Professional Documents

Culture Documents

Legal Opinion

Uploaded by

Anonymous Fwa0kNBt0 ratings0% found this document useful (0 votes)

17 views2 pagesLegal Opinion

Original Title

Legal Opinion (1)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLegal Opinion

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesLegal Opinion

Uploaded by

Anonymous Fwa0kNBtLegal Opinion

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

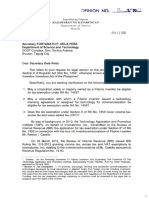

MARUNONG MASMARUNONG & PINAKAMARUNONG

To: Atty. Pinakamarunong

From: Atty. _________

Date: 15 March 2011

Re: Opinion on the Legality of Bureau of Internal Revenue Revenue

Regulation No. 2-2011 (Rev. Reg. 2-2011)

Issue

Whether Bureau of Internal Revenue Revenue Regulation No. 2-2011

(Rev. Reg. 2-2011) is valid.

Brief Answer

No, it is unconstitutional on due process, equal protection and privacy

grounds.

Statement of Facts

Our client, whose annual income from private business interests is

P 1.2M, wishes to know whether Rev. Reg. 2-2011 is valid.

Discussion

Rev. Reg. 2-2011 Offends Against the Substantive

Due Process Protection of the Constitution

Rev. Reg. 2-2011 requires private citizens to annually disclose

financial information or else pay a range of fine. This compelled

disclosure, undoubtedly a monitoring measure to increase revenue

collection, is an arbitrary and misguided exercise of police power.

Compelling individuals in the public service to periodically disclose

financial information is permissible because they hold offices imbued

with public interest and sustained by public funds, placing them well

within the State’s regulatory power (Morfe v. Mutuc, 22 SCRA 424

[1968]). The absence of this public interest element in the private sector

necessarily narrows government’s regulatory space, rendering broad

police power measures such as Rev. Reg. 2-2011 as violative of

substantive due process protection.

Rev. Reg. 2-2011 is Violative of the Equal Protection

Clause

Rev. Reg. 2-2011 limits its application to, among others, individual

taxpayers whose total annual income (taxable or exempt) exceeds

P 500,000. This threshold amount lacks any demonstrably reasonable

connection to the measure’s aim of increasing tax collection. Thus, it

unreasonably exempts from the sweep of its coverage (and its punitive

provisions) private individuals earning P 499,000 and below, who,

admittedly, form a substantial part of the pool of taxpayers.

Rev. Reg. 2-2011 Violates the Right to Informational

Privacy

Rev. Reg. 2-2011 compels, under pain of monetary penalty, private

taxpayers under its ambit to disclose, among others, interest and

dividends of passive income (such as bank and other deposits). As rates of

interests and dividends are public knowledge, disclosure of such

information indirectly allows the government to obtain information on the

amount of bank deposits and other savings in violation of Republic Act

No. 1405 (Secrecy of Bank Deposits Act) which the Supreme Court has

determined as protective of informational privacy (Ople v. Torres, 293

SCRA 141, 158 [1998], in relation to footnote 62). Worse, it exposes

private individuals such as our client to needless harm as information of

his financial status, although theoretically extracted by the BIR, could

spill beyond revenue officers and fall into the hands of individuals who

may well be encouraged to commit money driven crimes. This is a real

evil the Supreme Court has recognized as an offshoot of the violation of

the right to informational privacy (Ople v. Torres, supra.).

Recommendation

It is recommended that our client initiate judicial proceeding to strike down

Rev. Reg. 2-2011 as unconstitutional for being violative of the due

process, equal protection, and privacy guarantees. Pending proceedings, it

is advisable to seek an injunctive order to enjoin implementation of Rev.

Reg. 2-2011.

