Professional Documents

Culture Documents

Appendix 44 - Instructions - LR

Uploaded by

pdmu regionixCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix 44 - Instructions - LR

Uploaded by

pdmu regionixCopyright:

Available Formats

LIQUIDATION REPORT

(LR)

INSTRUCTIONS

A. The LR shall be used to liquidate cash advances for travel and related expenses by the

employees/officers concerned of the agency/entity. It shall be supported by the required

supporting documents. This shall be prepared by fund cluster.

B. It shall be accomplished as follows:

1. Period Covered –the period covered by the report from the date of the grant of cash advance

up to the date of liquidation

2. Entity Name – name of the agency/entity

3. Fund Cluster –the fund cluster name/code in accordance with the UACS

4. Serial No./Date –number assigned to the LR by the Accounting Division/Unit and the date of

the preparation of the report

5. Responsibility Center Code – code assigned to each cost/responsibility center

6. Particulars – brief description of expenses incurred or deviation from original itinerary of

travel

7. Amount – amount of expenses covered by the report

8. Total amount spent – actual amount spent

9. Amount of Cash Advance per DV No. – amount of cash advance as indicated in the DV on

the grant of cash advance; the DV number and date should be specified

10. Amount Refunded per OR No.– amount refunded representing excess of the cash advance

received over actual expenses incurred; the OR number and date should be specified

11. Amount to be Reimbursed – amount due to the payee/claimant representing the difference

between cash advance received and actual expenses incurred

12. Box A Certified: Correctness of the above data – name and signature of the

employee/officer who was granted the cash advance and the date it was signed.

13. Box B Certified: Purpose of travel/cash advance duly accomplished– name and signature

of immediate supervisor of the official/employee who incurred the expenses and the date it

was signed

14. Box C Certified: Supporting documents complete and proper –name and signature of the

Head of the Accounting Division/Unit and the date it was signed; the number of the JEV

used as basis in recording the liquidation in the GJ should be indicated

C. The amount spent per LR shall be taken up in the JEV, the refund shall be recorded in the CRJ,

and the amount to be reimbursed shall be covered by another DV.

D. It shall be prepared in two copies and shall be distributed as follows:

Original- COA Auditor, through the Accounting Division/Unit, together with the supporting

documents

Copy 2 - Accounting Division/Unit, to be attached to the JEV

Copy 3 -Officer/Employee's File

101

You might also like

- RCD Report InstructionsDocument2 pagesRCD Report Instructionsthessa_starNo ratings yet

- NORSA form instructionsDocument2 pagesNORSA form instructionsTesa GD100% (2)

- Invoice Receipt For Property Form GF 30 A 2Document1 pageInvoice Receipt For Property Form GF 30 A 2Rexis ReginanNo ratings yet

- Construction Industry Authority Audit Finds Delays in Cash LiquidationDocument4 pagesConstruction Industry Authority Audit Finds Delays in Cash LiquidationHoven MacasinagNo ratings yet

- Republic of The Philippines Application For: National Water Resources Board Renewal ofDocument2 pagesRepublic of The Philippines Application For: National Water Resources Board Renewal ofMark PesiganNo ratings yet

- Philippines court case against Jean Longcanaya TubalDocument1 pagePhilippines court case against Jean Longcanaya TubalPh Broker AppraiserNo ratings yet

- 1 DOCUMENTARY REQUIREMENTS PresentationDocument70 pages1 DOCUMENTARY REQUIREMENTS PresentationSelyun E OnnajNo ratings yet

- 01-BacarraIN2020 Audit ReportDocument91 pages01-BacarraIN2020 Audit ReportRichard MendezNo ratings yet

- AIA Philam Life Policy Fund Withdrawal FormDocument2 pagesAIA Philam Life Policy Fund Withdrawal Formippon_osotoNo ratings yet

- COA Resolution 2004-006Document4 pagesCOA Resolution 2004-006Haryeth CamsolNo ratings yet

- Appendix 65 - Instructions - WMRDocument1 pageAppendix 65 - Instructions - WMRNorvel BucaoNo ratings yet

- PPE and Inventory Issues in a Philippine City GovernmentDocument255 pagesPPE and Inventory Issues in a Philippine City GovernmentMerlo Sebasthian SilvaNo ratings yet

- National Government Sector Cluster NGS-5-Education and Employment Audit Group R16-C, Audit Team No. R16-C-04Document3 pagesNational Government Sector Cluster NGS-5-Education and Employment Audit Group R16-C, Audit Team No. R16-C-04Winnie Ann Daquil Lomosad-MisagalNo ratings yet

- FMF Pawnshop Financial StatementDocument123 pagesFMF Pawnshop Financial Statementaldred pera100% (1)

