Professional Documents

Culture Documents

Financial Accounting and Reporting Fundamentals Review

Uploaded by

Ryan PelitoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting and Reporting Fundamentals Review

Uploaded by

Ryan PelitoCopyright:

Available Formats

'."'I ?

a ...-, r

( cl';,'t-t .-t',, i

'

The Review School of Accountancy

PREWEEK LECTURE

.: IITANCIAL ACCOUNTING AND REPORTING(FAR) C, U berita/C. Espenilla/G.Macii riola

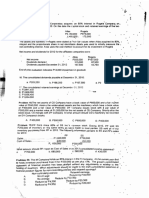

reto Company reported a Cash and Cash Equivalent balance of P-2,375,OADron Dec. 2016 which consisted of thq following:

I Petty cash fund ( of which P 78O is unreplenished vouchers for expenses; 8150 is IOU

I not€s and remaining currencies and coins amounting to P-3-80-0), 5,000 c: -',

:,11

f

-cash ?.'t

tt ,.:'"r

account in a different bank

Cash on hand including customers'postdated checks of P 6,500-

Cash in Bank, Administrators payroll account, after checks amounting to Pl25,000 dated 750,000

| ,'; a.

Dec. 31. 2016 but Unrqlg?qgd aS of Dec. 3i, 2015

Savings deposit, earmarketfToi' the acquisition of building which are expected to be 600,000 l,'j

disbursed withiq 6 rlgnthsfrom reporting date Ii

Money market instrument purchased on December 25, 2016 maturing on April 25,20L7

Cash in bank, General account B, incltding unrestricted compensating balances of

P200,000

1" How much !s the correct amount of Cash and C_ash -Equivalents to be shown in

Position at December 31, 2015?

a. t,8t7,570 c. 7,692,570

b. 1,617,300 d. 1,817,300

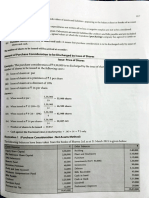

The Petty cash fund or Storm Trading atthe end of December 31, 2016 is composed of the following:

.\

L--'€na.es e.c co 4s 3,200

- -:-a3 ie.1iShff fa C \ CuChe.S

S -::.. es 600

Trars},?:tatrcn 100

iCu :-om er,Proyee 300

t.rnused supplres "' . '' I

50

. Check Orawn by a sales.staff dated.Jan.e ZOf Z 500

'' ' '. Check arawn by a customei'ctated Oec.'i6, zOrc 1,450

Check dr-awn by an office director dated Dec. 30, 2016 1,900

Envelope ccntaining cash contributions from employees for a

thanksgiving party ( currencies attacheC ) 800

The ger:erar ledger balance of the imprest petty cash fund at December 31, 2016 is P10,000.

2. How much is the corect petty cash fund at December 31, 2016?

a. 8,500 c. 3,200

b. 5,100 d. 6,55O

,,,!. i, -,1';

3. How much is the cash shortage/overage? i..)-

a. 3,400 c. 3,350

b. 1,100 d. 1,000

' |, t

The fotlowing bank reconciliation is presented for Sr:ntinel Company for the month of July 2017:

t

.r.r

Balance per bank statement, 7/31 P 1B0,0OO r'r' : ' la 'l ,

Add: Deposits in transit 40.000 :' ,..,",

1,.i,,, (. /'l '

"

Total p 22A,OOO (, . ! .: ,.

Less: Outstanding checks P 60,000 ;

1J'

t t' n

Bank credit recorded in error 1gp0Q _ 70.000

Balance per books,7lll P 15O,OOO

.\i

Data per bank statement for the month of August 2017 follow: I d.,

'

l":!..

August deposits, including note for P 50,000 collected in behalf of Sentinel Conrpany P 275,OOO .

August disbursements ( including NSF for P 35,000 and service charges of P 1,500) 220,000

All items that were outstanding as of July 31 cleared through the bank in August, including the bank credit. In addition,

P25,000 in checks were outstanding and deposits of P 35,000 were- in tran,sit as of August 3l: z1OL;/..

fl i;

4. How much is the adjusted disbursements for the month of August?

a. 183,500 c. 185,000

b. 175,000 d. 195,000 i:, t

. 5. How much is the correct cash balance on August 3Lt 2(J77? r

a. 245,OOO c.231,500

b. 270,ooo d. 235,000

PREWEEK-FAR ( BATCH 34 )

...rP49e 1 of 9

You might also like

- VSPD Audit 11Document3 pagesVSPD Audit 11DIPAK VINAYAK SHIRBHATENo ratings yet

- Chapter 2 JournalizingDocument21 pagesChapter 2 Journalizingkakao100% (1)

