Professional Documents

Culture Documents

Lladoc Vs Cir

Uploaded by

Rea RomeroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lladoc Vs Cir

Uploaded by

Rea RomeroCopyright:

Available Formats

Rev. Fr.

Casimiro Lladoc vs The Comissioner of Internal Revenue

G.R. No. L-19201, 16 June 1965, EN BANC, (Paredes, J.)

Facts:

M.B. Estate, Inc., of Bacolod City, donated P10,000.00 in cash to Rev. Fr. Crispin Ruiz, then

parish priest of Victorias, Negros Occidental, and predecessor of herein petitioner, for the

construction of a new Catholic Church in the locality. The total amount was actually spent for the

purpose intended. The donor M.B. Estate, Inc., filed the donor's gift tax return. Under date of

April 29, 1960, the respondent Commissioner of Internal Revenue issued an assessment for

donee's gift tax against the Catholic Parish of Victorias of which petitioner was the priest. The

tax amounted to P1,370.00 including surcharges.

Petitioner lodged a protest to the assessment and requested the withdrawal thereof. The protest

and the motion for reconsideration presented to the Commissioner of Internal Revenue were

denied. The petitioner appealed to the Court of Tax Appeals.

In the petition for review, the Rev. Fr. Casimiro Lladoc claimed, among others, that at the time of

the donation, he was not the parish priest in Victorias; that there is no legal entity or juridical

person known as the "Catholic Parish Priest of Victorias," and, therefore, he should not be liable

for the donee's gift tax. It was also asserted that the assessment of the gift tax, even against the

Roman Catholic Church, would not be valid, for such would be a clear violation of the provisions

of the Constitution.

The CTA decided in favor of the respondent CIR.

Issue: 1. Whether or not Church is exempted from paying the donor’s taxes? (No)

2. Whether or not petitioner should be liable for the assessed donee's gift tax on the P10,000.00

donated for the construction of the Victorias Parish Church? (No)

Held:

1st Issue:

Section 22 (3), Art. VI of the Constitution of the Philippines, exempts from taxation cemeteries,

churches and parsonages or convents, appurtenant thereto, and all lands, buildings, and

improvements used exclusively for religious purposes. The exemption is only from the payment

of taxes assessed on such properties enumerated, as property taxes, as contra distinguished

from excise taxes. In the present case, what the Collector assessed was a donee's gift tax; the

assessment was not on the properties themselves. It did not rest upon general ownership; it

was an excise upon the use made of the properties, upon the exercise of the privilege of

receiving the properties. Manifestly, gift tax is not within the exempting provisions of the section

just mentioned. A gift tax is not a property tax, but an excise tax imposed on the transfer of

property by way of gift inter vivos, the imposition of which on property used exclusively for

religious purposes, does not constitute an impairment of the Constitution.

2nd Issue: Petitioner herein is not personally liable for the said gift tax, and that the Head of the

Diocese, herein substitute petitioner, should pay, as he is presently ordered to pay, the said gift

tax, without special, pronouncement as to costs.

You might also like

- Your Serene Air Receipt - ZFZQU8Document3 pagesYour Serene Air Receipt - ZFZQU8Farrukh Jamil0% (1)

- Eisner Vs Macomber 3Document2 pagesEisner Vs Macomber 3JVLNo ratings yet

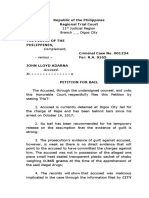

- Petition For Bail John LloydDocument3 pagesPetition For Bail John LloydRea RomeroNo ratings yet

- T MobileDocument1 pageT MobileMelissa AnneNo ratings yet

- Manila Memorial Park, Inc v. Secretary of DSWD, 711 Scra 302Document1 pageManila Memorial Park, Inc v. Secretary of DSWD, 711 Scra 302Mary Louis SeñoresNo ratings yet

- Cir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Document2 pagesCir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Crisbon ApalisNo ratings yet