- 08 BLGUMAGSAYSAYHILL 2022 AAR Part2 Findings and RecommendationsDocument22 pages08 BLGUMAGSAYSAYHILL 2022 AAR Part2 Findings and RecommendationsGil DavinNo ratings yet

- GPPB NPM 011-2010Document4 pagesGPPB NPM 011-2010Eric DykimchingNo ratings yet

- Annex F-ICQ DraftDocument5 pagesAnnex F-ICQ Draftrussel1435No ratings yet

- Annex N Coa 2005-027Document2 pagesAnnex N Coa 2005-027Naye TomawisNo ratings yet

- Local Budget Circular No. 110 - Internal Audit Manual For Local Government UnitsDocument3 pagesLocal Budget Circular No. 110 - Internal Audit Manual For Local Government UnitsLalaLaniba100% (1)

- SEC SMR Format 2yrs - 2018 - 10 CopiesDocument1 pageSEC SMR Format 2yrs - 2018 - 10 CopiesMarvin CeledioNo ratings yet

- Checklist ReliefDocument1 pageChecklist ReliefRobehgene Atud-JavinarNo ratings yet

- Government Bank Account ReportingDocument4 pagesGovernment Bank Account Reportingponak001No ratings yet

- People v. SandiganbayanDocument1 pagePeople v. SandiganbayananalynNo ratings yet

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- New Regular Contractor's License (SOLE - PROP) - 11192018Document27 pagesNew Regular Contractor's License (SOLE - PROP) - 11192018aileen manzanoNo ratings yet

- COA Management Letter On Lanao Del Sur 2nd District Infrastructure ProjectsDocument64 pagesCOA Management Letter On Lanao Del Sur 2nd District Infrastructure ProjectsRappler75% (4)

- Systems and Procedures Manual On The Management of Barangay Funds and PropertyDocument79 pagesSystems and Procedures Manual On The Management of Barangay Funds and PropertyNlNl Palmes BermeoNo ratings yet

- A.8 Report On The Physical Count of Semi Expendable PropertyDocument9 pagesA.8 Report On The Physical Count of Semi Expendable Propertyjaypee raguroNo ratings yet

- Obligation Request and Status Budget Utilization Request and StatusDocument2 pagesObligation Request and Status Budget Utilization Request and StatusKatrina SedilloNo ratings yet

- Direct Contracting Requirements Checklist PDFDocument1 pageDirect Contracting Requirements Checklist PDFHugh ManeNo ratings yet

- Certificate of Final Project AcceptanceDocument1 pageCertificate of Final Project AcceptanceJan Gerona ApostaderoNo ratings yet

- Preliminary Advice of Loss FormDocument1 pagePreliminary Advice of Loss FormWai Leong Edward Low0% (1)

- Accounts Receivable Confirmation Letter: March 2014 Agrees With YourDocument10 pagesAccounts Receivable Confirmation Letter: March 2014 Agrees With Yourmj192No ratings yet

- Unified Audit StrategyDocument8 pagesUnified Audit StrategyvangieNo ratings yet

- Letter of Introduction (LDDAP-ADA)Document1 pageLetter of Introduction (LDDAP-ADA)Glenda MacatangayNo ratings yet

- Write - Off Sample CasesDocument16 pagesWrite - Off Sample CasesLiDdy Cebrero BelenNo ratings yet

- CertificateDocument1 pageCertificateJomar Reuben A. RuecoNo ratings yet

- Terms and Conditions Capital Contribution PDFDocument4 pagesTerms and Conditions Capital Contribution PDFI-golot AkNo ratings yet

- AR Blank Confirmation LetterDocument1 pageAR Blank Confirmation LetterDominique VasalloNo ratings yet

- Appendix 30 - Instructions - RANCADocument1 pageAppendix 30 - Instructions - RANCApdmu regionixNo ratings yet

- Commission On Audit 1, .-: %LV.. ') Tz. Itepublit of The 1:11tilimaints Peiv EDocument2 pagesCommission On Audit 1, .-: %LV.. ') Tz. Itepublit of The 1:11tilimaints Peiv Eerrol100% (1)

- Dpwh-Dilg JMC 001 07-04-13 & MC 2014-153Document4 pagesDpwh-Dilg JMC 001 07-04-13 & MC 2014-153Arch. Steve Virgil SarabiaNo ratings yet

- LRA Circular No 12-2020 - Guidelines For Conversion On DemandDocument2 pagesLRA Circular No 12-2020 - Guidelines For Conversion On DemandjosephNo ratings yet

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNo ratings yet

- Appendix 28 - Instructions - CAFOADocument1 pageAppendix 28 - Instructions - CAFOAhehehedontmind meNo ratings yet

- GFFS General Form Rev 20061Document14 pagesGFFS General Form Rev 20061Genesis Manalili100% (1)

- Checks and Advices Record AppendixDocument1 pageChecks and Advices Record AppendixPau PerezNo ratings yet

