Professional Documents

Culture Documents

10 1 1 202 9758 PDF

Uploaded by

Tawsif HasanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 1 1 202 9758 PDF

Uploaded by

Tawsif HasanCopyright:

Available Formats

BF219: EQUITY SECURITIES

Course Description and Scope

The objective of this course is to provide students with a comprehensive coverage of the

principles and techniques in equity securities analysis. The course comprises three main subject

areas: asset valuation, fundamental equity analysis, and financial statement analysis. Asset

valuation presents the different approaches to valuing equity securities. Fundamental equity

analysis is multi-disciplinary in nature, encompassing subject areas of: macro-economic analysis,

industry analysis, and company analysis. Financial statement analysis focuses on identifying

drivers of value using information provided in the financial statements. Students learn techniques

for analyzing the statements of shareholders’ equity, income, cash flow, and balance sheet. Other

topics include: accounting measurement and valuation; analysis of growth, profitability and

sustainable earnings; and quality of current accounting.

Proposed Lecture Schedule

Week Instructor Topics Readings

Overview of Equity Securities & Markets, RB Ch 1, 3

1 EC

Fundamental Security Analysis

Valuation Principles & Practices, Aggregate RB Ch 11, 13

2 EC

Market Analysis

3 EC Economic Analysis and Industry Analysis RB Ch 12, 14

4 EC Earnings Forecast and Cash Flow Projections FF Ch 13

5 EC Company Analysis and Stock Selection RB Ch 11, 15

6 EC Analysis of Growth Companies RB Ch 11, 15

Introduction to the Financial Statements Pen Ch 2, pp. 26-39

7 JS Accounting Measurement Pen Ch 5, pp. 130-145

Business Activities and Financial Statements Pen Ch 7

8 RECESS

Analysis of Statement of Shareholders’ Equity Pen Ch 8

9 JS

Analysis of Balance Sheet and Income Statement Pen Ch 9

Analysis of Balance Sheet and Income Statement Pen Ch 9

10 JS

Analysis of Cash Flow Statement Pen Ch 10

11 JS Analysis of Profitability Pen Ch 11

12 JS Creating Accounting and Economic Value Pen Ch 17

13 JS Quality of Current Accounting Pen Ch 18

Note: EC – Edmund Choong; JS - Julia Sawicki

Basic Texts

RB Frank Reilly & Keith Brown (HG4521.R362 2003)

Investment Analysis and Portfolio Management, Harcourt Brace, 7th Edition

Penman Stephan H. Penman (HF5681.B2 P4134 2001)

Financial Statement Analysis & Security Valuation, McGraw-Hill International

Edition 2001

Supplementary References

FF Frank J. Fabozzi (HG4521.F121)

Investment Management, 2nd Edition, Prentice Hall, 1999.

MP Michael Porter (HD41.P847)

Competitive Strategy, Free Press

BS Benninga S. Z. & Sarig O.H. (1997), “Chapter 4: Building Pro-Forma Financial

Statements,” Corporate Finance: A Valuation Approach, McGraw Hill, p. 109.

[HG4028.V3 B376 1997].

Method of Instruction

Lectures : 2 hours per week

Tutorials : 2 hours per week

Course Assessment

Coursework 40%

Group Project 20%

Quiz 10%

Participation 10%

Final Examination 60%

100%

Lecturer Office Room No. DID E-mail Address

Mr. Edmund Choong B1A-34 6790-6118 acschoong@ntu.edu.sg

Dr. Julia Sawicki* B2B-65 6790-4669 ajsawicki@ntu.edu.sg

* Course Coordinator

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- What Is HOLT? What Makes HOLT Different?Document1 pageWhat Is HOLT? What Makes HOLT Different?Anonymous kgSMlxNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Airline Finance PDFDocument137 pagesAirline Finance PDFKatianna Pottier100% (1)

- CARITAS ET LABORA AUDIT PROGRAM RECEIVABLESDocument35 pagesCARITAS ET LABORA AUDIT PROGRAM RECEIVABLESowieNo ratings yet

