Professional Documents

Culture Documents

ACC613 Lecture 4 Tutorial

Uploaded by

John TomCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC613 Lecture 4 Tutorial

Uploaded by

John TomCopyright:

Available Formats

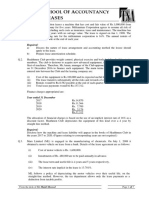

ACC613: Lecture 4: Leases – Tutorial

1. Rankin Ltd has entered into an agreement to lease an item of equipment that produces teddy bears.

The terms of the lease are as follows:

Date of entering the lease: 1 July 2014

Duration of lease: 10 years

Life of the lease asset: 10 years

There is no residual value

Lease payments: $5000 at lease inception, $5 500 on 30 June each year (that is, 10 payments).

Included within the lease payments are executory cost of $500.

Fair value of the machine at lease inception: $27 470.

REQUIRED

Determine the interest rate implicit in the lease.

2. Gregory Ltd enters into a non-cancellable five-year lease agreement with Sanders Ltd on 1 July 2009.

The lease id for an item of machinery that, at the inception of the lease, has a fair value of $231 140.

The machinery is expected to have an economic life of seven years, after which time it will have no

salvage value. There is a bargain purchase option, which Gregory Ltd will be able to exercise at the

end of the fifth year, for $50 000.

Sanders Ltd manufactures the machinery. The cost of the machinery to Sanders Ltd is $200 000.

There are to be five annual payments of $62 500, the first being made on 30 June 2010. Included

within the $62 500 lease payments is an amount of $6 250 representing payment to the lessor for

the insurance and maintenance of the machinery. The machinery is to be depreciated on a straight

line basis. The rate of interest implicit in the lease is 12 per cent.

REQUIRED

a) Calculate the present value of the minimum lease payments.

b) Prepare the journal entries for the years ending 30 June 2010 and 30 June 2011 in the books of:

i. Sanders Ltd

ii. Gregory Ltd

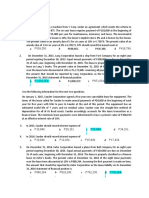

3. On 1 July 2009, Flyer Ltd decides to lease an aeroplane from France Ltd. The term of the lease is 20

years. The implicit interest rate in the lease is 10 per cent. It is expected that the aeroplane will be

scrapped at the end of the lease term. The fair value of the aeroplane at the commencement of the

lease is $2 428 400. The lease is non-cancellable, returns the aeroplane to France Ltd at the end of

the lease, and requires a lease payment of $300 000 on inception of the lease (1 July 2009) and lease

payments of $250 000 on 30 June each year (starting 30 June 2010). There is residual payment

required.

REQUIRED

a) Provide the entries for the lease in the books of Flyer Ltd as at 1 July 2009.

b) Provide entries for the lease in the books of France Ltd as at 1 July 2009.

c) Provide journal entries in the books of Flyer Ltd for the financial year of the lease (that is the

entry in 20 years’ time)

d) Provide journal entries in the books of France Ltd for the financial year of the lease (that is the

entry in 20 years’ time)

You might also like

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- Chapter E21Document2 pagesChapter E21Matus HanunNo ratings yet

- IFRS 16 13102022 100655am 1Document3 pagesIFRS 16 13102022 100655am 1Adnan MaqboolNo ratings yet

- Week 1 Tutorial QuestionsDocument3 pagesWeek 1 Tutorial QuestionsPardeep Ramesh AgarvalNo ratings yet

- Tutorial 11 (Exercise)Document2 pagesTutorial 11 (Exercise)Vidya IntaniNo ratings yet

- Leases - ASSIGNMENT 1Document2 pagesLeases - ASSIGNMENT 1PeachyNo ratings yet

- Lease Receivable Lease Liability Lease Receivable Lease LiabilityDocument1 pageLease Receivable Lease Liability Lease Receivable Lease LiabilityAnne Liezel PradoNo ratings yet

- Fa2 Tut 3Document5 pagesFa2 Tut 3Truong Thi Ha Trang 1KT-19No ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Calculate lease accounting under IFRS 16Document4 pagesCalculate lease accounting under IFRS 16Ellah Sharielle SantosNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- Assignment 1Document8 pagesAssignment 1Ivan SsebugwawoNo ratings yet

