Professional Documents

Culture Documents

Absorption Chiller Outlook PDF

Uploaded by

THERMAX007Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absorption Chiller Outlook PDF

Uploaded by

THERMAX007Copyright:

Available Formats

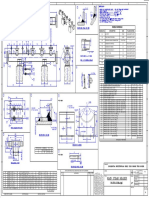

CH670520413AC

ABSORPTION CHILLERS MCP-6705

Outlook

The global market for absorption chillers is estimated at US$763.27 million for 2013. Growing at a

compounded annual rate of 3.21% over the analysis period 2010-2018, the market is likely to reach

US$921.80 million by 2018.

Asia-Pacific Continues to Lend Traction to the Market

Asia-Pacific continues to represent the largest and the fastest growing regional market for absorption

chillers. Rapid economic development, growth in manufacturing and processing activity, particularly in

emerging countries such as China and India and other industrialized nations such as Korea, Taiwan,

Singapore, and Indonesia, increased construction of commercial business facilities, and subsequent

growth in demand for comfort and process cooling equipment are particularly driving demand for

absorption chillers in the region. Inadequate power supply in many of the countries, and growing

consumer awareness on energy efficiency are also driving increased adoption of absorption chillers

for cooling systems in a range of industry segments in the region. Government mandates to control

noxious gas emissions, and improve energy efficiency in industrial and commercial facilities is also

helping drive increased adoption of absorption chillers in the region. Supply of gas in certain countries

such as Pakistan is also expected to fuel demand for gas-fired absorption chillers. Commissioning and

installation of new chemical facilities outside North America and Europe additionally resulted in shifting

of demand for absorption chillers from the developed to the emerging markets. Although a major

market already, Asia-Pacific still offers huge untapped market potential for absorption chillers,

particularly in Tier-II and Tier III industrial areas. Given the lucrative opportunities in store, global

players have already started focusing on Asia-Pacific market. Leading companies such as Carrier

Corporation, York International, Trane, Daikin McQuay, Dunham-Bush, and Kawasaki Thermal

Engineering, among others, already have established their presence in many countries in the region.

The expertise and knowledge of these manufacturers in other chiller segments is likely to provide a

robust platform for greater and easier penetration in the absorption chiller category in the region.

TABLE 3: Absorption Chillers as Percentage of Total Chillers Market (2011): Breakdown

by Region - Asia & Oceania, North & South America, Europe, and Rest of World

Region % Share % Share

Asia & Oceania 8.76 Asia & Oceania

North & South America

North & South America 2.83

Europe

Europe 1.23 Rest of world

Rest of world 3.14 0 1.9 3.8 5.7 7.6 9.5

Absorption Chillers Face Stiff Competition from Other Popular Chiller Categories

Despite the huge opportunities for growth, the absorption chillers continue to battle it out with other

competing chiller technologies such as screw, reciprocating, scroll and centrifugal chiller systems for

ABSORPTION CHILLERS - A GLOBAL STRATEGIC BUSINESS REPORT 04/13

This Report Is Protected With Digital Watermarks. Copyrights per US & ICC protocols.

This Document May Not Be Printed, Copied or Distributed Outside Your Organization in Any Form Without Our Express Written Permission

© Global Industry Analysts, Inc., Phone: 408-528-9966, Fax: 408-528-9977, 6150 Hellyer Avenue, San Jose, CA 95138, USA

www.StrategyR.com Page II-10

CH670520413AC

ABSORPTION CHILLERS MCP-6705

market share. As conventional chiller technologies have already gained considerable penetration in

commercial and industrial markets and enjoy significant success in implementations, they are not

likely to be replaced with new absorption chillers very soon, thus posing major hindrance to the

expansion of the absorption chillers market. Although absorption chillers make strong sense for

energy conservation and environmental reasons, they however are yet to achieve mass market

adoption in industrial and commercial applications. Absorption chillers suffer from perceived

drawbacks such as lower efficiency rates, high ownership costs, and large space requirements.

