Professional Documents

Culture Documents

Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On Salary

Uploaded by

SyedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On Salary

Uploaded by

SyedCopyright:

Available Formats

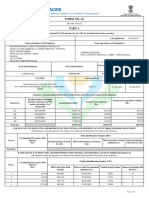

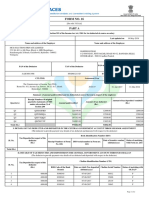

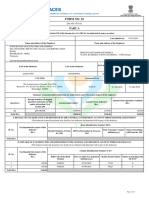

FORM 16 Certificate No.

: 593

[See Rule 31(1) (a)]

PART A

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source on Salary

Name and address of the Employer Name and address of the Employee

XAVIENT SOFTWARE SOLUTIONS INDIA PRIVATE LIMITED ABDUL QADIR KIDWAI

54,

SDF D-05, E-10,15,21 & 24

N.S.E.Z., PHASE-II NOIDA 201305

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference No.

AAACX0465F MRTX00005F CCOPK6147G XIND13517

CIT (TDS) Assessment year Period with the Employer

Address CIT SEC-20, NOIDA (U.P.)

From To

2018-19

01-Apr-2017 31-Mar-2018

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Receipt Numbers of original quarterly Amount of tax

Amount Amount of tax

Quarter statements of TDS under sub-section (3) of deposited/remitted

paid/credited deducted ( Rs. )

section 200. (Rs. )

1 QSOKFDHD 0 0

2 QSQOUVYD 0 0

418,826

3 QSVSQCYD 0 0

4 QSZGIVCF 0 0

Total 418,826 0 0

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductree)

Challan indentification number ( CIN )

Tax deposited in respect

SI. No. Status of

of the deductee (Rs.) BSR Code of Bank Date on which tax deposited Challan Serial

matching with

Branch (dd/mm/yyyy) Number

OLTAS

Totals

Verification

I Ashish Jain, son of Mr. O.P. Jain working in the capacity of Director-Finance & Accounts do hereby certify that a sum of Rs.0 [Rupees NIL] has

been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and

correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Digitally Signed By ASHISH JAIN

Signature of the person responsible for deduction of tax

Place: NOIDA Full Name: Ashish Jain

Date: 04-Jun-2018 Designation: Director-Finance & Accounts

Signature Not Verified

Digitally signed by: ASHISH JAIN

Date: 2018.06.06 18.51.14

Reason:

Location: NOIDA

XIND13517 ABDUL QADIR KIDWAI CCOPK6147G Certificate No.: 593

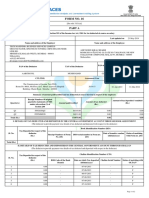

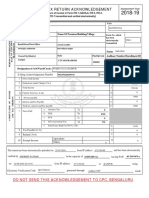

PART B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. Gross Salary (Rs.) (Rs.) (Rs.) (Rs.)

a. Salary as per provisions contained in section 17(1) 418,826

b. Value of perquisites under section 17(2) (as per Form No. 0

12BA, wherever applicable)

c. Profits in lieu of salary under section 17(3) (as per Form 0

No.12BA, wherever applicable)