- MFRS 16 LEASE ACCOUNTINGDocument2 pagesMFRS 16 LEASE ACCOUNTINGNIK HISHAMUDDIN BIN NIK AZIZ / UPMNo ratings yet

- Leases ProblemsDocument4 pagesLeases ProblemsCunanan, Malakhai JeuNo ratings yet

- FR OTQ Compilation IFRS 16 LeasesDocument9 pagesFR OTQ Compilation IFRS 16 LeasesIqmal khushairiNo ratings yet

- Accounting - LeasesDocument1 pageAccounting - Leasesmish27No ratings yet

- Soal Kuis Minggu 11Document7 pagesSoal Kuis Minggu 11Natasya ZahraNo ratings yet

- Accounting for Employee Benefits, Leases and Other LiabilitiesDocument3 pagesAccounting for Employee Benefits, Leases and Other LiabilitiesmarygraceomacNo ratings yet

- Assignment 02 Leases - Solution - OportoDocument4 pagesAssignment 02 Leases - Solution - OportoDevina OportoNo ratings yet

- IFRS-16 Lease accounting entriesDocument2 pagesIFRS-16 Lease accounting entriesWaseim khan Barik zaiNo ratings yet

- Operating Lease Vs Finance LeaseDocument5 pagesOperating Lease Vs Finance LeasexjammerNo ratings yet

- Quiz Far LeaseDocument2 pagesQuiz Far Leasefrancis dungcaNo ratings yet

- Solved Java Hut Leased A Specialty Expresso Machine For A 10 YearDocument1 pageSolved Java Hut Leased A Specialty Expresso Machine For A 10 YearAnbu jaromiaNo ratings yet

- MC Questions For LeaseDocument6 pagesMC Questions For LeaseJPNo ratings yet

- Special TopicsDocument89 pagesSpecial TopicsPeter Banjao100% (2)

- Special TopicsDocument77 pagesSpecial TopicsPeter BanjaoNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Leases Problems Part2Document2 pagesLeases Problems Part221100959No ratings yet

- IFRS 16 LeasesDocument7 pagesIFRS 16 LeasesMazni HanisahNo ratings yet

- Goring Dairy Leases Its Milking Equipment From King Finance PDFDocument1 pageGoring Dairy Leases Its Milking Equipment From King Finance PDFAnbu jaromiaNo ratings yet

- Accounting For Leases Handouts FinalDocument5 pagesAccounting For Leases Handouts FinalMichael BongalontaNo ratings yet

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacNo ratings yet

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Lease Practical Accounting ProblemsDocument2 pagesLease Practical Accounting ProblemsCamille BonaguaNo ratings yet

- Accounting For Leases by J. GonzalesDocument7 pagesAccounting For Leases by J. GonzalesGonzales JhayVeeNo ratings yet

- Leases PS GoodsDocument4 pagesLeases PS GoodsDissentNo ratings yet

- Grady Leasing Company Signs An Agreement On January 1 2010 PDFDocument1 pageGrady Leasing Company Signs An Agreement On January 1 2010 PDFAnbu jaromiaNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Rental Revenue Recognition for Operating LeasesDocument3 pagesRental Revenue Recognition for Operating LeasesKath LeynesNo ratings yet

- Examination: Subject CT1 - Financial Mathematics Core TechnicalDocument5 pagesExamination: Subject CT1 - Financial Mathematics Core TechnicalfeererereNo ratings yet

- Solve lease accounting problemsDocument2 pagesSolve lease accounting problemsJobelle Marie MahNo ratings yet

- Fieval Leasing Company Signs An Agreement On January 1 2010 PDFDocument1 pageFieval Leasing Company Signs An Agreement On January 1 2010 PDFAnbu jaromiaNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- CH 21 Answer To in Class Diiscussion ProblemsDocument20 pagesCH 21 Answer To in Class Diiscussion ProblemsJakeChavezNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Soal Latihan Sewa - RahmaDocument3 pagesSoal Latihan Sewa - RahmaAlya DRNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- XXX FilesDocument1 pageXXX FilesMaya JuanNo ratings yet

