Professional Documents

Culture Documents

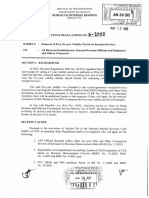

RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018

Uploaded by

sdysangcoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018

Uploaded by

sdysangcoCopyright:

Available Formats

F;BEr\U 0F

iti

LiieORSS'i!

REI)L]BLIC OF'fIII' PI.IILIPPIN L,S

DEPARTM I]-N I- OF FINANC E

Arfi 0 5 ?Aft rt

BTIREATJ OF INTtrRNAL ITE\/IiNLiE,

Quezon City

RECE IWff

March 28, 2018

g0

REVENUE REGULATToNS No. H - I8

SUBJECT Amending the Provisions of Revenue Regulations No. l1-18,

Particularly Sections 2 and 14

TO All Internal Revenue Officers and Others Concerned

SECTION 1. SCOPE - Pursuant to the provisions of Section 244 tnrelation to Section 245 of the

National Intemal Revenue Code of 1997 (Tax Code of 1997) as amended, these Regulations are

hereby promulgated to amend certain provisions of Revenue Regulations (RR) No. 11-2018.

SECTION 2. AMENDATORY PROVISIONS - The provisions of Sections 2 and,14 of RR 11-

2018, are hereby amended as follows:

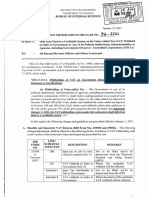

"SECTION 2. Certatn items of Section 2.57.2 of RR No. 2-98 is herebv

renumbered and further amended to read as follows:

SECTION 2.57.2, Income Payments Subject to Creditable l{ithholding

Tax and Rates Prescribed Thereon. - Except as herein otherwise provided, there

shall be withheld a creditable income tax at the rates herein specified for each class

of payee from the following items of income payments to persons residing in the

Philippines:

(A) Professional fees, talent fees, etc. for services renclered - on the gross

professional, promotional, and talent fees or any other lorm of remnneration

for the services rendered by the follou,ing:

Individual pa)ree:

If gross incorne for the current )rear did not exceed P3M - Five percent (5%)l

If sross income is more than P3M or VAT Registered

reqardless of amount - Ten percenl (10%o)

Non-individual payeej

s income for the current vear did not exceed P720.000-Ten percent 0ool

If gross income exceeds P720.000 " Fifteen percent (15%)

XXX XXX XXx

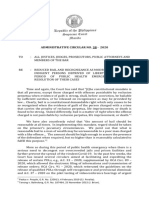

SECTION* 1 4. TRANSITORY PR.OUSIONS. lncome recipient I pav ee sr-rbj ect

to withholding tax under Section 2 (Section 2.57.2) hereof and availing to be

exempt from the prescribed withholding tax rates, shall submit on or before April

20, 20L8 a duly acoomplished "Income Payee's Swom Declaration of Gross

,fi' Receipts/Sales", together with a copy of the Certificate of Registration (COR) to

his'her income n3\ or * ithhLrldint: sgenr.

The income payor/withholding agent who/which received the "lncome Payee's

Swom Declaration of Gross Receipts/Sales" and the copy of the payee's COR sha1l

submit on or before April 30, 2018, a duly accomplished "Income

Payor/Withholding Agent's Sworn Declaration", together with the List of Payees

who have submitted "Income Payee's Swom Declaration of Gross Receipts/Sales"

and copies of CORs.

Any income tax withheld by the income payor/withholding agent in excess of what

is prescribed in these regulations shall be refunded to the payee by the said income

payor/withholding agent. The income payor/withholding agent shall reflect the

amount refunded as adjustment to the remittable withholding tax due for the first

quarter withholding tax retum. The adjusted amount of tax withheld shall also be

reflected in the Alphabetical List of Payees to be attached in the said first (1't)

quarter retum. The said list of payees, who are subject to refund either due to the

change ofrates of withholding or due to the quaiification to avail of exemption from

withholding tax (e.g. income recipient/payee submitted "Income Payee's Sworn

Declaration of Gross Receipts/Sa1es" and copy of COR), shall likewise be attached

in the said retum which shall be filed on or before April30, 2018.

In case the Certificate of Tax Withheld at Source (BIR Form No, 2307) has already

been given to the payee, the same shall be returned by the payee to the payor upon

receipt of the amount refunded by the income payor/withholding agent, together

with the corrected BIR Fonn No. 2307, if still applicable. Otherwise, the said

certificate to be given to the payee on or before the twentieth (201h) day after the

close of the first (1't) quarter must reflect the conected amount of tax withheld.

In no case shal1 income payee use BIR Form No. 2307 twice for the same amount

of income payment from the same income payor/withholding agent and for the same

period."

SECTION 3. REPEALING CLAUSE. A11 existing rules and regulations or parts thereof which

are inconsistent with the provisions of these regulations are hereby revoked.

