Professional Documents

Culture Documents

CH 06 - Problem Inventory Solutions

Uploaded by

Pooja AroraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 06 - Problem Inventory Solutions

Uploaded by

Pooja AroraCopyright:

Available Formats

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 6-1 (20-25 minutes)

1. A service is being sold – Costco will provide the customer with access to the store and

merchandise for one year.

2. A combination of goods and services is being sold – DOT is providing goods and financing

services for one year.

3. A service is being sold – Toronto Blue Jays is providing entertainment services for April 1

through October.

4. A service is being sold – CIBC is providing financing services (a loan) for two years.

5. A service is being sold – Seneca is providing educational services for September to

December.

6. A good is being sold – Sears is providing the sweater.

7. A combination of goods and services is being sold – Hometown is providing goods and

warranty service.

8. A service is being sold - Premier Health Clubs is in business to provide health club facilities

and services to members.

Solutions Manual 6-1 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

EXERCISE 6-2 (5–10 minutes)

(a) The journal entry to record the sale and related cost of goods sold are as follows.

Accounts Receivable ....................................... 600,000

Sales Revenue ($610,000 – $10,000) ....... 600,000

Cost of Goods Sold ......................................... 500,000

Inventory ................................................ 500,000

(b)

Cash ................................................................. 610,000

Sales Discounts Forfeited ...................... 10,000

Accounts Receivable .............................. 600,000

Solutions Manual 6-2 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

* EXERCISE 6-27 (20–25 minutes)

(a) Gross profit recognized in:

2017 2018 2019

Contract price $1,600,000 $1,600,000 $1,600,000

Costs:

Costs to date $400,000 $825,000 $1,070,000

Estimated costs to

complete 600,000 1,000,000 275,000 1,100,000 0 1,070,000

Total estimated profit 600,000 500,000 530,000

Percentage completed

to date X 40%* X 75%** X 100%

Total gross profit

recognized 240,000 375,000 530,000

Less: Gross profit

recognized in previous 0 240,000 375,000

years

Gross profit recognized

in current year $ 240,000 $ 135,000 $ 155,000

* *$400,000 ÷ $1,000,000 **$825,000 ÷ $1,100,000

Solutions Manual 6-3 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

* EXERCISE 6-27 (Continued)

(b)

2018

Contract Asset/Liability ($825,000 – $400,000) 425,000

Materials, Cash, Payables, etc. ............... 425,000

Accounts Receivable ($900,000 – $300,000) . 600,000

Contract Asset/Liability ........................... 600,000

Cash ($810,000 – $270,000) ............................ 540,000

Accounts Receivable ............................... 540,000

Contract Asset/Liability .................................. 560,000

Revenue from Long-Term Contracts ...... 560,000*

*$1,600,000 X (75% – 40%)

Construction Expenses ................................ 425,000

Contract Asset/Liability .......................... 425,000

(c) Gross profit recognized in:

Gross profit 2017 2018 2019

$–0– $–0– $530,000*

*$1,600,000 – $1,070,000

Solutions Manual 6-4 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

* EXERCISE 6-29 (15–20 minutes)

$640,000

(a) 2017: X $2,200,000 = $880,000

$640,000 + $960,000

2018: $2,200,000 (contract price) minus $880,000 (revenue

recognized in 2017) = $1,320,000 (revenue recognized

in 2018).

(b) All $2,200,000 of the contract price is recognized as revenue

in 2018.

(c) Using the percentage-of-completion method, the following

entries would be made:

Contract Asset/Liability .................................. 640,000

Materials, Cash, Payables, etc............... 640,000

Accounts Receivable ...................................... 420,000

Contract Asset/Liability ......................... 420,000

Cash ................................................................. 350,000

Accounts Receivable ............................. 350,000

To record revenues:

Contract Asset/Liability ................................. 880,000

Revenue from Long-Term Contracts ...... 880,000*

*$2,200,000 X [($640,000 ÷ ($640,000 + $960,000)]

To record expenses:

Construction Expenses ................................. 640,000

Construction Asset/Liability ................... 640,000

Solutions Manual 6-5 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

*PROBLEM 6-9

(a) 2017 2018 2019

Contract price $900,000 $900,000 $900,000

Less estimated cost:

Costs to date 270,000 450,000 610,000

Estimated cost to complete 330,000 150,000 —

Estimated total cost 600,000 600,000 610,000

Estimated total gross profit $300,000 $300,000 $290,000

Gross profit recognized in—

2017: $270,000 X $300,000 = $135,000

$600,000

2018: $450,000 X $300,000 = $225,000

$600,000

Less 2017 recognized gross

profit 135,000

Gross profit in 2018 $ 90,000

2019: Less 2017–2018 recognized

gross profit 225,000

Gross profit in 2019 $ 65,000

(b) In 2017 and 2018, no gross profit would be recognized.

Total Revenue .................................... $900,000

Total Construction Expenses .............. (610,000)

Gross profit recognized in 2019 .......... $290,000

Solutions Manual 6-6 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Eleventh Canadian Edition

LEGAL NOTICE

Copyright © 2016 by John Wiley & Sons Canada, Ltd. or related companies. All

rights reserved.

The data contained in these files are protected by copyright. This manual is furnished

under licence and may be used only in accordance with the terms of such licence.

The material provided herein may not be downloaded, reproduced, stored in a

retrieval system, modified, made available on a network, used to create derivative

works, or transmitted in any form or by any means, electronic, mechanical,

photocopying, recording, scanning, or otherwise without the prior written permission

of John Wiley & Sons Canada, Ltd.

