Professional Documents

Culture Documents

Whitaker New Entrant Form 278 Certified

Uploaded by

Law&CrimeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitaker New Entrant Form 278 Certified

Uploaded by

Law&CrimeCopyright:

Available Formats

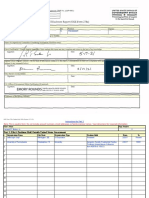

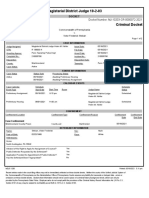

New Entrant Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No.

(3209-0001) (January 2018)

Executive Branch Personnel

Public Financial Disclosure Report (OGE Form 278e)

Filer's Information

Whitaker, Matthew

Chief of Staff & Senior Counselor, Office of the Attorney General, Department of Justice

Date of Appointment: 10/04/2017

Other Federal Government Positions Held During the Preceding 12 Months:

None

Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge.

/s/ Whitaker, Matthew [electronically signed on 11/18/2017 by Whitaker, Matthew in Integrity.gov] - Filer received a 14 day filing extension.

Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations

(subject to any comments below).

/s/ Allen, Michael H, Certifying Official [electronically signed on 11/20/2018 by Allen, Michael H in Integrity.gov]

Other review conducted by

/s/ Shaw, Cynthia K, Ethics Official [electronically signed on 11/20/2018 by Shaw, Cynthia K in Integrity.gov]

U.S. Office of Government Ethics Certification

Whitaker, Matthew - Page 1

Data Revised 11/20/2018

Data Revised 11/19/2018

Data Revised 11/16/2018

Data Revised 11/08/2018

Data Revised 11/07/2018

Comments of Reviewing Officials (public annotations):

PART # REFERENCE COMMENT

N/A N/A General (11/20/2018, Shaw, Cynthia K): Clarifications and revisions of information made, based on

information from filer.

Whitaker, Matthew - Page 2

1. Filer's Positions Held Outside United States Government

# ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO

TYPE

1 CNN/Time Warner Atlanta, Georgia Corporation Legal 7/2017 9/2017

Commentator

2 Matthew G Whitaker P.C. Des Moines, Corporation Owner 12/2009 9/2017

Iowa

3 American Trust Bank Dubuque, Iowa Corporation Advisor 6/2014 9/2017

4 Foundation for Accountability & Civic Trust Washington, Non-Profit Executive 10/2014 9/2017

District of Director

Columbia

2. Filer's Employment Assets & Income and Retirement Accounts

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 CNN/Time Warner N/A Consulting Fees $15,000

2 Matthew G Whitaker P.C. (Law firm and N/A Salary/Bonus/Di $103,400

consulting firm) stribution

3 IRA - Infracap MLP ETF (AMZA) Yes $1,001 - $15,000 None (or less

than $201)

4 American Trust Bank N/A Consulting Fees $1,750

5 Foundation for Accountability & Civic Trust N/A Salary $904,000

6 World Patent Marketing N/A Legal fees $1,875

Whitaker, Matthew - Page 3

3. Filer's Employment Agreements and Arrangements

None

4. Filer's Sources of Compensation Exceeding $5,000 in a Year

# SOURCE NAME CITY, STATE BRIEF DESCRIPTION OF DUTIES

1 CNN/Time Warner Atlanta, Georgia Consulting, Legal Commentator

2 Matthew G Whitaker P.C. Des Moines, Law Firm/Consulting Firm

Iowa

3 Foundation for Accountability & Civic Trust Washington, Executive Director

District of

Columbia

4 Nebraska Beef Omaha, Legal services, client of law firm

Nebraska

5 Mujo Becirovic Des Moines, Legal services, client of law firm

Iowa

6 Dan Sullivan Dallas, Texas Legal Services, client of law firm

7 Mike Pieper Keokuk, Iowa Legal services, client of law firm

5. Spouse's Employment Assets & Income and Retirement Accounts

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 MC2 Inc. (Sale of water treatment N/A salary, bonus

equipment)

2 Rollover IRA No $100,001 - Dividends $1,001 - $2,500

$250,000 Capital Gains

Whitaker, Matthew - Page 4

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.1 Aberdeen Fds Emerging Markets (ABEMX) No

