Professional Documents

Culture Documents

Maq Spring04 Calccostofcapital PDF

Uploaded by

Shoaib ShaikhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maq Spring04 Calccostofcapital PDF

Uploaded by

Shoaib ShaikhCopyright:

Available Formats

Calculating a Firm’s

VOL.5 NO.3

Spring

2004

Cost of Capital

B Y M I C H A E L S . PA G A N O , P H . D . , C FA , AND D AV I D E . S T O U T, P H . D .

THREE DIFFERENT METHODS OF DETERMINING THE WEIGHTED AVERAGE COST OF CAPITAL

FOR MICROSOFT AND GENERAL ELECTRIC PRODUCE DIFFERENT RESULTS FOR EACH FIRM.

THUS, CAREFUL JUDGMENT AND SENSITIVITY ANALYSIS ARE IMPORTANT COMPONENTS

FOR DEVELOPING RELIABLE COST OF CAPITAL ESTIMATES.

he idea of the “cost of capital” is fundamen- various assumptions and practical choices. Conventional

T tal to what managerial finance and account-

ing professionals do, directly or indirectly, as

part of their participation on cross-functional

decision teams. They need to understand

and apply techniques for estimating the cost of capital

for long-term capital budgeting; merger and acquisition

analysis; use of Economic Value Added (EVA®) as a

methods for estimating WACC, therefore, can yield

substantially different approximations depending on

the assumptions used in estimating Ks, so good judg-

ment and sensitivity analysis are required when

attempting to estimate a firm’s cost of capital for appli-

cations in accounting and finance.

firm-wide financial performance indicator; incentive THEORETICAL FRAMEWORK

systems for financial control, using residual income for Conceptually, a firm’s cost of capital is an investor’s

evaluating financial performance; equity valuation opportunity cost of investing his or her capital in that

analyses; and accounting for purchased goodwill.1 firm. An estimate of the firm’s WACC is an attempt to

Here we offer readers an overview of theoretical and quantify the average return expected by all investors in

empirical issues involved in estimating a firm’s weight- the firm: creditors of short-term and long-term interest-

ed average cost of capital (WACC), and we review and bearing debt, preferred stockholders, and common

apply several methods for estimating WACC for two stockholders.2 The firm’s cost of capital is a weighted

widely held U.S. firms: General Electric (GE) and average where the weights are determined by the value

Microsoft. The most difficult to estimate component of of the various sources of capital.3

a firm’s WACC relates to the cost of equity capital (Ks), In Equation 1 we show the conventional formula

a process complicated in practice by the need to make for estimating a firm’s WACC.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 13 SPRING 2004, VOL. 5, NO. 3

E Q UAT I O N 1

N

consistent set of return estimates. The standard CAPM

WACC = ∑ wi • Ki method says the required return on a risky asset such as

i=1

common stock is related linearly to a nondiversifiable

where, risk, otherwise known as “systematic” risk. Systematic

wi = the weight of the i-th source of capital (i = 1, …, N) risk is the riskiness of the “market portfolio” of all risky

based on that source’s aggregate market value in rela- marketable assets. This relationship can be summarized

tion to the firm’s total value, concisely, as shown in Equation 3.

∑i wi = 1, and

Ki = the expected return on the i-th security. E Q UAT I O N 3

Ki = Krf + ßi (Km - Krf )

The portion to the right of the equal sign in Equation 1 where,

can be rewritten in a simplified equation when there are Krf = the expected return on a riskless security;

only two sources of capital: long-term interest-bearing Km = the expected return on the systematic risk factor,

debt and (common) equity, as shown in Equation 2. i.e., the market portfolio’s return, which is represented

by the return on a large equity portfolio such as the

E Q UAT I O N 2 S&P 500; and

WACC = wdKd(1 -T ) = wsKs ßi = beta = a measure of the i-th security’s sensitivity to

where, the systematic risk factor.

Kd is the expected cost of long-term debt,

T is the firm’s marginal income tax rate (combined fed- A firm’s beta can be estimated from a regression

eral and state), using historical data for the returns on the stock (Ks)

Ks is the expected cost of common stock, and and a market portfolio proxy (Km). Typically, monthly

wd and ws are the weights of long-term debt and com- returns data are used when estimating this regression.

mon stock in the firm’s capital structure.4 Note that this This CAPM beta will be biased when estimating a for-

could be either its target or self-professed optimal capi- ward-looking cost of equity capital. A forward-looking

tal structure.5 estimate for Ks is important for our analysis because the

CAPM (as well as the APM) assumes that investors

When determining the weights of debt and equity, base their investment decisions on expected returns on

we use their market values rather than book values all marketable securities. In deriving their published

because market values are more reflective of the true estimates of corporate betas, brokerage and analytical

worth of the company. firms such as Merrill Lynch, Bloomberg, and Value Line

There are two models that can be used to estimate have used Marshall Blume’s idea to reduce the bias in

