABLE COST) / SALES

For example,

PRODUCTION OF 10000 UNITS PRODUCTION OF 14000 UNITS

SALES 10,00,000 SALES 14,00,000

LESS: VC(60%) 600,000 LESS: VC (60%) 840,000

CONTRIBUTION 400,000 CONTRIBUTION 5,60,000

LESS: FC 200,000 LESS: FC 200,000

EBIT 200,000 EBIT 360,000

As can be seen, EBIT increased from 200,000 to 3,60,000 as sales increased from

10,000 to 14,000 units. With an increase in sales of 40%, profits should also have

increased by 40% but they increased more due to constant fixed cost.

© Anuj Jindal successrbigradeb@gmail.com 3

It is also important to remember that fixed cost remain constant till the time

production is within 100% capacity of the company. The moment it goes above

its full capacity, additional fixed assets have to be purchased for production.

In the above question, contribution margin ratio is calculated as:

Sales – VC/ sales = 10,00,000 – 600,000/ 10,00,000 = 40%

PV Ratio helps us to decide whether to increase sales or not. In the above

example, an increase in sales turned profitable for the company as it was

operating at below 100% capacity and had the potential to produce more profits

for the company.

A low PV ratio (less contribution margin) is a sign that variable costs are too high

and need to be reduced in order to increase profits. It is a warning sign of very

high costs of production.

BREAK EVEN ANALYSIS:

Break-even analysis aims to tell us the level at which cost and revenue are in

equilibrium.

Break-even point is the point of production or sales at which there is no profit

and no loss. At a point above break-even point, the enterprise experiences profit

and if the company produces less than break-even sales, it experiences loss.

At the break-even point, profit being zero, contribution (sales – variable cost) is

equal to fixed cost. In other words, the break-even point is that point where the

company is able to cover its fixed costs completely.

For example,

Selling price per unit = Rs. 20

Variable cost per unit = Rs. 10

© Anuj Jindal successrbigradeb@gmail.com 4

Total fixed cost = Rs. 100,000

Let us make the chart for the above:

SALES (20 * X) 200,000

LESS: VC (10 * X) 100,000

CONTRIBUTION (10* X) 100,000

LESS: FIXED COST 100,000

EBIT NIL

Since, it is break-even point, so EBIT or operating profits will be ZERO.

We have to find the level of sales where break-even point is achieved. By using

the above chart, we find out the level of sales as Rs. 200,000 with 10,000 units of

Rs. 20 each.

If the company sells more than 10,000 units, it will make profits. You can justify

this by keeping a figure of 11000 units in sales.

BREAK EVEN POINT/ SALES FORMULA:

• Break even point = fixed costs/ contribution margin per unit

• Break even sales = fixed costs/ PV ratio

You can verify the above answer of 10,000 units and Rs 200,000 sales by using

the above-mentioned formulas.

© Anuj Jindal successrbigradeb@gmail.com 5

MARGIN OF SAFETY:

The difference between sales and break-even point is called as margin of safety.

The margin determines safety for the enterprise. A company with fewer margins

is on the verge of going into losses, if its production or sales reduces. On the

other hand, a company with higher margins is safe against running into losses.

The margin of safety can be found out by using the following formula:

1. Margin of safety = Profit / PV ratio

2. Margin of safety = profit * sales / sales – VC

ANGLE OF INCIDENCE:

The angle at which sales are equal to total costs is called angle of incidence. In

the above CHART, it is clear that the break-even point is at 10,000 units. The

angle made by income line and total cost line at the break-even point is what is

called as angle of incidence.

© Anuj Jindal successrbigradeb@gmail.com 6

A large angle of incidence is preferable by the enterprise as it shows that profits

increase faster after reaching break even point. A small angle of incidence shows

that variable cost forms a larger part of total cost, reducing the gap between

income and cost line.

The third concept, PROFIT VOLUME ANALYSIS has been studied partially

through profit-volume ratio / contribution margin ratio. A detailed study of this

concept is not required.