- Ubs - DCF PDFDocument36 pagesUbs - DCF PDFPaola VerdiNo ratings yet

- MBB Cases 2020Document170 pagesMBB Cases 2020Usman Aziz100% (1)

- Data Analysis With Pandas - Introduction To Pandas Cheatsheet - Codecademy PDFDocument3 pagesData Analysis With Pandas - Introduction To Pandas Cheatsheet - Codecademy PDFTawsif Hasan100% (1)

- 2019 Accounting Question BankDocument304 pages2019 Accounting Question BankHiền Nguyễn94% (17)

- SantuBabaTricks AppDocument41 pagesSantuBabaTricks AppSriheri DeshpandeNo ratings yet

- Estimation and Costing New by Made EasyDocument44 pagesEstimation and Costing New by Made EasyMutahhir Ahemad100% (2)

- Asian Paints - Financial Modeling (With Solutions) - CBADocument47 pagesAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745No ratings yet

- SSRN Id802724Document48 pagesSSRN Id802724kaosdfkapsdf100% (1)

- Overview of Income Tax 2014Document40 pagesOverview of Income Tax 2014masumidbNo ratings yet

- Auditing in PerspectivesDocument9 pagesAuditing in PerspectivesTawsif HasanNo ratings yet

- f5 2009 Jun ADocument10 pagesf5 2009 Jun A彭慕冰No ratings yet

- Assurance Test - Generated QuestionDocument1 pageAssurance Test - Generated QuestionTawsif HasanNo ratings yet

- 2 Accounting PDFDocument3 pages2 Accounting PDFibrahimbdNo ratings yet

- Toward An Auditing PhilosophyDocument17 pagesToward An Auditing PhilosophyTawsif HasanNo ratings yet

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document79 pagesEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1ব্যোমকেশNo ratings yet

- Question Shuffler - Assurance - Generated Question 6Document1 pageQuestion Shuffler - Assurance - Generated Question 6Tawsif HasanNo ratings yet

- Question Shuffler - Assurance - Generated Question 6Document1 pageQuestion Shuffler - Assurance - Generated Question 6Tawsif HasanNo ratings yet

- Question Shuffler - Assurance - Generated Question 6Document1 pageQuestion Shuffler - Assurance - Generated Question 6Tawsif HasanNo ratings yet

- CL 2accounting 08Document3 pagesCL 2accounting 08Tawsif HasanNo ratings yet

- Assurance Test - Generated QuestionDocument1 pageAssurance Test - Generated QuestionTawsif HasanNo ratings yet

- Accounting Nov Dec 18Document3 pagesAccounting Nov Dec 18ibrahimbdNo ratings yet

- Assurance Test - Generated QuestionDocument1 pageAssurance Test - Generated QuestionTawsif HasanNo ratings yet

- React Adjacent JSX PDFDocument2 pagesReact Adjacent JSX PDFBenefitsNo ratings yet

- FINANCIAL & CORPORATE REPORTING EXAMDocument6 pagesFINANCIAL & CORPORATE REPORTING EXAMTawsif HasanNo ratings yet

- Assurance Test - Generated QuestionDocument1 pageAssurance Test - Generated QuestionTawsif HasanNo ratings yet

- Building Front-End Applications With React - Advanced React Cheatsheet - Codecademy PDFDocument2 pagesBuilding Front-End Applications With React - Advanced React Cheatsheet - Codecademy PDFTawsif HasanNo ratings yet

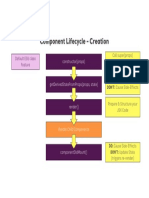

- 8.2 Lifecycle-Update-External-Learning-Card PDFDocument1 page8.2 Lifecycle-Update-External-Learning-Card PDFTawsif HasanNo ratings yet

- 7.1 Lifecycle-Creation-Learning-Card PDFDocument1 page7.1 Lifecycle-Creation-Learning-Card PDFTawsif HasanNo ratings yet

- International Financial Magement: Dr. Md. Hamid U BhuiyanDocument40 pagesInternational Financial Magement: Dr. Md. Hamid U BhuiyanTawsif HasanNo ratings yet