Ks: (1) a single-factor model called the Capital Asset the estimated beta and, in theory, improve one’s ability

Pricing Model (CAPM) and (2) a multiple-factor model to develop forward-looking return estimates.7 Value

called the Arbitrage Pricing Model (APM).6 Next, we Line’s adjustment technique is relatively simple, as

briefly outline these models below and a third model, shown in Equation 4.

the “bond yield plus risk premium model,” that finan-

cial analysts frequently use. E Q UAT I O N 4

ß̂i = 0.35 + 0.67 ßi

E S T I M AT I N G THE COST OF EQUITY WITH where,

CA P M ßi = beta estimated via Equation 3 using historical

To calculate Equation 2, we need a means of estimating time-series data and

the required returns (Ki) for each component of the ß̂i = an adjusted beta to account for the mean-reversion

firm’s capital structure. An asset-pricing model such as bias in the estimated beta.

the CAPM can provide a convenient and theoretically Estimating the other two key components of Equa-

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 14 SPRING 2004, VOL. 5, NO. 3

tion 3, the risk-free rate (Krf) and the market risk premi- THE “BOND YIELD PLUS RISK PREMIUM”

um (Km – Krf), also requires the analyst’s judgment.8 METHOD

Since the advent of the CAPM in the 1960s to The other technique for estimating Ks is the “Bond

explain the pricing of assets, there have been numer- Yield Plus Risk Premium” (BY+P). The BY+P method

ous theoretical and empirical developments in asset is popular among some practitioners (most notably

pricing. In particular, CAPM’s single-factor relation multibillionaire investor Warren Buffett) because of its

described by Equation 3 can be generalized to accom- simplicity and limited number of assumptions. The

modate multiple systematic risk factors using logic BY+P method is essentially an ad hoc empirical relation

based on the concept of “financial arbitrage.” This with no solid theoretical justification. Yet there appears

newer approach, called the Arbitrage Pricing Model to be some empirical validity in the notion that the

(APM), explicitly incorporates risk factors beyond the return on a company’s stock can be estimated by taking

market portfolio factor, but the APM does not spell out the firm’s bond yield-to-maturity (YTM) and adding a

what those extra factors should be, so researchers have fixed risk premium to this yield. So, for example, a firm

been forced to rely on extensive empirical testing of with a current bond YTM of 7% would lead to an esti-

numerous macroeconomic and financial variables to mated Ks of 10% once a fixed 3% risk premium is added

find additional factors that might improve the explana- to the YTM.12 Although there is no theoretical reason

tory power of the CAPM.9 S. David Young and for adding a 3% premium, it appears that this relation is

Stephen F. O’Bryne suggest using growth rates of real just as good or better for many stocks than using a for-

GDP and inflation, as well as interest rates, as addition- mal model such as the CAPM.

al factors in estimating Ks.10

Other researchers have popularized the use of a three- C A L C U L AT I N G G E AND MICROSOFT’S

factor model consisting of: (1) the “excess return,” or WAC C

risk premium, for the market portfolio (Km – Krf from Let’s see how Equations 1 through 4 can be used to

Equation 3); (2) the return on a portfolio that represents estimate a firm’s WACC. Our analysis uses 60 months of

the difference between the returns on a group of small recent stock return data from the Center for Research

capitalization stocks and the returns on a group of large in Security Prices’ (CRSP) database for all common

capitalization stocks (referred to as a “Small Minus Big” stocks.13 We computed excess market returns (“market

portfolio, or an “SMB” factor, which is related to the size risk premiums”) by subtracting the return on one-

of the company); and (3) the return on a portfolio that month U.S. T-bills from the market portfolio returns.

represents the difference between the returns on a For the market portfolio factor, we used the monthly

group of stocks with high market-to-book equity ratios return on the CRSP Value-Weighted Stock Index.14 In

and the returns on a group of stocks with low market-to- addition to the above data, we also collected financial

book equity ratios (referred to as a “High Minus Low” variables to estimate Eugene F. Fama and Kenneth

portfolio, or an “HML” factor, which is related to the French’s three-factor model, the APM.15

relative valuation of the company).11 In total, therefore, we use three models to derive our

These two extensions of the CAPM are based on WACC estimates for GE and Microsoft: (1) the adjust-

observed empirical relations and do not have a con- ed-beta CAPM, (2) the APM, and (3) the Bond Yield

vincing theoretical justification for the additional fac- Plus Risk Premium approach.

tors. This has led many practitioners to stay with the

more widely accepted and simpler CAPM approach. COST OF EQUITY

Yet there are advantages to using the APM, most In Table 1, we estimate the cost of equity capital, Ks,

notably the fact that it usually leads to greater explana- using the adjusted-beta CAPM approach and employ-

tory power of real-world stock returns when compared ing several different assumptions about the appropriate

to the CAPM. market risk premium (Km – Krf ) and the relevant risk-

free rate (Krf ).