Absorption chillers are perceived to be less efficient than compressor driven chillers given that they

use water as a refrigerant, which is less efficient as a refrigerant than fluorocarbon based

refrigerants. This lower efficiency mandates larger components, making absorption chillers larger

and more space consuming than electric chillers of same capacity. Also, absorption chillers need

dedicated space for installation and maintenance (volume of steam absorption chillers is 0.2 m3 per

KW). Therefore, any space constrains or structural limitations (especially in small buildings) can

become an impediment for use of absorption chillers. Although absorption chillers bring

considerable savings on electricity costs in the long run, they are highly expensive upfront, which

make most of the commercial and industrial consumers prefer less expensive products. Absorption

chillers also could not overshadow other chiller technologies over the years, given that most of

these models that came into the market were designed for use in large scale industrial and

commercial applications, thus limiting their adoption in light commercial and residential structures.

Additionally, given that water is the most important component for functioning of absorption chiller,

water supply shortages in certain areas is a major hindrance to its widespread adoption.

Robust Increase in Sales of Centrifugal Chillers - A Cause for Concern

Absorption chillers are facing stiff completion from the centrifugal chiller category. Growing popularity

of centrifugal chillers in industrial and commercial segments, and a flourishing multi-split air conditioners

market is biting into the share of absorption chillers. Subsequently, a large number of companies

are also launching newer and more efficient centrifugal chiller products in order to increase their

respective market shares. In case of the scroll/reciprocating chillers category, primarily air-cooled

modular scroll chillers rule the demand scene. Of late, sales of modular chillers has been witnessing

rapid growth and increase in market share, mainly due to their capability of addressing general

requirements, low-costs compared to screw chillers and easy maintenance and installation benefits.

Lack of Awareness - Major Concern

Lack of awareness among consumers about the availability of absorption chiller technology in the

market and its environmental and economical benefits is a major factor pulling back market growth.

Even in markets where chillers have a certain share, poor consumer perceptions regarding reliability

of the product restricts penetrations rates. Lack of technical skills and practical experience among

professionals, particularly in emerging markets is a setback to the absorption chiller market in these

regions, as the viability and usage benefits are not clearly propagated to end-users.

Technology Developments to Bring New Opportunities

Manufacturers currently are concentrating on research and development activities focused on

designing cost-effective absorption chiller units with high efficiency rates. Companies are also

ABSORPTION CHILLERS - A GLOBAL STRATEGIC BUSINESS REPORT 04/13

This Report Is Protected With Digital Watermarks. Copyrights per US & ICC protocols.

This Document May Not Be Printed, Copied or Distributed Outside Your Organization in Any Form Without Our Express Written Permission

© Global Industry Analysts, Inc., Phone: 408-528-9966, Fax: 408-528-9977, 6150 Hellyer Avenue, San Jose, CA 95138, USA

www.StrategyR.com Page II-11

CH670520413AC

ABSORPTION CHILLERS MCP-6705

integrating certain add on features such as microprocessors and sophisticated lamps for enhancing

the convenience benefits of these chiller machines. Most of the absorption chiller units sold today

use automatic purge systems that eliminate the need for manual purging. Not only has the

integration of automatic purging systems reduced risk of corrosion, integration of microprocessor

solid state controls and concentration sensing has significantly enhanced control system response

times and lowered chances of crystallization. Producers are also integrating absorption chillers with

mass spectrometers and LEP lamp to indicate the status of mechanic operation/shutdown along

with ensuring stringent quality control that would improve efficiency and convenience benefits

associated with absorption chillers.

Technological advancements that would enhance system technology, basic materials and

components would provide growth opportunities by lowering costs and ramping up performance.

Increasing developments in the absorption chillers market is likely to lower costs of the absorption

chiller unit leading to its widespread adoption and rapid upgradations.

Triple-Effect Absorption Chillers: An Upcoming Technology

In response to the ever-growing need for high-efficiency absorption chillers, a large number of

companies have introduced triple-effect systems and these are likely to emerge as one of the

fastest growing categories of absorption chillers. These chillers are expected to have a higher COP

than double-effect chillers and would be available with two different cycles. One variant includes

three condensers systems where the third condenser functions as a sub-cooler, while the second

variant uses two absorbers and two condensers. One of the most significant advantages associated

with advanced triple-effect chillers is the likelihood of achieving thermal efficiencies at par with

efficiency rates of mechanical/electrical chillers. Such superior performance would most likely

facilitate absorption chillers segment to gain a greater share in the chiller market.