COST INDIFFERENCE POINT:

Cost indifference point refers to that level of output where the total cost or the

profit of two alternatives is equal. When two or more alternative methods of

production are considered, and the use of one machine involves higher fixed cost

and lower variable cost while use of another machine involves lower fixed cost

and higher variable cost, cost indifference point will help in identifying the

alternative which is more profitable for a given output. When sales are below the

point of cost indifference, the machine with lower fixed cost will be more

profitable.

Cost Indifference point = difference in fixed cost / difference in contribution per

unit

Or,

Cost indifference point = difference in fixed cost / difference in PV ratio

© Anuj Jindal successrbigradeb@gmail.com 7

Let us solve some questions to understand what kind of questions may be asked

in the examination:

1. The selling price per Television is Rs. 100. Variable cost per TV is Rs 50.

The maximum capacity of the plant is 2000 TVs. Fixed cost is provide to

us as Rs. 50,000. Find out the break event sales for the company. Also, find

out the number of TVs, which need to be sold to get a profit of Rs. 50,000

Answer:

BES = Fixed cost / PV ratio;

BES = 50,000/ 0.5 = 100,000 rupees

Sales for desired profit = fixed cost + profit / contribution per unit

100,000/ 50 = 2000 units or sales of Rs 200,000

NOTE that this question can also be solved by taking help of the structure that

we have created on first page. Even if you fail to remember the formulas, it’s not

impossible to solve these kind of questions.

2. Break even point of a machine is given as 5000 units. Fixed cost is

provided to us as Rs. 60,000. The variable cost is given as Rs 12. Find out

the profit for the company at a production and sale of 10,000 units.

Answer:

At 5000 units production, there is no profit no loss. Therefore, at this level of

production, contribution is equal to fixed cost i.e. 60,000 rupees. Variable cost is

also Rs 60,000 (12 * 5000). Therefore, sales at break even point is 1,20,000

rupees with per unit sale price being Rs 24 (1,20,000/ 5000).

At sale units of 10,000 units, total sales is equal to 240,000 rupees. Now, using

the structure created to solve such questions, we get contribution as 1,20,000

and fixed cost is limited at 60,000. The profit at this level is Rs. 60,000.

IMPORTANT FORMULAS:

© Anuj Jindal successrbigradeb@gmail.com 8

• P/V RATIO = Change in Profit/ Change in Sales

• CONTRIBUTION = sales * P/V ratio

• Contribution = (sales at Break even point in Rs * PV ratio) + Profit

• Contribution = (sales at Break even point in units * contribution per unit)

+ Profit

• Contribution = (margin of safety * PV ratio) + Fixed cost

• Contribution = Profit/ margin of safety in %

• Sales for a desired profit = (Fixed Cost + desired profit) / PV Ratio

• Margin of Safety = Actual Sales – breakeven point

• Profit = Margin of Safety * PV ratio

• Profit = actual sales * M/ S ratio * PV ratio

• Fixed Cost = sales at Break Even Point in Rs. * PV ratio

• PV Ratio = change in profit * 100 / change in sales

Practice Questions:

1. Calculate break even point from the following information:

Selling price per unit of a product is given as Rs. 10. Variable cost of the

product is Rs. 7.50 per unit. The fixed cost is given as Rs 10,000.

Answer:

Contribution per unit = Rs 2.50

Fixed cost = Rs 10,000

Break even point = fixed cost / contribution per unit = 10,000/2.50 =

4000 units

2. The selling price of a product is given as Rs. 20 per unit. The variable cost

is Rs 14 per unit. The fixed costs are Rs. 792000. Find out Break even

sales and number of units that must be sold to earn a profit of Rs 60,000.

© Anuj Jindal successrbigradeb@gmail.com 9

Answer:

Contribution per unit = 20-14 = 6 per unit.

PV ratio = contribution / sales = 6/20 = 30%

Break even sales = fixed cost / PV ratio = 792000/ 30% = 2640,000.

Units to be sold to earn a profit of Rs 60,000 =

Fixed cost + desired profit / contribution per unit = 852000/ 6 = 1,42000

units

3. Fill in the blanks:

Selling price per unit ------

Variable cost as a% of sales 60%

Number of units sold 10,000

Contribution Rs 20,000

Fixed cost Rs 12,000

Profit ------

Answer:

(Profit = 8000; selling price per unit = Rs 5)

4. A company has a PV ratio of 40%. By what percentage must sales be

increased to offset a 10% reduction in selling price?