d. Total 418,826

2. Less: Allowance to the extent exempt under section 10

House Rent Allowance 81,170

Conveyance Allowance 19,200

Medical Reimbusement 9,403

Total 109,773

3. Balance (1 - 2) 309,053

4. Deductions

5. Aggregate of 4 0

6. Income chargeable under the head 'salaries' (3 - 5) 309,053

7. Add: Any other income reported by the employee

Total of above 0

8. Gross total income (6 + 7) 309,053

9. Deductions under Chapter VI-A Qualifying Deductible

Gross Amount

(A) Section 80C, 80CCC and 80CCD Amount Amount

(a) Section 80 C

a. Life Ins. Prem/Infra Bond/ULIP 10,412 10,412

Total of Section 80C, 80CCC and 80CCD 10,412 10,412 10,412

(B) Other Sections under Chapter VI-A

a. Section 80 D (Parents) 7,038 7,038

b. Section 80 D(others) 5,388 5,388

c. Section 80 E 16,696 16,696

Total of Other Sections under Chapter VI-A 29,122 29,122 29122

10. Aggregate of deductible amount under Chapter VI-A 39,534

11. Total Income (8 - 10) 269,520

12. Tax on total income 0

13. Education cess (on tax computed at S.No.12) 0

14. Tax payable (12+13) 0

15. Less: Relief under section 89 (attach details) 0

16. Tax payable (14-15) 0

Verification

I, Ashish Jain, son of Mr. O.P. Jain working in the capacity of Director-Finance & Accounts do hereby certify that the information given above is

true, complete and correct and is based on the books of account, documents, TDS statements, and other available records.

Digitally Signed By ASHISH JAIN

Signature of the person responsible for deduction of tax

Place: NOIDA Full Name: Ashish Jain

Date: 04-Jun-2018 Designation: Director-Finance & Accounts

Signature Not Verified

Digitally signed by: ASHISH JAIN

Date: 2018.06.06 18.51.14

Reason:

Location: NOIDA

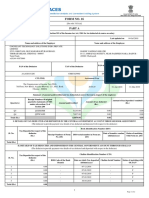

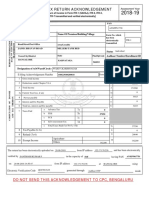

ABDUL QADIR KIDWAI Annexure to Form No. 16 Certificate No.: 593

1. Gross Salary Total(Rs.)

Basic 182,400

House Rent Allowance 102,135

Conveyance Allowance 19,200

Special Allowance 43,947

Medical Reimbursement 9,403

Leave Travel Assistance 11,385

Medical Taxable 5,597

Bonus 16,800

Arrears-HRA 2,435

Arrears-Spcl Allow 4,883

Shift Allowance 4,800

Comp Off Pay out 15,841

Gross Salary 418,826

HRA Exemption Calculation

Period Basic Rent Paid HRA Recd Rent Paid Less 40/50% Salary Least of

Non Metro Metro (A) 10% Salary (B) (C) (A,B,C)

Apr-2017 15,200 0 8,300 6,685 6,780 7,600 6,685

May-2017 15,200 0 8,300 6,685 6,780 7,600 6,685

Jun-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Jul-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Aug-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Sep-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Oct-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Nov-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Dec-2017 15,200 0 8,300 9,120 6,780 7,600 6,780

Jan-2018 15,200 0 8,300 9,120 6,780 7,600 6,780

Feb-2018 15,200 0 8,300 9,120 6,780 7,600 6,780

Mar-2018 15,200 0 8,300 9,120 6,780 7,600 6,780

Totals: 182,400 99,600 104,570 81,360 91,200 81,170

Signature Not Verified

Digitally signed by: ASHISH JAIN

Date: 2018.06.06 18.51.14

Reason:

Location: NOIDA

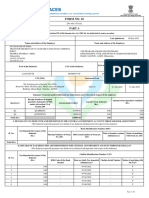

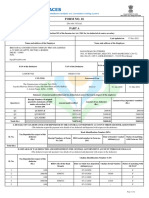

FORM NO. 12BA Certificate No.: 593

[{See Rule 26A(2)(b)}]

Statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of employer : XAVIENT SOFTWARE SOLUTIONS INDIA PRIVATE LIMITED

54,

SDF D-05, E-10,15,21 & 24

N.S.E.Z., PHASE-II NOIDA 201305

2. TAN MRTX00005F

3. TDS Assessment Range of employer: CIT SEC-20, NOIDA (U.P.)

4. Name,designation and ABDUL QADIR KIDWAI - SOFTWARE TEST ENGINEER

PAN of employee: CCOPK6147G

5. Is the employee a director or a person with substantial interest NO

in the company (where the employer is a company):

6. Income under the head 'Salaries' of the employee: 418,826

(other than from perquisites)

7. Financial Year 2017-18

8. Valuation of Perquisites

Amount, if any,

Value of perquisite Amount of perquisite

S.No. Nature of perquisites (see rule 3) recovered from the

as per rules chargeable to tax

employee

(Rs.) (Rs.) (Rs.)