- Planters Products, Inc. vs. Fertiphil CorporationDocument40 pagesPlanters Products, Inc. vs. Fertiphil CorporationMp CasNo ratings yet

- Lutz v. AranetaDocument3 pagesLutz v. AranetaPatricia GonzagaNo ratings yet

- Abra Valley College Vs AquinoDocument2 pagesAbra Valley College Vs AquinoMike Llamas100% (1)

- 17 Com. of Customs v. CTA & Campos Rueda Co.Document1 page17 Com. of Customs v. CTA & Campos Rueda Co.Gain DeeNo ratings yet

- Razon vs. TagitisDocument9 pagesRazon vs. TagitisempuyNo ratings yet

- Digest American Bible Society Vs City of Manila DigestDocument2 pagesDigest American Bible Society Vs City of Manila DigestHonorio Bartholomew Chan100% (3)

- Case Digest TaxDocument75 pagesCase Digest TaxIrish MartinezNo ratings yet

- CIR Vs CADocument1 pageCIR Vs CAJazem AnsamaNo ratings yet

- Southern Luzon Drug Corp. vs. DSWD, Et. Al., en Banc, GRN 199669, Apr 25, 2017Document2 pagesSouthern Luzon Drug Corp. vs. DSWD, Et. Al., en Banc, GRN 199669, Apr 25, 2017Amity Rose RiveroNo ratings yet

- Lung Center Vs QCDocument3 pagesLung Center Vs QCRose AnnNo ratings yet

- Lung Center of The Phil. vs. Quezon City, Et Al., G.R. No. 144104, June 29, 2004Document4 pagesLung Center of The Phil. vs. Quezon City, Et Al., G.R. No. 144104, June 29, 2004xxxaaxxx100% (1)

- Pagcor Vs BirDocument2 pagesPagcor Vs BirMarie ChieloNo ratings yet

- Ang Ladlad v. ComelecDocument4 pagesAng Ladlad v. ComelecSean GalvezNo ratings yet

- Tax2CaseDigest AbualasFatDocument29 pagesTax2CaseDigest AbualasFatLibra SunNo ratings yet

- Swedish Match V Treasurer of The City of ManilaDocument1 pageSwedish Match V Treasurer of The City of ManilaZoe VelascoNo ratings yet

- Title: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncDocument3 pagesTitle: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncKim GuevarraNo ratings yet

- Drugstores Association of The Phil Vs NCDADocument3 pagesDrugstores Association of The Phil Vs NCDAKim FernándezNo ratings yet

- Republic vs. Patanao (GR No. L-22356, July 21, 1967)Document3 pagesRepublic vs. Patanao (GR No. L-22356, July 21, 1967)anaNo ratings yet

- Ormoc Sugar Co., Inc. vs. Treasurer of Ormoc City, 22 SCRA 603, February 17, 1968Document6 pagesOrmoc Sugar Co., Inc. vs. Treasurer of Ormoc City, 22 SCRA 603, February 17, 1968milkteaNo ratings yet

- 170 CIR v. Burmeister & Wain Scandinavian Contractor Mindanao, Inc.Document4 pages170 CIR v. Burmeister & Wain Scandinavian Contractor Mindanao, Inc.earlanthonyNo ratings yet

- Abra Valley College V AquinoDocument9 pagesAbra Valley College V AquinoMaria Margaret MacasaetNo ratings yet

- Political Law DigestDocument95 pagesPolitical Law DigestAnonymous IobsjUatNo ratings yet

- 1 - MANILA GAS vs. CIR - PabloDocument2 pages1 - MANILA GAS vs. CIR - PabloCherith MonteroNo ratings yet

- Lutz Vs AranetaDocument1 pageLutz Vs AranetaLizzy WayNo ratings yet

- 11 Cabal v. KapunanDocument1 page11 Cabal v. KapunanloschudentNo ratings yet

- Tatad Vs SandiganbayanDocument2 pagesTatad Vs SandiganbayanJoanne PBNo ratings yet