- Accounting problems and solutions for auditing, inventory, and profit adjustmentsDocument3 pagesAccounting problems and solutions for auditing, inventory, and profit adjustmentsXhaNo ratings yet

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋNo ratings yet

- Preweek Practical Accounting 2-20Document1 pagePreweek Practical Accounting 2-20adssdasdsadNo ratings yet

- Cabauatan Jericho PDFDocument3 pagesCabauatan Jericho PDFcalliemozartNo ratings yet

- All About CashDocument18 pagesAll About CashJolianne SalvadoOfcNo ratings yet

- Exercise 3-1Document6 pagesExercise 3-1Mark SembreroNo ratings yet

- Business Combination and Consolidated FS Part 1Document6 pagesBusiness Combination and Consolidated FS Part 1markNo ratings yet

- Atal Pension Yojana (APY) - How to Voluntarily Close Your AccountDocument4 pagesAtal Pension Yojana (APY) - How to Voluntarily Close Your AccountTrivikram NayakNo ratings yet

- Assignment 1 (Date 10.8.23)Document3 pagesAssignment 1 (Date 10.8.23)Biswajit BNo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Cash BookDocument4 pagesCash Booknehal dagarNo ratings yet

- AccountDocument3 pagesAccountkarangasharon9No ratings yet

- Expense: DoubtfulDocument4 pagesExpense: DoubtfulTrang UôngNo ratings yet

- Changunarayan Group PVT - LTD I: Darbarmarga Kathmandu ofDocument1 pageChangunarayan Group PVT - LTD I: Darbarmarga Kathmandu ofAnonymous sUMZh8ZriDNo ratings yet

- Samsona, Melanie 2018-1383Document9 pagesSamsona, Melanie 2018-1383Melanie SamsonaNo ratings yet

- Cash and Accounts Receivable PDFDocument11 pagesCash and Accounts Receivable PDFAndrew Benedict PardilloNo ratings yet

- rgDocument1 pagergkhgngy5bbkNo ratings yet

- Sp0.000Cah: DepreclatiesDocument6 pagesSp0.000Cah: DepreclatiesAnuj SudraniaNo ratings yet

- p1 Review With AnsDocument7 pagesp1 Review With AnsJiezelEstebeNo ratings yet

- 3j-2Q!7. Iunds Iiot: ,,.rse. O1Document1 page3j-2Q!7. Iunds Iiot: ,,.rse. O1Ryan PelitoNo ratings yet

- H.R. Textile Mills Limited Statement of Cash FlowsDocument1 pageH.R. Textile Mills Limited Statement of Cash FlowsFerdausNo ratings yet

- Kasus 4Document1 pageKasus 4iron manNo ratings yet

- Cta 00 CV 05631 D 2000may11 RefDocument10 pagesCta 00 CV 05631 D 2000may11 RefRizaldy MenorNo ratings yet

- Leasing ProblemsDocument11 pagesLeasing ProblemsAbhishek AbhiNo ratings yet

- Solving Problems Set B with Dodge Inc's Bank ReconciliationDocument2 pagesSolving Problems Set B with Dodge Inc's Bank ReconciliationMd Musa PatoaryNo ratings yet

- Lembar Jawaban-2 Tugas KelompokDocument36 pagesLembar Jawaban-2 Tugas KelompokranjanisalsabilaaaNo ratings yet

- Sol. Man. - Chapter 2 - Cash & Cash Equivalents - Ia Part 1aDocument6 pagesSol. Man. - Chapter 2 - Cash & Cash Equivalents - Ia Part 1aMiguel AmihanNo ratings yet

- KIPAWADocument2 pagesKIPAWAruhy690No ratings yet

- University of The Punjab: PAPER:BC-401Document24 pagesUniversity of The Punjab: PAPER:BC-401asgarNo ratings yet

- Partnership Reviewer Part 2 of 2Document23 pagesPartnership Reviewer Part 2 of 2Chelit LadylieGirl FernandezNo ratings yet

- FA (1st) May2019 2Document3 pagesFA (1st) May2019 2Darsh KumarNo ratings yet

- Solution To Illustrative Problem On Petty Cash FundDocument3 pagesSolution To Illustrative Problem On Petty Cash FundHoy CrushNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Itel.: Accountancy & 734-3989Document1 pageItel.: Accountancy & 734-3989Jims Leñar CezarNo ratings yet

- Journal Transactions: Dwyer Delivery ServiceDocument10 pagesJournal Transactions: Dwyer Delivery ServiceClara Saty M LambaNo ratings yet

