Professional Documents

Culture Documents

ImportantpointsunderGSTregime 20170613051600.632 X

Uploaded by

Sainaath RCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ImportantpointsunderGSTregime 20170613051600.632 X

Uploaded by

Sainaath RCopyright:

Available Formats

Important points under GST regime:

On Day of Migration to GST, the following areas should be addressed & completed by all

Depots.

1) Opening Stock to be communicated to GST authorities.

2) Any pending ED Inputs which remain unutilized on 30.06.2017, will be carried forward

under GST, provided their ED Invoices are within ONE YEAR. Ie All Pending Inputs for

which ED Invoice dates are ON & After 01.07.2016, can be carried forward under GST.

ED Invoice copies should be available for carrying forward such Inputs under GST.

3) All Incoming Stock Transfers up-to June 30th, 2017should be taken into stock

immediately and corresponding ED Input taken simultaneously. GST Act provides time

up-to 31st July, 2017 for all GITs to be taken into stock. If there are any GITs -where

PGI dates are up-to 30.06.2017 -pending after 31.07.2017, then ED Input against

those Stock Transfers will NOT BE CARRIED FORWARD as Input Credit

4) All VAT Inputs for Incoming supplies should be preferably availed by 30.06.2017(June-

Return). Any un-utilized VAT Input will be carried forward under GST as ‘SGST’ Input.

GST Rates applicable for BEML:

1) For Equipment = 28% including Dumpers

The relevant clauses are reproduced as below:

Page no. 168 of the published GST rates both these categories of Equipment

come under 28% GST rate schedule

12) Fork -lift trucks; other works trucks fitted with lifting or handling equipment

[8427]

13) Other lifting, handling, loading or unloading machinery (for example, lifts,

escalators, conveyors, teleferics) [8428]

“14.- Self -propelled bulldozers, angle dozers, graders, levellers, scrapers, mechanical

shovels, excavators, shovel loaders, tamping machines and road rollers [8429]”

15. Other moving, grading, levelling, scraping, excavating tamping, compacting, extracting or

boring machinery, for earth, minerals or ores; pile-drivers and pile extractors; snow-ploughs

and snow-blowers [8430] “

Page 188- Dumpers are included in schedule-8704- Chapter ID 87041010

“Motor vehicles for Transport of goods, dumpers designed for Off-Highway use: with

net weight (excluding payload) exceeding 8 tons & maximum payload capacity not less

than 10 tons)”

2) for Spares : 18% except Dumper Spares , Engine Spares & certain assemblies as per

annexure.

16. {8431} Parts suitable for use solely or principally with the machinery of headings 8425

to 8430 )

-8708- Parts & accessories of the Motor Vehicles of headings 8701 to

8705- i.e Dumper Spares will carry GST @ 28%

Services = the Schedule of rates is attached herewith. Some of the commonly used

Services in BEML is mentioned below:

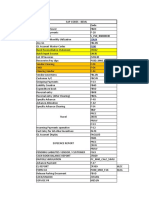

Sl Type Of Service Rates with

no Remarks

1 5%.No Credit for

Services of goods transport agency (GTA) in Inputs. No

relation to transportation of goods [other than used abatement

household goods for personal use]

2 5%.No Credit for

Renting of motor-cab Inputs. No

(If fuel cost is borne by the service recipient, then abatement

18% GST will apply)

3 Construction of a complex, building, civil structure or 12%

a part thereof, intended for sale to a buyer, wholly or With Full ITC but no

partly. refund of overflow of

[The value of land is included in the amount charged from the ITC

service recipient]

4 All other services not specified elsewhere 18%. Full ITC

Note: Other Services commonly used in BEML like: Maintenance & Repair( MARC),

Security, Labour, etc are not specifically covered in any schedule. Hence they will be

covered in Category ‘4’ above ie. 18% GST with full Input Tax credit( ITC).

Other Important points

1) Point of Taxation: Which date is relevant for GST?

The time of supply of goods determines the GST liability

The relevant date is the earliest of the following dates:

a) Date of Invoice

b) Date of payment realization.

c) Date of removal of goods or the date when it is made available to the Customer

d) Date of receipt of goods by Customer.

2) Assesable value for Stock Transfer under GST:

Will be the same transfer Price which is being currently adopted for Excise Duty.