Answer:

Let sales by (100*1) = Rs 100

Contribution will be Rs 40 (40% PV ratio) and Variable cost will be Rs 60

When selling price reduces by 10%, new sales = Rs 90

But variable cost will remain the same i.e. Rs 60

Therefore, new contribution is Rs 30

Volume of sales required to maintain the same sales =

Contribution * new sales / new contribution = 40*90 /30 = Rs 120

© Anuj Jindal successrbigradeb@gmail.com 10

5. A company has sales of Rs 140,000 and variable cost of Rs 75,000. The

fixed cost is given as Rs 50,000. Find out the required sales to get a profit

of Rs 30,000.

(Answer: Rs. 160,000)

6.

Sales Profit

Year 2004 Rs 120,000 8000

Year 2005 Rs 140,000 13,000

Find out the following:

a. PV ratio

b. B E point in 2004 and 2005

c. Profit when sales are Rs 180,000

d. Margin of safety in 2005

(Answer: PV Ratio = change in profit * 100 / change in sales = 25%;

BEP in 2004 = 88000 rupees; BEP in 2005 = 88000 rupees;

Profit = 23000;

Margin of safety = 52000)

7. A company sold in 2 consecutive periods 7000 units and 9000 units and

incurred a loss of 10,000 rupees in year 1 and profit of 10,000 in year 2.

The selling price per unit is Rs 100. Find out the PV ratio and number of

units to break even

(Answer: PV ratio= 10%; number of units to break even = 8000 units)

8. Find out fixed cost and PV ratio from the following information:

Total sales Total cost (fixed +

variable)

© Anuj Jindal successrbigradeb@gmail.com 11

Year 1 7000 5800

Year 2 9000 6600

(Answer: PV ratio = 60%; fixed cost = 3000)

9. Find out fixed cost and PV ratio from the following information:

sales Total cost

Year 1 2400,000 2180,000

Year 2 30,00000 26,00,000

(Answer: PV ratio = 30%; fixed cost = 10,00000)

10. If margin of safety is Rs. 2,40,000 (40% of sales) and PV ratio is 30%.

Calculate its break even sales and amount of profit on sales of Rs. 900,000

(Answer: break even sales = 3,60,000; profit on sales of 900,000 =

162,000)

11. A company earned a profit of Rs 30,000 during a financial year. If the

variable cost and selling price of the product are Rs 8 and Rs 10 per unit

respectively, find out the amount of margin of safety

(Answer: MOS= Rs. 150,000)

12. Fixed cost is given as Rs 4000. Break even sales are given as Rs 20,000.

Profit is Rs 1000. Calculate sales for earning a profit of Rs 1000?

(Answer: sales = Rs 25000)

13. Selling price per unit is given as Rs 20/ unit. Variable cost is Rs. 12. fixed

cost is given as Rs 96000. Find out break even units and break even sales.

(Answer: BEP = 12000 units. BES = Rs 240,000)

14.

© Anuj Jindal successrbigradeb@gmail.com 12

Sales Profit

Year 1 20,00,000 2,00,000

Year 2 30,00,000 4,00,000

Find out PV ratio and sales required to earn a profit of Rs 500,000

(Answer: PV ratio = 20%; sales for profit of 5 lakh = 3500,000)

15. A company has a fixed cost of Rs 20,000. It sells two products- A and B, in

the ratio of 2 units of A and 1 unit of B. contribution is Rs 1 per unit of A

and Rs 2 per unit of B. how many units of A and B would be sold at break

even point?

