Professional Documents

Culture Documents

Tightening Slows But Risk Premiums Remain Low

Uploaded by

montyviaderoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tightening Slows But Risk Premiums Remain Low

Uploaded by

montyviaderoCopyright:

Available Formats

2 September 2016 Credit Research

High Yield Pacenotes

Weekly Highlights Contents

When will turn too tight into too tight to last? _______ 2

iBoxx Rebalancing ___________________________ 4

■ Tightening slowed down somewhat over the week (iBoxx HY NFI -4bp to Rating Actions ______________________________ 5

356bp wow), but this must be seen against the massive decline in risk HY Calendar________________________________ 5

Recommendation Overview ____________________ 5

premiums in August. Last month, credit spreads tightened 38bp and

Latest Company News ________________________ 6

returned 1.8% whereas equities performed much more lackluster (Euro ALBA Group (Hold) _________________________ 6

STOXX 50 +1.1% mom). The iBoxx HY NFI hit the lowest level since Agrokor (Hold) ____________________________ 6

Altice (Buy), Telenet (Hold) ___________________ 7

June 2015 and all sectors posted significant gains (for details, please see

Areva (Hold) ______________________________ 8

our monthly High Yield Index Review). CABB (Hold) ______________________________ 9

HP Pelzer (Hold) ___________________________ 9

■ The overall picture of eurozone growth resilience prevailed. Although Lecta (Hold from Restricted) _________________ 10

final manufacturing PMI data in the eurozone came in slightly below the Matterhorn Telecom (Buy) __________________ 10

preliminary releases, Spain’s reading came in somewhat higher than RCS & RDS (Hold) ________________________ 11

Sappi (Buy) ______________________________ 12

initially reported (51 vs. 50.9), and Germany’s figure (53.6) was United Group (Hold from Restricted) __________ 12

confirmed, whereas French and Italian figures (48.3 and 49.8 Wind (Buy) ______________________________ 13

respectively) were reported lower than their initial estimates. A big Xella (Hold) ______________________________ 14

Zobele (Hold) ____________________________ 14

positive surprise was the UK’s final reading, which came in at 53.3 (vs. a HY Issuers and Bonds _______________________ 16

preliminary reading of 49).

■ Against this backdrop, our economists do not expect any FINANCIALS WEEKLY WINNERS AND LOSERS

announcements at next week’s ECB meeting. The bar for another

ECPG FRN Nov-21

increase in monthly asset purchases appears high, due to the UNIIM FRN Jun-21

LINDOR 9.5% Aug-22

intensification of scarcity problems that this would cause and the NOVBNC 3.5% Jan-43

ICBPI 8.25% May-21

IPFLN 5.75% Apr-21

countermeasures the ECB may have to take. In addition, the side effects DLNA 4.375% Perp

AIB 4.125% Nov-25

RBS 7.0916% Perp

of an even more negative deposit rate would outweigh the benefits. VICEN 9.5% Sep-25

iBoxx EUR HY Financials

UCGIM 3.125% May-24

■ In the US, a lukewarm labor market report followed weaker-than-expected

BACRED 5.75% Apr-23

RBIAV 6.625% May-21

BPIM 4.3% Jan-18

GYCGR 3.75% Perp

ISM manufacturing data (49.4 after 52.6), which showed its first contraction RBIAV 4.5% Feb-25

NDB 4.75% Oct-23

in six months amid declining new orders (49.1 after 56.9). Note that our MONTE 5% Apr-20

MONTE 5.6% Sep-20

MONTE FRN Nov-17

economists stick to their forecast of a 25bp rate hike in December after -3% -2% -1% 0% 1% 2%

nonfarm payrolls trailed estimates in August (+151k) and the weekly total return

unemployment rate stayed unchanged at 4.9%. In addition, details proved

Source: iBoxx, UniCredit Research

a tad softer as the average workweek declined (34.3, lowest since

February 2014) and hourly earnings increased merely 0.1% mom, lowering

the yoy rate to 2.4% (after 2.5%). However, the figures should not prevent

the Fed from raising before year-end as the month of August traditionally

tends to be on the weaker side, which seems to be a seasonal adjustment

issue more than underlying weakness, our economists note.

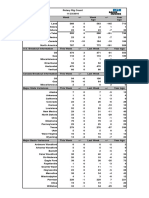

NON-FINANCIALS WEEKLY WINNERS AND LOSERS

AREVAF 3.125% Mar-23

AREVAF 3.5% Mar-21

AREVAF 4.875% Sep-24

AREVAF 3.25% Sep-20

OHLSM 4.75% Mar-22

OHLSM 5.5% Mar-23

AREVAF 4.375% Nov-19

OHLSM 7.625% Mar-20

VKFP 2.25% Sep-24

REPSM 4.5% Mar-75

iBoxx EUR HY Non-Financials

SCHMAN 7% Jul-23

PETBRA 4.75% Jan-25 Author

BULENR 4.875% Aug-21 Dr. Christian Weber, CFA (UniCredit Bank)

GAMENT 6% Aug-21 +49 89 378-12250

VERITS 7.5% Feb-23

CABBCO 6.875% Jun-22

christian.weber@unicredit.de

CMACG 7.75% Jan-21

Bloomberg

CMACG 8.75% Dec-18

IKKSFR 6.75% Jul-21 UCCR

QUIBB FRN Apr-19

Internet

-6% -4% -2% 0% 2% 4% 6% 8% 10% 12% 14% www.research.unicredit.eu

weekly total return

Source: iBoxx, UniCredit Research

UniCredit Research page 1 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

When will turn too tight into too tight to last?

iBoxx HY Excess Return vs. Bund Risk compensation in high yield is approaching critically low levels

Bund iBoxx EUR HY main cum xover cumulated excess

8% 300 5.5

6%

250 5

4%

Total return in %

2% 200 4.5

0%

150 4

-2%

-4% 100 3.5

-6%

50 3

-8% Spread (ASW) / leverage in bp 10Y median spread/lev.

3Y median spread / lev. Median net debt adj. / EBITDA (adj)

-10% 0 2.5

Apr-16

Oct-15

Sep-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

May-16

Jun-16

Jul-16

Aug-16

Sep-16

Oct-06

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Feb-06

Jun-06

Feb-07

Jun-07

Feb-08

Jun-08

Feb-09

Jun-09

Feb-10

Jun-10

Feb-11

Jun-11

Feb-12

Jun-12

Feb-13

Jun-13

Feb-14

Jun-14

Feb-15

Jun-15

Feb-16

Jun-16

Source: iBoxx, UniCredit Research

Risk compensation looking Ongoing easy access to financing and stagnating-to-receding earnings are elevating the

stretched…

downside risks. After trading wide at the beginning of the year and high yield still hovering

around reasonable valuation levels in 1H16, the ongoing rally in spreads has increasingly

been accompanied by rising leverage ratios in recent months. Median net debt/EBITDA crept

up to 4.4x at the end of August – the highest level since 2009 (grey line in the right chart).

This has suppressed risk compensation in high yield – as measured by the spread for one

unit of leverage (red line in the right chart) – to 81bp, the lowest level since mid-2007 and

about one third below the 10Y median of 114bp. While ongoing ECB purchases and

continued expansion may keep things calm for a while, the next consolidation phase could be

quite painful. Especially as development of the leverage ratio and risk compensation must be

balanced against a rating quality improvement in Europe since 2010. The share of BB issues

has climbed 6pp to 67% in the iBoxx HY NFI, meaning that risk compensation is not quite as

good as it was during the financial crisis – when about half the index’s issues were rated BB.

Risk compensation is well below its median value over the past three years (99bp, black

horizontal line). This comfort zone of risk compensation (red shaded area) between the 3Y

and 10Y median value (116bp, light red horizontal line) of spread-per-leverage suggests that

current risk premiums have substantially deviated from fundamentals.

…leaving investors exposed to Stretched fundamental valuations may prevail for some time, as history – and in particular the

increased downside risk

years leading up to the financial crisis – have shown. However, when the tables turn, history

has also shown – as recently as the beginning of the year – that the consolidation momentum

to overpricing can be high and does not necessarily stop at reasonable levels. The very

limited secondary trading capabilities, coupled with ultra-low yields, rising inflation rates

towards year-end, another rate hike by the Fed, and uncertainty following the Brexit vote all

add to significant downside risks – regardless of ECB asset purchases.

UniCredit Research page 2 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

INDEX PERFORMANCE

XOver vs. Cash Index Spread Index Performance

iBoxx EUR High Yield main cum xover iTraxx Eur Xover Spread (RS) iBoxx HY Non-Financials iBoxx HY Financials

600 160 NFI cumulated FIN cumulated

8%

550 140

6%

500 120

Total return in %

4%

450 100

400 80 2%

350 60

0%

300 40

-2%

250 20

200 0 -4%

Apr-16

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Mar-16

May-16

Jun-16

Jul-16

Aug-16

Sep-16

Feb-16

Apr-16

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

May-16

Jun-16

Jul-16

Aug-16

Sep-16

Source: iBoxx, Markit, UniCredit Research

PERFORMANCE & SPREAD BY RATING

3M cumulated performance by BB/B/CCC 3M daily spread movement by BB/B/CCC

iBoxx HY NFI BB iBoxx HY NFI B iBoxx HY NFI CCC iBoxx EUR High Yield NFI BB iBoxx EUR High Yield NFI B

iBoxx EUR High Yield NFI CCC

8% 1,400

6%

1,200

Total return in %

4%

1,000

ASW-Spread (bp)

2%

800

0%

600

-2%

400

-4%

200

-6%

Sep-15

Aug-16

Sep-16

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

0

Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-1

Source: iBoxx, UniCredit Research

RATING ISSUANCE & RATING STRUCTURE

Issuance by Rating Rating Structure

BB B CCC Avg Rating BB B CCC CC C

16 100%

90%

14 BB

Issuance volume in EUR bn

80%

Average rating at issuance

12

70%

iBoxx HY Weight

10

60%

8 B

50%

6 40%

4 30%

2 CCC 20%

0 10%

Aug-11

Nov-11

May-12

Aug-12

Nov-12

May-13

Aug-13

Nov-13

May-14

Aug-14

Nov-14

May-15

Aug-15

Nov-15

May-16

Aug-16

Feb-12

Feb-13

Feb-14

Feb-15

Feb-16

0%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Source: iBoxx, UniCredit Research

UniCredit Research page 3 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

DEFAULT RATES AND SECTOR STRUCTURE

Spread vs. Default Rate Sector Structure

Default Rate Global Baseline Forecast FNL CGD IDU TEL BSC CSV CNS OIG THE UTI HCA MDI

Global Pessimistic Forecast Global Optimistic Forecast 100%

iBoxx EUR HY main cum xover (RS)