Note : This is not an exhaustive list. For more details see Govt of India website – ‘cbec.in

You might also like

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- Transport Rules GSTDocument19 pagesTransport Rules GSTSudhir KumarNo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxPragya TyagiNo ratings yet

- GST On TransportDocument10 pagesGST On TransportShakti SharmaNo ratings yet

- White Paper: Analysis of GST Implications On Real Estate Sector in IndiaDocument9 pagesWhite Paper: Analysis of GST Implications On Real Estate Sector in IndiaAyushi PanditNo ratings yet

- FOURTH SEMESTER GSTDocument6 pagesFOURTH SEMESTER GSTKenny PhilipsNo ratings yet

- GST Amendments For Circulation - Nov 2018 UploadedDocument20 pagesGST Amendments For Circulation - Nov 2018 UploadedJay SuchakNo ratings yet

- CMA AmmendmentsDocument7 pagesCMA AmmendmentsCA Ishu BansalNo ratings yet

- Goods and Services Tax (GST) in India: Input Tax Credit (ITC)Document24 pagesGoods and Services Tax (GST) in India: Input Tax Credit (ITC)Noman AreebNo ratings yet

- GST Reforms-TB ChatterjeeDocument14 pagesGST Reforms-TB ChatterjeeJogender ChauhanNo ratings yet

- GST On Real Estate SectorDocument30 pagesGST On Real Estate SectorRajanNo ratings yet

- Unit - 2 Chap - 3 Input Tax CreditDocument17 pagesUnit - 2 Chap - 3 Input Tax CreditRakshit DattaniNo ratings yet

- GST Oct 17Document23 pagesGST Oct 17himanNo ratings yet

- Input Tax Credit Mechanism in GSTDocument9 pagesInput Tax Credit Mechanism in GSThanumanthaiahgowdaNo ratings yet

- Amendment Final N2020 BGSirDocument30 pagesAmendment Final N2020 BGSirAfnan KhanNo ratings yet

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarNo ratings yet

- MIGHTY 50 Nov 23Document62 pagesMIGHTY 50 Nov 23Bhuvanesh RavichandranNo ratings yet

- Wa0021.Document10 pagesWa0021.SnekaNo ratings yet

- BGMG & Associates: Chartered AccountantsDocument33 pagesBGMG & Associates: Chartered AccountantsAjit GuptaNo ratings yet

- AMFI GST FAQsDocument12 pagesAMFI GST FAQsMargi PatelNo ratings yet

- Input Tax credit-GSTDocument17 pagesInput Tax credit-GSTSandhya DangiNo ratings yet

- Goods Transport Agency.Document10 pagesGoods Transport Agency.SatyabartaNo ratings yet

- Goods Transportation in India: What Service of Transportation of Goods Is Exempt Under GST?Document10 pagesGoods Transportation in India: What Service of Transportation of Goods Is Exempt Under GST?computech instituteNo ratings yet

- GSTDocument6 pagesGSTPWD r&b nagalandNo ratings yet

- India KDP GST Summary PDFDocument13 pagesIndia KDP GST Summary PDFKhaja Afreen TNo ratings yet

- Input Tax CreditDocument16 pagesInput Tax CreditPreeti SapkalNo ratings yet

- Goods and Service Tax BBA 309 Unit 1: Prepared & Presented by Ms. Shanu Jain Assistant Professor, DME Management SchoolDocument30 pagesGoods and Service Tax BBA 309 Unit 1: Prepared & Presented by Ms. Shanu Jain Assistant Professor, DME Management SchoolNikhil KumarNo ratings yet

- Changes in GtaDocument5 pagesChanges in GtaTushar SuriNo ratings yet

- GST FrameworkDocument21 pagesGST FrameworkExecutive EngineerNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument42 pagesThe Institute of Chartered Accountants of IndiaXpacNo ratings yet

- 6 ItcDocument114 pages6 ItcRAUNAQ SHARMANo ratings yet

- Types of Supply GSTDocument46 pagesTypes of Supply GSTRajatKumarNo ratings yet

- Indian Railways - GSTDocument30 pagesIndian Railways - GSTghanghas_ankitNo ratings yet

- Blocked Credits Under GST Section 17 (5) of CGST ACT, 2017Document8 pagesBlocked Credits Under GST Section 17 (5) of CGST ACT, 2017ajayNo ratings yet