(Answer: A = 10,000 units; B = 5000 units)

© Anuj Jindal successrbigradeb@gmail.com 13

You might also like

- PSA - Financial Accounting PDFDocument684 pagesPSA - Financial Accounting PDFMinhajul Haque Sajal100% (1)

- Answer Key - LP-Application - Operations PDFDocument17 pagesAnswer Key - LP-Application - Operations PDFAnand Dharun0% (1)

- Goldman Sachs Samsung ProjectionsDocument147 pagesGoldman Sachs Samsung ProjectionsccabrichNo ratings yet

- The Golden PitchbookkDocument6 pagesThe Golden PitchbookkIftekharNo ratings yet

- Concor ProjectDocument51 pagesConcor ProjectAashish AnandNo ratings yet

- Cost of Sales Narrative: Inventory PurchaseDocument3 pagesCost of Sales Narrative: Inventory PurchaseCaterina De LucaNo ratings yet

- Tetley Brand Valuation Spreadsheets Blank 2022 23Document2 pagesTetley Brand Valuation Spreadsheets Blank 2022 23Kanika SubbaNo ratings yet

- 20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Document4 pages20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Jax TellerNo ratings yet

- Chart of Accounts BR: 0050Document117 pagesChart of Accounts BR: 0050Thiago Holanda CavalcanteNo ratings yet

- L.E.K. LEK Casebook Consulting Case Interview Book艾意凯咨询案例面试Document10 pagesL.E.K. LEK Casebook Consulting Case Interview Book艾意凯咨询案例面试issac li100% (1)

- Build Toll Roads EfficientlyDocument31 pagesBuild Toll Roads EfficientlyJeng PionNo ratings yet

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- Activity Based Costing - Case StudyDocument8 pagesActivity Based Costing - Case StudyViksit Choudhary100% (1)

- Xerox Case StudyDocument9 pagesXerox Case Studyadibhai06No ratings yet

- Income Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Document1 pageIncome Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Star RamirezNo ratings yet

- LPP FormulationDocument15 pagesLPP FormulationGaurav Somani0% (2)

- CarltonDocument5 pagesCarltonRaph AcuñaNo ratings yet

- Marginal Break EvenDocument39 pagesMarginal Break EvenNamrata NeopaneyNo ratings yet

- 1 Sampling DistDocument35 pages1 Sampling DistYogeshNo ratings yet

- Vanraj Mini TractorsDocument2 pagesVanraj Mini TractorsshagunparmarNo ratings yet

- Practice Problems of Inventory ManagementDocument8 pagesPractice Problems of Inventory ManagementChaerul Amien0% (1)

- Nptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)Document3 pagesNptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)yogeshgharpureNo ratings yet

- Solving Pramanik's Bottleneck ChallengeDocument7 pagesSolving Pramanik's Bottleneck ChallengeSaransh BagdiNo ratings yet

- Chapter 3 - Linear Programming: Computer Solution and Sensitivity AnalysisDocument9 pagesChapter 3 - Linear Programming: Computer Solution and Sensitivity AnalysisRel XandrrNo ratings yet

- Athol Furniture, IncDocument21 pagesAthol Furniture, Incvinoth kumar0% (1)

- Client Financial Analysis: Industry Ratio Client Name (Currency) Ratios Ratio Calculation Period 1 Period 2 Period 3Document1 pageClient Financial Analysis: Industry Ratio Client Name (Currency) Ratios Ratio Calculation Period 1 Period 2 Period 3Denys Valencia ChiroqueNo ratings yet

- Yamaha India Sales GrowthDocument6 pagesYamaha India Sales GrowthRadhzz RajiNo ratings yet

- B2B Class 1Document51 pagesB2B Class 1Siddhartha GhoshNo ratings yet

- Chapter 2 Homework4 PDFDocument3 pagesChapter 2 Homework4 PDFMarjorie PalmaNo ratings yet

- MOS GameDocument1 pageMOS GameRajesh1 SrinivasanNo ratings yet

- Case 7Document2 pagesCase 7Manas Kotru100% (1)

- 4 CVP AnalysisDocument36 pages4 CVP AnalysisBibaswan BanerjeeNo ratings yet

- Consumer BehaviourDocument16 pagesConsumer BehaviourAbhishekGuptaNo ratings yet

- Assembly LineDocument8 pagesAssembly LineAnshik YadavNo ratings yet

- XYZ Hospital Network Design Medical FaciDocument27 pagesXYZ Hospital Network Design Medical FaciAsifNo ratings yet

