Professional Documents

Culture Documents

Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

Volume 8, Issue 13

March 27, 2018

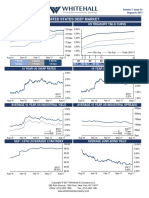

UNITED STATES DEBT MARKET

US LIBOR US TREASURY YIELD CURVE

300 bps 6.00%

250 bps 5.00%

200 bps 4.00%

150 bps 3.00%

100 bps 2.00%

50 bps 1.00%

30yr Avg 15yr Avg Today (3/27/18)

0 bps 0.00% I I I I I I

Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 2 3 5 7 10 30

1 Month 3 Month 6 Month 2yr 3yr 5yr 7yr 10yr 30yr

188 bps 229 bps 245 bps 2.30% 2.40% 2.61% 2.69% 2.82% 3.06%

10 YEAR US SWAP RATES 10 YEAR US TREASURY

3.50% 3.50%

3.00% 3.00%

2.50% 2.50%

2.00% 2.00%

1.50% 1.50%

3/27/18 3/27/18

2.84% 2.82%

1.00% 1.00%

Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18

AVERAGE 10 YEAR US INDUSTRIAL YIELD AVERAGE 10 YEAR US INDUSTRIAL SPREADS

200bps

4.50%

4.00% 150bps

3.50%

100bps

3.00%

3/27/18 3/27/18 50bps

A 2.50% A 94 bps

3.75%

BBB 4.16% BBB 134 bps

2.00% 0bps

Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18

S&P / LSTA LEVERAGED LOAN INDEX AVERAGE JUNK-BOND YIELD

100.00 7.00%

98.00

6.00%

96.00

94.00

5.00%

92.00

3/27/18 3/27/18

98.45% 6.01%

90.00 4.00%

Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

Volume 8, Issue 13

March 27, 2018

SELECT US PRIVATE PLACEMENTS

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

3/23 Coca-Cola Bottling Co. Consolidated Sr Notes $150 12 - 3.96% - Consumer, US

Non-Cyclical

3/23 STAG Industrial Inc Sr Notes $175 7 135bps - 2 Financial US

10 145bps

3/23 Tabcorp Holdings Ltd Sr Notes $105 8 180bps 4.57% 2 Consumer, Australia

$450 10 190bps 4.72% Cyclical

$520 12 200bps 4.82%

$175 15 215bps 4.97%

A$98 17 235bps 5.62%

A$98 18 240bps 5.70%

3/23 Terminal Investment Ltd Sr Notes $100 7 - 4.76% 2 Consumer, The

$175 10 5.10% Non-Cyclical Netherlands

$175 12 5.20%

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

3/23 Entergy Louisiana LLC Sr Secured $750 15 113bps 4.00% A/A2 Utilities US

3/22 Ohio Power Company Sr Notes $400 30 107bps 4.15% A-/A2 Utilities US

3/22 Peru LNG S.r.l Sr Notes $940 12 - 5.38% Baa3 Energy Peru

3/22 Virginia Electric & Power Company Sr Notes $700 10 95bps 3.80% BBB+/A2 Utilities US

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

3/22 Aker BP ASA Sr Notes $500 7 311bps 5.88% BB+/Ba2 Energy Norway

3/22 Compressco Partners LP 1st Lien $350 7 472bps 7.50% B+/B1 Energy US

3/23 Parkland Fuel Corporation Sr Notes $500 8 317bps 6.00% BB-/B1 Energy Canada

3/21 SEPLAT Petroleum Development Sr Notes $350 5 687bps 9.25% B-/B2 Energy Nigeria

Co Plc

3/23 USA Compression Partners LP Sr Notes $725 8 400bps 6.88% B+/B3 Energy US

SELECT CLOSED SYNDICATED LOANS

Date Issuer Type $mm Months Spread Rating Sector Country

3/23 ADES International Holding Ltd Term $450 59 500bps - Energy Egypt

3/21 NRG Energy, Inc Term $1,872 63 175bps - Utilities US

3/19 PRPC Refinery and Cracker Sdn. Bridge Term $7,000 11 - - Energy Malaysia

Bhd.

