Professional Documents

Culture Documents

Adv Acc MTPO1 PDF

Uploaded by

uma shankarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv Acc MTPO1 PDF

Uploaded by

uma shankarCopyright:

Available Formats

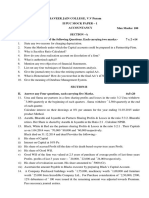

Test Series: August, 2018

MOCK TEST PAPER – 1

INTERMEDIATE (IPC) : GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any five questions from the remaining six questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

(Time allowed: three hours) (Maximum Marks: 100)

1. (a) Sun Limited wishes to obtain a machine costingRs.30 lakhs by way of lease. The effective life of

the machine is 14 years, but the company requires it only for the first 5 years. It enters into an

agreement with Star Ltd., for a lease rental for Rs.3 lakhs p.a. payable in arrears and the implicit

rate of interest is 15%. The chief accountant of Sun Limited is not sure about the treatment of

these lease rentals and seeks your advise. (use annuity factor at @ 15% for 3 years as 3.36)

(b) The Board of Directors of New Graphics Ltd. in its Board Meeting held on 18 th April, 2017,

considered and approved the Audited Financial results along with Auditors Report for the

Financial Year ended 31 st March, 2017 and recommended a dividend of Rs. 2 per equity share

(on 2 crore fully paid up equity shares of Rs. 10 each) for the year ended 31 st March, 2017 and if

approved by the members at the forthcoming Annual General Meeting of the company on 18 th

June, 2017, the same will be paid to all the eligible shareholders.

Discuss on the accounting treatment and presentation of the said proposed dividend in the

annual accounts of the company for the year ended 31 st March, 2017 as per the applicable

Accounting Standard and other Statutory Requirements.

(c) Suhana Ltd. issued 12% secured debentures of Rs. 100 Lakhs on 01.05.2016, to be utilized as under:

Particulars Amount (Rs. in lakhs)

Construction of factory building 40

Purchase of Machinery 35

Working Capital 25

In March 2017, construction of the factory building was completed and machinery was installed

and ready for it's intended use. Total interest on debentures for the financial year ended

31.03.2017 was Rs. 11,00,000. During the year 2016-17, the company had invested idle fund out

of money raised from debentures in banks' fixed deposit and had earned an interest of

Rs. 2,00,000.

Show the treatment of interest under Accounting Standard 16 and also explain nature of assets.

(d) During 2016-17, an enterprise incurred costs to develop and produce a routine, low risk computer

software product, as follows:

Amount (Rs.)

Completion of detailed programme and design 25,000

Coding and Testing 20,000

Other coding costs 42,000

Testing costs 12,000

Product masters for training materials 13,000

Packing the product (1,000 units) 11,000

© The Institute of Chartered Accountants of India

What amount should be capitalized as software costs in the books of the company, on Balance

Sheet date? (4 Parts x 5 Marks = 20 Marks)

2. A, B and C share profits and losses of a business as to 3:2:1 respectively. Their balance sheet as at

31st March, 2018 was as follows:

Liabilities Rs. Assets Rs.

Capital Accounts: Goodwill 10,000

A 70,000 Land 20,000

B 80,000 Buildings 1,10,000

C 10,000 Machinery 50,000

General Reserve 18,000 Motor Car 28,000

Investment Fluctuation Fund 4,000 Furniture 12,000

C Loan 33,000 Investments 18,000

Mrs. A’s loan 15,000 Loose tools 7,000

Creditors 96,000 Stock 18,000

Bills Payable 14,000 Bills receivable 20,000

Bank overdraft 60,000 Debtor: 40,000

Less: Provision 2,000 38,000

Cash 1,000

C’s current A/c 56,000

Profit and Loss A/c 12,000

4,00,000 4,00,000

The partners decide to convert their firm into a Joint Stock Company. For this purpose ABC Ltd. was

formed with an authorized capital of Rs. 10,00,000 divided into Rs. 100 equity Shares. The business of

the firm was sold to the company as at the date of balance sheet given above on the following terms:

(i) Motor car, furniture, investments, loose tools, debtors and cash are not to be taken over by the

company.

(ii) Liabilities for bills payable and bank overdraft are to be taken over by the company.

(iii) The purchase price is settled at Rs. 1,95,500 payable as to Rs. 75,500 in cash and the balance

in company’s fully paid shares of Rs. 100 each.

(iv) The remaining assets and liabilities of the firm are directly disposed of by the firm as per details

given below:

Investments are taken over by A for Rs. 13,000; debtors realize in all Rs. 20,000; Motor Car,

furniture and loose tools fetch Rs. 24,000, Rs. 4,000, and Rs. 1,000 respectively. A agrees to pay

his wife’s loan. The creditors were paid Rs. 94,000 in final settlement of their claims. The

realization expenses amount to Rs. 500.

(v) The equity share received from the vendor company are to be divided among the partners in

profit-sharing ratio.

You are required to prepare the necessary ledger accounts. (16 Marks)

3. (a) Mr. Chena Swami of Chennai trades in Refined Oil and Ghee. It has a branch at Salem. He

despatches 30 tins of Refined Oil @ Rs. 1,500 per tin and 20 tins of Ghee @ Rs. 5,000 per tin on

1st of every month. The Branch has incurred expenditure of Rs. 45,890 which is met out of its

collections; this is in addition to expenditure directly paid by Head Office.

© The Institute of Chartered Accountants of India

Following are the other details:

Chennai H.O. Salem B.O.

Amount (Rs.) Amount (Rs.)

Purchases:

Refined Oil 27,50,000

Ghee 48,28,000

Direct Expenses 6,35,800

Expenses paid by H.O. 76,800

Sales:

Refined Oil 24,10,000 5,95,000

Ghee 38,40,500 14,50,000

Collection during the year 20,15,000

Remittance by Branch to Head Office 19,50,000

Chennai H.O.