2.2 Diamond Hill Fds Large Cap (DHLRX) Yes

2.3 Edgewood Funds Growth Fund (EGFIX) Yes

2.4 Goldman Sachs Tr Finl Square Treas Instrs Yes

(FTIXX)

2.5 American Funds Growth (GFFFX) Yes

2.6 Hartford Mutl Fds (HFMIX) Yes

2.7 Lazard Fds Inc Intl (LZIEX) Yes

2.8 Meridian Fd Inc Small Cap Growth (MISGX) Yes

2.9 Metropolitan West Fds Total Return (MWTIX) Yes

2.10 Principal Funds Inc Global Real Estate Yes

(POSIX)

2.11 American Funds EuroPacific Growth Fund Yes

(AEPFX)

2.12 Nuveen Invt Fds Inc Real Estate Secs (FARCX) Yes

2.13 Touchstone FDS Group VIC Cap (TCVYX) Yes

2.14 Dean Small Cap Value (DASCX) Yes

2.15 Virtus Funds (HIEMX) Yes

2.16 Invesco Global Real Estate (ARGYX) Yes

2.17 Fundvantage Tr Gotham Absolute Return Yes

(GARIX)

2.18 Dodge & Cox Fds (DODFX) Yes

2.19 Eaton Vance Mutual Fds (EGRIX) Yes

2.20 Harbor Fund Small Cap (HASCX) Yes

Whitaker, Matthew - Page 5

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

2.21 Harbor Fd Cap Appreciation (HACAX) Yes

2.22 John Hancock Funds II (JCUIX) Yes

2.23 JP Morgan Tr I US Large Cap (JLPSX) Yes

2.24 Oppenheimer Dev Mkts (ODVYX) Yes

2.25 Pimco Fds Pac Invt (PEBIX) Yes

2.26 Principal Fds Inc High Yield (PHYTX) Yes

2.27 T Rowe Price Equity (PRFDX) Yes

2.28 T Rowe Price Mid-cap (RPMGX) Yes

6. Other Assets and Income

# DESCRIPTION EIF VALUE INCOME TYPE INCOME

AMOUNT

1 JEMM Properties LLC No

1.1 commercial real estate, Des Moines, Iowa N/A None (or less Capital Gains $50,001 -

than $1,001) $100,000

2 MEM Investment II LLC No

2.1 commercial real estate in Des Moines, Iowa N/A $1,001 - $15,000 Rent or $201 - $1,000

Royalties

3 DM Rink Partners LLC No

3.1 commercial real estate in Urbandale, Iowa N/A $50,001 - None (or less

$100,000 than $201)

4 MMCL Partners (partial interest in family No $100,001 - Rent or $2,501 - $5,000

farm in Ely, Iowa) $250,000 Royalties

Whitaker, Matthew - Page 6

7. Transactions

(N/A) - Not required for this type of report

8. Liabilities

# CREDITOR NAME TYPE AMOUNT YEAR RATE TERM

INCURRED

1 Chase Credit Card $10,001 - 2017 15 revolving

$15,000

2 Citibank Credit Card $10,001 - 2017 12 revolving

$15,000

9. Gifts and Travel Reimbursements

(N/A) - Not required for this type of report

Endnotes

Whitaker, Matthew - Page 7

Summary of Contents

1. Filer's Positions Held Outside United States Government

Part 1 discloses positions that the filer held at any time during the reporting period (excluding positions with the United States Government). Positions are reportable

even if the filer did not receive compensation.

This section does not include the following: (1) positions with religious, social, fraternal, or political organizations; (2) positions solely of an honorary nature; (3) positions

held as part of the filer's official duties with the United States Government; (4) mere membership in an organization; and (5) passive investment interests as a limited

partner or non-managing member of a limited liability company.

2. Filer's Employment Assets & Income and Retirement Accounts

Part 2 discloses the following:

● Sources of earned and other non-investment income of the filer totaling more than $200 during the reporting period (e.g., salary, fees, partnership share,

honoraria, scholarships, and prizes)

● Assets related to the filer's business, employment, or other income-generating activities that (1) ended the reporting period with a value greater than $1,000 or (2)

produced more than $200 in income during the reporting period (e.g., equity in business or partnership, stock options, retirement plans/accounts and their

underlying holdings as appropriate, deferred compensation, and intellectual property, such as book deals and patents)

This section does not include assets or income from United States Government employment or assets that were acquired separately from the filer's business,

employment, or other income-generating activities (e.g., assets purchased through a brokerage account). Note: The type of income is not required if the amount of

income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF).

