Professional Documents

Culture Documents

Mbaeducationsectionprojectexamples 13

Uploaded by

santosh0 ratings0% found this document useful (0 votes)

16 views2 pagesOriginal Title

mbaeducationsectionprojectexamples13.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesMbaeducationsectionprojectexamples 13

Uploaded by

santoshCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

E D U C A T I O N S E C T I O N E XA M P L E S

If you don’t have MBA Projects yet: choose 2-3 items to add - here are examples to help you think of

relevant ones for you:

Master of Business Administration, Emphases: Emphasis #1 | Emphasis #2, June 2012

University of California, Davis, Graduate School of Management, Working Professional Program

Relevant courses taken: Product Development, Portfolio Analysis, Corporate Finance, Merger &

Acquisition, Financial Accounting, Business Taxation.

Bay Area MBA Portfolio Challenge, CFA Society of San Francisco, Lead winning team 2010

Beta Gamma Sigma Honor Society (top 20% of the graduating class).

Completed 11 quarters of finance courses covering topics including equity valuation, derivative

securities, quantitative analysis, financial accounting, merger & acquisition, venture capital, and

corporate finance.

VP, Finance – UC Davis Bay Area Marketing Association, 2012 – Present

VP, UC Davis Bay Area NetImpact – Philanthropic Council, 2012 – Present

Way’s to Incorporate MBA Projects - choose 1 or 2 projects that will help target toward the job opening.

Below are MANY Project Examples from other GSM resumes to help you think of relevant ones for you:

Master of Business Administration, Emphases: Emphasis #1 | Emphasis #2, June 2012

University of California Davis, Graduate School of Management

Financial Modeling Project – Developed a detailed financial model for the leveraged buyout of Free

Scale semiconductor by Blackstone Capital. Used earnings projections, associated weighted average

cost of capital and DCF computations.

Business Plan Development Project – Prepared a detailed business plan to launch “Ziddle”, a service

that enables companies to be more socially responsible by offering green and productive commuting

options to their employees.

M&A Analysis Project: Analyzed financial and strategic highlights of the Adobe, Macromedia merger.

Performed a comparables analysis of other transactions in the enterprise application sector to research

key market valuation metrics.

Biotech Project: Analyzed Genentech’s manufacturing leadership structure which was presented to the

associate director for Cell Culture Manufacturing

Value Investing Project: Independently developed a tool automating over 500 hours of analysis effort

required from the class. In addition to extracting financial data, the tool applied data mining techniques

that automatically examined value investing strategies from entire markets within a matter of hours.

After completion, fund managers who taught the class retained me as a consultant to further automate

their analysis efforts.

New Ventures Project: Developed a complete business plan for a mobile application. Plan included a

detailed business model, marketing strategy, and full financial projections from initial funding through

IPO, leading to a 12x ROI. Professor requested that business plan be used as a benchmark for future

courses.

Data Mining Project: Utilized association rules in WEKA to analyze shopping patterns from over

150,000 HP sales orders. HP implemented a number of the report’s findings, ultimately increasing the

effectiveness of their dynamic recommendations system.

Business Plan Development Project – Worked on an MBA team to develop a complete business plan

for a cell phone dating application. The plan included a detailed business model, marketing strategy,

and financial projections. Submitted the business plan to both the UC Davis and UC Berkeley business

plan competitions.

Strategy Project: Worked on an MBA team to analyze AMD’s current organization and business in an

effort to develop strategic recommendations which would allow the company to attain profitable

growth. Recommendations included product development shifts, R&D organization changes, asset

management changes, and focus on competitive sales channels.

Corporate Strategy Project – Conducted a detailed industry analysis of Electronic Arts’ entry into the

mobile video gaming market, including strategy recommendations for maintaining revenue and profit

margins.

Decision Science Project – Constructed a socially responsible efficient stock portfolio utilizing mean-

variance/non-linear optimization based on the genetic algorithm.

Business Plan Development – Prepared a detailed business plan to launch “SmartShip”, a cloud based

supply chain optimization service that drastically reduces logistics costs via efficient planning,

scheduling, and consolidated shipping.

Negotiations – Analyzed negotiation tactics utilized by all stakeholders during Porsche’s pursuit of

Volkswagen that ended up in a Volkswagen acquisition of Porsche.

Marketing Strategy – Conducted a detailed comparative study of Cisco and Juniper’s marketing

strategies for network routers.

Valuation – Conducted end-to-end valuation exercises for two publicly listed companies, including

forecasting, ratio analysis, cost of capital and DCF calculation, and finally determine expected stock

price.