- Amalgamation Illustration PDFDocument25 pagesAmalgamation Illustration PDFyash nawariyaNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Cash and Bank Recon Illustrative ExamplesDocument6 pagesCash and Bank Recon Illustrative ExamplesRia BryleNo ratings yet

- CF Calculation: Income From ValuationDocument1 pageCF Calculation: Income From ValuationwilsonNo ratings yet

- Chapter 01Document20 pagesChapter 01NoreenNo ratings yet

- DAGUPLO c2 p16 p17Document7 pagesDAGUPLO c2 p16 p17Jane Leona Almosa Daguplo100% (1)

- CombinationDocument57 pagesCombinationGirl Lang Ako100% (1)

- Accrual Assignment TwoDocument2 pagesAccrual Assignment TwoNigus AyeleNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- ABC Company adjusted trial balanceDocument6 pagesABC Company adjusted trial balanceAye TubeNo ratings yet

- Exercise 2.2Document3 pagesExercise 2.2lheamaecayabyab4No ratings yet

- Ud Wirastri Worksheet Desember 2015Document2 pagesUd Wirastri Worksheet Desember 2015YOHANA100% (1)

- Fin PDFDocument16 pagesFin PDFRoselyn Perol RubiaNo ratings yet

- Tugas Tm4 042111233234 - Ifara Kumala SariDocument16 pagesTugas Tm4 042111233234 - Ifara Kumala SarinisaNo ratings yet

- Answer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionDocument8 pagesAnswer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionAnnie RapanutNo ratings yet

- 9 Accounting HomeworkDocument18 pages9 Accounting HomeworkCharlie RNo ratings yet

- Calculating Cash and Cash Equivalents for Financial StatementsDocument8 pagesCalculating Cash and Cash Equivalents for Financial StatementsWymple Kate Alexis FaisanNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- P1 3403-2 PDFDocument1 pageP1 3403-2 PDFRyan PelitoNo ratings yet

- P1 3401-1Document1 pageP1 3401-1Ryan PelitoNo ratings yet

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Document1 pageLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoNo ratings yet

- Far 34PW-2 PDFDocument1 pageFar 34PW-2 PDFRyan PelitoNo ratings yet

- Accounting for Current AssetsDocument1 pageAccounting for Current AssetsRyan PelitoNo ratings yet

- 'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Document1 page'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Ryan PelitoNo ratings yet

- 3j-2Q!7. Iunds Iiot: ,,.rse. O1Document1 page3j-2Q!7. Iunds Iiot: ,,.rse. O1Ryan PelitoNo ratings yet

- P1 3401-2 PDFDocument1 pageP1 3401-2 PDFRyan PelitoNo ratings yet

- Sorcerer's Stone Company EPS and Share ValuationDocument1 pageSorcerer's Stone Company EPS and Share ValuationRyan PelitoNo ratings yet

- P1 3402-2 PDFDocument1 pageP1 3402-2 PDFRyan PelitoNo ratings yet

- Far 34PW-9 PDFDocument1 pageFar 34PW-9 PDFRyan PelitoNo ratings yet

- Ap 34PW2-2 PDFDocument1 pageAp 34PW2-2 PDFRyan PelitoNo ratings yet

- Far 34PW-6 PDFDocument1 pageFar 34PW-6 PDFRyan PelitoNo ratings yet

- P1 3403-3 PDFDocument1 pageP1 3403-3 PDFRyan PelitoNo ratings yet

- Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JDocument1 pagePrt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JRyan PelitoNo ratings yet

- P1 3402-1 PDFDocument1 pageP1 3402-1 PDFRyan PelitoNo ratings yet

- Audit procedures and financial statement cyclesDocument1 pageAudit procedures and financial statement cyclesRyan PelitoNo ratings yet

- Ap 34PW2-3 PDFDocument1 pageAp 34PW2-3 PDFRyan PelitoNo ratings yet

- Ap 34PW2-1 PDFDocument1 pageAp 34PW2-1 PDFRyan PelitoNo ratings yet

- Reyes TacandongDocument1 pageReyes TacandongRyan PelitoNo ratings yet

- Analyzing Cash AccountsDocument1 pageAnalyzing Cash AccountsRyan PelitoNo ratings yet

- Ap 34PW-2 PDFDocument1 pageAp 34PW-2 PDFRyan PelitoNo ratings yet

- Market ProjDocument5 pagesMarket ProjRyan PelitoNo ratings yet

- SculptureDocument2 pagesSculptureRyan PelitoNo ratings yet

- Frequency Polygon: Class Limits Class Boundari Es F X CFDocument2 pagesFrequency Polygon: Class Limits Class Boundari Es F X CFRyan PelitoNo ratings yet

