Professional Documents

Culture Documents

Cpar PW-P1.3

Uploaded by

alellie0 ratings0% found this document useful (0 votes)

11 views2 pagesCPAR PW-P1.3

Original Title

CPAR PW-P1.3

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCPAR PW-P1.3

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesCpar PW-P1.3

Uploaded by

alellieCPAR PW-P1.3

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

|

| CPA REVIEW SCHOUL OF THE PHILIPPI :

| ! Manila :

PRACTICAL ACCOUNTING PROBLEMSI SME VALIX SIY VALIX FERRIR

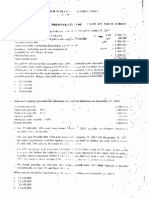

1. An SME prepared the following postclosing trial baianot on December 31, 2014:

* honfefindable purchase taxes. The purchase agreement provi

Property, plant and equipment ' 2,300,900

Intangibles assets * "850,000

Investraent in associate | 1,100,000

taxasset - | 40,000

Inventqny vi : 500,000

‘Trade rpeeivabiis | | 600,000

Cash of hand -~ . 1,15¢,000

Investment in aonputtable ordinary shares-listed-=*? $30,000

Investrgent ia nonconvertible nonputable preference shares-urlisted 500.000

oe eet ween # 400,000

Demanii deposit in bank 200,006

Loan rceivable froin employee — fixed term 10,000

Loan receivable from’ associate ~ on deraund 300,000

Bank loans 1,100,000

Other tpng-term employee benefits 250,000

Obligations under finance leases 400,000

Trade payables $80,000

Warrajty obligation— sve 20,000

Rent pple 10,000

Interes} pevabie 20,000

tax linoility © seed ee too 210,000

Bank dverdrafl-on demand 40,000

Share dapital 4,000,000

1,900,000

is the total amount of basic fi.ancial assets?

a. [4,810,000 | : +

b, 13,710,000 i

e. [3,750,000 > .

a. 13,160,000

2. Wifat is the total amount of basic financial liabilities?

a. [2,330,690

b, [2,120,000

«. | 1,720,000

4. | 1,930,009

On Jahuary 1, 2014, an SME acquired a building for P10,450,000 inciuding P500,000

ided for payment to be made in

December 31, 2014, Legal foes of P220,000 were incurred in cquiring the building

full

and paid on Jotitary 1, 204 The building is held to cam lease rentals end for capital

ay fation, The discount rate is 10% What is the initial cost of the investment property?

a. 10,170,000 :

b. 9,700,000 7

c, — 94500,000 .

‘On Japuary i, 2014, an SME acquired a building to be, held es investment property for

.000. The fai value ennnot be measured zeliably without undue cost or effort on an

‘basis. On December 31, 2014, management assessed the useful life at 50 yrars. At

Year-ebd, the enity declined sx: unsolicited offer to purchase the building for P6,500.000.

This ig # one-time offer that is unlikely to be repeated in the foreseeable future. What is the

lg amount of the investment property on December 31, 20147

4,900,000

. | 5831

| PRACTICAL ACCOUNTING PROBLEMS 1 F Page 2

4. On Janvery 1, 2014, SME acquired 25% of the equity of each of entities A und B for

P1,000(C00 and P3,500,000 respectively, Transaction costs of 10% of the purchase price of

__ the shabes were incuried by, SME, Cn Snnuary 2, 2014, entity A Meclared and paid dividend

of P8C0,000. For the yep ended Decenber 31, 2014, entity A recognized profit of

P1,000)000. However, entity B recognized a loss of P2,000,000 for that year. Published price

| quotstipns de not exist for the sharer ‘of entities A’ and B. Using appropriate valustion

‘technic SME detertnined the fair value of the investments in entities A.and B on

December 31, 2014 at: P1,500,000. and P2,000,000 ‘respectively. Costs of disposal are

estimalkd af 10% of the fiir Valuvof the investments. *

Ayo 1s Uniter the cost model, what is the total carrying amount of the investments in associates

A on Pecember 31, 20147

\2,900,009

{3,400,000

14,000,000 - :

{2,800,000

pee

le" the equity method, what is the total carrying amount of the investments in

bciater on December 31, 2014?