3. Filer's Employment Agreements and Arrangements

Part 3 discloses agreements or arrangements that the filer had during the reporting period with an employer or former employer (except the United States

Government), such as the following:

● Future employment

● Leave of absence

● Continuing payments from an employer, including severance and payments not yet received for previous work (excluding ordinary salary from a current employer)

● Continuing participation in an employee welfare, retirement, or other benefit plan, such as pensions or a deferred compensation plan

● Retention or disposition of employer-awarded equity, sharing in profits or carried interests (e.g., vested and unvested stock options, restricted stock, future share of

a company's profits, etc.)

Whitaker, Matthew - Page 8

4. Filer's Sources of Compensation Exceeding $5,000 in a Year

Part 4 discloses sources (except the United States Government) that paid more than $5,000 in a calendar year for the filer's services during any year of the reporting

period.

The filer discloses payments both from employers and from any clients to whom the filer personally provided services. The filer discloses a source even if the source

made its payment to the filer's employer and not to the filer. The filer does not disclose a client's payment to the filer's employer if the filer did not provide the services

for which the client is paying.

5. Spouse's Employment Assets & Income and Retirement Accounts

Part 5 discloses the following:

● Sources of earned income (excluding honoraria) for the filer's spouse totaling more than $1,000 during the reporting period (e.g., salary, consulting fees, and

partnership share)

● Sources of honoraria for the filer's spouse greater than $200 during the reporting period

● Assets related to the filer's spouse's employment, business activities, other income-generating activities that (1) ended the reporting period with a value greater

than $1,000 or (2) produced more than $200 in income during the reporting period (e.g., equity in business or partnership, stock options, retirement plans/accounts

and their underlying holdings as appropriate, deferred compensation, and intellectual property, such as book deals and patents)

This section does not include assets or income from United States Government employment or assets that were acquired separately from the filer's spouse's business,

employment, or other income-generating activities (e.g., assets purchased through a brokerage account). Note: The type of income is not required if the amount of

income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF). Amounts of income are not required for a spouse's earned income (excluding

honoraria).

6. Other Assets and Income

Part 6 discloses each asset, not already reported, that (1) ended the reporting period with a value greater than $1,000 or (2) produced more than $200 in investment

income during the reporting period. For purposes of the value and income thresholds, the filer aggregates the filer's interests with those of the filer's spouse and

dependent children.

This section does not include the following types of assets: (1) a personal residence (unless it was rented out during the reporting period); (2) income or retirement

benefits associated with United States Government employment (e.g., Thrift Savings Plan); and (3) cash accounts (e.g., checking, savings, money market accounts) at a

single financial institution with a value of $5,000 or less (unless more than $200 of income was produced). Additional exceptions apply. Note: The type of income is not

required if the amount of income is $0 - $200 or if the asset qualifies as an excepted investment fund (EIF).

7. Transactions

Whitaker, Matthew - Page 9

Part 7 discloses purchases, sales, or exchanges of real property or securities in excess of $1,000 made on behalf of the filer, the filer's spouse or dependent child during

reporting period.

This section does not include transactions that concern the following: (1) a personal residence, unless rented out; (2) cash accounts (e.g., checking, savings, CDs, money

market accounts) and money market mutual funds; (3) Treasury bills, bonds, and notes; and (4) holdings within a federal Thrift Savings Plan account. Additional

exceptions apply.

8. Liabilities

Part 8 discloses liabilities over $10,000 that the filer, the filer's spouse or dependent child owed at any time during the reporting period.

This section does not include the following types of liabilities: (1) mortgages on a personal residence, unless rented out (limitations apply for PAS filers); (2) loans

secured by a personal motor vehicle, household furniture, or appliances, unless the loan exceeds the item's purchase price; and (3) revolving charge accounts, such as

credit card balances, if the outstanding liability did not exceed $10,000 at the end of the reporting period. Additional exceptions apply.