3/21 Shell Brasil Ltda. Term $850 - - - Energy UK

3/21 SEPLAT Petroleum Development Rev $300 51 600bps - Energy Nigeria

Co Plc

CONTACT WHITEHALL

Jon Cody Timothy Page Richard Ashby Todd Brussel Brian Burchfield Matt Cody Roland DaCosta Bob Salandra Vincas Snipas

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director

(212) 205-1398 (212) 205-1399 (212) 205-1388 (212) 205-1397 (212) 205-1395 (212) 205-1398 (212) 205-1394 (212) 335-2561 (212) 205-1385

Van Thorne Geoffrey Wilson Mark Halpin Nadia Zaets Blaine Burke Nicholas Page Sang Joon Lee Aaron Richardson

Managing Director Managing Director Director Director Vice President Vice President Associate Associate

(212) 205-1386 (212) 205-1392 (212) 205-1393 (212) 335-2557 (212) 205-1382 (212) 205-1389 (212) 205-1391 (212) 205-1387

Ted Barrett Billy Kovanis Vitaliy Koretskyy Keir Wianecki

Analyst Analyst Analyst Analyst

(212) 205-1396 (212) 335-2550 (212) 335-2551 (212) 335-2552

Source: Bloomberg

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security.

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

You might also like

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Whitehall & CompanyNo ratings yet

- 1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Document2 pages1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Whitehall & CompanyNo ratings yet

- IC Email Marketing Dashboard Template 8673Document7 pagesIC Email Marketing Dashboard Template 8673Haytham NasefNo ratings yet

- Tube Molding Report - Sept 2010.Document3 pagesTube Molding Report - Sept 2010.Ogero Otekki MusaNo ratings yet

- Grafik PKPDocument10 pagesGrafik PKPNIA KURNIASIHNo ratings yet

- 1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Document2 pages1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Whitehall & CompanyNo ratings yet

- 1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Document2 pages1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Whitehall & CompanyNo ratings yet

- SCHEDULE TITLEDocument32 pagesSCHEDULE TITLEOlan BeeNo ratings yet

- TO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Document1 pageTO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Malik Raheel AhmadNo ratings yet

- 1.12 Whitehall: Monitoring The Markets Vol. 01 Iss. 12 (Apr. 19, 2011)Document2 pages1.12 Whitehall: Monitoring The Markets Vol. 01 Iss. 12 (Apr. 19, 2011)Whitehall & CompanyNo ratings yet

- AP Resultados Estudio de Ejecución 06 16Document168 pagesAP Resultados Estudio de Ejecución 06 16Hercha ValNo ratings yet

- Book 1Document2 pagesBook 1Rokhmatus Hada'asNo ratings yet

- The Data Strengthens Evidence That Vietnam Is A Potential Market For FMCGDocument3 pagesThe Data Strengthens Evidence That Vietnam Is A Potential Market For FMCGQuang Võ MinhNo ratings yet

- 1.08 Whitehall: Monitoring The Markets Vol. 01 Iss. 08 (Mar. 22, 2011)Document2 pages1.08 Whitehall: Monitoring The Markets Vol. 01 Iss. 08 (Mar. 22, 2011)Whitehall & CompanyNo ratings yet

- 1.14 Whitehall: Monitoring The Markets Vol. 1 Iss. 14 (May 2, 2011)Document2 pages1.14 Whitehall: Monitoring The Markets Vol. 1 Iss. 14 (May 2, 2011)Whitehall & CompanyNo ratings yet

- 26 08 2021-PoultryDocument14 pages26 08 2021-PoultryIgnacio López LazarenoNo ratings yet

- Business Ferret Sample Coffee Roaster 040111Document12 pagesBusiness Ferret Sample Coffee Roaster 040111Manvinder SinghNo ratings yet

- Anfrek Tapak MenjanganDocument1 pageAnfrek Tapak MenjanganAkademik HimasdaNo ratings yet

- Client Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveDocument1 pageClient Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveAbhishek KumarNo ratings yet

- Granulometric Analysis and Graphs of Aggregate SamplesDocument63 pagesGranulometric Analysis and Graphs of Aggregate SamplesblaslarrainNo ratings yet

- LeadershipDocument5 pagesLeadershipkaku009No ratings yet

- Ibm: PBV and RoeDocument3 pagesIbm: PBV and RoeyrperdanaNo ratings yet

- Kopi Kenangan - Financial Review Jul - v4Document6 pagesKopi Kenangan - Financial Review Jul - v4Riza AnimationNo ratings yet

- Manhour Histogram & 'S' Curve (Overall) : P.O Box 66, Abqaiq-31992 KsaDocument1 pageManhour Histogram & 'S' Curve (Overall) : P.O Box 66, Abqaiq-31992 KsaPushparaj ArokiasamyNo ratings yet

- Propuesta OVBK - V2Document3 pagesPropuesta OVBK - V2JUAN CAMILO GUZMANNo ratings yet

- Report On Economy of France: Submitted ToDocument16 pagesReport On Economy of France: Submitted ToMusfequr Rahman (191051015)No ratings yet

- [배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)Document26 pages[배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)최장윤No ratings yet

- S-Curve Talang Jimar Rev-8 (New)Document1 pageS-Curve Talang Jimar Rev-8 (New)wahyu hidayatNo ratings yet

