Professional Documents

Culture Documents

0452 s18 Ms 23

Uploaded by

Seong Hun LeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0452 s18 Ms 23

Uploaded by

Seong Hun LeeCopyright:

Available Formats

Cambridge Assessment International Education

Cambridge International General Certificate of Secondary Education

ACCOUNTING 0452/23

Paper 2 May/June 2018

MARK SCHEME

Maximum Mark: 120

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge International will not enter into discussions about these mark schemes.

Cambridge International is publishing the mark schemes for the May/June 2018 series for most

Cambridge IGCSE™, Cambridge International A and AS Level and Cambridge Pre-U components, and

some Cambridge O Level components.

IGCSE™ is a registered trademark.

This document consists of 11 printed pages.

© UCLES 2018 [Turn over

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Generic Marking Principles

These general marking principles must be applied by all examiners when marking candidate answers.

They should be applied alongside the specific content of the mark scheme or generic level descriptors

for a question. Each question paper and mark scheme will also comply with these marking principles.

GENERIC MARKING PRINCIPLE 1:

Marks must be awarded in line with:

• the specific content of the mark scheme or the generic level descriptors for the question

• the specific skills defined in the mark scheme or in the generic level descriptors for the question

• the standard of response required by a candidate as exemplified by the standardisation scripts.

GENERIC MARKING PRINCIPLE 2:

Marks awarded are always whole marks (not half marks, or other fractions).

GENERIC MARKING PRINCIPLE 3:

Marks must be awarded positively:

• marks are awarded for correct/valid answers, as defined in the mark scheme. However, credit

is given for valid answers which go beyond the scope of the syllabus and mark scheme,

referring to your Team Leader as appropriate

• marks are awarded when candidates clearly demonstrate what they know and can do

• marks are not deducted for errors

• marks are not deducted for omissions

• answers should only be judged on the quality of spelling, punctuation and grammar when these

features are specifically assessed by the question as indicated by the mark scheme. The

meaning, however, should be unambiguous.

GENERIC MARKING PRINCIPLE 4:

Rules must be applied consistently e.g. in situations where candidates have not followed

instructions or in the application of generic level descriptors.

GENERIC MARKING PRINCIPLE 5:

Marks should be awarded using the full range of marks defined in the mark scheme for the question

(however; the use of the full mark range may be limited according to the quality of the candidate

responses seen).

GENERIC MARKING PRINCIPLE 6:

Marks awarded are based solely on the requirements as defined in the mark scheme. Marks should

not be awarded with grade thresholds or grade descriptors in mind.

© UCLES 2018 Page 2 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

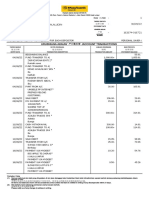

Question Answer Marks

1(a)(i) Statement of account 1

1(a)(ii) $335 1

1(a)(iii) 14 1

× 100 = 2%

(686 + 14)

1(a)(iv) Cash discount 1

1(b) 1

debit entry in ledger credit entry in ledger no entry would be

account of W Jones account of W Jones made

9(1)

1(c) 4

document issued name of person entries made by W Jones

issuing

account debited account credited

document

Invoice (1) J Smith (1) Purchases (1) J Smith (1)

1(d) 2

book of prime (original) entry used sales returns journal (1)

by J Smith

book of prime (original) entry used purchases returns journal (1)

by W Jones

1(e)(i) A bad debt is an amount owing to a business which will not be paid by the credit 1

customer

1(e)(ii) A bad debt recovered is when a credit customer pays some, or all of a debt previously 1

written off as a bad debt

1(f) Reduce credit sales/sell on a cash basis 2

Obtain references from new credit customers

Fix a credit limit for each customer

Introduce/improve credit control

Issue invoices and monthly statements promptly

Refuse further supplies until outstanding balance is paid

Give cash discount/discount for prompt payment

Charge interest on overdue account

Any 2 points (1) each

Accept other valid points

1(g) The profit for the year is not overstated (1) 2

The trade receivables (current assets) are not overstated (1)

Accept other valid points

1(h) The sales for which a business is unlikely to be paid (1) are regarded as an 2

expense of the year in which those sales are made (1)

1(i) 460 100 1

× = 2 12 %

18 400 1

© UCLES 2018 Page 3 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

1(j) J Smith 5

Provision for doubtful debts account

Date Details $ Date Details $

2018 2017

Apl 30 Income 20 May 1 Balance b/d (1) 460

statement (1)OF

Balance c/d (1) 440

460 460

2018

May 1 Balance b/d (1)OF 440

+ (1) dates

Question Answer Marks

2(a) Capital expenditure 8

Money spend on acquiring, improving and installing non-current assets (1)

Example

Purchase of any non-current asset, legal costs for purchase of premises,

cost of installation of non-current asset, cost of carriage on delivery of non-current

asset, etc.

