Professional Documents

Culture Documents

Assets: Liabilities:: Account Receivable

Uploaded by

111290Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assets: Liabilities:: Account Receivable

Uploaded by

111290Copyright:

Available Formats

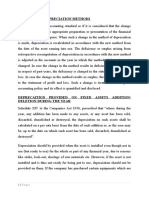

Problem 2.

5 A

HERE COME THE CLOWNS!

Balance Sheet

As of June 30, 2009

Assets: Liabilities:

Cash $ 32,520 Notes payable $ 180,000

Notes receivable $ 9,500 Accounts payable $ 26,100

Account receivable $ 7,450 Salaries payable $ 9,750

Cages $ 24,630 Total liabilities: $ 215,850

Tents $ 63,000 Owners’ equity:

Costumes $ 31,500 Capital stock $ 310,000

Animals $ 189,060 Retained Earnings $ 27,230

Trucks and wagons $ 105,840 Total owners’ equity : $ 337,230

Props and equipment $ 89,580

Total assets : $ 553,080

a. Total assets = Total liabilities + Total owners’ equity

$ 553,080 =$ 215,850 + $ 337,230

$ 553,080-$ 520,560= $ 32,520

Total assets = $553,080; Total liabilities = $215,850

b. It would be required to subtract from the cost of tents (63000-14300=48700) the sum

of destroyed tent, and then we should subtract the same amount from retained earnings

(27230-14300=12930), because assets must be equal to the sum of Total liabilities and

Owners’ equity. Assets decrease, Liabilities does not change Owners’ equity decrease.

Finally, the loss of an asset from the fire would require a revised balance sheet that shows

decrease in total assets.

Problem 2.6 A

Wilson Farm, Inc.

Balance Sheet

As of September 30, 2009

Assets: Liabilities:

Cash $ 16,710 Notes payable $ 330,000

Accounts receivable $ 22,365 Accounts payable $ 77,095

Barns and Sheds $ 78,300 Wages payable $ 5,820

Livestock $ 120,780 Property Taxes Payable $ 9,135

Land $ 490,000 Total liabilities: $ 422,050

Citrus trees $ 76,650 Owners’ equity:

Fences and Gates $ 33,570 Capital stock $ 290,000

Farm machinery $ 42,970 Retained Earnings $ 189,420

Irrigation system $ 20,125 Total owners’ equity : $ 479,420

Total assets : $ 901,470

a. Total assets = Total liabilities + Total owners’ equity

$ 901,470=$ 422,050+$ 479,420

b. It would be required to subtract from the cost of barns ($ 78,300-$13,700=$64,600)

the sum of destroyed barns, and because it was not insured then we should subtract

the same amount from retained earnings ($ 189,420-$13,700=$175,720), in addition

assets must be equal to the sum of Total liabilities and Owners’ equity. Assets

decrease, Liabilities does not change Owners’ equity decrease.

Problem 2.8 B

a. The Candy Shop

Balance Sheet

As of September 30, 2009

Assets: Liabilities:

Cash $ 6,900 Notes payable $ 50,000

Accounts receivable $ 5,000 Account payable $6,800

Suppliers $ 3,000 Total liabilities: $ 56,800

Land $ 72,000 Owners’ equity:

Building $ 80,000 Capital stock $ 100,000

Furniture and Fixtures $ 9,000 Retained earnings $ 19,100

Total assets : $ 175,900 Total owners’ equity: $ 119,100

Total assets = Total liabilities + Total owners’ equity

Total liabilities= Total assets - Total owners’ equity

$ 175,900-($ 119,100+$6,800)= 50,000

b.

Assets Liabilities Owners’ equity

Cash Acc. R Sup. Land Build. Furniture Notes Acc. Cap. Retained

Fixtures payable payable Stock earnings

Sep. 6,900 5,000 3,000 72,000 80,000 9,000 50,000 6,800 100,000 19,100

30

Oct. +30,000 -6,800 +30,000

3 -6,800

Oct. -900 +900 +8,000 +8,000

6

Oct. +8,000 +8,000

1- 6 -3,200 -3,200

T 34,000 5,000 3,900 72,000 80,000 17,000 50,000 8,000 130,000 $23,900

The Candy Shop

Balance Sheet

As of September 6, 2009

Assets: Liabilities:

Cash $ 40,700 Notes payable $ 50,000

Accounts receivable $ 5,000 Account payable $8,000

Suppliers $ 3,900 Total liabilities: $ 58,000

Land $ 72,000 Owners’ equity:

Building $ 80,000 Capital stock $ 130,000

Furniture and Fixtures $ 17,000 Retained earnings $ 23,900

Total assets : $ 211,900 Total owners’ equity: $ 153,900

The Candy Shop

Income statement

For the period of October 1-6, 2009

Revenue: $23,900

Expenses: (3,200)

Net income : 20,700

The Candy Shop

Statement of Cash Flows

For the Period October 1-6, 2009 c. The Candy shop is in a stronger

Cash flows from operating activities: financial position on October 6 than

on September 30. Because on Sep.