16% 1,600 90%

Moody's 12-Month Default Rate

14% 1,400 80%

70%

ASW-Spread (bp)

iBoxx HY Weight

12% 1,200

60%

10% 1,000

50%

8% 800

40%

6% 600

30%

4% 400 20%

2% 200 10%

0% 0 0%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: iBoxx, UniCredit Research

iBoxx Rebalancing

Sector Action Issuer iBoxx vol. Aug-16 (mn) iBoxx vol. Sep-16 (mn) ISIN Bond Volume

NFI OUT Fresenius 2,200 0 XS1013954646 FREGR 2.375% Feb-19 300

XS0759200321 FREGR 4.25% Apr-19 500

XS0873432511 FREGR 2.875% Jul-20 500

XS1013955379 FREGR 3% Feb-21 450

XS1026109204 FREGR 4% Feb-24 450

Gamenet 164 200 XS0954289913 GAMENT 7.25% Aug-18 164

Ineos 1,870 2,020 XS0928189777 INEGRP 6.5% Aug-18 500

Isolux 850 0 XS1046702293 ISOLUX 6.625% Apr-21 850

Lecta 1,091 600 XS0780141999 LECTA FRN May-18 291

XS0780068036 LECTA 8.875% May-19 200

Schaeffler 3,610 3,010 XS0923613060 SHAEFF 4.25% May-18 600

RED Huntsman 743 739 XS1395182683 HUN 4.25% Apr-25 -4

Innovia Films 342 267 XS1032974609 INNOGB FRN Mar-20 -75

Manutencoop 345 300 XS0808635352 MANTEN 8.5% Aug-20 -45

Petrobras 5,589 5,263 XS0982711631 PETBRA 2.75% Jan-18 -181

XS0716979249 PETBRA 4.875% Mar-18 -144

IN Adient 0 1,000 XS1468662801 ADGLHO 3.5% Aug-24 1,000

Axalta Coating Systems 250 585 XS1468538035 AXTA 4.25% Aug-24 335

Bulgarian Energy 500 1,050 XS1405778041 BULENR 4.875% Aug-21 550

Cellnex Telecom 600 1,350 XS1468525057 CLNXSM 2.375% Jan-24 750

Gamenet 164 200 XS1458462428 GAMENT 6% Aug-21 200

Ineos 1,870 2,020 XS1405769990 INEGRP 5.375% Aug-24 650

Schumann 0 400 XS1454980159 SCHMAN 7% Jul-23 400

Veritas US 0 262 XS1357678322 VERITS 7.5% Feb-23 262

TAP Horizon Holdings 525 725 XS1265903937 VERALL 5.125% Aug-22 +200

FNL OUT Alpha Bank 500 0 FR0010670422 ALPHA 10.653% Perp 500

Source: iBoxx, UniCredit Research

UniCredit Research page 4 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Rating Actions

Rating Date Issuer Agency action Rating Type From To

29-Aug-16 Fortescue Metals (FMGAU) S&P Outlook NEG STABLE

Fitch Senior Unsecured Debt BB+ BB+

Outlook NEG STABLE

Vale (VALEBZ) S&P Outlook NEG STABLE

31-Aug-16 Caixa Geral de Depositos (CXGD) S&P watch positive Issuer Credit Rating BB- BB-*+

1-Sep-16 Progroup (PROGRP) Moody's upgrade Issue Rating B1 Ba2

Outlook STABLE STABLE

Voto-Votrantim (VOTORA) S&P remove watch Issuer Credit Rating BB+*- BB+

negative

Outlook NEG

Source: iBoxx, Agencies, UniCredit Research

HY Calendar

Mon, 05 Sep Tue, 06 Sep Wed, 07 Sep Thu, 08 Sep Fri, 09 Sep

-- -- Gestamp: 1H16 results Xella: 1H16 conference call --

at 11:00 CET

Source: iBoxx, Agencies, UniCredit Research

Recommendation Overview

Buy Hold Sell

Altice Agrokor Motherson Bilfinger

Amplifon Alain Afflelou Nokia Bombardier

Faurecia ALBA Group Ontex Hapag-Lloyd

Grupo Antolin Anglo American OTE Hellenic Telecom Hertz

Guala Closures ArcelorMittal Phoenix Peugeot

HeidelbergCement Ardagh Piaggio Stora Enso

IGT Areva RCS & RDS ThyssenKrupp

Italcementi Bormioli Rocco Schmolz & Bickenbach

LKQ Buzzi Unicem Smurfit Kappa

Manutencoop CABB Snai

Matterhorn Telecom Cirsa STADA

MOL CMC di Ravenna Sunrise

Onorato Armatori CNH Industrial Techem

Prada Douglas Telecom Italia

Sappi Europcar Telenet

Schaeffler FCA Tesco

SFR Group FMC TMF Group

Thomas Cook Gestamp TUI

Wind Goodyear United Group

ZF Friedrichshafen Groupe Casino Unitymedia

Hornbach UPC

HP Pelzer Vestas

Ineos Virgin Media

Inovyn Volvo Car

ista Wienerberger

Lecta Xella

Leonardo-Finmeccanica Ziggo

Lufthansa Zobele

Mahle

Source: UniCredit Research

UniCredit Research page 5 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Latest Company News

ALBA Group (Hold)

Tuesday, 30 August ALBA Group (--/B-n/--) reported weak 1H16 results yesterday, mainly driven by the

1H16 results continue to be hit challenging scrap metals environment and changes in the portfolio in the course of 2015.

by challenging scrap metals ALBA’s revenues dropped by 25% yoy to EUR 903mn. This decline is mainly driven by the

environment

negative development in the ferrous and non-ferrous scrap markets. Additionally, a negative

EUR 62mn came from the Green Fuel transaction as well as by company sales and site

closures carried out 2015 in the Scrap and Metals business. EBITDA in 1H16 dropped by

36% to EUR 52mn, mainly related to the previously described portfolio changes. Adjusted for

extraordinary results, the company’s EBITDA dropped by 1% yoy to EUR 55mn. In segment

terms, 1H16 EBITDA at Waste & Metals declined by 16% yoy to EUR 43mn on lower margins

and volumes. On a like-for-like basis, i.e. adjusted for portfolio effects, the company’s sales

dropped by around 24% yoy, driven by headwinds in the scrap metals markets. In the

Services business, ALBA’s sales revenues (EUR 240mn) and EBITDA (EUR 20mn) remained

broadly stable yoy. We calculate negative EUR 38mn FCF at the end of the first half, while

the company’s net financial liabilities rose to around EUR 417mn compared to around EUR

376mn at 1Q16 and FYE 2015. On an adjusted basis (UniCredit-adjusted), we calculate net

debt/EBITDA of 5.4x in 1H16, up from 4.4x in FY15. Regarding liquidity, we note that the

company reported EUR 25mn in cash, and management said in the FY15 conference call that

it had more than EUR 100mn in an RCF. However, we note that over the first quarter ALBA

drew around EUR 20mn from its RCF. With regard to ALBA’s 2016 targets, the company

guides for a significant increase in EBITDA, a positive free cash flow and a significant

decrease in net debt. On current M&A activities, ALBA stated that in the first quarter of 2016,

the company initiated two disposal processes. First, the sale of a majority of certain parts of

its Waste and Metals activities for a roll-out of such businesses (together with an Asian

investor) in China. Second, the sale of a qualified majority in the group’s Service segment.

ALBA confirmed that both disposal processes are well on track. In the course of the strategic

development of ALBA, the Lübeck site, which currently belongs to ALBA Metall Nord GmbH,

will be sold effective 1 September 2016. The asset sale and purchase agreement was signed

on 1 August. This asset deal relates to the Scrap & Metals business and is part of the

company’s portfolio-optimization program. We keep our hold recommendation on ALBA.

While we do not expect a lot of upside for the bonds, current valuations seem attractive.

However, the challenging environment in the metals business and execution risks regarding

ALBA’s “China Growth” strategy and the equity process should dampen upside. Going

forward we see the latter point combined with the scrap metal prices as the main credit driver.

In the long term we continue to see debt refinancing as the major risk for the company.

Mehmet Dere (UniCredit Bank) Michael Gerstner (UniCredit Bank)

+49 89 378 11294 +49 89 378-15449

mehmet.dere@unicredit.de michael.gerstner@unicredit.de

Agrokor (Hold)

Tuesday, 30 August Agrokor (B2s/Bs/--) has released somewhat weak 1H16 results, with revenues declining by

Reports weak 1H16 results with 3.5% yoy to HRK 21.7bn on a consolidated basis. For the first half of 2016, we calculate an

adjusted leverage increasing EBITDA of HRK 942mn, down by 52.5% yoy (1Q15: HRK 811mn). For 1H16 we calculate

FCF of HRK 489mn (1H15: -1,354mn), mainly related to strong working capital generation.

Compared to FYE 2015, the company’s net debt dropped slightly to HRK 23.1bn (stable vs.

1Q16). All in all, on a UniCredit-adjusted basis (incl. PiK), we calculate a net debt/EBITDA of

6.5x compared to 6.2x at FYE 2015. In the conference call on its 1Q16 results, management

provided further clarification on its plans for potential refinancing. Regarding the capital

structure, we understand from management statements that around EUR 700-800mn of debt

UniCredit Research page 6 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

will mature over the next 12-24 months and that it is in discussions with its banks about

refinancing. However, we understand that the company is also open to approaching the

capital market. Just in order to provide some indication on potential pricing, Agrokor signed a

six-year EUR 350mn term loan facility in April for a coupon of around 6%. We keep our hold

recommendation on Agrokor bonds and note that, from a credit perspective, we will be

focused on a potential headlines and statements regarding potential refinancing as the bonds

trade at their next call levels. We do not expect significant deviations in bond prices in the

short term, which underpins our hold recommendation. Therefore, from an operational

perspective, our main concern in the short term is the challenging environment in Slovenia as

well as commodity-price-related changes in the EBITDA margin at its food manufacturing and

distribution business.

Mehmet Dere (UniCredit Bank) Michael Gerstner (UniCredit Bank)

+49 89 378 11294 +49 89 378-15449

mehmet.dere@unicredit.de michael.gerstner@unicredit.de

Altice (Buy), Telenet (Hold)

Friday, 02 September L’Echo reported today that Telenet, Orange and Apax have all expressed interest in buying

Sale of SFR belgium reportedly Altice’s SFR Belgium unit. The information was originally reported in July, but appears to have

gains traction become more concrete, with the three bidders reportedly having been selected by Lazard to

enter a second round of bidding. L’Echo cites a potential transaction value of EUR 500mn,

which sounds reasonable to us and is based on a 10x EBITDA multiple. We believe that the

rumors likely have substance because of the following: 1. Altice will likely struggle to grow in

Belgium with Telenet and Proximus now having dominant positions in the market with

converged product offerings; 2. Altice’s regional profile is becoming more complex to manage

with the shift toward the US, making the earlier, smaller acquisitions expendable; 3. especially

Telenet, but also Orange could benefit from adding more fixed assets to their existing

businesses. We see the sale as particularly interesting for Telenet, which could expand its

fixed business in Brussels. The acquisition could also generate additional synergies from the

BASE acquisition, which gave Telenet nationwide mobile coverage. The fact that Orange and

Apax are also showing interest should ensure that Altice would receive an attractive price for

the sale.