You might also like

- Proposed Topics For AdlawDocument3 pagesProposed Topics For AdlawRamon T. De VeraNo ratings yet

- NMIMS Business Law Case Study AnalysisDocument8 pagesNMIMS Business Law Case Study AnalysisrajnishatpecNo ratings yet

- CREBA v. ROMULO 614 SCRA 605 G.R. No. 160756. March 9 2010Document8 pagesCREBA v. ROMULO 614 SCRA 605 G.R. No. 160756. March 9 2010arden1imNo ratings yet

- Power and Process of Distrain-Final Version April 2017Document73 pagesPower and Process of Distrain-Final Version April 2017Samuel Oyenitun100% (1)

- 2015 Last Minute Reminders For Taxation Law by Atty. Noel Ortega-1Document28 pages2015 Last Minute Reminders For Taxation Law by Atty. Noel Ortega-1heirarchy67% (3)

- Justice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationDocument3 pagesJustice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationNicco AcaylarNo ratings yet

- ATTY VILLO TAX CASE DIGESTS: General PrinciplesDocument47 pagesATTY VILLO TAX CASE DIGESTS: General PrinciplesAbseniNalangKhoUyNo ratings yet

- Cic Decisons ExemptnsDocument35 pagesCic Decisons ExemptnsManuNo ratings yet

- Corona, J.:: G.R.No.160756: March 9, 2010Document3 pagesCorona, J.:: G.R.No.160756: March 9, 2010Weena Joy C. LegalNo ratings yet

- 97-Article Text-416-1-10-20220926Document19 pages97-Article Text-416-1-10-20220926Henry DP SinagaNo ratings yet

- Creba vs. RomuloDocument4 pagesCreba vs. RomuloJD BallosNo ratings yet

- 7 LG Electronics Philippines, Inc. vs. CIRDocument33 pages7 LG Electronics Philippines, Inc. vs. CIRJoanna ENo ratings yet

- Opinion No. 19 Dated June 22, 2021Document6 pagesOpinion No. 19 Dated June 22, 2021Simeon SuanNo ratings yet

- Answer in TaxationDocument11 pagesAnswer in TaxationMarella GemperoNo ratings yet

- Judy AnnDocument2 pagesJudy AnnheymissrubyNo ratings yet

- Justice Teresita Leonardo-De Castro Cases (2008-2015) : Scope and Limitations of Taxation (Constitutional Limitations)Document4 pagesJustice Teresita Leonardo-De Castro Cases (2008-2015) : Scope and Limitations of Taxation (Constitutional Limitations)jimNo ratings yet

- Tax Alert BIR Ruling 142 2011 PDFDocument3 pagesTax Alert BIR Ruling 142 2011 PDFJm CruzNo ratings yet

- Tax Reaction PaperDocument6 pagesTax Reaction PaperOscar Ryan Santillan100% (1)

- Power of Taxation: Subject: Income Taxation Topic: Introduction To TaxationDocument8 pagesPower of Taxation: Subject: Income Taxation Topic: Introduction To TaxationJoshua CabinasNo ratings yet

- Chambers Cheque Bounce U/s 138Document3 pagesChambers Cheque Bounce U/s 138Aditya MaheshwariNo ratings yet

- ABAKADA Guro Party List Vs Executive SecretaryDocument18 pagesABAKADA Guro Party List Vs Executive SecretaryrheaNo ratings yet

- Ra 11057Document16 pagesRa 11057Rio Sanchez100% (9)

- CREBA DigestDocument2 pagesCREBA DigestAnaliza Tampad Sta MariaNo ratings yet

- Personal Security Act ArticlesDocument8 pagesPersonal Security Act ArticlesPaula Aurora MendozaNo ratings yet

- Basic Taxation Questions & AnswersDocument55 pagesBasic Taxation Questions & AnswersJayson Malero100% (1)

- Taxation Law - Case Digest (Part 1)Document64 pagesTaxation Law - Case Digest (Part 1)Miro100% (3)

- Fort Bonifacio vs. CIRDocument16 pagesFort Bonifacio vs. CIRML RodriguezNo ratings yet

- Purpose and Scope of TaxationDocument6 pagesPurpose and Scope of TaxationMaria ThereseNo ratings yet

- The City of Iloilo vs. SMART Communications, Inc.Document13 pagesThe City of Iloilo vs. SMART Communications, Inc.Rommel RosasNo ratings yet

- PNB vs. EMILIO A. GANCAYCODocument1 pagePNB vs. EMILIO A. GANCAYCOKling KingNo ratings yet

- Privacy Policy Office Advisory Opinion No. 2020-002Document4 pagesPrivacy Policy Office Advisory Opinion No. 2020-002zooeyNo ratings yet