Corporate Finance – Developed a detailed financial model to evaluate financing options for a private

firm to support short and long term revenue growth.

Organizational Behavior – Conducted a detailed study of gender bias at Deloitte & Touche and their

WIN initiative for the retention and advancement of women employees.

IT Management – Conducted a detailed evaluation of a customer relationship management technology

implementation for non-profit organization and the potential value CRM tools provide to non-profit

organizations in general.

Marketing Research – Conducted an end-to-end primary market research study to aide the decision

making process for launching Skaboosh.com, a web-based travel activity/vendor management service.

This study entailed a focus group study, a general survey, and statistical data analysis using SPSS.

Investment Analysis – Constructed a detailed financial model to provide strategic and tactical asset

allocation recommendations to a private foundation.

Business Taxation – Conducted a detailed study of a tax arbitrage – Estee Lauder’s attempted use of

short selling to convert a massive tax liability into a tax refund.

You might also like

- Structural Transformation Through E-Business: Ezgi ÖztörünDocument23 pagesStructural Transformation Through E-Business: Ezgi Öztörünsantosh100% (1)

- Business Plan For Starting A Chocolate CompanyDocument24 pagesBusiness Plan For Starting A Chocolate CompanyChandan Pahelwani88% (17)

- YBA401 Rural Business Management Seminar TopicsDocument1 pageYBA401 Rural Business Management Seminar TopicssantoshNo ratings yet

- Mba HR - Project Topics: Page - 1Document2 pagesMba HR - Project Topics: Page - 1santoshNo ratings yet

- Table of ContentDocument1 pageTable of ContentsantoshNo ratings yet

- HR student paper titles and team membersDocument2 pagesHR student paper titles and team memberssantoshNo ratings yet

- Business Plan - Presentation: Master of Business AdministrationDocument37 pagesBusiness Plan - Presentation: Master of Business AdministrationsantoshNo ratings yet

- Bank financials comparison 2017 vs 2016Document1 pageBank financials comparison 2017 vs 2016santoshNo ratings yet

- Assignment Sathya MamDocument3 pagesAssignment Sathya MamsantoshNo ratings yet

- The Impact of Demonetisation of Currency in Thanjavur CityDocument3 pagesThe Impact of Demonetisation of Currency in Thanjavur CitysantoshNo ratings yet

- Definitions of TQM: A) "TQM Is A Corporate Business Management Philosophy Which Recognizes That Customer NeedsDocument4 pagesDefinitions of TQM: A) "TQM Is A Corporate Business Management Philosophy Which Recognizes That Customer NeedssantoshNo ratings yet

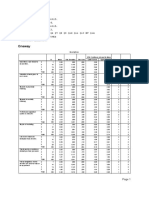

- Variable N Mean STD Dev Minimum MaximumDocument2 pagesVariable N Mean STD Dev Minimum MaximumsantoshNo ratings yet

- Forestry QuestionnaireDocument5 pagesForestry QuestionnaireJasmin QuebidoNo ratings yet

- Consumer Buying Behaviour For Ball PensDocument122 pagesConsumer Buying Behaviour For Ball PenssantoshNo ratings yet

- Training Evaluation FormDocument2 pagesTraining Evaluation FormMajid Dawood KhanNo ratings yet

- Objective (TNPL) - OCulusDocument1 pageObjective (TNPL) - OCulussantoshNo ratings yet

- G.Ashni and Dr.K.V.R.RajandranDocument5 pagesG.Ashni and Dr.K.V.R.RajandransantoshNo ratings yet

- Work Life BalanceDocument4 pagesWork Life BalancesantoshNo ratings yet

- Continuous Assessment: Assignment No - 01 ONDocument1 pageContinuous Assessment: Assignment No - 01 ONsantoshNo ratings yet

- Work Life BalanceDocument73 pagesWork Life BalanceRAMAKRISHNAN89% (9)

- Ybae68 Product Design: Question Bank Unit - IDocument1 pageYbae68 Product Design: Question Bank Unit - IsantoshNo ratings yet

- Your NEFT transaction confirmation from City Union BankDocument1 pageYour NEFT transaction confirmation from City Union BanksantoshNo ratings yet

- Ybae68 Product Design: Question Bank Unit - IDocument1 pageYbae68 Product Design: Question Bank Unit - IsantoshNo ratings yet

- MRDocument2 pagesMRsantoshNo ratings yet

- Anove NewDocument6 pagesAnove NewsantoshNo ratings yet

- Ybae68 Product DesignDocument2 pagesYbae68 Product DesignsantoshNo ratings yet

- Ybae68 Product Design: Question Bank Unit - IDocument1 pageYbae68 Product Design: Question Bank Unit - IsantoshNo ratings yet