MMXV xi F1

Solutions Manual 6-7 Chapter 6

Copyright © 2016 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

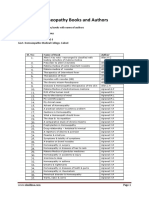

- Homeopathy Books and Authors PDFDocument52 pagesHomeopathy Books and Authors PDFPrasad javvaji75% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Rural Urban MigrationDocument42 pagesRural Urban MigrationSabitha Ansif100% (1)

- Inventory Policy Decisions: "Every Management Mistake Ends Up in Inventory." Michael C. BergeracDocument105 pagesInventory Policy Decisions: "Every Management Mistake Ends Up in Inventory." Michael C. Bergeracsurury100% (1)

- A Globalization and Public AdministrationDocument15 pagesA Globalization and Public AdministrationsemarangNo ratings yet

- A History of Pharmacy in PicturesDocument41 pagesA History of Pharmacy in PicturesAnaNo ratings yet

- Stihl HL 94: Instruction Manual Notice D'emploiDocument72 pagesStihl HL 94: Instruction Manual Notice D'emploiPooja AroraNo ratings yet

- Stihl HL 94: Instruction Manual Notice D'emploiDocument72 pagesStihl HL 94: Instruction Manual Notice D'emploiPooja AroraNo ratings yet

- Ppt07 (Cash Only Slides)Document24 pagesPpt07 (Cash Only Slides)apachemonoNo ratings yet

- Ppt07 (Cash Only Slides)Document22 pagesPpt07 (Cash Only Slides)Pooja AroraNo ratings yet

- Amy L. Lansky Impossible Cure: Reading ExcerptDocument7 pagesAmy L. Lansky Impossible Cure: Reading ExcerptLaurenNo ratings yet

- Cabwad CF September 2019Document2 pagesCabwad CF September 2019EunicaNo ratings yet

- HDFC Standard Life Insurance Company-Recruitment and SelectionDocument74 pagesHDFC Standard Life Insurance Company-Recruitment and Selectionindia2000050% (2)

- MITS5001 Project Management Case StudyDocument6 pagesMITS5001 Project Management Case Studymadan GaireNo ratings yet

- Final Individual Proposal - GelatissimoDocument12 pagesFinal Individual Proposal - Gelatissimoapi-521941371No ratings yet

- Impact of Microfinance Services On Rural Women Empowerment: An Empirical StudyDocument8 pagesImpact of Microfinance Services On Rural Women Empowerment: An Empirical Studymohan ksNo ratings yet

- MCQs Financial AccountingDocument12 pagesMCQs Financial AccountingPervaiz ShahidNo ratings yet

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanNo ratings yet

- Test Bank For Corporate Finance 4th Canadian Edition by BerkDocument37 pagesTest Bank For Corporate Finance 4th Canadian Edition by Berkangelahollandwdeirnczob100% (23)

- Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition Mintz Test BankDocument41 pagesEthical Obligations and Decision Making in Accounting Text and Cases 2nd Edition Mintz Test Bankhungden8pne100% (29)

- DHL TaiwanDocument25 pagesDHL TaiwanPhương VõNo ratings yet

- A38 - Rani - Digital Labour Platforms and Their Contribution To Development OutcomesDocument4 pagesA38 - Rani - Digital Labour Platforms and Their Contribution To Development OutcomesPhilip AchokiNo ratings yet

- As and Guidance NotesDocument94 pagesAs and Guidance NotesSivasankariNo ratings yet

- The Optimal Choice of Index-Linked Gics: Some Canadian EvidenceDocument14 pagesThe Optimal Choice of Index-Linked Gics: Some Canadian EvidenceKevin DiebaNo ratings yet

- GRI 3: Material Topics 2021: Universal StandardDocument30 pagesGRI 3: Material Topics 2021: Universal StandardMaría Belén MartínezNo ratings yet

- How To Make A Trade With BDO Securities Online PlatformDocument13 pagesHow To Make A Trade With BDO Securities Online PlatformJerome Christopher BaloteNo ratings yet

- Element of Corporate Governance in Islamic Banks Vs Conventional Banks: A Case StudyDocument7 pagesElement of Corporate Governance in Islamic Banks Vs Conventional Banks: A Case StudyMaryam EhsanNo ratings yet

- Excel AmortizationDocument16 pagesExcel AmortizationLaarnie QuiambaoNo ratings yet

- MELC - EPP 5 Entrep ICT MELCDocument2 pagesMELC - EPP 5 Entrep ICT MELCChristian GranadaNo ratings yet

- Case Study - IDocument3 pagesCase Study - IMamta Singh RajpalNo ratings yet

- Case Study On Citizens' Band RadioDocument7 pagesCase Study On Citizens' Band RadioরাসেলআহমেদNo ratings yet

- Republic Act No. 11360: Official GazetteDocument1 pageRepublic Act No. 11360: Official GazetteKirk BejasaNo ratings yet

- Presented To: Sir Safdar Hussain Tahir By: M. Fahad Ali G.C. Uni. FaisalabadDocument18 pagesPresented To: Sir Safdar Hussain Tahir By: M. Fahad Ali G.C. Uni. FaisalabadFahad AliNo ratings yet

- Market StructureDocument14 pagesMarket StructurevmktptNo ratings yet

- Incepta Pharmaceuticals - 2Document2 pagesIncepta Pharmaceuticals - 2itsshuvroNo ratings yet

- Review of Related LiteratureDocument3 pagesReview of Related LiteratureEaster Joy PatuladaNo ratings yet

- CRM Industry LandscapeDocument26 pagesCRM Industry LandscapeAdityaHridayNo ratings yet

- Number of Months Number of Brownouts Per Month: Correct!Document6 pagesNumber of Months Number of Brownouts Per Month: Correct!Hey BeshywapNo ratings yet