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 15 SPRING 2004, VOL. 5, NO. 3

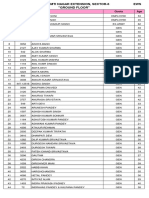

Table 1: Microsoft’s and GE’s Cost of Equity Capital

(Using the Adjusted-Beta Capital Asset Pricing Model)

Microsoft: Market Risk Premium Assumption

Risk-Free Rate Adjusted Beta 2% 4% 6% Average

1-month Rate (1%) 1.48 4.0% 6.9% 9.9% 6.9%

5-year Rate (4%) 1.48 7.0% 9.9% 12.9% 9.9%

10-year Rate (5%) 1.48 8.0% 10.9% 13.9% 10.9%

Average 6.3% 9.3% 12.2% 9.3%

General Electric: Market Risk Premium Assumption

Risk-Free Rate Adjusted Beta 2% 4% 6% Average

1-month Rate (1%) 1.08 3.2% 5.3% 7.5% 5.3%

5-year Rate (4%) 1.08 6.2% 8.3% 10.5% 8.3%

10-year Rate (5%) 1.08 7.2% 9.3% 11.5% 9.3%

Average 5.5% 7.7% 9.8% 7.7%

There is considerable debate about the appropriate many situations where uncertainty exists, the analyst

forward-looking U.S. market risk premium to use for must rely on his or her best judgment and also perform

capital budgeting, investment planning, and other sensitivity analyses to help quantify the impact of dif-

financial decisions. Financial economists Robert Shiller ferent assumptions on the output of whatever decision

and Roger Ibbotson examined the same set of historical model is being used.

data to determine current expectations for the market Table 1 presents some possible alternative combina-

risk premium, and they both came up with different tions of assumptions related to an analyst’s choice of

answers.16 One suggests that the market risk premium market risk premium and risk-free rate. We use three

in the U.S. is no more than 2% per annum while the sets of estimates for the risk-free rate (i.e., the approxi-

other expects an average of 4% for the market risk pre- mate levels of the one-month, five-year, and 10-year

mium as we progress in the early 21st century. Indeed, U.S. Treasury securities) and three different expected

both of these figures are lower than the historical aver- market risk premiums (based on the two TIAA-CREF

age U.S. risk premium of 6% to 8% that academic analysts’ estimates and a higher estimate of 6% based

researchers have calculated and reported. on historical experience). As can be seen from the

There also is no consensus about which maturity of results of using just one asset-pricing model (the adjust-

U.S. Treasury securities is appropriate for estimating a ed-beta CAPM), a firm’s estimated Ks can vary substan-

risk-free rate, Krf, within the CAPM framework.17 For tially. For example, Microsoft’s estimated cost of equity

example, finance textbooks typically use the yield on a can vary from a low of 4.0% to a maximum of 13.9%

short-term U.S. Treasury security such as a one-month, depending on the particular combination of risk-free

three-month, or one-year T-bill, while many corporate rate and expected market risk premium. Likewise,

practitioners use yields on longer-term instruments, GE’s estimated cost of equity also varies considerably,

such as five- or 10-year Treasury notes, in order to although less than Microsoft’s because of GE’s lower

match more closely the time horizon associated with adjusted-beta estimate of 1.08 versus Microsoft’s 1.48.

long-term investment projects.18 Using the APM approach, one can simply repeat the

So, which estimates should be used? As is typical in steps for the CAPM except that the regression now

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 16 SPRING 2004, VOL. 5, NO. 3

contains multiple variables—the returns on the market, bank loans and private placements of long-term debt.19

SMB, and HML portfolios—to estimate the regression Thus, it is common for analysts to use book values for

model’s parameters. Then, as in the CAPM results the short-term and long-term debt in the capital struc-

reported in Table 1, the expected returns on these ture while also using market values for the firm’s com-

three portfolios are multiplied by their respective mon equity—assuming the firm is publicly traded. If

regression parameter estimates and summed to obtain the firm is privately held, then an analyst must also

an APM-based estimate of the firm’s Ks. We followed decide whether to use the book value of equity for cal-

this procedure using five years of monthly data and culating the weights in the firm’s capital structure or

then used a five-year average of the three portfolios’ create a separate estimate of the market value of the

returns as our estimate of these variables’ expected firm’s equity using, for example, a DCF (Discounted

returns. The Ks estimates derived from our APM-based Cash Flow) valuation model. If the latter approach is

analysis are reported in Table 2. used, then a cost of equity capital must be estimated

Now, using the BY+P approach, we simply use an before the DCF equity valuation can be developed. In

estimate of the expected return on the firm’s long-term turn, this DCF estimate of the firm’s equity value can

bonds and add a fixed 3% risk premium to estimate a be used to develop the relevant weights of debt and

firm’s Ks. Similar to the APM estimates, we report the equity in the firm’s capital structure. Once again, the

BY+P’s estimates of the firms’ Ks in Table 2. way in which we estimate the value of equity of a pri-

vately held firm illustrates that calculating a firm’s

COST OF DEBT AND C A P I TA L S T R U C T U R E S WACC is both art and science.