- The Law of Construction Contracts in the Sultanate of Oman and the MENA RegionFrom EverandThe Law of Construction Contracts in the Sultanate of Oman and the MENA RegionNo ratings yet

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresFrom EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresRating: 4.5 out of 5 stars4.5/5 (3)

- Tutorial 3 AnswersDocument6 pagesTutorial 3 AnswersJohn TomNo ratings yet

- Tutorial 4 AnswersDocument5 pagesTutorial 4 AnswersJohn TomNo ratings yet

- Tutorial 5 AnswersDocument6 pagesTutorial 5 AnswersJohn TomNo ratings yet

- DocxDocument11 pagesDocxJohn TomNo ratings yet

- Tutorial Solutions For Acc710 Forensic Accounting InvestigationDocument4 pagesTutorial Solutions For Acc710 Forensic Accounting InvestigationJohn TomNo ratings yet

- BU511 Principles of Economics Course OverviewDocument3 pagesBU511 Principles of Economics Course OverviewJohn TomNo ratings yet

- Tutorial 2 AnswersDocument3 pagesTutorial 2 AnswersJohn TomNo ratings yet

- Forensic Accounting InvestigationDocument4 pagesForensic Accounting InvestigationJohn TomNo ratings yet

- ACC723 TUTORIAL 5 SOLUTIONSDocument3 pagesACC723 TUTORIAL 5 SOLUTIONSJohn TomNo ratings yet

- Power Point PresentationDocument22 pagesPower Point PresentationJohn TomNo ratings yet

- Advantage of Small Business Is Benefiting The FamilyDocument2 pagesAdvantage of Small Business Is Benefiting The FamilyJohn TomNo ratings yet

- Introduction To Accounting For Construction ContractsDocument4 pagesIntroduction To Accounting For Construction ContractsJohn TomNo ratings yet

- (Couchman V Hill) - That Is The Non-Performance of A Condition May Be Regarded As Grounds ToDocument1 page(Couchman V Hill) - That Is The Non-Performance of A Condition May Be Regarded As Grounds ToJohn TomNo ratings yet

- Activity 1 Calculations Using The Tax-Payable MethodDocument10 pagesActivity 1 Calculations Using The Tax-Payable MethodJohn TomNo ratings yet

- A1 Topic 4Document1 pageA1 Topic 4John TomNo ratings yet

- TQ PerpetuitiesDocument1 pageTQ PerpetuitiesJohn TomNo ratings yet

- Lecture 1Document23 pagesLecture 1John TomNo ratings yet

- Question 2Document1 pageQuestion 2John TomNo ratings yet

- T 4 Inventory - QS and SolutionsDocument3 pagesT 4 Inventory - QS and SolutionsJohn TomNo ratings yet

- Decisions Risks - SolutionsDocument1 pageDecisions Risks - SolutionsJohn TomNo ratings yet

- Finacial ManagementDocument2 pagesFinacial ManagementJohn TomNo ratings yet

- TQ3Document2 pagesTQ3John TomNo ratings yet

- Acc741: Corporate Financial Management I: Topic Four: Time Value of Money Tutorial QuestionsDocument2 pagesAcc741: Corporate Financial Management I: Topic Four: Time Value of Money Tutorial QuestionsJohn TomNo ratings yet

- T 2 Decisions Certainty - QuestionsDocument2 pagesT 2 Decisions Certainty - QuestionsJohn TomNo ratings yet

- All Practice Set SolutionsDocument22 pagesAll Practice Set SolutionsJohn TomNo ratings yet

- ACCY200, Autumn, 2011 Past Exam QuestionsDocument21 pagesACCY200, Autumn, 2011 Past Exam QuestionsJohn TomNo ratings yet

- Solomon Islands Electorial Commission-1Document1 pageSolomon Islands Electorial Commission-1John TomNo ratings yet

- Church Liaison OfficerDocument5 pagesChurch Liaison OfficerJohn TomNo ratings yet

- Topic 4Document31 pagesTopic 4John TomNo ratings yet

- Tutorial 2 ACC723Document1 pageTutorial 2 ACC723John TomNo ratings yet

- Customer Satisfaction of DairyDocument118 pagesCustomer Satisfaction of DairynitindeoraNo ratings yet

