Professional Documents

Culture Documents

Film Development Council of The Philippines vs. Colon

Uploaded by

Elaine HonradeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Film Development Council of The Philippines vs. Colon

Uploaded by

Elaine HonradeCopyright:

Available Formats

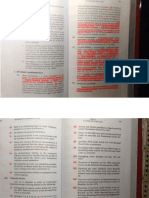

Film Development Council of the Philippines vs.

Colon Heritage still see to it that (a) the taxpayer will not be over-burdened or saddled

Realty Corporation with multiple and unreasonable impositions; (b) each LGU will have

758 SCRA 537 its fair share of available resources; (c) the resources of the national

2015 government will not be unduly disturbed; and (d) local taxation will

be fair, uniform, and just.

Facts:

It is beyond cavil that the City of Cebu had the authority to

The City of Cebu passed Ordinance No. 69 whereby Sections issue its City Ordinance No. LXIX and impose an amusement tax on

42 and 43 thereof require proprietors, lessees or operators of theatres, cinemas pursuant to Sec. 140 in relation to Sec. 151 of the LGC. Sec.

cinemas, concert halls, circuses, boxing stadia, and other places of 140 states, among other things, that a “province may levy an

amusement, to pay an amusement tax equivalent to thirty percent amusement tax to be collected from the proprietors, lessees, or

(30%) of the gross receipts of admission fees to the Office of the City operators of theaters, cinemas, concert halls, circuses, boxing stadia,

Treasurer of Cebu City. Thereafter, Republic Act (R.A.) No. 9167, and other places of amusement at a rate of not more than thirty percent

Sections 13 and 14 thereof states that producers of graded A and B (30%) of the gross receipts from admission fees.” By operation of said

films shall be entitled to incentives equivalent to the amusement tax Sec. 151, extending to them the authority of provinces and

imposed and collected on such graded films. The Film Development municipalities to levy certain taxes, fees, and charges, cities, such as

Council of the Philippines (FDCP), in implementing the statute, respondent city government, may therefore validly levy amusement

argued that the Congress restricted the delegated power of the City of taxes subject to the parameters set forth under the law.

Cebu in imposing amusement taxes, when it enacted Secs. 13 and 14

of R.A. No. 9167. The lower court ruled, however, that said provisions For RA 9167, however, the covered LGUs were deprived of

are contrary to the basic policy in local autonomy that all taxes, fees, the income which they will otherwise be collecting should they impose

and charges imposed by the LGUs shall accrue exclusively to them, as amusement taxes, or, in petitioner’s own words, “Section 14 of [RA

articulated in Article X, Sec. 5 of the 1987 Constitution. 9167] can be viewed as an express and real intention on the part of

Congress to remove from the LGU’s delegated taxing power, all

Issue: revenues from the amusement taxes on graded films which would

Whether or not Secs. 13 and 14 of R.A. No. 9167 violates otherwise accrue to [them] pursuant to Section 140 of the [LGC].”

fiscal autonomy Taking the resulting scheme into consideration, it is apparent

Ruling: that what Congress did in this instance was not to exclude the authority

to levy amusement taxes from the taxing power of the covered LGUs,

Yes, Secs. 13 and 14 of R.A. No. 9167 violates fiscal but to earmark, if not altogether confiscate, the income to be received

autonomy. by the LGU from the taxpayers in favor of and for transmittal to

FDCP, instead of the taxing authority. This, to Our mind, is in clear

The basic rationale for the current rule on local fiscal

contravention of the constitutional command that taxes levied by

autonomy is the strengthening of LGUs and the safeguarding of their

LGUs shall accrue exclusively to said LGU and is repugnant to the

viability and self-sufficiency through a direct grant of general and

power of LGUs to apportion their resources in line with their priorities.

broad tax powers. Nevertheless, the fundamental law did not intend

the delegation to be absolute and unconditional. The legislature must

You might also like

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- Carpio Morales Vs CA and BinayDocument2 pagesCarpio Morales Vs CA and BinayRachelle Casimiro100% (1)

- Smart Communications vs. Municipality of MalvarDocument3 pagesSmart Communications vs. Municipality of MalvarClark Edward Runes Uytico0% (1)

