Professional Documents

Culture Documents

Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

Volume 8, Issue 32

August 7, 2018

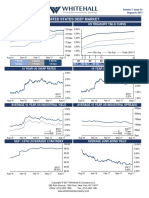

UNITED STATES DEBT MARKET

US LIBOR US TREASURY YIELD CURVE

300 bps 6.00%

250 bps 5.00%

200 bps 4.00%

150 bps 3.00%

100 bps 2.00%

50 bps 1.00%

30yr Avg 15yr Avg Today (8/7/18)

0 bps 0.00% I I I I I I

Aug-17 Nov-17 Feb-18 May-18 Aug-18 2 3 5 7 10 30

1 Month 3 Month 6 Month 2yr 3yr 5yr 7yr 10yr 30yr

208 bps 234 bps 252 bps 2.66% 2.72% 2.83% 2.88% 2.96% 3.11%

10 YEAR US SWAP RATES 10 YEAR US TREASURY

3.50% 3.50%

3.00% 3.00%

2.50% 2.50%

2.00% 2.00%

1.50% 1.50%

8/7/18 8/7/18

3.03% 2.96%

1.00% 1.00%

Aug-17 Nov-17 Feb-18 May-18 Aug-18 Aug-17 Nov-17 Feb-18 May-18 Aug-18

AVERAGE 10 YEAR US INDUSTRIAL YIELD AVERAGE 10 YEAR US INDUSTRIAL SPREADS

200bps

4.50%

4.00% 150bps

3.50%

100bps

3.00%

8/7/18 8/7/18 50bps

A 2.50% A 87 bps

3.82%

BBB 4.31% BBB 136 bps

2.00% 0bps

Aug-17 Nov-17 Feb-18 May-18 Aug-18 Aug-17 Nov-17 Feb-18 May-18 Aug-18

S&P / LSTA LEVERAGED LOAN INDEX AVERAGE JUNK-BOND YIELD

100.00 7.00%

98.00

6.00%

96.00

94.00

5.00%

92.00

8/7/18 8/7/18

98.40% 5.98%

90.00 4.00%

Aug-17 Nov-17 Feb-18 May-18 Aug-18 Aug-17 Nov-17 Feb-18 May-18 Aug-18

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

Volume 8, Issue 32

August 7, 2018

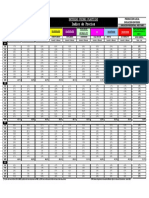

SELECT US PRIVATE PLACEMENTS

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

8/3 Nicor Gas Sr Notes $100 21 105bps 4.08% 1 Energy US

$100 30 110bps 4.19%

$100 40 125bps 4.34%

8/3 Sodexo Sr Notes $400 5 - 3.70% 2 Consumer, France

Cyclical

8/3 SVF Holdings Real Estate Sr Notes $50 6 120bps 4.11% 1 Financial UK

Investment

Trust $50 10 125bps 4.24%

$200 12 135bps 4.33%

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

8/2 Burlingtn Northern Santa Fe, LLC Sr Notes $750 30 113bps 4.15% A+/A3 Industrial US

8/2 Norfolk Southern Corporation Sr Notes $600 100 200bps 5.10% BBB+/Baa1 Industrial US

8/1 POSCO Sr Notes $500 5 - 4.00% BBB+/Baa1 Basic Materials South Korea

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date Issuer Type $mm Years Spread Coupon Rating Sector Country

7/31 Altice France 1st Lien $1,750 8 528bps 8.13% B/B1 Communications France

8/1 Hi-Crush Partners LP Sr Notes $450 8 655bps 9.50% B-/B3 Basic Materials US

8/2 Party City Holdings, Inc Sr Notes $500 8 - 6.63% B-/B1 Consumer, US

Cyclical

\

SELECT CLOSED SYNDICATED LOANS

Date Issuer Type $mm Months Spread Rating Sector Country

8/1 AL Midcoast Holdings, LLC Term $600 84 550bps BB- Energy US

8/1 Brookfield WEC Holdings, Inc Asset-Based $200 60 - B2 Industrial US

Rev $200 60 - B2

Term $2,730 84 375bps B/B2

Term $325 96 675bps B-/Caa1

7/31 Koch Industries, Inc Rev $4,000 59 63bps - Diversified US

7/31 Noble Midstream Services, LLC Delay-Draw $500 36 100bps - Energy US

Term

CONTACT WHITEHALL

Jon Cody Timothy Page Richard Ashby Todd Brussel Brian Burchfield Matt Cody Roland DaCosta Thomas Friebel Bob Salandra

Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director Managing Director

(212) 205-1398 (212) 205-1399 (212) 205-1388 (212) 205-1397 (212) 205-1395 (212) 205-1398 (212) 205-1394 (212) 335-2565 (212) 335-2561

Vincas Snipas Van Thorne Geoffrey Wilson Mark Halpin Nadia Zaets Blaine Burke Nicholas Page Sang Joon Lee Aaron Richardson

Managing Director Managing Director Managing Director Director Director Vice President Vice President Associate Associate

(212) 205-1385 (212) 205-1386 (212) 205-1392 (212) 205-1393 (212) 335-2557 (212) 205-1382 (212) 205-1389 (212) 205-1391 (212) 205-1387

Ted Barrett Daniel Charen Charles Joerss Ben Koeppel Vitaliy Koretskyy Billy Kovanis Keir Wianecki

Analyst Analyst Analyst Analyst Analyst Analyst Analyst

(212) 205-1396 (212) 335-2567 (212) 335-2555 (212) 335-2566 (212) 335-2551 (212) 335-2550 (212) 335-2552

Source: Bloomberg

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security.

