Professional Documents

Culture Documents

Revenue Regulation No. 3-2018 PDF

Uploaded by

Clifford ParishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Regulation No. 3-2018 PDF

Uploaded by

Clifford ParishCopyright:

Available Formats

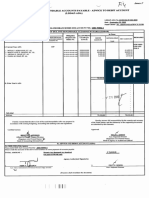

REPUBLIC OF THE PHILIPPINES BUBEAU OF INMNNAI, Ni;.iI.

i;1:Ui,

DEI'AI{TMENT OF FINANCE *o%:,yg'i^i;: '

BUREAU OF INTERNAL RE\'ENUE 'rAN

ls uf,lh^

QLrezon City RECETVEAL,

Januan', 5. 201 8

REVENUE REGULATIONS NO. 3 ' AD/g

SUBJECT : Providing for the Revised Tax Rates on Tobacco Products Pursuant

to the Provisions of Republic Act No. 10963, otherwise known as

"Tax Reform for Acceleration and Inclusion (TRAIN) Lan"',

Amending for the Purpose Revenue Regulations No. 17-2012

TO All Internal Revenue Olficers and Others Concerned.

SECTION t. SCOPE. - Pursuant to the provisions of Section 244 i"t relation to Section

245 of the National Internal Revenue Code of 1997 (NIRC), as amended and Section 84 of

Republic Act No. 10963, otherwise known as "Tax Reform for Acceleration and lnclusiou

(TRAIN) Law'', these RegLrlations are hereby promulgated to provide Ibr the revised tax

rates on cigalettes, amending cefiain provisions of Revenue Regulations (RR) No. I 7-

2012.

SEC. 2. AMENDATORY PROVISIONS. - The provisions of Section 3 Items B(4) and

B(5) of RR No. l7-2012 is hereby amended as follows:

"SEC. 3. REVISED RATES AND BASES OF THE SPECIFIC TAX. - There

shall be levied, assessed and collected an excise tax on tohacco products, in

accordance with the following schedule:

DATE OF EFFECTIVITY OF TAX RATES

Jan ua ry Jull' I, Januart,l, Januarl'l,

January l,

PRODUCT l, 201 8 2018 until 2020 until 2022 until

2424

until ,lune DecemLrer December Decemtrer

onwards

30.20r8 31,20t9 31,2021 31,2023

xxx

B. TOBACCO PRODUCTS

xxx

Per Pack Per Pack Per Pack Per Pack E,ffective

(4)Cigarettes packed by hand

Php 32.50

Php 35.00 Php 37.-s0 Php 40.00 I 112024. the

specific tax

(5) Cigarettes packed by rate shall be

r.nachine increased by

Php 32.50 Php 35.00 Php 37.50 Php 40.00

496 ever7,

Year

tliereafier

xxx

Reven ue Regul ctl ions lrlo

Page 2 of2

SEC. 4. REPEALING CLAUSE. - All regulations. rulings or orders or portions thereof

not consistent with the provisions o1'these RegLrlations are hereby revoked. repealed or

amended accordingly.

SEC. 5. EFFECTIVITY CLAUSE. - These Regulations shall take effect inrmediatell,

following its publication in a newspaper of gelteral circulatiott.

CARLOS G. DOMINreUEZ

Secretary of Finance

i oooTte

JAt'l 1 1 2018

Recornrnendi ng Approva I :

-AY"x^At'

CAESAR R. DULAY

1 BIiREAU

R

3F IiJIUBNAI BE*EI{'',E

gCOP.DS MGT. DTVIS]iON

tD:40 A.U,

'01245e

Commissioner of Internal Revenue

JAN t5 20tg

,rM*

RE CEtrVEW

BIR TRAIN IRR/RR Drafting Cornnrittee

You might also like

- KMC MAG Solutions, Inc.: During The Internship Period, You Will Be Exposed To These AreasDocument1 pageKMC MAG Solutions, Inc.: During The Internship Period, You Will Be Exposed To These AreasClifford ParishNo ratings yet

- Trojan Horse in The West Philippine SeaDocument2 pagesTrojan Horse in The West Philippine SeaClifford ParishNo ratings yet

- Teofilo Evangelista Vs People of The PhilippinesDocument2 pagesTeofilo Evangelista Vs People of The PhilippinesClifford ParishNo ratings yet

- Dale Strickland vs. Ernst & Young LLPDale Strickland vs. Punongbayan & AraulloDocument24 pagesDale Strickland vs. Ernst & Young LLPDale Strickland vs. Punongbayan & AraulloAnthony ReandelarNo ratings yet

- People of The Philippines Vs Yu HaiDocument2 pagesPeople of The Philippines Vs Yu HaiClifford ParishNo ratings yet

- SRC Rule 68, As Amended Rules and Regulations Covering Form and Content of Financial StatementsDocument18 pagesSRC Rule 68, As Amended Rules and Regulations Covering Form and Content of Financial StatementsClifford ParishNo ratings yet