1 Total value of perquisites 0 0 0

2 Total value of profits in lieu of salary as per section 17(3) 0 0 0

9. Details of tax:

(a) Tax deducted from salary of the employee under section 192(1) 0

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0

(c) Total tax paid 0

(d) Date of payment into Government treasury as per Form-16

DECLARATION BY EMPLOYER

I, Ashish Jain, son of Mr. O.P. Jain working as Director-Finance & Accounts do hereby declare on behalf of XAVIENT SOFTWARE SOLUTIONS

INDIA PRIVATE LIMITED that the information given above is based on the books of account, documents and other relevant records or

information available with us and the details of value of each such perquisite are in accordance with section 17 and rules framed thereunder and

that such information is true and correct.

Digitally Signed By ASHISH JAIN

Signature of the person responsible for deduction of tax

Place: NOIDA Full Name: Ashish Jain

Date: 04-Jun-2018 Designation: Director-Finance & Accounts

Signature Not Verified

Digitally signed by: ASHISH JAIN

Date: 2018.06.06 18.51.14

Reason:

Location: NOIDA

You might also like

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form 16 Salary CertificateDocument9 pagesForm 16 Salary CertificateHarish KumarNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- Aoapk6856n 2019-20 PDFDocument2 pagesAoapk6856n 2019-20 PDFSiva Kumar KNo ratings yet

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Form 16 SummaryDocument4 pagesForm 16 SummaryniranjansankaNo ratings yet

- Salary details and tax deductionsDocument3 pagesSalary details and tax deductionsBALANo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form16Document5 pagesForm16er_ved06No ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryPradeep NegiNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AFuture ArtistNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- Wipro Form 16 DetailsDocument8 pagesWipro Form 16 DetailssaisindhuNo ratings yet

- Form 16 TDS Certificate SummaryDocument2 pagesForm 16 TDS Certificate SummaryPravin HireNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahesh JadhavNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- BLJPM3369M 2014-15Document2 pagesBLJPM3369M 2014-15jackproewildNo ratings yet

- Form No. 16: Part ADocument10 pagesForm No. 16: Part ARAJASHEKAR KYAROLLANo ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- TDS Certificate Form 16Document9 pagesTDS Certificate Form 16Aman AgrawalNo ratings yet

- RPT Pay SlipDocument1 pageRPT Pay SlipAllia sharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Aikpd4798c 2019-20Document2 pagesAikpd4798c 2019-20Satyanarayana Sharma ValluriNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Form 16 Salary CertificateDocument6 pagesForm 16 Salary CertificatePritha DasNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Logic and Computer Design: Dr. Sanjay P. Ahuja, PH.DDocument25 pagesLogic and Computer Design: Dr. Sanjay P. Ahuja, PH.DNandini GuptaNo ratings yet

- NAUBASTA LAYOUT PLAN-ModelDocument1 pageNAUBASTA LAYOUT PLAN-ModelSyedNo ratings yet

- Project Profile On White and Black PhenylDocument7 pagesProject Profile On White and Black PhenylSyedNo ratings yet

- DRAFT Subscriber Sheet LLPDocument1 pageDRAFT Subscriber Sheet LLPSyedNo ratings yet

- Subscribers and Consent SheetDocument1 pageSubscribers and Consent SheetSyedNo ratings yet

- Btech 2012 To 2016 AMUDocument58 pagesBtech 2012 To 2016 AMUSyedNo ratings yet

- Zambia HIV/AIDS Data IntegrityDocument1 pageZambia HIV/AIDS Data IntegrityReal KezeeNo ratings yet

