Professional Documents

Culture Documents

Acc2202 (1) July2017

Uploaded by

natlyh0 ratings0% found this document useful (0 votes)

51 views8 pagesAccount 2

Original Title

ACC2202 (1) JULY2017

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccount 2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views8 pagesAcc2202 (1) July2017

Uploaded by

natlyhAccount 2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

INTL cee

International University

aK

FINAL

Examination Paper

(COVER PAGE)

Session _MAY 2017 é 7

Programme : Bachelor of Accountancy (Hons)

Bachelor of Financial Planning (Hons) iH

Course ‘| ACC2202: Financial Accounting 2 oe

Date of Examination: 28 July 2017 iz

Time : 0900 - 1210 Reading Time : _ 10 minutes

Duration ‘ 3 hours 10 minutes

Special Instructions:

Section A: Answer THREE (3) compulsory questions,

Section B: Answer any TWO (2) questions.

Materials permitted

‘Non-Programmable Calculator

Materials provided:

Nil

Examiner(s) : Affiza Mohamad Tallaha

Moderator ; Annie Wang, Christine Gan, Salwa Binti Abu Bakar

This paper consists of 8 printed pages, including the cover page.

ACC2202 (F) / Page 1 of 7

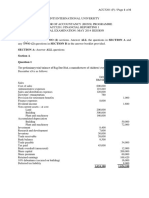

INTL INTERNATIONAL UNIVERSITY

BACHELOR OF ACCOUNTANCY (HONS) PROGRAMME

BACHELOR OF FINANCIAL PLANNING (HONS) PROGRAMME,

ACC2202: FINANCIAL ACCOUNTING 2.

FINAL EXAMINATION: MAY 2017 SESSION

This paper consists of TWO (2) sections. Answer ALL questions in SECTION A and any TWO

(2) questions in SECTION B in the answer booklet provided.

SECTION A: Answer THREE (3) compulsory questions.

Question 1

(a) Define the meaning of accounting.

(b) State THREE (8) purposes of Accounting Information,

(2 marks)

(marks)

() Explain FOUR (4) qualitative characteristics of financial information contained in the IASC’s

framework (2010).

Question 2

(12 marks)

(Total: 20 marks)

Bush, Home and Wilson share profits and losses in the ratios 4:1:3 respectively. Their trial balance

as at 30 April 2017 was as follows:

Sales

Returns inwards

Purchases

Carriage inwards

Stock 30 April 2016

Discounts allowed

Salaries and wages

Bad debts

Provision for doubtful debts 30 April 2016

General expenses

Business rates

Dr

RM

10,200

196,239

3,100

68,127

190

54,117

1,620

1,017

2,900

Cr

RM.

334,618

950

ACC2202 (F)/ Page 2 of 7

Postage 845

Computers at cost 8,400

Office equipment at cost 5,700

Provisions for depreciation at 30 April 2016:

Computers 3,600

Office equipment 2,900

Creditors 36,480

Debtors 51,320

Cash at bank. 5214

Drawings: Bush 39,000

Home 16,000,

Wilson 28,000

Current accounts: Bush 5,940

Home 2,117

Wilson 9,618

Capital accounts: Bush 60,000

Home 10,000

Wilson _ 30,000

494,106 494,106

The following notes are relevant at 30 April 2017:

i. Stock 30 April 2017, RM 74,223.

Business rates in advance RM 200; Stock of postage stamps RM 68.

|. _ Increase provision for doubtful debts to RM 1,400.

iv, Salaries: Home RM 18,000; Wilson RM 14,000. Not yet recorded.

'y, Interest on Drawings: Bush RM 300; Home RM 200; Wilson RM 240,

vi, Interest on Capitals at 8 per cent.

vil. Depreciate Computers RM 2,800; Office equipment RM 1,100.

Required:

Prepare an income statement together with an appropriation account at 30 Ay

statement of financial position as at that date.

(Total: 20 marks)

Question 3

‘The trial balance extracted from the books of Growing Sdn Bhd at 31 December 2017 was as

follows:

Dr cr

RM RM

Bank 8,100

Accounts receivable 321,219

Accounts payable 237,516

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Budgeting in The Public SectorDocument21 pagesBudgeting in The Public SectornatlyhNo ratings yet

- Introduction To Human Resource ManagementDocument23 pagesIntroduction To Human Resource ManagementnatlyhNo ratings yet

- Tutorial 2 MCQDocument4 pagesTutorial 2 MCQnatlyhNo ratings yet

- Prepared by Graeme Wines: P A T (T 6)Document4 pagesPrepared by Graeme Wines: P A T (T 6)natlyhNo ratings yet

- HRM MCQDocument4 pagesHRM MCQnatlyhNo ratings yet

- Integrated Case StudyDocument2 pagesIntegrated Case StudynatlyhNo ratings yet

- Measuring Housing Affordability: The Two ApproachesDocument17 pagesMeasuring Housing Affordability: The Two ApproachesnatlyhNo ratings yet

- Acc3204 - Jan2018Document5 pagesAcc3204 - Jan2018natlyhNo ratings yet

- ACC5213 (F) JAN14 Case StudyDocument13 pagesACC5213 (F) JAN14 Case StudynatlyhNo ratings yet

- ACC4206 Topic 2 Tutorial Q1 - Q5Document3 pagesACC4206 Topic 2 Tutorial Q1 - Q5natlyhNo ratings yet

- Article Evolution of MA Kaplan July 1984Document30 pagesArticle Evolution of MA Kaplan July 1984natlyhNo ratings yet

- Tutorial 2e Residence StatusDocument2 pagesTutorial 2e Residence StatusnatlyhNo ratings yet

- CHAPTER2 Residence StatusDocument42 pagesCHAPTER2 Residence StatusnatlyhNo ratings yet

- Chapter 6 NotesDocument4 pagesChapter 6 NotesnatlyhNo ratings yet

- SECTION C in The Answer Booklet ProvidedDocument12 pagesSECTION C in The Answer Booklet ProvidednatlyhNo ratings yet

- Acc3201 (F) Aug2014Document5 pagesAcc3201 (F) Aug2014natlyhNo ratings yet

- Acc3201 (F) Jan14Document7 pagesAcc3201 (F) Jan14natlyhNo ratings yet

- TWO (2) Questions in SECTION B in The Answer Booklet Provided. SECTION A: Answer ALL QuestionsDocument6 pagesTWO (2) Questions in SECTION B in The Answer Booklet Provided. SECTION A: Answer ALL QuestionsnatlyhNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- ACC3201Document7 pagesACC3201natlyhNo ratings yet

- Ias 10 Q7Document2 pagesIas 10 Q7natlyhNo ratings yet

- ACC3201Document6 pagesACC3201natlyh100% (1)