Rising Demand for Compact Absorption Chillers from Residential Sectors

Commercially sold absorption chillers with capacities ranging from medium level (50-300kW) to high

(300kW and up) level have been successfully implemented in a host of solar cooling applications

and CHPs for industrial and large commercial applications. Growing need for development of

solutions that can bring down electricity costs, especially to fulfill air conditioning requirements in

residential and small commercial facilities has prompted introduction of smaller capacity absorption

cooling systems with capacity less than 50kW. Initiatives taken by the International Energy Agency

(IEA) under Task 25 and Task 38 have led to the introduction of small capacity absorption units into

the market. The 16 KW and 23 KW capacity absorption chillers, which are suitable for such small-

scale applications are especially witnessing high demand and are accounting for higher percentage

of sales than large capacity chillers. Compact absorption chillers effectively make use of waste

process low-intensity heat generated as a waste product or by-product in various industrial

processes. Further, natural heat from the sun can also be channelized to solar thermal systems and

heating networks and converted efficiently to meet cooling and air conditioning requirements in

residential buildings, and commercial and industrial establishments. Consequently, the need for

compact and high capacity absorption chilling units is rising at a rapid pace. Modular and compactly

designed twin container absorption chillers that can be easily disassembled and reassembled on

the site are increasing being installed across various facilities and establishments. During the winter

months, absorption chillers can be also be used as a heat pump in district heating units.

ABSORPTION CHILLERS - A GLOBAL STRATEGIC BUSINESS REPORT 04/13

This Report Is Protected With Digital Watermarks. Copyrights per US & ICC protocols.

This Document May Not Be Printed, Copied or Distributed Outside Your Organization in Any Form Without Our Express Written Permission

© Global Industry Analysts, Inc., Phone: 408-528-9966, Fax: 408-528-9977, 6150 Hellyer Avenue, San Jose, CA 95138, USA

www.StrategyR.com Page II-12

CH670520413AC

ABSORPTION CHILLERS MCP-6705

Despite potential in store, compact and small capacity absorption chillers market continues to face

pressing challenges. The typically high investment cost, limited number of manufacturers focusing

on these products, and need for additional equipment for its functioning are especially proving to be

a key bottleneck for its mass adoption. Additionally, lack of adequate evaluation standards, test

procedures and best practice guides for the evaluation of these chilling systems are likely to restrict

growth of absorption chillers market.

Government Initiatives & Regulatory Measures Assure Market Expansion

Initiatives taken by various governments and other market entities can help the absorption chiller

market reach a critical level in terms of volume sales, thereby providing a strong platform for growth

to become self-sustaining. To achieve desired growth, some measures that need to be taken by

governments include:

Banning use of refrigerants that are not environmentally safe

Providing financial incentives to customers in the form of discounted gas rates, financing

purchase of the equipment, tax credits and tax concessions, among others

Making provisions in building regulations that discourage extensive consumption of electricity for

cooling purposes

Providing support to manufacturers for engaging in technological developments, improving

efficiencies of the products, and attaining standardization of chiller equipment, thereby helping

them reach mass market levels

Government measures to induce organizations and other end-users to improve energy

efficiencies and eliminate green house emissions.

Industry Promotional & Marketing Efforts to Help Drive Increased Adoption

Demonstration Projects: A Launch Pad for Absorption Chillers

Demonstration projects set up particularly in regions that have low acceptance and presence of the

product would bring about standardization in system technology and would showcase results that

would provide a platform for gaining new customers and increasing equipment installations. This

would also encourage new facilities to install absorption chillers.

Training and Marketing Initiatives to Foster Awareness Levels

Providing technology-based training for professionals and conducting product related marketing

campaigns targeted at various consumers such as installers, architects, organizations, industries

and also government bodies would most likely result in enhancing awareness among suppliers and

relevant stakeholders.

Other initiatives

Other manufacturer initiatives that would enhance the demand for absorption chillers include:

Quantifying and promoting economic and environmental benefits of absorption cooling

implementations through seminars, workshops, conferences and publications.

Promoting various marketing strategies to augment share of the absorption chiller market.

ABSORPTION CHILLERS - A GLOBAL STRATEGIC BUSINESS REPORT 04/13

This Report Is Protected With Digital Watermarks. Copyrights per US & ICC protocols.

