Professional Documents

Culture Documents

12 Month Profit and Loss Projection 1

Uploaded by

briomeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Month Profit and Loss Projection 1

Uploaded by

briomeCopyright:

Available Formats

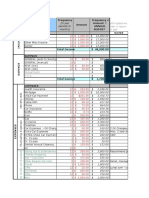

Profit and Loss Projection (12 Months)

Enter your Company Name here

Fiscal Year Begins Jun-05

Y

.%

L

5

- 05

5

-05

-06

6

-06

5

5

A

g-0

y-0

v-0

AR

c-0

r-0

r-0

t-0

l-0

B/

IND

p

n

%

n

%

%

Ma

Ma

Au

No

Ap

Oc

YE

De

Se

Ju

Ju

Fe

Ja

%

Revenue (Sales)

Category 1 - - - - - - - - - - - - 0 -

Category 2 - - - - - - - - - - - - 0 -

Category 3 - - - - - - - - - - - - 0 -

Category 4 - - Notes on Preparation

- - - - - - - - - - 0 -

Category 5 - - - - - - - - - - - - 0 -

Category 6 - - Note: You -may want to- print this information

- to- use as reference

- later.- To delete these

- - - - 0 -

Category 7 - - instructions,

- click the border

- of this- text box and- then press- the DELETE - key. - - - - 0 -

Total Revenue (Sales) 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0

You should change "category 1, category 2", etc. labels to the actual names of your sales

Cost of Sales categories. Enter sales for each category for each month. The spreadsheet will add up total

Category 1 - - annual sales.

- In the "%"- columns, -the spreadsheet

- will show

- the % of -total sales contributed

- - - - 0 -

Category 2 - - by each category.

- - - - - - - - - - 0 -

Category 3 - - - - - - - - - - - - 0 -

COST OF GOODS SOLD (also called Cost of Sales or COGS): COGS are those expenses

Category 4 - - - - - - - - - - - - 0 -

directly related to producing or buying your products or services. For example, purchases of

Category 5 - - - - - - - - - - - - 0 -

inventory or raw materials, as well as the wages (and payroll taxes) of employees directly

Category 6 - - involved in- producing your

- - -

products/services, are included- in COGS. These

- -

expenses - - - 0 -

Category 7 - - usually go -up and down - along with- the volume- of production

- or sales. -Study your -records to - - - 0 -

Total Cost of Sales 0 - 0 - determine

0 -COGS0for each

- 0 category.

sales - 0 Control

- of 0COGS

- is the

0 key- to profitability

0 - for 0 - 0 - 0 - 0 -

most businesses, so approach this part of your forecast with great care. For each category

Gross Profit 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

of product/service, analyze the elements of COGS: how much for labor, for materials, for

Expenses packing, for shipping, for sales commissions, etc.? Compare the Cost of Goods Sold and

- Gross Profit

- of your various

Salary expenses - - sales categories.

- Which

- are most

- profitable,

- and which

- are least - - - 0 -

- and why? Underestimating COGS can lead to under pricing, which can destroy your ability

Payroll expenses - - - - - - - - - - - - 0 -

to earn a profit. Research carefully and be realistic. Enter the COGS for each category of

Outside services - - - - - - - - - - - - 0 -

sales for each month. In the "%" columns, the spreadsheet will show the COGS as a % of

Supplies (office and sales dollars for that category.

operating) - - - - - - - - - - - - 0 -

Repairs and GROSS PROFIT: Gross Profit is Total Sales minus Total COGS. In the "%" columns, the

maintenance - - spreadsheet

- will show -Gross Profit- as a % of Total

- Sales. - - - - - - 0 -

Advertising - - - - - - - - - - - - 0 -

Car, delivery and travel - - OPERATING - EXPENSES - (also called

- Overhead):

- These are

- necessary

- expenses- which, - - - 0 -

Accounting and legal - - however, are

- not directly

- related to- making or buying

- your -products/services.

- Rent,

- utilities, - - - 0 -

Rent - - telephone,-interest, and

- the salaries- (and payroll- taxes) of-office and management

- - - - - 0 -

Telephone - - employees- are examples.

- Change- the names -of the Expense - categories

- to suit your

- type of - - - 0 -

Utilities - - business and

- your accounting

- system.

- You may- need to combine

- some

- categories,

- - - - 0 -

Insurance - - however, to

- stay within- the 20 line -limit of the spreadsheet.

- - Most operating

- expenses

- remain - - - 0 -

reasonably fixed regardless of changes in sales volume. Some, like sales commissions,

Taxes (real estate, etc.) - - may vary with

- sales. Some,

- like utilities,

- may vary

- with the- time of year.

