Professional Documents

Culture Documents

Quiz 2 - A331-321-334

Uploaded by

Nikki GarciaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 2 - A331-321-334

Uploaded by

Nikki GarciaCopyright:

Available Formats

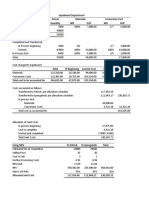

Problem 1: On December 31, 2015 KTV Co.

, with outstanding share capital of P60,000 had the following assets and liabilities: Problem 1: On December 31, 2015 KTV Co., with outstanding share capital of P60,000 had the following assets and liabilities:

Cash P 10,000 Materials P 8,000 Cash P 10,000 Materials P 8,000

Accounts Receivable 20,000 Prepaid Expense 1,000 Accounts Receivable 20,000 Prepaid Expense 1,000

Finished Goods 12,000 Property, Plant and Equipment 60,000 Finished Goods 12,000 Property, Plant and Equipment 60,000

Work in Process 4,000 Current Liabilities 35,000 Work in Process 4,000 Current Liabilities 35,000

During 2016, the retained earnings account increased 50% as a result of the year’s business. No dividends were paid during During 2016, the retained earnings account increased 50% as a result of the year’s business. No dividends were paid during

the year. Balances of accounts receivable, prepaid expenses, current liabilities, and share capital were the same on December the year. Balances of accounts receivable, prepaid expenses, current liabilities, and share capital were the same on December

31, 2016, as they had been on December 31, 2015.Inventories were reduced by exactly 50% except for finished goods 31, 2016, as they had been on December 31, 2015.Inventories were reduced by exactly 50% except for finished goods

inventory, which was reduced by 33 1/3%. Plant assets(net) were reduced by depreciation of P8,000, charged ¾ to factory inventory, which was reduced by 33 1/3%. Plant assets(net) were reduced by depreciation of P8,000, charged ¾ to factory

overhead and ¼ to administrative expense. Sales of P120,000 were made on account, costing P76,000. Direct labor cost was overhead and ¼ to administrative expense. Sales of P120,000 were made on account, costing P76,000. Direct labor cost was

P18,000, Factory overhead was applied at a rate of 100% of direct labor costs, leaving P4,000 underapplied that was closed P18,000, Factory overhead was applied at a rate of 100% of direct labor costs, leaving P4,000 underapplied that was closed

to cost of goods sold account. Total marketing and administrative expenses amounted to 10% and 15% of gross sales to cost of goods sold account. Total marketing and administrative expenses amounted to 10% and 15% of gross sales

respectively. respectively.

Required: Prepare the statement of financial position and income statement with note showing details of cost of goods sold. Required: Prepare the statement of financial position and income statement with note showing details of cost of goods sold.

Problem 2: Mare’s Co., uses job order cost accumulation and applies overhead based on direct labor hours. Any under/over Problem 2: Mare’s Co., uses job order cost accumulation and applies overhead based on direct labor hours. Any under/over

applied overhead is adjusted directly to Cost of Goods Sold at the end of each month. On April 1, Job cost sheets indicated applied overhead is adjusted directly to Cost of Goods Sold at the end of each month. On April 1, Job cost sheets indicated

the following: the following:

Job 201 Job 202 Job 203 Job 204 Job 201 Job 202 Job 203 Job 204

Direct Materials P 3,590 P 2,000 P 1,480 P 2,000 Direct Materials P 3,590 P 2,000 P 1,480 P 2,000

Direct labor 2,700 1,500 1,000 1,200 Direct labor 2,700 1,500 1,000 1,200

Applied Overhead 2,160 1,200 800 960 Applied Overhead 2,160 1,200 800 960

Total Cost P 8,450 P 4,700 P 3,280 P 4,150 Total Cost P 8,450 P 4,700 P 3,280 P 4,150

Job Status Finished In Process In Process In Process Job Status Finished In Process In Process In Process

On April 30, Finished goods contained only Jobs 204 and 207, which had the following total costs: On April 30, Finished goods contained only Jobs 204 and 207, which had the following total costs:

Direct Materials Direct labor Applied Overhead Total Cost Direct Materials Direct labor Applied Overhead Total Cost

Job 204 P 2,970 P 2,200 P 1,760 P 6,930 Job 204 P 2,970 P 2,200 P 1,760 P 6,930

Job 207 2,450 1,900 1,520 5,870 Job 207 2,450 1,900 1,520 5,870

Besides working on Jobs 204 and 207 in April, Mare’s, continued work on jobs 202 and 203 and started work on jobs 205 and Besides working on Jobs 204 and 207 in April, Mare’s, continued work on jobs 202 and 203 and started work on jobs 205 and