- 1.01 Whitehall: Monitoring The Markets Vol. 01 Iss. 01 (Jan 31, 2011)Document2 pages1.01 Whitehall: Monitoring The Markets Vol. 01 Iss. 01 (Jan 31, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Schedule G Sale and Purchase Agreement (Land and Building), Contract For Sale, Housing AccommodationDocument25 pagesSchedule G Sale and Purchase Agreement (Land and Building), Contract For Sale, Housing AccommodationDamiaa' Yusuf MudaNo ratings yet

- Aof Dsa Odmfs05837 30112023Document8 pagesAof Dsa Odmfs05837 30112023kbank0510No ratings yet

- Intro To Banking M3 BankBusinessAndOperatingModels FINALDocument17 pagesIntro To Banking M3 BankBusinessAndOperatingModels FINALanuj guptaNo ratings yet

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNo ratings yet

- Calculating present value of lease payments and journal entriesDocument8 pagesCalculating present value of lease payments and journal entriesraihan aqilNo ratings yet

- Credit Rating Changes and Stock Market Reaction: The Impact of Investor SentimentDocument30 pagesCredit Rating Changes and Stock Market Reaction: The Impact of Investor SentimenttavaxoNo ratings yet

- 14th Annual Book PDFDocument78 pages14th Annual Book PDFAbhayNo ratings yet

- Cebu People's Multi-Purpose Cooperative V Carbonilla JRDocument15 pagesCebu People's Multi-Purpose Cooperative V Carbonilla JRPrecious Ditucalan - TungcalingNo ratings yet

- Topic: MONEY and Finance: Sample Answers, Useful Vocabulary and Resources For IELTS Speaking ExamDocument22 pagesTopic: MONEY and Finance: Sample Answers, Useful Vocabulary and Resources For IELTS Speaking Examwindi_arielNo ratings yet

- Chinese Silver Standard EconomyDocument24 pagesChinese Silver Standard Economyage0925No ratings yet

- Bankers Trust and Birth of Modern Risk ManagementDocument49 pagesBankers Trust and Birth of Modern Risk ManagementIgnat FrangyanNo ratings yet

- INTERNAL CONTROL SYSTEM GUIDEDocument64 pagesINTERNAL CONTROL SYSTEM GUIDETeal JacobsNo ratings yet

- Financial Behavior and Problems Among University Students: Need For Financial EducationDocument18 pagesFinancial Behavior and Problems Among University Students: Need For Financial EducationDarlene Mae HerrasNo ratings yet

- Property Investment Tips Ebook - RWinvest PDFDocument40 pagesProperty Investment Tips Ebook - RWinvest PDFddr95827No ratings yet

- Rotomac Global Public Banks Conned AgainDocument3 pagesRotomac Global Public Banks Conned AgainAkansha SharmaNo ratings yet

- CFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileDocument2 pagesCFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileMatthewGentileNo ratings yet

- Perils of The Sea Perils of The ShipDocument15 pagesPerils of The Sea Perils of The ShipEd Karell GamboaNo ratings yet

- 9 TAXREV - Michigan Holdings v. City Treasurer of MakatiDocument1 page9 TAXREV - Michigan Holdings v. City Treasurer of MakatiRS SuyosaNo ratings yet

- EM416 Cost of QualityDocument24 pagesEM416 Cost of QualityYao SsengssNo ratings yet

- Chapter 1Document37 pagesChapter 1Elma UmmatiNo ratings yet

- Small BusinessDocument11 pagesSmall BusinessSaahil LedwaniNo ratings yet

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDocument11 pagesChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNo ratings yet

- 2012-2013 PNHA Tables - 2Document9 pages2012-2013 PNHA Tables - 2Juan CarlosNo ratings yet

- Alveo Trading API - Apiary FundDocument2 pagesAlveo Trading API - Apiary Fundfuturegm2400No ratings yet

- Jurnal Tesis Muhamad Rifki SeptiadiDocument14 pagesJurnal Tesis Muhamad Rifki Septiadirifki muhamadNo ratings yet

- Edristi Current Affairs Jan 2017 V2Document161 pagesEdristi Current Affairs Jan 2017 V2dassreerenjiniNo ratings yet

- QuizDocument13 pagesQuizMolay SharmaNo ratings yet

- Oliver HartDocument3 pagesOliver HartNamrata SinghNo ratings yet

- Outcome of Board Meeting - Scheme of Arrangement (Board Meeting)Document3 pagesOutcome of Board Meeting - Scheme of Arrangement (Board Meeting)Shyam SunderNo ratings yet

- 2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalDocument54 pages2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalAdedimeji FredNo ratings yet

![[배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)](https://imgv2-1-f.scribdassets.com/img/document/719845222/149x198/d8ebab17c6/1712196292?v=1)