- Your projections

- - - - 0 -

should reflect these fluctuations. The only rule is that the projections should simulate your

Interest - - - - - - - - - - - - 0 -

financial reality as nearly as possible. In the "%" columns, the spreadsheet will show

Depreciation - - - - - - - - - - - - 0 -

Operating Expenses as a % of Total Sales.

Other expenses (specify) - - NET PROFIT:

- -

The spreadsheet will- subtract Total

- - Expenses- from Gross- Profit to

Operating - - - 0 -

calculate Net Profit. In the "%" columns, it will show Net Profit as a % of Total Sales.

Other expenses (specify) - - - - - - - - - - - - 0 -

INDUSTRY AVERAGES: The first column, labeled "IND. %" is for posting average cost

Other expenses (specify) - - factors for -firms of your- size in your

- industry. Industry

- average

- data is- commonly -available - - - 0 -

from industry associations, major manufacturers who are suppliers to your industry, and

Misc. (unspecified) - local colleges,

- Chambers

- of Commerce,- and public

- libraries.

- One common- source- is the - - - 0 -

Total Expenses 0 - 0 - book 0Statement

- Studies

0 - published

0 - annually

0 by- Robert 0 Morris

- Associates.

0 - It can

0 be- found0 in - 0 - 0 - 0 -

major libraries, and your banker almost surely has a copy. It is unlikely that your expenses

Net Profit 0 - 0 - will be0 exactly

- in line

0 with

- industry

0 -averages,

0 but - they0can -be helpful

0 in- areas0in which

- 0 - 0 - 0 - 0 -

expenses may be out of line.

You might also like

- Sample Profit and Loss StatementDocument2 pagesSample Profit and Loss Statementwhyrice100% (1)

- Monthly Budget PlannerDocument6 pagesMonthly Budget Plannerppavan_hr3376No ratings yet

- Personal-Monthly-Budget 1Document6 pagesPersonal-Monthly-Budget 1api-296696430No ratings yet

- Estimating Start-Up Capital: Your Company, IncDocument1 pageEstimating Start-Up Capital: Your Company, IncnightclownNo ratings yet

- Excel Business Plan TemplateDocument26 pagesExcel Business Plan TemplateAdil Hassan100% (1)

- Personal Monthly BudgetDocument2 pagesPersonal Monthly Budgetbernadeth_remaNo ratings yet

- Personal Cash Flow SpreadsheetDocument4 pagesPersonal Cash Flow SpreadsheetBella RamadhantiNo ratings yet

- Unified Chart of Accounts Guide for NonprofitsDocument4 pagesUnified Chart of Accounts Guide for NonprofitsmcmonizNo ratings yet

- Profit and Loss StatementDocument1 pageProfit and Loss StatementClement TanNo ratings yet

- Job Description GuidelinesDocument3 pagesJob Description GuidelinesMuhammad Hamza ShahidNo ratings yet

- Personal Budget SpreadsheetDocument8 pagesPersonal Budget SpreadsheetCraig Richard Minson100% (1)

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsEyob SNo ratings yet

- Personal Budget SpreadsheetDocument7 pagesPersonal Budget Spreadsheetamiller1987No ratings yet

- 1 Blank Business Plan TemplateDocument11 pages1 Blank Business Plan TemplateNhi Chu100% (1)

- Annual Budget and Income TrackerDocument8 pagesAnnual Budget and Income TrackerMargaretNo ratings yet

- TFN Declaration FormDocument6 pagesTFN Declaration FormTim DunnNo ratings yet

- Work Order TemplateDocument5 pagesWork Order TemplateMuhammad SaadNo ratings yet

- Starbucks Sales Conference BudgetDocument2 pagesStarbucks Sales Conference Budgetapi-431642485No ratings yet

- Accounting Excel Reports - Report Generalledger ExcelDocument36 pagesAccounting Excel Reports - Report Generalledger ExcelMark Ceddrick MioleNo ratings yet

- Estimate guidelines summaryDocument14 pagesEstimate guidelines summaryRamelfebea Montedelobenia100% (1)

- Home Budget Worksheet by Vertex42Document3 pagesHome Budget Worksheet by Vertex42davidjc77No ratings yet

- Doc-Balance Sheet Cheat Sheet PDFDocument2 pagesDoc-Balance Sheet Cheat Sheet PDFConnor McloudNo ratings yet

- Expense Claim Form: March 2018-Feb 2019Document1 pageExpense Claim Form: March 2018-Feb 2019Varun SirohiNo ratings yet

