Professional Documents

Culture Documents

BOC CMO 17-2018 Nationwide Implementation of The 1-Assessment System Formerly Known As EGDVS

Uploaded by

PortCalls0 ratings0% found this document useful (0 votes)

534 views10 pagesThe Bureau of Customs has released guidelines for the nationwide implementation of 1-Assessment, formerly called the enhanced goods declaration verification system or EGDVS.

Customs Commissioner Isidro Lapeña on October 11 signed Customs Memorandum Order No. 17-2018 to implement in all ports the 1-Assessment, a web-based queue management software/application that provides bias-free assessment by randomly assigning appraisers and examiners to goods declarations filed.

Original Title

BOC CMO 17-2018 Nationwide Implementation of the 1-Assessment System Formerly Known as EGDVS

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Bureau of Customs has released guidelines for the nationwide implementation of 1-Assessment, formerly called the enhanced goods declaration verification system or EGDVS.

Customs Commissioner Isidro Lapeña on October 11 signed Customs Memorandum Order No. 17-2018 to implement in all ports the 1-Assessment, a web-based queue management software/application that provides bias-free assessment by randomly assigning appraisers and examiners to goods declarations filed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

534 views10 pagesBOC CMO 17-2018 Nationwide Implementation of The 1-Assessment System Formerly Known As EGDVS

Uploaded by

PortCallsThe Bureau of Customs has released guidelines for the nationwide implementation of 1-Assessment, formerly called the enhanced goods declaration verification system or EGDVS.

Customs Commissioner Isidro Lapeña on October 11 signed Customs Memorandum Order No. 17-2018 to implement in all ports the 1-Assessment, a web-based queue management software/application that provides bias-free assessment by randomly assigning appraisers and examiners to goods declarations filed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

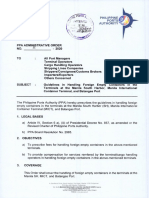

Republic of the Philippines ieicn COPY

Department of Finance

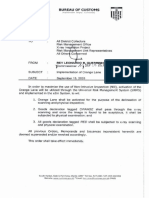

” BUREAU OF CUSTOMS

1099 Manila

CUSTOMS MEMORANDUM ORDER (CMO)

No. _I}- 2

SUBJECT: Nationwide Implementation of the 1-Assessment System

(Formerly Known as Enhanced Goods Declaration Verification

System or EGDVS)

INTRODUCTION. This Order implements Section 109 and other relevant provisions

of Republic Act (R.A.) No. 10863, otherwise known as the Customs Modernization

and Tariff Act (CMTA), in relation to R.A. No. 11032, otherwise known as the Ease of

Doing Business and Service Delivery Act of 2018. This Order also supplements the

Provisions of CMO 10-2018" and supersedes CMO No. 31-20172

Section 1. Objectives.

11 To prevent corruption by institutionalizing the ‘Zero Contact Policy”

(Section 7 of R.A. No. 11032) and suppress the “suki system’ in the

cargo clearance process through the random assignment of examiners

and appraisers to a given goods declaration;

1.2 To enable brokers and importers to obtain real-time information on the

status of their goods declaration lodged with the Bureau of Customs

(BOC); and

1.3. To define the liability and strengthen accountability of licensed customs

brokers and customs personnel involved in the cargo clearance

process.

Section 2. Scope.

2.1 The 1-Assessment System shall apply only to import consumption

entries cleared under the formal entry process in all ports of entry,

‘subject to the exceptions provided herein.

* Implementation of Enhanced Goods Declaration Verification System (EGDVS), dated July

12, 2018 (initial implementation in the Ports of Clark, Subic and Batangas)

? Implementation of Goods Declaration Verification System (GDVS), dated December 6,

2017

Page 1of9

wieren COPY

Section 3. Definition of Terms — For purposes of this Order, the following terms are

defined accordingly:

3.1 1-Assessment System ~ refers to a web-based queue management

software/application that provides bias-free assessment by randomly

assigning Appraisers and Examiners to goods declaration filed

3.2 Bill of Lading — refers to a transport document issued by shipping

lines, carriers and international freight forwarders or non-vessel

Operating common carrier for water-bome freight. The holder or

consignee of the bill has the right to claim delivery of the goods at the

Port of destination. It is a contract of carriage between the carrier and

the shipper, which defines the liabilities of each party. In addition, it

contains transport instructions to shipping lines and carriers, a

description of the goods, and applicable transportation charges. It may

refer to a Master Bill of Lading or a House Bill of Lading.

3.3 Commercial Invoice -refers to a legal document between the supplier

and the customer that clearly describes the sold goods, and the amount

due on the customer. The commercial invoice is one of the main

documents used by customs in determining customs duties.

34 Country of Origin Certificate -refers to a mandatory documentary

requirement to be filed together with the Import Entry and Internal

Revenue Declaration (IEIRD) for the release of shipments from the

BOC.

3.5 Customs Broker - refers to any person who is a bona fide holder of a

valid Certificate of Registration/Professional Identification Card issued

by the Professional Regulatory Board and Professional Regulation

Commission pursuant to Republic Act No. 9280, as amended,

otherwise known as the "Customs Brokers Act of 2004"

3.5 Customs Client Number ~ refers to a stakeholder’s unique identifier in

the CPRS for every role that the stakeholder acquires in the CPRS

registration. It is issued by way of a Certificate of Registration (CoR).

3.7 Declarant- refers to any person who makes goods declaration or in

whose name a goods declaration is made. In the processing of goods

declaration under the formal entry process, the declarant must be

registered in the BOCs existing Client Profile Registration System

(CPRS) and recognized to electronically lodge the goods declaration,

3.8 Discharge Port Survey Report — refers to a report issued by an

Accredited Cargo Surveying Company (ACSC) for the survey of

imported cargoes at the Port of Discharge and submitted to the BOC.