- TESDA cannot be sued without consentDocument2 pagesTESDA cannot be sued without consentSee GeeNo ratings yet

- City of Manila Vs Colet, GR No. 120051, December 10, 2014Document2 pagesCity of Manila Vs Colet, GR No. 120051, December 10, 2014Vel June De LeonNo ratings yet

- Batangas V Shell DigestDocument3 pagesBatangas V Shell DigestAysNo ratings yet

- CIR v. FilinvestDocument4 pagesCIR v. FilinvestJoy Raguindin100% (1)

- FILM DEVELOPMENT COUNCIL OF THE PHILIPPINES vs. COLON HERITAGE REALTY CORPORATIONDocument3 pagesFILM DEVELOPMENT COUNCIL OF THE PHILIPPINES vs. COLON HERITAGE REALTY CORPORATIONDaniel BaclaoNo ratings yet

- Genil vs. RiveraDocument2 pagesGenil vs. RiveraElaine HonradeNo ratings yet

- FDCP vs. Colon Heritage DigestDocument4 pagesFDCP vs. Colon Heritage DigestGeorge Almeda44% (9)

- Nippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002Document21 pagesNippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002EnzoGarcia100% (1)

- Entry of Appearance SampleDocument2 pagesEntry of Appearance Samplefina_ong6259No ratings yet

- CIR vs BOAC Philippine Income TaxDocument2 pagesCIR vs BOAC Philippine Income TaxKim Lorenzo CalatravaNo ratings yet

- Tolentino Chapter 1Document12 pagesTolentino Chapter 1Brian Balio100% (2)

- ABC TriangleDocument7 pagesABC TriangleCornelia NatasyaNo ratings yet

- Interlocutory ApplicationDocument5 pagesInterlocutory ApplicationankitaprakashsinghNo ratings yet

- CIR vs. CADocument3 pagesCIR vs. CAAngela Mericci G. MejiaNo ratings yet

- Villanueva V City of IloiloDocument1 pageVillanueva V City of IloiloEllaine Virayo100% (1)

- Creba v. Romulo Case DigestDocument2 pagesCreba v. Romulo Case DigestApril Rose Villamor60% (5)

- Philippine Airlines V CIRDocument5 pagesPhilippine Airlines V CIRBettina Rayos del SolNo ratings yet

- A) Negros Oriental II Electric Cooperative Vs Sanguniang Panlungsod of Dumaguete DigestDocument1 pageA) Negros Oriental II Electric Cooperative Vs Sanguniang Panlungsod of Dumaguete DigestSolomon Malinias Bugatan100% (1)

- Alta Vista Golf and Country Club vs. City of CebuDocument2 pagesAlta Vista Golf and Country Club vs. City of CebuaaronNo ratings yet

- Talento v. EscaladaDocument2 pagesTalento v. EscaladaAaliyah AndreaNo ratings yet

- Globalization and The Asia Pacific and South AsiaDocument14 pagesGlobalization and The Asia Pacific and South AsiaPH100% (1)

- Philippine Bank Tax Refund PrescriptionDocument2 pagesPhilippine Bank Tax Refund PrescriptionAaron Ariston100% (2)

- Renato Diaz v. Secretary of Finance: VAT on Tollway FeesDocument2 pagesRenato Diaz v. Secretary of Finance: VAT on Tollway FeesDexter MantosNo ratings yet

- Petron vs. Tiangco | LGUs cannot impose taxes on petroleumDocument1 pagePetron vs. Tiangco | LGUs cannot impose taxes on petroleumAleli Joyce Bucu100% (1)

- CTA Ruling Holds Benjamin Kintanar Liable for Failure to File Income Tax ReturnsDocument2 pagesCTA Ruling Holds Benjamin Kintanar Liable for Failure to File Income Tax ReturnsNolaida AguirreNo ratings yet

- City of Iriga vs. CamSurDocument1 pageCity of Iriga vs. CamSurxx_stripped52No ratings yet

- GSIS vs. City Treasurer of Manila DIGESTDocument3 pagesGSIS vs. City Treasurer of Manila DIGESTGhuilberth Eyts PheelarhNo ratings yet