- Cash Flow TemplateDocument13 pagesCash Flow TemplateJohn ArikoNo ratings yet

- Monthly BudgetDocument8 pagesMonthly BudgetNhanVoNo ratings yet

- Cash Flow Small BusinessDocument39 pagesCash Flow Small Businessmariusdr84No ratings yet

- Personlig BudgetDocument6 pagesPersonlig BudgetAnn SundkvistNo ratings yet

- Pricing ScheduleDocument13 pagesPricing ScheduleAnonymous ZcrLZQNo ratings yet

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrhowieg43100% (2)

- Project Costs: Project Task Labor Hours Labor Cost ($) Material Cost ($) Travel Cost ($) Other Cost ($) Total Per TaskDocument1 pageProject Costs: Project Task Labor Hours Labor Cost ($) Material Cost ($) Travel Cost ($) Other Cost ($) Total Per TaskKaruppasamy Gurusamy100% (1)

- Event Budget For (Event Name) : EstimatedDocument3 pagesEvent Budget For (Event Name) : Estimatedhellfire8No ratings yet

- Ebook FB AdsDocument86 pagesEbook FB AdsPMK100% (2)

- Accounting Worksheet V 1.0Document6 pagesAccounting Worksheet V 1.0Adil IqbalNo ratings yet

- Cash Flow StatementDocument6 pagesCash Flow StatementLakshya BatraNo ratings yet

- Invoice 301 for <Company NameDocument1 pageInvoice 301 for <Company NameNAEEM MALIKNo ratings yet

- Budget TemplateDocument3 pagesBudget TemplateDaisyNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessChandraKishore DeshmukhNo ratings yet

- Profit and Loss Projection 1yr 0 0 GPDocument1 pageProfit and Loss Projection 1yr 0 0 GPGary PearsNo ratings yet

- Personal Monthly BudgetDocument3 pagesPersonal Monthly BudgetIgnes de CastroNo ratings yet

- Profit and Loss Statement1Document1 pageProfit and Loss Statement1Ana Marie Santelices Agna-Antones100% (1)

- Samaan Solutions - Business Plan - BusDocument7 pagesSamaan Solutions - Business Plan - Buslildjjohn100% (1)

- Project On SpicesDocument96 pagesProject On Spicesamitmanisha50% (6)

- Sample Resume - SAP ABAPDocument12 pagesSample Resume - SAP ABAPnehra72No ratings yet

- Staff Vetting TemplateDocument1 pageStaff Vetting Templateney issaNo ratings yet

- Diluted Earnings Per ShareDocument15 pagesDiluted Earnings Per ShareHarvey Dienne Quiambao100% (1)

- Profit & Loss StatementDocument1 pageProfit & Loss StatementNabila Ayuningtias100% (1)

- FY 2019 ANNUAL INVESTMENT PROGRAM SUMMARYDocument31 pagesFY 2019 ANNUAL INVESTMENT PROGRAM SUMMARYercelito varquezNo ratings yet

- START-UP FINANCIAL PLAN FOR YOUR COFFEE SHOPDocument10 pagesSTART-UP FINANCIAL PLAN FOR YOUR COFFEE SHOPMónica EstefaníaNo ratings yet

- Fitness Center Budgeting Model InstructionsDocument28 pagesFitness Center Budgeting Model InstructionsZahed AliNo ratings yet

- Employee Expense Report TemplateDocument4 pagesEmployee Expense Report TemplateTyler Beth VandeWaterNo ratings yet

- Philadelphia Business Journal/Feb. 2, 2018Document32 pagesPhiladelphia Business Journal/Feb. 2, 2018Craig EyNo ratings yet

- NMG Life Insurance Growth Markets 2012Document12 pagesNMG Life Insurance Growth Markets 2012smarandacirlanNo ratings yet

- In-Kind Matching Reference Chart: by Other Federal Grant Agreements. Except AsDocument5 pagesIn-Kind Matching Reference Chart: by Other Federal Grant Agreements. Except AsAmerica's Service CommissionsNo ratings yet

- Scul BudgetDocument1 pageScul Budgetmarianghinea2006No ratings yet

- Maison Des Fleurs - Flower ShopDocument17 pagesMaison Des Fleurs - Flower ShopCheryl CoxNo ratings yet

- Employee ScheduleDocument4 pagesEmployee ScheduleEhsanNo ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Small Business Cash Flow ProjectionDocument3 pagesSmall Business Cash Flow ProjectionFauzi AzwarNo ratings yet

- Invoice: WholesalestoreindiaDocument7 pagesInvoice: WholesalestoreindiaTIPS ON TECHNOLOGYNo ratings yet

- Create Your Zero-Based Budget Template or SpreadsheetDocument4 pagesCreate Your Zero-Based Budget Template or SpreadsheetNabila ArifannisaNo ratings yet