206. A summary of direct materials used and direct labor hours worked on Jobs 202, 203, 205 and 206 during April showed 206. A summary of direct materials used and direct labor hours worked on Jobs 202, 203, 205 and 206 during April showed

the following: the following:

Job 202 Job 203 Job 205 Job 206 Job 202 Job 203 Job 205 Job 206

Direct Materials P 1,250 P 555 P 2,500 P 1,980 Direct Materials P 1,250 P 555 P 2,500 P 1,980

Direct labor hours 100 75 105 50 Direct labor hours 100 75 105 50

Other information: Other information:

a) On April 30, the only jobs still in process were 203 and 206. a) On April 30, the only jobs still in process were 203 and 206.

b) All workers are paid P20 per hour. Wages rate have been stable throughout the year. b) All workers are paid P20 per hour. Wages rate have been stable throughout the year.

c) Mare’s maintain only one raw materials account (Material Control) from which it issues both direct and indirect c) Mare’s maintain only one raw materials account (Material Control) from which it issues both direct and indirect

materials. The balance in this account was P2,750 on April 1. materials. The balance in this account was P2,750 on April 1.

d) All Sales are billed on account at 50% above cost. d) All Sales are billed on account at 50% above cost.

e) Other items in April were: Depreciation factory equipment – P1,375; Raw materials purchased – P11,500; Indirect e) Other items in April were: Depreciation factory equipment – P1,375; Raw materials purchased – P11,500; Indirect

labor – P2,500; Factory rent – P2,700; and Indirect materials used – P2,790. labor – P2,500; Factory rent – P2,700; and Indirect materials used – P2,790.

Required: Required:

1) Determine the balance of material control account and work in process account as of April 30. 1) Determine the balance of material control account and work in process account as of April 30.

2) Prepare the journal entries April. 2) Prepare the journal entries April.

3) Calculate the cost of goods manufactured (Cost of goods manufactured statement is not required) 3) Calculate the cost of goods manufactured (Cost of goods manufactured statement is not required)

4) Calculate the under or over applied overhead for April. 4) Calculate the under or over applied overhead for April.

5) Calculate the gross profit for April. 5) Calculate the gross profit for April.

You might also like

- Job Order Costing Problem - Materials, Entries, OverheadTITLECost Accounting Problem - Inventory, COGS, Overhead CalculationDocument2 pagesJob Order Costing Problem - Materials, Entries, OverheadTITLECost Accounting Problem - Inventory, COGS, Overhead CalculationCharlé0% (2)

- Unit Iii - Job Order Costing Lesson 1 - Concept and ApplicationDocument4 pagesUnit Iii - Job Order Costing Lesson 1 - Concept and ApplicationSol GomezNo ratings yet

- AaaaDocument11 pagesAaaaJessica JaroNo ratings yet

- Job Order Costing ProblemsDocument15 pagesJob Order Costing ProblemsClarissa Teodoro100% (2)

- Cost Accounting Theoretical Questions Nad Problem SolvingDocument23 pagesCost Accounting Theoretical Questions Nad Problem SolvingSofia Mae AlbercaNo ratings yet

- L1 Assignment JobordercostingDocument3 pagesL1 Assignment JobordercostingUnknowingly AnonymousNo ratings yet

- Job Order Activity For Take HomeDocument12 pagesJob Order Activity For Take HomeRg Cyrus SerranoNo ratings yet

- Oki Oki Use This As A Reference in Any of Your Activity As It May Deem Applicable - CompressDocument13 pagesOki Oki Use This As A Reference in Any of Your Activity As It May Deem Applicable - CompressjommaetiNo ratings yet

- MODULE 3 Job Order Costing PDFDocument9 pagesMODULE 3 Job Order Costing PDFjay mhonsaint100% (1)

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- Job Order Costing Case StudyDocument1 pageJob Order Costing Case StudyNaurah Atika DinaNo ratings yet

- Job Order Costing System for Richards CompanyDocument27 pagesJob Order Costing System for Richards CompanyTrois90% (10)

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Cost Accounting Midterm Exam ReviewDocument4 pagesCost Accounting Midterm Exam ReviewAdam Smith100% (1)

- 1 Manufacturing ExercisesDocument3 pages1 Manufacturing ExercisesRead this SecretNo ratings yet

- Understanding Cost Accounting ConceptsDocument8 pagesUnderstanding Cost Accounting ConceptsMeg sharkNo ratings yet