This Document May Not Be Printed, Copied or Distributed Outside Your Organization in Any Form Without Our Express Written Permission

© Global Industry Analysts, Inc., Phone: 408-528-9966, Fax: 408-528-9977, 6150 Hellyer Avenue, San Jose, CA 95138, USA

www.StrategyR.com Page II-13

CH670520413AC

ABSORPTION CHILLERS MCP-6705

Conveying environmental and energy saving benefits of absorption chillers to government

authorities in order to gain subsidies and implementation financing.

Lowering costs by engaging in mass production of chillers

Providing efficient after sales services and technical assistance to existing customers, not only

maintain the existing customer base but to appeal to new ones

Establishing committees and associations (Such as The Green Chiller Association in Europe

formed to promote solar and thermal cooling systems) that encourage and support use of energy

efficient technologies, especially the absorption technology.

Need based Products Likely to Prove Advantageous

To obtain high penetration rates in a particular regional market segments, manufacturers need to

focus on promoting products taking into consideration availability of resources or the market needs

in that region. For instance, gas-fired absorption chillers should be targeted in countries where gas

is available at inexpensive rates and where its supply is stable.

District Cooling and Trigeneration Systems Offer the Needed Push

Trigeneration and district cooling systems are expected to provide the needed push to the

absorption chiller market as many countries around the world are now widely implementing

these systems.

Trigeneration

The major use of absorption chillers worldwide can be seen across various energy cascading

systems such as trigeneration plants. Trigeneration refers to the simultaneous production of cooling,

heat and electricity. This system combines various technologies such as IC engines, chillers, gas

turbines and fuel cells among others that together fulfill the requirements for cooling, heat and

power by achieving optimal utilization of energy. Trigeneration may also be referred to as CHCP

(Combine heat, cooling and power) or BCHP (Building cooling, heat and power).

Boom in Construction Industry Translates to Strong Absorption Market Development

The absorption chiller market is no exception to the impact that general economic conditions of a

country have on various businesses and markets. Recession, rise in prices of raw materials, oil/gas

crisis are some of the economic factors that had an impact on the demand in the absorption chiller

market in the past. As seen in most regional markets, the demand for these chillers is driven by

growth in large building constructions. With globalization and improving economic scenarios in

many regions (including developing economies), the construction industry is likely to reach new

heights, that would in turn open up growth avenues for absorption chillers.

Existing Chillers Segments: A Threat to the Absorption Chiller Market

Despite the huge opportunities for growth, the absorption chiller segment being a part of the chiller

market faces tough competition from other chiller groups such as screw, reciprocating, scroll and

ABSORPTION CHILLERS - A GLOBAL STRATEGIC BUSINESS REPORT 04/13

This Report Is Protected With Digital Watermarks. Copyrights per US & ICC protocols.

This Document May Not Be Printed, Copied or Distributed Outside Your Organization in Any Form Without Our Express Written Permission

© Global Industry Analysts, Inc., Phone: 408-528-9966, Fax: 408-528-9977, 6150 Hellyer Avenue, San Jose, CA 95138, USA

www.StrategyR.com Page II-14

You might also like

- CheIng - June 2010 PDFDocument68 pagesCheIng - June 2010 PDFErvin WatzlawekNo ratings yet

- (December 20, 2023 Letter) WWEMA RFI ResponseDocument8 pages(December 20, 2023 Letter) WWEMA RFI ResponsesamuelNo ratings yet

- Chemical Engineering July 2013Document74 pagesChemical Engineering July 2013Alejandro GorostietaNo ratings yet

- Final Report of BancoDocument33 pagesFinal Report of BancomahendrabpatelNo ratings yet

- August 2013Document62 pagesAugust 2013ceshesolNo ratings yet

- Chemical Engineering July 2013Document66 pagesChemical Engineering July 2013Angel Mayca100% (2)

- Automotive Coolant Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast - Facts and TrendsDocument3 pagesAutomotive Coolant Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Processes and Types of Rolling MillsDocument7 pagesProcesses and Types of Rolling Millsdroy21No ratings yet

- Mechanical Seals Often Fail As A Consequence of Prior Bearing DistressDocument4 pagesMechanical Seals Often Fail As A Consequence of Prior Bearing DistressMagical RiyaNo ratings yet

- COVID-19: Triple Offset Butterfly Valve MarketDocument9 pagesCOVID-19: Triple Offset Butterfly Valve MarketAhmed ShawkyNo ratings yet

- JARN - Factory Visit Report PDFDocument1 pageJARN - Factory Visit Report PDFkevinjunNo ratings yet