9. Gifts and Travel Reimbursements

This section discloses:

● Gifts totaling more than $390 that the filer, the filer's spouse, and dependent children received from any one source during the reporting period.

● Travel reimbursements totaling more than $390 that the filer, the filer's spouse, and dependent children received from any one source during the reporting period.

For purposes of this section, the filer need not aggregate any gift or travel reimbursement with a value of $156 or less. Regardless of the value, this section does not

include the following items: (1) anything received from relatives; (2) anything received from the United States Government or from the District of Columbia, state, or

local governments; (3) bequests and other forms of inheritance; (4) gifts and travel reimbursements given to the filer's agency in connection with the filer's official travel;

(5) gifts of hospitality (food, lodging, entertainment) at the donor's residence or personal premises; and (6) anything received by the filer's spouse or dependent children

totally independent of their relationship to the filer. Additional exceptions apply.

Whitaker, Matthew - Page 10

Privacy Act Statement

Title I of the Ethics in Government Act of 1978, as amended (the Act), 5 U.S.C. app. § 101 et seq., as amended by the Stop Trading on Congressional Knowledge Act of

2012 (Pub. L. 112-105) (STOCK Act), and 5 C.F.R. Part 2634 of the U. S. Office of Government Ethics regulations require the reporting of this information. The primary use

of the information on this report is for review by Government officials to determine compliance with applicable Federal laws and regulations. This report may also be

disclosed upon request to any requesting person in accordance with sections 105 and 402(b)(1) of the Act or as otherwise authorized by law. You may inspect

applications for public access of your own form upon request. Additional disclosures of the information on this report may be made: (1) to any requesting person,

subject to the limitation contained in section 208(d)(1) of title 18, any determination granting an exemption pursuant to sections 208(b)(1) and 208(b)(3) of title 18; (2) to

a Federal, State, or local law enforcement agency if the disclosing agency becomes aware of violations or potential violations of law or regulation; (3) to another Federal

agency, court or party in a court or Federal administrative proceeding when the Government is a party or in order to comply with a judge-issued subpoena; (4) to a

source when necessary to obtain information relevant to a conflict of interest investigation or determination; (5) to the National Archives and Records Administration or

the General Services Administration in records management inspections; (6) to the Office of Management and Budget during legislative coordination on private relief

legislation; (7) to the Department of Justice or in certain legal proceedings when the disclosing agency, an employee of the disclosing agency, or the United States is a

party to litigation or has an interest in the litigation and the use of such records is deemed relevant and necessary to the litigation; (8) to reviewing officials in a new

office, department or agency when an employee transfers or is detailed from one covered position to another; (9) to a Member of Congress or a congressional office in

response to an inquiry made on behalf of an individual who is the subject of the record; (10) to contractors and other non-Government employees working on a

contract, service or assignment for the Federal Government when necessary to accomplish a function related to an OGE Government-wide system of records; and (11)

on the OGE Website and to any person, department or agency, any written ethics agreement filed with OGE by an individual nominated by the President to a position

requiring Senate confirmation. See also the OGE/GOVT-1 executive branch-wide Privacy Act system of records.

Public Burden Information

This collection of information is estimated to take an average of three hours per response, including time for reviewing the instructions, gathering the data needed, and

completing the form. Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this

burden, to the Program Counsel, U.S. Office of Government Ethics (OGE), Suite 500, 1201 New York Avenue, NW., Washington, DC 20005-3917.

Pursuant to the Paperwork Reduction Act, as amended, an agency may not conduct or sponsor, and no person is required to respond to, a collection of information

unless it displays a currently valid OMB control number (that number, 3209-0001, is displayed here and at the top of the first page of this OGE Form 278e).