SECTION 4. EFFECTIVITY. These regulations shall take effect immediately.

CARLOS G. DOi\fIN

Secretary of Financ6

rDO n1')011

Hi rr t-r (,/ L!:iu

Recommending Approval :

-

lP,-<^^tn

CAESAR R.. DE-I-AY

Commissioner of internal Revenue

0153 20 E EI

You might also like

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Streamlined BIR Transfer Pricing GuidelinesDocument3 pagesStreamlined BIR Transfer Pricing GuidelinesJejomarNo ratings yet

- RMC No 89-2017Document3 pagesRMC No 89-2017Mark Lord Morales BumagatNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- Digest RR 14-2018Document1 pageDigest RR 14-2018Carlota Nicolas VillaromanNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- RR 12-01Document6 pagesRR 12-01matinikkiNo ratings yet

- Amendments to Revenue Regulations on Deficiency Tax AssessmentsDocument2 pagesAmendments to Revenue Regulations on Deficiency Tax AssessmentsChristopher ArellanoNo ratings yet

- Uprii ,: Memorandum Circular Clarifies CertainDocument9 pagesUprii ,: Memorandum Circular Clarifies CertainBert AslorNo ratings yet

- RR 3-02Document6 pagesRR 3-02matinikkiNo ratings yet

- REVOKING REVENUE REGULATIONS REINSTATING PRIOR PROVISIONSDocument2 pagesREVOKING REVENUE REGULATIONS REINSTATING PRIOR PROVISIONSAndrew Benedict PardilloNo ratings yet

- Who To File RPTDocument9 pagesWho To File RPTLacie Hohenheim (Doraemon)No ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- 2019 Year End AdjustmentDocument86 pages2019 Year End AdjustmentATRIYO ENTERPRISESNo ratings yet

- RR No. 22-2020 PDFDocument2 pagesRR No. 22-2020 PDFSandyNo ratings yet

- Bureau of Internal RevenueDocument4 pagesBureau of Internal RevenueYna YnaNo ratings yet

- Revenue Regulations No. 34-2020Document3 pagesRevenue Regulations No. 34-2020zelayneNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- Amending Exchange of Information RegulationsDocument2 pagesAmending Exchange of Information Regulationsjomari ian simandoNo ratings yet

- Philippines extends tax payment program deadlineDocument2 pagesPhilippines extends tax payment program deadlineJejomarNo ratings yet

- RR No. 02-2006Document10 pagesRR No. 02-2006odessaNo ratings yet

- Memo Circular No. 2016-014Document27 pagesMemo Circular No. 2016-014Evelyn Rose LumbisNo ratings yet

- Revenue Regulations No. 2-2011Document3 pagesRevenue Regulations No. 2-2011Jose IbarraNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- RR No. 31-2020Document3 pagesRR No. 31-2020nathalie velasquezNo ratings yet

- RR No. 31-2020Document3 pagesRR No. 31-2020JejomarNo ratings yet

- RMC No. 76-2020Document11 pagesRMC No. 76-2020Bobby LockNo ratings yet

- BIR issues guidelines for monitoring top withholding agentsDocument4 pagesBIR issues guidelines for monitoring top withholding agentsJames Salviejo PinedaNo ratings yet

- PEZA Reportorial RequirementsDocument25 pagesPEZA Reportorial RequirementsDarioNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument2 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceLlyod Francis LaylayNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- RR No. 12-2021Document3 pagesRR No. 12-2021eric yuulNo ratings yet

- Mc2023051 (Application for ESD Clearance)Document7 pagesMc2023051 (Application for ESD Clearance)jgagarinNo ratings yet

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055No ratings yet

- Chapter 8 Income TaxationDocument7 pagesChapter 8 Income TaxationChristine Joy Rapi MarsoNo ratings yet

- RMC No 51-2008Document7 pagesRMC No 51-2008Yasser MangadangNo ratings yet

- Jllois: in ToDocument2 pagesJllois: in ToA2 ZNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2Boss NikNo ratings yet

- Withholding Taxes: Carlo P. Divedor 19 October 2017Document20 pagesWithholding Taxes: Carlo P. Divedor 19 October 2017Melanie Grace Ulgasan LuceroNo ratings yet

- Revenue Regulations No. 6 ' 9.0 2 2: Muauc Ofthe Philippines Department or FinanceDocument3 pagesRevenue Regulations No. 6 ' 9.0 2 2: Muauc Ofthe Philippines Department or FinancerodrigoNo ratings yet

- Income Not Part of Total Income Full NotesDocument93 pagesIncome Not Part of Total Income Full NotesCA Rishabh DaiyaNo ratings yet

- RMC 72-04Document9 pagesRMC 72-04ai0412No ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- Removing 5-Year Validity of ReceiptsDocument3 pagesRemoving 5-Year Validity of Receiptschato law officeNo ratings yet

