Professional Documents

Culture Documents

History of Insurance

Uploaded by

Daryll Gayle AsuncionCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

History of Insurance

Uploaded by

Daryll Gayle AsuncionCopyright:

Available Formats

The earliest form of insurance is probably marine insurance, although forms of mutuality (group self-

insurance) existed before that. Marine insurance originated with the merchants of the Hanseatic

league and the financiers of Lombardy in the 12th and 13th centuries, recorded in the name of

Lombard Street in the City of London, the oldest trading insurance market. In those early days,

insurance was intrinsically coupled with the expansion of mercantilism, and exploration (and

exploitation) of new sources of gold, silver, spices, furs and other precious goods - including slaves -

from the New World. For these merchant adventurers, insurance was the "means whereof it comes

to pass that upon the loss or perishing of any ship there followed not the undoing of any man, but the

loss lighteth rather easily upon many than upon a few... whereby all merchants, especially those of

the younger sort, are allured to venture more willingly and more freely."[1]

The expansion of English maritime trade made London the centre of an insurance market that, by

the 18th century, was the largest in the world. Underwriters sat in bars, or newly fashionable coffee-

shops such as that run by Edward Lloyd on Lombard Street, considering the details of proposed

mercantile "adventures" and indicating the extent to which they would share upon the risks entailed

by writing their "scratch" or signature upon the documents shown to them.

At the same time, eighteenth-century judge William Murray, Lord Mansfield, was developing the

substantive law of insurance to an extent where it has largely remained unchanged to the present

day - at least insofar as concerns commercial, non-consumer business - in the common-law

jurisdictions. Mansfield drew from "foreign authorities" and "intelligent merchants"

"Those leading principles which may be considered the common law of the sea, and the common

law of merchants, which he found prevailing across the commercial world, and to which every

question of insurance was easily referrable. Hence the great celebrity of his judgments, and hence

the respect they command in foreign countries".[2]

By the 19th century membership of Lloyd's was regulated and in 1871, the Lloyd's Act was passed,

establishing the corporation of Lloyd's to act as a market place for members, or "Names". And in the

early part of the twentieth century, the collective body of general insurance law was codified in 1904

into the Marine Insurance Act 1906, with the result that, since that date, marine and non-marine

insurance law have diverged, although fundamentally based on the same original principles.

You might also like

- History of Insurance-WWW - SELUR.TKDocument9 pagesHistory of Insurance-WWW - SELUR.TKselurtimaNo ratings yet

- The Pharoah'S DreamDocument8 pagesThe Pharoah'S DreamAnonymous bmJQDgNo ratings yet

- Metlife HistoryDocument26 pagesMetlife HistoryImam Hosen IqbalNo ratings yet

- History of Marine InsuranceDocument5 pagesHistory of Marine InsuranceG100% (3)

- Introduction To Stock ExchangeDocument9 pagesIntroduction To Stock ExchangeRahul TanverNo ratings yet

- 100 Marks InsuranceDocument57 pages100 Marks InsuranceGeetha KannanNo ratings yet

- Marine Insurance and Its Legal Aspects in Indi PDFDocument17 pagesMarine Insurance and Its Legal Aspects in Indi PDFBharat RkNo ratings yet

- Desert at IonDocument12 pagesDesert at IonSultan AribeenNo ratings yet

- Stock ExchangeDocument15 pagesStock ExchangeVignesh VictoryNo ratings yet

- History of Insu-Wps OfficeDocument2 pagesHistory of Insu-Wps OfficeSIDHARTH TiwariNo ratings yet

- BF ProjectDocument105 pagesBF ProjectAliya UmairNo ratings yet

- The Marine Insurance Act Centenary A Cause For Celebration?Document8 pagesThe Marine Insurance Act Centenary A Cause For Celebration?ManojNo ratings yet

- History and Development of Insurance IndustryDocument35 pagesHistory and Development of Insurance IndustryTejashwini JNo ratings yet

- A Modern - I - Lex Mercatoria - I - Political Rhetoric or SubstantivDocument24 pagesA Modern - I - Lex Mercatoria - I - Political Rhetoric or SubstantivИмран ХабибулинNo ratings yet

- The History of Insurance Throughout The WorldDocument29 pagesThe History of Insurance Throughout The WorldNrnNo ratings yet

- Insurance Law ProjectDocument4 pagesInsurance Law ProjectRajdeep DuttaNo ratings yet

