Professional Documents

Culture Documents

Investment Summary

Uploaded by

Mohammad helal uddin ChowdhuryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Summary

Uploaded by

Mohammad helal uddin ChowdhuryCopyright:

Available Formats

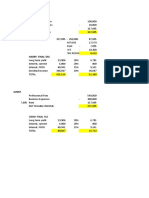

Grameenphone Limited

Market Profile Valuation Date: 21/8/2017 Recommendation: BUY Stock Exchange: DSE

Market Category A

Current Price: BDT 391.90 Target Price: BDT 422.53 Industry:

Closing Price BDT 391.90 Telecommunication

52 week's BDT 260 - Ticker: GP Upside: 7.82%

moving range 394.80

Market Cap BDT GP: Go beyond

(mn) 528642.459

Shares 1,350,300,022 We issue a BUY recommendation on Grameenphone Limited (GP)

Outstanding with a one-year target price of BDT 422.53 using the Discounted

Beta 0.93033987

Enterprise Value 699,885.96 Free Cash Flow to Firm Method and relative valuation methods.

(mn) This offers a 7.82% upside from its closing price of BDT 391.90 on

Source: DSE website & Group Analysis

August 21, 2017. The intrinsic price based on FCF method is BDT

Valuation Snapshot:

Methodology Weight Price ( TK) 502.28 per share. We have used South Asian mobile operator

FCF 0.5 502.28 companies as the proxy of the peer group in relative valuation, as

EV/EBITDA 0.25 301.93

P/E 0.25 383.63 only two companies is listed in telecommunication industry in

Target Price 422.53

Bangladesh.

Source: DSE website & Group Analysis

Revenue Drivers:

The basic two revenue driver for GP are Voice calls; data and other value

added service. Average revenue per user (ARPU) growth is fundamental

factor here.

Key Risks:

The key risks to our target include: upcoming 4G Auction, increased

platform competition, potential legal and regulatory restrictions, and

uncertain management succession plans.

Key Financials and Ratios 2016 A 2017 2018 2019 2020 2021

Total Revenue 114862160 121481998 128679568 136198921 145453843 154299878

YoY Revenue Growth 9.65% 5.76% 5.92% 5.84% 6.80% 6.08%

Current ratio 0.16 0.28 0.30 0.33 0.40 0.44

Quick ratio 0.15 0.27 0.29 0.32 0.39 0.43

Operating profit margin 36.19% 35.68% 35.49% 35.72% 35.67% 35.75%

Pretax margin 33.24% 36.02% 35.93% 35.94% 35.87% 35.98%

Net profit margin 19.61% 19.81% 19.55% 20.25% 20.17% 20.22%

ROA 17.26% 16.61% 16.79% 17.90% 17.88% 18.06%

ROE 67.10% 75.24% 81.24% 88.40% 93.38% 98.50%

EPS 16.68 17.82 18.63 20.42 21.73 23.10

You might also like

- Beyond the Annual Budget: Global Experience with Medium Term Expenditure FrameworksFrom EverandBeyond the Annual Budget: Global Experience with Medium Term Expenditure FrameworksNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Outcome of Board Meeting 22.05.2023Document27 pagesOutcome of Board Meeting 22.05.2023vkengiworks786No ratings yet

- Datasonic Trading Buy Maintained on Recovery HopesDocument4 pagesDatasonic Trading Buy Maintained on Recovery HopesGiddy YupNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- Investors - Presentation - 11-02-2021 Low MarginDocument32 pagesInvestors - Presentation - 11-02-2021 Low Marginravi.youNo ratings yet

- KPIT Income Statement Analysis and ForecastingDocument13 pagesKPIT Income Statement Analysis and ForecastingAnonymous Fr37v90cqNo ratings yet

- 637957201521149984_Godrej Consumer Products Result Update - Q1FY23Document4 pages637957201521149984_Godrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- NSE India - Nov22 - EUDocument9 pagesNSE India - Nov22 - EUpremalgandhi10No ratings yet