- Accountability Report FormsDocument2 pagesAccountability Report FormsNoel Buenafe Jr100% (1)

- Ruben G. Tecson, CPA: Independent Auditor'S ReportDocument3 pagesRuben G. Tecson, CPA: Independent Auditor'S Reportfranchesca marie t. uyNo ratings yet

- Audit Report - TuburanDocument87 pagesAudit Report - TuburanMaria100% (1)

- Government Funds AccountabilityDocument33 pagesGovernment Funds AccountabilityAh Mhi100% (1)

- Appendix 74 - Instructions - IIRUPDocument3 pagesAppendix 74 - Instructions - IIRUPNorvel BucaoNo ratings yet

- Implementing Government Disbursement ControlsDocument12 pagesImplementing Government Disbursement ControlsMerlina Cuare100% (1)

- Ngas Vol 1 To 6 Acctng PoliciesDocument184 pagesNgas Vol 1 To 6 Acctng PoliciesresurgumNo ratings yet

- Chapter 7. Supplies or Property: 356c of The LGC)Document11 pagesChapter 7. Supplies or Property: 356c of The LGC)JeykeiPanganibanNo ratings yet

- ASSET MANAGEMENT (Supply Officer)Document67 pagesASSET MANAGEMENT (Supply Officer)Audrey Burato LopezNo ratings yet

- Updated Procedures for Reconciling Treasury AccountsDocument6 pagesUpdated Procedures for Reconciling Treasury AccountsJade Darping KarimNo ratings yet

- Journal Entry Voucher (Jev) : Liquidation Report (LR)Document4 pagesJournal Entry Voucher (Jev) : Liquidation Report (LR)Mariechi BinuyaNo ratings yet

- Appendix 39 - Instructions - RCDisbDocument1 pageAppendix 39 - Instructions - RCDisbhehehedontmind meNo ratings yet

- Report Cash Disbursements (RCDisbDocument1 pageReport Cash Disbursements (RCDisbTesa GD100% (2)

- Supplies ledger card appendix 57Document1 pageSupplies ledger card appendix 57Tesa GDNo ratings yet

- Appendix 54 - Instructions - SAPDocument1 pageAppendix 54 - Instructions - SAPpdmu regionixNo ratings yet

- Appendix 57 - Instructions - SLCDocument1 pageAppendix 57 - Instructions - SLCpdmu regionix100% (1)

- Appendix 52 - ADADJDocument2 pagesAppendix 52 - ADADJpdmu regionixNo ratings yet

- Appendix 54 - SAPDocument2 pagesAppendix 54 - SAPpdmu regionixNo ratings yet

- Appendix 55 - SARDocument2 pagesAppendix 55 - SARpdmu regionixNo ratings yet

- Appendix 56 - Instructions - RAWODocument1 pageAppendix 56 - Instructions - RAWOpdmu regionixNo ratings yet

- Appendix 55 - Instructions - SARDocument1 pageAppendix 55 - Instructions - SARpdmu regionixNo ratings yet

- Appendix 52 - Instructions - ADADJDocument1 pageAppendix 52 - Instructions - ADADJpdmu regionixNo ratings yet

- Appendix 45 - Itinerary of TravelDocument4 pagesAppendix 45 - Itinerary of TravelAngeli Lou Joven Villanueva100% (2)

- Appendix 56 - RAWODocument1 pageAppendix 56 - RAWOpdmu regionixNo ratings yet

- Appendix 80 - BRS-MDSDocument1 pageAppendix 80 - BRS-MDSbolNo ratings yet

- Appendix 32 - DVDocument1 pageAppendix 32 - DVpdmu regionixNo ratings yet

- Appendix 47 - Instructions - CTCDocument1 pageAppendix 47 - Instructions - CTCpdmu regionixNo ratings yet

- Appendix 46 - RERDocument1 pageAppendix 46 - RERpdmu regionixNo ratings yet

- Appendix 36 - Instructions - JEVDocument1 pageAppendix 36 - Instructions - JEVJames BagtasNo ratings yet

- Appendix 80 - BRS-MDSDocument1 pageAppendix 80 - BRS-MDSbolNo ratings yet

- Appendix 46 - Instructions - RERDocument1 pageAppendix 46 - Instructions - RERpdmu regionixNo ratings yet

- Appendix 45 - Instructions - IoTDocument1 pageAppendix 45 - Instructions - IoTpdmu regionixNo ratings yet

- Appendix 47 - CTCDocument1 pageAppendix 47 - CTCpdmu regionixNo ratings yet

- Appendix 31 - Instructions - RANTADocument1 pageAppendix 31 - Instructions - RANTApdmu regionixNo ratings yet

- Appendix 31 - RANTADocument1 pageAppendix 31 - RANTApdmu regionixNo ratings yet