Balance as on 01-04-2017 31-03-2018

Amount (Rs.) Amount (Rs.)

Stock:

Refined Oil 44,000 8,90,000

Ghee 10,65,000 15,70,000

Building 5,10,800 7,14,780

Furniture & Fixtures 88,600 79,740

Salem Brach Office

Balance as on 01-04-2017 31-03-2018

Amount (Rs.) Amount (Rs.)

Stock:

Refined Oil 22,500 19,500

Ghee 40,000 90,000

Sundry Debtors 1,80,000 ?

Cash in hand 25,690 ?

Furniture & Fixtures 23,800 21,420

Additional information:

(i) Addition to Building on 01-04-2017 Rs. 2,41,600 by H.O.

(ii) Rate of depreciation: Furniture & Fixtures @ 10% and Building @ 5% (already adjusted in

the above figure)

(iii) The Branch Manager is entitled to 10% commission on branch profits after charging such

commission.

(iv) The General Manager is entitled to a salary of Rs. 20,000 per month.

(v) General expenses incurred by Head Office is Rs. 1,86,000.

© The Institute of Chartered Accountants of India

You are requested to prepare Branch Account in the Head Office books and also prepare Chena

Swami’s Trading and Profit & loss Account (excluding branch transactions) for the year ended

31st March, 2018.

(b) What are the conditions to be fulfilled by a company to buy-back its equity shares as per the

companies Act, 2013. Explain in brief. (12 + 4 = 16 Marks)

4. The following were the summarized Balance Sheets of P Ltd. and V Ltd. as at 31 -3-20X1:

Liabilities P Ltd. V Ltd.

(Rs. in lakhs) (Rs. in lakhs)

Equity Share Capital (Fully paid shares of Rs. 10 each) 15,000 6,000

Securities Premium 3,000 –

Foreign Project Reserve – 310

General Reserve 9,500 3,200

Profit and Loss Account 2,870 825

12% Debentures – 1,000

Trade payables 1,200 463

Provisions 1,830 702

33,400 12,500

Assets P Ltd. V Ltd.

(Rs. in lakhs) (Rs. in lakhs)

Land and Buildings 6,000 –

Plant and Machinery 14,000 5,000

Furniture, Fixtures and Fittings 2,304 1,700

Inventory 7,862 4,041

Trade receivables 2,120 1,100

Cash at Bank 1,114 609

Cost of Issue of Debentures — 50

33,400 12,500

All the bills receivable held by V Ltd. were P Ltd.’s acceptances.

On 1st April 20X1, P Ltd. took over V Ltd in an amalgamation in the nature of merger. It was agreed

that in discharge of consideration for the business P Ltd. would allot three fully paid equity shares of

Rs. 10 each at par for every two shares held in V Ltd. It was also agreed that 12% debentures in V

Ltd. would be converted into 13% debentures in P Ltd. of the same amount and denomination.

Details of trade receivables and trade payables as under:

Assets P Ltd. V Ltd.

(Rs. in lakhs) (Rs. in lakhs)

Trade payables

Bills Payable 120 -

Creditors 1,080 463

1,200 463

Trade receivables

Debtors 2,120 1,020

Bills Receivable — 80

2,120 1,100

4

© The Institute of Chartered Accountants of India

Expenses of amalgamation amounting to Rs. 1 lakh were borne by P Ltd.

You are required to:

(i) Pass journal entries in the books of P Ltd. and

(ii) Prepare P Ltd.’s Balance Sheet immediately after the merger considering that the cost of issue of

debentures shown in the balance sheet of the V Ltd. company is not transferred to the P Ltd.

company. (16 Marks)

5. (a). X Fire Insurance Co. Ltd. commenced its business on 1.4.20X1. It submits you the following

information for the year ended 31.3.20X2:

Rs.

Premiums received 15,00,000

Re-insurance premiums paid 1,00,000

Claims paid 7,00,000

Expenses of Management 3,00,000

Commission paid 50,000

Claims outstanding on 31.3.20X2 1,00,000

Create reserve for unexpired risk @50%

Prepare Revenue account of X Fire Insurance company for the year ended 31.3.20X2.

(b) A liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount

distributed to Preferential Creditors and 3% on the payment made to Unsecured Creditors. The

assets were realized for Rs. 45,00,000 against which payment was made as follows :

Liquidation expenses Rs. 50,000

Secured Creditors Rs. 15,00,000

Preferential Creditors Rs. 1,25,000

The amount due to Unsecured Creditors was Rs. 15,00,000. You are asked to calculate the total

remuneration payable to liquidator. Calculation shall be made to the nearest multiple of a rupee.

(c) Mohan started a business on 1 st April 2017 with Rs. 12,00,000 represented by 60,000 units of

Rs. 20 each. During the financial year ending on 31 st March, 2018, he sold the entire stock for

Rs. 30 each. In order to maintain the capital intact, calculate the maximum amount, which can

be withdrawn by Mohan in the year 2017-18 if Financial Capital is maintained at historical cost.

(8 +4 + 4 = 16 Marks)

6. The following are the figures extracted from the books of TOP Bank Limited as on 31.3.2017.

Rs.

Interest and discount received 59,29,180

Interest paid on deposits 32,59,920

Issued and subscribed capital 16,00,000

Salaries and allowances 3,20,000

Directors fee and allowances 48,000

Rent and taxes paid 1,44,000

Postage and telegrams 96,460

Statutory reserve fund 12,80,000

Commission, exchange and brokerage 3,04,000

Rent received 1,04,000

Profit on sale of investments 3,20,000

Depreciation on bank’s properties 48,000

5

© The Institute of Chartered Accountants of India

Statutory expenses 44,000

Preliminary expenses 40,000

Auditor’s fee 28,000

The following further information is given:

(i) A customer to whom a sum of Rs. 16 lakhs has been advanced has become insolvent and it is

expected only 40% can be recovered from his estate.