- Ac Pas 8Document9 pagesAc Pas 8Ryan PelitoNo ratings yet

- Ac Pas 8Document9 pagesAc Pas 8Ryan PelitoNo ratings yet

- Feedback Mechanism InstrumentDocument2 pagesFeedback Mechanism InstrumentKing RickNo ratings yet

- Ies RP 7 2001Document88 pagesIes RP 7 2001Donald Gabriel100% (3)

- SISU Datenblatt 7-ZylDocument2 pagesSISU Datenblatt 7-ZylMuhammad rizkiNo ratings yet

- Cache Memory in Computer Architecture - Gate VidyalayDocument6 pagesCache Memory in Computer Architecture - Gate VidyalayPAINNo ratings yet

- Gilette Case - V3Document23 pagesGilette Case - V3Vidar Halvorsen100% (3)

- Spec 2 - Activity 08Document6 pagesSpec 2 - Activity 08AlvinTRectoNo ratings yet

- 3 BPI Employee Union-Davao V BPI - DigestDocument1 page3 BPI Employee Union-Davao V BPI - DigestRonyr RamosNo ratings yet

- Comparing environmental impacts of clay and asbestos roof tilesDocument17 pagesComparing environmental impacts of clay and asbestos roof tilesGraham LongNo ratings yet

- Appendix 9A: Standard Specifications For Electrical DesignDocument5 pagesAppendix 9A: Standard Specifications For Electrical Designzaheer ahamedNo ratings yet

- Microprocessor Based Systems: by Nasir Mahmood Nasir - Mahmood@seecs - Edu.pkDocument15 pagesMicroprocessor Based Systems: by Nasir Mahmood Nasir - Mahmood@seecs - Edu.pkMuhammad ZubairNo ratings yet

- Final Year Project - Developing A Plastic Bottle Solar CollectorDocument78 pagesFinal Year Project - Developing A Plastic Bottle Solar CollectorLegendaryN0% (1)

- Ganbare Douki Chan MALDocument5 pagesGanbare Douki Chan MALShivam AgnihotriNo ratings yet

- Infineon ICE3BXX65J DS v02 - 09 en PDFDocument28 pagesInfineon ICE3BXX65J DS v02 - 09 en PDFcadizmabNo ratings yet

- Duplex Color Image Reader Unit C1 SMDocument152 pagesDuplex Color Image Reader Unit C1 SMWatcharapon WiwutNo ratings yet

- SQL DBA Mod 1 IntroDocument27 pagesSQL DBA Mod 1 IntroDivyaNo ratings yet

- IT ManagementDocument7 pagesIT ManagementRebaz Raouf Salih MohammedNo ratings yet

- Method Statement For LVAC Panel TestingDocument9 pagesMethod Statement For LVAC Panel TestingPandrayar MaruthuNo ratings yet

- CIS2103-202220-Group Project - FinalDocument13 pagesCIS2103-202220-Group Project - FinalMd. HedaitullahNo ratings yet

- Carbon Trust Certification OverviewDocument2 pagesCarbon Trust Certification OverviewMatt MaceNo ratings yet

- Supplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDocument8 pagesSupplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDinuka MalinthaNo ratings yet

- Summer Training Report On HCLDocument60 pagesSummer Training Report On HCLAshwani BhallaNo ratings yet

- 7 - Lakhs Bank EstimateDocument8 pages7 - Lakhs Bank Estimatevikram Bargur67% (3)

- 2.1 Elements of Computational ThinkingDocument25 pages2.1 Elements of Computational ThinkingHamdi QasimNo ratings yet

- BSC in EEE Full Syllabus (Credit+sylabus)Document50 pagesBSC in EEE Full Syllabus (Credit+sylabus)Sydur RahmanNo ratings yet

- Ey Blockchain Innovation Wealth Asset ManagementDocument16 pagesEy Blockchain Innovation Wealth Asset ManagementmichaeleslamiNo ratings yet

- Distribution Requirements PlanningDocument8 pagesDistribution Requirements PlanningnishantchopraNo ratings yet

- Progress ReportDocument5 pagesProgress Reportapi-394364619No ratings yet

- تقرير سبيس فريم PDFDocument11 pagesتقرير سبيس فريم PDFAli AkeelNo ratings yet

- Katie Todd Week 4 spd-320Document4 pagesKatie Todd Week 4 spd-320api-392254752No ratings yet