- Serrano Vs GallantDocument3 pagesSerrano Vs GallantAgnesNo ratings yet

- Gaston vs. Republic PlantersDocument1 pageGaston vs. Republic PlantersAlyanna BarreNo ratings yet

- 607 Abella Vs NLRCDocument2 pages607 Abella Vs NLRCJulius ManaloNo ratings yet

- Tio Vs Videogram CasedigestDocument2 pagesTio Vs Videogram CasedigestAaron BurkeNo ratings yet

- C23 Eslaban v. de Onorio, GR 146062, 28 June 2001Document1 pageC23 Eslaban v. de Onorio, GR 146062, 28 June 2001Hanna Mari Carmela Flores100% (1)

- Cir Vs Estate of Benigno TodaDocument2 pagesCir Vs Estate of Benigno TodaHarvey Leo RomanoNo ratings yet

- Cir VS PLDTDocument1 pageCir VS PLDTKling KingNo ratings yet

- US vs. BustosDocument1 pageUS vs. BustosPauline DgmNo ratings yet

- 57-CIR v. Isabela Cultural Corp. G.R. No. 172231 February 12, 2007Document5 pages57-CIR v. Isabela Cultural Corp. G.R. No. 172231 February 12, 2007Jopan SJNo ratings yet

- G.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, Petitioner, ALGUE, INC., and THE COURT OF TAX APPEALS, RespondentsDocument1 pageG.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, Petitioner, ALGUE, INC., and THE COURT OF TAX APPEALS, RespondentsJon SantosNo ratings yet

- 63 - Yrasegui v. PALDocument3 pages63 - Yrasegui v. PALRoger Pascual CuaresmaNo ratings yet

- Bishop of Nueva Segovia vs. Provincial Board of Ilocos NorteDocument1 pageBishop of Nueva Segovia vs. Provincial Board of Ilocos NorteJunelyn T. EllaNo ratings yet

- Taxicab Operators Vs Board of Transpo (DIGEST)Document1 pageTaxicab Operators Vs Board of Transpo (DIGEST)Hannah Tolentino-Domantay100% (2)

- In Re Habeas Corpus of Datukan Malang Salibo DigestDocument2 pagesIn Re Habeas Corpus of Datukan Malang Salibo DigestKling KingNo ratings yet

- American Bible Society vs. City of Manila (Religious Freedom)Document2 pagesAmerican Bible Society vs. City of Manila (Religious Freedom)Earl LarroderNo ratings yet

- Philippine Press Institute v. COMELEC, GR 119694, 1994Document11 pagesPhilippine Press Institute v. COMELEC, GR 119694, 1994Christia Sandee SuanNo ratings yet

- TAN Vs DEL ROSARIODocument2 pagesTAN Vs DEL ROSARIOMark Leo Bejemino100% (1)

- Carlos Superdrug Corp Vs DSWDDocument3 pagesCarlos Superdrug Corp Vs DSWDSoah JungNo ratings yet

- Ang Tibay V CIRDocument7 pagesAng Tibay V CIRMae Alvie VillahermosaNo ratings yet

- Tan vs. Del Rosario (1994) - GR No. 10199289Document1 pageTan vs. Del Rosario (1994) - GR No. 10199289delayinggratificationNo ratings yet

- Philex Mining Corp v. CIRDocument2 pagesPhilex Mining Corp v. CIRautumn moon100% (1)

- ABS-CBN Broadcasting Corp Vs Comelec - 133486 - January 28, 2000 - JDocument8 pagesABS-CBN Broadcasting Corp Vs Comelec - 133486 - January 28, 2000 - JulticonNo ratings yet

- Deutsche Bank AG Manila Branch Versus Commissioner of Internal RevenueDocument1 pageDeutsche Bank AG Manila Branch Versus Commissioner of Internal RevenueCheng AyaNo ratings yet