- Human Resource Glossary of TermsDocument10 pagesHuman Resource Glossary of TermssantoshNo ratings yet

- Attendance Sheet: Name: Degree: Identity Card No.: Institution: Area of Training: Project Period: ToDocument2 pagesAttendance Sheet: Name: Degree: Identity Card No.: Institution: Area of Training: Project Period: TosantoshNo ratings yet

- FromDocument1 pageFromsantoshNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignment 2 HRMN 300Document12 pagesAssignment 2 HRMN 300Sheraz HussainNo ratings yet

- MEC713 ProjectManagement MidtermlExam 2013Document8 pagesMEC713 ProjectManagement MidtermlExam 2013Fadi RonaldoNo ratings yet

- Report: Devops Literature Review: October 2014Document28 pagesReport: Devops Literature Review: October 2014ROHAN DARVENo ratings yet

- Chapter 3Document30 pagesChapter 3SultanNo ratings yet

- Jack Welch ResumeDocument16 pagesJack Welch ResumeBharat SmartIMSNo ratings yet

- Commissioning Team Roles & ResponsibilitiesDocument8 pagesCommissioning Team Roles & ResponsibilitiesGabrielNo ratings yet

- Lecture 2-The Strategic Role of HRMDocument18 pagesLecture 2-The Strategic Role of HRMjohboy2418No ratings yet

- QAD Provides: Enterprise Resource Planning SoftwareDocument7 pagesQAD Provides: Enterprise Resource Planning SoftwarersvbitsmsNo ratings yet

- COO Healthcare Multi-Unit Operations in Phoenix AZ Resume Scott GemberlingDocument2 pagesCOO Healthcare Multi-Unit Operations in Phoenix AZ Resume Scott GemberlingScottGemberlingNo ratings yet

- PhoenixSolar-Annual Report 2015Document152 pagesPhoenixSolar-Annual Report 2015Alex MartayanNo ratings yet

- CIE AssignmentDocument20 pagesCIE AssignmentsheharaNo ratings yet

- ISO IEC 27001 Lead AuditorDocument9 pagesISO IEC 27001 Lead AuditorAd000121No ratings yet

- Activity-Based Costing: Learning ObjectivesDocument41 pagesActivity-Based Costing: Learning ObjectivesFarisha RazNo ratings yet

- Disposal ProcessDocument2 pagesDisposal ProcessRey Regaspi TuyayNo ratings yet

- CA Final Afm t380Document257 pagesCA Final Afm t380Bijay AgrawalNo ratings yet

- Chapter 2 - Business ProcessesDocument4 pagesChapter 2 - Business ProcessesKim VisperasNo ratings yet

- Guide - Html#purpose Scrum GlossaryDocument5 pagesGuide - Html#purpose Scrum GlossarynahikariNo ratings yet

- HR Tools Used in Recruitment & Selection AnalyticsDocument12 pagesHR Tools Used in Recruitment & Selection AnalyticsNIMIT BANSAL100% (1)

- Chapter 7 SOA For Business AutomationDocument25 pagesChapter 7 SOA For Business AutomationAmalNo ratings yet

- How To Measure and Increase Customer LoyaltyDocument4 pagesHow To Measure and Increase Customer Loyaltysalesforce.com100% (6)

- Accounting Research Part 1Document2 pagesAccounting Research Part 1Leonard CañamoNo ratings yet

- Rooms and Division ManagementDocument9 pagesRooms and Division ManagementZiyovuddin Abduvaliev100% (1)

- Chapter 1 Managing The Digital FirmDocument50 pagesChapter 1 Managing The Digital FirmEslam MansourNo ratings yet

- Johnson & JohnsonDocument13 pagesJohnson & JohnsonmubeenNo ratings yet

- Recruitment Advertisement For Faculty Positions (Regular)Document16 pagesRecruitment Advertisement For Faculty Positions (Regular)Khushboo Haider RizviNo ratings yet

- Material Management and PlanningDocument6 pagesMaterial Management and PlanningDr.Rachanaa DateyNo ratings yet

- Reflection Essay On Simulation - EditedDocument3 pagesReflection Essay On Simulation - EditedKevin LamarNo ratings yet

- Assessment Questions - Service Level ManagementDocument2 pagesAssessment Questions - Service Level ManagementojajahNo ratings yet

- SCM AssignmentDocument11 pagesSCM AssignmentMD MizanNo ratings yet

- Chapter 6 MGMT 480Document18 pagesChapter 6 MGMT 480Mina BeshayNo ratings yet