Professional Documents

Culture Documents

Tirstrup BioMechanics (Denmark)

Uploaded by

Ioana PunctOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tirstrup BioMechanics (Denmark)

Uploaded by

Ioana PunctCopyright:

Available Formats

Tirstrup BioMechanics (Denmark):

Raising Dollar Debt

Although it was still August, Julie Harbjerg bent over for the initial assessmentof financing proposals fol

against the first chill of autumn and hurried up Tirstrup's international investments.

Copenhagen'sStr/get-the historic cobblestonedpedes- In2003,the Tirstrup Group's products encompasseda

trian street that begins at the City Ha[l and extends full anay of electromechanicalmedical devices.The prodl

through the heart of the old city. She tried to keep her uct line included cardiac rhythm deviceg pacing systems,

mind clear so that shecould properly evaluatethe various and implantable defibrillators. A major corporate objec-

financing proposalsthat had been discussedin previous tive was to reduceTirstrup's dependencyon cardiacprod-

weeks with the many bankers who had visited ucts. In 2003,600/oof its estimated US$2.1 billion sales

Copenhagen.As assistant treasurer (international) for (kr6.60aal$)were outside Denmark, although 85% of the

Tirstrup BioMechanicsof Denmark, Julie wasresponsible Group,s$2.4billioninassetsremainedinthecountry.

..

Tirstrup wasconsideringan acquisitionof $4L0million w Private Placement in the United States. Several

in the United States,and Julie Harbjerg was responsible bankers.had recommendeda private placement of

for constructinga financingpackage.Tirstrup had roughly debt with an institutional investor in the United

$30million in cashon hand, and the seller had offered to States.Nordeabank felt that their New York spe-

carry a note for $75million of the total.The note would be cialists could place as much as $200 million of

for five years at 7.50"/oper annum. Julie's boss, Knut Tirstrup's paper in this manner.The immediate cost

Wicksell, director of finance, felt that funding should be would be about 5.3o/o,alittle bit higher than a pub-

suchthat repaymentwas deferred for at least sevenyears. lic issuein the United States(a Yankeebond),but

Since Tirstrup had been burned during the last rise in the fees were significantlylower-about 7187"of

short-term rates, it was generally understood that man- the principal.

agement'sgoal was to increasethe proportion of fixed- !ffi Yankee Bond. As noted, Tirstrup could issue a

rate debt.Julie had alreadybeen told byWicksell that any bond in the United States.Theproblem wasthat the

equity issuancewas out of the question. company currently had no real operations in the

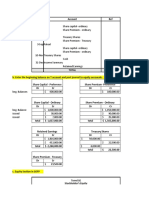

Back in the office, Julie looked at the three U.S.dollar United Statesand had very little name recognition

choices that she had previously considered and double- as a borrower. Bankers expected the company to

checked her all-in-cost (AIC) calculations again (see pay about 5.75Yofor a seven-yearissuance, with an

Exhibit 1). additionalL5% in up-front fees.

W Eurodollar Bond. Probablythe most obviouschoice In addition to giving consideration to the dollar-

to finance a U.S.acquisitionwas a Eurodollar bond. denominated issuances,Julie was also considering two

The bankersfelt thatTirstrup's namewassufficiently nondollar-denominatedissuances.one euro and one

well known in Europe that it could float a $100mil- Danish kroner.

lion Eurobond at a fixed rate of 5.60Y" (L2-year M €-Denominated Eurobond. Dresdner Bank

maturity). Feeswould probably total2Yo. (Germany) had recommendeda euro-denominated

PrivatePlacement U$$Eurobond YankeeBond Euro-Eurobond Danishl0oner

Principal(millions) $200.000 $1oo,ooo $100.000 € 100.000 kr 650.000

Maturity(yeard 10 12 7 7 7

FixedFlate(per annum) 6.500% 5.600% 5.7500/o 4.gooo/o 4.6500/o

Fees(of principal) 0.875% 2.OOOo/o 1.500% 2.OOOo/o 1.500%

Year CashFlows CashFlows GashFlows GashFlows GashFlows

0 $198.250 $98.000 $ga.soo € 98.00d kr 640.250

1 ($11.ooo) ($5.ooo; ($5.750) - € 4.800 (kr 30.225)

2 ($1t.ooo1 ($s.ooo1 ($s.zso1 - € 4.800 (kr30.225)