After estimating the cost of equity capital, Ks, we can Now we have an estimate of the firm’s capital struc-

proceed to estimating the other components of GE’s ture and can turn to the final step in estimating GE’s

and Microsoft’s WACC. For most firms, this entails esti- and Microsoft’s WACC: estimating the after-tax cost of

mating the after-tax cost of (interest-bearing) debt and debt (referred to as Kd (1-T) in Equation 2). It is typi-

debt’s relative weight within the capital structure. Some cally accomplished by either (1) looking up the current

firms such as Microsoft, however, have no debt (or even yield-to-maturity (YTM) of a representative sample of

preferred stock) in their capital structure. So estimating publicly traded corporate bonds that are judged to be of

Microsoft’s WACC is simplified greatly because we only equivalent credit risk to the firm or (2) using the cur-

need its cost of equity capital. In fact, for an “all- rent YTMs of the firm’s outstanding bonds or bank

equity” firm (a company with no debt or preferred loans.

stock), the firm’s WACC is equal to its cost of equity To obtain data for the latter approach, an analyst can

(Ks). To see this, review Equation 2 and note that turn to the firm’s latest 10-K report, checking the foot-

ws = 1.0 when the firm has only equity in its capital note about the firm’s indebtedness. Here the firm will

structure. In this case, wd = 0; therefore, Equation 2 typically report its weighted-average interest rate on its

simplifies to WACC = Ks. Thus, for Microsoft, we can long-term debt (including publicly and privately held

stop here because estimates of Kd are not needed. bonds, bank loans, mortgages, etc.). For the former

For most companies, however, the capital structure approach, the analyst can look at the market-based

does include at least some form of short-term and/or YTM of the firm’s bonds (or bonds of other companies

long-term interest-bearing debt. For them, we must with similar bond ratings and debt maturities) if the

estimate an after-tax cost of debt as well as debt’s bonds are publicly traded and if Moody’s or Standard &

weight within the capital structure. As noted earlier, Poor’s has rated the firm’s debt.

market values of debt and common equity are preferred Our two stocks (as of this writing) have strong bond

over book values because market values are more ratings (AAA for GE and AA for Microsoft). Thus, we

reflective of the true worth of the company. Yet the can use a current estimate of the Moody’s Industrial

market value of a firm’s debt can be difficult to obtain, average YTM for long-term corporate bonds rated AAA

especially if the firm has privately issued debt such as for GE, which is 6.63%. We do not need to estimate Kd

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 17 SPRING 2004, VOL. 5, NO. 3

for Microsoft’s after-tax cost of debt because the compa-

ny does not have any. But, for completeness, we also

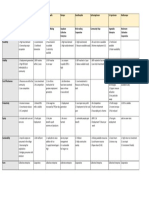

Table 2: Three Approaches to

include in Table 2 the YTM for AA Industrial bonds of Estimating Microsoft’s and GE’s

6.83% for Microsoft.20 As for the tax rate, T, we used an

Cost of Capital

effective marginal tax rate of 40% for both firms to sim-

plify our task. In practice, an analyst can examine the Cost of Capital Components Microsoft GE

firm’s tax situation in more detail by accounting for tax Weight of Debt (wd) 0.000 0.434

loss carry forwards and other tax-related items to com- Weight of Equity (ws) 1.000 0.566

pute a more precise marginal tax rate. After-Tax Cost of Debt: Kd (1 - T) 4.10% 3.98%

Ks using Average Adjusted CAPM 9.26% 7.65%

R E S U LT S Ks using APM 8.32% 12.06%

Table 2 reports a column for each firm in our analysis. Ks using Bond Yield + Risk Premium 9.83% 9.63%

The first three rows of the table present the capital

structure (i.e., weights) and the after-tax cost of (long- Weighted Average Cost of Capital

term) debt estimates for each firm. The next three WACC using Adjusted-Beta CAPM 9.26% 6.06%

rows report the cost-of-equity estimates for each of our WACC using APM 8.32% 8.55%

three models. For the adjusted-beta CAPM estimates, WACC using Bond Yield + Risk Premium 9.83% 7.18%

we used the overall average Ks figure from Table 1

(9.3% for Microsoft and 7.7% for GE). We can view

these estimates as ones based on an average market risk ranges from 6.06% (using the adjusted-beta CAPM) to

premium of 4% and an average risk-free rate of 3.33% 8.55% (based on the APM). Microsoft’s estimates are

(obtained by averaging the one-month, five-year, and less dispersed than GE’s but also display a sizable range

10-year Treasury yields from Table 1). As shown of 1.5 percentage points (from a low of 8.32% to a high

in Table 2, there are sizable differences in the Ks esti- of 9.83%). In general, deviations similar to the magni-

mates across the three models. For GE, the Ks estimates tude reported in Table 2 (if not greater) are commonly

range from 7.65% (for the adjusted-beta CAPM approach) found when applying the theory of cost-of-capital esti-

to 12.06% (for the APM approach). mation to real-world companies.