- Cost FlowDocument30 pagesCost FlowAndrea Nicole MASANGKAYNo ratings yet

- QUIZ 1 Without AnswerDocument8 pagesQUIZ 1 Without AnswerQuincy Lawrence DimaanoNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingJohn Allen Cruz Caballa100% (2)

- Cost Accounting MidtermsDocument5 pagesCost Accounting MidtermsJerico Mamaradlo0% (3)

- Cost Management Part 1: Manufacturing Costs and Inventory CalculationsDocument4 pagesCost Management Part 1: Manufacturing Costs and Inventory CalculationsJosh YuuNo ratings yet

- Job Order Pure ProblemsDocument19 pagesJob Order Pure ProblemsolafedNo ratings yet

- Job Order Pure ProblemsDocument19 pagesJob Order Pure Problemsakber khan khanNo ratings yet

- COSTING - With AnswersDocument6 pagesCOSTING - With AnswersAndrea Nicole MASANGKAYNo ratings yet

- AFAR - Final Preboard With AnswersDocument9 pagesAFAR - Final Preboard With AnswersLuiNo ratings yet

- 3.3 MCQ - Job Order Costing (With Spoilage and Defective Goods)Document2 pages3.3 MCQ - Job Order Costing (With Spoilage and Defective Goods)Roselyn LumbaoNo ratings yet

- Titles Are Automatically Indented When Amount Is Entered. Do Not Indent Manually.)Document3 pagesTitles Are Automatically Indented When Amount Is Entered. Do Not Indent Manually.)music niNo ratings yet

- NJPIA REGION 3 COUNCIL PRACTICAL ACCOUNTING 2 MOCK EXAMDocument6 pagesNJPIA REGION 3 COUNCIL PRACTICAL ACCOUNTING 2 MOCK EXAMJessica Marie B. Mendoza0% (1)

- Final Deptals COST.1 PDFDocument5 pagesFinal Deptals COST.1 PDFIllion IllionNo ratings yet

- 2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Document3 pages2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Darius Delacruz50% (2)

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Inventories Opening ClosingDocument16 pagesInventories Opening ClosingKristine PunzalanNo ratings yet

- Sample Questions - Accounting For OverheadDocument4 pagesSample Questions - Accounting For OverheadRedNo ratings yet

- Cost Notes888Document29 pagesCost Notes888yojNo ratings yet

- Uts Ab 2007Document5 pagesUts Ab 2007AhmadAdiSuhendraNo ratings yet

- Solutions - Problems 1 To 5 (Handout-Manufacturing)Document4 pagesSolutions - Problems 1 To 5 (Handout-Manufacturing)Reniella AllejeNo ratings yet

- Cost Accounting ProblemsDocument3 pagesCost Accounting ProblemsJoshua S. Umali50% (4)

- Marvin Manufacturing Cost of Goods Sold StatementDocument3 pagesMarvin Manufacturing Cost of Goods Sold StatementRowena TamboongNo ratings yet

- UCP - CA 03 - Cost Accounting CycleDocument6 pagesUCP - CA 03 - Cost Accounting CycleJoshua UmaliNo ratings yet

- Costing Problems SolutionsDocument16 pagesCosting Problems SolutionsJAY AUBREY PINEDA50% (2)

- Job Order CostingDocument2 pagesJob Order CostingChyna Bee SasingNo ratings yet

- Penyimpanan Barang Ke GudangDocument10 pagesPenyimpanan Barang Ke Gudangajeng.saraswatiNo ratings yet

- Manufacturing ExercisesDocument3 pagesManufacturing ExercisesHershey Julienne AlvarezNo ratings yet

- Practice Exercises AnswerDocument24 pagesPractice Exercises AnswerCatherine OrdoNo ratings yet

- 1ST QUIZ Cost AccountingDocument6 pages1ST QUIZ Cost AccountingJoseph Francis PamaongNo ratings yet

- Cost Accounting TudorDocument2 pagesCost Accounting TudorLorie RoncalNo ratings yet

- Acco 20073 Instructional Materials CompressDocument23 pagesAcco 20073 Instructional Materials CompressNestyn Hanna VillarazaNo ratings yet

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- Job Order Quiz 05 PDFDocument3 pagesJob Order Quiz 05 PDFZamantha Tiangco0% (1)

- Assignment - Variable Costing and Absorption CostingDocument3 pagesAssignment - Variable Costing and Absorption Costingsam imperialNo ratings yet

- Discussion Problems Job Order CostingDocument5 pagesDiscussion Problems Job Order CostingEl AgricheNo ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- Job Order Costing ExercisesDocument2 pagesJob Order Costing ExercisesLUCYDHARYLL JOHN E. SEJALBONo ratings yet

