Professional Documents

Culture Documents

IRA Blank Form 2017 1

Uploaded by

ValerieAnnVilleroAlvarezValienteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRA Blank Form 2017 1

Uploaded by

ValerieAnnVilleroAlvarezValienteCopyright:

Available Formats

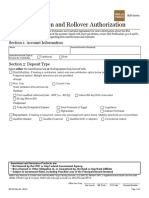

IRA DISTRIBUTION REQUEST

IRA Account Holder Payee Name (If Different from IRA Holder) IRA Account Number

Residence Address ( If different from address on SS# or Tax ID to be used for Tax Reporting Trust Officer’s Printed Name

record)

City: State: Zip:

Please complete Section A, B, and C to initiate a distribution from your IRA.

A. REASON FOR WITHDRAWAL (Please select all that apply)

1. Normal Distribution (Over 59 ½) 6. Payment Due to owner’s Death or Disability

2. Early Distribution (Under 59 ½) Reason for W/D 7. Terminate my entire IRA & distribute outright-taxable event.

3. Required Minimum Dist $ 8. Roth Distribution

4. Series of Substantially Equal Periodic Payment 9. Qualified Charitable Distribution (QCD)

5. Withdrawal of Excess Contribution a. Must be 70 ½ on date of distribution

Including gain/loss for tax year 20 b. Not allowed if IRA has received a current year SEP contribution

B. DISTRIBUTION AMOUNT AND FREQUENCY (Please indicate the amount of the distribution and tax election)

1. Standing Instructions for Merrill Lynch Clients ONLY: Distribute upon If selected, must complete Standing Authorization

my request to the account(s) listed in Section C and in accordance with section below and Fed and State Income Tax Withholding

Sections 3 through 6 below. elections (sections 3 through 6 below).

2. GROSS AMOUNT (The gross amount to be distributed one-time OR EVERY $ Gross = the amount before withholding is deducted. Not

month, quarter, semi-annual pymt) required if Net Amt is provided

3. I AM A NON-RESIDENT ALIEN (check one) YES NO If not selected, default is NO

4. DO NOT WITHHOLD FEDERAL INCOME TAX Required, if electing out of fed income tax

5. FEDERAL INCOME TAX WITHHOLDING (% OR $) 0 If requested, cannot be less than 10%

6. STATE INCOME TAX WITHHOLDING (% OR $) 0 *STATE OF RESIDENCE

If a net amount is specified, fed & state fields are

7. SPECIFIC NET AMOUNT (after withholding deductions) $

required to calculate the Gross Amount

8. Frequency: One Time Payment PERIODIC: Monthly Quarterly Semi-Annually Annually

9. Distribution Date: - - Stop Date: - -

C. METHOD OF DISTRIBUTION (Please select the appropriate method)

Mail check to Payee Mail check to Payee via overnight mail Mail check to City Office-Sub Class (required Trust Officer)

Credit Bank of America Bank Account # Checking Savings ABA#

Credit Merrill Lynch Account # Acct Type (required)

Credit U.S. TRUST Acct # Acct Type (required)

[I/I or I/P or P/I or P/P] (if left blank, default is P/P) (required by Trust Officer

ACH deposit to: Bank Name: Checking Savings ABA#

Acct #

WIRE DOMESTIC INTERNATIONAL FOREIGN

Wire Transfer to: Bank Name: ABA#

Credit Account Name: Acct #

FFC – Account Name: Acct #

Standing Authorization to Relay Distribution Requests Through Named Financial Advisor

I authorize this option. Note: Check the first box in Section B, indicate withholding election, and select one or more payment methods in Section C listed above.

The undersigned hereby authorizes U.S. Trust to make distributions from the above referenced account to me upon my verbal request based on any distribution instructions

provided in Sections B and C listed above. I agree to phone any such instructions either (1) directly to my Trust Officer (or his/her associate) or (2) directly to my Merrill Lynch

financial advisor (or his/her associate) listed below who shall then communicate such instructions to my Trust Officer. U.S. Trust is authorized to rely on such verbal instructions

consistent with the terms of my account’s governing instrument and the terms of this authorization.