Each method of estimating a company’s weighted

average cost of capital yields significant variation. It VA R I A B I L I T Y IN WAC C E S T I M AT E S

should also be noted that the APM estimates are based With such large variations in estimates of companies’

on regression models that appear to describe real-world WACC, an analyst must exercise judgment when select-

stock returns more accurately than the CAPM’s regres- ing a final estimate of the firm’s weighted average cost

sion results. For example, GE’s adjusted R2 statistics for of capital. For example, the analyst might consider cre-

the CAPM and APM approaches are 0.51 and 0.66, ating a simple average of the various WACC estimates.

respectively.21 Microsoft shows a similar improvement In theory, this averaging process could produce a more

in its R2 statistic, rising from 0.34 to 0.49 when the accurate final WACC estimate because errors in one

APM approach is used. Thus, our results support the estimation method might be canceled by errors attribut-

notion that the APM method often is more descriptive able to another method.22

of actual stock returns than the CAPM. Alternatively, the analyst might consider performing

The last three rows of Table 2 present the three sets sensitivity analyses by using each of the different

of WACC estimates based on the adjusted-beta CAPM, WACC estimates within the particular decision model—

APM, and BY+P methods. Given the variability in the such as the DCF capital budgeting model. The analyst

cost-of-equity estimates in Table 1, it is not surprising might find that the net present value (NPV) calculation

that the three methods for calculating WACC also yield in the model is not affected greatly by the choice of

substantial differences. For example, GE’s WACC either the high, low, or average WACC estimates. In this

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 18 SPRING 2004, VOL. 5, NO. 3

case, he or she can feel more confident about the capital net assets acquired) was recorded on the books only during a

“purchase” combination. In the past, purchased goodwill gen-

budgeting decision and valuation estimate. erally was amortized using the straight-line method over a

A serious dilemma arises, however, when different period of 40 years. Now companies are required to “reevalu-

WACC estimates yield materially different “signals” ate” or “reassess” the “value” of goodwill each year and

explicitly estimate impairment charges if the fair value of

from the valuation model. In this case, disclosure of the goodwill must be written down. Many companies are writing

valuation model’s sensitivity to the choice of WACC off a substantial part of what was previously carried on the bal-

ance sheet as an asset. “The new accounting treatment

might be appropriate. For example, when the valuation requires companies to test the value of goodwill they carry on

model’s estimates are highly sensitive to the choice of their financial statements every year and write down its value

WACC, the analyst could report the minimum and max- if that figure is deemed excessive as a result of changing busi-

ness circumstances,” according to Henny Sender, “Floods of

imum valuation estimates in order to provide some Firms to Take Goodwill Write-Downs,” The Wall Street Journal,

indication of the magnitude of this sensitivity. April 24, 2002, p. C5. The article continues: “The [new]

accounting standard’s preferred approach for estimating fair

value is a discounted cash-flow valuation model… such models

GRAPPLING WITH I M P R E C I S E E S T I M AT E S will be highly dependent upon the assumptions management

Finance and accounting professionals need to be able to makes, in particular the cost of capital and cash-flow growth

assumptions.” See, also, AAA Financial Accounting Standards

estimate the weighted average cost of capital because it Committee, “Equity Valuation Models and Goodwill Impair-

pervades their work. They need WACC estimates for ment,” Accounting Horizons, June 2001, pp. 161-170.

2 Noninterest-bearing liabilities such as accounts payable and

implementing the asset-impairment requirements of taxes payable are not included in this calculation because a

Statement of Financial Accounting Standards (SFAS) firm’s financial management does not typically control them.

No. 144, “Accounting for the Impairment of Long- These “spontaneous” liabilities are due to sales and spending

activity, and they directly affect a firm’s operating cash flows

Lived Assets,” for example. They also need WACC for rather than its WACC. From a DCF valuation perspective,

capital budgeting and equity valuation analyses, and for these noninterest-bearing liabilities are treated as a factor

influencing the firm’s cash flows rather than the discount rate

computing financial performance metrics such as EVA® or WACC that is used to discount these cash flows.

and residual income. 3 By this definition, the WACC estimate should be forward-

A way forward, therefore, is for corporate accounting looking rather than based on past historical data. As we shall

note later in this article, however, often the only practical way

and finance professionals to use several methods for to form a forward-looking WACC estimate is by using past data

estimating WACC and choose a simple average of the and historical relationships.