(ii) There were also other debts for which a provision of Rs. 2,10,000 was found necessary by the

auditors.

(iii) Rebate on bills discounted on 31.3.2016 was Rs. 19,000 and on 31.3.2017 was Rs. 25,000.

(iv) Preliminary expenses are to be fully written off during the year.

(v) Provide Rs. 9,00,000 for Income-tax.

(vi) Profit and Loss account opening balance was Nil as on 31.3.2016.

Prepare the Profit and Loss account of TOP Bank Limited for the year ended 31.3.2017. (16 Marks)

7. Answer any four of the followings:

(a) An airline is required by law to overhaul its aircraft once in every five years. The pacific Airlines

which operate aircrafts does not provide any provision as required by law in its final accounts.

Discuss with reference to relevant Accounting Standard 29.

(b) A company had imported raw materials worth US Dollars 6,00,000 on 5 th January, 2017, when

the exchange rate was Rs. 43 per US Dollar. The company had recorded the transaction in the

books at the above mentioned rate. The payment for the import transaction was made on

5th April, 2017 when the exchange rate was Rs. 47 per US Dollar. However, on 31 st March, 2017,

the rate of exchange was Rs. 48 per US Dollar. The company passed an entry on 31 st March,

2017 adjusting the cost of raw materials consumed for the difference between Rs. 47 and Rs. 43

per US Dollar.

In the background of the relevant accounting standard, is the company’s accounting treatment

correct? Discuss.

(c) A company has its share capital divided into shares of Rs. 10 each. On 1-1-20X1, it granted

5,000 employees stock options at Rs. 50, when the market price was Rs. 140. The options were

to be exercised between 1-3-20X2 to 31-03-20X2. The employees exercised their options for

4,800 shares only; remaining options lapsed. Pass the necessary journal entries for the year

ended 31-3-20X2, with regard to employees’ stock options.

(d) Department X sells goods to Department Y at a profit of 50% on cost and to Department Z at

20% on cost. Department Y sells goods to Department X and Z at a profit of 25% and 15%

respectively on sales. Department Z charges 30% profit on cost to Department X and 40 profit on

sale to Y.

Stocks lying at different departments at the end of the year are as under:

Dept. X Dept. Y Dept. Z

Rs. Rs. Rs.

Transfer from Department X 75,000 48,000

Transfer from Department Y 50,000 82,000

Transfer from Department Z 52,000 56,000

Calculate the unrealized profit of each department and also total unrealized profit.

(e) Explain the Limitations of Liability of Limited Liability Partnership (LLP) and its partners.

(4 Parts x 4 Marks = 16 Marks)

6

© The Institute of Chartered Accountants of India

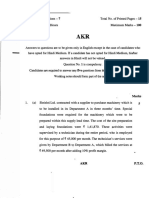

Test Series: August, 2018

MOCK TEST PAPER – 1

INTERMEDIATE (IPC) : GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

SUGGESTED ANSWERS/HINTS

1. (a) As per AS 19 ‘leases’, a lease will be classified as finance lease if at the inception of the lease,

the present value of minimum lease payment amounts to at least substantially all of the fair value

of leased asset. In the given case, the implicit rate of interest is given at 15%. The present value

of minimum lease payments at 15% using PV- Annuity Factor can be computed as:

Annuity Factor (Year 1 to Year 5) 3.36 (approx.)

Present Value of minimum lease payments Rs.10.08 lakhs (approx.)

(Rs.3 lakhs each year)

Thus present value of minimum lease payments is Rs.10.08 lakhs and the fair value of the

machine is Rs. 30 lakhs. In a finance lease, lease term should be for the major part of the

economic life of the asset even if title is not transferred. However, in the given case, the effective

useful life of the machine is 14 years while the lease is only for five years . Therefore, lease

agreement is an operating lease. Lease payments under an operating lease should be

recognized as an expense in the statement of profit and loss on a straight line basis over the

lease term unless another systematic basis is more representative of the time pattern of the

user’s benefit.

(b) As per the amendment in AS 4 “Contingencies and Events Occurring After the Balance Sheet

Date” vide Companies (Accounting Standards) Amendments Rules, 2016 dated 30 th March, 2016,

the events which take place after the balance sheet date, are sometimes reflected in the financial

statements because of statutory requirements or because of their special nature.

However, dividends declared after the balance sheet date but before approval of financial statements

are not recognized as a liability at the balance sheet date because no statutory obligation exists at

that time. Hence such dividends are disclosed in the notes to financial statements.

No, provision for proposed dividends is not required to be made. Such proposed dividends are to

be disclosed in the notes to financial statements. Accordingly, the dividend of Rs. 4 crores

recommended by New Graphics Ltd. in its Board meeting on 18 th April, 2017 shall not be

accounted for in the books for the year 2016-17 irrespective of the fact that it pertains to the year

2016-17 and will be paid after approval in the Annual General Meeting of the members /

shareholders.

(c) As per AS 16 “Borrowing Costs”, borrowing costs that are directly attributable to the acquisi tion,

construction or production of a qualifying asset should be capitalised as part of the cost of that

asset. The amount of borrowing costs eligible for capitalisation should be determined in

accordance with this Standard. Other borrowing costs should be recognised as an expense in the

period in which they are incurred.

Also AS 16 “Borrowing Costs” states that to the extent that funds are borrowed specifically for the

purpose of obtaining a qualifying asset, the amount of borrowing costs eligible for capi talisation

on that asset should be determined as the actual borrowing costs incurred on that borrowing

during the period less any income on the temporary investment of those borrowings.