The report shall be submitted to the BOC directly from the ACSC in a

secured electronic format.

Page 2 of 9

STER COPY

3.9 Goods Declaration ~ refers to a statement made in the manner

Prescribed by the BOC and other appropriate agencies, by which the

Persons concerned indicate the procedure to be observed in the

application for the entry or admission of imported goods and the

Particulars of which the customs administration shall require

3.10 Load Port Survey (LPS) Report ~ refers to a report issued by an

ACSC for bulk or break-bulk cargo to be imported into the Philippines.

The report shall be submitted to the BOC directly from the ACSC in a

secured electronic format.

3.11 Packing List — refers to an itemized list of articles usually included in

each shipping package, giving the quantity, description, and weight of

the contents,

5.12. Port of Entry ~ refers to the first Philippine port of call of a foreign

carrier. These shall be the ports designated as such by applicable laws

or by the President in the exercise of his authority to open or close any

port.

3.13, Post-Entry Modification’ SAD Cancellation — refers to the process

used when it is necessary to revise the data in the SAD in cases where

the shipment is already assessed but not yet released. The procedure

and conditions are provided under CMO 27-2009, CMO 53-2010 and

CMO 27-2017.

3.14 Single Administrative Document (SAD) — refers to an internationally

used form as customs declaration or goods declaration. It was

designed to standardize customs documents, harmonize codification

and simplify procedures in international trade exchanges.

3.15 Security - refers to any form of guaranty, such as a surety bond, cash

bond, standby letter of credit or irrevocable letter of credit, which

ensures the satisfaction of an obligation to the Bureau

3.16 Tax Identification Number (TIN)- refers to an identifying number

issued by the Bureau of Internal Revenue (BIR) to individuals or

juridical entities to track tax obligations and payments.

3.17 Tentative Assessment - refers to a case where the duties and taxes

initially assessed are disputed by the importer. The assessment shall

be completed upon final readjustment based on the tariff ruling in case

of classification dispute, or the final resolution of the protest case

involving valuation, rules of origin, and other customs issues. The

District Collector may allow the release of the imported goods under

tentative assessment upon the posting of sufficient security to cover the

applicable duties and taxes equivalent to the amount that is disputed

Page 3 0f 9

You might also like

- Draft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021Document10 pagesDraft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021PortCallsNo ratings yet

- Bureau of Customs Customs Memorandum Order 28-2021Document2 pagesBureau of Customs Customs Memorandum Order 28-2021PortCalls100% (1)

- Bureau of Internal Revenue Revenue Regulations 15-2021Document1 pageBureau of Internal Revenue Revenue Regulations 15-2021PortCallsNo ratings yet

- Bureau of Customs - Customs Administrative Order 12-2020Document5 pagesBureau of Customs - Customs Administrative Order 12-2020PortCallsNo ratings yet

- BOC AOCG Memo Dated September 11Document1 pageBOC AOCG Memo Dated September 11PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 02-2021Document8 pagesPhilippine Ports Authority Administrative Order No. 02-2021PortCallsNo ratings yet

- Bureau of Customs Customs Memorandum Order No. 09-2021Document32 pagesBureau of Customs Customs Memorandum Order No. 09-2021PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 11 - 2020Document4 pagesPhilippine Ports Authority Administrative Order No. 11 - 2020PortCallsNo ratings yet

- Civil Aviation Authority of The Philippines Memorandum Circular No. 03 2021Document3 pagesCivil Aviation Authority of The Philippines Memorandum Circular No. 03 2021PortCallsNo ratings yet

- Joint Memorandum Circular No. 2021-01Document3 pagesJoint Memorandum Circular No. 2021-01PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 13-2020Document3 pagesPhilippine Ports Authority Administrative Order No. 13-2020PortCallsNo ratings yet

- Bureau of Customs Memo Activating The Orange LaneDocument1 pageBureau of Customs Memo Activating The Orange LanePortCallsNo ratings yet

- Ds Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedDocument33 pagesDs Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedPortCallsNo ratings yet

- PortCalls (September 7, 2020)Document14 pagesPortCalls (September 7, 2020)PortCalls100% (1)

- BOC AOCG Memo Dated September 11Document2 pagesBOC AOCG Memo Dated September 11PortCalls100% (1)

- NorthPort Advisory - June 8, 2020Document1 pageNorthPort Advisory - June 8, 2020PortCallsNo ratings yet

- Shippers' Protection Office Rules of ProceduresDocument10 pagesShippers' Protection Office Rules of ProceduresPortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 05-2020Document5 pagesPhilippine Ports Authority Administrative Order No. 05-2020PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-009Document4 pagesDepartment of Transportation Department Order No. 2020-009PortCallsNo ratings yet

- MC DS-2020-01Document3 pagesMC DS-2020-01PortCallsNo ratings yet

- SBMA Seaport Memorandum On Anti Pilferage SealDocument1 pageSBMA Seaport Memorandum On Anti Pilferage SealPortCallsNo ratings yet

- Department of Trade and Industry Advisory No. 20-02Document1 pageDepartment of Trade and Industry Advisory No. 20-02PortCallsNo ratings yet

- Ppa MC 23-2020Document1 pagePpa MC 23-2020PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-008Document6 pagesDepartment of Transportation Department Order No. 2020-008PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- Now Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuideDocument12 pagesNow Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuidePortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- PortCalls April 27 IssueDocument13 pagesPortCalls April 27 IssuePortCallsNo ratings yet

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020Document14 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020PortCallsNo ratings yet

- Department of Trade and Industry Memorandum Circular No. 20-22 Series of 2020Document8 pagesDepartment of Trade and Industry Memorandum Circular No. 20-22 Series of 2020PortCalls0% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)