- Question 3-FSDocument1 pageQuestion 3-FSRax-Nguajandja KapuireNo ratings yet

- 1982 SAMAHAN ConstitutionDocument11 pages1982 SAMAHAN ConstitutionSAMAHAN Central BoardNo ratings yet

- Code of Business Conduct For Suppliers To The Coca-Cola CompanyDocument1 pageCode of Business Conduct For Suppliers To The Coca-Cola CompanyMonicaNo ratings yet

- Indian Air Force AFCAT Application Form: Personal InformationDocument3 pagesIndian Air Force AFCAT Application Form: Personal InformationSagar SharmaNo ratings yet

- Assignment No 1. Pak 301Document3 pagesAssignment No 1. Pak 301Muhammad KashifNo ratings yet

- Right to Life and Duty to Investigate Under ICCPRDocument16 pagesRight to Life and Duty to Investigate Under ICCPRRosedemaeBolongaitaNo ratings yet

- Chem Office Enterprise 2006Document402 pagesChem Office Enterprise 2006HalimatulJulkapliNo ratings yet

- Licensing AgreementDocument9 pagesLicensing AgreementberrolawfirmNo ratings yet

- Clean Water Act and RA 9275 rolesDocument3 pagesClean Water Act and RA 9275 rolesKristela Alexis OsorioNo ratings yet

- Final Sociology Project - Dowry SystemDocument18 pagesFinal Sociology Project - Dowry Systemrajpurohit_dhruv1142% (12)

- 3-Investment Information and Securities TransactionDocument59 pages3-Investment Information and Securities TransactionAqil RidzwanNo ratings yet

- Misha Regulatory AffairsDocument26 pagesMisha Regulatory AffairsGULSHAN MADHURNo ratings yet

- Model articles of association for limited companies - GOV.UKDocument7 pagesModel articles of association for limited companies - GOV.UK45pfzfsx7bNo ratings yet

- CFPB Your Money Your Goals Choosing Paid ToolDocument6 pagesCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrNo ratings yet

- DENR V DENR Region 12 EmployeesDocument2 pagesDENR V DENR Region 12 EmployeesKara RichardsonNo ratings yet

- Onga 735Document12 pagesOnga 735review20No ratings yet

- FIN-03. Receiving ProcedureDocument5 pagesFIN-03. Receiving ProcedureVu Dinh ThietNo ratings yet

- NSO Layered Service Architecture: Americas HeadquartersDocument34 pagesNSO Layered Service Architecture: Americas HeadquartersAla JebnounNo ratings yet

- I. True or FalseDocument5 pagesI. True or FalseDianne S. GarciaNo ratings yet

- Eepc Foreign TradeDocument3 pagesEepc Foreign Tradepeerspot.me3No ratings yet

- Compromise AgreementDocument2 pagesCompromise AgreementPevi Mae JalipaNo ratings yet

- Mila Exam LegalDocument2 pagesMila Exam LegalSarmila ShanmugamNo ratings yet

- Pieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Document9 pagesPieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- Hydrochloric Acid MSDS: 1. Product and Company IdentificationDocument7 pagesHydrochloric Acid MSDS: 1. Product and Company IdentificationdeaNo ratings yet

- JOIN OUR BATCH FOR AMUEEE PREPARATIONDocument16 pagesJOIN OUR BATCH FOR AMUEEE PREPARATIONDRAG-E-SPORT100% (1)

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- ADocument109 pagesALefa Doctormann RalethohlaneNo ratings yet

- Lacson Vs Roque DigestDocument1 pageLacson Vs Roque DigestJestherin Baliton50% (2)

- Caterpillar Cat 301.8C Mini Hydraulic Excavator (Prefix JBB) Service Repair Manual (JBB00001 and Up) PDFDocument22 pagesCaterpillar Cat 301.8C Mini Hydraulic Excavator (Prefix JBB) Service Repair Manual (JBB00001 and Up) PDFfkdmma33% (3)