- RR No. 1-2018 PDFDocument3 pagesRR No. 1-2018 PDFlance757No ratings yet

- RR No. 2-2018 PDFDocument4 pagesRR No. 2-2018 PDFTRISHANo ratings yet

- List of Due and Demandable Accounts Payable - Advice To Debit AccountDocument4 pagesList of Due and Demandable Accounts Payable - Advice To Debit AccountClifford ParishNo ratings yet

- Midyear Bonus 2017 GuidelinesDocument7 pagesMidyear Bonus 2017 GuidelinesMark Madrona100% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Resolution No. 248: Province of South CotabatoDocument2 pagesResolution No. 248: Province of South CotabatoCristina QuincenaNo ratings yet

- THE INDIAN CONSTITUTION Foundation Course ProjectDocument22 pagesTHE INDIAN CONSTITUTION Foundation Course ProjectSoham DevlekarNo ratings yet

- ORDER DENYING REHEARINGS AND MOTIONS TO STAY - November 15, 2017)Document25 pagesORDER DENYING REHEARINGS AND MOTIONS TO STAY - November 15, 2017)2rQiTPh4KnNo ratings yet

- Nyasidhi Primary Schol Inauguration of Bom Meeting Held at Wagai Primary School On 1Document6 pagesNyasidhi Primary Schol Inauguration of Bom Meeting Held at Wagai Primary School On 1gracerace internetvillaNo ratings yet

- Decentralized Governance Accountability, Transparency & CorruptionDocument4 pagesDecentralized Governance Accountability, Transparency & CorruptionAnubhab MukherjeeNo ratings yet

- Inception ReportDocument13 pagesInception ReportPrincess TiosejoNo ratings yet

- Pakistan - A Personal History - Imran KhanDocument257 pagesPakistan - A Personal History - Imran KhanAhmad Touqir100% (1)

- Substitution FormDocument3 pagesSubstitution FormPeter Paul Hormachuelos NacuaNo ratings yet

- VERIFICATION and Certification SampleDocument3 pagesVERIFICATION and Certification SampleRichard Colunga100% (7)

- Efficient Use of Paper RuleDocument6 pagesEfficient Use of Paper RuleMaria Margaret Macasaet100% (1)

- Intuit IDC - Commute Service SOP's PDFDocument3 pagesIntuit IDC - Commute Service SOP's PDFNimisha JithNo ratings yet

- Fundamental Rights: Q. What Do You Understand by Fundamental Rights? Discuss With Respect To Indian ConstitutionDocument4 pagesFundamental Rights: Q. What Do You Understand by Fundamental Rights? Discuss With Respect To Indian ConstitutionShubhika PantNo ratings yet

- Government 97: The Sophomore Tutorial in GovernmentDocument10 pagesGovernment 97: The Sophomore Tutorial in GovernmentDylan SchafferNo ratings yet

- Adobe Scan 05 Jun 2022 ADocument21 pagesAdobe Scan 05 Jun 2022 AAlisterNo ratings yet

- Cim 16000 8BDocument449 pagesCim 16000 8BAnnthony Goom'zNo ratings yet

- Great Depression - Graphic OrganizerDocument2 pagesGreat Depression - Graphic Organizerapi-252609657No ratings yet

- 7th Grade US History Lesson Plans Week 8Document7 pages7th Grade US History Lesson Plans Week 8christopher salberNo ratings yet

- How your name is listed can diminish legal status to slaveryDocument3 pagesHow your name is listed can diminish legal status to slaverycylinkean56100% (2)

- Case - 2 - Kalamazoo - Zoo SolutionDocument27 pagesCase - 2 - Kalamazoo - Zoo SolutionAnandNo ratings yet

- Women and Human Rights Project - Protection of Women From Domestic Violence ActDocument22 pagesWomen and Human Rights Project - Protection of Women From Domestic Violence ActSmriti SrivastavaNo ratings yet

- Red TapeDocument26 pagesRed TapeRoma OrtizNo ratings yet

- Using Mercenaries and Private Security Companies Areas of ConflictDocument9 pagesUsing Mercenaries and Private Security Companies Areas of ConflictpokeyballNo ratings yet

- Just A Few Years Left For Us Non NationDocument17 pagesJust A Few Years Left For Us Non NationlazyENo ratings yet

- Employment Application (PDF Format)Document2 pagesEmployment Application (PDF Format)anon-54100100% (1)

- fflanila: L/epublit of TbeDocument2 pagesfflanila: L/epublit of TbeRonil ArbisNo ratings yet

- China-Pakistan Relations 2017 PDFDocument49 pagesChina-Pakistan Relations 2017 PDFKAZMI01No ratings yet

- DOJ DirectoryDocument80 pagesDOJ DirectoryAmil Macalimbon100% (2)

- MACEDONIA: ITS RACES AND THEIR FUTUREDocument406 pagesMACEDONIA: ITS RACES AND THEIR FUTUREEmilian MărgăritNo ratings yet

- Free TravelDocument2 pagesFree Travelssr1170No ratings yet

- Saudi Arabia-Iran Contention and The Role ofDocument13 pagesSaudi Arabia-Iran Contention and The Role ofAdonay TinocoNo ratings yet