- Security Bank and Trust Company vs. GanDocument2 pagesSecurity Bank and Trust Company vs. GanElaine HonradeNo ratings yet

- Alvarez Vs GuingonaDocument3 pagesAlvarez Vs GuingonaKukaiSitonNo ratings yet

- People v. BeronillaDocument1 pagePeople v. BeronillaThird VillareyNo ratings yet

- RP vs CA| 59: Court of Appeals Did Not Err in Ordering Remand to Determine Just CompensationDocument4 pagesRP vs CA| 59: Court of Appeals Did Not Err in Ordering Remand to Determine Just CompensationVanityHughNo ratings yet

- 57 VASAK KAREL The International Dimensions of Human RightsDocument774 pages57 VASAK KAREL The International Dimensions of Human RightstaysantlordNo ratings yet

- Castillo v. de Leon-CastilloDocument2 pagesCastillo v. de Leon-CastilloElaine HonradeNo ratings yet

- ABAKADA GURO PARTY LIST VS EXECUTIVE SECRETARY VAT RATE CHALLENGEDocument3 pagesABAKADA GURO PARTY LIST VS EXECUTIVE SECRETARY VAT RATE CHALLENGEAnonymous s2jaDmP5FNo ratings yet

- Mining Claim DisputeDocument2 pagesMining Claim DisputeMa. Cristel Ann Sy100% (1)

- CIR Vs de La SalleDocument2 pagesCIR Vs de La SalleOlenFuerte100% (6)

- Samar-I Electric Coop V CIR (2014) DigestDocument2 pagesSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- 40 Nippon Life V CIRDocument2 pages40 Nippon Life V CIRMae SampangNo ratings yet

- Marubeni v. CIR DigestDocument4 pagesMarubeni v. CIR DigestStradivariumNo ratings yet

- Davao v. RTC, GSISDocument4 pagesDavao v. RTC, GSISJelorie Gallego67% (3)

- 084 CIR v. Citytrust (Potian)Document3 pages084 CIR v. Citytrust (Potian)Erika Potian100% (1)

- Tax 2 Digests Part 2 PDFDocument73 pagesTax 2 Digests Part 2 PDFSohayle MacaunaNo ratings yet

- Dissenting Opinion LeonenDocument64 pagesDissenting Opinion LeonenRapplerNo ratings yet

- Dissenting Opinion LeonenDocument64 pagesDissenting Opinion LeonenRapplerNo ratings yet

- PMA Cadet Appeals Dismissal for Alleged Honor Code ViolationDocument7 pagesPMA Cadet Appeals Dismissal for Alleged Honor Code ViolationElaine HonradeNo ratings yet

- Maceda vs. MacaraigDocument2 pagesMaceda vs. MacaraigShella Antazo100% (5)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwNo ratings yet

- 22 Film Development Council of The Philippines v. Colon Heritage Realty CorporationDocument3 pages22 Film Development Council of The Philippines v. Colon Heritage Realty CorporationPao Infante100% (1)

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- CIR vs. BOAC Tax DisputeDocument1 pageCIR vs. BOAC Tax DisputeAngela Mericci G. Mejia100% (1)

- Local Tax Double Taxation CaseDocument1 pageLocal Tax Double Taxation CaseEmmanuel YrreverreNo ratings yet

- PNOC Vs CADocument2 pagesPNOC Vs CAjohnkyle67% (3)

- Saura vs. AgdeppaDocument1 pageSaura vs. AgdeppaElaine HonradeNo ratings yet

- Inmates of New Bilibid Prison vs. de Lima, Roxas, Et Al.Document3 pagesInmates of New Bilibid Prison vs. de Lima, Roxas, Et Al.Moairah Larita100% (3)

- Court Rules Against Local Ordinances Authorizing Confiscation of Driver's LicensesDocument16 pagesCourt Rules Against Local Ordinances Authorizing Confiscation of Driver's LicensesAriel LunzagaNo ratings yet

- Bal Thackeray V/s Harish Pimpa (2005) 1 SCC 254: Professional EthicsDocument11 pagesBal Thackeray V/s Harish Pimpa (2005) 1 SCC 254: Professional Ethicsjanvi0% (1)