- (ACC EPRI STANDARD) 1007688 - 2005 Air Cooled Condenser Design, Specification and Operation Guidelines - NOTESDocument176 pages(ACC EPRI STANDARD) 1007688 - 2005 Air Cooled Condenser Design, Specification and Operation Guidelines - NOTESHidayati KelanaNo ratings yet

- Chemical Engineering - 2010-04 (April)Document100 pagesChemical Engineering - 2010-04 (April)Staszek BanachNo ratings yet

- Strategic Analysis of Voltas LimitedDocument10 pagesStrategic Analysis of Voltas LimitedShalini NagavarapuNo ratings yet

- May 2016 - International PDFDocument104 pagesMay 2016 - International PDFBánh Cuốn Tôm ThịtNo ratings yet

- RDH Hy08-M1320-1 NaDocument64 pagesRDH Hy08-M1320-1 NaAlex LakeNo ratings yet

- SKF BearingsDocument12 pagesSKF BearingsKartik GuptaNo ratings yet

- Entrepreneurship Project 2Document18 pagesEntrepreneurship Project 2Jawad ShahidNo ratings yet

- 200918TS018 - Final ReportDocument38 pages200918TS018 - Final ReportgsmageshNo ratings yet

- Che200906 DLDocument70 pagesChe200906 DLOrlando BarriosNo ratings yet

- Project Report On Discontinuous Puf Panels Using Cyclopentane As A Blowing AgentDocument6 pagesProject Report On Discontinuous Puf Panels Using Cyclopentane As A Blowing AgentEIRI Board of Consultants and PublishersNo ratings yet

- D23 Solar Industrial Process HeatDocument15 pagesD23 Solar Industrial Process HeatMizuo OiNo ratings yet

- Oil Refinery ThesisDocument4 pagesOil Refinery ThesisNathan Mathis100% (3)

- Air Cooled ASP Series PDFDocument13 pagesAir Cooled ASP Series PDFAAR143No ratings yet

- FEB 2011 UptimeDocument52 pagesFEB 2011 UptimeLammie Sing Yew LamNo ratings yet

- Petrol Saver-BBA-MBA Project ReportDocument52 pagesPetrol Saver-BBA-MBA Project ReportpRiNcE DuDhAtRaNo ratings yet

- Base - Actuator Combination Closure Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument2 pagesBase - Actuator Combination Closure Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Presented By:-Prince Saquib Narendra Minni Manish TanzinDocument25 pagesPresented By:-Prince Saquib Narendra Minni Manish TanzinPrince SachdevaNo ratings yet

- DTB Project - Formatted - A19Document10 pagesDTB Project - Formatted - A19somechnitjNo ratings yet

- Marketing VoltasDocument31 pagesMarketing VoltasNiraj Kumar100% (1)

- Chemical Engineering 12 2012Document70 pagesChemical Engineering 12 2012Leonardo Ramos100% (1)

- Powermag200909 2 DLDocument80 pagesPowermag200909 2 DLOrlando BarriosNo ratings yet

- Farr2012Using Systems PDFDocument27 pagesFarr2012Using Systems PDFAnderson F Miranda SilvaNo ratings yet

- Treat Heat Like A National Treasure: Maintenance - Reliability - Engineering - ProductionDocument48 pagesTreat Heat Like A National Treasure: Maintenance - Reliability - Engineering - ProductionCarlos Mohan100% (1)

- Imi Edition 17 FullDocument4 pagesImi Edition 17 FullJoeWallerNo ratings yet

- The Magazine of ASMEDocument68 pagesThe Magazine of ASMERahul SinghNo ratings yet

- October 2013Document68 pagesOctober 2013jpsi6No ratings yet

- Auto Miniature LampDocument16 pagesAuto Miniature LampAmit NaikNo ratings yet

- Solterra Renewable Technologies ProfileDocument2 pagesSolterra Renewable Technologies ProfilemineralmeNo ratings yet

- New Long-Run Record Set by 50-Year-Old TVA UnitDocument68 pagesNew Long-Run Record Set by 50-Year-Old TVA UnitOrlando BarriosNo ratings yet

- B2B Project SegmentationDocument8 pagesB2B Project SegmentationAmit SonchhatraNo ratings yet

- Chemicalengineeringmagzinejul2013 PDFDocument75 pagesChemicalengineeringmagzinejul2013 PDF施君儒No ratings yet