J ($tt.ooo; $5.600) ($5.zso1 - € 4.800 (kr30.225)

4 ($tt.ooo; ($5.600) ($s.zso; - € 4.800 (kr30.225)

5 ($11.ooo) ($s.ooo1 ($5.750) - € 4.800 (kr30.225)

6 ($1t,ooo1 ($5.600) ($5.zso1 - € 4.800 (kr30.225)

7 ($11.ooo) ($s.ooo; ($105.750) - € 104.800 (kr680.225)

I ($tl.ooo; ($5.600)

Y ($11 .ooo) ($5.600)

10 ($211.000) ($s.ooo1

11 $5.600)

12 ($105.600)

(AlC)

All-in-cost 5.617o/o 5.836% 6.019% 5.147o/o 4.908o/o

Nofe: All-in-costis calculatedas the internalrate of return of the complete seriesof cash flows associatedwith the issuance,includingproceedsnet of fees

and complete repaymentof principaland interest.

You might also like

- PDF Beams Advanced Accounting 11th Edition CH 12 DLDocument9 pagesPDF Beams Advanced Accounting 11th Edition CH 12 DLVispyanthika 03No ratings yet

- FX Risk Hedging and Exchange Rate EffectsDocument6 pagesFX Risk Hedging and Exchange Rate EffectssmileseptemberNo ratings yet

- 683sol04 PDFDocument46 pages683sol04 PDFJonah MoyoNo ratings yet

- Rangkuman UTSDocument7 pagesRangkuman UTSscorpion182No ratings yet

- BUS3026W Objective Test 8 SolutionsDocument5 pagesBUS3026W Objective Test 8 Solutionsapi-3708231100% (1)

- Corporate Finance 5E 2020-356-394Document39 pagesCorporate Finance 5E 2020-356-394Emanuele GennarelliNo ratings yet

- Foreign Currency Transaction: Factors Cause Foreign Currency Exchange Rates To ChangeDocument13 pagesForeign Currency Transaction: Factors Cause Foreign Currency Exchange Rates To ChangeJeska QuirozNo ratings yet

- Measuring Exposure to Exchange Rate FluctuationsDocument6 pagesMeasuring Exposure to Exchange Rate Fluctuationsgeorgeterekhov100% (1)

- Chapter 014Document12 pagesChapter 014Shinju Sama100% (1)

- Chapter 10 Blades CaseDocument2 pagesChapter 10 Blades CaseJanka SiposNo ratings yet

- Redacted 2019 Financial ReportDocument7 pagesRedacted 2019 Financial ReportDepDepFinancial100% (3)

- Chapter 8Document24 pagesChapter 8Cynthia AdiantiNo ratings yet

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Document11 pagesExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Trần Thị Bảo TrinhNo ratings yet

- M&a Paper ACTG421Document11 pagesM&a Paper ACTG421Alex AdamovNo ratings yet

- Ps1 EF4331 - Revised Answer)Document9 pagesPs1 EF4331 - Revised Answer)Jason YP KwokNo ratings yet

- End of Chapter Exercises - Answers: Chapter 18: Spot and Forward MarketsDocument4 pagesEnd of Chapter Exercises - Answers: Chapter 18: Spot and Forward MarketsYvonneNo ratings yet

- Risk Management Techniques for Hedging Foreign Exchange ExposureDocument21 pagesRisk Management Techniques for Hedging Foreign Exchange Exposuremoody84No ratings yet

- Chapter 4Document14 pagesChapter 4Selena JungNo ratings yet

- IFM Capital BudgetingDocument4 pagesIFM Capital Budgetingjayson RebeiroNo ratings yet

- Reading 10 Multinational Operations - AnswersDocument95 pagesReading 10 Multinational Operations - Answerstristan.riolsNo ratings yet

- UntitledDocument4 pagesUntitledRima WahyuNo ratings yet

- IBF301 Ch006Document38 pagesIBF301 Ch006Đặng Quỳnh TrangNo ratings yet

- Chapter 4-Exchange Rate DeterminationDocument21 pagesChapter 4-Exchange Rate DeterminationMelva CynthiaNo ratings yet

- Sample Exam Part IDocument3 pagesSample Exam Part ISw00per100% (1)

- Operating Exposure (Or Chapter 9)Document19 pagesOperating Exposure (Or Chapter 9)sindhupallavigundaNo ratings yet