- Tenebro v. CADocument2 pagesTenebro v. CAElaine HonradeNo ratings yet

- Supreme Court Rules Sections 13-14 of RA 9167 Violate Fiscal Autonomy of Local GovernmentsDocument1 pageSupreme Court Rules Sections 13-14 of RA 9167 Violate Fiscal Autonomy of Local GovernmentsPhie CuetoNo ratings yet

- Rosete vs. LimDocument2 pagesRosete vs. LimElaine Honrade100% (1)

- Pelizloy Realty Corp. v. The Province of Benguet IIDocument3 pagesPelizloy Realty Corp. v. The Province of Benguet IIR. Bonita100% (1)

- National Housing Authority ordered to allocate Tatalon Estate lotsDocument4 pagesNational Housing Authority ordered to allocate Tatalon Estate lotsElaine HonradeNo ratings yet

- POEA Ruling on Death BenefitsDocument3 pagesPOEA Ruling on Death BenefitsKobe BryantNo ratings yet

- Magdayao vs. PeopleDocument2 pagesMagdayao vs. PeopleElaine HonradeNo ratings yet

- Mercado vs. VitrioloDocument2 pagesMercado vs. VitrioloElaine HonradeNo ratings yet

- Manila Wine Merchants v. CIRDocument3 pagesManila Wine Merchants v. CIRPio MathayNo ratings yet

- Film Development Council vs. Colon HeritageDocument2 pagesFilm Development Council vs. Colon HeritageIsay YasonNo ratings yet

- CIR v. Philippine Airlines Tax RefundDocument2 pagesCIR v. Philippine Airlines Tax RefundSarah RosalesNo ratings yet

- Consolidated Tax Digested CasesDocument34 pagesConsolidated Tax Digested CasesEmmaNo ratings yet

- Uberrimafides..case Digests - Tolentino vs. Secretary of Finance G.R. No. 115455, August 25, 1994Document2 pagesUberrimafides..case Digests - Tolentino vs. Secretary of Finance G.R. No. 115455, August 25, 1994Jason BuenaNo ratings yet

- G.R. No. L-68252Document4 pagesG.R. No. L-68252Klein Carlo100% (1)

- Lamb vs Phipps Mandamus CaseDocument2 pagesLamb vs Phipps Mandamus CaseRojan PaduaNo ratings yet

- Yamane v. B.A. Lepanto CondominiumDocument6 pagesYamane v. B.A. Lepanto CondominiumSuzyNo ratings yet

- CASE DIGEST No. 3Document8 pagesCASE DIGEST No. 3Cyrus DaitNo ratings yet

- 65 Commissioner of Internal Revenue v. Puregold Duty Free, IncDocument2 pages65 Commissioner of Internal Revenue v. Puregold Duty Free, IncjNo ratings yet

- Ruling - CIR V FilinvestDocument1 pageRuling - CIR V FilinvestryanmeinNo ratings yet

- Time Inc v Reyes Libel CaseDocument1 pageTime Inc v Reyes Libel CaseMalcolm AdiongNo ratings yet

- Regala VS SBDocument5 pagesRegala VS SBElaine HonradeNo ratings yet

- Wiegel v. Sempio-DyDocument1 pageWiegel v. Sempio-DyElaine HonradeNo ratings yet

- Small ClaimsDocument66 pagesSmall ClaimsarloNo ratings yet

- Paz vs. Pavon G.R. No. 166579 18 February 2010Document2 pagesPaz vs. Pavon G.R. No. 166579 18 February 2010vestiahNo ratings yet

- Art. 41, Family Code, Judicial Declaration of Presumptive Death Manuel v. People 476 SCRA 461 2005 FactsDocument2 pagesArt. 41, Family Code, Judicial Declaration of Presumptive Death Manuel v. People 476 SCRA 461 2005 FactsElaine HonradeNo ratings yet

- PPL Vs SandiganbayanDocument1 pagePPL Vs SandiganbayanElaine HonradeNo ratings yet