- Appendix 44 LRDocument1 pageAppendix 44 LRkaloy33No ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollRogie Apolo67% (3)

- Appendix 33 - Instructions - PayrollDocument1 pageAppendix 33 - Instructions - Payrollpdmu regionixNo ratings yet

- DV BackDocument1 pageDV BackptsievccdNo ratings yet

- Appendix 36 - JEVDocument1 pageAppendix 36 - JEVTesa GDNo ratings yet

- Appendix 38 - Instructions - IoPDocument1 pageAppendix 38 - Instructions - IoPpdmu regionixNo ratings yet

- Appendix 38 - IoPDocument4 pagesAppendix 38 - IoPpdmu regionixNo ratings yet

- Ranjith Keerikkattil MartiniqueDocument2 pagesRanjith Keerikkattil MartiniqueB PNo ratings yet

- North ExportersDocument13 pagesNorth ExportersSubhrajyoti DuarahNo ratings yet

- Yalkut Shimoni On TorahDocument12 pagesYalkut Shimoni On TorahLeandroMaiaNo ratings yet

- Philippine Corporate Law SyllabusDocument102 pagesPhilippine Corporate Law SyllabusRoa Emetrio NicoNo ratings yet

- Trade Union Act 1926Document14 pagesTrade Union Act 1926Jyoti DaveNo ratings yet

- Statistical Report 2013Document33 pagesStatistical Report 2013AES DominicanaNo ratings yet

- Data PimpinanDocument66 pagesData PimpinanEuis JuwitaNo ratings yet

- Othello Argumentative EssayDocument3 pagesOthello Argumentative EssayJoNo ratings yet

- Final Quiz - Cybersecurity EssentialsDocument32 pagesFinal Quiz - Cybersecurity EssentialsNetaji Gandi50% (26)

- Their Education and OursDocument20 pagesTheir Education and OursDeborah HermannsNo ratings yet

- Chap 020Document32 pagesChap 020Ahmed DapoorNo ratings yet

- List of Countries and Dependencies by AreaDocument16 pagesList of Countries and Dependencies by Arearpraj3135No ratings yet

- Acknowledging Guidance and SupportDocument6 pagesAcknowledging Guidance and SupportBabiejoy Beltran AceloNo ratings yet

- As 01Document23 pagesAs 01Super TuberNo ratings yet

- An Easy Guide to Literary CriticismDocument43 pagesAn Easy Guide to Literary Criticismcity cyber67% (3)

- The Essence of Remembrance (ZikrDocument25 pagesThe Essence of Remembrance (ZikrnasimNo ratings yet

- Introduction To WTO: Objectives, Scope and FunctionsDocument40 pagesIntroduction To WTO: Objectives, Scope and Functionscastro dasNo ratings yet

- Learn Greek (2 of 7) - The Greek Alphabet, Part IIDocument16 pagesLearn Greek (2 of 7) - The Greek Alphabet, Part IIBot Psalmerna100% (4)

- 80-100Tph Tin Stone Crushing LineDocument3 pages80-100Tph Tin Stone Crushing LineМаксим СтратилаNo ratings yet

- Common Mistakes That Singles Make: EncounterDocument33 pagesCommon Mistakes That Singles Make: EncounterMadeleine BayaniNo ratings yet

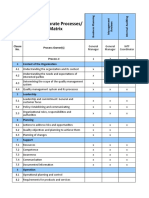

- IATF 16949 Corporate Processes/ Clause Matrix: Process Owner(s) Process # Context of The Organization Clause NoDocument6 pagesIATF 16949 Corporate Processes/ Clause Matrix: Process Owner(s) Process # Context of The Organization Clause NoshekarNo ratings yet

- Clickstream analysis explainedDocument4 pagesClickstream analysis explainedutcm77No ratings yet

- Case 9Document6 pagesCase 9KFNo ratings yet

- Ankur Final Dissertation 1Document99 pagesAnkur Final Dissertation 1pratham singhviNo ratings yet

- PR Franklin 042711Document3 pagesPR Franklin 042711Michael AllenNo ratings yet

- Qutbuddin Bakhtiar Kaki - SufiWikiDocument18 pagesQutbuddin Bakhtiar Kaki - SufiWikimaher0zainNo ratings yet

- Robbery With Physical InjuriesDocument3 pagesRobbery With Physical InjuriesyoungkimNo ratings yet

- Presentation II Hacking and Cracking Wireless LANDocument32 pagesPresentation II Hacking and Cracking Wireless LANMuhammad TaufikNo ratings yet

- Parkland Complaint Full With ExhibitsDocument46 pagesParkland Complaint Full With ExhibitsLancasterOnlineNo ratings yet

- Stake TechnologyDocument14 pagesStake TechnologyEzra Dwayne Datoon MagnoNo ratings yet