- 6.input Tax CreditDocument24 pages6.input Tax CreditBhuvaneswari karuturiNo ratings yet

- Input Tax Credit Is The Backbone of The GST Regime.: Tuesday, July 24, 2018 Amit Ray 1Document61 pagesInput Tax Credit Is The Backbone of The GST Regime.: Tuesday, July 24, 2018 Amit Ray 1sureshNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- GST Unit 1Document52 pagesGST Unit 1SANSKRITI YADAV 22DM236No ratings yet

- Goods and Services Tax - 2021Document43 pagesGoods and Services Tax - 2021gsvighneshnairNo ratings yet

- Goods Transport Agency (GTA) in GSTDocument6 pagesGoods Transport Agency (GTA) in GSTbhanupriya beheraNo ratings yet

- Key FTP Benefits and Other Aspects - Webinar (August 14 2020)Document39 pagesKey FTP Benefits and Other Aspects - Webinar (August 14 2020)vishal2205No ratings yet

- Simplified Goods & Services Tax (GST) For Hotels & RestaurantsDocument14 pagesSimplified Goods & Services Tax (GST) For Hotels & Restaurantsvishaljain_caNo ratings yet

- Transfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Document11 pagesTransfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Vishal DubeyNo ratings yet

- GST-603 Unit-3Document23 pagesGST-603 Unit-3GauharNo ratings yet

- CGST LawDocument30 pagesCGST LawPranit Anil ChavanNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Input Tax Credit Under GST Regime - Flawless Credit or Mechanism of FlawDocument15 pagesInput Tax Credit Under GST Regime - Flawless Credit or Mechanism of FlawSUDHANSU SEKHAR PANDANo ratings yet

- Input Tax Credit (GST)Document16 pagesInput Tax Credit (GST)ravi.pansuriya07No ratings yet

- GST Understanding Form GSTR 3BDocument10 pagesGST Understanding Form GSTR 3BAkhil SoodNo ratings yet

- 66978bos54003 Fnew p8Document17 pages66978bos54003 Fnew p8Yash BansalNo ratings yet

- JULY Fnew p8 - MergedDocument59 pagesJULY Fnew p8 - MergedGeethika karnamNo ratings yet

- 18 GSTDocument1,042 pages18 GSTSwetaNo ratings yet

- 66978bos54003 Fnew p8Document17 pages66978bos54003 Fnew p8Yash BansalNo ratings yet

- Impact of GST Law On Real EstateDocument14 pagesImpact of GST Law On Real EstateHumanyu KabeerNo ratings yet

- Activating GST For Your Company: Tally ERP Material Unit - 3 GSTDocument47 pagesActivating GST For Your Company: Tally ERP Material Unit - 3 GSTMichael WellsNo ratings yet

- ReportDocument5 pagesReportsvijayambikeNo ratings yet

- GST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Document20 pagesGST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Atul VermaNo ratings yet

- GST 49th Council Meeting 200223Document3 pagesGST 49th Council Meeting 200223Divay PranavNo ratings yet

- TCS On Sale of Goods: Padmanathan K V, Chartered AccountantDocument20 pagesTCS On Sale of Goods: Padmanathan K V, Chartered AccountantSainaath RNo ratings yet

- Webnote Ps 25jan19Document1 pageWebnote Ps 25jan19Sainaath RNo ratings yet

- 51 GST Flyer Chapter48Document4 pages51 GST Flyer Chapter48Sainaath RNo ratings yet

- ST ManagDocument26 pagesST ManagSainaath RNo ratings yet

- Worksheet November 21 SolutionsDocument7 pagesWorksheet November 21 SolutionsSainaath R0% (1)

- Int Trade FinDocument14 pagesInt Trade FinSainaath RNo ratings yet

- Man Fin InstDocument9 pagesMan Fin InstSainaath RNo ratings yet

- Inter Office Memo Amh / Gen. / / 2016, Sept 08, Beml LTD HyderabadDocument1 pageInter Office Memo Amh / Gen. / / 2016, Sept 08, Beml LTD HyderabadSainaath RNo ratings yet

- Work ManualDocument116 pagesWork ManualSainaath RNo ratings yet

- Acct & Finance Harmonized Curriculum 3RD Round FinalDocument184 pagesAcct & Finance Harmonized Curriculum 3RD Round FinalSainaath R100% (10)