Thus, eligible borrowing cost

= Rs. 11,00,000 – Rs. 2,00,000

= Rs. 9,00,000

1

© The Institute of Chartered Accountants of India

Sr. Particulars Nature of assets Interest to be Interest to be

No. Capitalized (Rs.) charged to Profit

& Loss Account

(Rs.)

i Construction of factory Qualifying Asset* 9,00,000x40/100 NIL

building = Rs. 3,60,000

ii Purchase of Machinery Not a Qualifying Asset NIL 9,00,000x35/100

= Rs. 3,15,000

iii Working Capital Not a Qualifying Asset NIL 9,00,000x25/100

= Rs. 2,25,000

Total Rs. 3,60,000 Rs. 5,40,000

* A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for

its intended use or sale.

(d) As per AS 26, costs incurred in creating a computer software product should be charged to

research and development expense when incurred until technological feasibility/asset recogn ition

criteria has been established for the product. Technological feasibility/asset recognition criteria

have been established upon completion of detailed programme design or working model. In this

case, Rs. 45,000 would be recorded as an expense (Rs. 25,000 for completion of detailed

program design and Rs. 20,000 for coding and testing to establish technological feasibility/asset

recognition criteria). Cost incurred from the point of technological feasibility/asset recognition

criteria until the time when products costs are incurred are capitalized as software cost

(Rs. 42,000 + Rs. 12,000 + Rs. 13,000) Rs. 67,000.

2. Realisation Account

Particulars Rs. Rs. Particulars Rs. Rs.

To Goodwill 10,000 By Provision to doubtful Debts 2,000

To Land 20,000 By Trade creditors 96,000

To Buildings 1,10,000 By Bills Payable 14,000

To Machinery 50,000 By Bank overdraft 60,000

To Motor Car 28,000 By Mrs. A’s loan 15,000

To Furniture 12,000 By ABC Ltd. (Purchase price) 1,95,500

To Investments 18,000 By A’s Capital A/c (Investments) 13,000

To Loose tools 7,000 By Cash A/c:

To Stock 18,000 Debtors 20,000

To Bill receivable 20,000 Motor Car 24,000

To Debtors 40,000 Furniture 4,000

To A’s Capital A/c 15,000 Loose tools 1,000 49,000

(Mrs. A’s Loan)

To Cash A/c:

Creditors 94,000

Realisation expenses 500 94,500

To Profit on Realisation

t/f to:

A’s Capital A/c 1,000

B’s Capital A/c 667

C’s Capital A/c 333 2,000

4,44,500 4,44,500

© The Institute of Chartered Accountants of India

ABC Ltd. Account

Particulars Rs. Particulars Rs.

To Realisation A/c 1,95,500 By Cash A/c 75,500

By Shares in ABC Ltd. 1,20,000

1,95,500 1,95,500

Partners’ Capital Accounts

Particulars A B C Particulars A B C

Rs. Rs. Rs. Rs. Rs. Rs.

To Profit and 6,000 4,000 2,000 By Balance b/d 70,000 80,000 10,000

Loss A/c

To Realisation A/c 13,000 - - By C’s Loan A/c - - 33,000

To C’s Current A/c - - 56,000 By General reserve 9,000 6,000 3,000

To shares in 60,000 40,000 20,000 By Investment Fluctuation

ABC Ltd. Fund 2,000 1,333 667

To Cash A/c 18,000 44,000 - By Realization A/c 1,000 667 333

By Realisation A/c (Mrs. A’s 15,000 - -

loan A/c)

By Cash A/c - 31,000

97,000 88,000 78,000 97,000 88,000 78,000

C’s Current Account

Particulars Rs. Particulars Rs.

To Balance b/d 56,000 By C’s Capital A/c-transfer 56,000

56,000 56,000

Shares in ABC Ltd. Account

Particulars Rs. Particulars Rs.

To ABC Ltd. Account 1,20,000 By A’s Capital A/c 60,000

By B’s Capital A/c 40,000

By C’s Capital A/c 20,000

1,20,000 1,20,000

Cash Account

Particulars Rs. Particulars Rs.

To Balance b/d 1,000 By Realisation A/c (Liabilities and expenses) 94,500

To ABC Ltd. 75,500 By A’s Capital A/c 18,000

To Realisation A/c (sale of assets) 49,000 By B’s Capital A/c 44,000

To C’s Capital A/c 31,000 -

1,56,500 1,56,500

Note : Investment Fluctuation Fund Account may be transferred to Realisation Account.

3. (a) In the books of Mr. Chena Swami

Salem Branch Account

Rs. Rs.

To Balance b/d By Bank (Remittance to H.O.) 19,50,000

© The Institute of Chartered Accountants of India

Opening stock:

Ghee 40,000 By Balance c/d

Refined Oil 22,500 Closing stock:

Debtors 1,80,000 Refined oil 19,500

Cash on hand 25,690 Ghee 90,000

Furniture & fittings 23,800 Debtors (W.N. 1) 2,10,000

To Goods sent to Branch A/c Cash on hand (W.N. 2) 44,800

Refined Oil (30x1500x12) 5,40,000 Furniture & fittings 21,420

Ghee (20x5000x12) 12,00,000

To Bank (Expenses paid by H.O.) 76,800

To Branch manager’s commission 20,630

(2,26,930 x 10/110)

To Net Profit transferred

to General P & L A/c 2,06,300

23,35,720 23,35,720

Mr. Chena Swami

Trading and Profit and Loss account for the year ended 31st March, 2018

(Excluding branch transactions)

Rs. Rs.