- CVP AnalysisDocument1 pageCVP AnalysisTawsif HasanNo ratings yet

- React Adjacent JSX PDFDocument2 pagesReact Adjacent JSX PDFBenefitsNo ratings yet

- 8.2 Lifecycle-Update-External-Learning-Card PDFDocument1 page8.2 Lifecycle-Update-External-Learning-Card PDFTawsif HasanNo ratings yet

- 39.1 Lifecycle-Creation-Learning-Card PDFDocument1 page39.1 Lifecycle-Creation-Learning-Card PDFTawsif HasanNo ratings yet

- 6202 TQM SolutionDocument5 pages6202 TQM SolutionTawsif HasanNo ratings yet

- Machine Learning - Supervised LearningDocument3 pagesMachine Learning - Supervised LearningTawsif HasanNo ratings yet

- 6202 TQM SolutionDocument5 pages6202 TQM SolutionTawsif HasanNo ratings yet

- Intermediate Financial Accounting I: Inventories: MeasurementDocument89 pagesIntermediate Financial Accounting I: Inventories: MeasurementDaphne BlakeNo ratings yet

- Morningstar US Market Outlook 2023 Near Term TurbulenceDocument55 pagesMorningstar US Market Outlook 2023 Near Term TurbulenceBrainNo ratings yet

- BP Annual Report and Form 20f Financial Statements 2018Document160 pagesBP Annual Report and Form 20f Financial Statements 2018Jennifer DabalosNo ratings yet

- Monsanto ReportDocument12 pagesMonsanto ReportAR KhanNo ratings yet

- Controls for Cash ReceiptsDocument35 pagesControls for Cash ReceiptsEmey CalbayNo ratings yet

- Valuation of Early Stage StartupsDocument2 pagesValuation of Early Stage StartupsPaulo Timothy AguilaNo ratings yet

- Kieso10eChp09 MidtermDocument30 pagesKieso10eChp09 MidtermJohn FinneyNo ratings yet

- NUS MBA Investment Analysis Module OutlineDocument5 pagesNUS MBA Investment Analysis Module OutlineNikhilNo ratings yet

- DRB 2019Document261 pagesDRB 2019Ratna TazulazharNo ratings yet

- BFD Crash Course (ICAP) - Muhammad Samie - 12-11-2021Document11 pagesBFD Crash Course (ICAP) - Muhammad Samie - 12-11-2021Aqib SheikhNo ratings yet

- Abcd AirtelDocument12 pagesAbcd AirtelPrakhar RatheeNo ratings yet

- Presentation Glimar 3 1Document25 pagesPresentation Glimar 3 1KFG MAGHREBNo ratings yet

- Wissal Ben Letaifa 2016 Study of Dividend Policies in Periods Pre and Post - MergerDocument4 pagesWissal Ben Letaifa 2016 Study of Dividend Policies in Periods Pre and Post - MergerismailNo ratings yet

- MRF Tyres LTD OverviewDocument9 pagesMRF Tyres LTD OverviewVivek Mohan KumarNo ratings yet

- SM III Keu 39Document5 pagesSM III Keu 39desyNo ratings yet

- Bank Negara Malaysia Guidelines Related Party TransactionDocument12 pagesBank Negara Malaysia Guidelines Related Party TransactionYan QingNo ratings yet

- Mphasis Annual Report 2021Document204 pagesMphasis Annual Report 2021saurav kumarNo ratings yet

- 1 Discuss Briefly About Fair Value Measurement and ImpairmentDocument13 pages1 Discuss Briefly About Fair Value Measurement and ImpairmentBosena TadegeNo ratings yet

- Penman and Yehuda, 2004, The Pricing of Earnings and Cash FlowsDocument50 pagesPenman and Yehuda, 2004, The Pricing of Earnings and Cash FlowsAbdul KaderNo ratings yet

- Ias 40 ThesisDocument5 pagesIas 40 Thesislaurabrownvirginiabeach100% (2)

- Existing Company - First CalgaryDocument38 pagesExisting Company - First CalgaryPal ACNo ratings yet