- 7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Document4 pages7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Nicholas ChehNo ratings yet

- Redington India A LTDDocument9 pagesRedington India A LTDNagarajan GNo ratings yet

- MindTree Kotak Institutional-Q4FY22Document14 pagesMindTree Kotak Institutional-Q4FY22darshanmadeNo ratings yet

- Current Price (BDT) : BDT 1,010.0Document6 pagesCurrent Price (BDT) : BDT 1,010.0Uzzal AhmedNo ratings yet

- Bajaj Finance Sell: Result UpdateDocument5 pagesBajaj Finance Sell: Result UpdateJeedula ManasaNo ratings yet

- Tarsons Products IPO details and key financialsDocument7 pagesTarsons Products IPO details and key financialsmedicostuffNo ratings yet

- Tarsons Products LTD: All You Need To Know AboutDocument7 pagesTarsons Products LTD: All You Need To Know AboutmedicostuffNo ratings yet

- Q3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleDocument12 pagesQ3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleSAGAR VAZIRANINo ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- Initiating Coverage on Divi's Laboratories with a Buy RatingDocument7 pagesInitiating Coverage on Divi's Laboratories with a Buy Ratingvigneshnv77No ratings yet

- 1Q21 Profit in Line With Estimates: SM Investments CorporationDocument8 pages1Q21 Profit in Line With Estimates: SM Investments CorporationJajahinaNo ratings yet

- 1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023Document5 pages1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023robynxjNo ratings yet

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- Financial Results For The Quarter Ended December 31, 2022: by Bps BpsDocument3 pagesFinancial Results For The Quarter Ended December 31, 2022: by Bps BpsSurekha ShettyNo ratings yet

- Tatva Chintan Pharma Chem LTD ReportDocument8 pagesTatva Chintan Pharma Chem LTD Reportshivkumar singhNo ratings yet

- Note For Investment Operation CommitteeDocument4 pagesNote For Investment Operation CommitteeAyushi somaniNo ratings yet

- Bajaj Finance 29072019Document7 pagesBajaj Finance 29072019Pranav VarmaNo ratings yet

- Analyst Presentation and Factsheet - Q4 FY16Document17 pagesAnalyst Presentation and Factsheet - Q4 FY16indpubg0611No ratings yet

- Dangote CementDocument9 pagesDangote CementGodfrey BukomekoNo ratings yet

- UAE Equity Research Rates Agthia Group a Buy on Solid Growth OutlookDocument5 pagesUAE Equity Research Rates Agthia Group a Buy on Solid Growth Outlookxen101No ratings yet

- English Edition - 11 December, 2020, 09:02 PM ISTDocument7 pagesEnglish Edition - 11 December, 2020, 09:02 PM ISTRANAJAY PALNo ratings yet

- UAE Equity Research: Agthia Group PJSC Rating Maintained at BUYDocument5 pagesUAE Equity Research: Agthia Group PJSC Rating Maintained at BUYxen101No ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- Trent 10 08 2023 IscDocument7 pagesTrent 10 08 2023 Iscaghosh704No ratings yet

- Volume 8 - October 2022: 16.4% 33% 26% RP 153.15 Bill RP 40.69 Bill 276%Document4 pagesVolume 8 - October 2022: 16.4% 33% 26% RP 153.15 Bill RP 40.69 Bill 276%fielimkarelNo ratings yet

- CMS Info Systems IPO detailsDocument8 pagesCMS Info Systems IPO detailsPanktiNo ratings yet

- FIN435 Imrul Farhan Pritom 1620326030 Sec5 PartC PDFDocument10 pagesFIN435 Imrul Farhan Pritom 1620326030 Sec5 PartC PDFঅদেখা ভুবনNo ratings yet

- Tech Mahindra: Financial Analysis To Determine Investment Decision by Group C10Document9 pagesTech Mahindra: Financial Analysis To Determine Investment Decision by Group C10Sucharita SahaNo ratings yet