Cash received from revenues $ 23,900

30, the company had highly liquid

Cash paid for expenses (3,200) assets of $11,900 which barely

Cash paid for accounts payable (8000) exceeded the $6,800 in liabilities

Cash paid for supplies (900) (accounts payable) due in the near

Cash used in operating activities $ (11,800) future. On October 6, after

Cash flows from investing activities: None investment of cash by stockholders,

the company's cash exceeded its

short-term obligations.

Cash flows from financing activities:

Cash received from sale of capital stock $ 30,000

Increase in cash $ 33,800

Cash balance, October 1, 2009 $ 6,900

Cash balance, October 6, 2009 $ 40,700

You might also like

- Acctg 115 - CH 2 SolutionsDocument9 pagesAcctg 115 - CH 2 SolutionsRand_A100% (1)

- Assets Liabilities & Owner's EquityDocument14 pagesAssets Liabilities & Owner's EquitysaraNo ratings yet

- Deep River Lodge Balance Sheet AnalysisDocument8 pagesDeep River Lodge Balance Sheet AnalysissaraNo ratings yet

- Double Entry Accounting Assessment QuestionsDocument7 pagesDouble Entry Accounting Assessment QuestionsLhaiela AmanollahNo ratings yet

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Indonesian Accounting Class Discussion on Solving Accounting Challenge ProblemsDocument34 pagesIndonesian Accounting Class Discussion on Solving Accounting Challenge Problemssuci monalia putriNo ratings yet

- CH 3 Example 1Document3 pagesCH 3 Example 1Kamel HassounNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Accounting for Special Transactions Chapter 17 SolutionsDocument16 pagesAccounting for Special Transactions Chapter 17 SolutionsJoshua CabinasNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Basic Acco VariousDocument26 pagesBasic Acco VariousJasmine Acta100% (1)

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Accounting Assignment cpt-1Document9 pagesAccounting Assignment cpt-1Parvez RahmanNo ratings yet

- Partnership AppDocument22 pagesPartnership AppPeter AkramNo ratings yet

- Solution Chapter 1Document8 pagesSolution Chapter 1Khải Hưng NguyễnNo ratings yet

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Document6 pagesACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIENo ratings yet

- Act 202 - Financial Accounting QDocument3 pagesAct 202 - Financial Accounting QShebgatul MursalinNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Accounting principles assignment breakdownDocument7 pagesAccounting principles assignment breakdownsilva yunizaNo ratings yet

- Here are the capital account changes for each partner:C: P 3,000 decrease P: P 25,500 decreaseA: P 7,500 decreaseDocument8 pagesHere are the capital account changes for each partner:C: P 3,000 decrease P: P 25,500 decreaseA: P 7,500 decreasetide podsNo ratings yet

- Balance Sheet and Transactions Analysis for Charles CompanyDocument14 pagesBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Accounting and Law - NotesDocument11 pagesAccounting and Law - NotesCrystal ApinesNo ratings yet

- A&Co's Trial Balance and Financial StatementsDocument5 pagesA&Co's Trial Balance and Financial StatementsArt and Fashion galleryNo ratings yet

- Ejercicios ContabilidadDocument3 pagesEjercicios ContabilidadCarolina RvNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- 9 Accounting HomeworkDocument18 pages9 Accounting HomeworkCharlie RNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- Ruth Assignment On Financial and Managerial Accounting (Hallmark College)Document7 pagesRuth Assignment On Financial and Managerial Accounting (Hallmark College)kal4evr19No ratings yet

- Quiz 1 - Solutions - Feb 2016Document3 pagesQuiz 1 - Solutions - Feb 2016Danika TimotheeNo ratings yet

- Acct 108 Consolidated Financial Statements QuizDocument5 pagesAcct 108 Consolidated Financial Statements QuizGround ZeroNo ratings yet

- Assignment CH 6 and 8Document11 pagesAssignment CH 6 and 8Bushra IbrahimNo ratings yet

- Practice Final Acct 1Document12 pagesPractice Final Acct 1hannahkellum08No ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Group 9 - Chapter 2Document7 pagesGroup 9 - Chapter 2Joshua SanotaNo ratings yet

- Partnership Formation and Capital AccountsDocument157 pagesPartnership Formation and Capital AccountsRaven PicorroNo ratings yet

- Accounting CH 1 - HomeworkDocument6 pagesAccounting CH 1 - HomeworkAxel OngNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Baskoro Riyanto - 023001800063 - Latihan Soal AKL IIDocument4 pagesBaskoro Riyanto - 023001800063 - Latihan Soal AKL IIBaskoro RiyantoNo ratings yet

- ACC CUỐI KÌDocument5 pagesACC CUỐI KÌNguyen Thi Thu Phuong (K16HL)No ratings yet

- AP 1st Monthly AssessmentDocument6 pagesAP 1st Monthly AssessmentCiena Mae Asas100% (1)