- The Companies Act 2013 by Cs Shishir DudejaDocument141 pagesThe Companies Act 2013 by Cs Shishir DudejaSainaath RNo ratings yet

- AstroDocument3 pagesAstroSainaath RNo ratings yet

- Experience Cum Relieving Certificate: Date: 01.09.2014Document1 pageExperience Cum Relieving Certificate: Date: 01.09.2014Sainaath RNo ratings yet

- Nsic HRDocument2 pagesNsic HRSainaath RNo ratings yet

- Arizona FBLA Test 1 (New Numbers)Document10 pagesArizona FBLA Test 1 (New Numbers)bob smithNo ratings yet

- Bir Ruling No. 455-93Document2 pagesBir Ruling No. 455-93Cristelle Elaine ColleraNo ratings yet

- Pfe Chap02Document32 pagesPfe Chap02Gabriela Madalina MateiNo ratings yet

- Wealth Management ProjectDocument10 pagesWealth Management ProjectShirsendu DasNo ratings yet

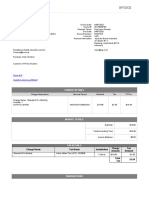

- Invoice: Zoom W-9 Question About Your Billing?Document2 pagesInvoice: Zoom W-9 Question About Your Billing?Ardhan FadhlurrahmanNo ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- 30%, 70% PLP Payment PlanDocument1 page30%, 70% PLP Payment PlanDhruv SainiNo ratings yet

- ConfirmationDocument2 pagesConfirmationArslan ShafqatNo ratings yet

- Gra Nhil ReturnDocument2 pagesGra Nhil ReturnpapapetroNo ratings yet

- 1702 Qjuly 2008Document2 pages1702 Qjuly 2008Chona MenorNo ratings yet

- Cin Training 1: Larsen Toubro Infotech LimitedDocument44 pagesCin Training 1: Larsen Toubro Infotech Limitednamea2zNo ratings yet

- Boat 235V2 Fast Charging Bluetooth Headset: Grand Total 889.00Document1 pageBoat 235V2 Fast Charging Bluetooth Headset: Grand Total 889.00Abhay SrivastavaNo ratings yet

- Doing Business in Vietnam - Grant Thornton 2022Document72 pagesDoing Business in Vietnam - Grant Thornton 2022Hoài HạNo ratings yet

- Connecticut Resident Income Tax InformationDocument11 pagesConnecticut Resident Income Tax InformationShraddhanand MoreNo ratings yet

- Scope of TaxDocument13 pagesScope of Taxraja usamaNo ratings yet

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliNo ratings yet

- SME Part 2 RevisedDocument44 pagesSME Part 2 RevisedJennifer RasonabeNo ratings yet

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- Form 11: Tax Return and Self-Assessment For The Year 2014Document32 pagesForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82No ratings yet

- Payroll WorksheetDocument2 pagesPayroll WorksheetGena Duresa100% (1)

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Tax I R K FINAL AS AT 20 2 06Document315 pagesTax I R K FINAL AS AT 20 2 06Adarsh. UdayanNo ratings yet

- Generation-Skipping Transfer Tax Return For Terminations: General InformationDocument3 pagesGeneration-Skipping Transfer Tax Return For Terminations: General InformationIRSNo ratings yet

- Dot Notice ZD080623051455D 20230615041115Document5 pagesDot Notice ZD080623051455D 20230615041115khushinagar9009No ratings yet

- Storm Fiber Pakistan InvoiceDocument1 pageStorm Fiber Pakistan InvoiceSalman YousafNo ratings yet

- ImperialDocument1 pageImperialapi-393642335No ratings yet

- Aggregation of IncomeDocument30 pagesAggregation of Incomeraja naiduNo ratings yet

- Screenshot 2022-12-18 at 17.49.01Document33 pagesScreenshot 2022-12-18 at 17.49.01j75xwwtbd8No ratings yet

- Agent Compensation Schedule - 16april2020 PDFDocument9 pagesAgent Compensation Schedule - 16april2020 PDFRajat GuptaNo ratings yet

- City University of PasayDocument19 pagesCity University of PasayFroilan G. AgatepNo ratings yet