- Tech Mahindra: Financial Analysis To Determine Investment Decision by Group C10Document9 pagesTech Mahindra: Financial Analysis To Determine Investment Decision by Group C10Sucharita SahaNo ratings yet

- Avenue Supermarts (DMART IN) : Q1FY20 Result UpdateDocument8 pagesAvenue Supermarts (DMART IN) : Q1FY20 Result UpdatejigarchhatrolaNo ratings yet

- Projected Financials of SamsungDocument18 pagesProjected Financials of SamsungSehar IrfanNo ratings yet

- Dish TV - Result UpdateDocument2 pagesDish TV - Result UpdateRahulNo ratings yet

- Tech Mahindra, 7th February, 2013Document12 pagesTech Mahindra, 7th February, 2013Angel BrokingNo ratings yet

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yNo ratings yet

- Voltas LatestDocument10 pagesVoltas LatestSambaran DasNo ratings yet

- Can Fin Homes 3QFY17 Result UpdateDocument2 pagesCan Fin Homes 3QFY17 Result UpdatemilandeepNo ratings yet

- Final English Press Release Q2fy23Document3 pagesFinal English Press Release Q2fy23AsutosaNo ratings yet

- Microsoft Investment AnalysisDocument4 pagesMicrosoft Investment AnalysisdkrauzaNo ratings yet

- A Report ON Valuation of Satyam Computers Services LimitedDocument15 pagesA Report ON Valuation of Satyam Computers Services LimitedAshmita DeNo ratings yet

- 4 Q23 Management ReportDocument7 pages4 Q23 Management Reportk33_hon87No ratings yet

- Fin480 Report Final 222Document26 pagesFin480 Report Final 222Asad Uz JamanNo ratings yet

- Large Rhino - MindTree LTDDocument4 pagesLarge Rhino - MindTree LTDRaprnaNo ratings yet

- Mahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Document14 pagesMahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Yash DoshiNo ratings yet

- DIWALI PICK 2022-12-October-2022-904894269Document12 pagesDIWALI PICK 2022-12-October-2022-904894269RamNo ratings yet

- Q223 EarningsDocument24 pagesQ223 Earningsdinesh suresh KadamNo ratings yet

- Bluedart Express: Strategic Investments Continue To Weigh On MarginsDocument9 pagesBluedart Express: Strategic Investments Continue To Weigh On MarginsYash AgarwalNo ratings yet

- Anupam Rasayan India Limited ReportDocument8 pagesAnupam Rasayan India Limited Reportankur taunkNo ratings yet

- AFFLE - Investor Presentation - 05-Feb-22 - TickertapeDocument26 pagesAFFLE - Investor Presentation - 05-Feb-22 - TickertapebhanupalavarapuNo ratings yet

- Ceramics 3Document3 pagesCeramics 3Mohammad helal uddin ChowdhuryNo ratings yet

- Ceramics 2Document3 pagesCeramics 2Mohammad helal uddin ChowdhuryNo ratings yet

- Analysis of UK supermarket industry & business functionsDocument4 pagesAnalysis of UK supermarket industry & business functionsMohammad helal uddin ChowdhuryNo ratings yet

- Define HRM - Human Resource Management Based Functions Are Mainly Related To TheDocument21 pagesDefine HRM - Human Resource Management Based Functions Are Mainly Related To TheMohammad helal uddin ChowdhuryNo ratings yet

- ElementsDocument1 pageElementsMohammad helal uddin ChowdhuryNo ratings yet

- 2.3 Sources of Mistakes Giving Rise To ComplaintsDocument2 pages2.3 Sources of Mistakes Giving Rise To ComplaintsMohammad helal uddin ChowdhuryNo ratings yet

- XYZ Hotel Chain Business Decision AnalysisDocument8 pagesXYZ Hotel Chain Business Decision AnalysisMohammad helal uddin ChowdhuryNo ratings yet