- Maceda Vs MacaraigDocument1 pageMaceda Vs Macaraigerica peji100% (1)

- Dumlao Vs Comelec DigestDocument1 pageDumlao Vs Comelec DigestCecille Garces-SongcuanNo ratings yet

- Francisco vs. FernandoDocument1 pageFrancisco vs. FernandoMilcah MagpantayNo ratings yet

- 1259 Gov't of USA v. Hon. Purganan LoyolaDocument3 pages1259 Gov't of USA v. Hon. Purganan LoyolaJuan Samuel IsmaelNo ratings yet

- Punzalan vs. Municipal Board of ManilaDocument1 pagePunzalan vs. Municipal Board of Manilathornapple25No ratings yet

- Tan vs. Del Rosario 237 SCRA 324Document1 pageTan vs. Del Rosario 237 SCRA 324Jon SantosNo ratings yet

- Lladoc Vs CIRDocument2 pagesLladoc Vs CIRBryne Angelo BrillantesNo ratings yet

- Lladoc vs. CommissionerDocument3 pagesLladoc vs. CommissionerJanMarkMontedeRamosWongNo ratings yet

- Corpus Vs Sto Tomas GDocument2 pagesCorpus Vs Sto Tomas GRea RomeroNo ratings yet

- Tunay Na Pagkakaisa NG Manggagawa Sa Asia BreweryDocument3 pagesTunay Na Pagkakaisa NG Manggagawa Sa Asia BreweryRea RomeroNo ratings yet

- Gil Puyat Vs Ron Zabarte GDocument3 pagesGil Puyat Vs Ron Zabarte GRea RomeroNo ratings yet

- Cena and Rabor CaseDocument8 pagesCena and Rabor CaseRea RomeroNo ratings yet

- Tang Ho Vs The Board of Tax AppealsDocument2 pagesTang Ho Vs The Board of Tax AppealsRea RomeroNo ratings yet

- Saligumba Vs PalanogDocument2 pagesSaligumba Vs PalanogRea RomeroNo ratings yet

- Request For Assistance Relative To Special ProceedDocument1 pageRequest For Assistance Relative To Special ProceedRea RomeroNo ratings yet

- Case Digest 3 AgencyDocument4 pagesCase Digest 3 AgencyRea RomeroNo ratings yet

- Saligumba Vs PalanogDocument2 pagesSaligumba Vs PalanogRea RomeroNo ratings yet

- Rivera Vs RamirezDocument2 pagesRivera Vs RamirezRea RomeroNo ratings yet

- Union Bank of The Philippines Vs AriolaDocument2 pagesUnion Bank of The Philippines Vs AriolaRea RomeroNo ratings yet

- Silverio Vs CA and SilverioDocument1 pageSilverio Vs CA and SilverioRea RomeroNo ratings yet

- Lopez Vs OlbesDocument1 pageLopez Vs OlbesRea RomeroNo ratings yet

- Pahamotang Vs PNBDocument2 pagesPahamotang Vs PNBRea RomeroNo ratings yet

- Heirs of Maglasang Vs Manila Banking CorpDocument2 pagesHeirs of Maglasang Vs Manila Banking CorpRea Romero100% (1)

- Visayan Cebu Terminal Vs CIRDocument2 pagesVisayan Cebu Terminal Vs CIRRea RomeroNo ratings yet

- 20140107-Retirement Options Sample Computation PDFDocument11 pages20140107-Retirement Options Sample Computation PDFRea Romero100% (1)

- El Oriente Vs Posadas and CirDocument2 pagesEl Oriente Vs Posadas and CirRea RomeroNo ratings yet

- Calendar 2018 Blog Landscape Part 1Document9 pagesCalendar 2018 Blog Landscape Part 1Rea RomeroNo ratings yet