- Acknowledgment: Cost Benefit Analysis of Increased Ship Owner ResponsibilityDocument95 pagesAcknowledgment: Cost Benefit Analysis of Increased Ship Owner ResponsibilityaleventNo ratings yet

- Chapter 1Document7 pagesChapter 1Eko WaluyoNo ratings yet

- Risk Management Module 5Document16 pagesRisk Management Module 5Pamela Anne LasolaNo ratings yet

- History of Insurance 11gcwejDocument6 pagesHistory of Insurance 11gcwejKirona Mae Dari BalanayNo ratings yet

- Prime Life Insurance LimitedDocument36 pagesPrime Life Insurance LimitedFaquir Sanoar SanyNo ratings yet

- History of Insurance Adjusting, Part 2: The Rise of Medieval GuildsDocument4 pagesHistory of Insurance Adjusting, Part 2: The Rise of Medieval GuildshenrydeeNo ratings yet

- Stock Market: History Types of Stock Exchanges Function & PurposeDocument64 pagesStock Market: History Types of Stock Exchanges Function & PurposeMrinmayi NaikNo ratings yet

- Law 455 - Maritime LawDocument17 pagesLaw 455 - Maritime LawKarma Yangzom100% (1)

- Insurance Reviewer - Largely Based On CamposDocument75 pagesInsurance Reviewer - Largely Based On Camposcmv mendozaNo ratings yet

- Carale MergedDocument285 pagesCarale MergedKari LeyvaNo ratings yet

- Hidden Interest: The Prohibition of Usury in Medieval EuropeDocument15 pagesHidden Interest: The Prohibition of Usury in Medieval Europeekinymm9445No ratings yet

- The Dispatch of Merchants - Copy P.7Document72 pagesThe Dispatch of Merchants - Copy P.7Luc LeblancNo ratings yet

- 1 DocumentDocument13 pages1 DocumentAbhishek SadhwaniNo ratings yet

- Law of Negotiable Instruments ExplainedDocument24 pagesLaw of Negotiable Instruments Explainedshiftn7100% (3)

- What Is Maritime LawDocument31 pagesWhat Is Maritime LawMullur SrinivasanNo ratings yet

- Admiralty Law - WikipediaDocument59 pagesAdmiralty Law - WikipediaHarel Santos RosaciaNo ratings yet

- Stock Exchange From GoogleDocument18 pagesStock Exchange From GoogleImran HassanNo ratings yet

- Introduction Stock ExchangeDocument27 pagesIntroduction Stock ExchangeAditya SawantNo ratings yet

- Gerard de Malynes and The Theory of The Foreign Exchanges PDFDocument16 pagesGerard de Malynes and The Theory of The Foreign Exchanges PDFVlatko LackovićNo ratings yet

- Commercial Instruments The Law Merchant and Negotiability: University of Minnesota Law SchoolDocument19 pagesCommercial Instruments The Law Merchant and Negotiability: University of Minnesota Law SchoolEsther MaugoNo ratings yet

- History of InsuranceDocument22 pagesHistory of InsuranceTuhin RahmanNo ratings yet

- Insurance and Economic Development Chapter SummaryDocument16 pagesInsurance and Economic Development Chapter SummaryMohmmad QadiNo ratings yet

- Governance and Institutional Change in Marine Insurance, 1350 - 1850Document18 pagesGovernance and Institutional Change in Marine Insurance, 1350 - 1850Lahiru VirajNo ratings yet

- Sales Process Max NewDocument67 pagesSales Process Max NewumeshrathoreNo ratings yet

- History of BankingDocument6 pagesHistory of Bankinglianna marieNo ratings yet

- Understanding Marine InsuranceDocument49 pagesUnderstanding Marine InsurancePoonam NavaleNo ratings yet

- Origins of Freedom and FEWDocument13 pagesOrigins of Freedom and FEWchris.haigh1No ratings yet

- History of Insurance - WikipediaDocument14 pagesHistory of Insurance - WikipediaSuhani YadavNo ratings yet

- Guide to Understanding Stock ExchangesDocument15 pagesGuide to Understanding Stock ExchangesNickolas YoungNo ratings yet

- Maritime Law IntroductionDocument94 pagesMaritime Law IntroductionAmrutha PrakashNo ratings yet

- Origin and Creation: London Guilds of the Twelfth Century Katherine PayneDocument8 pagesOrigin and Creation: London Guilds of the Twelfth Century Katherine PayneEPNo ratings yet