- Ceramics 4Document3 pagesCeramics 4Mohammad helal uddin ChowdhuryNo ratings yet

- Ceramics 5Document3 pagesCeramics 5Mohammad helal uddin ChowdhuryNo ratings yet

- Formula and discount factor sheetDocument3 pagesFormula and discount factor sheetMohammad helal uddin ChowdhuryNo ratings yet

- HRM Practices for Workforce Planning and RecruitmentDocument10 pagesHRM Practices for Workforce Planning and RecruitmentMohammad helal uddin ChowdhuryNo ratings yet

- Banking Ethics, CSR and SustainabilityDocument14 pagesBanking Ethics, CSR and SustainabilityMohammad helal uddin ChowdhuryNo ratings yet

- Claim LetterDocument1 pageClaim LetterMohammad helal uddin ChowdhuryNo ratings yet

- HNBS 332 Business StrategyDocument8 pagesHNBS 332 Business StrategyMohammad helal uddin ChowdhuryNo ratings yet

- 204 Main FinalDocument61 pages204 Main FinalMohammad helal uddin Chowdhury100% (1)

- 3.1 Sajeeb CorporationDocument1 page3.1 Sajeeb CorporationMohammad helal uddin ChowdhuryNo ratings yet

- Claim LetterDocument1 pageClaim LetterMohammad helal uddin ChowdhuryNo ratings yet

- HRM Practices for Workforce Planning and RecruitmentDocument10 pagesHRM Practices for Workforce Planning and RecruitmentMohammad helal uddin ChowdhuryNo ratings yet

- 3.1 Sajeeb CorporationDocument1 page3.1 Sajeeb CorporationMohammad helal uddin ChowdhuryNo ratings yet

- 2.3 Sources of Mistakes Giving Rise To ComplaintsDocument2 pages2.3 Sources of Mistakes Giving Rise To ComplaintsMohammad helal uddin ChowdhuryNo ratings yet

- ch16 Mish11ge EmbfmDocument29 pagesch16 Mish11ge EmbfmLazaros KarapouNo ratings yet

- 2.9 What Is Adjustment Letter?Document2 pages2.9 What Is Adjustment Letter?Mohammad helal uddin ChowdhuryNo ratings yet

- Commercial Paper Risks and Mitigants in Context of Bangladesh PDFDocument14 pagesCommercial Paper Risks and Mitigants in Context of Bangladesh PDFMohammad helal uddin ChowdhuryNo ratings yet

- CGDF-Junior Auditor - 2019 (IBA) - Math Part Solution by Khairul AlamDocument8 pagesCGDF-Junior Auditor - 2019 (IBA) - Math Part Solution by Khairul AlamMohammad helal uddin ChowdhuryNo ratings yet

- ch05 Mish11ge EmbfmDocument33 pagesch05 Mish11ge EmbfmMohammad helal uddin ChowdhuryNo ratings yet

- Investment Banking, Bank, Scope and Future in BangladeshDocument42 pagesInvestment Banking, Bank, Scope and Future in BangladeshMehedi HassanNo ratings yet

- ch17 Mish11ge EmbfmDocument26 pagesch17 Mish11ge EmbfmMohammad helal uddin ChowdhuryNo ratings yet

- ch03 Mish11ge EmbfmDocument18 pagesch03 Mish11ge EmbfmLazaros KarapouNo ratings yet

- Bergen Edu ELRC Guidemxtnsex HTMLDocument3 pagesBergen Edu ELRC Guidemxtnsex HTMLMohammad helal uddin ChowdhuryNo ratings yet

- Draft Prospectus-Bdpl (26.12.19)Document300 pagesDraft Prospectus-Bdpl (26.12.19)Mohammad helal uddin ChowdhuryNo ratings yet

