Professional Documents

Culture Documents

Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

Volume 8, Issue 14

April 2, 2018

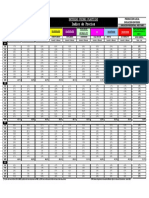

UNITED STATES DEBT MARKET

US LIBOR US TREASURY YIELD CURVE

300 bps 6.00%

250 bps 5.00%

200 bps 4.00%

150 bps 3.00%

100 bps 2.00%

50 bps 1.00%

30yr Avg 15yr Avg Today (4/2/18)

0 bps 0.00% I I I I I I

Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 2 3 5 7 10 30

1 Month 3 Month 6 Month 2yr 3yr 5yr 7yr 10yr 30yr

188 bps 231 bps 245 bps 2.28% 2.38% 2.59% 2.66% 2.77% 3.01%

10 YEAR US SWAP RATES 10 YEAR US TREASURY

3.50% 3.50%

3.00% 3.00%

2.50% 2.50%

2.00% 2.00%

1.50% 1.50%

4/2/18 4/2/18

2.81% 2.77%

1.00% 1.00%

Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18

AVERAGE 10 YEAR US INDUSTRIAL YIELD AVERAGE 10 YEAR US INDUSTRIAL SPREADS

200bps

4.50%

4.00% 150bps

3.50%

100bps

3.00%

4/2/18 4/2/18 50bps

A 2.50% A 95 bps

3.69%

BBB 4.11% BBB 137 bps

2.00% 0bps

Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18

S&P / LSTA LEVERAGED LOAN INDEX AVERAGE JUNK-BOND YIELD

100.00 7.00%

98.00

6.00%

96.00

94.00

5.00%

92.00

4/2/18 4/2/18

98.42% 5.97%

90.00 4.00%

Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

Volume 8, Issue 14

April 2, 2018

SELECT US PRIVATE PLACEMENTS

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

3/30 Boral Ltd Sr Notes $75 8 130bps - 2 Australia

$225 8 135bps 4.05%

3/30 Plexus Corp Sr Notes $100 7 130bps 4.05% 2 US

$50 10 140bps 4.22%

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

3/29 Bell Canada Sr Notes $750 30 140bps 4.46% BBB+/Baa1 Communications Canada

3/28 Centerpoint Energy Resources Corp Sr Notes $300 5 97bps 3.55% A-/Baa2 Utilities US

$300 10 117bps 4.00%

3/28 Connecticut Light and Power Sr Secured $500 30 93bps 4.00% AA-/A2 Utilities US

Company

3/29 Valero Energy Partners LP Sr Notes $500 10 170bps 4.50% BBB-/Baa3 Energy US

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

3/27 Mississippi Power Company Sr Notes $300 2 - 2.94% Ba1 Utilities US

$300 10 115bps 3.95%

SELECT CLOSED SYNDICATED LOANS

Date Issuer Type $mm Months Spread Rating Sector Country

3/29 China Water Affairs Group Limited Term $200 59 195bps - Industrial Hong Kong

3/29 Coronado Australian Holdings Pty Term $700 84 650bps B1 Energy Australia

3/29 Ltd Seasons Hotels Limited

Four Term $891 68 200bps - Consumer, Canada

Cyclical

3/27 Ormat Technologies, Inc Term $100 131 - - Utilities US

3/26 Sustainable Power Group LLC Rev $175 35 275bps - Energy US

3/26 Viva Energy Holding Pty Ltd Rev $700 23 110bps - Energy Australia

CONTACT WHITEHALL

Jon Cody Timothy Page Richard Ashby Todd Brussel Brian Burchfield Matt Cody Roland DaCosta Bob Salandra Vincas Snipas

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director

(212) 205-1398 (212) 205-1399 (212) 205-1388 (212) 205-1397 (212) 205-1395 (212) 205-1398 (212) 205-1394 (212) 335-2561 (212) 205-1385

Van Thorne Geoffrey Wilson Mark Halpin Nadia Zaets Blaine Burke Nicholas Page Sang Joon Lee Aaron Richardson

Managing Director Managing Director Director Director Vice President Vice President Associate Associate

(212) 205-1386 (212) 205-1392 (212) 205-1393 (212) 335-2557 (212) 205-1382 (212) 205-1389 (212) 205-1391 (212) 205-1387

Ted Barrett Billy Kovanis Vitaliy Koretskyy Keir Wianecki

Analyst Analyst Analyst Analyst

(212) 205-1396 (212) 335-2550 (212) 335-2551 (212) 335-2552

Source: Bloomberg

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security.