3,650,000

12,950,000

3,650,000

3,950,000

ler the isir value model, whot is the total carrying amount of the investments in

eiates on December 31, 2014?

3,100,000 :

4,000,000

3,5¢0,000

3,150,000

Q

BPTPR Bc pe oP gs

A, > An SMB incu:red and paid the following expenditures in acquiring an administration

‘buildirlg and the land on which itis built during 2014:

January 1 20% of the price is attributable to land 50,000,000

January 1 ‘Nonrefundable transfer taxes not included in the

PSU,000,000 purchase price 1,000,000

January 1 Legal cost, directly aitributable to the acquisition 200,000

January 1 ibursig the previous ovmer for prepeying the

‘nonrefiindable local government property taxes for the

six-mohth period erding June 30, 2014 100,600

Sune 3} N ible apnaal local goyerninent property taxes for

the year ending fume 30, 2015 200,090

During 2014 Day, to-day repairs and maintenance, 250,000

On Di ‘ber 31, 2014, SME assessed tat the useful life of the building is 4¢ years with

+ residudi value of P2,000,000, On same date, the fair value less cost of disposal of the land

wand building is P60,000,000. What is the initial carrying amount of the land and building,

ly? : ; :

a, 10,240,000 and. 40,960,000

. 101200,009 and 40,800,000

¢. 10]000,000 and 40,000,000 4

&. 12/000,000 and 48,000,000

: : END

: | 5831

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- QUIZ1Document4 pagesQUIZ1alellieNo ratings yet

- Prelim ExamDocument12 pagesPrelim ExamCyd Chary Limbaga BiadnesNo ratings yet

- Prelim Exam - Doc2Document16 pagesPrelim Exam - Doc2alellie100% (1)

- MQ1Document8 pagesMQ1alellieNo ratings yet

- Fin ExamDocument6 pagesFin ExamKissesNo ratings yet

- Cpar-Pw P1.2Document10 pagesCpar-Pw P1.2Charry RamosNo ratings yet

- HandoutDocument3 pagesHandoutalellieNo ratings yet

- PQ2Document2 pagesPQ2alellieNo ratings yet

- University of Saint Louis Midterm Exam ReviewDocument34 pagesUniversity of Saint Louis Midterm Exam ReviewalellieNo ratings yet

- Cpar PW-P1.4Document10 pagesCpar PW-P1.4alellieNo ratings yet

- Preweek Taxation 2014Document59 pagesPreweek Taxation 2014alellieNo ratings yet

- Cpar PW-P1.1Document14 pagesCpar PW-P1.1alellieNo ratings yet

- Accounts Payable and Total Liabilities AnalysisDocument39 pagesAccounts Payable and Total Liabilities AnalysisalellieNo ratings yet

- Preweek Practical Accounting 2Document44 pagesPreweek Practical Accounting 2alellieNo ratings yet

- CPA REVIEW: Calculating Depreciation and Estimated LiabilityDocument41 pagesCPA REVIEW: Calculating Depreciation and Estimated LiabilityalellieNo ratings yet

- Preweek Auditing Theory 2014 PDFDocument31 pagesPreweek Auditing Theory 2014 PDFJc Quismundo0% (1)

- Preweek Auditing Theory 2014Document29 pagesPreweek Auditing Theory 2014alellieNo ratings yet

- Past CPA Board On MASDocument22 pagesPast CPA Board On MASJaime Gomez Sto TomasNo ratings yet

- Preweek Practical Accounting 1Document24 pagesPreweek Practical Accounting 1alellieNo ratings yet

- Preliminary Examination - Tax 2Document6 pagesPreliminary Examination - Tax 2alellie100% (2)

- Quiz-Chapter1 Partnership Formation and OperationsDocument2 pagesQuiz-Chapter1 Partnership Formation and Operationsalellie100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)