Name of Primary advisor: Name of Alternate advisor:

If the verbal instructions are inconsistent with certain internally established U.S. Trust procedures and guidelines, it is understood that U.S. Trust reserves the right to require that

such verbal requests must be memorialized in the form of a written letter of authorization.

Withholding Notice – For Traditional IRA Only

Federal Income taxes are required to be withheld (subtracted) from your non-periodic distributions at a flat rate of 10% and from your periodic distributions as if the distributions are

wages and you are married with three exemptions, unless you tell us that you don’t want any taxes withheld. State income taxes will be withheld according to the specific

requirements of the state in which you reside. You must use this form to instruct us whether you want income taxes withheld from the distributions you will receive from your

retirement account and to withhold on a different basis than the prescribed methods. Even if you elect not to have Federal and State income taxes withheld from your distribution,

you are liable for payment of Federal and State income taxes on the taxable portion of your distribution. If you do not want any Federal Income Taxes withheld from your

distribution, please check the appropriate box located under the Gross Amount field. Please consult with your tax advisor to determine if State Income Tax is mandatory in your

State of Residence.

Estimated taxes. Under Internal Revenue Service rules, if you choose not to have federal income taxes withheld - or if the amount withheld from your distributions is not sufficient -

you may be responsible for paying estimated taxes every quarter. When your actual taxes for a year are determined, you could incur IRS penalties if your estimated federal income

tax payments were not sufficient. You may incur similar tax penalties under state law.

The undersigned herby authorizes and directs Bank of America to withdraw funds from the indicated account above and to disburse them in accordance with the above instructions.

The undersigned hereby certifies that this distribution request satisfies the requirements of the Internal Revenue Code regarding required minimum annual IRA distributions. Bank of

America may rely on this certification without further investigation and inquiry and shall incur no liability thereon, including calculations provided by Bank of America. The

undersigned, also acknowledges that he/she has been advised to seek competent tax and/or estate planning advice. The undersigned expressly assumes the responsibility of any

adverse consequences that may arise from this distribution. The undersigned understands that neither Bank of America nor its employees can give an opinion or advice regarding

the consequences of the tax or other laws as they relate to a particular situation, and the undersigned has neither received nor relied upon any such opinion or advice from Bank of

America or its employees.

Comments: This is instruction to transfer ALL REMAINING BALANCE OF THE ACCOUNT.

I have read the terms of the Bank of America Trusteed IRA from which I am taking the withdrawal and my instructions comply with those terms.

IRA Holder’s Printed Name: IRA Holder’s Signature Date:

Revise Date -1-13-2017

00-42-2683NSB, RPP 6012B

You might also like

- IRA Blank Form 2017 1Document1 pageIRA Blank Form 2017 1ValerieAnnVilleroAlvarezValienteNo ratings yet

- Account Owner Information: IRA Single Distribution RequestDocument9 pagesAccount Owner Information: IRA Single Distribution RequestJenkins Isaías Perez MontillaNo ratings yet

- FIC8Document5 pagesFIC8David ReaverNo ratings yet

- 2017412294869DistributionFormOut PD PDFDocument27 pages2017412294869DistributionFormOut PD PDFMichael BowkerNo ratings yet

- Withdrawal Great American Life FormsDocument13 pagesWithdrawal Great American Life FormsMax PowerNo ratings yet

- 133304Document3 pages133304Sharon Downing OstremNo ratings yet

- Distribution & Direct Rollover Request 10.2022Document19 pagesDistribution & Direct Rollover Request 10.2022Rose BeckerNo ratings yet

- IRA Distribution Form: Personal InformationDocument3 pagesIRA Distribution Form: Personal Informationaztd50No ratings yet

- Disbur Form Series 100-500, 800 & 801Document12 pagesDisbur Form Series 100-500, 800 & 801Geno GottschallNo ratings yet

- A Mba Lo SurrenderDocument6 pagesA Mba Lo SurrenderGabe AmbaloNo ratings yet

- Non Retirement Withdrawal Request Form Jhi PDFDocument3 pagesNon Retirement Withdrawal Request Form Jhi PDFKshama AgrawalNo ratings yet