- Sux Til BaltazarDocument17 pagesSux Til BaltazarRea RomeroNo ratings yet

- ElliCalendar2017 FinalDocument12 pagesElliCalendar2017 FinalRea RomeroNo ratings yet

- Course Outline MidtermsDocument9 pagesCourse Outline MidtermsRea RomeroNo ratings yet

- Financial Analysis of ASTRO Malaysia Holdings Berhad: November 2019Document17 pagesFinancial Analysis of ASTRO Malaysia Holdings Berhad: November 2019Ahmad AimanNo ratings yet

- A CASE STUDY OF EVEREST BANK LIMITED Mbs ThesisDocument74 pagesA CASE STUDY OF EVEREST BANK LIMITED Mbs Thesisशिवम कर्ण100% (1)

- Elliott Wave: Fact or Fiction?: by F. David MinbashianDocument5 pagesElliott Wave: Fact or Fiction?: by F. David Minbashianapi-19771937No ratings yet

- L03-DLP-Financial InsitutionDocument4 pagesL03-DLP-Financial InsitutionKim Mei HuiNo ratings yet

- Fintechresearchreport 181002173055Document6 pagesFintechresearchreport 181002173055Seth KlarmanNo ratings yet

- RCA Study - Wilbur Smith Traffic & Revenue Forecasts - 012712Document103 pagesRCA Study - Wilbur Smith Traffic & Revenue Forecasts - 012712Terry MaynardNo ratings yet

- Reading Gaps in Charts PDFDocument11 pagesReading Gaps in Charts PDFkalelenikhlNo ratings yet

- AVT Natural Products-R-26032018 PDFDocument7 pagesAVT Natural Products-R-26032018 PDFBoss BabyNo ratings yet

- Internship Offer LetterDocument1 pageInternship Offer LetterChujja ChuNo ratings yet

- Historical Development of AccountingDocument25 pagesHistorical Development of AccountingstrifehartNo ratings yet

- 4 Managing Debts Effectively PDFDocument48 pages4 Managing Debts Effectively PDFLawrence CezarNo ratings yet

- SwiggyDocument9 pagesSwiggyEsha PandyaNo ratings yet

- Questionnaire Costs of Logistics in EnterprisesDocument3 pagesQuestionnaire Costs of Logistics in EnterprisesLeontin LeonNo ratings yet

- 10 Administrative DecentralisationDocument16 pages10 Administrative DecentralisationAlia Al ZghoulNo ratings yet

- Final Exam Cfas WoDocument11 pagesFinal Exam Cfas WoAndrei GoNo ratings yet

- Iip FinalDocument57 pagesIip FinalNagireddy KalluriNo ratings yet

- Working Capital NikunjDocument82 pagesWorking Capital Nikunjpatoliyanikunj002No ratings yet

- Coating OverheadsDocument162 pagesCoating Overheadsanon_672065362No ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Let MathDocument6 pagesLet MathJanin R. CosidoNo ratings yet

- Case - A Survey of Capital Budgeting Techniques by US FirmsDocument8 pagesCase - A Survey of Capital Budgeting Techniques by US FirmsYatin PushkarnaNo ratings yet

- Credit Risk Analysis of Rupali Bank LimitedDocument105 pagesCredit Risk Analysis of Rupali Bank Limitedkhansha ComputersNo ratings yet

- What Is BudgetDocument4 pagesWhat Is BudgetDhanvanthNo ratings yet

- Name: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Document4 pagesName: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Eigha apriliaNo ratings yet

- Departmental Directory IncometaxDocument362 pagesDepartmental Directory IncometaxShubham SinuNo ratings yet

- Mutual Fund:: Asset Management CompanyDocument43 pagesMutual Fund:: Asset Management CompanymalaynvNo ratings yet

- Lydia Sumipat v. Brigido BangaDocument2 pagesLydia Sumipat v. Brigido BangaRosanne SoliteNo ratings yet

- Invoice DMXDocument1 pageInvoice DMXNurhadi HadinataNo ratings yet