To Opening Stock: By Sales:

Refined Oil 44,000 Refined Oil 24,10,000

Ghee 10,65,000 Ghee 38,40,500

To Purchases: By Closing Stock:

Refined Oil 27,50,000 Refined Oil 8,90,000

Less: Goods sent Ghee 15,70,000

to Branch (5,40,000) 22,10,000

Ghee 48,28,000

Less: Goods sent

to Branch (12,00,000) 36,28,000

To Direct Expenses 6,35,800

To Gross Profit 11,27,700

87,10,500 87,10,500

To Manager’s Salary 2,40,000 By Gross Profit 11,27,700

To General Expenses 1,86,000 By Branch Profit 2,26,930

transferred

To Depreciation

Furniture (88,600-79,740) 8,860

Building

(5,10,800+2,41,600- 7,14,780) 37,620

To Net profit 8,82,150

13,54,630 13,54,630

© The Institute of Chartered Accountants of India

Working Notes:

(1) Debtors Account

Rs. Rs.

To Balance b/d 1,80,000 By Cash Collections 20,15,000

To Sales made during By Balance c/d 2,10,000

the year: (Bal. Figure)

Refined oil 5,95,000

Ghee 14,50,000

22,25,000 22,25,000

(2) Branch Cash Account

Rs. Rs.

To Balance b/d 25,690 By Remittance 19,50,000

To Collections 20,15,000 By Exp. 45,890

By Balance c/d (Bal. Figure) 44,800

20,40,690 20,40,690

(b) As per the provisions of the Companies Act, 2013:

No company shall purchase its own shares or other specified securities unless —

(a) the buy-back is authorised by its articles;

(b) a special resolution has been passed in general meeting of the company authorising the

buy-back; however, if the buy back is upto 10% of paid up equity + free reserves, the same

may be done with the authorization of the Board Resolution without the necessity of its

being authorized by the articles of association of the company and by a special resolution of

its members passed at a general meeting of the company.

(c) the buy-back must be equal or less than twenty-five per cent of the total paid-up capital and

free reserves of the company: (Resource Test)

(d) Further, the buy-back of shares in any financial year must not exceed 25% of its total paid-

up capital and free reserves: (Share Outstanding Test)

(d) the ratio of the debt owed by the company (both secured and unsecured) after such buy -

back is not more than twice the total of its paid up capital and its free reserves: (Debt-Equity

Ratio Test)

Note: Central Government may prescribe a higher ratio of the debt than that specified under

this clause for a class or classes of companies.

(e) all the shares or other specified securities for buy-back are fully paid-up;

(f) the buy-back of the shares or other specified securities listed on any recognised stock

exchange is in accordance with the regulations made by the Securities and Exchange Board

of India in this behalf;

No offer of buy back under this sub section shall be made within a period of one year reckoned

from the date of closure of a previous offer of buy back if any. Section 69 (1) of the Companies

Act also states that where a company purchases its own shares out of the free reserves or

securities premium account, a sum equal to the nominal value of shares so purchased shall be

transferred to the Capital Redemption Reserve Account and details of such account shall be

disclosed in the Balance Sheet.

The shares or other specified securities which are proposed to be bought-back must be fully

paid-up.

5

© The Institute of Chartered Accountants of India

4. Books of P Ltd.

Journal Entries

Dr. Cr.

(Rs. in Lacs) (Rs. in Lacs)

Business Purchase A/c Dr. 9,000

To Liquidator of V Ltd. 9,000

(Being business of V Ltd. taken over for consideration

settled as per agreement)

Plant and Machinery Dr. 5,000

Furniture & Fittings Dr. 1,700

Inventory Dr. 4,041

Debtors Dr. 1,020

Cash at Bank Dr. 609

Bills Receivable Dr. 80

To Foreign Project Reserve 310

To General Reserve (3,200 - 3,000) 200

To Profit and Loss A/c (825 – 50*) 775

To Liability for 12% Debentures 1,000

To Creditors 463

To Provisions 702

To Business Purchase 9,000

(Being assets & liabilities taken over from V Ltd.)

Liquidator of V Ltd. A/c Dr. 9,000

To Equity Share Capital A/c 9,000

(Purchase consideration discharged in the form of equity

shares)

Profit & loss A/c Dr. 1

To Bank A/c 1

(Liquidation expenses paid by P Ltd.)

Liability for 12% Debentures A/c Dr. 1,000

To 13% Debentures A/c 1,000

(12% debentures discharged by issue of 13% debentures)

Bills Payable A/c Dr. 80

To Bills Receivable A/c 80

(Cancellation of mutual owing on account of bills)

6

© The Institute of Chartered Accountants of India

Balance Sheet of P Ltd. as at 1st April, 20X1 (after merger)

Particulars Notes Rs. (in lakhs)

Equity and Liabilities

1 Shareholders' funds

A Share capital 1 24,000

B Reserves and Surplus 2 16,654

2 Non-current liabilities

A Long-term borrowings 3 1,000

3 Current liabilities

A Trade Payables (1,543 + 40) 1,583

B Short-term provisions 2,532

Total 45,769

Assets

1 Non-current assets

A Fixed assets

Tangible assets 4 29,004

2 Current assets

A Inventories 11,903

B Trade receivables 3,140

C Cash and cash equivalents 1,722

Total 45,769

Notes to accounts

Rs.

1. Share Capital

Equity share capital

Authorised, issued, subscribed and paid up

24 crores equity shares of Rs. 10 each (Of the above shares, 9 crores shares

have been issued for consideration other than cash) 24,000

Total 24,000

2. Reserves and Surplus

General Reserve 9,700

Securities Premium 3,000

Foreign Project Reserve 310

Profit and Loss Account 3,644

Total 16,654

3. Long-term borrowings

Secured

13% Debentures 1,000

4. Tangible assets

Land & Buildings 6,000

© The Institute of Chartered Accountants of India

Plant & Machinery 19,000

Furniture & Fittings 4,004

Total 29,004

Working Note:

Computation of purchase consideration

The purchase consideration was discharged in the form of three equity shares of P Ltd. for every two

equity shares held in V Ltd.