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

You might also like

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Whitehall & CompanyNo ratings yet

- 1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Document2 pages1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Whitehall & CompanyNo ratings yet

- TO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Document1 pageTO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Malik Raheel AhmadNo ratings yet

- 1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Document2 pages1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Whitehall & CompanyNo ratings yet

- 1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Document2 pages1.04 Whitehall: Monitoring The Markets Vol. 01 Iss. 04 (Feb. 22, 2011)Whitehall & CompanyNo ratings yet

- Time Schedule: #REF! #REF! Bobot A Persiapan Area B Pek. PondasiDocument32 pagesTime Schedule: #REF! #REF! Bobot A Persiapan Area B Pek. PondasiOlan BeeNo ratings yet

- 3.work Progress Curves ActualDocument1 page3.work Progress Curves ActualRim BdidaNo ratings yet

- Tube Molding Report - Sept 2010.Document3 pagesTube Molding Report - Sept 2010.Ogero Otekki MusaNo ratings yet

- 1.14 Whitehall: Monitoring The Markets Vol. 1 Iss. 14 (May 2, 2011)Document2 pages1.14 Whitehall: Monitoring The Markets Vol. 1 Iss. 14 (May 2, 2011)Whitehall & CompanyNo ratings yet

- Indice de Precios: Materias Primas PlasticasDocument1 pageIndice de Precios: Materias Primas PlasticasMelisa JaksicNo ratings yet

- 1.12 Whitehall: Monitoring The Markets Vol. 01 Iss. 12 (Apr. 19, 2011)Document2 pages1.12 Whitehall: Monitoring The Markets Vol. 01 Iss. 12 (Apr. 19, 2011)Whitehall & CompanyNo ratings yet

- S-Curve Talang Jimar Rev-8 (New)Document1 pageS-Curve Talang Jimar Rev-8 (New)wahyu hidayatNo ratings yet

- Official Score Report: Overall Assessment: B2 4.2Document3 pagesOfficial Score Report: Overall Assessment: B2 4.2saul garciaNo ratings yet

- IC Email Marketing Dashboard Template 8673Document7 pagesIC Email Marketing Dashboard Template 8673Haytham NasefNo ratings yet

- Grafik PKPDocument10 pagesGrafik PKPNIA KURNIASIHNo ratings yet

- Propuesta OVBK - V2Document3 pagesPropuesta OVBK - V2JUAN CAMILO GUZMANNo ratings yet

- The Data Strengthens Evidence That Vietnam Is A Potential Market For FMCGDocument3 pagesThe Data Strengthens Evidence That Vietnam Is A Potential Market For FMCGQuang Võ MinhNo ratings yet

- MITOTIC STAGE-WPS OfficeDocument5 pagesMITOTIC STAGE-WPS OfficeJomari Cruz LlanitaNo ratings yet

- IC Retail Analysis Dashboard1Document9 pagesIC Retail Analysis Dashboard1minhmaruNo ratings yet

- 26 08 2021-PoultryDocument14 pages26 08 2021-PoultryIgnacio López LazarenoNo ratings yet

- AP Resultados Estudio de Ejecución 06 16Document168 pagesAP Resultados Estudio de Ejecución 06 16Hercha ValNo ratings yet

- LeadershipDocument5 pagesLeadershipkaku009No ratings yet

- (배포) 23년 물류 시황 회고 및 24년 전망 231207 주요 Q A 포함Document26 pages(배포) 23년 물류 시황 회고 및 24년 전망 231207 주요 Q A 포함최장윤No ratings yet

- Interpolación 2Document4 pagesInterpolación 2Ronal RomeroNo ratings yet

- Profit RatesDocument3 pagesProfit Ratesshahidameen2No ratings yet

- IC Retail Analysis Dashboard1Document9 pagesIC Retail Analysis Dashboard1Samuel FLoresNo ratings yet

- Itep ResultsDocument3 pagesItep ResultsjocsanvkNo ratings yet

- Stock Screen: Riding The Momentum Value Play Yield Seeker Unloved PseiDocument7 pagesStock Screen: Riding The Momentum Value Play Yield Seeker Unloved PseiJM CrNo ratings yet