- Traditional IRA Withdrawal Request All StatesDocument4 pagesTraditional IRA Withdrawal Request All StatesAndrew Erickson100% (1)

- OM UnitTrust DO AmendmentForm (FINAL) ElectronicDocument6 pagesOM UnitTrust DO AmendmentForm (FINAL) ElectronicMonika ShanikaNo ratings yet

- Fidelity RolloverDocument5 pagesFidelity Rollovertimosh16No ratings yet

- IRA Contribution and RolloverDocument4 pagesIRA Contribution and Rolloverja leeNo ratings yet

- Policy Fund Withdrawal Form: FWP/FSC CodeDocument2 pagesPolicy Fund Withdrawal Form: FWP/FSC CodeEra gasperNo ratings yet

- Policy Fund Withdrawal FormDocument2 pagesPolicy Fund Withdrawal FormJulius Harvey Prieto BalbasNo ratings yet

- ACH W9 FillableDocument1 pageACH W9 FillableEAZY CHARNo ratings yet

- Credit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsDocument4 pagesCredit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsaksynNo ratings yet

- Term Deposit FormDocument2 pagesTerm Deposit FormVishnu VNo ratings yet

- Direct Deposit Form A-24 Updated 1-3-20Document2 pagesDirect Deposit Form A-24 Updated 1-3-20james pearsonNo ratings yet

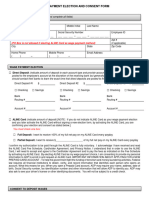

- Adp Wage Payment Election and Consent FormDocument2 pagesAdp Wage Payment Election and Consent FormjermarionNo ratings yet

- Scan Doc0005Document1 pageScan Doc0005chikenbone420No ratings yet

- Secondary Direct DepositDocument1 pageSecondary Direct DepositParamintaramaha ParamintaramahaNo ratings yet

- Fixed Deposit FormDocument2 pagesFixed Deposit FormNikita JainNo ratings yet

- Card Autopay SetupDocument3 pagesCard Autopay SetupaksynNo ratings yet

- WEX Transfer FormDocument3 pagesWEX Transfer FormGraham EvansNo ratings yet

- Transfer Request Tci TF F 110-11-0117Document2 pagesTransfer Request Tci TF F 110-11-0117JameriaNo ratings yet

- Form 601-Partial Withdrawal Under NPSDocument3 pagesForm 601-Partial Withdrawal Under NPSRanga Nayak PaltyaNo ratings yet

- For All "Bank To Bank" Telex Transfers: Policy Number/s Currency Option USD SAR CAD GBP EUR INR OthersDocument2 pagesFor All "Bank To Bank" Telex Transfers: Policy Number/s Currency Option USD SAR CAD GBP EUR INR Otherskarpagam nddNo ratings yet

- FATCA CRS Individual Declaration FormDocument2 pagesFATCA CRS Individual Declaration FormSrigandh's WealthNo ratings yet

- In-Service Withdrawal FormDocument1 pageIn-Service Withdrawal FormlanzahouseNo ratings yet

- L 19073 TcaDocument4 pagesL 19073 TcabrocodebymindsNo ratings yet

- PayOptionsDirectDeposit (E1993) PDFDocument1 pagePayOptionsDirectDeposit (E1993) PDFBrenda DeeNo ratings yet

- HPK3PZDocument7 pagesHPK3PZDiane LeeNo ratings yet

- Application Form For Subscriber Registration: Tier I & Tier II AccountDocument9 pagesApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghNo ratings yet

- Subscriber Registration Form: (Administered by Pension Fund Regulatory and Development Authority)Document4 pagesSubscriber Registration Form: (Administered by Pension Fund Regulatory and Development Authority)Arun RockyNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- Sba Form 413 PersonalfinancialstatementDocument2 pagesSba Form 413 Personalfinancialstatementapi-183669361No ratings yet

- Form 5 - Application To Withdraw or Transfer Money From An Ontario Locked-In AccountDocument6 pagesForm 5 - Application To Withdraw or Transfer Money From An Ontario Locked-In AccountDimitrios LatsisNo ratings yet

- Declare Tax Residency and Sign Consent for Online Unit Trust InvestmentDocument3 pagesDeclare Tax Residency and Sign Consent for Online Unit Trust InvestmentNoloR ManameNo ratings yet