Any suitable example (1)

Capital receipt

Amounts received which do not form part of the day-to-day trading activities (1)

Example

Receipt of loan, additional capital, proceeds of sale of non-current asset at book value,

etc.

Any suitable example (1)

Revenue expenditure

Money spent on the running of a business on a day-to-day basis (1)

Example

Any expense such as wages, rent, insurance, etc.

Any suitable example (1)

Revenue receipt

Amounts received in the day-to-day trading activities and other items of income (1)

Example

Sales, commission received, interest received, rent received, etc.

Any suitable example (1)

© UCLES 2018 Page 4 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

2(b) 6

effect on profit for the effect on closing capital

error year

overstated understated overstated understated no effect

error 1 9 9

error 2 9(1) 9(1)

error 3 9(1) 9(1)

error 4 9(1) 9(1)

2(c) It is a book of prime (original) entry because it is written up from business 2

documents (1)

It is part of the double entry system as it acts as ledger accounts for cash and

bank (1)

2(d) 3

entry required in cash book

item debit credit

$ $

cash book error 100

dishonoured cheque 140 (1)

charges 15 (1)

rates (direct debit) 400 (1)

2(e) entry in bank reconciliation statement 4

item added to bank deducted from bank

statement balance statement balance

CD Limited 9(1)

sales 9(1)

FF Limited 9(1)

Bank error (standing order) 9(1)

© UCLES 2018 Page 5 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

3(a) Reducing (diminishing) balance method 1

Revaluation method

Any one (1)

3(b) Principle of materiality – not practical/too many items/too difficult/too costly to 2

depreciate each item separately

Do not depreciate by an equal amount each year

May be certain amount of loss of tools each year

Or other suitable reason

Any 2 reasons (1) each

3(c) Calculation of depreciation for the year ended 31 December 2016 2

depreciation on office depreciation on office total

machine A machine B

calculation calculation

20% × 15 000 20% × 18 000 × 3/12

answer $3 000 (1) answer $900 (1) $3 900

3(d) Calculation of depreciation for the year ended 31 December 2017 3

depreciation on depreciation on depreciation on total

office machine A office machine B office machine C

calculation calculation calculation

20% × 15 000 × 20% × 18 000 20% × 20 000 ×

6/12 6/12

answer $1 500(1) answer $3 600 (1) answer $2 000(1) $7 100

© UCLES 2018 Page 6 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

3(e) Jamil 11

Office machinery account

Date Details $ Date Details $

2016 2016

Jan 1 Balance A b/d 15 000 Dec 31 Balance c/d 33 000

Oct 1 Bank B (1) 18 000

33 000 33 000

2017 2017

Jan 1 Balance b/d 33 000 July 1 Disposal A (1) 15 000

(1)OF

Dec 31 Balance c/d 38 000

July 1 XY Limited C (1) 20 000 53 000

53 000

2018

Jan 1 Balance b/d 38 000

(1)OF

Provision for depreciation of office machinery account

Date Details $ Date Details $

2016 2016

Dec 31 Balance c/d 9 900 Jan 1 Balance A b/d 6 000

Dec 31 Income 3 900

statement (1)OF

9 900 9 900

2017 2017

July 1 Disposal A (1) OF 10 500 Jan 1 Balance b/d 9 900

(1)OF

Dec 31 Balance c/d 6 500 Dec 31 Income 7 100

statement (1)OF

17 000 17 000

2018

Jan 1 Balance b/d 6 500

(1)OF

+ (1) dates

3(f) $ 4

Cost 15 000 (1)

Depreciation to date (6000 + 3000 + 1500) 10 500 (1) OF

Book value 4 500

Proceeds of sale 6 000

Profit (1) OF on disposal 1 500 (1) OF

© UCLES 2018 Page 7 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

4(a) AB Limited 6

Statement of Changes in Equity for the year ended 31 March 2018

Ordinary General Retained Total

share reserve earnings

capital

$ $ $ $

On 1 April 2017 200 000 14 000 6 000 220 000

Profit for the year 35 000 (1) 35 000

Final dividend paid

(for year ended 31 .................. .................. (10 000) (1) (10 000)