Whitaker, Matthew - Page 11

You might also like

- Matthew Whitaker's Financial Disclosure FormDocument10 pagesMatthew Whitaker's Financial Disclosure FormLaw&CrimeNo ratings yet

- Barr, William P. Final278Document36 pagesBarr, William P. Final278Erin LaviolaNo ratings yet

- New Entrant Report for White House Assistant Communications DirectorDocument9 pagesNew Entrant Report for White House Assistant Communications DirectorMonte AltoNo ratings yet

- Devos FinancialDocument80 pagesDevos FinancialThe Washington PostNo ratings yet

- Fraudulent Assignment of DotDocument48 pagesFraudulent Assignment of DotSherry Hernandez100% (4)

- Anita+Dunn+ +278Document93 pagesAnita+Dunn+ +278Washington ExaminerNo ratings yet

- Elias - Ne RPTDocument10 pagesElias - Ne RPTThomas JonesNo ratings yet

- Trump Staff Public Financial Disclosure - Cordish, Reed PDFDocument66 pagesTrump Staff Public Financial Disclosure - Cordish, Reed PDFMonte AltoNo ratings yet

- 1542 Jeffrey D Zients Oge 278eDocument11 pages1542 Jeffrey D Zients Oge 278eWashington ExaminerNo ratings yet

- Fauci DocumentsDocument96 pagesFauci DocumentsVirutron ResearchNo ratings yet

- Bradsher.2022 RPTDocument8 pagesBradsher.2022 RPTThomas JonesNo ratings yet

- Margaret J PeterlinDocument7 pagesMargaret J PeterlinWAKESHEEP Marie RNNo ratings yet

- Trump Staff Public Financial Disclosure - Blase, Brian CDocument9 pagesTrump Staff Public Financial Disclosure - Blase, Brian CMonte AltoNo ratings yet

- Ross, Patricia.2022 RPTDocument8 pagesRoss, Patricia.2022 RPTThomas JonesNo ratings yet

- Trump Oge Financial Disclosure Jan 2021Document79 pagesTrump Oge Financial Disclosure Jan 2021File 411No ratings yet

- Jacobs.2022 RPTDocument16 pagesJacobs.2022 RPTThomas JonesNo ratings yet

- Sanfilippo.2022 RPTDocument8 pagesSanfilippo.2022 RPTThomas JonesNo ratings yet

- Trump Donald J AssetsDocument79 pagesTrump Donald J Assetsinfinitylove_No ratings yet

- Gonzalez Prats.2022 RPTDocument8 pagesGonzalez Prats.2022 RPTThomas JonesNo ratings yet

- USVI Doc - Approving Hyperion Air As Client (No Flags) Acknowledging Cutler Approved Keeping Epstein As ClientDocument8 pagesUSVI Doc - Approving Hyperion Air As Client (No Flags) Acknowledging Cutler Approved Keeping Epstein As ClientRA Martens100% (1)

- Steve Bannon Financial DisclosureDocument12 pagesSteve Bannon Financial DisclosureM MaliNo ratings yet

- Peter Navarro PFDDocument12 pagesPeter Navarro PFDThinkProgressNo ratings yet

- Donors Trust 2017 990Document192 pagesDonors Trust 2017 990jpeppardNo ratings yet

- Joseph Mondello's Executive Branch Personnel Public Financial Disclosure ReportDocument16 pagesJoseph Mondello's Executive Branch Personnel Public Financial Disclosure ReportNewsdayNo ratings yet

- Frueh.2022 RPTDocument9 pagesFrueh.2022 RPTThomas JonesNo ratings yet

- Farina.2022 RPTDocument10 pagesFarina.2022 RPTThomas JonesNo ratings yet

- Trey Glenn DisclosureDocument10 pagesTrey Glenn DisclosureJohn Archibald100% (1)

- Penny - Ne RPTDocument8 pagesPenny - Ne RPTThomas JonesNo ratings yet

- Declaración de Ingresos de Donald TrumpDocument101 pagesDeclaración de Ingresos de Donald TrumpFelipe DuarteNo ratings yet

- Bank of America Deed To FHLMC Dory GOEBEL 10 Mar 2005Document3 pagesBank of America Deed To FHLMC Dory GOEBEL 10 Mar 2005William A. Roper Jr.No ratings yet

- McClain.2022 RPTDocument9 pagesMcClain.2022 RPTThomas JonesNo ratings yet

- Member'S Public Disclosure StatementDocument5 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Prietula.2022 RPTDocument11 pagesPrietula.2022 RPTThomas JonesNo ratings yet