- Ch.1 L1.3 History of Marine, Fire & Life InsuranceDocument9 pagesCh.1 L1.3 History of Marine, Fire & Life InsurancevibhuNo ratings yet

- Mercantilism - Practice of State Dirigism and ProtectionismDocument12 pagesMercantilism - Practice of State Dirigism and ProtectionismAbraham L ALEMUNo ratings yet

- MarineDocument25 pagesMarineIdrisNo ratings yet

- 8Document3 pages8Hole StudioNo ratings yet

- History of Insurance 002Document31 pagesHistory of Insurance 002Jaime DaliuagNo ratings yet

- Bill of LadingDocument13 pagesBill of LadingHarikrishnaNo ratings yet

- IMLI-Marine Insurance LawDocument25 pagesIMLI-Marine Insurance LawHERBERTO PARDONo ratings yet

- Gerard De Malynes' Theory of Foreign ExchangesDocument16 pagesGerard De Malynes' Theory of Foreign ExchangesVlatko LackovićNo ratings yet

- The Role of Insurance in Society.: (5 Pages)Document5 pagesThe Role of Insurance in Society.: (5 Pages)Venkatesh SubramaniamNo ratings yet

- Stock ExchangeDocument15 pagesStock Exchangeshiva977No ratings yet

- Meralco Securities Corporation vs. SavellanoDocument2 pagesMeralco Securities Corporation vs. SavellanoDaryll Gayle AsuncionNo ratings yet

- UP Bar Reviewer 2013 - Civil LawDocument406 pagesUP Bar Reviewer 2013 - Civil LawPJGalera100% (37)

- Civil Syllabus PDFDocument14 pagesCivil Syllabus PDFHabib SimbanNo ratings yet

- SY PO Vs CADocument1 pageSY PO Vs CADaryll Gayle AsuncionNo ratings yet

- Poquiz Labor Law ReviewerDocument16 pagesPoquiz Labor Law Reviewerwhisper13941No ratings yet

- CIR Vs MagsaysayDocument5 pagesCIR Vs MagsaysayDaryll Gayle AsuncionNo ratings yet

- Remedies 2Document1 pageRemedies 2Daryll Gayle AsuncionNo ratings yet

- Marcos II Vs CADocument1 pageMarcos II Vs CADaryll Gayle AsuncionNo ratings yet

- Cir V Pagcor RealtyDocument1 pageCir V Pagcor RealtyDaryll Gayle AsuncionNo ratings yet

- NDC sale of vessels not subject to VATDocument5 pagesNDC sale of vessels not subject to VATDaryll Gayle AsuncionNo ratings yet

- Income Tax Cases 2Document50 pagesIncome Tax Cases 2Daryll Gayle AsuncionNo ratings yet

- IBP ComplaintDocument6 pagesIBP ComplaintDaryll Gayle AsuncionNo ratings yet

- RemediesDocument36 pagesRemediesDaryll Gayle AsuncionNo ratings yet

- Income Tax CasesDocument13 pagesIncome Tax CasesDaryll Gayle AsuncionNo ratings yet

- CIR Vs MagsaysayDocument5 pagesCIR Vs MagsaysayDaryll Gayle AsuncionNo ratings yet

- Cases in TaxationDocument1 pageCases in TaxationDaryll Gayle AsuncionNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossDaryll Gayle AsuncionNo ratings yet

- Affirmative and Negative EasementsDocument1 pageAffirmative and Negative EasementsDaryll Gayle AsuncionNo ratings yet

- PALE CASES March 3Document32 pagesPALE CASES March 3Daryll Gayle AsuncionNo ratings yet

- Cases Spec ProDocument31 pagesCases Spec ProDaryll Gayle AsuncionNo ratings yet

- The Foreclosure Process Step by StepDocument10 pagesThe Foreclosure Process Step by StepDaryll Gayle AsuncionNo ratings yet

- Attorney-client relationship disputeDocument259 pagesAttorney-client relationship disputeDaryll Gayle AsuncionNo ratings yet

- General ProvisionDocument1 pageGeneral ProvisionKim GuevarraNo ratings yet

- Republic of The PhilippinesDocument1 pageRepublic of The PhilippinesDaryll Gayle AsuncionNo ratings yet

- Court Drops Sheriff From Rolls Due To AbsencesDocument70 pagesCourt Drops Sheriff From Rolls Due To AbsencesDaryll Gayle AsuncionNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossDaryll Gayle AsuncionNo ratings yet