March 2017)

Interim dividend paid

(for year ended 31 .................. .................. (4 000) (1) (4 000)

March 2018)

Transfer to general

.................. 2 000 (2 000) (1) ..................

reserve

At 31 March 2018 200 000 16 000 25 000 (1) 241 000 (1)

© UCLES 2018 Page 8 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

4(b) AB Limited 14

Statement of Financial Position at 31 March 2018

$ $ $

Non-current assets Cost Depreciation Book

to date value

Premises 195 000 195 000

Machinery 98 000 35 280 62 720 (1)

Office equipment 39 500 15 800 23 700 (1)

332 500 51 080 281 420 (1)OF

Current assets

Inventory 12 120

Trade receivables 9 900

Less Provision for doubtful 198 9 702 (1)

debts

Other receivables 568 (1)

Petty cash 200 (1)

22 590

Total assets 304 010

Capital and liabilities

Capital and reserves

Ordinary shares 200 000 (1)

General reserve 16 000 (1)

Retained earnings 25 000 (1)OF

241 000 (1)OF

Non-current liabilities

4% Debentures

(repayable 1 April 2022) 30 000 (1)

Current liabilities

Trade payables 10 020

Other payables 950

Bank 2 040 (1)

Bank loan

(repayable 1 January 2019) 20 000 (1)

33 010 (1)OF

Total equity and liabilities 304 010

4(c) Interest on debentures must be paid irrespective of whether there is a profit (but profit 2

is expected to increase after two years)

Prior claim on the assets of the company in a winding up

Funds have to be available when repayment is due

Prior claim on the profits of the company/less profit available for ordinary share

dividend (this may only be a disadvantage in the first two years)

Or other relevant point

Any 2 points (1) each

© UCLES 2018 Page 9 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

4(d) Dilution of ownership of company 2

New shares rank equally with existing ordinary shares with regard to

dividend(even though profit expected to increase after two years dividend may reduce)

New shares rank equally with existing ordinary shares with regard to repayment in a

winding up

Or other relevant point

Any 2 points (1) each

Question Answer Marks

5(a) Aretta 12

Income Statement for the month ended 30 April 2018

$ $

Revenue 15 640 }(2)CF

}(1)OF

Cost of sales

Purchases (15 000 (1) + 810 (1)) 15 810

Less Closing inventory 4 080 11 730 (1)OF

Gross profit 3 910 (1)OF

Rent (2400 × 1/6) 400 (1)

Insurance (3600 × 1/12) 300 (1)

Operating expenses 980 }

Wages 1 900 }(1)

Loan interest (5% × 7200 × 1/12) 30 (1)

Depreciation shop fixtures and fittings

(12% x 9500 × 1/12) 95 (1) 3 705

Profit for the month 205 (1)OF

5(b) Current assets – inventory : current liabilities 1

5(c) 5

proposal effect on quick ratio

increase decrease no effect

1 purchase a motor vehicle on

9

credit

2 pay credit suppliers early to

9(1)

receive cash discount

3 obtain a bank overdraft and

9(1)

repay the loan immediately

4 arrange for the loan to be

9(1)

extended to 2 years

5 sell on credit terms rather than

9(1)

on cash terms

6 reduce inventory by selling half

9(1)

at cost price

© UCLES 2018 Page 10 of 11

0452/23 Cambridge IGCSE – Mark Scheme May/June 2018

PUBLISHED

Question Answer Marks

5(d) Proposal number 6 (1) 3

Current Ratio

Total of current assets remains unchanged (1)

OR inventory decreases and cash/bank increases by same amount (1)

Quick (acid test) Ratio

Total of current assets excluding inventory increases (1)

OR Inventory is excluded from the calculation but cash/bank increases (1)

5(e) Should compare with a business of approximately the same size/same capital 4

Should compare with a business of the same type (sole trader)

The length of time the business has been operating

The financial year may end at different times of the trading cycle

The financial statements may be for one year which will not show trends

The financial statements may be for a year which is not a typical year

The businesses may operate different accounting policies

The businesses may have different types of expenses

The statements do not show non-monetary factors

It may not be possible to obtain all the information needed to make comparisons

Or other suitable points excluding type of business (given in the question)