- CycleBar - 2015-01-31 - FDD - Xponential Fitness BrandDocument214 pagesCycleBar - 2015-01-31 - FDD - Xponential Fitness BrandFuzzy PandaNo ratings yet

- Trustee Supplements Fee App Support With Forms 1 & 2Document7 pagesTrustee Supplements Fee App Support With Forms 1 & 2Gary SeitzNo ratings yet

- A Comparison Bill White's and Rick Perry's Available Financial InformationDocument11 pagesA Comparison Bill White's and Rick Perry's Available Financial InformationbillwhitefortexasNo ratings yet

- Member'S Public Disclosure StatementDocument4 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Appraisal of The Medical Arts Center Building On Marco Island - Nov. 3, 2020Document110 pagesAppraisal of The Medical Arts Center Building On Marco Island - Nov. 3, 2020Omar Rodriguez OrtizNo ratings yet

- Waterfront Philippines Directors and Officers Complete Corporate Governance TrainingDocument20 pagesWaterfront Philippines Directors and Officers Complete Corporate Governance TrainingRj ArevadoNo ratings yet

- U.S. Office of Government Ethics Report For Betsy DeVosDocument108 pagesU.S. Office of Government Ethics Report For Betsy DeVosJosh White100% (9)

- Abold Labreche.2022 RPTDocument13 pagesAbold Labreche.2022 RPTThomas JonesNo ratings yet

- Davidson.2022 RPTDocument7 pagesDavidson.2022 RPTThomas JonesNo ratings yet

- Mike Flynn's Executive Branch Public Financial Disclosure Report Dated Feb. 11th, 2017 Eleven PagesDocument11 pagesMike Flynn's Executive Branch Public Financial Disclosure Report Dated Feb. 11th, 2017 Eleven PagesHarry the GreekNo ratings yet

- NVR Inc 10-K 02/14/2018 ORDocument143 pagesNVR Inc 10-K 02/14/2018 ORGrace StylesNo ratings yet

- Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e)Document18 pagesExecutive Branch Personnel Public Financial Disclosure Report (OGE Form 278e)Washington ExaminerNo ratings yet

- New Valley Bank & Trust Public Co. FileDocument91 pagesNew Valley Bank & Trust Public Co. FileJim KinneyNo ratings yet

- I2 TECHNOLOGIES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-20Document18 pagesI2 TECHNOLOGIES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-20http://secwatch.comNo ratings yet

- Club Pilates - 2018-04-13 - FDD - Xponential FitnessDocument323 pagesClub Pilates - 2018-04-13 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Harris Kamala D. 2021 Annual 278Document15 pagesHarris Kamala D. 2021 Annual 278Daniel ChaitinNo ratings yet

- NEWPARK RESOURCES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-20Document12 pagesNEWPARK RESOURCES INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-20http://secwatch.comNo ratings yet

- United States Bankruptcy Court Central District of California DivisionDocument8 pagesUnited States Bankruptcy Court Central District of California DivisionChapter 11 DocketsNo ratings yet

- Remy.2022 RPTDocument33 pagesRemy.2022 RPTThomas JonesNo ratings yet

- Corporate Governance Orientation for Acesite Directors and OfficersDocument22 pagesCorporate Governance Orientation for Acesite Directors and OfficersRj ArevadoNo ratings yet

- Biden Joseph R. 2021 Annual 278Document11 pagesBiden Joseph R. 2021 Annual 278Daniel ChaitinNo ratings yet

- RIVERVIEW BANCORP INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Document12 pagesRIVERVIEW BANCORP INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.com100% (2)

- Beard.2022 RPTDocument9 pagesBeard.2022 RPTThomas JonesNo ratings yet

- Power Attorney AffidavitDocument7 pagesPower Attorney AffidavitblaisetembongNo ratings yet

- Member'S Public Disclosure StatementDocument3 pagesMember'S Public Disclosure StatementKaren KleissNo ratings yet

- Discover Financial Services 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Document4 pagesDiscover Financial Services 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.comNo ratings yet

- Divorce and Domestic Relations Litigation: Financial Adviser's GuideFrom EverandDivorce and Domestic Relations Litigation: Financial Adviser's GuideNo ratings yet