- 2021 Investco 403b 7 Distribution FormDocument19 pages2021 Investco 403b 7 Distribution FormMax PowerNo ratings yet

- Cigna Claim FormDocument2 pagesCigna Claim FormLoganBohannonNo ratings yet

- Distribution Withdrawal Form: Pacific Southwest Irrigation Corporation 401 (K) Profit Sharing PlanDocument3 pagesDistribution Withdrawal Form: Pacific Southwest Irrigation Corporation 401 (K) Profit Sharing PlanpayrossNo ratings yet

- Coronavirus-Related Withdrawal: SECTION 1: What's Included in This KitDocument10 pagesCoronavirus-Related Withdrawal: SECTION 1: What's Included in This KitandryNo ratings yet

- Withdrawal of Contributions AppDocument7 pagesWithdrawal of Contributions AppJoey Daniel FinleyNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- Disposal Instruction For Handling Foreign Inward RemittancesDocument3 pagesDisposal Instruction For Handling Foreign Inward RemittancesSelvamuthu KumaranNo ratings yet

- Loan repayment schedule and FAQsDocument3 pagesLoan repayment schedule and FAQsFrank RoseNo ratings yet

- 15 Wage Payment Election PDFDocument2 pages15 Wage Payment Election PDFHenry MorenoNo ratings yet

- Mountain BizWorks Investor AgreementDocument2 pagesMountain BizWorks Investor AgreementRam Kumar BasakNo ratings yet

- CRS Self-Certification Form for IndividualsDocument6 pagesCRS Self-Certification Form for IndividualsJoris RectoNo ratings yet

- Di FormatDocument3 pagesDi FormatStudents AffairsNo ratings yet

- Myplan 2018 - EnglishDocument1 pageMyplan 2018 - EnglishkleansoulNo ratings yet

- Registration Form Cum Mandate For Electronic Clearing Services (Ecs) /direct Debit/NachDocument2 pagesRegistration Form Cum Mandate For Electronic Clearing Services (Ecs) /direct Debit/NachPatel DipenNo ratings yet

- Brian Smith Account 11990790488 Statement Period - Jan 1 - Jan 31, 2022Document1 pageBrian Smith Account 11990790488 Statement Period - Jan 1 - Jan 31, 2022novelNo ratings yet

- Electronic Fund Transfer AuthorizationDocument1 pageElectronic Fund Transfer Authorizationkhalifaf10No ratings yet

- Petition For Admin Recon of TitleDocument4 pagesPetition For Admin Recon of TitleValerieAnnVilleroAlvarezValienteNo ratings yet

- Contract Agreement: - , of Legal Age, FilipinoDocument2 pagesContract Agreement: - , of Legal Age, FilipinoValerieAnnVilleroAlvarezValienteNo ratings yet

- Echo'Z Stone Hollow Blocks Maker: Brgy. 97 (Cabalawan), Tacloban City Contact No. 09067017774Document1 pageEcho'Z Stone Hollow Blocks Maker: Brgy. 97 (Cabalawan), Tacloban City Contact No. 09067017774ValerieAnnVilleroAlvarezValienteNo ratings yet

- Rape in The Philippines Is Considered A Criminal Offense. in Philippine Jurisprudence, It Is A Heinous CrimeDocument1 pageRape in The Philippines Is Considered A Criminal Offense. in Philippine Jurisprudence, It Is A Heinous CrimeValerieAnnVilleroAlvarezValienteNo ratings yet

- Deed of Absolute Sale of Motor VehicleDocument1 pageDeed of Absolute Sale of Motor VehicleValerieAnnVilleroAlvarezValienteNo ratings yet

- Court of Appeal: DecisionDocument8 pagesCourt of Appeal: DecisionValerieAnnVilleroAlvarezValienteNo ratings yet

- Crime Stories in The PhilippinesDocument7 pagesCrime Stories in The PhilippinesValerieAnnVilleroAlvarezValienteNo ratings yet