4 Note that target weights rather than those based on existing

estimates. Also, because of the inherent subjectivity market or book values are justified by the assumption that the

involved in the WACC estimation process, we recom- firm’s capital structure will, over time, gravitate toward these

mend they use sensitivity analysis whenever such esti- target values and, therefore, can be considered more appropri-

ate than market or book values reported at one point in time.

mates are used in managerial decision models. ■ Yet in Robert F. Bruner, Kenneth M. Eades, Robert S. Harris,

and Robert C. Higgins, “Best Practices in Estimating the Cost

of Capital: Survey and Synthesis,” Financial Practice and Edu-

Michael S. Pagano, Ph.D., CFA, is assistant professor of cation, Spring/Summer 1998, pp. 13-28, we find that the vast

finance in the College of Commerce and Finance at majority of large firms used market values rather than book or

Villanova University in Villanova, Pa. You can reach him target values when estimating the relative weights of debt,

equity, and preferred stock.

at (610) 519-4389 or michael.pagano@villanova.edu. 5 If the firm also has preferred stock in its capital structure,

Equation 2 is amended to include the product of the weight of

preferred stock in its capital structure, wps, and the expected

David E. Stout, Ph.D., is the Andrews Chair in Accounting return on the preferred stock, Kps. Typically, the market value

at the Williamson College of Business Administration at of preferred stock is used to estimate wps, or a target percent-

Youngstown State University in Youngstown, Ohio. You can age can be used, and the current dividend yield is used as an

estimate of the expected return on the preferred stock, that is,

reach him at (330) 941-3509 or destout@ysu.edu. Kps = Dividendps/Market Priceps.

6 S. David Young and Stephen F. O’Byrne, EVA® and Value-

Based Management: A Practical Guide to Implementation, McGraw-

Hill, New York, N.Y., 2001, pp. 161-203; and Bruner, Eades,

1 Prior to the August 2001 issuance of Statement of Financial

Harris, and Higgins, 1998, describe the assumptions underly-

Accounting Standards (SFAS) No. 144, “Accounting for the

ing these two models and how to estimate Ks using both

Impairment of Long-Lived Assets,” goodwill (the excess of

approaches. The interested reader can consult these books for

the purchase price over the fair market value of identifiable

a detailed treatment of these two methods of estimating Ks.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 19 SPRING 2004, VOL. 5, NO. 3

7 Marshall Blume, “Betas and Their Regression Tendencies,” 21 An R2 statistic closer to 1.0 indicates the regression model is

Journal of Finance, June 1975, pp. 785-795. Blume’s key insight a better fit to the actual observed stock returns for a company.

is that a firm’s beta measured over one time period tends to Therefore, R2 represents a valid measure of a model’s

revert toward a mean close to 1.0 when measured over a subse- “goodness-of-fit.”

quent time period. Thus, empirically estimated betas tend to 22 This averaging technique implicitly assumes that errors across

revert over time to a mean of approximately 1.0. Blume’s 1975 models are independent of each other (which may not be true

article shows in detail how to adjust for this “mean-reversion” in practice).

bias in estimated betas.

8 See Young and O’Byrne, 2001, pp. 161-203, and Bruner, Eades,

Harris, and Higgins, 1998, pp. 13-28. The issues related to esti-

mating these other components are discussed later when we

present our empirical results for GE and Microsoft.

9 The search for extra factors has been motivated, in part, by the

fact that empirical research has shown that the CAPM does

not explain a good portion of the variation in common stock

returns for individual firms. The CAPM, however, explains a

great deal—typically 90% or more—of the variation of the

returns on large portfolios such as mutual fund returns.

10 Young and O’Byrne, 2001, pp. 161-203.

11 Eugene F. Fama and Kenneth French, “Common Risk Factors

in the Returns on Stocks and Bonds,” Journal of Financial Eco-

nomics, February 1993, pp. 3-56.

12 Some analysts will adjust this fixed risk premium downward if,

in their judgment, a firm is less risky than the average firm;

conversely, they will adjust the risk premium upward if they

view the firm as being more risky than the average firm.

13 The average return data and the CAPM beta estimates are

based on monthly data over a five-year period. Many practi-

tioners use a 60-month period to estimate a CAPM beta, but

other sample period lengths and time frequencies (such as,

daily and weekly returns for one to 10 years) have been used.

The key trade-off between using daily returns versus monthly

returns, for example, is the advantage of having more observa-

tions when daily data are used and the disadvantage that daily

data are typically much “noisier” in a statistical sense. Thus,

betas based on daily return data are typically less reliable in

statistical and economic significance when compared to betas

based on monthly return data, which are inherently less

“noisy.” See Young and O’Byrne, 2001, for more details.