3

Purchase consideration = Rs. 6,000 lacs × = Rs. 9,000 lacs.

2

* Cost of issue of debenture adjusted against P & L Account of V Ltd.

5. (a). Form B – RA (Prescribed by IRDA)

Name of the Insurer: X Fire Insurance Co. Ltd.

Registration No. and Date of registration with the IRDA: …………………..

Revenue Account for the year ended 31st March, 20X2

Particulars Schedule Current year ended

on 31st March, 20X2

Rs.

1. Premium earned (Net) 1 7,00,000

Total (A) 7,00,000

1. Claims incurred (Net) 2 8,00,000

2. Commission 3 50,000

3. Operating Expenses related to insurance business 4 3,00,000

Total (B) 11,50,000

Operating Profit/(Loss) from Fire Insurance Business

[C = (A – B)] (4,50,000)

Schedule 1

Premium earned (Net)

Rs.

Premium received from direct business written 15,00,000

Less: Premium on re-insurance ceded (1,00,000)

14,00,000

Adjustment for change in reserve for unexpired risk 7,00,000

Net Premium Earned 7,00,000

Schedule 2

Claims incurred (Net)

Rs.

Claims paid – Direct 7,00,000

Add: Claims outstanding on 31.3.20X2 1,00,000

Total claims incurred 8,00,000

Schedule 3

Commission

8

© The Institute of Chartered Accountants of India

Commission paid 50,000

Net commission 50,000

Schedule 4

Operating expenses related to insurance business

Rs.

Expenses of Management 3,00,000

(b) Calculation of Total Remuneration payable to Liquidator

Amount in Rs.

2% on Assets realised (45,00,000 x 2%) 90,000

3% on payment made to Preferential creditors (1,25,000 x 3%) 3,750

3% on payment made to Unsecured creditors (Refer W.N) 45,000

Total Remuneration payable to Liquidator 1,38,750

Working Note:

Liquidator’s remuneration on payment to unsecured creditors =

Cash available for unsecured creditors after all payments including liquidation expenses,

payment to secured creditors, preferential creditors & liquidator’s remuneration

= Rs. 45,00,000 – Rs. 50,000 – Rs. 15,00,000 – Rs. 1,25,000 – Rs. 90,000 – Rs. 3,750

= Rs. 27,31,250

Sufficient amount is available for unsecured creditors therefore Liquidator’s remuneration on

payment to unsecured creditors = 3% x Rs. 15,00,000 = Rs. 45,000

(c)

Particulars Financial Capital Maintenance at Historical Cost

(Rs.)

Closing equity

18,00,000 represented by cash

(Rs. 30 x 60,000 units)

Opening equity 60,000 units x Rs. 20 = 12,00,000

Permissible drawings to keep Capital intact 6,00,000 (18,00,000 – 12,00,000)

Thus, in order to maintain the capital intact, Mohan can withdraw Rs. 6,00,000 as the maximum

amount.

6. TOP Bank Limited

Profit and Loss Account for the year ended 31st March, 2017

Schedule Year ended 31.03.2017

(Rs. in ‘000s)

I. Income:

Interest earned 13 5923.18

Other income 14 728.00

Total 6,651.18

II. Expenditure

Interest expended 15 3259.92

© The Institute of Chartered Accountants of India

Operating expenses 16 768.46

Provisions and contingencies (960+210+900) 2,070.00

Total 6,098.38

IIII. Profits/Losses

Net profit for the year 552.80

Profit brought forward nil

552.80

IV. Appropriations

Transfer to statutory reserve (25%) 138.20

Balance carried over to balance sheet 414.60

552.80

Year ended 31.3. 2017

(Rs. in ‘000s)

Schedule 13 – Interest Earned

I. Interest/discount on advances/bills (Refer W.N.) 5923.18

5923.18

Schedule 14 – Other Income

I. Commission, exchange and brokerage 304

II. Profit on sale of investments 320

III. Rent received 104

728

Schedule 15 – Interest Expended

I. Interests paid on deposits 3259.92

Schedule 16 – Operating Expenses

I. Payment to and provisions for employees 320

II. Rent and taxes 144

III. Depreciation on bank’s properties 48

IV. Director’s fee, allowances and expenses 48

V. Auditors’ fee 28

VI. Law (statutory) charges 44

VII. Postage and telegrams 96.46

VIII. Preliminary expenses 40

768.46

Working Note:

(Rs. in ‘000s)

Interest/discount 5,929.18

Add: Rebate on bills discounted on 31.3. 2016 19.00

Less: Rebate on bills discounted on 31.3. 2017 ( 25.00)

5,923.18

10

© The Institute of Chartered Accountants of India

7. (a) A provision should be recognized only when an enterprise has a present obligation arising from a

past event or obligation. In the given case, there is no present obligation but a future one,

therefore no provision is recognized as per AS 29.

The cost of overhauling aircraft is not recognized as a provision because it is a future obligation

and the incurring of the expenditure depends on the company’s decision to continue operating

the aircrafts. Even a legal requirement to overhaul does not require the company to make a

provision for the cost of overhaul because there is no present obligation to overhaul the aircrafts.

Further, the enterprise can avoid the future expenditure by its future action, for example by

selling the aircraft. However, an obligation might arise to pay fines or penalties under the

legislation after completion of five years. Assessment of probability of incurring fi nes and

penalties depends upon the provisions of the legislation and the stringency of the enforcement

regime. A provision should be recognized for the best estimate of any fines and penalties if

airline continues to operate aircrafts for more than five years.