- Finance Act 2010 Explanatory NotesDocument24 pagesFinance Act 2010 Explanatory NotesNiraj JainNo ratings yet

- Revei (Ue Memorai/Dum Crrcular No.: Interi (AlDocument2 pagesRevei (Ue Memorai/Dum Crrcular No.: Interi (AlRONIN LEENo ratings yet

- Withholding Taxes 2Document20 pagesWithholding Taxes 2hildaNo ratings yet

- RR No 21-2018Document3 pagesRR No 21-2018Larry Tobias Jr.No ratings yet

- Remedies: TaxAdmin-PowerRemedyDocument101 pagesRemedies: TaxAdmin-PowerRemedyJm CruzNo ratings yet

- RMO 07-15 List of PenaltiesDocument23 pagesRMO 07-15 List of PenaltiesMatthew TiuNo ratings yet

- RMC No 42-2018 PDFDocument1 pageRMC No 42-2018 PDFAna DocallosNo ratings yet

- Major Changes to Income Tax and Wealth Tax in Budget 2009-2010Document9 pagesMajor Changes to Income Tax and Wealth Tax in Budget 2009-2010Irfan AhmadNo ratings yet

- RR No. 1-2017Document3 pagesRR No. 1-2017Kayelyn LatNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Approaches Essay and Discussion QuestionsDocument1 pageApproaches Essay and Discussion QuestionssdysangcoNo ratings yet

- Colin Combe - Introduction To Management (2014, Oxford University Press) - Libgen - LiDocument660 pagesColin Combe - Introduction To Management (2014, Oxford University Press) - Libgen - LisdysangcoNo ratings yet

- An Introduction To Theory and PracticeDocument16 pagesAn Introduction To Theory and PracticesdysangcoNo ratings yet

- TOEFLDocument6 pagesTOEFLsdysangcoNo ratings yet

- NUS - Faculty of Law - Asia's Global Law SchoolDocument6 pagesNUS - Faculty of Law - Asia's Global Law SchoolsdysangcoNo ratings yet

- 1987 PH Constitution (Filipino)Document77 pages1987 PH Constitution (Filipino)sdysangcoNo ratings yet

- Is 290 SyllabusDocument9 pagesIs 290 Syllabusjoan_corradoNo ratings yet

- LLM FAQsDocument5 pagesLLM FAQssdysangcoNo ratings yet

- Class A Operator Quiz Jan. 2017 ManagementDocument10 pagesClass A Operator Quiz Jan. 2017 ManagementReema100% (1)

- The Legacy of NeofunctionalismDocument10 pagesThe Legacy of NeofunctionalismsdysangcoNo ratings yet

- Opinion - How To Run The New York City Marathon, Slowly - The New York TimesDocument3 pagesOpinion - How To Run The New York City Marathon, Slowly - The New York TimessdysangcoNo ratings yet

- State of The Nation Address OF His Excellency Ferdinand R. Marcos Jr. President of The Philippines To The Congress of The PhilippinesDocument23 pagesState of The Nation Address OF His Excellency Ferdinand R. Marcos Jr. President of The Philippines To The Congress of The PhilippinesagathaNo ratings yet

- Opinion - Why I Stopped Running During The Pandemic (And How I Started Again) - The New York TimesDocument3 pagesOpinion - Why I Stopped Running During The Pandemic (And How I Started Again) - The New York TimessdysangcoNo ratings yet

- Application ProceduresDocument3 pagesApplication ProceduressdysangcoNo ratings yet

- 2008 Political LawDocument4 pages2008 Political LawsdysangcoNo ratings yet

- 2008 Remedial LawDocument5 pages2008 Remedial LawsdysangcoNo ratings yet

- Petitioner Respondents Leonides S. Respicio & Associates Law Office Galileo P. BrionDocument4 pagesPetitioner Respondents Leonides S. Respicio & Associates Law Office Galileo P. BrionsdysangcoNo ratings yet

- Supreme Court: Administrative Circular No. 14 - 2021Document1 pageSupreme Court: Administrative Circular No. 14 - 2021Bobby Olavides SebastianNo ratings yet

- Bedrock Land's manual on land registration and acquisitionDocument4 pagesBedrock Land's manual on land registration and acquisitionsdysangcoNo ratings yet

- 2007 Political and Public International LawDocument4 pages2007 Political and Public International LawsdysangcoNo ratings yet

- Amicable SettelementDocument1 pageAmicable SettelementsdysangcoNo ratings yet

- 2006 Remedial LawDocument4 pages2006 Remedial LawsdysangcoNo ratings yet

- 2006 Political and Public International LawDocument3 pages2006 Political and Public International LawsdysangcoNo ratings yet