14 Practitioners can and do use other market portfolio bench-

marks, such as the Center for Research in Security Prices’

(CRSP) Equal-Weighted Stock Index, the S&P 500, the Rus-

sell 2000, the Morgan Stanley World Stock Index, etc. Typical-

ly, the analyst will use an index that is widely available and

representative of alternative investments that the average

investor would consider part of his or her portfolio of risky

assets. The CRSP Value-Weighted Stock Index is advanta-

geous because it is the most comprehensive index of the mar-

ket value and return behavior for an investor interested in

investing in U.S. stocks.

15 Fama and French, 1993, pp. 3-56.

16 Robert Shiller and Roger Ibbotson, “Measuring Equity Risk

Premium,” TIAA-CREF Investment Forum, June 2002, pp. 10-12.

17 Bruner, Eades, Harris, and Higgins, 1998, pp. 13-28.

18 Ibid, pp. 13-28.

19 Privately placed securities typically are sold directly to large

institutional investors. These securities are cheaper to issue

but have limited marketability because usually only large insti-

tutional investors are permitted to transact in this market.

20 In reality, we need this estimate of Microsoft’s Kd not for esti-

mating Kd (1 – T) but because later we want to estimate the

firm’s cost of equity via the Bond Yield Plus Risk Premium

approach.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 20 SPRING 2004, VOL. 5, NO. 3

You might also like

- 101 EligDocument36 pages101 EligShoaib ShaikhNo ratings yet

- Financial Management of Tamilnadu Water Supply Program - : A Contrarian ExperienceDocument21 pagesFinancial Management of Tamilnadu Water Supply Program - : A Contrarian ExperienceShoaib ShaikhNo ratings yet

- 40+ law students profilesDocument5 pages40+ law students profilesShoaib ShaikhNo ratings yet

- Rejection List IC 08 17915 PDFDocument29 pagesRejection List IC 08 17915 PDFShoaib ShaikhNo ratings yet

- BCCL Director Technical PositionDocument4 pagesBCCL Director Technical PositionShoaib ShaikhNo ratings yet

- Young Professional Policy PDFDocument3 pagesYoung Professional Policy PDFShoaib ShaikhNo ratings yet

- Admin - Asst - OBC - 01 - 01 - 19 PDFDocument3 pagesAdmin - Asst - OBC - 01 - 01 - 19 PDFShoaib ShaikhNo ratings yet

- MGNREGA data availability status for Danapur block in Patna district of BiharDocument1 pageMGNREGA data availability status for Danapur block in Patna district of BiharShoaib ShaikhNo ratings yet

- Rejection List IC 08 17915 PDFDocument29 pagesRejection List IC 08 17915 PDFShoaib ShaikhNo ratings yet

- Case Study 2: Remedial Education in India: Povertyactionlab ORGDocument13 pagesCase Study 2: Remedial Education in India: Povertyactionlab ORGShoaib ShaikhNo ratings yet

- Proposed Project For Livestock Production - 6Document2 pagesProposed Project For Livestock Production - 6Anonymous yIlaBBQQNo ratings yet

- Asset Register OlichakDocument1 pageAsset Register OlichakShoaib ShaikhNo ratings yet

- F3 Another Fake DocumentDocument1 pageF3 Another Fake DocumentShoaib ShaikhNo ratings yet

- Swachch Bharat AbhiyanDocument6 pagesSwachch Bharat AbhiyanShoaib ShaikhNo ratings yet

- MPSRLM Report on Poverty AlleviationDocument22 pagesMPSRLM Report on Poverty AlleviationShoaib ShaikhNo ratings yet

- F4 Another Fake DocumentDocument1 pageF4 Another Fake DocumentShoaib ShaikhNo ratings yet

- Data Tools Participatory Rural Appraisal TechniquesDocument45 pagesData Tools Participatory Rural Appraisal TechniquesShoaib ShaikhNo ratings yet

- Growing Opportunities in Dairy FarmingDocument4 pagesGrowing Opportunities in Dairy FarmingShoaib ShaikhNo ratings yet

- Rural Self Employment Training InstitutesDocument2 pagesRural Self Employment Training InstitutesShoaib ShaikhNo ratings yet

- IIST PROJECT REPORT FORMATDocument8 pagesIIST PROJECT REPORT FORMATLee SweeneyNo ratings yet

- F2 Another Fake DocumentDocument1 pageF2 Another Fake DocumentShoaib ShaikhNo ratings yet

- NSQFDocument2 pagesNSQFShoaib ShaikhNo ratings yet

- Farm Income Statistics in India-RASDocument23 pagesFarm Income Statistics in India-RASShoaib ShaikhNo ratings yet

- Baseline Study Interim Report for WCLDocument312 pagesBaseline Study Interim Report for WCLShoaib ShaikhNo ratings yet

- Report - Working Group On Institutional Financing WorkingDocument30 pagesReport - Working Group On Institutional Financing WorkingShoaib ShaikhNo ratings yet

- Business Plan ComparisonDocument1 pageBusiness Plan ComparisonShoaib ShaikhNo ratings yet