- PALEDocument5 pagesPALEDaryll Gayle AsuncionNo ratings yet

- General ProvisionDocument1 pageGeneral ProvisionKim GuevarraNo ratings yet

- Case Digests in Insurance Daryll Gayle Asuncion October 4, 2018Document9 pagesCase Digests in Insurance Daryll Gayle Asuncion October 4, 2018Daryll Gayle AsuncionNo ratings yet

- General ProvisionDocument1 pageGeneral ProvisionKim GuevarraNo ratings yet

- Marie Curie Presentation Financial ReportingDocument28 pagesMarie Curie Presentation Financial ReportingArmantoCepongNo ratings yet

- Commercial Banks: Investopedia)Document3 pagesCommercial Banks: Investopedia)Minmin WaganNo ratings yet

- Precious Metal AgreementDocument25 pagesPrecious Metal AgreementlboninsouzaNo ratings yet

- Marketing of Banking Services Through TechnologyDocument21 pagesMarketing of Banking Services Through TechnologyGaurav AgarwalNo ratings yet

- Review Questions - Doc - EthicsDocument35 pagesReview Questions - Doc - EthicsExam Dost100% (1)

- Rental Agreement-Bouncy RentalsDocument2 pagesRental Agreement-Bouncy RentalsZury MansurNo ratings yet

- Loan Origination System - Final Note - July 26 2022Document22 pagesLoan Origination System - Final Note - July 26 2022Ahsan Bin Asim100% (1)

- NETPAY APPLICATION FORM FOR LELONG MERCHANTSDocument10 pagesNETPAY APPLICATION FORM FOR LELONG MERCHANTSmr4zieNo ratings yet

- FB Marketplace New FormatDocument7 pagesFB Marketplace New Formatwisdomdurojaiye80% (5)

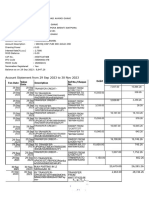

- Bank Statement2023 12 02 15 56 04 7980Document5 pagesBank Statement2023 12 02 15 56 04 7980kazeemshaikNo ratings yet

- The North Face Case Audit MaterialityDocument2 pagesThe North Face Case Audit MaterialityAjeng TriyanaNo ratings yet

- FIN 254 Time Value Add. ProbDocument1 pageFIN 254 Time Value Add. ProbEhsan MajidNo ratings yet

- My Card Place PDFDocument3 pagesMy Card Place PDFDIGITAL PATRIOTSNo ratings yet

- Awards of Icici Bank in 2012Document4 pagesAwards of Icici Bank in 2012Gaurav VermaNo ratings yet

- MetLife Enroll Form All ProductDocument5 pagesMetLife Enroll Form All ProducttxceoNo ratings yet

- Third Party Car Insurance Policy PDFDocument15 pagesThird Party Car Insurance Policy PDFWasimNo ratings yet

- Transportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)Document2 pagesTransportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)jobelle barcellanoNo ratings yet

- Case Study of Satyam ScamDocument34 pagesCase Study of Satyam Scamshubhendra8967% (15)

- Key Principle and Characteristics of Micro FinanceDocument18 pagesKey Principle and Characteristics of Micro Financedeepakbrt85% (40)

- 0130 G.R. No. 150197 July 28, 2005 Prudential Bank Vs Don A. AlviarDocument5 pages0130 G.R. No. 150197 July 28, 2005 Prudential Bank Vs Don A. AlviarrodolfoverdidajrNo ratings yet

- Final Reports by SunilDocument34 pagesFinal Reports by Sunilryu_clan100% (3)

- Eefm PresentationDocument11 pagesEefm Presentationkarthik100% (1)

- How to retrieve refunded amounts from ARN numbersDocument4 pagesHow to retrieve refunded amounts from ARN numbersEng Muhammad Afzal AlmaniNo ratings yet

- Associated Bank V. CA (1996) : G.R. No. 107382/G.R. No. 107612Document14 pagesAssociated Bank V. CA (1996) : G.R. No. 107382/G.R. No. 107612MiguelNo ratings yet

- Master Circular on customer service guidelinesDocument49 pagesMaster Circular on customer service guidelinesAnirudh SinghaNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- SMCH 18 BeamsDocument19 pagesSMCH 18 BeamsAtika DaretyNo ratings yet