- Risk and Return Sdp-1: Er (%) Risk C 14.00% 6.00% S 8.00% 3.00%Document4 pagesRisk and Return Sdp-1: Er (%) Risk C 14.00% 6.00% S 8.00% 3.00%Urja ManderaNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Contract of Loan With MortgageDocument3 pagesContract of Loan With MortgageMikee PortesNo ratings yet

- What Is A Coupon BondDocument3 pagesWhat Is A Coupon BondNazrul IslamNo ratings yet

- Accounting Principles: The Recording ProcessDocument52 pagesAccounting Principles: The Recording ProcessPseu DoNo ratings yet

- Assignment of Management of Working Capital On Chore CommitteeDocument4 pagesAssignment of Management of Working Capital On Chore CommitteeShubhamNo ratings yet

- Friendly Loan AgreementDocument6 pagesFriendly Loan AgreementGeorge KimsinNo ratings yet

- Working Capital: Apl Apollo Tubes LTDDocument17 pagesWorking Capital: Apl Apollo Tubes LTDDhirajsharma123No ratings yet

- Insolvency and Bankruptcy CODE 2016 Regulatory Framework For Distressed M&As Under IBC 2016Document60 pagesInsolvency and Bankruptcy CODE 2016 Regulatory Framework For Distressed M&As Under IBC 2016IIM RohtakNo ratings yet

- Rev 4 - Review in AuditingDocument3 pagesRev 4 - Review in AuditingGenevieve VargasNo ratings yet

- Simple Interest StudentsDocument9 pagesSimple Interest Studentsjudy bernusNo ratings yet

- Company Accounts & Audit Intermediate-paper-12-RevisedDocument920 pagesCompany Accounts & Audit Intermediate-paper-12-Revisedsumit4up6r100% (2)

- Money, Power Wall StreetDocument2 pagesMoney, Power Wall StreetAdyotNo ratings yet

- General Math Las and Lectures 2nd QuarterDocument21 pagesGeneral Math Las and Lectures 2nd QuarterPaul Vincent JimenezNo ratings yet

- Learning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Document5 pagesLearning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Von Violo BuenavidesNo ratings yet

- Notes Payable and Bonds Payable - Quiz - With Answers - For PostingDocument8 pagesNotes Payable and Bonds Payable - Quiz - With Answers - For PostingWinny PoeNo ratings yet

- Debt Securitization by KrishnaDocument5 pagesDebt Securitization by Krishnaashokpani82No ratings yet

- Ch04 P35 Build A ModelDocument17 pagesCh04 P35 Build A ModelAbhishek Surana100% (2)

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- IAS 37 Provisions, Contingent Assets and Contingent LiabilitiesDocument73 pagesIAS 37 Provisions, Contingent Assets and Contingent LiabilitiesValeria PetrovNo ratings yet

- Séptimo Informe Sobre La Bancarrota Del Banco Del Orinoco N.VDocument10 pagesSéptimo Informe Sobre La Bancarrota Del Banco Del Orinoco N.VPresents 360No ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementAmolsKordeNo ratings yet

- Activity in Basic Accounting - Analysis of TransactionsDocument10 pagesActivity in Basic Accounting - Analysis of TransactionsKyleZapantaNo ratings yet

- Pari Passu Clause 2Document26 pagesPari Passu Clause 2Marina Evgenia KoroliNo ratings yet

- Personal Loan PDFDocument3 pagesPersonal Loan PDFbusiness loanNo ratings yet

- Corporate Law Ii: The Position and Power of Liquidator in Winding Up The CompanyDocument17 pagesCorporate Law Ii: The Position and Power of Liquidator in Winding Up The CompanyIshraque Zeya KhanNo ratings yet

- Midterm AnswersDocument7 pagesMidterm AnswersGabriel Adrian ObungenNo ratings yet

- Morgan Rizvi PDFDocument1 pageMorgan Rizvi PDFSuttonFakesNo ratings yet

- Final JV Sheet For Accruals Mar 16Document64 pagesFinal JV Sheet For Accruals Mar 16qasmi576No ratings yet

- Abo Royce Stephen Cfas Activities AnswersDocument37 pagesAbo Royce Stephen Cfas Activities Answerscj gamingNo ratings yet

- Annuities, Sinking Fund and Amortization Problems + SolutionsDocument11 pagesAnnuities, Sinking Fund and Amortization Problems + SolutionsAziza AbdullayevaNo ratings yet

- Term Paper of Financial Markets & InstitutionsDocument30 pagesTerm Paper of Financial Markets & InstitutionsFowziah Nahid Priya75% (4)