Now that the rumors on the sale of SFR Belgium have become more concrete, we would

expect TNETBB bonds, in particular, to have a weaker performance until details on the

valuation and financing are clarified. The transaction would probably have a negative impact

on Telenet’s leverage at first, but would be positive in the longer term due to the stronger

business profile and the synergies that would be generated. We confirm our hold

recommendation on TNETBB bonds, which we expect will struggle to outperform in the short

term. The primary beneficiary within the Altice group would be ALTICE bonds, as SFR

Belgium is part of Altice International. We also would not rule out that Altice might decide to

sell other, smaller subsidiaries within Altice International in the medium term as part of a

portfolio optimization process. However, we see upside for ATCNA bonds (Altice Luxembourg

SA), which would also benefit from deleveraging within Altice International. In addition, it is

possible that deleveraging at the Altice International level could eventually result in cash

upstreaming to the ATCNA level to deleverage more directly there if leverage at the ALTICE

level declined substantially below 4.0x. We therefore reiterate our buy recommendations on

ALTICE and ATCNA bonds.

Jonathan Schroer, CFA (UniCredit Bank)

+49 89 378-13212

jonathan.schroer@unicredit.de

UniCredit Research page 7 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Areva (Hold)

Wednesday, 31 August Yesterday, Areva reported that it had formally initiated the process for transferring all assets

Initiates transfer process, and liabilities related to its nuclear fuel cycle activities (including Mining, Front End and Back

provides update on capital End activities) as well as all bondholder debt to its NewCo. Areva further confirmed the

increase and liability transfer

projected EUR 5bn capital increase (subject to approval by the European Commission), which

will be divided into EUR 2bn in Areva and EUR 3bn into NewCo. The liability transfer will

exclude the 2016 bond issue, which will be repaid by Areva at maturity. The remuneration of

the contribution will be determined on the basis of the actual value of the assets and liabilities

transferred, in the order of EUR 1.4bn, valuing NewCo post-transfer at around EUR 2bn. A

bondholder meeting will take place on 19 September for bonds issued by Areva and maturing

between 2017 and 2024, to approve the draft partial transfer agreement. Bonds will be

granted a temporary guarantee by Areva until completion of the NewCo capital increase, in

the form of an irrevocable joint and several guarantee. Last Friday, S&P affirmed Areva’s

ratings and kept its developing outlook. This is mainly driven by S&P’s belief that Areva is

thus far on track to achieving its plan of focusing on the nuclear fuel cycle, cutting costs and

disposing of some key assets. However, S&P thinks that material execution risks (e.g. a

successful sale of Areva NP or a firm offer from a minority investor in Areva New Co) remain.

According to S&P, the EUR 5bn capital increase (by 20 January 2017), which is subject to

approval from the European competition authorities later this year, will be critical to address

Areva's current unsustainable leverage (>10x at 1H16). In view of Areva's pending bond

repayment, sizable negative free cash flow in 2H16 and the maturity of its undrawn bridge

facility in January 2017, S&P regards Areva’s liquidity as largely dependent on a short-term

shareholder loan being approved (assumed by the end of November) if there is a delay to the

capital increase. S&P adds that it regards the approval of a shareholder loan as highly likely.

The developing outlook reflects that S&P may take a positive rating action if the capital

increase is executed in line with the agency’s expectations in early 2017. Additional upside

would stem from tangible progress on the company's plan to dispose of non-strategic assets

for a total of EUR 2.9bn by year-end 2017, achieve cost savings, and reduce negative FOCF

over the medium term. Conversely, S&P could downgrade Areva by one or several notches if

the company does not receive the shareholder loan or obtain approval for the capital increase

by the end of November. For FY16, Areva expects net cash flow from operations to be close

to EUR -1.5bn (previously: EUR -2bn to EUR -1.5bn). As of 30 June 2016, Areva’s available

gross cash totaled EUR 2.1bn, compared to EUR 1.9bn in current financial debt. Areva’s

2016 liquidity is ensured by an undrawn bridge loan of EUR 1.2bn, which would be due in

January 2017 if drawn. Beyond that, liquidity will be ensured by the EUR 5bn capital increase

(January 2017). In the event of a temporary delay, Areva would request a shareholder loan.

With regard to the evolution on its restructuring, we regard the latest set of news as

encouraging. We further note that Areva is already making good progress with regard to its

smaller disposals. Also, the latest announcement on how EUR 5bn capital increase will be

split between Areva and the New Co and the amount of debt that will be finally transferred to

the New Co finally provides some clarity for bond investors. Cash prices for Areva’s five bond

issues maturing between 2019 and 2024 are up between 6 to 7 points this morning. However,

we note that some major topics are still open. These are: 1. a final approval of the EUR 5bn

capital increase by the European Commission, and 2. the successful sale of Areva NP, which

we think is somewhat related to the results of the Flamanville inspection. Hence, today’s price

reaction might be somewhat excessive. That said, we keep our hold recommendation on the

name. We expect volatility on Areva’s bonds to continue and view the AREVAF 4.375% 11/19

bond as the most attractive on the curve, offered at a cash price of around 101 (4% YTM).

Michael Gerstner (UniCredit Bank)

+49 89 378-15449

michael.gerstner@unicredit.de

UniCredit Research page 8 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

CABB (Hold)

Monday, 29 August On Friday, CABB reported 2Q16 results that were below our expectations in terms of sales

2Q16 below expectations but and EBITDA. Sales of EUR 104.7mn (-14.7% yoy) were behind our forecast of EUR 115mn

full-year EBITDA outlook and EBITDA of EUR 22mn compared to our forecast of EUR 26mn. The margin of 21% was

confirmed

therefore also behind our forecast of 22.6%. Both of the company’s main segments reported

sales declines, but Custom Manufacturing was down particularly sharply, with a decline of

17.3% to EUR 78.7mn. CABB cited lower demand for its products as the reason for the drop.

The company noted that its agrochemical customers, in particular, were impacted by the

difficult market environment, due to high commodity stock levels, low crop prices, poor

weather conditions and reduced farm incomes. The company expects these factors to remain

in place throughout 2016. Custom Manufacturing EBITDA was down by EUR 4.6mn, or 22%,

in line with the company’s expectations. The decline was attributable to lower volumes and a

negative product mix, which was partially offset by ongoing cost control. Revenues in the

Acetyls segment were down EUR 3.3mn, or 7.0%, to EUR 43.7mn. The company said that

demand was solid in Europe, but weaker in the Americas and India, due to soft agrochemical,

oil and shale-gas markets. CABB also stated that the new MCA plant in China is ramping up

more slowly than anticipated and is now expected to reach full capacity in 4Q16. EBITDA in

Acetyls was down EUR 1.2mn, or 14.5%, due to the lower demand and weaker prices

described above. The company said that EBITDA in the segment was short of expectations in

2Q16. Group FCF for 2Q16 was positive at EUR 7.0mn. Fully-adjusted net leverage

(including pensions) came to 6.3x, which was above our estimate, due to the weaker EBITDA

and an increase in pensions qoq. With the FY16 results, CABB left its FY16 outlook

unchanged overall and continues to expect a maximum high single-digit EBITDA decline this

year (and neutral W/C). Hence, the floor is expected to remain at EUR 90mn EBITDA this

year. In FY17, management expects capex to decline slightly from EUR 40mn this year to the

high thirties. We reiterate our hold recommendation on CABB, despite the somewhat softer

2Q16 results. We continue to prefer the unsecured CABBCO 6.875% 22 offered at a cash

price of 90 (YTW: 9.1%), given the company’s still solid liquidity, strong long-term growth

prospects, substantial equity cushion and the over 400bp pickup in Z-spread that the bond

offers to the secured CABBO 5.25% 21 (for around 2.0x additional net leverage through the

unsecured tranche at 2016E EBITDA).

Christian Aust, CFA (UniCredit Bank)

+49 89 378-12806

christian.aust@unicredit.de

HP Pelzer (Hold)

Tuesday, 30 August HP Pelzer (B1s/B+n/Bs) reported strong 2Q16 results on the sales (+12.5%) and EBITDA

Strong 2Q16 results at sales level (+16.6%). In 2Q16, sales increased by 12.5% to EUR 36.7mn. From a regional

and EBITDA level perspective, sales in Europe improved by 38% to EUR 178.2mn driven by an increase in

serial sales. Sales in NAFTA decreased by 17.7% to EUR 74.1mn and remained more or less

stable in Asia (+1.1%). In 2Q16, EBITDA increased by 16.6% to EUR 29.6mn. In 1H16, cash

flow from operating activities was EUR 18.9mn (1H15: EUR 11.5mn). At 30 June 2016, net

debt remained more or less stable at EUR 260.1mn (31 Dec. 2015: EUR 254.9mn). In the

FY15 conference call, management highlighted that it expects organic revenue growth of 2-

2.5%, in line with the market. The company’s internal capex plan is to spend a maximum of a

third of its EBITDA. We note that the bond covenants allow an increase in leverage to up to

3.5x. We expect adjusted EBITDA of EUR 115mn in FY16 and FCF of EUR 18mn (after the

EUR 3mn annual payment for its EUR 15mn cartel fine) and derive net leverage of 2.1x in

FY16. We believe that, given M&A transactions and consolidation headlines in the interiors

business (e.g. Antolin acquired Magna’s interior assets and Motherson is interested in IAC),

as well as the company’s low leverage, HP Pelzer’s desire for a growth transaction is

UniCredit Research page 9 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

understandable. On 14 July, Moody’s upgraded HP Pelzer by one notch to B1 with stable

outlook, the same level as S&P. Moody’s said this reflects that, over the past two years, HP

Pelzer has been able to significantly improve its profitability on the back of strong cost control

and a stronger focus on profitable contracts, resulting in an overall stable leverage of around

3.5x despite a tap issue in 2015. Moody’s added that, although a further upgrade is currently

unlikely given HP Pelzer's narrow business profile. Given the risk of releveraging and possibly

bond supply risk, as well as increased headwind from raw material prices and FX, and as any

bond upside is quite limited given its call price, we keep our hold recommendation on the

PELHOL 7.5% 7/21 bond, which has its first call on 15 July 2017 at 103.75 and has traded in

a price range of between 105 and 106.5 since mid-May. HP Pelzer will hold a conference call

today at 14:00 GMT.

Dr. Sven Kreitmair, CFA (UniCredit Bank) Dr. Silke Stegemann, CEFA (UniCredit Bank)

+49 89 378-13246 +49 89 378-18202

sven.kreitmair@unicredit.de silke.stegemann@unicredit.de

Lecta (Hold from Restricted)

Monday, 29 August Lecta reported 2Q16 results this morning that confirmed the improved profitability of the group

negative FCF in 2Q16 due to but came in weak on the FCF side. LECTA reported 2Q16 revenues down 4.5% yoy to EUR

working capital 358mn, driven by lower paper volumes (-3%) and energy prices (-27%), while average paper

prices (EUR 905/t) remained broadly stable yoy (still reflecting the capacity closures in the

industry in past quarters). Reported EBITDA of EUR 31.4mn in 2Q16 (8.9% margin, stable

sequentially) improved a comparable 11% yoy, reflecting lower raw material costs (pulp,

energy) and continued cost savings. However, FCF was disappointing and remained negative

at EUR 19mn in what is usually a seasonally positive FCF quarter. This was mainly due to the

payment of suppliers in the quarter (potentially a timing issue). Hence, Lecta's cash position

(net of overdrafts) dropped to EUR 95.5mn at end-June 2016 (from EUR 117mn in 1Q16).

However, we note that Lecta – in combination with the recent refinancing of the bonds in July

2016 – had negotiated a new 2022 RCF of EUR 65mn (replaced the old EUR 80mn 2018

RCF, which was unused as of end-June 2016). As management had already indicated solid

EBITDA performance in 2Q16 (update on April/May 2016 had been provided ahead of the

refinancing), we expect the focus today to remain on the weak FCF generation due to W/C in

2Q16. While this could trigger some profit-taking in the new Lecta notes, we reinstate our hold

recommendation on Lecta (from restricted) as the refinancing has pushed out debt maturities

to 2022/23 and overall liquidity remains solid which should support the continued

transformation of the group in order to further sustain the EBITDA turnaround.

Christian Aust, CFA (UniCredit Bank)

+49 89 378-12806

christian.aust@unicredit.de

Matterhorn Telecom (Buy)

Monday, 29 August Salt Mobile reported 2Q16 results that were slightly better than our expectations, particularly

2Q16 results show improving as strong cash generation led to lower net leverage. Revenues of CHF 272.3mn (or CHF

operating momentum 275.2mn excluding instalment accounting) were just under our forecast of CHF 278mn but

adjusted EBITDA of CHF 107.3mn (or CHF 111.9mn excluding instalment accounting) was

slightly above our forecast of CHF 105mn. Similar to 1Q16, revenue in 2Q16 was down 15%

yoy (or -10.7% excluding instalment accounting), due to a decrease in equipment revenue as

well as to the negative effect of instalment accounting. In terms of KPIs, mobile subscribers

fell 11.3% yoy overall to 1,906,000 in 1H16. However, most of this decline was from prepay

subscribers (-26.8% to 736,000) as the number of postpaid subscribers were up 2.4% to

1,169,000. This compares to a 6.2% gain in postpaid customers and a 9.6% decline yoy in

UniCredit Research page 10 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

prepaid at Sunrise Communications (2Q16). Mobile ARPU (excluding instalment accounting)

was up 1.6% yoy to CHF 37.7 in 1H15. This compares to a 3.9% decline in blended mobile

ARPU at Sunrise (2Q16) to CHF 32.2. Adjusted EBITDA was up 8.3% yoy to CHF 107.3mn

(or +26% excluding instalment accounting), showing an improvement from the 2.3% decline

yoy in 1Q16 to CHF 102.2mn (or +17.9% excluding instalment accounting). The adjusted

EBITDA margin was up to 40.7% in 2Q16 (excluding instalment accounting) from 38.0% in

1Q16, demonstrating a sequential increase in operating momentum. Salt attributed this to

savings on commercial and operating expenses, such as lower labor costs. FCF of CHF

98mn in 2Q16 was above our expectation and led to net debt of CHF 1,780mn, lower than we

had expected. As a result, the leverage ratio (based on adjusted EBITDA excluding

instalment accounting) was 4.23x, which was lower than our expectation of 4.54x and was

down meaningfully from the 4.68x reported for 1Q16. In a recently published credit update,

S&P expects that the adjusted debt-to-EBITDA ratio will improve from 5.9x at FYE 2015 to

5.5x or below in 2016-2017 and that the FOCF-to-debt ratio will remain above 5%. Rating

upgrade potential by one notch would be driven by an adjusted debt-to-EBITDA ratio

declining towards 5.0x. We note that Salt’s management has the priority to reduce reported

leverage to below 4x (from around 4.9x at FYE 2015). However, any rating upside would

likely be limited to one notch given the lack of information on private holding company NJJ

Capital. Given Salt's fast deleveraging in 1H16, a one notch upgrade after the release of

FY16 results appears likely, in our view.

We expect further details on the competitive environment for telecoms in Switzerland at the

company’s results conference call on Tuesday. However, based on the information released

so far, it appears that Salt is holding up well in a tough environment. The improvement in

EBITDA and strong cash flow generation demonstrated rising operating efficiency, despite

slightly weaker revenue generation yoy and qoq. Current deleveraging is quite rapid and will

likely result in positive rating action during the next 12 months (in the absence of M&A

activity), in our view. We therefore reiterate our buy recommendation on MATTER bonds.

Stephan Haber, CFA (UniCredit Bank) Jonathan Schroer, CFA (UniCredit Bank)

+49 89 378-15192 +49 89 378-13212

stephan.haber@unicredit.de jonathan.schroer@unicredit.de

RCS & RDS (Hold)

Monday, 29 August RCS & RDS (B1a/B+s/--) reported 2Q16 revenues and EBITDA bang in line with our

2Q16 results in line with expectations. Revenues in the quarter came to EUR 205.3mn (UniCredit: EUR 205mn), up

forecasts and recent trends 11.3%. Every region showed growth, but – as in previous quarters – the main driver of

revenue growth was the Romanian mobile business, where revenues were up 43.4% to

EUR 28.1mn. This was due to a 26% surge in mobile RGUs in Romania to 2.95mn and a

13% increase in ARPU yoy. Revenues in Romania collectively were up 12.4% to

EUR 148.5mn, compared to revenue growth of 6.1% to EUR 33.3mn in Hungary, 17.0% to

EUR 21.3mn in Spain and 21% to EUR 2.3mn in Italy. EBITDA came to EUR 65.7mn

(UniCredit: 66mn), up 15.3% yoy, for a margin of 32%. RGUs were up significantly in all of the

company’s most important product categories (e.g. cable TV, fixed internet and data).

However, as usual, capex came in above expectations at EUR 48mn. With EUR 106.6mn so

far through 1H16, it therefore appears the company will struggle to meet its EUR 190mn

target for FY16. As we expected, FOCF (OCF – capex) was slightly negative in the quarter at

EUR 7.4mn, bringing net debt to EUR 662mn from EUR 664mn as of 1Q16. Since RCS &

RDS usually includes some other items in its net debt calculations, such as financial leases

and “other debt”, this should have kept the net leverage ratio around 2.7x, which is in line with

our expectation.

RCS & RDS continues to show rising operating momentum as the mobile products in

Romania gain from strong subscriber and ARPU growth. The company’s other key region,

UniCredit Research page 11 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Hungary, also shows sustained growth, although not as strong as that of Romania. The only

negative aspect of the company’s performance is capex, which continues to run above

budget. This prevents stronger FCF generation and, thus, more deleveraging momentum.

Without stronger cash generation, we expect deleveraging momentum to slow down from this

point, as the easier yoy increases in EBITDA disappear starting in 3Q16. Nevertheless, we

see no reason why the company’s revenue and EBITDA growth will not continue in the

coming quarters, although probably at a less rapid pace in a yoy comparison.

CBLCSY currently trades at a minimal yield on a YTW basis, with the bid price of 105.0 just

above the call price of 103.75. Given low turnover of the bond at this point, we expect the

price to remain stable until the call date on 1 November. We see the likelihood of the bond

being called as very high at this point. However, there are clearly much more attractive yields

available in the high-yield cable universe. If the bond is not called in November, then the YTM

looks much more attractive, with a mid-yield of 5.9%. We therefore reiterate our hold

recommendation for now, notably for investors seeking short-term exposure to CEE credits.

Jonathan Schroer, CFA (UniCredit Bank)

+49 89 378-13212

jonathan.schroer@unicredit.de

Sappi (Buy)

Thursday, 01 September Following release of the security package for the SAPSJ secured bonds due to Sappi having

Moody's and S&P change issue maintained a reported net leverage level of below 2.5x since 2Q15/16 (two consecutive

ratings following release of quarters), Moody’s and S&P have made changes to the issue and recovery ratings while

security package

Sappi’s corporate ratings remain at Ba3/positive and BB-/positive, respectively. Moody’s

lowered the issue ratings of the (formerly) secured tranches by one notch to Ba3 (but left the

rating of the unsecured USD 32s bond at B2) while S&P aligned the rating of the always

unsecured SAPSJ USD 32s with that of the now unsecured bonds at BB- (rating unchanged).

We note that the SAPSJ 32s, unlike the former secured SAPSJ bonds, are not guaranteed by

Sappi’s main operating subsidiaries (outside South Africa) but are also issued by Sappi

Papier Holding GmbH. We expect no impact on the (former secured) outstanding SAPSJ

bonds from the rating changes but a positive impact on the SAPSJ 32s bond, still trading at a

YTW of 8.5%. We keep a buy recommendation on Sappi as we expect the deleveraging to

result in an upgrade of the corporate rating at Moody’s and S&P and as SAPSJ 22s and 23s

continue to trade with a pick-up to other similarly-rated (and unsecured) paper/packaging

peers (e.g. STERV 23s).

Christian Aust, CFA (UniCredit Bank)

+49 89 378-12806

christian.aust@unicredit.de

United Group (Hold from Restricted)

Tuesday, 30 August United Group (B2s/Bs/--) reported 2Q16 results that were above our expectations on the

2H16 results above our revenue and EBITDA lines. Revenue of EUR 118mn in 2Q16 was up 21% yoy compared with

expectations, but M&A activity our estimate of EUR 109mn (1H16: +29% to EUR 222mn). This compares with EUR 104mn

increasing

reported in 1Q16 and thus shows a good sequential operating dynamic. EBITDA in 2Q16 was

up 20% to EUR 49mn, exceeding our estimate of 46mn (1H16: +28% to EUR 94mn).

However, the 41% margin in the quarter was slightly below our estimate of 42%. In terms of

RGUs, all products showed good growth yoy, although qoq growth was slow in some key

products, such as cable TV (1.0%) and broadband internet (+2.3%). On the other hand,

Mobile services showed strong qoq momentum at 5.2%. Capex was up significantly in 2Q16,

to EUR 38mn from EUR 24mn in 1Q16 and EUR 30mn in 2Q15. United Group explained the

UniCredit Research page 12 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

expansion in capex through investments in network expansion, additional spending on

Tušmobil’s 4G network and acquisitions of end-user equipment. This spending – together with

the bond coupon payments – kept FOCF firmly in the red at EUR -33mn in 2Q16. Net debt

was up to EUR 753mn from EUR 722mn in 1Q16. Although United Group’s M&A activity has

been negligible so far in FY16, the company announced that it agreed in August to acquire a

cable operator in Serbia, Ikom, for EUR 45mn. Ikom has around 100,000 unique cable

subscribers. In addition, the acquisition of M-Kabl was completed in July, leading to a cash

outflow of EUR 11mn. The EUR 4mn acquisition of Maxtel is still awaiting regulatory approval.

This compares with EUR 65mn in acquisitions in FY15, indicating that the company may have

room for a few more bolt-on acquisitions in the coming months. Leverage was stable, as we

expected, at 3.97x, compared to 4.01x in 1Q16.

We see United Group’s results as demonstrating further solid operating growth. It is

encouraging that mobile products seem to be making a contribution to top-line growth without

diluting the margin more than expected. Despite a relatively acquisitive credit profile, the

company has managed to keep leverage close to the 4.0x level recently. It remains to be

seen what kind of effect the forthcoming acquisitions will have on leverage, since we have no

details on their profitability so far, but it appears that the company can continue to balance

acquisition-driven growth, supported by sustained organic growth, with rising net debt to keep

leverage broadly stable. However, this – together with rising capex – will have to be

monitored in the coming quarters.

ADRBID is callable in November 2016 at 103.938. The bond is trading slightly above this level

and we believe there is a significant chance that it will be refinanced at the coming call date.

However, if it is not, the mid-YTM of 6.4% is attractive. Nevertheless, considering the minimal

yields on a YTC basis, we believe there are a number of more attractive bonds within the

high-yield cable peer group. We expect the ADRBID bond price to trade near the call price in

the coming months and we therefore reinstate our hold recommendation – particularly for

investors seeking short-term CEE exposure – after previously being restricted on the name.

Jonathan Schroer, CFA (UniCredit Bank)

+49 89 378-13212

jonathan.schroer@unicredit.de

Wind (Buy)

Friday, 02 September Yesterday, the EC approved the JV between Wind and Hutchison’s 3 Italia. EC Competition

EC approves Hutchison/Wind Commissioner Margrethe Vestager stated that without the companies’ agreement to sell

JV assets to Iliad, allowing it to become the fourth mobile player in the Italian market, “We could

not have allowed this transaction to go ahead”. The EC added that Iliad “has the know-how

and expertise to operate, invest and innovate in the Italian market”. The companies welcomed

the announcement in a joint press release, saying that customers will benefit from improved

coverage, faster 4G/LTE rollout, greater reliability and faster download speeds. They also

expect the transaction to result in EUR 7bn being invested in Italy’s mobile infrastructure. The

companies also said that the joint venture would benefit “from a healthier debt profile” and

that they would “be in a position to deliver solid deleveraging in the medium term”. Previously,

Wind has said that, although it expects Iliad to have an impact on the market – and potentially

on the synergies that the JV can generate – it doubts that it can replicate the disruptive effect

it has had on the French market. Iliad’s impact will be partially offset by proceeds from the

asset sales and the benefits from the JV arrangement. We agree with this assessment since

Iliad’s lack of 700MHz spectrum in Italy means that it is most likely to focus on the low-price,

low-margin segment at first, at prices similar to those of 3 Italia. In addition, mobile prices in

Italy are already low in a European context. Wind confirmed its EUR 5bn synergy target in its

most recent conference call, indicating that the target has not been affected by the decision to

UniCredit Research page 13 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

divest assets to Iliad for now. We reiterate our buy recommendation on WINDIM, particularly

for the unsecured bonds. The secured WINDIM 4.0% 04/21 is trading near its call price of

102, while the unsecured WINDIM 7% 04/21 is trading at a mid-YTW of 4.1%.

Stephan Haber, CFA (UniCredit Bank) Jonathan Schroer, CFA (UniCredit Bank)

+49 89 378-15192 +49 89 378-13212

stephan.haber@unicredit.de jonathan.schroer@unicredit.de

Xella (Hold)

Tuesday, 30 August Xella released solid 2Q16 results with reported sales growth accelerating to 5% (EUR 362mn)

Solid 2Q16 results, but focus to and adj. EBITDA up 18% yoy to EUR 91mn. Volume growth in Building Materials and Dry

remain on sponsor exit Lining was carried by a strong recovery in the Netherlands and better performance in Eastern

European countries as well as Germany, Switzerland and the UK, offsetting still challenging

markets in Russia and China as well as lower sales in Lime. The improved top line, as well as

continued benefits from the X-celerate cost savings program, moved the adj. EBITDA margin

to 25.1% in 2Q16 (+270bp yoy; 1H16: 21.9%), with all three segments contributing. In

combination with improved W/C management (i.e. reduced seasonal build-up), operating

cash flow in 1H16 improved to EUR 30mn (before interest) and was used for yoy slightly

higher capex (EUR 30mn vs. EUR 27mnin 1H15). Reported net debt at end-June 2016 was

only marginally up vs. FYE 2015 at EUR 705mn (but clearly down from EUR 767mn in 2Q15)

which translates into a reduction in reported net debt/adj. EBITDA to 2.7x (FY15: 3.0x).

Despite the solid 2Q16 results and our expectation of continued EBITDA improvements in the

seasonally more cash generative 2H16 on the back of supportive (residential) construction

markets and Xella’s self-help measures (further cost savings from X-celerate envisaged), we

expect the focus to remain on a potential exit of Xella’s sponsors. Following the

cancelled/postponed IPO in 2H15, rumors have re-emerged in recent months that GS Capital

Partners and PAI Partners might now also explore an outright sale of the company as part of

a dual-track strategy. We think a sale will mainly attract financial investors as we see limited

probability of a strategic European buyer/consolidation, given the size of the business which

is 1. likely to prevent the few European peers from submitting offers due to regulatory issues

(e.g. Wienerberger, Saint-Gobain, Braas Monier, HeidelbergCement), and 2. is simply too

large for many of Xella’s smaller regional competitors.

We note that the Xella FRN E+375bp 06/19 benefits from a CoC at 101 and we assume the

bond would be refinanced in any sale or IPO scenario (the bond is already callable at 100 and

continues to trade at around par). Hence, we see only very limited impact from an exit of GS

and PAI or the 2Q16 results and confirm our hold recommendation on Xella.

Christian Aust, CFA (UniCredit Bank)

+49 89 378-12806

christian.aust@unicredit.de

Zobele (Hold)

Tuesday, 30 August Zobele (B2s/B+/--) reported strong 2Q16 operating results and margins. In 2Q16, sales

Strong 2Q16 operating results decreased by 3.8% to EUR 80.3mn. From a business perspective, Air Care (54.7% of sales)

decreased by 2.9% yoy to EUR 43.9mn, Insecticide (35.6% of sales) by 6.5% yoy to EUR

28.6mn and Home, Health and Personal Care improved by 1.3% to EUR 7.8mn (9.7% of

sales). In Air Care Products, the decrease was mainly attributable to reduced demand for

traditional air care products in North America and Asia Pacific from its Global FMCG

customers. This effect has been partially offset by the introduction of new aerosol dispensers

and static products and by the strong order levels for other air care products in Europe. The

UniCredit Research page 14 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

decline in insecticide product sales was mainly due to a different quarterly phasing of demand

in Europe compared to last year and by unfavorable weather conditions in southern Europe.

Net sales in Home, Health and Personal Care improved due to new products. From a

geographic perspective, net sales improved in Europe (+7.2%), South America (+7.9%) and

Africa-Middle East (+47.4%) but decreased in North America (-19.8%). In 2Q16, EBITDA

(before non-recurring transaction) improved by 8.9% to EUR 13.4mn and the margin jumped

by 200bp to 16.7%. Total operating free cash flow improved in 1H16 by EUR 0.3mn to EUR

3.1mn. Net financial debt at 30 June, remained more or less stable at EUR 177.24mn (31

Dec. 2015: EUR 176.5mn). As of 1H16, we calculate a ratio of adjusted net debt/EBITDA of

3.5x (UniCredit FY15: 3.6x, 1H15: 3.8x) and adj. FFO/net debt of 16.3% (FY15: 14.9%, 1H15:

12.8%). For FY16, we estimate that adjusted net leverage will decrease further yoy (UniCredit

estimate FY16: 2.8x) supported by a gradual improvement in EBITDA due to new product

launches and growth in existing and new markets. We confirm our hold recommendation on

ZOBELE bonds. There will be a conference call today at 16:00 CET, at which we hope for

more insight on 2016 assumptions. For the time being, we take comfort in the company's solid

position in growing niche markets (air care and pest-control devices have low penetration

rates in less developed markets), its strong and long-standing customer relationships with

global FMCG companies, and strong growth prospects in emerging markets. Additional

margin support is expected from a better customer mix and restructured production capacity.

Dr. Silke Stegemann, CEFA (UniCredit Bank)

+49 89 378-18202

silke.stegemann@unicredit.de

UniCredit Research page 15 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

HY Issuers and Bonds

Sec Name Instrument Rating Out PX Yield Spread TR 1w TR 1m ER 1w ER 1m

CON Accor (MW) ACFP 5Y CDS 88

FR0012005924 4.125% PERP --/BB/BB 900 101.25 3.86 447 +0.2 +1.1 -0.2 -0.7

Adient (No rec) ADGLHO

XS1468662801 3.5% Aug 24 Ba3/BB/-- 1,000 104.35 2.93 329 -0.3 -0.3 -0.3 -0.3

Agrokor (Hold) AGROK

XS0776111188 9.875% May 19 B2/B/-- 300 105.68 5.80 853 -0.1 +0.6 -0.4 -1.2

XS0836495183 9.125% Feb 20 B2/B/-- 325 107.09 4.19 769 +0.0 +0.5 -0.3 -1.3

Albea Beauty (No rec) ALBHSA

XS0783934168 8.75% Nov 19 B2/B/-- 245 106.74 5.07 726 +0.4 +0.7 +0.0 -1.1

Alize (No rec) ALLGRP

XS1137505290 6.25% Dec 21 B2/B+/-- 360 107.41 2.91 532 +0.1 +0.0 -0.3 -1.8

Arcelik (No rec) ACKAF

XS1109959467 3.875% Sep 21 --/BB+/BB+ 350 101.72 3.60 415 +0.1 +1.2 -0.3 -0.6

Auris (No rec) AUDIOL

XS1153374084 8% Jan 23 Caa1/B-/-- 275 111.06 3.14 658 +0.1 +2.4 -0.2 +0.6

Autodis (No rec) AUTODI

XS0982711128 6.5% Feb 19 B2/B/-- 270 104.13 2.17 570 +0.0 +0.6 -0.4 -1.2

XS1117280039 9% Nov 20 B3/CCC+/-- 239 102.66 7.38 920 +0.3 +2.2 -0.1 +0.4

Barry Callebaut (No rec) BARY

BE6222320614 5.625% Jun 21 Ba1/BB+/-- 250 122.54 0.89 145 +0.1 +0.8 -0.3 -0.9

BE6286963051 2.375% May 24 Ba1/--/-- 450 106.58 1.49 187 +0.3 +2.0 -0.1 +0.3

Boing (No rec) IMOCAR

XS1028951009 6.625% Jul 19 B2/B/-- 240 94.93 9.23 986 +0.0 +2.4 -0.4 +0.7

Boparan (No rec) BOPRLN 5Y CDS 431

XS1082473395 4.375% Jul 21 B2/B+/-- 300 96.99 5.28 583 +0.1 +2.0 -0.3 +0.3

Bormioli Rocco (Hold) BORMIO

XS0615235966 10% Aug 18 B3/B/-- 250 103.44 6.70 911 +0.2 +1.1 -0.2 -0.7

BUT (No rec) BUTSAS

XS1080611970 7.375% Sep 19 B3/B/B+*+ 246 104.30 5.12 673 +0.1 +0.5 -0.3 -1.2

Campofrio (No rec) CPFSM

XS1117299211 3.375% Mar 22 Ba3/BB+/-- 500 104.14 2.08 320 +0.0 +0.8 -0.4 -0.9

Carlson Wagonlit (No rec) CARWAG

XS0652911776 7.5% Jun 19 B1/B+/-- 300 104.48 4.84 669 +0.2 +0.7 -0.2 -1.1

Cirsa (Hold) CIRSA

XS1400351653 5.75% May 21 B2/B+/-- 450 106.57 3.75 493 +0.4 +2.0 +0.0 +0.2

XS1227583033 5.875% May 23 B2/B+/-- 500 105.58 4.43 548 +0.3 +2.0 +0.0 +0.2

CNH Industrial (Hold) CNHI 5Y CDS 230

XS0604641034 6.25% Mar 18 Ba2/BB+/-- 1,200 108.63 0.73 140 +0.0 +0.3 -0.4 -1.4

XS1046851025 2.75% Mar 19 Ba2/BB+/-- 1,000 104.02 1.27 191 -0.1 +0.4 -0.4 -1.4

XS1114452060 2.875% Sep 21 Ba2/BB+/-- 700 106.39 1.64 218 -0.1 +1.5 -0.5 -0.3

XS1412424662 2.875% May 23 Ba2/BB+/BB+ 500 103.54 2.36 279 -0.2 +0.7 -0.5 -1.1

Cott (No rec) BCBCN

XS1436943309 5.5% Jul 24 B3/B-/-- 450 108.72 4.02 473 +1.2 +2.3 +0.8 +0.6

Darling Ingredients (No rec) DAR

XS1240984754 4.75% May 22 Ba3/BB+/-- 515 105.42 3.24 434 +0.3 +2.0 +0.0 +0.2

Darty (No rec) DRTYLN

XS1038807340 5.875% Mar 21 --/BB-/-- 250 105.60 1.52 524 +0.0 +0.3 -0.4 -1.4

Deutsche Raststaetten (No rec) TANKRA

XS0997664411 6.75% Dec 20 --/B/-- 459 105.75 1.02 603 +0.0 +0.2 -0.4 -1.6

Douglas (Hold) DOUGR

XS1251078009 6.25% Jul 22 B1/B/-- 300 110.92 2.21 478 +0.9 +2.0 +0.5 +0.2

XS1251078694 8.75% Jul 23 Caa1/CCC+/-- 335 110.94 5.25 741 +0.7 +2.7 +0.4 +1.0

Spread: FIX bonds – z-spread, FRN – discount margin, PIK bonds – mid swap, 5Y CDS spread Source: Agencies, iBoxx, Markit, UniCredit Research

TR: 1w/1m: weekly/monthly total return (%); ER: 1w/1m weekly/monthly excess return vs. iBoxx HY NFI/FIN (%)

Out: Outstanding volume in EUR mn; Sec: CON: Consumers, ENG: Energy, IDU: Industrials, TMT: TMT, FNL: Financials

UniCredit Research page 16 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Sec Name Instrument Rating Out PX Yield Spread TR 1w TR 1m ER 1w ER 1m

CON Dufry (No rec) DUFSCA

XS1087753353 4.5% Jul 22 Ba3/BB/BB- 500 105.99 1.96 398 +0.1 +0.4 -0.2 -1.3

XS1266592457 4.5% Aug 23 Ba3/BB/BB- 700 107.09 2.67 387 +0.1 +0.8 -0.3 -1.0

Europcar (Hold) EUROCA

XS1028950704 5.125% Jul 21 B2/B+/-- 350 105.51 2.00 459 +0.3 +1.9 -0.1 +0.1

XS1241053666 5.75% Jun 22 B3/B-/-- 600 105.43 4.36 532 +0.8 +3.9 +0.4 +2.1

Faurecia (Buy) EOFP 5Y CDS 494

XS1204116088 3.125% Jun 22 Ba3/--/BB 700 103.52 2.24 307 +0.2 +0.8 -0.2 -1.0

XS1384278203 3.625% Jun 23 Ba3/--/BB 700 104.88 2.60 335 +0.5 +1.1 +0.1 -0.7

FCA (Hold) FCAIM 5Y CDS 342

XS0906420574 6.625% Mar 18 B1/BB/BB- 1,250 108.66 1.08 175 +0.1 +0.6 -0.2 -1.2

XS0647264398 7.375% Jul 18 B1/BB/BB- 600 111.18 1.41 207 +0.1 +0.5 -0.2 -1.3

XS0953215349 6.75% Oct 19 B1/BB/BB- 1,250 115.83 1.60 223 +0.1 +1.3 -0.3 -0.5

XS1048568452 4.75% Mar 21 B1/BB/BB- 1,000 111.71 2.10 267 +0.2 +2.1 -0.2 +0.3

XS1088515207 4.75% Jul 22 B1/BB/BB- 1,350 111.05 2.75 324 +0.1 +1.6 -0.2 -0.1

XS1388625425 3.75% Mar 24 B1/BB/BB- 1,250 104.48 3.12 349 +0.3 +1.9 -0.1 +0.1

Financiere Quick (No rec) QUIBB 5Y CDS 979

XS1054086928 FRN Apr 19 B3/B-/-- 360 81.30 14.06 1,470 -3.9 -2.5 -4.3 -4.2

Findus (No rec) FINDUS

XS1028948716 8.25% Aug 19 --/CCC+/-- 228 98.34 9.54 1,017 +0.1 +0.4 -0.3 -1.4

Frigoglass (No rec) FRIGOG

XS0932291007 8.25% May 18 Caa1/CCC+/-- 250 63.14 45.61 4,627 +1.2 +4.9 +0.8 +3.1

FTE Automotive (No rec) FTEAU

XS0952827094 9% Jul 20 B2/B*+/-- 263 106.07 5.34 807 +0.1 +0.8 -0.3 -1.0

Galapagos (No rec) GALAPG 5Y CDS 641

XS1071411547 FRN Jun 21 B1/B/-- 325 98.75 5.00 556 +0.4 +9.7 +0.0 +8.0

XS1071419524 5.375% Jun 21 B1/B/-- 200 99.71 5.70 626 +0.3 +8.6 -0.1 +6.8

XS1071420027 7% Jun 22 Caa1/CCC+/-- 250 90.15 9.72 1,023 +0.7 +16.4 +0.3 +14.6

Gamenet (Restr.) GAMENT

XS1458462428 6% Aug 21 B1/B/-- 200 103.23 5.18 598 -0.8 -0.8 -0.9 -0.9

Gestamp (Hold) GESTAM

XS1409497283 3.5% May 23 Ba3/BB+/-- 500 104.55 2.57 328 +0.2 +0.4 -0.2 -1.4

Goodyear (Hold) GT 5Y CDS 164

XS1333193875 3.75% Dec 23 Ba1/BB/BB 250 106.06 2.07 331 +0.0 +0.3 -0.4 -1.5

Groupe Casino (Hold) COFP 5Y CDS 295

FR0010893396 4.481% Nov 18 --/BB+/BBB- 508 110.77 0.80 145 +0.2 +0.0 -0.2 -1.7

FR0011606169 4.87% PERP --/B+/BB 750 93.74 8.12 877 +0.5 -1.5 +0.2 -3.3

FR0011301480 4.407% Aug 19 --/BB+/BBB- 1,000 109.63 1.16 180 +0.1 -0.8 -0.3 -2.6

FR0011215508 3.994% Mar 20 --/BB+/BBB- 600 112.36 1.52 213 +0.1 -1.1 -0.3 -2.8

FR0011052661 5.976% May 21 --/BB+/BBB- 850 117.43 2.15 271 +0.1 -1.3 -0.2 -3.1

FR0011400571 3.311% Jan 23 --/BB+/BBB- 853 109.61 2.88 334 +0.2 -2.0 -0.2 -3.7

FR0011765825 3.248% Mar 24 --/BB+/BBB- 900 107.76 3.25 366 -0.1 -2.5 -0.5 -4.2

FR0012369122 2.33% Feb 25 --/BB+/BBB- 450 101.29 3.37 368 -0.1 -2.5 -0.5 -4.3

FR0012074284 4.048% Aug 26 --/BB+/BBB- 602 105.16 3.47 367 +0.0 -2.8 -0.4 -4.6

Grupo Antolin (Buy) ANTOLN

XS1046537665 4.75% Apr 21 B1/BB-/-- 400 104.46 1.89 440 +0.1 +0.3 -0.3 -1.4

XS1246049073 5.125% Jun 22 B1/BB-/-- 400 107.15 2.75 437 +0.2 +0.8 -0.2 -1.0

Hanesbrands (No rec) HBI

XS1419661118 3.5% Jun 24 Ba1/BB/-- 500 107.48 2.50 288 +0.5 +3.3 +0.1 +1.6

Hema (No rec) HEMABV 5Y CDS 1,372

XS1075799319 FRN Jun 19 --/B/-- 250 74.37 18.09 1,873 -0.1 +0.7 -0.5 -1.1

XS1075833860 6.25% Jun 19 --/B/-- 315 78.21 17.46 1,810 +0.3 +1.0 +0.0 -0.8

XS1075845526 8.5% Dec 19 --/CCC+/-- 150 49.73 40.49 4,112 -0.2 +6.6 -0.6 +4.8

Hertz (Sell) HTZ 5Y CDS 339

XS0995045951 4.375% Jan 19 B2/B/-- 425 105.96 2.04 269 +0.1 +1.2 -0.3 -0.6

Spread: FIX bonds – z-spread, FRN – discount margin, PIK bonds – mid swap, 5Y CDS spread Source: Agencies, iBoxx, Markit, UniCredit Research

TR: 1w/1m: weekly/monthly total return (%); ER: 1w/1m weekly/monthly excess return vs. iBoxx HY NFI/FIN (%)

Out: Outstanding volume in EUR mn; Sec: CON: Consumers, ENG: Energy, IDU: Industrials, TMT: TMT, FNL: Financials

UniCredit Research page 17 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Sec Name Instrument Rating Out PX Yield Spread TR 1w TR 1m ER 1w ER 1m

CON Hornbach (Hold) HBMGR

DE000A1R02E0 3.875% Feb 20 Ba1/BB+/-- 250 109.70 1.11 172 +0.1 +0.7 -0.3 -1.1

HP Pelzer (Hold) PELHOL

XS1028947585 7.5% Jul 21 B1/B+/BB- 280 107.50 3.73 650 +0.4 +1.6 +0.0 -0.2

Iglo Foods (No rec) IGBOND

XS1084586822 FRN Jun 20 B1/BB-/-- 500 100.53 2.10 482 +0.2 +0.6 -0.2 -1.1

IGT (Buy) IGT 5Y CDS 185

XS0564487568 6.625% Feb 18 Ba2/BB+/-- 500 109.00 0.56 123 +0.0 +0.2 -0.4 -1.5

XS1204431867 4.125% Feb 20 Ba2/BB+/-- 700 108.04 1.70 248 -0.1 +0.6 -0.5 -1.2

XS0860855930 4.75% Mar 20 Ba2/BB+/-- 500 110.68 1.73 234 +0.2 +1.5 -0.2 -0.3

XS1204434028 4.75% Feb 23 Ba2/BB+/-- 850 109.90 3.04 361 +0.2 +2.0 -0.1 +0.2

Ikks (No rec) IKKSFR

XS1084836441 6.75% Jul 21 --/B-/B 320 88.83 10.16 1,072 -3.2 -2.2 -3.6 -3.9

Intralot (No rec) INLOTG

XS0947176631 9.75% Aug 18 B1/B/BB- 297 105.59 4.36 773 +0.1 +1.0 -0.2 -0.8

XS1064899120 6% May 21 B1/B/BB- 230 97.38 6.93 749 +0.4 +4.1 +0.0 +2.3

Labeyrie (No rec) LABERE

XS1044528849 5.625% Mar 21 --/B/B+ 355 104.98 2.53 516 +0.1 +0.7 -0.3 -1.1

LKQ (Buy) LKQ

XS1395004408 3.875% Apr 24 Ba2/BB/-- 500 108.84 2.63 304 +0.2 +2.5 -0.2 +0.8

Lufthansa (Hold) LHAGR 5Y CDS 127

XS1109110251 1.125% Sep 19 Ba1/BBB-/-- 500 102.81 0.24 87 +0.0 -0.1 -0.3 -1.8

XS1271836600 5.125% Aug 75 --/BB/-- 500 106.97 3.52 409 +0.1 +0.7 -0.2 -1.0

LuxGEO Travel (No rec) LUXGEO

XS0879569464 7.5% Aug 18 B3/B/-- 295 101.71 5.16 773 +1.1 +4.2 +0.7 +2.4

Marcolin (No rec) MCLIM

XS0991759076 8.5% Nov 19 B2/B-/-- 200 102.63 7.64 856 +0.2 +0.9 -0.2 -0.9

Merlin Entertainments (No rec) MERLLN

XS1204272709 2.75% Mar 22 Ba2/BB/-- 500 102.60 2.35 288 +0.1 +2.0 -0.3 +0.3

Motherson (Hold) MSSIN

XS1082399301 4.125% Jul 21 --/BB+/-- 500 103.37 3.13 409 +0.1 +0.9 -0.3 -0.8

New Look (No rec) NEWLOK 5Y CDS 671

XS1248517341 FRN Jul 22 B1/B/B 415 94.34 5.64 614 +0.2 +1.4 -0.1 -0.4

NH Hoteles (No rec) NHHSM

XS0954676283 6.875% Nov 19 --/BB-/B+ 250 110.72 1.27 418 +0.3 +1.0 -0.1 -0.8

Novalis (No rec) ELISGP 5Y CDS 118

XS1225112272 3% Apr 22 Ba2/BB/-- 800 103.35 2.13 297 +0.2 +1.1 -0.2 -0.6

ODEON & UCI Cinemas (No rec) ODEON

XS0627135774 FRN Aug 18 B3/B-*+/-- 200 99.88 5.14 580 +0.4 +0.3 +0.1 -1.4

Ontex (Hold) ONTEX

BE6272861657 4.75% Nov 21 Ba2/BB/-- 250 107.09 1.16 392 +0.2 +0.6 -0.2 -1.2

Peugeot (Sell) PEUGOT 5Y CDS 178

FR0011439975 7.375% Mar 18 Ba2/--/BB 558 111.00 0.29 96 -0.1 +0.2 -0.4 -1.6

FR0011567940 6.5% Jan 19 Ba2/--/BB 430 114.89 0.36 101 +0.1 +0.2 -0.3 -1.6

FR0013153707 2.375% Apr 23 Ba2/--/BB 500 106.25 1.42 186 -0.1 -1.5 -0.5 -3.2

FR0010014845 6% Sep 33 Ba2/--/BB 600 124.32 4.04 391 +0.0 +1.8 -0.4 +0.0

Piaggio (Hold) PIAGIM

XS1061086846 4.625% Apr 21 B1/B+/BB- 250 104.46 2.34 433 +0.1 +0.6 -0.3 -1.2

Picard Surgeles (No rec) PICSUR

XS1117298833 7.75% Feb 20 B3/B-/CCC+ 428 106.48 2.61 651 +0.1 +0.9 -0.3 -0.9

Port Aventura (No rec) PORTAV

XS0982712019 FRN Dec 19 B3/B-/-- 150 100.62 5.43 605 +0.1 +0.5 -0.3 -1.2

XS0982712365 7.25% Dec 20 B3/B-/-- 270 104.93 4.22 675 +0.1 +1.1 -0.2 -0.7

PVH (No rec) PVH

XS1435229460 3.625% Jul 24 Ba2/BB+/-- 350 107.72 2.58 296 +0.5 +2.7 +0.1 +0.9

Spread: FIX bonds – z-spread, FRN – discount margin, PIK bonds – mid swap, 5Y CDS spread Source: Agencies, iBoxx, Markit, UniCredit Research

TR: 1w/1m: weekly/monthly total return (%); ER: 1w/1m weekly/monthly excess return vs. iBoxx HY NFI/FIN (%)

Out: Outstanding volume in EUR mn; Sec: CON: Consumers, ENG: Energy, IDU: Industrials, TMT: TMT, FNL: Financials

UniCredit Research page 18 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Sec Name Instrument Rating Out PX Yield Spread TR 1w TR 1m ER 1w ER 1m

CON R&R Ice Cream (No rec) ICECR 5Y CDS 104

XS0928190940 9.25% May 18 Caa1/CCC+/-- 253 101.00 2.82 352 +0.0 +0.9 -0.4 -0.9

XS1080255067 4.75% May 20 B2/B/-- 150 102.83 3.85 454 +0.2 +0.6 -0.2 -1.2

Safari (No rec) LPLAYG

XS1029172514 8.25% Feb 21 B2/B/-- 235 107.05 2.97 723 -0.4 +1.9 -0.8 +0.2

Schaeffler (Buy) SHAEFF 5Y CDS 146

XS0954907787 6.875% Aug 18 Ba3/B+/-- 300 102.87 4.22 624 +0.1 +0.7 -0.2 -1.1

XS1067862919 2.75% May 19 Ba2/BB/-- 500 102.11 0.91 273 +0.1 +0.4 -0.3 -1.3

XS1067864881 3.25% May 19 Ba3/B+/-- 500 102.04 2.02 326 +0.0 +0.2 -0.3 -1.6

XS1212469966 2.5% May 20 Ba2/BB/-- 400 102.80 0.87 244 +0.0 +0.2 -0.4 -1.5

XS1126486239 5.75% Nov 21 Ba3/B+/-- 210 108.72 1.16 454 +0.1 +0.8 -0.3 -1.0

XS1067864022 3.5% May 22 Ba2/BB/-- 500 103.69 1.30 340 +0.0 +0.2 -0.4 -1.5

XS1212470972 3.25% May 25 Ba2/BB/-- 600 106.99 1.85 270 +0.3 +0.6 -0.1 -1.1

Schumann (No rec) SCHMAN

XS1454980159 7% Jul 23 B1/B+/B+ 400 103.29 6.41 701 -0.6 -0.6 -0.7 -0.7

Selecta (No rec) SELNSW 5Y CDS 1,017

XS1078234330 6.5% Jun 20 B3/B/-- 350 89.31 10.54 1,115 +0.5 +6.1 +0.2 +4.3

Sisal Holding (No rec) SISTP

XS0931919947 7.25% Sep 17 B1*+/B+/-- 275 100.38 5.72 793 +0.2 +0.7 -0.2 -1.0

SMCP (No rec) SMCPFP

XS0943327378 8.875% Jun 20 B3/B/-- 290 104.90 6.00 828 +0.0 +0.6 -0.3 -1.2

Snai (Hold) SNAIM

XS0982712449 7.625% Jun 18 B2/B-/-- 320 103.78 2.63 638 +0.2 +0.4 -0.2 -1.3

XS0982711805 12% Dec 18 Caa2/CCC/-- 160 105.57 9.84 1,049 +0.2 +1.2 -0.1 -0.6

Takko (No rec) TAKKO

XS0908516080 9.875% Apr 19 Caa1/CCC+/-- 380 59.99 37.92 3,857 +0.5 +2.5 +0.1 +0.7