- Rona - Assignment Sep 20Document3 pagesRona - Assignment Sep 20John Ray RonaNo ratings yet

- 1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Document8 pages1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Roselyn LumbaoNo ratings yet

- Exercise 2 Job Order Costing Final ProblemsDocument5 pagesExercise 2 Job Order Costing Final ProblemsClene DoconteNo ratings yet

- Manufacturing Costs and Inventory Costing: Session 4Document37 pagesManufacturing Costs and Inventory Costing: Session 4MarcoNo ratings yet

- Advance Financial Accounting and Reporting: Additional InformationDocument4 pagesAdvance Financial Accounting and Reporting: Additional InformationRoxell CaibogNo ratings yet

- File Not AvailableDocument3 pagesFile Not AvailableNikki GarciaNo ratings yet

- Cpar Far Must ReviewDocument23 pagesCpar Far Must ReviewNikki GarciaNo ratings yet

- Tax Requirements and ExemptionsDocument16 pagesTax Requirements and ExemptionsNikki GarciaNo ratings yet

- RR 9-2019Document3 pagesRR 9-2019Nikki GarciaNo ratings yet

- SYM CompanyDocument6 pagesSYM CompanyNikki GarciaNo ratings yet

- SolutionDocument8 pagesSolutionNikki GarciaNo ratings yet

- PWCPH 2019 Taxcalendar PDFDocument56 pagesPWCPH 2019 Taxcalendar PDFKim RoqueNo ratings yet

- 2019PressRelease Hold Departure Order Issued Against KAPA Scam Operators 07042019Document2 pages2019PressRelease Hold Departure Order Issued Against KAPA Scam Operators 07042019Nikki GarciaNo ratings yet

- Ifrs News A Revised Conceptual Framework For Financial ReportingDocument12 pagesIfrs News A Revised Conceptual Framework For Financial ReportingDaniella SpizzirriNo ratings yet

- PWCPH 2019 Taxcalendar PDFDocument56 pagesPWCPH 2019 Taxcalendar PDFKim RoqueNo ratings yet

- Digest RR 8-2019Document2 pagesDigest RR 8-2019Nikki GarciaNo ratings yet

- Digest RR 8-2019Document2 pagesDigest RR 8-2019Nikki GarciaNo ratings yet

- Seatwork - A334-A331 - Lala MalalaDocument8 pagesSeatwork - A334-A331 - Lala MalalaNikki GarciaNo ratings yet

- Advanced Accounting Part 1 Quiz SolutionsDocument20 pagesAdvanced Accounting Part 1 Quiz SolutionsNikki GarciaNo ratings yet

- Solution Midterm Quiz 2 PCDocument10 pagesSolution Midterm Quiz 2 PCNikki GarciaNo ratings yet

- Process Costing - Max CorporationDocument7 pagesProcess Costing - Max CorporationNikki GarciaNo ratings yet

- Solution To Bikini Bottom - Accounting For JC and BPDocument6 pagesSolution To Bikini Bottom - Accounting For JC and BPNikki GarciaNo ratings yet

- Solution in Partnership Liquidation LumpsumDocument4 pagesSolution in Partnership Liquidation LumpsumNikki GarciaNo ratings yet

- Process Costing - Loss UnitsDocument10 pagesProcess Costing - Loss UnitsAkira Marantal ValdezNo ratings yet

- Advanced Accounting Part 1 Quiz SolutionsDocument20 pagesAdvanced Accounting Part 1 Quiz SolutionsNikki GarciaNo ratings yet

- Seatwork - A334-A331 - Lala MalalaDocument8 pagesSeatwork - A334-A331 - Lala MalalaNikki GarciaNo ratings yet

- Chapter 2 Advance Acctg.Document20 pagesChapter 2 Advance Acctg.Clarize R. Mabiog82% (11)

- Solution To Final QuizzesDocument8 pagesSolution To Final QuizzesNikki GarciaNo ratings yet

- Process Costing - Loss UnitsDocument7 pagesProcess Costing - Loss UnitsNikki GarciaNo ratings yet

- Simulationprob 2Document4 pagesSimulationprob 2Nikki GarciaNo ratings yet

- Process Costing - Max CorporationDocument1 pageProcess Costing - Max CorporationNikki GarciaNo ratings yet

- HAVA Powerpoint Presentation: Imperial Resources, IncDocument4 pagesHAVA Powerpoint Presentation: Imperial Resources, IncNikki GarciaNo ratings yet

