Professional Documents

Culture Documents

Maf5101 Fa Cat 1 2018

Uploaded by

Muya KihumbaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maf5101 Fa Cat 1 2018

Uploaded by

Muya KihumbaCopyright:

Available Formats

UNIT CODE: MAF5101 UNIT TITLE: FINANCIAL

ACCOUNTING

Briefly describe any five methods of proving for depreciation.

1. Straight Line Method

Under this method, a fixed percentage of original cost is written off the asset every year.

The amount to be written off every year is arrived at as under:

= (Cost – Estimated Scrap Value) / Estimated Life

2. Written Down Value Method

Under this method, the rate or percentage of depreciation is fixed, but it applies to the value at

which the asset stands in the books in the beginning of the year. In other words, under this

method, a fixed percentage is written off every year on the reduced balance of the asset. Thus,

the percentage of depreciation is not applied to the original cost but only to the balance, which

remains after charging depreciation in the beginning of a year. The percentage of depreciation

remains fixed for all the years of the working life of an asset but the actual amount of

depreciation written off every year goes on decreasing with the reduction in the value of the

asset.

3. Sum of the Digits Method

Under this method, amount of the depreciation to be written off each year is calculated by the

following formula:

= Remaining Life of the Asset (including the Current Year) / Sum of all the Digits of the Life of

the Asset in Years x Cost of the Asset

4. Revaluation Method

This method is used only in case of small items like cattle (Livestock), or loose tools where it

may be too much to maintain an account of each single item. The amount of depreciation to be

written off is determined by comparing the value at the end of the year (valuation being done by

someone having expert knowledge of the valuation of the asset) with the value in the beginning.

5. Machine Hour Rate Method

This is more or less like the depreciation method. Instead of the usual method of estimating the

life of a machine in years, it is estimated in hours. Then, an accurate record is kept recording the

number of hours each machine is run and depreciation is calculated accordingly.

Briefly explain why provide for deprecation.

To ascertain the net earnings/profit for an accounting period, depreciation need to be

computed. Depreciation normally constitutes a major part of the expenses of the business.

As the business buys fixed assets, it expects the fixed assets over the useful lives are able

to generate the necessary revenues for its business. Whilst revenues being earned and if

there is no allocation of depreciation cost to match these revenue, income will then be

overstated. Depreciation therefore follows very closely to the matching concept;

The fixed assets in the Balance Sheet will be overstated if depreciation is not provided

for. Only that part of the costs of fixed assets that have not expired should be reflected in

the Balance sheet otherwise the financial statement will not reflect a true and fair view;

If depreciation is not provided for and assuming if the whole profits were withdrawn

during the life of the asset, additional capital would have to be raised when it is time to

replace the fixed assets. By charging depreciation against profits, the ultimate residual

profit available for distribution is lowered and that funds are retained in the

business for future replacement.

You might also like

- CCM 120 April June CATDocument1 pageCCM 120 April June CATMuya KihumbaNo ratings yet

- The Kenya Institute of Management Certificate Course in Management Section 1 October - December 2016 Cat CCM 111: Principles of Accounts Question OneDocument2 pagesThe Kenya Institute of Management Certificate Course in Management Section 1 October - December 2016 Cat CCM 111: Principles of Accounts Question OneMuya KihumbaNo ratings yet

- CCM 111 Make Up Cat Oct Dec 16Document2 pagesCCM 111 Make Up Cat Oct Dec 16Muya KihumbaNo ratings yet

- Interest Rate Caps Around The WorldDocument39 pagesInterest Rate Caps Around The WorldMuya KihumbaNo ratings yet

- Frozenonthe RatesDocument8 pagesFrozenonthe RatesMuya KihumbaNo ratings yet

- Topic One Mathematical MethodsDocument7 pagesTopic One Mathematical MethodsMuya KihumbaNo ratings yet

- Topic One Mathematical MethodsDocument7 pagesTopic One Mathematical MethodsMuya KihumbaNo ratings yet

- Systems of Linear Equations and Augmented Matrices: SectionDocument19 pagesSystems of Linear Equations and Augmented Matrices: SectionMuya KihumbaNo ratings yet

- Intro To MatricesDocument19 pagesIntro To MatricesnandoNo ratings yet

- Intro MatrixDocument9 pagesIntro MatrixMuya KihumbaNo ratings yet

- The Impact of Capping Interest Rates On The Kenyan EconomyDocument3 pagesThe Impact of Capping Interest Rates On The Kenyan EconomyMuya KihumbaNo ratings yet

- Interest Rate Caps Around The WorldDocument39 pagesInterest Rate Caps Around The WorldMuya KihumbaNo ratings yet

- Baf 1101 Fa Cat TwoDocument4 pagesBaf 1101 Fa Cat TwoMuya KihumbaNo ratings yet

- The Case For An Interest Rate CapDocument27 pagesThe Case For An Interest Rate CapMuya KihumbaNo ratings yet

- Frozenonthe RatesDocument8 pagesFrozenonthe RatesMuya KihumbaNo ratings yet

- Maf 5102Document2 pagesMaf 5102Muya KihumbaNo ratings yet

- The Case For An Interest Rate CapDocument27 pagesThe Case For An Interest Rate CapMuya KihumbaNo ratings yet

- The Impact of Capping Interest Rates On The Kenyan EconomyDocument3 pagesThe Impact of Capping Interest Rates On The Kenyan EconomyMuya KihumbaNo ratings yet

- Book 1Document4 pagesBook 1Muya KihumbaNo ratings yet

- Maf5102 Fa Cat 2 2018Document4 pagesMaf5102 Fa Cat 2 2018Muya KihumbaNo ratings yet