- 2008 Remedial LawDocument5 pages2008 Remedial LawsdysangcoNo ratings yet

- 2006 Remedial LawDocument4 pages2006 Remedial LawsdysangcoNo ratings yet

- G.R. No. 107383Document3 pagesG.R. No. 107383sdysangcoNo ratings yet

- Administrative Circular No. 38 - 2020Document3 pagesAdministrative Circular No. 38 - 2020Sarita Alvarado-de JesusNo ratings yet

- Administrative Circular No. 13-2001Document1 pageAdministrative Circular No. 13-2001sdysangcoNo ratings yet

- 2006 Civil LawDocument5 pages2006 Civil LawsdysangcoNo ratings yet

- Go-Tan Vs Spouses TanDocument7 pagesGo-Tan Vs Spouses TanZor RoNo ratings yet

- WK03 - UT01 - Post Assignment PDFDocument3 pagesWK03 - UT01 - Post Assignment PDFAkshay GiteNo ratings yet

- Non Linear Hydrodynamic Journal BearingDocument7 pagesNon Linear Hydrodynamic Journal BearingMuhammad AlBaghdadyNo ratings yet

- Company Profile InductionDocument11 pagesCompany Profile InductionGuptaVipinNo ratings yet

- Dynashears Inc CaseDocument4 pagesDynashears Inc Casepratik_gaur1908No ratings yet

- Nu-Calgon Application BulletinDocument4 pagesNu-Calgon Application BulletinJoe HollandNo ratings yet

- Transformational Leadership: Ronald E. RiggioDocument4 pagesTransformational Leadership: Ronald E. RiggioEmmanuel PicazoNo ratings yet

- Marine Resources Landing: An Interview-Based Study of Kota Kinabalu Fish Market VendorsDocument22 pagesMarine Resources Landing: An Interview-Based Study of Kota Kinabalu Fish Market VendorsZhang LauNo ratings yet

- Automated Optical Inspection TrainingDocument30 pagesAutomated Optical Inspection TrainingSelvakumar100% (1)

- Payslip Jun 2019 PDF DocumentDocument6 pagesPayslip Jun 2019 PDF DocumentAbdus SubhanNo ratings yet

- The Impact of Motivation On Employees Job Performance in On OrganizationDocument21 pagesThe Impact of Motivation On Employees Job Performance in On OrganizationShelveyElmoDias100% (2)

- 1 Phase TransformerDocument14 pages1 Phase TransformerprakashNo ratings yet

- Blackbook Project On Modernization in Banking System in India - 163418955Document81 pagesBlackbook Project On Modernization in Banking System in India - 163418955Varun ParekhNo ratings yet

- 19 Circular For Internal Audit Requirement For RTAs and Issuers Having Electronic Connectivity With NSDLDocument3 pages19 Circular For Internal Audit Requirement For RTAs and Issuers Having Electronic Connectivity With NSDLnayana savalaNo ratings yet

- CV Europass 20181011 enDocument1 pageCV Europass 20181011 endrinahuangNo ratings yet

- OB2301W On BrightElectronicsDocument11 pagesOB2301W On BrightElectronicsIlago BenignoNo ratings yet

- Locomotive Package PDFDocument141 pagesLocomotive Package PDFrahulNo ratings yet

- Philippine Supreme Court Rules on Bank Loans and Foreclosure CasesDocument158 pagesPhilippine Supreme Court Rules on Bank Loans and Foreclosure CasescrazybedanNo ratings yet

- Patents: Md. Noman SiddikeeDocument27 pagesPatents: Md. Noman SiddikeezulfikarNo ratings yet

- Ipcrf 3-4Document12 pagesIpcrf 3-4adrienn earl NarzabalNo ratings yet

- Come Fly With MeDocument6 pagesCome Fly With MeKintyre On Record100% (2)

- Compiler DirectivesDocument4 pagesCompiler DirectivesSreekanth PagadapalliNo ratings yet

- U4 LaADocument3 pagesU4 LaAelsieNo ratings yet

- Foundations For Assisting in Home Care 1520419723Document349 pagesFoundations For Assisting in Home Care 1520419723amasrurNo ratings yet

- Intro To MA Aug 2013Document14 pagesIntro To MA Aug 2013Nakul AnandNo ratings yet

- DO MigrateCisco2Juniper.V2Document105 pagesDO MigrateCisco2Juniper.V2Anderson OlivierNo ratings yet

- A330 - Tutorials - MAY-2022Document675 pagesA330 - Tutorials - MAY-2022c4yszymmny100% (1)

- Sabitsana vs. MuerteguiDocument7 pagesSabitsana vs. MuerteguiElephantNo ratings yet

- Resuming maiden name after divorceDocument15 pagesResuming maiden name after divorceNurlailah AliNo ratings yet

- Travel Agent Handbook 818g EngDocument403 pagesTravel Agent Handbook 818g Englupetescupe100% (1)