- New Office at AtlanticDocument3 pagesNew Office at Atlanticparas_bhatnagar89No ratings yet

- GEP Gameplan 2022 BschoolDocument16 pagesGEP Gameplan 2022 BschoolDiva SharmaNo ratings yet

- Cost Sheet For The Month of January: TotalDocument9 pagesCost Sheet For The Month of January: TotalgauravpalgarimapalNo ratings yet

- Chapter 5Document11 pagesChapter 5L LNo ratings yet

- Activity Based Costing ExampleDocument7 pagesActivity Based Costing ExampleMohsin BashirNo ratings yet

- Historical cost of inventories destroyed in manufacturing plant fireDocument2 pagesHistorical cost of inventories destroyed in manufacturing plant fireAngie Pamela Peña VelezNo ratings yet

- Canara Bank Research Report - SWOT and Competitive AnalysisDocument5 pagesCanara Bank Research Report - SWOT and Competitive AnalysisAhana SarkarNo ratings yet

- Wipro TechnologiesDocument12 pagesWipro TechnologiesVivek SinhaNo ratings yet

- Merton Trucks Case Note: I I M A IIMA/QM-xxxDocument8 pagesMerton Trucks Case Note: I I M A IIMA/QM-xxxAyush GuptaNo ratings yet

- End TermDocument2 pagesEnd TermRahul GuptaNo ratings yet

- Break Even Analysis Chapter IIDocument7 pagesBreak Even Analysis Chapter IIAnita Panigrahi100% (1)

- PM Case StudyDocument1 pagePM Case StudyBILLING GLCPLNo ratings yet

- SCM - Managing Uncertainty in DemandDocument27 pagesSCM - Managing Uncertainty in DemandHari Madhavan Krishna KumarNo ratings yet

- Samsung and The Theme Park Industry in KoreaDocument13 pagesSamsung and The Theme Park Industry in KoreaJohn SmithNo ratings yet

- Comp-XM Basix Guide PDFDocument6 pagesComp-XM Basix Guide PDFJai PhookanNo ratings yet

- Practice Set #9 Revenue Management - AnsDocument14 pagesPractice Set #9 Revenue Management - AnsFung CharlotteNo ratings yet

- Accounting Formulas and ConceptsDocument10 pagesAccounting Formulas and ConceptsDilip KumarNo ratings yet

- Ashok RajguruuuuDocument16 pagesAshok Rajguruuuusouvik88ghosh0% (1)

- Memory Manufacturing Company MMC Produces Memory Modules in A Two StepDocument1 pageMemory Manufacturing Company MMC Produces Memory Modules in A Two StepAmit PandeyNo ratings yet

- 2 Manas BuildingDocument6 pages2 Manas BuildingSandhali JoshiNo ratings yet

- Statistics For Business and Economics (13e) : Anderson, Sweeney, Williams, Camm, Cochran © 2017 Cengage LearningDocument48 pagesStatistics For Business and Economics (13e) : Anderson, Sweeney, Williams, Camm, Cochran © 2017 Cengage LearningAbhi PatelNo ratings yet

- CISCO Systems Implements ERP Successfully Despite Initial ResistanceDocument2 pagesCISCO Systems Implements ERP Successfully Despite Initial Resistancearpit_96880% (1)

- Merloni Elettrodomestici Spa: The Transit Point Experiment: SCM - 2 Group 12Document8 pagesMerloni Elettrodomestici Spa: The Transit Point Experiment: SCM - 2 Group 12Prasoon SudhakaranNo ratings yet

- Tata Motors JLR Group 6Document36 pagesTata Motors JLR Group 6Anirban ChakrabortyNo ratings yet

- ERP (Group Week 1)Document14 pagesERP (Group Week 1)Nguyên Nguyễn KhôiNo ratings yet

- HMT: Relaunch Strategy by Rohan ChackoDocument35 pagesHMT: Relaunch Strategy by Rohan Chackorohanchacko67% (3)

- Additional Practice Prob With Solutions - Session 1 - 3Document2 pagesAdditional Practice Prob With Solutions - Session 1 - 3Aniket AnilNo ratings yet