- Equipment Leasing and Finance: A Progressive, Global IndustryDocument44 pagesEquipment Leasing and Finance: A Progressive, Global Industryasim hussainNo ratings yet

- Income StatementDocument26 pagesIncome StatementRashad MallakNo ratings yet

- Contracts AdministrationDocument2 pagesContracts AdministrationMaria JordanNo ratings yet

- IQS VIX LowDocument8 pagesIQS VIX LowZerohedge100% (1)

- Export Manager or Latin America Sales ManagerDocument3 pagesExport Manager or Latin America Sales Managerapi-77675289No ratings yet

- Tutorial Chapter 4 Product and Process DesignDocument29 pagesTutorial Chapter 4 Product and Process DesignNaKib NahriNo ratings yet

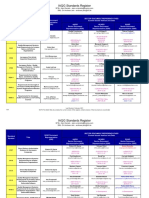

- IAQG Standards Register Tracking Matrix February 01 2021Document4 pagesIAQG Standards Register Tracking Matrix February 01 2021sudar1477No ratings yet

- HR Getting Smart Agile Working - 2014 - tcm18 14105.pdf, 08.07.2018 PDFDocument38 pagesHR Getting Smart Agile Working - 2014 - tcm18 14105.pdf, 08.07.2018 PDFKhushbuNo ratings yet

- RAM Guide 080305Document266 pagesRAM Guide 080305Ned H. CriscimagnaNo ratings yet

- BUITEMS Entry Test Sample Paper NAT IGSDocument10 pagesBUITEMS Entry Test Sample Paper NAT IGSShawn Parker100% (1)

- Edms ErmsDocument1 pageEdms Ermsprsiva2420034066No ratings yet

- Chapter-I: Customer Service and Loan Activities of Nepal Bank LimitedDocument48 pagesChapter-I: Customer Service and Loan Activities of Nepal Bank Limitedram binod yadavNo ratings yet

- MFRS11 Joint Arrangements MFRS12 Disclosure of Interests in Other Entities MFRS5 Non-Current Assets Held For Sale &Document20 pagesMFRS11 Joint Arrangements MFRS12 Disclosure of Interests in Other Entities MFRS5 Non-Current Assets Held For Sale &cynthiama7777No ratings yet

- What Makes a Great Product ManagerDocument16 pagesWhat Makes a Great Product Managerpresident fishrollNo ratings yet

- Apics CPIM ModuleDocument2 pagesApics CPIM ModuleAvinash DhoneNo ratings yet

- The Daimlerchrysler Merger - A Cultural Mismatch?Document10 pagesThe Daimlerchrysler Merger - A Cultural Mismatch?frankmdNo ratings yet

- Shareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaDocument3 pagesShareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaCasper MaungaNo ratings yet

- Mail Merge in ExcelDocument20 pagesMail Merge in ExcelNarayan ChhetryNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Find the perfect candidate for Wakil Kepala Klinik Utama GR Setra CMIDocument2 pagesFind the perfect candidate for Wakil Kepala Klinik Utama GR Setra CMIRscmi Dan LaboratoriumNo ratings yet

- Microeconomics Midterm Review QuestionsDocument14 pagesMicroeconomics Midterm Review QuestionsRashid AyubiNo ratings yet

- BOP - Payments ChartDocument11 pagesBOP - Payments ChartThe Russia MonitorNo ratings yet

- IGNOU MBS MS-09 Solved Assignments 2010Document19 pagesIGNOU MBS MS-09 Solved Assignments 2010jayakumargarudaNo ratings yet

- Dhurjoti Bhattacharjee's ResumeDocument6 pagesDhurjoti Bhattacharjee's ResumeSai Anil KumarNo ratings yet

- Corporate ExcellenceDocument14 pagesCorporate ExcellenceJyoti WaindeshkarNo ratings yet

- Yamaha Piano Contract DisputeDocument11 pagesYamaha Piano Contract DisputeGalvin ChongNo ratings yet

- Activity #1:: V F3QpgxbtdeoDocument4 pagesActivity #1:: V F3QpgxbtdeoSafaNo ratings yet

- Concurrent Engineering Development and Practices For Aircraft Design at AirbusDocument9 pagesConcurrent Engineering Development and Practices For Aircraft Design at Airbusanon_658728459No ratings yet

- Scope and Methods of EconomicsDocument4 pagesScope and Methods of EconomicsBalasingam PrahalathanNo ratings yet

- MTAP Saturday Math Grade 4Document2 pagesMTAP Saturday Math Grade 4Luis SalengaNo ratings yet