Any 2 points (1) basic statement and (1) for development

© UCLES 2018 Page 11 of 11

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- New Accountant Appointment LetterDocument2 pagesNew Accountant Appointment Letterkeeran100% (1)

- Contemporary Strategic Analysis - Robert M Grant 7th EditionDocument6 pagesContemporary Strategic Analysis - Robert M Grant 7th EditionSundeep Tariyal67% (3)

- ISO 55000 NEW STANDARDS FOR ASSET MANAGEMENT (PDFDrive)Document35 pagesISO 55000 NEW STANDARDS FOR ASSET MANAGEMENT (PDFDrive)Vignesh Bharathi0% (1)

- Visual MerchandisingDocument40 pagesVisual MerchandisingDhandapani Surendhar100% (1)

- Chapter 8 Student Textbook JJBDocument24 pagesChapter 8 Student Textbook JJBapi-30995537633% (3)

- ACCA F3 - Final Mocks - QuestionsDocument20 pagesACCA F3 - Final Mocks - Questionsbunipat100% (1)

- 2012 Revenue Code of The City of Calapan For Review of Sangguniang PanlalawiganDocument282 pages2012 Revenue Code of The City of Calapan For Review of Sangguniang PanlalawiganSheila CantosNo ratings yet

- Cambridge Checkpoint English P1 Specimen 2012Document8 pagesCambridge Checkpoint English P1 Specimen 2012Pungky Yanuarto83% (6)

- Ch04 Completing The Accounting CycleDocument68 pagesCh04 Completing The Accounting CycleGelyn CruzNo ratings yet

- Strategic Management ReportDocument15 pagesStrategic Management Reportatif0078No ratings yet

- MBBsavings - 162674 016721 - 2022 09 30 PDFDocument3 pagesMBBsavings - 162674 016721 - 2022 09 30 PDFAdeela fazlinNo ratings yet

- Ind As 16Document41 pagesInd As 16Vidhi AgarwalNo ratings yet

- CA Zambia June 2022 Q ADocument394 pagesCA Zambia June 2022 Q AChanda LufunguloNo ratings yet

- Diploma in Accountancy Exams Level 1 Financial AccountingDocument236 pagesDiploma in Accountancy Exams Level 1 Financial AccountingMusonda Mwape100% (1)

- CA Zambia March 2021 Examination Session QaDocument419 pagesCA Zambia March 2021 Examination Session QaSmart SokoNo ratings yet

- Sample MCQDocument8 pagesSample MCQJacky LamNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearParth GamiNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Course Packet in G WORLDDocument66 pagesCourse Packet in G WORLDadel fernandezNo ratings yet

- Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2019Document14 pagesCambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2019xСιτʀιƞιẜyNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 March 2018Document11 pagesCambridge Assessment International Education: Accounting 0452/22 March 2018Jyoti WadhwaniNo ratings yet

- 0452 s18 Ms 21 PDFDocument18 pages0452 s18 Ms 21 PDFIG UnionNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/21 May/June 2018Document18 pagesCambridge Assessment International Education: Accounting 0452/21 May/June 2018IG UnionNo ratings yet

- 0452 s18 Ms 21Document18 pages0452 s18 Ms 21Seong Hun LeeNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/11 May/June 2019Document17 pagesCambridge Assessment International Education: Accounting 0452/11 May/June 2019Shayan KhanNo ratings yet

- Cambridge O Level: Accounting 7707/22 October/November 2020Document14 pagesCambridge O Level: Accounting 7707/22 October/November 2020Iman100% (1)

- Cambridge IGCSE™: Accounting 0452/22 October/November 2020Document14 pagesCambridge IGCSE™: Accounting 0452/22 October/November 2020Voon Chen WeiNo ratings yet

- Mark Scheme PrinciplesDocument23 pagesMark Scheme PrinciplesV-academy MathsNo ratings yet