- Rape in The Philippines Is Considered A Criminal Offense. in Philippine Jurisprudence, It Is A Heinous CrimeDocument1 pageRape in The Philippines Is Considered A Criminal Offense. in Philippine Jurisprudence, It Is A Heinous CrimeValerieAnnVilleroAlvarezValienteNo ratings yet

- WorstmurderDocument6 pagesWorstmurderJacob AgboNo ratings yet

- 2022 Phil ElectionsDocument5 pages2022 Phil ElectionsValerieAnnVilleroAlvarezValienteNo ratings yet

- 2022 Phil ElectionsDocument1 page2022 Phil ElectionsValerieAnnVilleroAlvarezValienteNo ratings yet

- Accounting StandardsDocument1 pageAccounting StandardsValerieAnnVilleroAlvarezValienteNo ratings yet

- Volcano EruptionDocument5 pagesVolcano EruptionValerieAnnVilleroAlvarezValienteNo ratings yet

- ARTICLEDocument4 pagesARTICLEValerieAnnVilleroAlvarezValienteNo ratings yet

- Log HistoryDocument320 pagesLog HistoryValerieAnnVilleroAlvarezValienteNo ratings yet

- For Cooking ClassesDocument1 pageFor Cooking ClassesValerieAnnVilleroAlvarezValienteNo ratings yet

- Deed of Absolute Sale of Motor VehicleDocument1 pageDeed of Absolute Sale of Motor VehicleValerieAnnVilleroAlvarezValienteNo ratings yet

- Certificate of AcceptanceDocument6 pagesCertificate of AcceptanceValerieAnnVilleroAlvarezValienteNo ratings yet

- Global Demographic Trends and PatternsDocument5 pagesGlobal Demographic Trends and PatternsValerieAnnVilleroAlvarezValienteNo ratings yet

- Cert of CompletionDocument1 pageCert of CompletionValerieAnnVilleroAlvarezValienteNo ratings yet

- VictimologyDocument1 pageVictimologyValerieAnnVilleroAlvarezValienteNo ratings yet

- BIDDING DOCUMENTS - Security Services 1Document108 pagesBIDDING DOCUMENTS - Security Services 1ValerieAnnVilleroAlvarezValienteNo ratings yet

- Business Letter Template for Consignment DiscussionDocument10 pagesBusiness Letter Template for Consignment DiscussionValerieAnnVilleroAlvarezValienteNo ratings yet

- Easy Egg Pie Recipe with Flaky DoughDocument1 pageEasy Egg Pie Recipe with Flaky DoughValerieAnnVilleroAlvarezValienteNo ratings yet

- Business Letter Proposes Trial ConsignmentDocument10 pagesBusiness Letter Proposes Trial ConsignmentValerieAnnVilleroAlvarezValiente100% (1)

- 21st Century Literature From The Philippines and The WorldDocument1 page21st Century Literature From The Philippines and The WorldValerieAnnVilleroAlvarezValienteNo ratings yet

- Cinderella StoryDocument3 pagesCinderella StoryValerieAnnVilleroAlvarezValienteNo ratings yet

- Case DigestDocument11 pagesCase DigestValerieAnnVilleroAlvarezValienteNo ratings yet

- Cyberbullying or Cyberharassment Is A Form Of: Bullying HarassmentDocument1 pageCyberbullying or Cyberharassment Is A Form Of: Bullying HarassmentValerieAnnVilleroAlvarezValienteNo ratings yet

- A.Cheese: See Campus)Document5 pagesA.Cheese: See Campus)ValerieAnnVilleroAlvarezValienteNo ratings yet

- Taking A Look at PPP Loan Forgiveness: Duo Receive ScholarshipDocument1 pageTaking A Look at PPP Loan Forgiveness: Duo Receive ScholarshipPrice LangNo ratings yet

- FAR Final Exam Answer Key and Solutions For StudentsDocument8 pagesFAR Final Exam Answer Key and Solutions For StudentsAli IsaacNo ratings yet

- Jaime v. Salvador loan transaction disputeDocument2 pagesJaime v. Salvador loan transaction disputeKaren Ryl Lozada BritoNo ratings yet

- NTPCDocument19 pagesNTPCamritNo ratings yet

- Negotiable Instruments Law SyllabusDocument13 pagesNegotiable Instruments Law Syllabusk santosNo ratings yet