- OTC 18381 Flow-Assurance Field Solutions (Keynote) : Are We There Yet?Document3 pagesOTC 18381 Flow-Assurance Field Solutions (Keynote) : Are We There Yet?lulalala8888No ratings yet

- Consulting and Specifying Engineers Magazine Sep 2016Document88 pagesConsulting and Specifying Engineers Magazine Sep 2016Shawn MelvilleNo ratings yet

- Global Conductive Picking Bins Market - Innovations & Competitive Analysis - ForecastDocument2 pagesGlobal Conductive Picking Bins Market - Innovations & Competitive Analysis - Forecastsurendra choudharyNo ratings yet

- Chemicalengineeringmagzineaug2012 PDFDocument74 pagesChemicalengineeringmagzineaug2012 PDF施君儒100% (1)

- Vortex Pump Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument2 pagesVortex Pump Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- ChallengeColdChain DevelopmentDocument25 pagesChallengeColdChain DevelopmentAnurag KushwahaNo ratings yet

- Adsorption Chillers Vs Absorption Chillers - Industry TodayDocument1 pageAdsorption Chillers Vs Absorption Chillers - Industry TodayMR. ASHA'ARI BAKARNo ratings yet

- Gulfpub HP 201103Document97 pagesGulfpub HP 201103Vijay AadityaNo ratings yet

- Map Project MbaDocument58 pagesMap Project Mbaankit PadhyaNo ratings yet

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet

- Ejectors for Efficient Refrigeration: Design, Applications and Computational Fluid DynamicsFrom EverandEjectors for Efficient Refrigeration: Design, Applications and Computational Fluid DynamicsNo ratings yet

- Process Intensification: Engineering for Efficiency, Sustainability and FlexibilityFrom EverandProcess Intensification: Engineering for Efficiency, Sustainability and FlexibilityNo ratings yet

- Why Industrial Bearings Fail: Analysis, Maintenance, and PreventionFrom EverandWhy Industrial Bearings Fail: Analysis, Maintenance, and PreventionNo ratings yet

- Summary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisFrom EverandSummary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisNo ratings yet

- Water Finance: Public Responsibilities and Private OpportunitiesFrom EverandWater Finance: Public Responsibilities and Private OpportunitiesNo ratings yet

- Project Finance for the International Petroleum IndustryFrom EverandProject Finance for the International Petroleum IndustryRating: 3 out of 5 stars3/5 (2)

- Tank Heating DiscussionsDocument26 pagesTank Heating DiscussionsTHERMAX007No ratings yet

- Sonic Soot BlowerDocument10 pagesSonic Soot BlowerTHERMAX007No ratings yet

- CoalDocument53 pagesCoalghoshtapan4321No ratings yet

- Vam OutlookDocument5 pagesVam OutlookTHERMAX007No ratings yet

- Absorption Chillers Global MarketDocument246 pagesAbsorption Chillers Global MarketTHERMAX007100% (1)

- Absorption Chillers Global MarketDocument246 pagesAbsorption Chillers Global MarketTHERMAX007100% (1)

- Main Steam Header: FIG - NO.XII/ 93 (A) OF IBRDocument1 pageMain Steam Header: FIG - NO.XII/ 93 (A) OF IBRTHERMAX007No ratings yet

- Absorption Chillers Global MarketDocument246 pagesAbsorption Chillers Global MarketTHERMAX007100% (1)

- Timber vs. PFRPDocument2 pagesTimber vs. PFRPTHERMAX007No ratings yet

- Design Consideration of Hot Oil SystemDocument24 pagesDesign Consideration of Hot Oil SystemOmar EzzatNo ratings yet

- Refinery of Palm OilDocument14 pagesRefinery of Palm OilEvantono Balin Christianto100% (1)

- OILON BURNER CATALOG - Group 4 200-700Document32 pagesOILON BURNER CATALOG - Group 4 200-700THERMAX007No ratings yet

- Deflected Profile of A BeamDocument2 pagesDeflected Profile of A BeamPasindu MalithNo ratings yet

- Finding Buyers Leather Footwear - Italy2Document5 pagesFinding Buyers Leather Footwear - Italy2Rohit KhareNo ratings yet

- Preparedness of Interns For Hospital Practice Before and After An Orientation ProgrammeDocument6 pagesPreparedness of Interns For Hospital Practice Before and After An Orientation ProgrammeTanjir 247No ratings yet