- 0452 s18 Ms 12Document14 pages0452 s18 Ms 12Seong Hun LeeNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/21 October/November 2018Document11 pagesCambridge Assessment International Education: Accounting 9706/21 October/November 2018Takudzwa GudoNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/22 March 2020Document7 pagesCambridge International AS & A Level: Accounting 9706/22 March 2020Javed MushtaqNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/23 October/November 2018Document9 pagesCambridge Assessment International Education: Accounting 9706/23 October/November 2018Muhtasim RosulNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/11Document12 pagesCambridge International AS & A Level: Accounting 9706/11OSHADA AKALANKA 11-BNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/31 May/June 2020Document6 pagesCambridge International AS & A Level: Accounting 9706/31 May/June 2020Mayur MandhubNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/31 May/June 2020Document15 pagesCambridge International AS & A Level: Accounting 9706/31 May/June 2020Mayur MandhubNo ratings yet

- Diploma in Accountancy Examination June 2019 Q ADocument229 pagesDiploma in Accountancy Examination June 2019 Q ADixie CheeloNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/21 October/November 2018Document17 pagesCambridge Assessment International Education: Accounting 0452/21 October/November 2018Iron OneNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary EducationDocument16 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary EducationDaksh JainNo ratings yet

- 0452/21/m/j/18 QPDocument20 pages0452/21/m/j/18 QPAnshNo ratings yet

- 9706 m19 Ms 32Document22 pages9706 m19 Ms 32Ryan Xavier M. BiscochoNo ratings yet

- Cambridge International AS & A Level: Business 9609/23 May/June 2020Document11 pagesCambridge International AS & A Level: Business 9609/23 May/June 2020VinayakNo ratings yet

- Midterm Exam On Sep 2017 Answer Keys For MorningDocument16 pagesMidterm Exam On Sep 2017 Answer Keys For MorningBuntheaNo ratings yet

- Cambridge International Examinations: Accounting 0452/12 March 2017Document8 pagesCambridge International Examinations: Accounting 0452/12 March 2017Mike ChindaNo ratings yet

- 0452 s19 QP 13 PDFDocument24 pages0452 s19 QP 13 PDFmarryNo ratings yet

- Cambridge O Level: Business Studies 7115/11 May/June 2020Document11 pagesCambridge O Level: Business Studies 7115/11 May/June 2020Fred SaneNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/11 May/June 2020Document10 pagesCambridge IGCSE™: Business Studies 0450/11 May/June 2020Daniel NAMNo ratings yet

- Answer Mock PPR 2 Econs PDFDocument14 pagesAnswer Mock PPR 2 Econs PDFHamiz AizuddinNo ratings yet

- MS Cambridge O Accounting-11 112018Document20 pagesMS Cambridge O Accounting-11 112018ngwenyapetro164No ratings yet

- 0452 w19 Ms 21 PDFDocument17 pages0452 w19 Ms 21 PDFbipin jainNo ratings yet

- 9706 m19 Ms 22Document16 pages9706 m19 Ms 22Ryan Xavier M. BiscochoNo ratings yet

- 2022 Fy13ce Accounting Detailed SolutionDocument16 pages2022 Fy13ce Accounting Detailed SolutionRashmi KumarNo ratings yet

- Mark Scheme: Extra Assessment Material For First Teaching September 2017Document13 pagesMark Scheme: Extra Assessment Material For First Teaching September 2017shamNo ratings yet

- 2019 May MS 4ac0 1R PDFDocument18 pages2019 May MS 4ac0 1R PDFmahdiarahman10No ratings yet

- NCE Business Entrepreneurship Education Section B 2021 2022Document12 pagesNCE Business Entrepreneurship Education Section B 2021 2022rianaalyNo ratings yet

- Paper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Document8 pagesPaper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Jeremy LuNo ratings yet

- Mark Scheme: Accounting 5121Document12 pagesMark Scheme: Accounting 5121SaadArshadNo ratings yet

- Financial Accounting I 1005Document28 pagesFinancial Accounting I 1005meetwithsanjayNo ratings yet

- Pre-Q Acc T1 Exam 2022Document13 pagesPre-Q Acc T1 Exam 2022fzpoggtjvevbfkyagyNo ratings yet

- Cambridge Assessment International Education: This Document Consists of 12 Printed PagesDocument12 pagesCambridge Assessment International Education: This Document Consists of 12 Printed PagesTalha FarooquiNo ratings yet

- 0452 m17 Ms 12Document8 pages0452 m17 Ms 12Mohammed MaGdyNo ratings yet

- 9609_s18_ms_23Document11 pages9609_s18_ms_23LightNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/34 May/June 2021Document13 pagesCambridge International AS & A Level: Accounting 9706/34 May/June 2021Mayur MandhubNo ratings yet