- Merrill Lynch CaseDocument2 pagesMerrill Lynch CaseHailey Judkins100% (2)

- Christopher Seifert's Portfolio ProjectDocument4 pagesChristopher Seifert's Portfolio ProjectChris SeifertNo ratings yet

- Chapter-14-Solution - Part BDocument3 pagesChapter-14-Solution - Part BFaisal Naqvi100% (1)

- Maxim Group - Suntech Power (STP) With Cracks at Seams Lowering Price Target To $0Document15 pagesMaxim Group - Suntech Power (STP) With Cracks at Seams Lowering Price Target To $0ac310No ratings yet

- International Finance IF4 - FX MarketsDocument37 pagesInternational Finance IF4 - FX MarketsMariem StylesNo ratings yet

- McElvaine Investment Management - We Are Here - 30junDocument4 pagesMcElvaine Investment Management - We Are Here - 30junthebigpicturecoilNo ratings yet

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Document11 pagesExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%rufik der100% (2)

- Respuestas de Paridad InternacionalDocument15 pagesRespuestas de Paridad InternacionalDavid BoteroNo ratings yet

- Asset-Liability Management 3Document20 pagesAsset-Liability Management 3Bạch Thị Trâm AnhNo ratings yet

- International Parity Relationships and Forecasting FX Rates: Chapter FiveDocument30 pagesInternational Parity Relationships and Forecasting FX Rates: Chapter FiveNamrata PrajapatiNo ratings yet

- FXMarkets Part1Document43 pagesFXMarkets Part1treiptreuNo ratings yet

- FX reserves explainedDocument4 pagesFX reserves explainedmintoskijindgi2525No ratings yet

- Beams AdvAcc11 Chapter12 PDFDocument9 pagesBeams AdvAcc11 Chapter12 PDFBellaNovindraNo ratings yet

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Document9 pagesThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNo ratings yet

- Practice Questions - International FinanceDocument18 pagesPractice Questions - International Financekyle7377No ratings yet

- FIN 534 Homework Ch.17Document2 pagesFIN 534 Homework Ch.17pokadotloknot100% (1)

- CHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsDocument9 pagesCHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsKamran ShafiNo ratings yet

- Reading 5 Currency Exchange Rates - Understanding Equilibrium Value - AnswersDocument27 pagesReading 5 Currency Exchange Rates - Understanding Equilibrium Value - Answerstristan.riolsNo ratings yet

- 7 Int Parity RelationshipDocument40 pages7 Int Parity RelationshipumangNo ratings yet

- Accounting For StockDocument3 pagesAccounting For Stockkevin phillipsNo ratings yet

- Chapter 4Document17 pagesChapter 4celinekhalil2003No ratings yet

- Update 28 August 2023Document18 pagesUpdate 28 August 2023ivanNo ratings yet

- FIN3352 1st Test (With Answers)Document4 pagesFIN3352 1st Test (With Answers)p9vdp7d9fkNo ratings yet

- International Corporate FinanceDocument8 pagesInternational Corporate FinanceAnirudh DewadaNo ratings yet

- Chapter 17 Capital BudgetingDocument31 pagesChapter 17 Capital BudgetingdimasNo ratings yet

- Chapter 8 - Futures CurrencyDocument16 pagesChapter 8 - Futures CurrencyYa YaNo ratings yet

- Chapter Fourteen Foreign Exchange RiskDocument14 pagesChapter Fourteen Foreign Exchange Risknmurar01No ratings yet

- Definition of Money MarketsDocument21 pagesDefinition of Money Marketsnelle de leonNo ratings yet

- Solutions Nss NC 19Document8 pagesSolutions Nss NC 19lethiphuongdanNo ratings yet

- HW2 Assignment - CH 4,5 - FIN465 Fall 2015Document3 pagesHW2 Assignment - CH 4,5 - FIN465 Fall 2015Le Quang AnhNo ratings yet

- Energy And Environmental Hedge Funds: The New Investment ParadigmFrom EverandEnergy And Environmental Hedge Funds: The New Investment ParadigmRating: 3.5 out of 5 stars3.5/5 (2)

- Inside the Currency Market: Mechanics, Valuation and StrategiesFrom EverandInside the Currency Market: Mechanics, Valuation and StrategiesNo ratings yet

- Moran V Office of The PresidentDocument5 pagesMoran V Office of The PresidentnazhNo ratings yet