- ISO 18794. Café. Análisis Sensorial. Vocabulario. Ingles PDFDocument16 pagesISO 18794. Café. Análisis Sensorial. Vocabulario. Ingles PDFluigi sanchezNo ratings yet

- Science and Technology Study Material For UPSC IAS Civil Services and State PCS Examinations - WWW - Dhyeyaias.comDocument28 pagesScience and Technology Study Material For UPSC IAS Civil Services and State PCS Examinations - WWW - Dhyeyaias.comdebjyoti sealNo ratings yet

- Event Driven Dynamic Systems: Bujor PăvăloiuDocument35 pagesEvent Driven Dynamic Systems: Bujor Păvăloiuezeasor arinzeNo ratings yet

- Development of Overall Audit StrategyDocument4 pagesDevelopment of Overall Audit StrategyPhrexilyn PajarilloNo ratings yet

- DECIDE ChecklistDocument2 pagesDECIDE ChecklistGuilioNo ratings yet

- Lurgi Methanol ProcessDocument5 pagesLurgi Methanol ProcessDertySulistyowatiNo ratings yet

- A LITTLE CHEMISTRY Chapter 2-1 and 2-2Document5 pagesA LITTLE CHEMISTRY Chapter 2-1 and 2-2Lexi MasseyNo ratings yet

- 21 V-Ax Formation ENDocument49 pages21 V-Ax Formation ENMauro SousaNo ratings yet

- Kodak 3D 電腦斷層系統Document28 pagesKodak 3D 電腦斷層系統fomed_twNo ratings yet

- Significance of Six SigmaDocument2 pagesSignificance of Six SigmaShankar RajkumarNo ratings yet

- I Forgot My Password: LoginDocument6 pagesI Forgot My Password: LoginMithun ShinghaNo ratings yet

- Practical Exercise - Analysis of The Collapse of Silicon Valley BankDocument2 pagesPractical Exercise - Analysis of The Collapse of Silicon Valley Bankhanna.ericssonkleinNo ratings yet

- Guidelines For Selecting Correct Hot Forging Die LubricantsDocument4 pagesGuidelines For Selecting Correct Hot Forging Die LubricantsSrikar Shenoy100% (1)

- Meat and Bone Meal As A Renewable Energy Source inDocument7 pagesMeat and Bone Meal As A Renewable Energy Source inIhsan FajrulNo ratings yet

- Underground Cable FaultDocument8 pagesUnderground Cable FaultMohammad IrfanNo ratings yet

- Test Booklet Primary-1 PDFDocument53 pagesTest Booklet Primary-1 PDFReynold Morales Libato100% (1)

- DBMSII PracBook Ass1 PDFDocument5 pagesDBMSII PracBook Ass1 PDFSankha PalihawadanaNo ratings yet

- Writing Patterns NotesDocument2 pagesWriting Patterns NoteslwitsfadontNo ratings yet

- Listening & Speaking Test_Unit 6 ReviewDocument4 pagesListening & Speaking Test_Unit 6 ReviewMaii PhươngNo ratings yet

- Chương 1 - GenomicDocument32 pagesChương 1 - GenomicNguyễn Hữu Bảo MinhNo ratings yet

- Fire Resistance Ratings - ANSI/UL 263: Design No. U309Document4 pagesFire Resistance Ratings - ANSI/UL 263: Design No. U309DavidNo ratings yet

- Learning Team Aet562 - Self-Guided Social Media Training ManualDocument18 pagesLearning Team Aet562 - Self-Guided Social Media Training Manualapi-646128900No ratings yet

- Replit Ubuntu 20 EnablerDocument4 pagesReplit Ubuntu 20 EnablerDurval Junior75% (4)

- JAG Energy Case StudyDocument52 pagesJAG Energy Case StudyRei JelNo ratings yet

- Service: Audi A6 2011 Audi A7 Sportback 2011Document160 pagesService: Audi A6 2011 Audi A7 Sportback 2011Javier SerranoNo ratings yet

- Metamorphic differentiation explainedDocument2 pagesMetamorphic differentiation explainedDanis Khan100% (1)

- Business Ethics and Social ResponsibilityDocument16 pagesBusiness Ethics and Social Responsibilitytitan abcdNo ratings yet