- PolicyBazaar and KuveraDocument18 pagesPolicyBazaar and KuveraBendi YashwanthNo ratings yet

- Accounting As The Language of BusinessDocument2 pagesAccounting As The Language of BusinessjuliahuiniNo ratings yet

- Act 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Document34 pagesAct 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Adam Haida & CoNo ratings yet

- Date Consignee/Recipient Documents Sent Waybill NumberDocument1 pageDate Consignee/Recipient Documents Sent Waybill NumberRenshel Joy OnnaganNo ratings yet

- Derivatives and Hedging RiskDocument44 pagesDerivatives and Hedging RiskShivanshuBelongsToYouNo ratings yet

- Construction - Draws - v8 (Ver-1) (2) GNX PDFDocument5 pagesConstruction - Draws - v8 (Ver-1) (2) GNX PDFMark McClureNo ratings yet

- Assignment - VAT On Sale of Services, Use or Lease of Property, ImportationDocument3 pagesAssignment - VAT On Sale of Services, Use or Lease of Property, ImportationBenzon Agojo OndovillaNo ratings yet

- Arthan Finance - HR TraineeDocument2 pagesArthan Finance - HR TraineePriyadharshini RamamurthyNo ratings yet

- Pay The PriceDocument8 pagesPay The PriceTinaStiffNo ratings yet

- 5479-Article Text-9982-1-10-20210515Document7 pages5479-Article Text-9982-1-10-20210515overkillNo ratings yet

- BAJAJ FINANCE LIMITED Company Overview, Board, ShareholdingDocument12 pagesBAJAJ FINANCE LIMITED Company Overview, Board, ShareholdingNagarjuna ReddyNo ratings yet

- Pharmaceutical Industry AnalysisDocument8 pagesPharmaceutical Industry AnalysisMARIA M (RC2153001011009)No ratings yet

- Notice: Banks and Bank Holding Companies: Formations, Acquisitions, and MergersDocument1 pageNotice: Banks and Bank Holding Companies: Formations, Acquisitions, and MergersJustia.comNo ratings yet

- CFA Level II Mock Exam 2 - Questions (PM)Document36 pagesCFA Level II Mock Exam 2 - Questions (PM)Sardonna Fong100% (1)

- BBBY S CaseDocument4 pagesBBBY S CaseKarina Taype NunuraNo ratings yet

- Banking Supervision in the Philippines: Lessons Learned and Future DirectionsDocument16 pagesBanking Supervision in the Philippines: Lessons Learned and Future DirectionsatoydequitNo ratings yet

- Dialogue of The Deaf - The Government and The RBI - T.C.A. Srinivasa RaghavanDocument235 pagesDialogue of The Deaf - The Government and The RBI - T.C.A. Srinivasa Raghavanmaheshmuralinair6No ratings yet

- No. Group Members Name Student ID No. 1 2 3 4 5 6: SUBMISSION DATE: 16th December 2022Document50 pagesNo. Group Members Name Student ID No. 1 2 3 4 5 6: SUBMISSION DATE: 16th December 2022Hoong AngNo ratings yet

- Owner's Equity AccountsDocument6 pagesOwner's Equity AccountsJanna GunioNo ratings yet

- Coursera Courses for MBA AspirantsDocument2 pagesCoursera Courses for MBA AspirantsAkhilGovindNo ratings yet

- Circular Economy Finance GuidelinesDocument4 pagesCircular Economy Finance GuidelinesAbu NawasNo ratings yet

- Midterm Exam Review: Accounting Problems and SolutionsDocument16 pagesMidterm Exam Review: Accounting Problems and SolutionsPrincess Claris Araucto33% (3)

- GST Rahul 1 Project WorkDocument29 pagesGST Rahul 1 Project WorkRohan 70KNo ratings yet

- Audit of BanksDocument10 pagesAudit of BanksIra Grace De Castro100% (2)

- Chapter Eleven: Liquidity and Reserves Management: Strategies and PoliciesDocument34 pagesChapter Eleven: Liquidity and Reserves Management: Strategies and PoliciestusedoNo ratings yet