- Creba vs. Romulo - Cir vs. LingayenDocument6 pagesCreba vs. Romulo - Cir vs. LingayenBea Dominique AbeNo ratings yet

- Gonzales - Rachelle Anne - BL3 - F6 PDFDocument9 pagesGonzales - Rachelle Anne - BL3 - F6 PDFRamil GonzalesNo ratings yet

- Assignment 5 - TaxDocument99 pagesAssignment 5 - TaxLoNo ratings yet

- Client Bulletin - FATCA 2011.06Document2 pagesClient Bulletin - FATCA 2011.06Jim WolfeNo ratings yet

- Chamber of Real Estates challenges constitutionality of MCIT and CWTDocument4 pagesChamber of Real Estates challenges constitutionality of MCIT and CWTCresteynTeyngNo ratings yet

- Module 2 General Principles of TaxationDocument18 pagesModule 2 General Principles of TaxationLyric Cyrus Artianza CabreraNo ratings yet

- PNB compelled to disclose bank deposits of official under investigationDocument2 pagesPNB compelled to disclose bank deposits of official under investigationHendrix GregorioNo ratings yet

- Tax Remedies Under The Nirc (Repaired)Document119 pagesTax Remedies Under The Nirc (Repaired)RSOG PRO6No ratings yet

- Dela Llana vs. The Chairperson Commision On AuditDocument1 pageDela Llana vs. The Chairperson Commision On AuditJuralexNo ratings yet

- SC DECISIONS ON POLITICAL LAWDocument12 pagesSC DECISIONS ON POLITICAL LAWMeynard MagsinoNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- Taxation CasesDocument24 pagesTaxation CasesMary Ann JagolinoNo ratings yet

- RA 11057 or The Personal Property Security ActDocument14 pagesRA 11057 or The Personal Property Security ActLaughLy ReuyanNo ratings yet

- Police Power, Eminent Domain, and Taxation Discussed in Senior Citizen Discount CaseDocument2 pagesPolice Power, Eminent Domain, and Taxation Discussed in Senior Citizen Discount CaseFayda CariagaNo ratings yet

- 11 Soriano Et Al V Secretary of Finance and The CIRDocument1 page11 Soriano Et Al V Secretary of Finance and The CIRAnn QuebecNo ratings yet

- AYALA Commercial Banking HW2Document3 pagesAYALA Commercial Banking HW2French D. AyalaNo ratings yet

- Republic Act No. 1405: Ateneo de Naga University College of Business and Accountancy Ateneo de Naga University Naga CityDocument5 pagesRepublic Act No. 1405: Ateneo de Naga University College of Business and Accountancy Ateneo de Naga University Naga CityJomer FernandezNo ratings yet

- Notes Taxation UVDocument12 pagesNotes Taxation UVJohn MarstonNo ratings yet

- Deutsche Bank Ag Manila Branch VS CirDocument4 pagesDeutsche Bank Ag Manila Branch VS CirJen DeeNo ratings yet

- Privacy Policy Office Advisory Opinion No. 2020-015Document4 pagesPrivacy Policy Office Advisory Opinion No. 2020-015zooeyNo ratings yet

- Tax Alert BIR Ruling 142-2011Document3 pagesTax Alert BIR Ruling 142-2011Ia Bolos0% (1)

- Deutsche Bank AG Manila Branch v. Commissioner of Internal Revenue, G.R. No. 18850, August 19, 2013Document2 pagesDeutsche Bank AG Manila Branch v. Commissioner of Internal Revenue, G.R. No. 18850, August 19, 2013Dominique VasalloNo ratings yet

- Tax 1 Case Digests and Doctrines (Domondon, 2017)Document51 pagesTax 1 Case Digests and Doctrines (Domondon, 2017)Gemma F. TiamaNo ratings yet

- Soriano Vs Secretary of FinanceDocument3 pagesSoriano Vs Secretary of FinanceSultan Kudarat State UniversityNo ratings yet

- Philippines Supreme Court Upholds Simplified Net Income Tax LawDocument8 pagesPhilippines Supreme Court Upholds Simplified Net Income Tax LawJenNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Filinvest Land, Inc Vs CADocument2 pagesFilinvest Land, Inc Vs CAis_still_artNo ratings yet