- Applications and Solutions of Linear Programming Session 1Document19 pagesApplications and Solutions of Linear Programming Session 1Simran KaurNo ratings yet

- Cisco System Inc - Summary - FinalDocument7 pagesCisco System Inc - Summary - FinalRishabh KumarNo ratings yet

- Worksheet For Cost Accounting11Document3 pagesWorksheet For Cost Accounting11Abdii Dhufeera100% (1)

- Cost Volume Profit AnalysisDocument20 pagesCost Volume Profit AnalysisVineethkrishnan NairNo ratings yet

- Cost - Volume - Profit - Analysis - 2 - Lyst4983Document15 pagesCost - Volume - Profit - Analysis - 2 - Lyst4983ramNo ratings yet

- CVP Analysis Break-Even Point ProfitDocument6 pagesCVP Analysis Break-Even Point ProfitMark Aldrich Ubando0% (1)

- Prices of Products, Volume or Level of Activity, Per Unit Variable Costs, Total Fixed Costs, and Mix of Products SoldDocument40 pagesPrices of Products, Volume or Level of Activity, Per Unit Variable Costs, Total Fixed Costs, and Mix of Products SoldSnn News TubeNo ratings yet

- Model Answer Assignment 3Document7 pagesModel Answer Assignment 3Nouran Mohamed IsmailNo ratings yet

- DISSERTATION RE NikhilDocument37 pagesDISSERTATION RE NikhilNikhil Ranjan50% (2)

- FM Questions RevisedDocument15 pagesFM Questions RevisedRajarshi DaharwalNo ratings yet

- Clearbanc: The EntrepreneurDocument8 pagesClearbanc: The EntrepreneurShubham SehgalNo ratings yet

- FM11 GuideDocument15 pagesFM11 GuideRoss CarpenterNo ratings yet

- Financial Performance of Indian Pharmaceutical Industry - A Case StudyDocument25 pagesFinancial Performance of Indian Pharmaceutical Industry - A Case Studyanon_544393415No ratings yet

- Apple Matrik SpaceDocument25 pagesApple Matrik SpaceChandra SusiloNo ratings yet

- Chapter 5 - Financial Management and Policies - SyllabusDocument7 pagesChapter 5 - Financial Management and Policies - SyllabusharithraaNo ratings yet

- Review of Literature For Altman Z ScoreDocument5 pagesReview of Literature For Altman Z ScoreLakshmiRengarajanNo ratings yet

- NIRI White Paper: Social Media Use in Investor RelationsDocument4 pagesNIRI White Paper: Social Media Use in Investor RelationsNational Investor Relations InstituteNo ratings yet

- GRI Reports List 2013 2014 EjercicioDocument3,269 pagesGRI Reports List 2013 2014 EjercicioIrina Michelle AlvaradoNo ratings yet

- Q1 Module 1 To 5Document16 pagesQ1 Module 1 To 5Rajiv WarrierNo ratings yet

- Financial Instruments Outline Reschstaffen Spring 2012Document7 pagesFinancial Instruments Outline Reschstaffen Spring 2012BeccaNo ratings yet

- Bankruptcy Due To Credit Card Debts Young Executives FinanceDocument4 pagesBankruptcy Due To Credit Card Debts Young Executives FinanceSophia RusliNo ratings yet

- 2019-2021 Mtef - FSP UpdatedDocument45 pages2019-2021 Mtef - FSP UpdatediranadeNo ratings yet

- Systems of Equations Lesson Notes: LESSON TWO - Substitution MethodDocument0 pagesSystems of Equations Lesson Notes: LESSON TWO - Substitution MethodaaoneNo ratings yet

- LPMDocument15 pagesLPMsteve hillNo ratings yet

- BA 141 Chapter 1: Introduction To Corporate Finance Corporate FinanceDocument5 pagesBA 141 Chapter 1: Introduction To Corporate Finance Corporate FinanceJoy PeleteNo ratings yet

- AntelopeDocument2 pagesAntelopeVivek ShankarNo ratings yet

- INFLATION ACCOUNTING METHODSDocument20 pagesINFLATION ACCOUNTING METHODSVijayaraj JeyabalanNo ratings yet