Professional Documents

Culture Documents

ACC 142 (ACCTNG For BUS. COMBI)

Uploaded by

Si Kaka Mia0 ratings0% found this document useful (0 votes)

36 views6 pagesOriginal Title

ACC 142 (ACCTNG for BUS. COMBI).doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views6 pagesACC 142 (ACCTNG For BUS. COMBI)

Uploaded by

Si Kaka MiaCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 6

RC Al-Khwarizmi International College Foundation, Inc.

DEPARTMENT OF ACCOUNTANCY

Basak Malutlut, Marawi City

COURSE SYLLABUS IN ACC 143 (ACCOUNTING FOR BUSINESS COMBINATION)

Course Code ACC 142

Course Name Accounting for Business Combination

Course Credits 3 units

Course Description This course is a continuation of Accounting for Special Transactions. It deals mainly with consolidation and mergers, parent-subsidiary relationships, and

consolidated statements including intercompany transactions among subsidiaries. The other topics deal with accounting for the effects of changes in foreign

exchange rates and other similar current issues.

Contact hours/week 64 hours/16 weeks

Pre-requisite(s) ACC 123 (Intermediate Accounting III)

Mission The mission of Al-Khwarizmi International College is to provide high quality of advance, professional and technical education to the Muslims and other youths in the

Philippines and the ASEAN region serving as catalyst of development in Muslim Communities especially in Autonomous Region in Muslim Mindanao (ARMM)

through the traditional functions of instructions, research, and extension services.

Goals and Objectives The objective of Al-Khwarizmi International College is to implement high standard of higher education in computer and information technology, Accountancy and

Business Management, Science and Engineering and Education in order to contribute to the attainment of lasting peace in Mindanao and the whole world.

Program Outcomes The graduates have the ability to:

1. Articulate and discuss the latest development in the specific field of practice.

2. Effectively communicate orally and in writing using both English and Filipino

3. Work effectively and independently in multi-disciplinary and multi-cultural teams.

4. Act in recognition of professional, social and ethical responsibility

5. Preserve and promote “Filipino historical and cultural heritage”

A graduate of BS in Accountancy should be able to:

1. Resolve business issues and problems, with a global and strategic perspective using knowledge and technical proficiency in the areas of financial accounting

and reporting, cost accounting and management, accounting and control, taxation and accounting information systems;

2. Conduct accountancy research through independent studies of relevant literature and appropriate use of accounting theory and methodologies;

3. Employ technology as a business tool in capturing financial and non-financial information, generating reports and making decisions;

4. Apply knowledge and skills to successfully respond to various types of assessments; and (including professional licensure and certifications); and

5. Confidently maintain a commitment to good corporate citizenship, social responsibility and ethical practice in performing functions as an accountant

Course Outcomes 1. Identify the recognition, variation and measurement principles applicable for special accounting problems.

2. Compute for the amounts to be presented on the financial statements as assets, liability, equity, income and expenses arising from special accounting problems.

3. Prepare journal entries for special accounting problems.

4. Support the mission and goals/objectives of the College and the Department.

5. Develop awareness of the importance of business combination as a way of business survival.

6. Comply with accounting standards pertaining to special accounting problems.

7. Support the work of the Financial Reporting and Standard Council of the Philippine Interpretations Committee in the development of accounting standards and

relevant implementation guidelines.

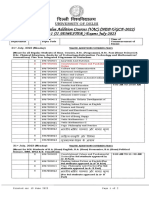

ALIGNMENT OF COURSE OUTCOMES WITH SUMMATIVE ASSESSMENT TASKS

Course Outcomes and Course Objectives Summative Assessment Tasks Details

Identify the recognition, variation and measurement principles Quiz on the topic and assignments Assess student’s learning about the topic discussed.

applicable for special accounting problems.

Compute for the amounts to be presented on the financial Quiz on the topic and assignments Prepare financial statements.

statements as assets, liability, equity, income and expenses

arising from special accounting problems.

Prepare journal entries for special accounting problems. Quiz on the topic and assignments Prepare journal entries

Support the mission and goals/objectives of the College and submit reflection paper Students to submit reflection paper on their realization.

the Department.

Develop awareness of the importance of business combination Quiz on the topic and assignments Assess student’s learning about the topic discussed.

as a way of business survival.

Comply with accounting standards pertaining to special Quiz on the topic and assignments Assess student’s learning about the topic discussed.

accounting problems.

Support the work of the Financial Reporting and Standard Quiz on the topic and assignments Assess student’s learning about the topic discussed.

Council of the Philippine Interpretations Committee in the

development of accounting standards and relevant

implementation guidelines.