- Declining Balance Depreciation Alpha 0.15 N 10Document2 pagesDeclining Balance Depreciation Alpha 0.15 N 10Ysabela Angela FloresNo ratings yet

- Honda Cars ApplicationDocument2 pagesHonda Cars ApplicationHonda Cars RizalNo ratings yet

- F3 Mock Answers 201603Document3 pagesF3 Mock Answers 201603getcultured69No ratings yet

- The Workmen's Compensation ActDocument23 pagesThe Workmen's Compensation ActMonika ShindeyNo ratings yet

- Define Ngo, Types of Ngo, Difference Between National Ngo and International NgoDocument8 pagesDefine Ngo, Types of Ngo, Difference Between National Ngo and International NgoPRIYANKANo ratings yet

- Point: Cryptocurrencies in KenyaDocument7 pagesPoint: Cryptocurrencies in KenyaMETANOIANo ratings yet

- 3059 10-5 TenderBulletinDocument56 pages3059 10-5 TenderBulletinFadyNo ratings yet

- 232 Sumifru (Phils.) Corp. v. Spouses CerenoDocument2 pages232 Sumifru (Phils.) Corp. v. Spouses CerenoHBNo ratings yet

- Durable Power of Attorney Form For Health CareDocument3 pagesDurable Power of Attorney Form For Health CareEmily GaoNo ratings yet

- Icao Annex 10 Aeronauticaltelecommunicationsvolumeiv-SurveillancDocument220 pagesIcao Annex 10 Aeronauticaltelecommunicationsvolumeiv-SurveillancrdpereirNo ratings yet

- Model articles of association for limited companies - GOV.UKDocument7 pagesModel articles of association for limited companies - GOV.UK45pfzfsx7bNo ratings yet

- Nuclear Power in The United KingdomDocument188 pagesNuclear Power in The United KingdomRita CahillNo ratings yet

- ADR R.A. 9285 CasesDocument9 pagesADR R.A. 9285 CasesAure ReidNo ratings yet

- 15 09 Project-TimelineDocument14 pages15 09 Project-TimelineAULIA ANNANo ratings yet

- People Vs MagnoDocument2 pagesPeople Vs MagnoJan Christiane Maningo SaleNo ratings yet

- Case Digests - Simple LoanDocument14 pagesCase Digests - Simple LoanDeb BieNo ratings yet

- Organizational ManagementDocument7 pagesOrganizational ManagementMacqueenNo ratings yet

- STAMPF V TRIGG - OpinionDocument32 pagesSTAMPF V TRIGG - Opinionml07751No ratings yet

- MID - Media Monitoring Report - July-2019 - English Version - OnlineDocument36 pagesMID - Media Monitoring Report - July-2019 - English Version - OnlineThetaungNo ratings yet

- Capital Budget Project OverviewDocument2 pagesCapital Budget Project OverviewddNo ratings yet

- IRR of BP 33, Amended by PD 1865Document14 pagesIRR of BP 33, Amended by PD 1865rajNo ratings yet

- Leagues of Local GovernmentunitsDocument3 pagesLeagues of Local GovernmentunitsLumalabang Barrista100% (1)

- UP Law Reviewer 2013 - Constitutional Law 2 - Bill of RightsDocument41 pagesUP Law Reviewer 2013 - Constitutional Law 2 - Bill of RightsJC95% (56)

- SS 102 - Pakistan Studies-Culture & Heritage (ZS)Document7 pagesSS 102 - Pakistan Studies-Culture & Heritage (ZS)BushraShehzadNo ratings yet

- Magnitude of Magnetic Field Inside Hydrogen Atom ModelDocument6 pagesMagnitude of Magnetic Field Inside Hydrogen Atom ModelChristopher ThaiNo ratings yet

- Doosan Generator WarrantyDocument2 pagesDoosan Generator WarrantyFrank HigueraNo ratings yet

- CH 12 Fraud and ErrorDocument28 pagesCH 12 Fraud and ErrorJoyce Anne GarduqueNo ratings yet

- Misha Regulatory AffairsDocument26 pagesMisha Regulatory AffairsGULSHAN MADHURNo ratings yet

- Cape Law Syllabus: (Type The Company Name) 1Document3 pagesCape Law Syllabus: (Type The Company Name) 1TrynaBeGreat100% (1)