- Maf 5102: Financial Management CAT 1 20 Marks Instructions Attempt All Questions Question OneDocument6 pagesMaf 5102: Financial Management CAT 1 20 Marks Instructions Attempt All Questions Question OneMuya KihumbaNo ratings yet

- Gross Profit/ (Loss) : (Assume Montly Salary Is 2,000)Document6 pagesGross Profit/ (Loss) : (Assume Montly Salary Is 2,000)Muya KihumbaNo ratings yet

- Baf 1101 Fa Cat OneDocument4 pagesBaf 1101 Fa Cat OneMuya KihumbaNo ratings yet

- Maf 5102Document2 pagesMaf 5102Muya KihumbaNo ratings yet

- Maf5101 Fa Cat 1 2018 1Document1 pageMaf5101 Fa Cat 1 2018 1Muya KihumbaNo ratings yet

- Maf 5102Document2 pagesMaf 5102Muya KihumbaNo ratings yet

- Bed 1101 Cat 1 MicroeconomicsDocument10 pagesBed 1101 Cat 1 MicroeconomicsMuya KihumbaNo ratings yet

- Maf 5102Document2 pagesMaf 5102Muya KihumbaNo ratings yet

- Law of AgencyDocument20 pagesLaw of AgencyMuya KihumbaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Understanding Consumer Preference For Coconut Sugar Using Conjoint Analysis Approach 121212Document5 pagesUnderstanding Consumer Preference For Coconut Sugar Using Conjoint Analysis Approach 121212Ralph Justin IINo ratings yet

- Utility and Demand: Answers To The Review QuizzesDocument16 pagesUtility and Demand: Answers To The Review QuizzesWeko CheangNo ratings yet

- Marketing Sales Operations in Chicago IL Resume Curt PetersonDocument3 pagesMarketing Sales Operations in Chicago IL Resume Curt PetersoncurtpetersonNo ratings yet

- Ch06 Solutions Manual 2015-07-16Document34 pagesCh06 Solutions Manual 2015-07-16Prema Khatwani KesariyaNo ratings yet

- Engineering Economy, 3rd Ed With SolutionDocument398 pagesEngineering Economy, 3rd Ed With SolutionJay Dalwadi100% (1)

- Crossword Marketing PricingBasics - KeyDocument1 pageCrossword Marketing PricingBasics - KeyShaikh GhaziNo ratings yet

- Modified Kuppuswamy Socioeconomic Scale 2022 UpdatDocument4 pagesModified Kuppuswamy Socioeconomic Scale 2022 UpdatShamNo ratings yet

- Concept of Business Profit Holding Gains/lossesDocument9 pagesConcept of Business Profit Holding Gains/lossesPutriNo ratings yet

- Chapter 9 - BudgetingDocument27 pagesChapter 9 - BudgetingPria JakartaNo ratings yet

- Cgse StatsDocument20 pagesCgse StatsChandu SagiliNo ratings yet

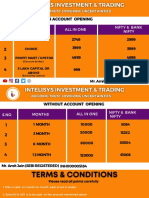

- Intelisys Pricing PlanDocument5 pagesIntelisys Pricing PlanregsNo ratings yet

- Case Study Abstract MC DonaldDocument2 pagesCase Study Abstract MC DonaldpradipkumarpatilNo ratings yet

- Case Problem 3Document21 pagesCase Problem 3Josh StevensNo ratings yet

- Fraction, Decimal and PercentDocument49 pagesFraction, Decimal and PercentTashaun NizodNo ratings yet

- DOVE FinalDocument27 pagesDOVE FinalAllen Keah100% (1)

- Anern Integrated Solar Garden Light-201604Document1 pageAnern Integrated Solar Garden Light-201604Godofredo VillenaNo ratings yet

- Security Analysis Paper For Wrigley and The Hershey CompanyDocument11 pagesSecurity Analysis Paper For Wrigley and The Hershey Companysegunpopoola1849100% (3)

- Economy PerformanceDocument16 pagesEconomy PerformanceMuhammad UmarNo ratings yet

- Absorption CostDocument2 pagesAbsorption Costsidra khanNo ratings yet

- Dynapac Soil CompactorsDocument20 pagesDynapac Soil CompactorsAchmad PrayogaNo ratings yet

- International Islamic University Islamabad Faculty of Management SciencesDocument10 pagesInternational Islamic University Islamabad Faculty of Management SciencesArslanNo ratings yet

- Bearish PatternsDocument41 pagesBearish PatternsKama Sae100% (1)

- Reinventing Metro Packet (9-19)Document42 pagesReinventing Metro Packet (9-19)CincinnatiEnquirerNo ratings yet

- 2013 Risk Premium Report Excerpt DP PDFDocument124 pages2013 Risk Premium Report Excerpt DP PDFJuan GSNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- DiscountDocument4 pagesDiscountKartik BhargavaNo ratings yet

- Flash Boys Insider Perspective on HFTDocument131 pagesFlash Boys Insider Perspective on HFTPruthvish Shukla100% (1)

- Chelsea Parker 2442series HY25-2142-M1Document20 pagesChelsea Parker 2442series HY25-2142-M1Carlos Alberto Ramirez ParraNo ratings yet

- JP Morgan Best Equity Ideas 2014Document61 pagesJP Morgan Best Equity Ideas 2014Sara Lim100% (1)

- 6351 01 Que 20070118Document20 pages6351 01 Que 20070118Xin Ying LNo ratings yet