TIME FRAME AND COURSE OUTLINE

Week 1 Mission, goals/objectives and Classroom policies

Week 1-3 Accounting for Business Combinations

Week 4-8 Consolidated Financial Statements

Week 9 PRELIMINARY EXAMINATIONS

Week 10-12 Consolidated Financial Statements - Intercompany Transactions

Week 13-15 Accounting for Foreign Currency Transactions and Translation of Financial Statements of foreign entity subsidiaries

Week 16 FINAL EXAMINATIONS

LEARNING PLAN

Desired Outcomes Course Content/Subject Matter Textbook References Teaching and Learning Assessment tasks for each Time Table

Activities component

Support the mission and Mission, Goals/objectives and Policies NONE Lecture/Discussion Students to submit Week 1 (2 hours)

goals/objectives of the reflection paper on their

college. Mission and goals/objectives of the Sharing of expectations realization from the initial

Explain the subject content college. from the teacher and discussion.

and grading system Classroom policies and grading system. the students

Explain the relationship Discussion of the course syllabus

between and among various

courses and Accounting 143.

Explain purchase of Interest Accounting for Business Combinations Advanced Accounting, Lecture/ Discussion Quiz on the topic Week 1-3 (10 hours)

method of acquisitions A Procedural

Prepare pre-forma financial Definition of terms related to business Approach, Volume 2, Board work Assignments

statements based on combinations Pedro P. Guerrero and

Reasons for business combinations Seatwork

proposed mergers and Jose F. Peralta 2015

consolidations Stock distribution/allocation Issue, 2015 Edition Sharing of insights

Compute the stock Method of accounting for business

allotment for constituent combinations Problem-based

companies Preparation of financial statements discussion

Prepare journal entries to after business combination

reflect the absorption of

other companies by one

corporation

Prepare financial statements

based on mergers and

consolidations

Explain the relevance of Consolidated Financial Statements Advanced Accounting, Lecture/discussion Quiz on the topic Week 4-8 (20 hours)

consolidated financial A Procedural

statements Definition of terms related to Approach, Volume 2, Board work Assignments

Compute the book value of acquisitions Pedro P. Guerrero and

subsidiary interest acquired Jose F. Peralta 2015 Seatwork

by a parent and the Basic concepts, approaches, procedures Issue, 2015 Edition

in preparing consolidated financial Sharing of insights

treatment of any difference

between investment cost statements

Problem-based

and said book value discussion

Consolidated balance sheet at date of

Prepare elimination entries

acquisition

Prepare working papers for

consolidation of financial Consolidated financial statements

statements. subsequent to date of acquisition.

Compute for the

consolidated income and Preparation of consolidated statements

retained earnings

Prepare consolidated

financial statements

Prepare required disclosures

COMPREHENSIVE QUIZ (ALL TOPIC DISCUSSED) Week 9 (2 hours)

PRELIMINARY EXAMINATION (ALL TOPIC DISCUSSED) Week 9 (2 hours)

Explain terms and nature of Consolidated Financial Statements - Advanced Accounting, Lecture/discussion Quiz on the topic Week 10-12 (12 hours)

intercompany transaction Intercompany Transactions A Procedural

(inventories, depreciable Approach, Volume 2, Board work Assignments

assets and land) between Basic concepts, approaches, procedures Pedro P. Guerrero and

in accounting for intercompany Seatwork

parent and subsidiaries Jose F. Peralta 2015

Prepare elimination entries transactions between parent and Issue, 2015 Edition Sharing of insights

Prepare working papers for subsidiaries.

consolidation of financial Problem-based

Effect of Intercompany transactions in

statements. discussion

the Consolidated financial statements

Compute for the

consolidated income and Preparation of consolidated financial

retained earnings statements

Prepare consolidated

financial statements

Prepare required disclosures

Explain terms and nature of Accounting for Foreign Currency Advanced Accounting, Lecture/discussion Quiz on the topic Week 13-15 (12 hours)

foreign currency Transactions and Translation of Financial A Procedural

transactions Statements of foreign entity subsidiaries Approach, Volume 2, Board work Assignments

Explain the different types of Pedro P. Guerrero and

foreign currency Definition and nature of foreign Jose F. Peralta 2015 Seatwork

transactions currency transactions and foreign Issue, 2015 Edition

currency financial statements Sharing of insights

Compute the for the

exchange gain or loss to be Problem-based

Journal entries showing gain or loss on

recognized discussion

exchange difference

Explain the nature and types

of derivatives Translation methods-temporal,

Explain hedging and hedge monetary, non-monetary and current

accounting

Prepare entries for various Translation adjustment treatment

types of derivatives

Prepare required disclosures

COMPREHENSIVE QUIZ (Consolidated Financial Statements - Intercompany Transactions & Accounting for Foreign Currency Transactions and Translation of Financial

Statements of foreign entity subsidiaries) Week 16 (2 hours)

FINAL EXAMINATION (ALL TOPIC DISCUSSED) Week 16 (2 hours)

Suggested References Practical Accounting 2, Antonio J. Dayag, 2015 Edition

Practical Accounting 2, Pedro P. Guerrero, 2015 Edition

Practical Accounting 2, Punzalan

Course Requirements None

Grading System Prelim 50% % Grade Description

Major exam 50% 100-96 1.00 Excellent

Quizzes 40% 95-92 1.25

Others 10% 91-88 1.50 Very good

Final 50% 87-85 1.75

Major exam 50% 84-82 2.00 Good

Quizzes 40% 81-79 2.25

Others 10% 78-76 2.50 Satisfactory

TOTAL 100% 75-73 2.75

72-70 3.00 Passing

Below 70 5.00 Failure

Classroom Policies Academic Dishonesty

All students are expected to be academically honest. Cheating, lying and other forms of unethical behavior will not be tolerated. Any student found guilty of

cheating in any assignment, quiz, examination or plagiarism in submitted course requirement will receive a grade of 5.0 or failure in the said requirement.