(b) As per AS 11 (revised 2003), ‘The Effects of Changes in Foreign Exchange Rates’, monetary

items denominated in a foreign currency should be reported using the closing rate at each

balance sheet date. The effect of exchange difference should be ta ken into profit and loss

account. Trade payables is a monetary item, hence should be valued at the closing rate i.e.,

Rs. 48 at 31 st March, 2017 irrespective of the payment for the same subsequently at lower rate in

the next financial year. The difference of Rs. 5 (Rs. 48 less Rs. 43) per US dollar should be

shown as an exchange loss in the profit and loss account for the year ended 31 st March, 2017

and is not to be adjusted against the cost of raw materials. In the subsequent year, the company

would record an exchange gain of Rs.1 per US dollar, i.e., the difference between

Rs. 48 and Rs. 47 per US dollar. Hence, the accounting treatment adopted by the company is

incorrect.

(c) In the books of Company

Journal Entries

Date Particulars Dr. Rs. Cr. Rs.

1-3-X2 to Bank A/c Dr. 2,40,000

31-3-X2 Employees compensation expenses A/c Dr. 4,32,000

To Equity Share Capital A/c 48,000

To Securities Premium A/c 6,24,000

(Being allotment to employees 4,800 shares of

Rs. 10 each at a premium of Rs. 130 at an exercise

price of Rs. 50 each)

31-3-X2 Profit and Loss account Dr. 4,32,000

To Employees compensation expenses A/c 4,32,000

(Being transfer of employees compensation expenses)

Working Note:

1. Employee Compensation Expenses = Discount between Market Price and option price =

Rs. 140 – Rs. 50 = Rs. 90 per share = Rs. 90 x 4,800 = Rs. 4,32,000 in total.

2. The Employees Compensation Expense is transferred to Securities Premium Account.

3. Securities Premium Account = Rs. 50 – Rs. 10 = Rs. 40 per share + Rs. 90 per share on

account of discount of option price over market price = Rs. 130 per share = Rs. 130 x 4,800

= Rs. 6, 24,000 in total.

(d) Calculation of unrealized profit of each department and total unrealized profit

Dept. X Dept. Y Dept. Z Total

11

© The Institute of Chartered Accountants of India

Rs. Rs. Rs. Rs.

Unrealized Profit of:

Department X 75,000 x 50/150 48,000 x 20/120 =

= 25,000 8,000 33,000

Department Y 50,000 x .25 = 82,000 x .15 =

12,500 12,300 24,800

Department Z 52,000 x 30/130 = 56,000 x 40/100

12,000 = 22,400 34,400

92,200

(e) Under section 27 (3) of the LLP Act, 2008 an obligation of an LLP arising out of a contract or

otherwise, shall be solely the obligation of the LLP;

The Liabilities of an LLP shall be met out of the properties of the LLP;

Under section 28 (1) a partner is not personally liable, directly or indirectly, for an obligation

referred to in Section 27 (3) above, solely by reason of being a partner in the LLP;

Section 27 (1) states that an LLP is not bound by anything done by a partner in dealing with

a person, if:

• The partner does not have the authority to act on behalf of the LLP in doing a particular

act; and

• The other person knows that the partner has no authority or does not know or believe

him to be a partner in the LLP

Under section 30 (1) the liability of the LLP and the partners perpetrating fraudulent dealings

shall be unlimited for all or any of the debts or other liabilities of the LLP.

12

© The Institute of Chartered Accountants of India

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- PAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaDocument7 pagesPAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaAnmol JajuNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- October2022 B Com WithCredits RegularunderCBCSPatternF Y B Com 956AA1A3Document3 pagesOctober2022 B Com WithCredits RegularunderCBCSPatternF Y B Com 956AA1A3All timeNo ratings yet

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Financial Accounting II MinDocument4 pagesFinancial Accounting II MinAsna Rachal ShibuNo ratings yet

- Accounting for Company Transactions and AmalgamationsDocument68 pagesAccounting for Company Transactions and AmalgamationsOsamaNo ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- FUFA Question Paper_Compre_FOFA(ECON F212) 1st Sem 2018-19 (1) (1) (1)Document2 pagesFUFA Question Paper_Compre_FOFA(ECON F212) 1st Sem 2018-19 (1) (1) (1)vineetchahar0210No ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- Ipcc Advance Accounting Practice Question 2Document5 pagesIpcc Advance Accounting Practice Question 2Shahnawaz Shaikh100% (1)

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- AssigmentDocument8 pagesAssigmentMuhammad Rafique0% (1)

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T) (1)Document5 pages4 CO4CRT11 - Corporate Accounting II (T) (1)emildaraisonNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Advanced AccountingDocument39 pagesAdvanced AccountingHemanth Singh RajpurohitNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Accountancy Revision Test 1Document3 pagesAccountancy Revision Test 1KHUSHI ARORA SOSHNo ratings yet

- FR (Old) MTP Compiler Past 8Document122 pagesFR (Old) MTP Compiler Past 8Pooja GuptaNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- CFS-1 Shot - (C)Document4 pagesCFS-1 Shot - (C)xjnk6fwfvhNo ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- 13. INCOMPLETE RECORDSDocument32 pages13. INCOMPLETE RECORDSSunil KumarNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- CBSE Class 12 Accountancy 2014 Delhi Paper SolutionDocument11 pagesCBSE Class 12 Accountancy 2014 Delhi Paper SolutionAshish GangwalNo ratings yet

- 591617884861 (1)Document9 pages591617884861 (1)YashviNo ratings yet

- Accounts DPP Retirement of A PartnerDocument15 pagesAccounts DPP Retirement of A PartnerPreeti SharmaNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Intermediate - Accounts (19.07.2019)Document10 pagesIntermediate - Accounts (19.07.2019)Åådil MirNo ratings yet