- State Seeks Death Penalty in Idaho Four CaseDocument3 pagesState Seeks Death Penalty in Idaho Four CaseLaw&Crime100% (1)

- Bryan Kohberger: State's Motion For Protective OrderDocument33 pagesBryan Kohberger: State's Motion For Protective OrderLaw&Crime100% (3)

- US V Abbott Labs - Baby Formula Consent DecreeDocument33 pagesUS V Abbott Labs - Baby Formula Consent DecreeLaw&CrimeNo ratings yet

- Tou Thao - State's Resp Mot SanctionsDocument15 pagesTou Thao - State's Resp Mot SanctionsLaw&CrimeNo ratings yet

- Florida Order PDFDocument23 pagesFlorida Order PDFLaw&Crime100% (1)

- US V Abbott Labs - Baby Formula Complaint For Permanent InjunctionDocument21 pagesUS V Abbott Labs - Baby Formula Complaint For Permanent InjunctionLaw&CrimeNo ratings yet

- Emma Lou Presler - Affidavit For Arrest WarrantDocument4 pagesEmma Lou Presler - Affidavit For Arrest WarrantLaw&CrimeNo ratings yet

- BURWELL V PORTLAND SCHOOL DISTRICT NO. 1JDocument7 pagesBURWELL V PORTLAND SCHOOL DISTRICT NO. 1JLaw&CrimeNo ratings yet

- CT V Harlee Swols - Arrest Warrant and Affidavit Aug 11 2021Document9 pagesCT V Harlee Swols - Arrest Warrant and Affidavit Aug 11 2021Law&Crime0% (1)

- Martin D Greenberg Professional Medical Conduct DocumentsDocument8 pagesMartin D Greenberg Professional Medical Conduct DocumentsLaw&CrimeNo ratings yet

- Voss V GreenbergDocument14 pagesVoss V GreenbergLaw&CrimeNo ratings yet

- PA V Victor Frederick StebanDocument2 pagesPA V Victor Frederick StebanLaw&CrimeNo ratings yet

- Scotus Order ListDocument16 pagesScotus Order ListLaw&CrimeNo ratings yet

- Montgomery BriefDocument5 pagesMontgomery BriefLaw&CrimeNo ratings yet

- Tennessee HB1182Document2 pagesTennessee HB1182Law&CrimeNo ratings yet

- Mcgahn Agreement 2021-05-12Document10 pagesMcgahn Agreement 2021-05-12Law&CrimeNo ratings yet

- U S D C: Nited Tates Istrict OurtDocument4 pagesU S D C: Nited Tates Istrict OurtLaw&CrimeNo ratings yet

- 5.17.21 Appellant's Brief On The MeritsDocument52 pages5.17.21 Appellant's Brief On The MeritsLaw&CrimeNo ratings yet

- Warnagiris Charging DocsDocument8 pagesWarnagiris Charging DocsLaw&CrimeNo ratings yet

- Ben Shapiro NLRB DismissalDocument6 pagesBen Shapiro NLRB DismissalLaw&CrimeNo ratings yet

- I65 Supreme DecisionDocument58 pagesI65 Supreme Decisionthe kingfishNo ratings yet

- Kerry Wayne Persick ComplaintDocument5 pagesKerry Wayne Persick ComplaintLaw&CrimeNo ratings yet

- Greenberg PleaDocument86 pagesGreenberg PleaDaniel Uhlfelder100% (4)

- Allen Russell MS CT of Appeals RulingDocument21 pagesAllen Russell MS CT of Appeals RulingLaw&CrimeNo ratings yet

- Brandon Pope ComplaintDocument16 pagesBrandon Pope ComplaintLaw&CrimeNo ratings yet

- Complaint For DamagesDocument44 pagesComplaint For DamagesLaw&Crime100% (1)

- CNN Steve BissDocument5 pagesCNN Steve BissLaw&CrimeNo ratings yet

- State V Chauvin - Judge's Verdict On Upward Sentencing DepartureDocument6 pagesState V Chauvin - Judge's Verdict On Upward Sentencing DepartureLaw&CrimeNo ratings yet

