Professional Documents

Culture Documents

Aviva PLC - at A Glance March 2018

Uploaded by

Aviva GroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva PLC - at A Glance March 2018

Uploaded by

Aviva GroupCopyright:

Available Formats

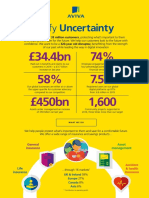

Defy uncertainty

We give our 33 million customers the confidence and control to be ready for

life’s opportunities and challenges. We want to be a 320+ year old disruptor,

benefitting from the strength of our past, while leading the way in digital innovation.

£34.6 billion 75% 800,000

Paid out in benefits and claims to Employee engagement: our people New customers in 2017*

our customers in 2017 are passionate about making a

difference for our customers

59 million £490 billion 2,400

Customer policies globally - 30% of Assets under management Community projects supported in

our customers have more than one 2017, helping 729,000 people

(as at 31 December 2017)

product with us

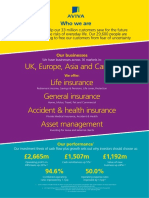

What we do

We offer a wide range of insurance and savings products which help people

to protect what’s important and save for a more comfortable future.

Life insurance General insurance Asset management Accident & health insurance

Our businesses

We are the UK’s largest insurer, with a strong international presence in selected markets in

Europe, Canada and Asia. We’re focused on markets and businesses where we can achieve

scale, profitability and competitive advantage.

Our geographic diversification is one of our strengths.

* Net number and excluding Aviva Spain customers.

“We are here for our customers, helping them to defy uncertainty. We

support them when bad stuff happens and we help them to lead their

lives with confidence. Doing this well means we will deliver growth in

earnings and dividends for our shareholders.”

Mark Wilson, Group CEO, Aviva plc

Our strategy

Our strategy puts the customer at the heart of everything we do and provides clear

direction across all our markets for how we run our business:

True Customer Composite Digital First Not Everywhere

Meeting customer needs across Emphasising customer Focussing on markets

life, general, accident & health experience driven by digital and segments where

insurance and asset management. – online, mobile and tablet. we can win.

Financial performance

2017 was another year of delivering on our promises of cashflow plus growth.

Total dividend per share Operating earnings per share Group adjusted operating profit1

27.4p 54.8p £3,068m

Up 18% Up 7% Up 2%

Solvency II cover ratio2 Value of new business General insurance net

written premiums

198% £1,243m £9,141m

Up 9 ppts Up 25% Up 11%

1

Group adjusted operating profit is a non-GAAP Alternative Performance Measure (APM) which is not bound by the requirements of IFRS

2

The above relates to the estimated shareholder’s view of Solvency II and includes pro-forma adjustments.

Find out more about Aviva at www.aviva.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Ebook IOP PDFDocument125 pagesEbook IOP PDFamruta ayurvedalayaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- InstallmentDocument40 pagesInstallmentMich Salvatorē50% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Diluted Earnings Per ShareDocument3 pagesDiluted Earnings Per ShareJohn Ace MadriagaNo ratings yet

- TTV Midterm 26 Aug - Sample - 3Document8 pagesTTV Midterm 26 Aug - Sample - 3Steven NimalNo ratings yet

- Boiler MaintenanceDocument6 pagesBoiler MaintenanceRamalingam PrabhakaranNo ratings yet

- Accounting For MusharakahDocument10 pagesAccounting For MusharakahAthira HusnaNo ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryEJ BuanNo ratings yet

- Tomato KetchupDocument9 pagesTomato Ketchupygnakumar100% (3)

- 2017 Preliminary Results AnnouncementDocument143 pages2017 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Interim Results AnnouncementDocument10 pagesAviva 2018 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva 2017 Interim Results AnnouncementDocument131 pagesAviva 2017 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva 2018 Key Metrics InfographicDocument1 pageAviva 2018 Key Metrics InfographicAviva GroupNo ratings yet

- Enabling Europe To Compete in The Global World of FinTechDocument2 pagesEnabling Europe To Compete in The Global World of FinTechAviva GroupNo ratings yet

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDocument4 pagesMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNo ratings yet

- Aviva PLC 2016 Results InfographicDocument2 pagesAviva PLC 2016 Results InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 Interims Results AnnouncementDocument127 pagesAviva PLC 2016 Interims Results AnnouncementAviva GroupNo ratings yet

- Aviva 2017 Interim Results Analyst PresentationDocument64 pagesAviva 2017 Interim Results Analyst PresentationAviva GroupNo ratings yet