- Cambridge International Examinations: Accounting 0452/11 May/June 2017Document11 pagesCambridge International Examinations: Accounting 0452/11 May/June 2017Ayman ZarifNo ratings yet

- Ms May 20 p1Document19 pagesMs May 20 p1Tahmid MahabubNo ratings yet

- 0452 m17 QP 12Document20 pages0452 m17 QP 12Mohammed MaGdyNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International General Certificate of Secondary EducationabeerNo ratings yet

- Paper1 29 May 2013Document12 pagesPaper1 29 May 2013Ross RodgersNo ratings yet

- Qa Ca Zambia Programme December 2019 ExaminationDocument449 pagesQa Ca Zambia Programme December 2019 ExaminationimasikudenisiahNo ratings yet

- Ems GR 9 Paper 1 Answer SheetDocument5 pagesEms GR 9 Paper 1 Answer Sheetemmanuelmutemba919No ratings yet

- 03 0452 12 MS Final ScorisDocument10 pages03 0452 12 MS Final ScorisFarman FaheemNo ratings yet

- ACCOf131Ta (1)Document6 pagesACCOf131Ta (1)Sinazo XhosaNo ratings yet

- Myself and Others: Friendship, Leisure Time, and Personal InterestsDocument4 pagesMyself and Others: Friendship, Leisure Time, and Personal InterestsSeong Hun LeeNo ratings yet

- Group 00Document62 pagesGroup 0086superchargedNo ratings yet

- UNIT 1 Checkpoint English Year 7 - The Senses Term 2Document4 pagesUNIT 1 Checkpoint English Year 7 - The Senses Term 2Seong Hun LeeNo ratings yet

- 3단원 Mensuration-15차 수학Document33 pages3단원 Mensuration-15차 수학Seong Hun LeeNo ratings yet

- UNIT 1 Checkpoint English Year 7: The Senses Term 3Document3 pagesUNIT 1 Checkpoint English Year 7: The Senses Term 3Seong Hun LeeNo ratings yet

- Sample Questions and Mark SchemesDocument14 pagesSample Questions and Mark SchemesSeong Hun LeeNo ratings yet

- Cambridge Checkpoint: FeedbackDocument24 pagesCambridge Checkpoint: Feedbacktwlee1973No ratings yet

- Marking SchemeDocument4 pagesMarking SchemeSeong Hun LeeNo ratings yet

- Cambridge Secondary 1: English Curriculum FrameworkDocument16 pagesCambridge Secondary 1: English Curriculum FrameworkSeong Hun LeeNo ratings yet

- The Advantages of Abi Shaker's Compost MachineDocument4 pagesThe Advantages of Abi Shaker's Compost MachineSeong Hun LeeNo ratings yet

- UNIT 2 Checkpoint English Year 8 - Myself and Others Term 1Document4 pagesUNIT 2 Checkpoint English Year 8 - Myself and Others Term 1Seong Hun LeeNo ratings yet

- UNIT 3 Checkpoint English Year 9Document11 pagesUNIT 3 Checkpoint English Year 9Seong Hun LeeNo ratings yet

- Checkpoint English: WWW - Learn.co - Uk WWW - Teachit.co - Uk WWW - Bbc.co - Uk/schools/ks3bitesizeDocument2 pagesCheckpoint English: WWW - Learn.co - Uk WWW - Teachit.co - Uk WWW - Bbc.co - Uk/schools/ks3bitesizeSeong Hun LeeNo ratings yet

- University of Cambridge International Examinations Cambridge CheckpointDocument4 pagesUniversity of Cambridge International Examinations Cambridge CheckpointSeong Hun LeeNo ratings yet

- Maximum Mark: 50: University of Cambridge International Examinations Cambridge CheckpointDocument6 pagesMaximum Mark: 50: University of Cambridge International Examinations Cambridge CheckpointSeong Hun LeeNo ratings yet

- UNIT 2 Check Point English Year 8: Myself and Others Term 2Document3 pagesUNIT 2 Check Point English Year 8: Myself and Others Term 2Seong Hun LeeNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International General Certificate of Secondary EducationSeong Hun LeeNo ratings yet

- Maximum Mark: 50: University of Cambridge International Examinations Cambridge CheckpointDocument6 pagesMaximum Mark: 50: University of Cambridge International Examinations Cambridge CheckpointSeong Hun LeeNo ratings yet