- Speluncean Explorers Murder CaseDocument5 pagesSpeluncean Explorers Murder CaseKarl PunzalNo ratings yet

- XYZ Cement Co nuisance case analyzedDocument4 pagesXYZ Cement Co nuisance case analyzedKershey Salac50% (2)

- Carno PhallogocentrismDocument9 pagesCarno PhallogocentrismmadspeterNo ratings yet

- XXX - Optional IrishliteratureDocument168 pagesXXX - Optional IrishliteratureMada AnandiNo ratings yet

- Manila Standard Today - August 17, 2012 IssueDocument16 pagesManila Standard Today - August 17, 2012 IssueManila Standard TodayNo ratings yet

- Ja of Arrest Prac C. 2.1Document2 pagesJa of Arrest Prac C. 2.1Roxanne Diane100% (2)

- Agreement Between Author and Publisher MJSDocument4 pagesAgreement Between Author and Publisher MJSmadhuchikkakall7113No ratings yet

- Family Law IDocument15 pagesFamily Law ISiddharth DewanganNo ratings yet

- Bs-En Iso 544 2003 PDFDocument16 pagesBs-En Iso 544 2003 PDFPacoNo ratings yet

- Evidence Law - CorroborationDocument9 pagesEvidence Law - CorroborationFatin Abd WahabNo ratings yet

- Comelec Reso 9716-2013Document9 pagesComelec Reso 9716-2013Farica Arradaza ZgamboNo ratings yet

- Decree Pertaining To HolidayDocument2 pagesDecree Pertaining To HolidayBounna PhoumalavongNo ratings yet

- Sample Booking Agreement PDFDocument1 pageSample Booking Agreement PDFgshearod2uNo ratings yet

- Special ProceedingsDocument21 pagesSpecial Proceedingsstargazer0732No ratings yet

- People v. DimaanoDocument8 pagesPeople v. DimaanoNikki Joanne Armecin LimNo ratings yet

- World Armwrestling Federation (WAF) Rules of Armwrestling Sitdown and StandingDocument13 pagesWorld Armwrestling Federation (WAF) Rules of Armwrestling Sitdown and StandingZil FadliNo ratings yet

- Paul Brown's Smooth Jazz HandbookDocument33 pagesPaul Brown's Smooth Jazz HandbookMeli valdes100% (1)

- Wills and Succession CassesDocument58 pagesWills and Succession Cassesrobertoii_suarez100% (1)

- 6 - Report of The Committee On Social Matters-GA 32 FinalDocument6 pages6 - Report of The Committee On Social Matters-GA 32 FinalJoril SarteNo ratings yet

- Letter From Bad Check Restitution ProgramDocument5 pagesLetter From Bad Check Restitution Programnoahclements1877No ratings yet

- Aifs To Segregate and Ring-Fence Assets and Liabilities of Each Scheme Parameters Provided For First Close, Tenure and Change of Sponsor/ManagerDocument4 pagesAifs To Segregate and Ring-Fence Assets and Liabilities of Each Scheme Parameters Provided For First Close, Tenure and Change of Sponsor/ManagerELP LawNo ratings yet

- Quiz 6.13 Answer KeyDocument4 pagesQuiz 6.13 Answer KeyAngelo LabiosNo ratings yet

- Non-Leasehold CovenantsDocument1 pageNon-Leasehold CovenantssrvshNo ratings yet

- Sri Lanka Procurement ManualDocument163 pagesSri Lanka Procurement ManualvihangimaduNo ratings yet

- The LLP ActDocument13 pagesThe LLP ActshanumanuranuNo ratings yet

- BPI Vs HerridgeDocument8 pagesBPI Vs HerridgePau JoyosaNo ratings yet

- Project 1Document14 pagesProject 1Deepak SharmaNo ratings yet

- Special Proceedings Brondial DoctrinesDocument54 pagesSpecial Proceedings Brondial DoctrinesFaith Alexis Galano50% (2)

- Order - Case T-515-19 - General Court of The European Union - Lego v. EUIPODocument2 pagesOrder - Case T-515-19 - General Court of The European Union - Lego v. EUIPODarius C. GambinoNo ratings yet