- Obstfeld, Taylor - Global Capital Markets PDFDocument374 pagesObstfeld, Taylor - Global Capital Markets PDFkterink00767% (3)

- Globalization Becomes Truly Global: Lessons Learned at LenovoDocument9 pagesGlobalization Becomes Truly Global: Lessons Learned at LenovormvffrankenbergNo ratings yet

- Week 1 (MGMT 4512) Exercise Questions (Excel)Document4 pagesWeek 1 (MGMT 4512) Exercise Questions (Excel)Big DripNo ratings yet

- Oe/Ee/Hps:: Instructions To Bidder FORDocument46 pagesOe/Ee/Hps:: Instructions To Bidder FORRabana KaryaNo ratings yet

- Constitutional Law2 Surigao Del Norte Electric Cooperative Inc Vs Energy Regulatory Commission GR No 183626 October 4, 2010 January 22, 2020 CASE DIGESTDocument3 pagesConstitutional Law2 Surigao Del Norte Electric Cooperative Inc Vs Energy Regulatory Commission GR No 183626 October 4, 2010 January 22, 2020 CASE DIGESTBrenda de la GenteNo ratings yet

- E StatementDocument3 pagesE StatementBkho HashmiNo ratings yet

- Chapter 5 Solutions Chap 5 SolutionDocument9 pagesChapter 5 Solutions Chap 5 Solutiontuanminh2048No ratings yet

- Operational Effectiveness + StrategyDocument7 pagesOperational Effectiveness + StrategyPaulo GarcezNo ratings yet

- Steel Industry PitchDocument17 pagesSteel Industry Pitchnavinmba2010No ratings yet

- Master Data Online Trustworthy, Reliable Data: DatasheetDocument2 pagesMaster Data Online Trustworthy, Reliable Data: DatasheetSahilNo ratings yet

- Solow Model Exam QuestionsDocument5 pagesSolow Model Exam QuestionsLeaGabrielleAbbyFariolaNo ratings yet

- Tri-R and Gardenia Reaction PaperDocument7 pagesTri-R and Gardenia Reaction PaperKatrina LeonardoNo ratings yet

- Main - Product - Report-Xiantao Zhuobo Industrial Co., Ltd.Document8 pagesMain - Product - Report-Xiantao Zhuobo Industrial Co., Ltd.Phyo WaiNo ratings yet

- Water ManagementDocument2 pagesWater ManagementIwan PangestuNo ratings yet

- NBPDocument57 pagesNBPbeehajiNo ratings yet

- Apple Vs SamsungDocument10 pagesApple Vs SamsungREEDHEE2210No ratings yet

- Question BankDocument7 pagesQuestion BankJahnavi GoelNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- Review of Literature-Car FinancingDocument5 pagesReview of Literature-Car FinancingRaj Kumar50% (4)

- Problemele Adolescentilor Si Consilierea Parintilor Florin UleteDocument46 pagesProblemele Adolescentilor Si Consilierea Parintilor Florin UleteGabriela Marinescu100% (1)

- Prelim Que. Paper - EEFM 23-24Document4 pagesPrelim Que. Paper - EEFM 23-24ffqueen179No ratings yet

- Introduction To "Services Export From India Scheme" (SEIS)Document6 pagesIntroduction To "Services Export From India Scheme" (SEIS)Prathaamesh Chorge100% (1)

- Dividend Discount Model - Commercial Bank Valuation (FIG)Document2 pagesDividend Discount Model - Commercial Bank Valuation (FIG)Sanjay RathiNo ratings yet

- Chapter 30Document2 pagesChapter 30Ney GascNo ratings yet

- Relaxo Footwear: Consumption Play or Brand Play?Document51 pagesRelaxo Footwear: Consumption Play or Brand Play?Ribhu MehraNo ratings yet

- Long-Term Rating Grades Mapping TableDocument1 pageLong-Term Rating Grades Mapping TableSidrah ShaikhNo ratings yet

- Printers' Marketplace September 21, 2010Document66 pagesPrinters' Marketplace September 21, 2010Christopher AllenNo ratings yet

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- Advertisment and MediaDocument21 pagesAdvertisment and MediaMohit YadavNo ratings yet