Copyright © 2018 Whitehall & Company LLC

280 Park Avenue, 15th Floor, New York, NY 10017

Office: (212) 205-1380 Fax: (212) 205-1381

www.whitehallandcompany.com

You might also like

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 25 (June 27, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 24 (June 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 38 (September 26, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 39 (October 3, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 21 (May 23, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 31 (August 09, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 10 (March 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 48 (December 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 43 (October 31, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 23 (June 12, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 11 (March 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 41 (October 17, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 8 (February 21, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 42 (October 24, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 45 (November 14, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 7 (February 13, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 44 (November 7, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 50 (December 19, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 36 (September 12, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 46 (November 21, 2017)Whitehall & CompanyNo ratings yet

- HBA INTEREST CALCULATOR ShareDocument1 pageHBA INTEREST CALCULATOR ShareLazy BuoyNo ratings yet

- 1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Document2 pages1.06 Whitehall: Monitoring The Markets Vol. 01 Iss. 06 (Mar 8, 2011)Whitehall & CompanyNo ratings yet

- TO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Document1 pageTO% Category Format Division TO% TO% Slabs TO% Slabs TO%: Trade Offers - Secondary Towns (1st Jan Till 31st Jan)Malik Raheel AhmadNo ratings yet

- IC Email Marketing Dashboard Template 8673Document7 pagesIC Email Marketing Dashboard Template 8673Haytham NasefNo ratings yet

- SCHEDULE TITLEDocument32 pagesSCHEDULE TITLEOlan BeeNo ratings yet

- Indice de Precios: Materias Primas PlasticasDocument1 pageIndice de Precios: Materias Primas PlasticasMelisa JaksicNo ratings yet

- 1ntercept: Atlanta Falcons (1-0)Document1 page1ntercept: Atlanta Falcons (1-0)api-369514202No ratings yet

- IC Retail Analysis Dashboard1Document9 pagesIC Retail Analysis Dashboard1minhmaruNo ratings yet

- Propuesta OVBK - V2Document3 pagesPropuesta OVBK - V2JUAN CAMILO GUZMANNo ratings yet

- Retail Analysis Dashboard Shows Monthly Stock LevelsDocument9 pagesRetail Analysis Dashboard Shows Monthly Stock LevelsSamuel FLoresNo ratings yet

- Tube Molding Report - Sept 2010.Document3 pagesTube Molding Report - Sept 2010.Ogero Otekki MusaNo ratings yet

- 26 08 2021-PoultryDocument14 pages26 08 2021-PoultryIgnacio López LazarenoNo ratings yet

- Audit Cuci TanganDocument6 pagesAudit Cuci TanganDewi HastutiNo ratings yet

- 1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Document2 pages1.07 Whitehall: Monitoring The Markets Vol. 01 Iss. 07 (Mar 16, 2011)Whitehall & CompanyNo ratings yet

- [배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)Document26 pages[배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)최장윤No ratings yet

- Trend Rasio Rujukan dan Angka Kontak Tahun 2019Document1 pageTrend Rasio Rujukan dan Angka Kontak Tahun 2019rinaNo ratings yet

- Client Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveDocument1 pageClient Logo: Contract No ABC /XY/YY/ZZ Project Name, Location Overall Progress S CurveAbhishek KumarNo ratings yet

- The COVID-19 Impact On Consumption in Real Time and High DefinitionDocument7 pagesThe COVID-19 Impact On Consumption in Real Time and High DefinitionBryan GonzalesNo ratings yet

- 1.-Coeficientes y Cedulas de Cultivos de La Region PunoDocument5 pages1.-Coeficientes y Cedulas de Cultivos de La Region PunoJackelinne Tello ChavezNo ratings yet

- 1ntercept: Pittsburgh Steelers (1-0)Document1 page1ntercept: Pittsburgh Steelers (1-0)api-369514202No ratings yet

- Monthly Defect Percentages by WeekDocument2 pagesMonthly Defect Percentages by WeekshreenareshNo ratings yet

- 1ntercept: Cincinnati Bengals (0-1)Document1 page1ntercept: Cincinnati Bengals (0-1)api-369514202No ratings yet

- 1ntercept: Green Bay Packers (1-0)Document1 page1ntercept: Green Bay Packers (1-0)api-369514202No ratings yet