- Roth vs. USDocument2 pagesRoth vs. USElaine HonradeNo ratings yet

- Chavez Vs PEADocument3 pagesChavez Vs PEAElaine HonradeNo ratings yet

- BPI Vs SMPDocument1 pageBPI Vs SMPElaine HonradeNo ratings yet

- Ra 10641Document6 pagesRa 10641Sarah Jean CaneteNo ratings yet

- Ocampo vs. Abando SC ruling on murder case against CPP-NPA membersDocument7 pagesOcampo vs. Abando SC ruling on murder case against CPP-NPA membersElaine Honrade100% (1)

- Republic vs. Marcos-ManotocDocument4 pagesRepublic vs. Marcos-ManotocElaine HonradeNo ratings yet

- Environmental AnnotationDocument63 pagesEnvironmental AnnotationIvan Angelo ApostolNo ratings yet

- Other Special LawsDocument9 pagesOther Special LawsElaine HonradeNo ratings yet

- Sex TraffickingDocument14 pagesSex TraffickingElaine Honrade100% (1)

- Lim vs. Court of AppealsDocument2 pagesLim vs. Court of AppealsElaine HonradeNo ratings yet

- Separate Opinion BernabeDocument35 pagesSeparate Opinion BernabeRapplerNo ratings yet

- CaguioaDocument64 pagesCaguioaRappler100% (1)

- 'Machiavelli and Erasmus Compared' by Gennady Stolyarov IIDocument4 pages'Machiavelli and Erasmus Compared' by Gennady Stolyarov IIRussel Matthew PatolotNo ratings yet

- ADAC RS Sample Executive OrderDocument2 pagesADAC RS Sample Executive OrderJoseph Rimando SermoniaNo ratings yet

- Alternative circumstances in criminal casesDocument6 pagesAlternative circumstances in criminal casesDaniel FradejasNo ratings yet

- 1 An Overview of The Gender SituationDocument3 pages1 An Overview of The Gender SituationShien Brojas OropesaNo ratings yet

- (A284) Jacob v. SandiganbayanDocument19 pages(A284) Jacob v. Sandiganbayanms aNo ratings yet

- Price Vs InnodataDocument20 pagesPrice Vs InnodataMRNo ratings yet

- Expert & Non-Testifying Witnesses ChartDocument1 pageExpert & Non-Testifying Witnesses ChartRonnie Barcena Jr.No ratings yet

- Rule of LawDocument15 pagesRule of LawAadityaVasuNo ratings yet

- AdjudicationDocument6 pagesAdjudicationManoj LankaNo ratings yet

- DeLanis V Metro, MendesDocument30 pagesDeLanis V Metro, MendesUSA TODAY NetworkNo ratings yet

- Demapiles Vs COMELECDocument2 pagesDemapiles Vs COMELECKelly EstradaNo ratings yet

- Doctrine of Extra-Territorial OperationDocument31 pagesDoctrine of Extra-Territorial Operationirisha anandNo ratings yet

- Pre-Test 1 - ProblemsDocument3 pagesPre-Test 1 - ProblemsKenneth Bryan Tegerero TegioNo ratings yet

- Statcon DigestzDocument9 pagesStatcon DigestzAirelle AvilaNo ratings yet

- Citizenship CasesDocument320 pagesCitizenship CasesYong MgdnglNo ratings yet

- IGR Concept of InterdependenceDocument5 pagesIGR Concept of InterdependenceZhanice RulonaNo ratings yet

- BOD Meeting RulesDocument6 pagesBOD Meeting RulesJose Sanchez Daag IVNo ratings yet

- DARAB Rules of Procedure 2009Document30 pagesDARAB Rules of Procedure 2009Sundae SolomonNo ratings yet

- Get Smart: Combining Hard and Soft PowerDocument5 pagesGet Smart: Combining Hard and Soft PowerLuis Alberto Miranda CelyNo ratings yet

- The Enemy is Us: How Allied Strategy Aids AQAP in YemenDocument154 pagesThe Enemy is Us: How Allied Strategy Aids AQAP in YemenMiguel CabreraNo ratings yet

- Fadia and Fadia Public Administration PDFDocument2 pagesFadia and Fadia Public Administration PDFSujata Malik0% (1)