- Aviva HY16 Results Summary - InfographicDocument1 pageAviva HY16 Results Summary - InfographicAviva GroupNo ratings yet

- Aviva PLC 2016 ResultsDocument71 pagesAviva PLC 2016 ResultsAviva GroupNo ratings yet

- Aviva PLC Capital Markets DayDocument2 pagesAviva PLC Capital Markets DayAviva GroupNo ratings yet

- Aviva 2015 Full Year Results TranscriptDocument3 pagesAviva 2015 Full Year Results TranscriptAviva GroupNo ratings yet

- What Are We in Business For? Being A Good AncestorDocument22 pagesWhat Are We in Business For? Being A Good AncestorAviva GroupNo ratings yet

- Aviva 2015 Preliminary AnnouncementDocument10 pagesAviva 2015 Preliminary AnnouncementAviva GroupNo ratings yet

- Aviva 2014 Results PresentationDocument26 pagesAviva 2014 Results PresentationAviva GroupNo ratings yet

- Aviva at A Glance InfographicDocument2 pagesAviva at A Glance InfographicAviva GroupNo ratings yet

- Aviva Half Year 2015 Analyst PresentationDocument30 pagesAviva Half Year 2015 Analyst PresentationAviva GroupNo ratings yet

- 2015 Half Year Results Interview With Group CEO Mark WilsonDocument4 pages2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva 2015 Results InfographicDocument1 pageAviva 2015 Results InfographicAviva GroupNo ratings yet

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDocument5 pagesInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNo ratings yet

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDocument4 pagesAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNo ratings yet

- Aviva Half Year 2015 AnnouncementDocument163 pagesAviva Half Year 2015 AnnouncementAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDocument7 pages2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva PLC 2014 Preliminary Results AnnouncementDocument9 pagesAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Bookkeeping Basics MCQDocument65 pagesBookkeeping Basics MCQRana AwaisNo ratings yet

- Payslip 0213Document1 pagePayslip 0213sathiya moorthyNo ratings yet

- Business Plan Composite Materials Corporation: Submitted To: Group MembersDocument32 pagesBusiness Plan Composite Materials Corporation: Submitted To: Group MembersWajahat SheikhNo ratings yet

- Types of CompensationDocument9 pagesTypes of CompensationthuybonginNo ratings yet

- Lawsuit Against Pennsylvania Turnpike Filed by Trucking AssociationsDocument43 pagesLawsuit Against Pennsylvania Turnpike Filed by Trucking AssociationsBarbara MillerNo ratings yet

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- OracleDocument412 pagesOracleTarek MohamadNo ratings yet

- CF Micro8 Tif02Document61 pagesCF Micro8 Tif02هناءالحلوNo ratings yet

- VAT Exemption Guide for Foreign MissionsDocument10 pagesVAT Exemption Guide for Foreign MissionsXhris ChingNo ratings yet

- Santa Barbara Budget Book 10-11 CompleteDocument716 pagesSanta Barbara Budget Book 10-11 CompleteGlenn HendrixNo ratings yet

- Syndicate 5 OM - 1-800-FlowersDocument24 pagesSyndicate 5 OM - 1-800-Flowersmeidianiza100% (1)

- Part IV. Theory of Competition PolicyDocument33 pagesPart IV. Theory of Competition PolicyRafa SambeatNo ratings yet

- 2020 Financial PerformanceDocument166 pages2020 Financial PerformanceYenny AngkasaNo ratings yet

- MidtermsDocument10 pagesMidtermsKIM RAGA0% (1)

- BCCC173938 Tender Doc PDFDocument391 pagesBCCC173938 Tender Doc PDFTrapti SinghNo ratings yet

- Money, Its Meaning...and Everything You Need to KnowDocument19 pagesMoney, Its Meaning...and Everything You Need to KnowJayson GambaNo ratings yet

- Modulo Ingles Comercial IIIDocument0 pagesModulo Ingles Comercial IIIMiller AponteNo ratings yet

- Tcs-Offer-Letterpdf OCRDocument18 pagesTcs-Offer-Letterpdf OCRChethan VNo ratings yet

- PT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDocument62 pagesPT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDhen NurdiansyahNo ratings yet

- Rajat Ghosh's electric mobility futureDocument21 pagesRajat Ghosh's electric mobility futuremeghana chavanNo ratings yet

- Convergys India Services Pvt. Ltd. Payslip For The Month of October - 2021Document2 pagesConvergys India Services Pvt. Ltd. Payslip For The Month of October - 2021Nand kishore guptaNo ratings yet

- ValuationDocument3 pagesValuationRendry Da Silva SantosNo ratings yet