- Nepali Grade 12 Accounting SolutionsDocument10 pagesNepali Grade 12 Accounting SolutionsPrem RajwanshiNo ratings yet

- Business Accounting and Analysis (Semester I) q1xAKCGPn2Document3 pagesBusiness Accounting and Analysis (Semester I) q1xAKCGPn2PriyankaNo ratings yet

- Advance Accountancy Inter PaperDocument14 pagesAdvance Accountancy Inter PaperAbhishek goyalNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- CLG Cetificate 2Document1 pageCLG Cetificate 2uma shankarNo ratings yet

- Ar 2016-17 English PDFDocument366 pagesAr 2016-17 English PDFuma shankarNo ratings yet

- Aditya Business School KakinadaDocument5 pagesAditya Business School Kakinadauma shankarNo ratings yet

- Aditya Business School KakinadaDocument5 pagesAditya Business School Kakinadauma shankarNo ratings yet

- UG CBCS Odd Semester Revised Practical Notification-24Aug18 PDFDocument1 pageUG CBCS Odd Semester Revised Practical Notification-24Aug18 PDFuma shankarNo ratings yet

- Bharat Sanchar Nigam Limited (A Government of India Enterprise)Document14 pagesBharat Sanchar Nigam Limited (A Government of India Enterprise)uma shankarNo ratings yet

- Tools Techniques PDFDocument18 pagesTools Techniques PDFuma shankarNo ratings yet

- Itsm Mtpo1 PDFDocument15 pagesItsm Mtpo1 PDFuma shankarNo ratings yet

- RRB Digest FinalDocument51 pagesRRB Digest Finaluma shankarNo ratings yet

- CG. Ownership Concentration, Foreign Shareholding, Audit Quality, and Stock Price Synchronicity - Evidence From ChinaDocument18 pagesCG. Ownership Concentration, Foreign Shareholding, Audit Quality, and Stock Price Synchronicity - Evidence From ChinaElena DobreNo ratings yet

- Chapter 2 Financial Statement and Analysis PDFDocument26 pagesChapter 2 Financial Statement and Analysis PDFRagy SelimNo ratings yet

- 51938bos41633 p1qDocument5 pages51938bos41633 p1qAman GuptaNo ratings yet

- JP Morgan Emerging MarketsDocument404 pagesJP Morgan Emerging Marketsvini1984100% (1)

- Accountability in A Free-Market Economy - The British Company Audit, 1886Document25 pagesAccountability in A Free-Market Economy - The British Company Audit, 1886bram wahyuNo ratings yet

- Due DiligenceDocument5 pagesDue DiligenceKeith Parker100% (3)

- Goal Assure BrochureDocument20 pagesGoal Assure BrochureBharat19No ratings yet

- Percentage Tax on Services and International CarriersDocument37 pagesPercentage Tax on Services and International CarriersAnie MartinezNo ratings yet

- AC Energy Stock Rights Offer GuidelinesDocument13 pagesAC Energy Stock Rights Offer GuidelinesSpecReliaNo ratings yet

- ch16 0Document9 pagesch16 0HandsomeNo ratings yet

- Kinnaras Capital Management LLCDocument8 pagesKinnaras Capital Management LLCamit.chokshi2353No ratings yet

- Acctg 46 - Business Valuation and ManagementDocument304 pagesAcctg 46 - Business Valuation and ManagementShiela Jane CrismundoNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNo ratings yet

- Manila Bulletin Publishing Corporation Sec Form 17a 2018Document128 pagesManila Bulletin Publishing Corporation Sec Form 17a 2018Kathryn SantosNo ratings yet

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by MelicherDocument13 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by Melichera447816203No ratings yet

- The Statement of Cash Flows: HapterDocument48 pagesThe Statement of Cash Flows: HapterLouiseNo ratings yet

- SEBI LODR RegulationsDocument159 pagesSEBI LODR RegulationsHarshwardhan KakkarNo ratings yet

- GM - Q2 - Las-11-Week 3Document4 pagesGM - Q2 - Las-11-Week 3Ymma Bravo MalanaNo ratings yet

- Lesson 2 Financial Statement AnalysisDocument81 pagesLesson 2 Financial Statement AnalysisRovic OrdonioNo ratings yet

- Project Report - Shriram Transport FinanceDocument40 pagesProject Report - Shriram Transport FinanceVikas Rathod100% (1)

- Managing The Finance FunctionDocument22 pagesManaging The Finance FunctionJohn Eddrien TubongbanuaNo ratings yet

- Chapter 1 Smart Book Financial AccountingDocument40 pagesChapter 1 Smart Book Financial AccountingEmi NguyenNo ratings yet

- AutoZone case study on share repurchases and alternativesDocument1 pageAutoZone case study on share repurchases and alternativesVoramon PolkertNo ratings yet

- Sekuritas Hibrida: Utang Konvertibel: Convertible DebtDocument10 pagesSekuritas Hibrida: Utang Konvertibel: Convertible DebtErna hkNo ratings yet

- All About CryptocurrencyDocument2 pagesAll About Cryptocurrencyshibasis pandaNo ratings yet

- FM300 Syllabus Section A 2012-13Document5 pagesFM300 Syllabus Section A 2012-13dashapuskarjovaNo ratings yet

- EFM4, CH 02, Slides, 07-02-18Document17 pagesEFM4, CH 02, Slides, 07-02-18adiasning navaratriNo ratings yet

- Securities Markets: Learning ObjectivesDocument31 pagesSecurities Markets: Learning ObjectivesFrancisca FusterNo ratings yet

- BCom Syllabi Full KannurDocument79 pagesBCom Syllabi Full KannurrajeshernamNo ratings yet

- PRESENTATION ON Finincial Statement FinalDocument28 pagesPRESENTATION ON Finincial Statement FinalNollecy Takudzwa Bere100% (2)