- Bank reconciliation and journal entriesDocument6 pagesBank reconciliation and journal entriesmeifangNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- Professor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsDocument3 pagesProfessor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsPrecious Uminga100% (1)

- 22i 2763Document3 pages22i 2763i222763 Asma JavaidNo ratings yet

- UntitledDocument3 pagesUntitledi222763 Asma JavaidNo ratings yet

- Analyzing Accounts Receivable and Notes ReceivableDocument3 pagesAnalyzing Accounts Receivable and Notes ReceivableTIÊN NGUYỄN LÊ MỸNo ratings yet

- Home Work One - MBADocument2 pagesHome Work One - MBAIslam SamirNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Accounting Assignment 1Document2 pagesAccounting Assignment 1Hamna FarooqNo ratings yet

- Assignment # 1 Feb 2023Document5 pagesAssignment # 1 Feb 2023GIAN ALEXANDER CARTAGENANo ratings yet

- Prac 001 JustificationDocument2 pagesPrac 001 JustificationVanessa San JoseNo ratings yet

- Fair Value Fair ValueDocument4 pagesFair Value Fair ValueJay Ann DomeNo ratings yet

- P2Document40 pagesP2Michiko Kyung-soonNo ratings yet

- DocxDocument35 pagesDocxjikee11No ratings yet

- ACCT1101 - Solution - Chapter 07Document7 pagesACCT1101 - Solution - Chapter 07hayleyNo ratings yet

- A. Chart of Accounts: Salaries PayableDocument12 pagesA. Chart of Accounts: Salaries PayableJerome SerranoNo ratings yet

- Final Project MrunalDocument53 pagesFinal Project MrunalPravin RamtekeNo ratings yet

- Class Notes - 1Document23 pagesClass Notes - 1ushaNo ratings yet

- AssetManagement Final 2017Document65 pagesAssetManagement Final 2017Adam HudzaifahNo ratings yet

- Fundamental Accounting Principles 22nd Edition Wild Solutions ManualDocument35 pagesFundamental Accounting Principles 22nd Edition Wild Solutions Manualloanmaiyu28p7100% (19)

- Financial Analysis Part2Document15 pagesFinancial Analysis Part2Llyod Francis LaylayNo ratings yet

- 07 PPE Cost s19Document35 pages07 PPE Cost s19Nosipho NyathiNo ratings yet

- Elrc 7607 - Capstone ProjectDocument7 pagesElrc 7607 - Capstone Projectapi-454914316No ratings yet

- Changing DepreciationDocument12 pagesChanging DepreciationIsiyaku AdoNo ratings yet

- Financial AccountingDocument58 pagesFinancial AccountingAnonymous HumanNo ratings yet

- Pharmaceutical Repackaging Plant Business PlanDocument19 pagesPharmaceutical Repackaging Plant Business PlanSheroze MasoodNo ratings yet

- UNI 20230306154519093616 781498 uniROC IpayobDocument7 pagesUNI 20230306154519093616 781498 uniROC IpayobxidaNo ratings yet

- Midterm Examination in Basic AccountingDocument3 pagesMidterm Examination in Basic AccountingCarlo100% (1)

- Tcs Company With Ethical GoveranceDocument27 pagesTcs Company With Ethical GoveranceshashipaulNo ratings yet

- The Balance Sheet of LifeDocument3 pagesThe Balance Sheet of LifeSivachandranNo ratings yet

- CSS Profile InstructionsDocument10 pagesCSS Profile InstructionsVickyNo ratings yet

- Kohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Document54 pagesKohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Sohail AdnanNo ratings yet

- 9706 m17 QP 32Document12 pages9706 m17 QP 32FarrukhsgNo ratings yet

- Business Plan SampleDocument12 pagesBusiness Plan Sampleyam yam100% (2)

- Almi Annual 2019Document119 pagesAlmi Annual 2019PGAS JKNo ratings yet

- SMCH 16Document20 pagesSMCH 16FratFoolNo ratings yet

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsDocument9 pagesSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadNo ratings yet

- PHI Learning Business Management May 2022 PDFDocument212 pagesPHI Learning Business Management May 2022 PDFShiva Johri100% (1)

- IIFM Sukuk Report 1st Edition A Comprehensive Study of The Global Sukuk MarketDocument52 pagesIIFM Sukuk Report 1st Edition A Comprehensive Study of The Global Sukuk MarketRahmat Abdul GaniNo ratings yet

- Praveen Kumar MCPDocument82 pagesPraveen Kumar MCPPadmashreeNo ratings yet

- Accounting TerminologyDocument17 pagesAccounting TerminologyMurali Krishna GbNo ratings yet

- Linkedin ValuationDocument12 pagesLinkedin ValuationAmit AdmuneNo ratings yet

- Chapter 1 DayagDocument14 pagesChapter 1 DayagMau Bautista100% (1)

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument17 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet