Professional Documents

Culture Documents

FIEO - Guide To Obtaining IEC Code

Uploaded by

harshadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIEO - Guide To Obtaining IEC Code

Uploaded by

harshadCopyright:

Available Formats

Username •••••••• Login

Forgot Username/Password | Create Username

Custom Search

Home About Us Membership Publications/Press Trade Policy Downloads Links and Resources Employee Zone Buy/Sell Contact Us

Home Guidance & Provisons for Exports Guide to Obtaining IEC Code

Guide to Obtaining IEC Code Guide to Obtaining IEC Code

Foreign Exchange Update through SMS &

Reports

Basic Guidance on How to Export

1. What is IEC?

Export Benefits

IEC or Importer Exporter Code is unique 10 digit code issued byDGFT – Director Foreign Trade Policy

General of Foreign Trade, Ministry of Commerce, Government of India to Indian

Companies and individuals to enable them carry International Trade. GST & Exports

2. Why is IEC required?

To import or export in India, IEC Code is mandatory. No person or entity shall make

any Import or Export without IEC Code Number, unless specifically exempted.

3. Who can get IEC?

An individual or a company who wants to do international business can get an IEC.

Individuals can use either the name of their company or their name directly to apply

for IEC.

4. Who issues IEC?

IEC is issued by Directorate General of Foreign Trade (DGFT) which is under

Ministry of Commerce.

5. What is the fee for IEC?

Application fee to get IEC is Rs. 500/-

6. What is the validity of IEC?

An IEC allotted to an applicant shall have permanent validity.

7. Is there any Application form for applying IEC?

Yes. Application has to filed in ANF 2A format for grant of IEC

8. Where I can find application for applying IEC?

· Go to www.dgft.gov.in/

· Go to IEC (How to apply IEC)

· Select Manual application to get ANF 2A

9. What is the technical requirement for filing an IEC?

Internet Explorer 11 or above, chrome 6.3.2 or above with JavaScript enabled.

Changes in IEC with the introduction of GST

· As a measure of ease of doing business, it has been decided to keep the identity of an

entity uniform across the Ministries/Departments. Henceforth, PAN of an entity will

be used for the purpose of IEC, i.e., IEC will be issued by DGFT with the difference

that it will be alpha numeric (instead of 10 digit numeric at present) and will be same

as PAN of an entity.

· For new applicants, w.e.f. 12.06.2017, application for IEC will be made to DGFT and

applicant’s PAN will be authorized as IEC. For residuary categories under Para 2.07

of HBP 2015-20, the IEC will be either UIN issued by GSTN and authorized by

DGFT or any common number to be notified by DGFT.

· Further, for existing IEC holders, necessary changes in the system are being carried out

by DGFT so that their PAN becomes their IEC. DGFT system will undertake this

migration and the existing IEC holders are not required to undertake any additional

exercise in this regard. IEC holders are required to quote their PAN (in place of

exisiting IEC) in all their future documentation, w.e.f. the notified date. The legacy

data which is based on IEC would be converted into PAN based in due course of

time.

Home :: About Us :: Membership :: Publications/Press :: Trade Policy :: Downloads :: Links and Resources :: Employee Zone :: Contact Us :: Privacy Policy ::

Sitemap :: Search Fieo :: Search Web :: Disclaimer :: Feedback :: Subscribe :: Unsubscribe

Niryat Bhawan, Rao Tula Ram Marg, Opp. Army Hospital Research & Referral, New Delhi 110057, India.

Phone: 91112615010104/46042222 Fax: 911126150066/26150077/26148194. Email : fieo@nda.vsnl.net.in

Copyright © 2012 Federation of Indian Export Organisations

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Export House List PDFDocument199 pagesExport House List PDFharshad67% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- How To Instantly Connect With AnyoneDocument337 pagesHow To Instantly Connect With AnyoneF C100% (2)

- Required Documents For EnrolmentDocument7 pagesRequired Documents For EnrolmentCamillus Carillo AngelesNo ratings yet

- 8 Tips For Finding Buyers On The European Fresh Fruit and Vegetables MarketDocument9 pages8 Tips For Finding Buyers On The European Fresh Fruit and Vegetables MarketharshadNo ratings yet

- Contact List-Niryat BandhuDocument5 pagesContact List-Niryat BandhuharshadNo ratings yet

- Quick Estimates May 2018Document4 pagesQuick Estimates May 2018harshadNo ratings yet

- Onion AnswersDocument12 pagesOnion Answersharshad0% (1)

- Basis OF Judicial Clemency AND Reinstatement To The Practice of LawDocument4 pagesBasis OF Judicial Clemency AND Reinstatement To The Practice of LawPrincess Rosshien HortalNo ratings yet

- Personal Information Sheet: Fully Accomplish The Form Do Not Leave Blanks Write (N/A) If Not ApplicableDocument2 pagesPersonal Information Sheet: Fully Accomplish The Form Do Not Leave Blanks Write (N/A) If Not ApplicableAdrian NunezNo ratings yet

- Form - 28Document2 pagesForm - 28Manoj GuruNo ratings yet

- Business Law and Regulations 1Document4 pagesBusiness Law and Regulations 1Xyrah Yvette PelayoNo ratings yet

- Live2D Cubism 320 and Euclid Editor 131 Win PDFDocument3 pagesLive2D Cubism 320 and Euclid Editor 131 Win PDFDavidNo ratings yet

- FCI Recruitment NotificationDocument4 pagesFCI Recruitment NotificationAmit KumarNo ratings yet

- Arnold Emergency Motion 22cv41008 Joseph Et AlDocument13 pagesArnold Emergency Motion 22cv41008 Joseph Et AlKaitlin AthertonNo ratings yet

- Good MoralDocument8 pagesGood MoralMary Grace LemonNo ratings yet

- Basic Accounting For HM and TM SyllabusDocument2 pagesBasic Accounting For HM and TM Syllabusjune dela cernaNo ratings yet

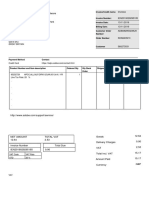

- Invoice: VAT No: IE6364992HDocument2 pagesInvoice: VAT No: IE6364992HRajNo ratings yet

- 04 Dam Safety FofDocument67 pages04 Dam Safety FofBoldie LutwigNo ratings yet

- 05 Solution 1Document18 pages05 Solution 1Mohar SinghNo ratings yet

- IMO Online. AdvtDocument4 pagesIMO Online. AdvtIndiaresultNo ratings yet

- Engine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Document9 pagesEngine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Akmal NizametdinovNo ratings yet

- Print For ZopfanDocument31 pagesPrint For Zopfannorlina90100% (1)

- Panay Autobus v. Public Service Commission (1933)Document2 pagesPanay Autobus v. Public Service Commission (1933)xxxaaxxxNo ratings yet

- Lledo V Lledo PDFDocument5 pagesLledo V Lledo PDFJanica DivinagraciaNo ratings yet

- SystemupdateDocument9 pagesSystemupdatealishaNo ratings yet

- Qcourt: 3republic of Tbe LlbilippinesDocument10 pagesQcourt: 3republic of Tbe LlbilippinesThe Supreme Court Public Information Office100% (1)

- Chapter 17 - Supply Chains (17th Edition)Document23 pagesChapter 17 - Supply Chains (17th Edition)meeshakeNo ratings yet

- The Oecd Principles of Corporate GovernanceDocument8 pagesThe Oecd Principles of Corporate GovernanceNazifaNo ratings yet

- 0452 s03 Ms 2Document6 pages0452 s03 Ms 2lie chingNo ratings yet

- IFN Guide 2019 PDFDocument104 pagesIFN Guide 2019 PDFPastel IkasyaNo ratings yet

- IPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsDocument18 pagesIPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsAdnan MoquaddamNo ratings yet

- Tax Invoice UP1222304 AA46663Document1 pageTax Invoice UP1222304 AA46663Siddhartha SrivastavaNo ratings yet

- Accounting For Insurance Contracts Deferred Tax and Earnings Per ShareDocument2 pagesAccounting For Insurance Contracts Deferred Tax and Earnings Per ShareJanine CamachoNo ratings yet

- Part A BarDocument137 pagesPart A BarkertzunhkNo ratings yet