- 1111 2012 SP 2 PDFDocument8 pages1111 2012 SP 2 PDFSeong Hun LeeNo ratings yet

- UNIT 1 Checkpoint English Year 7 - The Senses: Term 1Document4 pagesUNIT 1 Checkpoint English Year 7 - The Senses: Term 1Seong Hun LeeNo ratings yet

- Cambridge Checkpoint: Resources ListDocument4 pagesCambridge Checkpoint: Resources ListSeong Hun Lee0% (1)

- 0452 s18 QP 21Document20 pages0452 s18 QP 21Seong Hun LeeNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International General Certificate of Secondary EducationSeong Hun LeeNo ratings yet

- FreeExamPapers.comDocument8 pagesFreeExamPapers.comHitechSoft HitsoftNo ratings yet

- CIE Checkpoint PaperDocument4 pagesCIE Checkpoint PaperThuran NathanNo ratings yet

- Cambridge International Examinations Cambridge Checkpoint English Paper 2 May 2003 1 Hour Plus 7 Minutes' Reading TimeDocument4 pagesCambridge International Examinations Cambridge Checkpoint English Paper 2 May 2003 1 Hour Plus 7 Minutes' Reading TimeSeong Hun LeeNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument24 pagesCambridge International General Certificate of Secondary EducationSeong Hun LeeNo ratings yet

- Accounting: Paper 0452/11 Paper 11Document25 pagesAccounting: Paper 0452/11 Paper 11Seong Hun LeeNo ratings yet

- 0452 s18 QP 22Document24 pages0452 s18 QP 22Seong Hun LeeNo ratings yet

- Introduction Lingang Fengxian ParkDocument34 pagesIntroduction Lingang Fengxian ParkmingaiNo ratings yet

- SyllabusDocument42 pagesSyllabusvasudevprasadNo ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- Comparative Economic SystemsDocument8 pagesComparative Economic SystemsDan GregoriousNo ratings yet

- DGPR-The Death of Portfolio DiversificationDocument6 pagesDGPR-The Death of Portfolio DiversificationdevnevNo ratings yet

- Marine Assignment 2 - Article ReviewDocument4 pagesMarine Assignment 2 - Article ReviewTerrie JohnnyNo ratings yet

- ACE Variable IC Online Mock Exam - 08182021Document11 pagesACE Variable IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Nigerian Youth MigrationDocument1 pageNigerian Youth MigrationElyas NazmiyeNo ratings yet

- Sample Co Hosting ContractDocument7 pagesSample Co Hosting ContractArte CasaNo ratings yet

- RELATIONSHIP MARKETING USING DIGITAL PLATFORMSDocument32 pagesRELATIONSHIP MARKETING USING DIGITAL PLATFORMSAwien MazlannNo ratings yet

- 4 Preparing A Bank ReconciliationDocument9 pages4 Preparing A Bank ReconciliationSamuel DebebeNo ratings yet

- Statement of Employment Expenses For Working at Home Due To COVID-19Document2 pagesStatement of Employment Expenses For Working at Home Due To COVID-19Igor GoesNo ratings yet

- Challenges in Devising A Compensation PlanDocument6 pagesChallenges in Devising A Compensation PlanPrithwiraj Deb0% (1)

- What Is Non-Fund Based Lending?: Following Are The Parties Involved in A Letter of CreditDocument3 pagesWhat Is Non-Fund Based Lending?: Following Are The Parties Involved in A Letter of CreditAbhijeet RathoreNo ratings yet

- Online Course: Political and Market Framework: VietnamDocument32 pagesOnline Course: Political and Market Framework: VietnamTruong Dac HuyNo ratings yet

- Long-Term Debt, Preferred Stock, and Common Stock Long-Term Debt, Preferred Stock, and Common StockDocument22 pagesLong-Term Debt, Preferred Stock, and Common Stock Long-Term Debt, Preferred Stock, and Common StockRizqan AnshariNo ratings yet

- Accounting Ratios Information: An Instrument For Business Performance AnalysisDocument6 pagesAccounting Ratios Information: An Instrument For Business Performance AnalysisEditor IJTSRDNo ratings yet

- Chapter: 3 Theory Base of AccountingDocument2 pagesChapter: 3 Theory Base of AccountingJedhbf DndnrnNo ratings yet