- Process Costing - Loss UnitsDocument7 pagesProcess Costing - Loss UnitsNikki GarciaNo ratings yet

- Qty Schedule - 1-10-17Document14 pagesQty Schedule - 1-10-17Akira Marantal ValdezNo ratings yet

- FDR Report 2021 v1.0 3 November 2021Document96 pagesFDR Report 2021 v1.0 3 November 2021Seba CabezasNo ratings yet

- Strategic Analysis of Pharmaceutical Firms in BangladeshDocument13 pagesStrategic Analysis of Pharmaceutical Firms in BangladeshTarequl IslamNo ratings yet

- AT Quizzer 17 - Other Assurance and Non Assurance ServicesDocument10 pagesAT Quizzer 17 - Other Assurance and Non Assurance ServicesRachel LeachonNo ratings yet

- Abdi Jundi ResDocument43 pagesAbdi Jundi ResBobasa S AhmedNo ratings yet

- PMC - Scope of ServicesDocument8 pagesPMC - Scope of ServicesAr Kajal GangilNo ratings yet

- A Study On Satisfaction, Perception and Expectation Level of Institutional Consumers Towards Paint Brands in Al-Kharj Region, Kingdom of Saudi ArabiaDocument16 pagesA Study On Satisfaction, Perception and Expectation Level of Institutional Consumers Towards Paint Brands in Al-Kharj Region, Kingdom of Saudi ArabiaShekhar MauryaNo ratings yet

- Merger & AcquisitionDocument25 pagesMerger & AcquisitionSANJAY ANANDANNo ratings yet

- Purvi Verma SipDocument43 pagesPurvi Verma Siprajitasharma30No ratings yet

- Insured Receipt Acknowledges Hospitalization BenefitsDocument6 pagesInsured Receipt Acknowledges Hospitalization BenefitsClark Jay PonceNo ratings yet

- Robert Whitaker ResumeDocument3 pagesRobert Whitaker ResumeBrandon GordonNo ratings yet

- Vennu Task 1 - Model AnswerDocument1 pageVennu Task 1 - Model Answersid100% (1)

- Difference Between MNE and TNCDocument11 pagesDifference Between MNE and TNCNiche QureshiNo ratings yet

- MRP Process in SAP Business OneDocument33 pagesMRP Process in SAP Business OneaunhavcNo ratings yet

- Daily Sales Sheet 17 AugustDocument70 pagesDaily Sales Sheet 17 AugustSandiego AlexanderNo ratings yet

- Country Attractiveness 1Document17 pagesCountry Attractiveness 1Selena NguyenNo ratings yet

- MGT80002 - Session 2A - Strategy Concept and MeaningsDocument18 pagesMGT80002 - Session 2A - Strategy Concept and MeaningsWizky OnNo ratings yet

- TNS Shopper Journey - Pat McCannDocument29 pagesTNS Shopper Journey - Pat McCannumuttk5374No ratings yet

- Pooja KukrejaDocument97 pagesPooja Kukrejachandershekhar0% (1)

- Welcome To: Cloud MiningDocument1 pageWelcome To: Cloud MiningSatish YadavNo ratings yet

- Internet Statistics CompendiumDocument35 pagesInternet Statistics CompendiummNo ratings yet

- Volkswagen ChronicleDocument264 pagesVolkswagen ChronicleSSPK_92100% (1)

- Topic 4 (Logistics)Document2 pagesTopic 4 (Logistics)Eli SuanNo ratings yet

- E-Bidding Document: Govt. of Assam Mising Autonomous Council Gogamukh:: Dhemaji:: AssamDocument30 pagesE-Bidding Document: Govt. of Assam Mising Autonomous Council Gogamukh:: Dhemaji:: AssamAchyut PhukanNo ratings yet

- Advertising Promotion ResearchDocument24 pagesAdvertising Promotion ResearchIndujiCanganNo ratings yet

- What's The Right Value Creation Model?Document8 pagesWhat's The Right Value Creation Model?ddubyaNo ratings yet

- Sarah-Marie Chan ResumeDocument2 pagesSarah-Marie Chan Resumeapi-240680338No ratings yet

- Session 1Document44 pagesSession 1Rajveer deepNo ratings yet

- Phuong (Lily) Tran Package 3Document7 pagesPhuong (Lily) Tran Package 3phtran123No ratings yet

- Temporary National Economic CommitteeDocument364 pagesTemporary National Economic CommitteerwdavisNo ratings yet

- Analysis ReportDocument5 pagesAnalysis ReportAsif AliNo ratings yet