- Unit 1 - Organization Structure & TheoriesDocument18 pagesUnit 1 - Organization Structure & TheoriesShoaib ShaikhNo ratings yet

- Mandi PresentationDocument12 pagesMandi PresentationShoaib ShaikhNo ratings yet

- Evolution of Thinking About Poverty: Phase I: Income and Expenditure Based ThinkingDocument9 pagesEvolution of Thinking About Poverty: Phase I: Income and Expenditure Based ThinkingShoaib ShaikhNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Team Management WorkBookDocument43 pagesTeam Management WorkBookDAlexanderGrados100% (2)

- Lecture Prineconomics (0047) ADocument83 pagesLecture Prineconomics (0047) ATony E. ManaoisNo ratings yet

- Segmentacija, Targetiranje, PozicioniranjeDocument14 pagesSegmentacija, Targetiranje, Pozicioniranjecarina1983No ratings yet

- QNET Compensation Plan FINALDocument31 pagesQNET Compensation Plan FINALNishikigoi Kendari100% (3)

- Decoding Digital Transformation in Construction VF PDFDocument7 pagesDecoding Digital Transformation in Construction VF PDFArgon UsmanNo ratings yet

- Secure Scheduling PresentationDocument15 pagesSecure Scheduling PresentationheidigrooverNo ratings yet

- CH 3 FEIADocument30 pagesCH 3 FEIASnegapriya Sivaraman100% (1)

- Solution Manual For Management Information Systems 7th EditionDocument2 pagesSolution Manual For Management Information Systems 7th EditionMary Raney100% (36)

- l1 - Technopreneur Perspective & MotivationDocument27 pagesl1 - Technopreneur Perspective & MotivationAzizul AsriNo ratings yet

- Cost & Management AccountingDocument3 pagesCost & Management AccountingAkash VijayanNo ratings yet

- AC 904 OrientationDocument14 pagesAC 904 OrientationriyqNo ratings yet

- CIDC Model EPC Agreement 22032018Document342 pagesCIDC Model EPC Agreement 22032018Chetan Kumar jainNo ratings yet

- Termination of Contract, Corporate Recovery and Insolvency: RICS Professional Guidance, UKDocument33 pagesTermination of Contract, Corporate Recovery and Insolvency: RICS Professional Guidance, UKHicham FaresNo ratings yet

- V V V V V V V V: Industrial Financing/ Corporate Financing Money Market International TradeDocument24 pagesV V V V V V V V: Industrial Financing/ Corporate Financing Money Market International TradeSushma ChandraShekarNo ratings yet

- ENTREP - Chap4Document5 pagesENTREP - Chap4Myla MoriNo ratings yet

- Hull RMFI4 e CH 22Document11 pagesHull RMFI4 e CH 22jlosamNo ratings yet

- SA - Khizer SalesforceDocument1 pageSA - Khizer SalesforcerjnemoNo ratings yet

- Chapter 01Document8 pagesChapter 01Anh MusicNo ratings yet

- Aerospace Lean Six Sigma NadeemDocument4 pagesAerospace Lean Six Sigma NadeemSyedNadeemAhmedNo ratings yet

- Post Project Review TemplateDocument10 pagesPost Project Review TemplatehymerchmidtNo ratings yet

- Generation and Control of Supplier Document Requirement Lists and Supplier Document ListsDocument16 pagesGeneration and Control of Supplier Document Requirement Lists and Supplier Document ListsVelmurugan RamamoorthyNo ratings yet

- BUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISEDocument4 pagesBUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISERichard MamisNo ratings yet

- Department of Education: Business Mathematics Budget of Work SY 2020 - 2021Document3 pagesDepartment of Education: Business Mathematics Budget of Work SY 2020 - 2021Xerxes Duane MagdaluyoNo ratings yet

- A1 Pet ClinicDocument3 pagesA1 Pet ClinicAnn MaNo ratings yet

- ABA Principles of Banking Table of ContentsDocument11 pagesABA Principles of Banking Table of ContentsCápMinhQuyền0% (3)

- Section 400 418Document7 pagesSection 400 418Macy Andrade100% (1)

- Introducing PLAXIS CONNECT Edition: Frequently Asked QuestionsDocument4 pagesIntroducing PLAXIS CONNECT Edition: Frequently Asked QuestionsFidel Ruiz TorresNo ratings yet

- Senior Professional in Human Resource - International™ (Sphri™)Document4 pagesSenior Professional in Human Resource - International™ (Sphri™)Medo O. EzzatNo ratings yet

- Tas Bhd Cost Statement AnalysisDocument8 pagesTas Bhd Cost Statement AnalysisbiarrahsiaNo ratings yet

- Job Enrichment Presentation on Employee Motivation TechniquesDocument9 pagesJob Enrichment Presentation on Employee Motivation TechniquesChandra SravanthiNo ratings yet