- Thao Mot Sanctions Pros Misconduct Witness CoercionDocument13 pagesThao Mot Sanctions Pros Misconduct Witness CoercionLaw&Crime100% (1)

- US V ANTON LUNYKDocument6 pagesUS V ANTON LUNYKLaw&CrimeNo ratings yet

- Oliver HartDocument3 pagesOliver HartNamrata SinghNo ratings yet

- Aof Dsa Odmfs05837 30112023Document8 pagesAof Dsa Odmfs05837 30112023kbank0510No ratings yet

- LU20 - Tax StrategyDocument56 pagesLU20 - Tax StrategyAnil HarichandreNo ratings yet

- AACE Cash FlowDocument17 pagesAACE Cash FlowFrancois-No ratings yet

- 12 Step by Step Process To Successful ExportingDocument4 pages12 Step by Step Process To Successful ExportingPhilip MuwanikaNo ratings yet

- Introduction To SBP-BSC and Vacancy AnnouncedDocument2 pagesIntroduction To SBP-BSC and Vacancy AnnouncedAqeel AbbasNo ratings yet

- Car firms merger talks benefits and challengesDocument3 pagesCar firms merger talks benefits and challengessamgosh100% (1)

- Agency Theory AssignmentDocument6 pagesAgency Theory AssignmentProcurement PractitionersNo ratings yet

- Fundamentals of Accounting - Financial StatementsDocument8 pagesFundamentals of Accounting - Financial StatementsAuroraNo ratings yet

- Prescribed Barangay FormsDocument53 pagesPrescribed Barangay FormsSeth Cabrera100% (1)

- Bos 46137 CP 1Document36 pagesBos 46137 CP 1dharmesh vyasNo ratings yet

- Enron Scandal - Wikipedia, The Free EncyclopediaDocument31 pagesEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88No ratings yet

- Financial Reporting and Analysis QuestionsDocument16 pagesFinancial Reporting and Analysis QuestionsPareshNo ratings yet

- Applied Economics PPT 3Document9 pagesApplied Economics PPT 3Angel AquinoNo ratings yet

- EBIT (Earnings Before Interest and Taxes) Analysis: Common Stock Financing Debt FinancingDocument2 pagesEBIT (Earnings Before Interest and Taxes) Analysis: Common Stock Financing Debt FinancingKunalNo ratings yet

- Module-1.1 PUBLIC FINANCEDocument5 pagesModule-1.1 PUBLIC FINANCEPauline Joy Lumibao100% (2)

- Jet Airways Case StudyDocument7 pagesJet Airways Case StudySachin KinareNo ratings yet

- Investment Principles and Checklists OrdwayDocument149 pagesInvestment Principles and Checklists Ordwayevolve_us100% (2)

- Community Profile LeskovacDocument118 pagesCommunity Profile Leskovacsrecko_stamenkovicNo ratings yet

- Financial Analysis and ReportingDocument5 pagesFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- Beauty SalonDocument6 pagesBeauty SalonsharatchandNo ratings yet

- Internship Report 2020Document45 pagesInternship Report 2020Naomii HoneyNo ratings yet

- Was Gandhi a British Intelligence AssetDocument33 pagesWas Gandhi a British Intelligence AssetAshish RajeNo ratings yet

- 2019 Mid-Semester Mock Exam SolutionDocument11 pages2019 Mid-Semester Mock Exam SolutionMichael BobNo ratings yet

- Ali Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillDocument1 pageAli Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillMuhammad Irfan ButtNo ratings yet

- Wallstreetjournaleurope 20170320 The Wall Street Journal EuropeDocument22 pagesWallstreetjournaleurope 20170320 The Wall Street Journal EuropestefanoNo ratings yet

- Sales Case DigestDocument7 pagesSales Case Digestrian5852No ratings yet

- History of 3M India LTD., Company - GoodreturnsDocument4 pagesHistory of 3M India LTD., Company - GoodreturnsGaganNo ratings yet

- 1 STND Cost Calculation CK11N and CK24 - PPC1 & ZPC2Document15 pages1 STND Cost Calculation CK11N and CK24 - PPC1 & ZPC2Mohammad Aarif100% (1)

- Company Law 2Document12 pagesCompany Law 2PRABHAT SINGHNo ratings yet