Absences and Tardiness

Prepared by: Recommending Approval: Approved by:

DR. BENANING OMACA-AN DR. CAMAR A. UMPA

Dean President

You might also like

- Ayatul Kursi & QadrDocument11 pagesAyatul Kursi & QadrSi Kaka MiaNo ratings yet

- Bar Repeaters 2010Document3 pagesBar Repeaters 2010Si Kaka MiaNo ratings yet

- Legal FormsDocument8 pagesLegal Formssalv075527No ratings yet

- The Glorious House ofDocument1 pageThe Glorious House ofSi Kaka MiaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assessment and Rating of Learning OutcomesDocument28 pagesAssessment and Rating of Learning OutcomesElisa Siatres Marcelino100% (1)

- Researchmethodology JavedDocument27 pagesResearchmethodology JavedbecbellaryNo ratings yet

- Research On Customer SatisfactionDocument30 pagesResearch On Customer SatisfactionDona Mae BayoranNo ratings yet

- Las Science 10 Melc 1 q2 Week1Document7 pagesLas Science 10 Melc 1 q2 Week1LINDSY MAE SULA-SULANo ratings yet

- Health Committees ReportDocument6 pagesHealth Committees ReportKailash NagarNo ratings yet

- Department OF Education: Director IVDocument2 pagesDepartment OF Education: Director IVApril Mae ArcayaNo ratings yet

- DROID: A Large-Scale In-The-Wild Robot Manipulation DatasetDocument21 pagesDROID: A Large-Scale In-The-Wild Robot Manipulation Datasetxepit98367No ratings yet

- Site Directed MutagenesisDocument22 pagesSite Directed MutagenesisARUN KUMARNo ratings yet

- FDARDocument33 pagesFDARRaquel M. Mendoza100% (7)

- Dorothy Joy Nadela-Activity 2Document2 pagesDorothy Joy Nadela-Activity 2DOROTHY JOY NADELANo ratings yet

- Unit - VDocument75 pagesUnit - Vgokul100% (1)

- Glory Field Writing AssignmentDocument2 pagesGlory Field Writing AssignmentRohanSinhaNo ratings yet

- Sizanani Mentor Ship ProgramDocument2 pagesSizanani Mentor Ship ProgramsebafsudNo ratings yet

- MIL 11 12 Q3 0102 What Is Media and Information Literacy PSDocument14 pagesMIL 11 12 Q3 0102 What Is Media and Information Literacy PS2marfu4No ratings yet

- TCF-Annual Report (Website)Document64 pagesTCF-Annual Report (Website)communitymarketsNo ratings yet

- Howardl j3 Depm 622 9040Document7 pagesHowardl j3 Depm 622 9040api-279612996No ratings yet

- 2023 06 19 VacDocument2 pages2023 06 19 VacAnanyaNo ratings yet

- MS401L16 Ready and Resilient Program SRDocument5 pagesMS401L16 Ready and Resilient Program SRAlex LogvinovskyNo ratings yet

- Module 7Document4 pagesModule 7trishia marie monteraNo ratings yet

- 4 PsDocument14 pages4 Psapi-301137304No ratings yet

- Features of 21st Century HRD and Training ProgramsDocument9 pagesFeatures of 21st Century HRD and Training Programstvglacaba1213100% (1)

- Mathematics in The Modern World: CCGE - 104Document42 pagesMathematics in The Modern World: CCGE - 104Mary Rose NaboaNo ratings yet

- LE 2 - Activity 1Document3 pagesLE 2 - Activity 1Niña Gel Gomez AparecioNo ratings yet

- ASFDocument2 pagesASFVince EspinoNo ratings yet

- Dalian University of Foreign LanguagesDocument22 pagesDalian University of Foreign LanguagesCultural Section, Philippine Embassy in ChinaNo ratings yet

- Dokumen Penjajaran Kurikulum Bahasa Inggeris Tingkatan 2 KSSMDocument7 pagesDokumen Penjajaran Kurikulum Bahasa Inggeris Tingkatan 2 KSSMQhairunisa HinsanNo ratings yet

- CTE Microproject Group 1Document13 pagesCTE Microproject Group 1Amraja DaigavaneNo ratings yet

- Dementia Tri-Fold BrochureDocument2 pagesDementia Tri-Fold Brochureapi-27331006975% (4)

- Panjab University BA SyllabusDocument245 pagesPanjab University BA SyllabusAditya SharmaNo ratings yet

- What Is A ParagraphDocument3 pagesWhat Is A ParagraphZaki AbdulfattahNo ratings yet