Tereos (No rec) TEREOS

FR0011439900 4.25% Mar 20 --/BB/BB 500 107.00 1.61 293 +0.4 +2.1 +0.0 +0.3

FR0013183571 4.125% Jun 23 --/BB/BB 400 104.59 3.41 386 +0.1 +3.2 -0.3 +1.5

Tesco (Hold) TSCOLN 5Y CDS 217

XS0992632702 1.25% Nov 17 Ba1/BB+/BB+ 500 100.99 0.54 121 +0.0 +0.2 -0.4 -1.6

XS0697395472 3.375% Nov 18 Ba1/BB+/BB+ 750 106.10 0.62 127 +0.0 +0.5 -0.4 -1.3

XS1082970853 1.375% Jul 19 Ba1/BB+/BB+ 1,250 101.07 1.06 169 +0.0 +0.5 -0.4 -1.2

XS0992638220 2.125% Nov 20 Ba1/BB+/BB+ 500 103.53 1.28 190 +0.0 +0.6 -0.4 -1.1

XS1082971588 2.5% Jul 24 Ba1/BB+/BB+ 750 103.35 2.09 243 -0.1 +1.0 -0.4 -0.7

XS0295018070 5.125% Apr 47 Ba1/BB+/BB+ 600 103.38 4.96 461 +0.0 +2.5 -0.4 +0.7

Thom Europe (No rec) THOEUR

XS1087760648 7.375% Jul 19 B2/B/-- 347 105.89 3.19 603 +0.1 +0.8 -0.2 -1.0

Thomas Cook (Buy) TCGLN

XS0937169570 7.75% Jun 20 --/B/B+ 525 103.45 6.12 760 +0.5 +4.8 +0.1 +3.0

XS1172436211 6.75% Jun 21 --/B/B+ 400 103.08 6.02 680 +1.0 +9.2 +0.6 +7.4

TUI (Hold) TUIGR 5Y CDS 149

XS1028943162 4.5% Oct 19 Ba2/BB-/-- 300 103.34 2.85 417 +0.2 +0.7 -0.2 -1.0

Twinset (No rec) TWSSBS

XS1086778641 FRN Jul 19 B2/B/-- 150 96.89 7.28 791 +0.6 +1.5 +0.2 -0.3

Univeg (No rec) UNIVEG

XS0992644038 7.875% Nov 20 B3/CCC+/-- 285 104.68 5.99 746 +0.1 +0.6 -0.2 -1.1

Volvo (MW) VLVY 5Y CDS 91

XS1150673892 4.2% Jun 75 Ba1/BB+/BB+ 900 104.45 3.09 370 +0.3 +1.8 -0.1 +0.0

XS1150695192 4.85% Mar 78 Ba1/BB+/BB+ 600 105.27 4.00 445 +0.6 +2.3 +0.3 +0.6

Volvo Car (Hold) VOVCAB

XS1409634612 3.25% May 21 Ba3/BB/-- 500 107.49 1.70 226 +0.1 +1.2 -0.3 -0.6

Vougeot (No rec) VUECIN 5Y CDS 277

XS0953085627 FRN Jul 20 B2/B/-- 290 100.96 1.43 549 +0.1 +0.6 -0.3 -1.2

Spread: FIX bonds – z-spread, FRN – discount margin, PIK bonds – mid swap, 5Y CDS spread Source: Agencies, iBoxx, Markit, UniCredit Research

TR: 1w/1m: weekly/monthly total return (%); ER: 1w/1m weekly/monthly excess return vs. iBoxx HY NFI/FIN (%)

Out: Outstanding volume in EUR mn; Sec: CON: Consumers, ENG: Energy, IDU: Industrials, TMT: TMT, FNL: Financials

UniCredit Research page 19 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Sec Name Instrument Rating Out PX Yield Spread TR 1w TR 1m ER 1w ER 1m

CON WEPA (No rec) WEPAHY

DE000A2AA0W5 3.75% May 24 B1/BB/-- 450 106.14 2.27 331 +0.1 +1.7 -0.2 -0.1

ZF Friedrichshafen (Buy) ZFFNGR

DE000A14J7F8 2.25% Apr 19 Ba1/BB+/-- 1,150 104.59 0.66 130 +0.1 +0.1 -0.3 -1.7

DE000A14J7G6 2.75% Apr 23 Ba1/BB+/-- 1,100 107.36 1.64 208 +0.4 +1.7 +0.1 -0.1

Zobele (Hold) ZOBELE

XS0882293557 7.875% Feb 18 B2/B+/-- 180 102.83 2.58 700 +0.2 +1.2 -0.2 -0.5

ENG Bulgarian Energy (No rec) BULENR

XS0989152573 4.25% Nov 18 --/--/BB- 500 103.78 2.55 320 +0.1 +0.6 -0.3 -1.1

XS1405778041 4.875% Aug 21 Ba2/--/BB- 550 104.49 3.94 449 -0.7 -0.7 -0.7 -0.7

CGG (No rec) CGGFP

XS1061175607 5.875% May 20 Caa2/CCC/-- 400 54.52 28.00 2,861 +0.9 +1.1 +0.6 -0.7

ContourGlobal (No rec) CONGLO

XS1433185755 5.125% Jun 21 --/BB/BB- 550 106.75 2.91 427 -0.2 +3.1 -0.5 +1.4

EDP (OW) EDPPL 5Y CDS 160

PTEDPUOM0024 5.375% Sep 75 Ba2/B+/BB 750 105.52 4.13 470 +0.8 +3.6 +0.4 +1.8

XS0399353506 0% Nov 23 --/BB+/-- 160 87.57 2.19 257 +0.1 +1.3 -0.3 -0.4

ENCE (No rec) ENCSM

XS1117280112 5.375% Nov 22 Ba3/BB-/-- 250 107.85 3.06 453 +0.3 +0.4 +0.0 -1.4

Enel (MW) ENELIM 5Y CDS 75

XS0954675129 6.5% Jan 74 Ba1/BB+/BBB- 1,250 109.80 2.32 297 +0.1 +0.9 -0.3 -0.8

XS1014997073 5% Jan 75 Ba1/BB+/BBB- 1,000 108.35 2.49 311 +0.2 +1.3 -0.2 -0.5

Gas Natural (MW) GASSM 5Y CDS 72

XS1139494493 4.125% PERP Ba1/BB+/BBB- 1,000 104.70 3.35 382 +0.7 +2.7 +0.3 +0.9

XS1224710399 3.375% PERP Ba1/BB+/BBB- 500 97.50 3.83 419 +0.7 +2.9 +0.3 +1.1

Gazprom (Trans.) GAZPRU 5Y CDS 272

XS0290581569 5.44% Nov 17 Ba1/BB+/BBB- 500 104.94 1.38 206 +0.1 +0.2 -0.3 -1.6

XS0327237136 6.605% Feb 18 Ba1/BB+/BBB- 1,200 107.60 1.49 216 +0.1 +0.4 -0.3 -1.4

XS0954912514 3.7% Jul 18 Ba1/BB+/BBB- 900 104.08 1.68 234 +0.1 +0.4 -0.3 -1.4

XS1307381928 4.625% Oct 18 Ba1/BB+/BBB- 1,000 105.88 1.89 255 +0.1 +0.1 -0.3 -1.7

XS0906946008 3.389% Mar 20 Ba1/BB+/BBB- 1,000 104.31 2.22 283 +0.1 +1.0 -0.2 -0.7

XS1038646078 3.6% Feb 21 Ba1/BB+/BBB- 750 105.26 2.43 301 +0.2 +1.8 -0.2 +0.0

XS0906949523 4.364% Mar 25 Ba1/BB+/BBB- 500 108.18 3.31 361 +0.2 +2.0 -0.2 +0.2

Gazprom Neft (Trans.) SIBNEF

XS0922296883 2.933% Apr 18 Ba1/BB+/BBB- 750 101.86 1.97 263 +0.1 +0.4 -0.3 -1.3

MOL (Buy) MOLHB 5Y CDS 253

XS1401114811 2.625% Apr 23 --/BB+/BBB- 750 104.38 1.96 240 +0.2 +1.1 -0.2 -0.6

Origin Energy (No rec) ORGAU 5Y CDS 279

XS1109795176 4% Sep 74 Ba2/BB/-- 1,000 94.78 6.25 688 +0.8 +8.7 +0.4 +6.9

Petrobras (No rec) PETBRA 5Y CDS 520

XS0982711631 2.75% Jan 18 B3/B+/BB 540 99.95 3.05 373 +0.0 +0.4 -0.3 -1.4

XS0716979249 4.875% Mar 18 B3/B+/BB 574 102.58 3.37 404 +0.0 +0.7 -0.3 -1.1

XS0835886598 3.25% Apr 19 B3/B+/BB 1,300 98.87 3.86 450 +0.1 +2.2 -0.3 +0.4

XS0982711987 3.75% Jan 21 B3/B+/BB 750 95.73 4.98 556 -0.3 +2.6 -0.7 +0.8

XS0716979595 5.875% Mar 22 B3/B+/BB 600 101.23 5.69 621 -0.3 +3.8 -0.7 +2.1

XS0835890350 4.25% Oct 23 B3/B+/BB 700 91.57 5.81 622 -0.2 +3.8 -0.6 +2.1

XS0982711714 4.75% Jan 25 B3/B+/BB 800 90.31 6.34 666 -0.7 +3.4 -1.1 +1.6

Preem Petroleum (No rec) PREEM

XS1400707771 11.75% May 21 --/B/B 570 93.15 14.45 1,502 -0.3 -0.1 -0.6 -1.8

Repsol (OW) REPSM 5Y CDS 169

XS1207054666 3.875% PERP Ba1/BB/BB+ 1,000 97.46 4.65 522 +1.5 +5.8 +1.1 +4.1

XS1207058733 4.5% Mar 75 Ba1/BB/BB+ 1,000 94.59 5.37 567 +2.4 +8.7 +2.0 +6.9

RWE (MW) RWE 5Y CDS 80

XS1219498141 2.75% Apr 75 Ba2/BB/BB+*- 700 92.27 5.00 558 +1.0 +5.4 +0.6 +3.6

XS1219499032 3.5% Apr 75 Ba2/BB/BB+*- 550 85.36 5.78 606 +1.4 +5.4 +1.0 +3.6

Spread: FIX bonds – z-spread, FRN – discount margin, PIK bonds – mid swap, 5Y CDS spread Source: Agencies, iBoxx, Markit, UniCredit Research

TR: 1w/1m: weekly/monthly total return (%); ER: 1w/1m weekly/monthly excess return vs. iBoxx HY NFI/FIN (%)

Out: Outstanding volume in EUR mn; Sec: CON: Consumers, ENG: Energy, IDU: Industrials, TMT: TMT, FNL: Financials

UniCredit Research page 20 See last pages for disclaimer.

2 September 2016 Credit Research

High Yield Pacenotes

Sec Name Instrument Rating Out PX Yield Spread TR 1w TR 1m ER 1w ER 1m

ENG Santos (No rec) STOAU

XS0543710395 8.25% Sep 70 --/BB+/-- 1,000 104.05 4.95 563 -0.1 +4.2 -0.5 +2.4

Veolia Environnement (MW) VIEFP 5Y CDS 53

FR0011391820 4.45% PERP Baa3/BB+/BB+ 1,000 105.59 1.17 184 +0.1 +0.3 -0.3 -1.5

Viridian (No rec) VRDLN

XS1179900102 7.5% Mar 20 B2/--/B+ 600 107.11 4.52 612 +0.1 +2.5 -0.2 +0.7

IDU Alain Afflelou (Hold) AAFFP