- Fraud Chapter 17Document6 pagesFraud Chapter 17Jeffrey O'LearyNo ratings yet

- INTERNATIONAL ACCOUNTING FINAL TEST 2020Document8 pagesINTERNATIONAL ACCOUNTING FINAL TEST 2020Faisel MohamedNo ratings yet

- Conceptual Framework of AccountingDocument10 pagesConceptual Framework of AccountingJimbo ManalastasNo ratings yet

- Example:: Basis Assets LiabilitiesDocument23 pagesExample:: Basis Assets LiabilitiesAmbika Prasad ChandaNo ratings yet

- Pas 36: Impairment of Assets: ObjectiveDocument6 pagesPas 36: Impairment of Assets: ObjectiveLEIGHANNE ZYRIL SANTOSNo ratings yet

- 001 - CHAPTER 00 - Introduction To Class PDFDocument12 pages001 - CHAPTER 00 - Introduction To Class PDFIFRS LabNo ratings yet

- Step Wise Procedure For Buy Back of SharesDocument3 pagesStep Wise Procedure For Buy Back of Sharesharshit mehtaNo ratings yet

- Physical Fitness Gym Business PlanDocument28 pagesPhysical Fitness Gym Business Planabasyn_university83% (6)

- Articles of Incorporation and By-Laws - Non Stock CorporationDocument30 pagesArticles of Incorporation and By-Laws - Non Stock CorporationneneNo ratings yet

- Midterm - ReviewerDocument11 pagesMidterm - Reviewerangel ciiiNo ratings yet

- 8 - Stock MarketsDocument78 pages8 - Stock MarketsDineAbs01No ratings yet

- Kap 1 5th Workbook Se CH 3Document20 pagesKap 1 5th Workbook Se CH 3DakshNo ratings yet

- Section 272 of Companies Act 2013 Petition For Winding UpDocument3 pagesSection 272 of Companies Act 2013 Petition For Winding UpBazim sayd usmanNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- Chapter Four: Taxation and Corporate Decision MakingDocument18 pagesChapter Four: Taxation and Corporate Decision Makingembiale ayalu100% (1)

- Corrections Volume II Chapters 12-19Document2 pagesCorrections Volume II Chapters 12-19xxxxxxxxxNo ratings yet

- Who Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionDocument46 pagesWho Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionVincent S Vincent0% (1)

- Introduction To Business Processes: True-False QuestionsDocument4 pagesIntroduction To Business Processes: True-False QuestionsDoan Thi Thanh ThuyNo ratings yet

- Samyak Jain - IIM RanchiDocument2 pagesSamyak Jain - IIM RanchiNeha GuptaNo ratings yet

- Introduction and Overview of IBCDocument3 pagesIntroduction and Overview of IBCArushi JindalNo ratings yet

- Bindura Nickel Corporation Limited PDFDocument1 pageBindura Nickel Corporation Limited PDFBusiness Daily ZimbabweNo ratings yet

- Bbac 2018 Annual Report - 0Document166 pagesBbac 2018 Annual Report - 0hhhhhhqwNo ratings yet

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- PTFC Redevelopment Corporation SEC Form 17-ADocument261 pagesPTFC Redevelopment Corporation SEC Form 17-AqrqrqrqrqrqrqrqrqrNo ratings yet

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- Indenture PDVSA 2020Document16 pagesIndenture PDVSA 2020Miguel ZajíaNo ratings yet

- Changed World, Unchanged Promises: DM (F©H$ (Anmoq © DTDocument409 pagesChanged World, Unchanged Promises: DM (F©H$ (Anmoq © DTVinayrajNo ratings yet

- IFRS 1 - For PresDocument27 pagesIFRS 1 - For Presnati67% (3)

- IntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFDocument9 pagesIntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFAndrea Nicole BanzonNo ratings yet

- MIS Rati Global - Nov 21 (Recovered)Document72 pagesMIS Rati Global - Nov 21 (Recovered)305. Gaurav JhaNo ratings yet