- 820 Specimen 2018Document12 pages820 Specimen 2018Sunny KiskuNo ratings yet

- Coinbase UK and CB Payments User Agreement 14 March 2018 PDFDocument37 pagesCoinbase UK and CB Payments User Agreement 14 March 2018 PDFLiezel DahotoyNo ratings yet

- AFISCO Insurance Pool Ruled Taxable CorporationDocument2 pagesAFISCO Insurance Pool Ruled Taxable Corporationstickygum08100% (2)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.From EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Rating: 5 out of 5 stars5/5 (43)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryFrom EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryRating: 5 out of 5 stars5/5 (1)

- Nicole Brown Simpson: The Private Diary of a Life InterruptedFrom EverandNicole Brown Simpson: The Private Diary of a Life InterruptedRating: 3.5 out of 5 stars3.5/5 (16)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIFrom EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIRating: 4 out of 5 stars4/5 (19)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansFrom EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansRating: 4 out of 5 stars4/5 (17)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenFrom EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenRating: 3.5 out of 5 stars3.5/5 (36)

- The Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalFrom EverandThe Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalRating: 4.5 out of 5 stars4.5/5 (45)

- The Gardner Heist: The True Story of the World's Largest Unsolved Art TheftFrom EverandThe Gardner Heist: The True Story of the World's Largest Unsolved Art TheftNo ratings yet

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodFrom EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodRating: 4.5 out of 5 stars4.5/5 (1788)

- The Bigamist: The True Story of a Husband's Ultimate BetrayalFrom EverandThe Bigamist: The True Story of a Husband's Ultimate BetrayalRating: 4.5 out of 5 stars4.5/5 (101)

- The Last Outlaws: The Desperate Final Days of the Dalton GangFrom EverandThe Last Outlaws: The Desperate Final Days of the Dalton GangRating: 4 out of 5 stars4/5 (2)

- Double Lives: True Tales of the Criminals Next DoorFrom EverandDouble Lives: True Tales of the Criminals Next DoorRating: 4 out of 5 stars4/5 (34)

- Swamp Kings: The Story of the Murdaugh Family of South Carolina & a Century of Backwoods PowerFrom EverandSwamp Kings: The Story of the Murdaugh Family of South Carolina & a Century of Backwoods PowerNo ratings yet

- Gotti's Rules: The Story of John Alite, Junior Gotti, and the Demise of the American MafiaFrom EverandGotti's Rules: The Story of John Alite, Junior Gotti, and the Demise of the American MafiaNo ratings yet

- Unanswered Cries: A True Story of Friends, Neighbors, and Murder in a Small TownFrom EverandUnanswered Cries: A True Story of Friends, Neighbors, and Murder in a Small TownRating: 4 out of 5 stars4/5 (178)

- The Nazis Next Door: How America Became a Safe Haven for Hitler's MenFrom EverandThe Nazis Next Door: How America Became a Safe Haven for Hitler's MenRating: 4.5 out of 5 stars4.5/5 (77)

- The Rescue Artist: A True Story of Art, Thieves, and the Hunt for a Missing MasterpieceFrom EverandThe Rescue Artist: A True Story of Art, Thieves, and the Hunt for a Missing MasterpieceRating: 4 out of 5 stars4/5 (1)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemFrom EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemRating: 4 out of 5 stars4/5 (25)

- Our Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownFrom EverandOur Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownRating: 4.5 out of 5 stars4.5/5 (86)

- To the Bridge: A True Story of Motherhood and MurderFrom EverandTo the Bridge: A True Story of Motherhood and MurderRating: 4 out of 5 stars4/5 (73)

- Beyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceFrom EverandBeyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceRating: 4 out of 5 stars4/5 (107)

- Cold-Blooded: A True Story of Love, Lies, Greed, and MurderFrom EverandCold-Blooded: A True Story of Love, Lies, Greed, and MurderRating: 4 out of 5 stars4/5 (53)

- The Truth About Aaron: My Journey to Understand My BrotherFrom EverandThe Truth About Aaron: My Journey to Understand My BrotherNo ratings yet

- The Better Angels of Our Nature: Why Violence Has DeclinedFrom EverandThe Better Angels of Our Nature: Why Violence Has DeclinedRating: 4 out of 5 stars4/5 (414)

- A Special Place In Hell: The World's Most Depraved Serial KillersFrom EverandA Special Place In Hell: The World's Most Depraved Serial KillersRating: 4 out of 5 stars4/5 (52)