- Capital Market Presence Choice or CompulsionDocument127 pagesCapital Market Presence Choice or Compulsionthe libyan guyNo ratings yet

- A08 S Curve PDFDocument1 pageA08 S Curve PDFAbhishek KumarNo ratings yet

- Grafik CakupanDocument22 pagesGrafik CakupanjenalNo ratings yet

- Dashboard OEE ExcellDocument7 pagesDashboard OEE ExcellNurhadi100% (1)

- 1ntercept: Tampa Bay Buccaneers (0-0)Document1 page1ntercept: Tampa Bay Buccaneers (0-0)api-369514202No ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Whitehall & CompanyNo ratings yet

- Excel TrainingDocument28 pagesExcel TrainingNiraj Arun ThakkarNo ratings yet

- Update Bank Details for PayoutsDocument2 pagesUpdate Bank Details for Payoutss.sabapathyNo ratings yet

- Apptuto CFA L1 LOS Changes 2016Document18 pagesApptuto CFA L1 LOS Changes 2016NattKoonNo ratings yet

- ABM - BF12 IIIb 8Document4 pagesABM - BF12 IIIb 8Raffy Jade SalazarNo ratings yet

- 2016-FAC611S-Chapter 15 Property Plant and Equipment 2013Document32 pages2016-FAC611S-Chapter 15 Property Plant and Equipment 2013Bol Sab SachNo ratings yet

- Finance ManagementDocument2 pagesFinance ManagementSakib ShaikhNo ratings yet

- Introduction to Derivatives: Risk Management, Trading Efficiency and ParticipantsDocument82 pagesIntroduction to Derivatives: Risk Management, Trading Efficiency and Participantskware215No ratings yet

- Australian School of BusinessDocument12 pagesAustralian School of BusinessMaria Luisa Laniado IllingworthNo ratings yet

- Phase Test 2017 - 18Document15 pagesPhase Test 2017 - 18AKSHIT SHUKLANo ratings yet

- Deeds Under HK LawDocument2 pagesDeeds Under HK LawAdina MadchenNo ratings yet

- Pro Forma Financial StatementsDocument13 pagesPro Forma Financial StatementsAlex liaoNo ratings yet

- Credit Risk Management in BanksDocument20 pagesCredit Risk Management in BanksJayesh MalwankarNo ratings yet

- Financial Markets Exam - Key Terms, Concepts, and InstitutionsDocument1 pageFinancial Markets Exam - Key Terms, Concepts, and InstitutionsNishad AlamNo ratings yet

- Bibica - Default Risk AnalysisDocument2 pagesBibica - Default Risk AnalysisThậpTamNguyệtNo ratings yet

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckFirst Round CapitalNo ratings yet

- Sample Questions:: Section I: Subjective QuestionsDocument8 pagesSample Questions:: Section I: Subjective Questionsnaved katuaNo ratings yet

- AccountsStatement 63379769Document2 pagesAccountsStatement 63379769omanshNo ratings yet

- Accounting TransactionsDocument28 pagesAccounting TransactionsPaolo100% (1)

- Jumbo Group Limited FactsheetDocument2 pagesJumbo Group Limited FactsheetInvest StockNo ratings yet

- What To Ask .. Team Building: Some Questions For A Potential Service ProviderDocument2 pagesWhat To Ask .. Team Building: Some Questions For A Potential Service ProviderHo Thuy DungNo ratings yet

- (John Burley.) 7 Levels of Investor PDFDocument25 pages(John Burley.) 7 Levels of Investor PDFEphone HoNo ratings yet

- Managerial Accounting Reviewer PreFinalsxDocument10 pagesManagerial Accounting Reviewer PreFinalsxGenelyn BalancarNo ratings yet

- Consumer Financing in Pakistan Issues & Challenges - PROJECTDocument88 pagesConsumer Financing in Pakistan Issues & Challenges - PROJECTFarman Memon100% (1)

- Petron F (1) .S 3Document74 pagesPetron F (1) .S 3cieloville06100% (1)

- Financial InstrumentDocument84 pagesFinancial Instrumentmamta yadavNo ratings yet

- NTPC Group crosses 3GW renewable energy capacity; FuelBuddy partners with IOCLDocument3 pagesNTPC Group crosses 3GW renewable energy capacity; FuelBuddy partners with IOCLLikhitha YerraNo ratings yet

- Learning ObjectivesDocument11 pagesLearning ObjectivesWendyMayVillapaNo ratings yet

- 08 Risk Management QuestionnaireDocument7 pages08 Risk Management QuestionnaireBhupendra ThakurNo ratings yet

- Syllabus Private Equity Spring MGMT E2790 2013Document8 pagesSyllabus Private Equity Spring MGMT E2790 2013eruditeaviatorNo ratings yet

![[배포]_23년_물류_시황_회고_및_24년_전망_231207_주요_Q_A_포함 (1)](https://imgv2-1-f.scribdassets.com/img/document/719845222/149x198/d8ebab17c6/1712196292?v=1)